what is Crossover:

Crossover say morad forex market ke aik aice sorat e hall hote hey jahan par forex market kay 2 indiator aik dosray ko cross kartay hein jab aisa hota hey to yeh aam tor par es bat ke allamat hota hey keh forex market ka trend tabdel honay wala hota hey or aik assert buy ya sell ke taraf eshara karta hey

MA ka estamal kartay hovay crossover ke pehchan:

sab say zyada crossover golden cross over or death crossover hota hey yeh dono os time bantay hei jab 2 kesam ke moving average forex market mein buy ya sell ke taraf eshara karte hein

forex market mein golden cross os time banta hey jab forex market mein aik long period moving average hote hey jo keh 200priod ke he hote hey or aik chota jo keh aik dosray jo aik dosray ko cross karta hey

start karay walon kay ley moving average aik kesam ka indicator hota hey jo keh aik khas period time mein forex market ke overall direction or average ko track kar sakta hey moving average ke kai kesmen hote hein

Golden Cross or Death Cross:

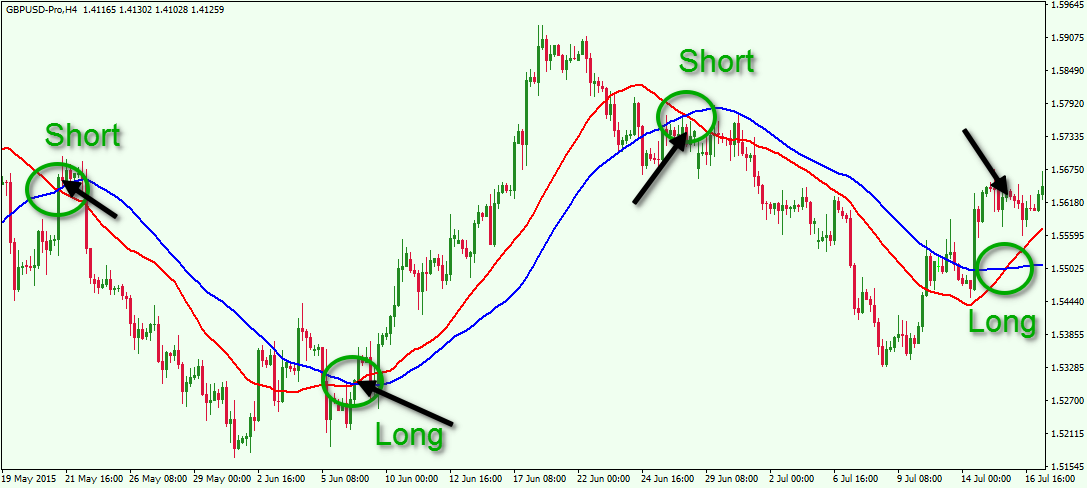

agerchay forex market mei moving average estamal karnay kay bohut say tareekay hotay hein crossover behtareen mein say aik hota hey es moamllay mein kheyal yeh hota hey keh forex marketkay mokhtalef period kay 2 levels shamel hote hein or es bat ke pehchan karne chihay keh woh kab crossover ho sakte hein

forex market mein golden cross or death cross en mein say aik hote hey or zyada maqbol 200 day or 50 day ke hote hey

ager forex market mein 2 crossover oper ke taraf say hote hein to yeh aam tor par forex market mein es bat ke allamat hotay hein keh forex market meij bulls jeet rahay hei or price inrease hote ja rehe hey ager woh nechayke taraf movement kartayhein to yeh es bat ke allamat hote hey keh nechay ke taraf new trend start honay wala hey

jabkleh forex market mein 200 Day or 50 Day ke moving average sab say zyada maqbol hote hein trader apni tarjehe period kay sath aa saktay hein sab say aam 14 den ke or 7 den ke moving average hote hey

nechay deyageya chart EUR/USD ka chart hey jo keh 2moving average crossover ka estamal karta hey

Crossover kay estamal kay faiday:

forex market mein crossover kay estamal kay kai faiday hotay hein sab say pehlay woh forex market kay tools ko bhe estamal kar saktay hein aik kay ley short or long period moving average ko yakja kar kay estamal kar saktay hein es kay elawah dosray teen kesam kay crossover ko lago kar kay estamal bhe keya ja sakta hey jen ko hum nay oper daikha hey

dosra crossover forex market mein es kay sath estamal keya jata hey mesal kay tor par moving average stocks MACD ka crossover es bat ke confirmation karta hey keh forex market reversal kab honay wale hey

tesara ap apni marze ke crossover ke strategy kay sath aa saktay hein end mein ap robot ka estamal kartay hovay moving average mein assane kar saktay hein

Conclusion :

trading stock forex market commodities or stock kay darmean mein aik maqbol cheez hote hey yeh estamal karna nesbatan assan amal hota hey or sab say zyada sahi mein say aik hota hey tahum forex market mein kamtyab honay kay ley ap ko thora bohut es par amal karnay ke zaroorat hote hey

Crossover say morad forex market ke aik aice sorat e hall hote hey jahan par forex market kay 2 indiator aik dosray ko cross kartay hein jab aisa hota hey to yeh aam tor par es bat ke allamat hota hey keh forex market ka trend tabdel honay wala hota hey or aik assert buy ya sell ke taraf eshara karta hey

MA ka estamal kartay hovay crossover ke pehchan:

sab say zyada crossover golden cross over or death crossover hota hey yeh dono os time bantay hei jab 2 kesam ke moving average forex market mein buy ya sell ke taraf eshara karte hein

forex market mein golden cross os time banta hey jab forex market mein aik long period moving average hote hey jo keh 200priod ke he hote hey or aik chota jo keh aik dosray jo aik dosray ko cross karta hey

start karay walon kay ley moving average aik kesam ka indicator hota hey jo keh aik khas period time mein forex market ke overall direction or average ko track kar sakta hey moving average ke kai kesmen hote hein

- Simple Moving Average

- Exponential Moving Average

- Smooth Moving Average

- Weighted Moving Average

Golden Cross or Death Cross:

agerchay forex market mei moving average estamal karnay kay bohut say tareekay hotay hein crossover behtareen mein say aik hota hey es moamllay mein kheyal yeh hota hey keh forex marketkay mokhtalef period kay 2 levels shamel hote hein or es bat ke pehchan karne chihay keh woh kab crossover ho sakte hein

forex market mein golden cross or death cross en mein say aik hote hey or zyada maqbol 200 day or 50 day ke hote hey

ager forex market mein 2 crossover oper ke taraf say hote hein to yeh aam tor par forex market mein es bat ke allamat hotay hein keh forex market meij bulls jeet rahay hei or price inrease hote ja rehe hey ager woh nechayke taraf movement kartayhein to yeh es bat ke allamat hote hey keh nechay ke taraf new trend start honay wala hey

jabkleh forex market mein 200 Day or 50 Day ke moving average sab say zyada maqbol hote hein trader apni tarjehe period kay sath aa saktay hein sab say aam 14 den ke or 7 den ke moving average hote hey

nechay deyageya chart EUR/USD ka chart hey jo keh 2moving average crossover ka estamal karta hey

Crossover kay estamal kay faiday:

forex market mein crossover kay estamal kay kai faiday hotay hein sab say pehlay woh forex market kay tools ko bhe estamal kar saktay hein aik kay ley short or long period moving average ko yakja kar kay estamal kar saktay hein es kay elawah dosray teen kesam kay crossover ko lago kar kay estamal bhe keya ja sakta hey jen ko hum nay oper daikha hey

dosra crossover forex market mein es kay sath estamal keya jata hey mesal kay tor par moving average stocks MACD ka crossover es bat ke confirmation karta hey keh forex market reversal kab honay wale hey

tesara ap apni marze ke crossover ke strategy kay sath aa saktay hein end mein ap robot ka estamal kartay hovay moving average mein assane kar saktay hein

Conclusion :

trading stock forex market commodities or stock kay darmean mein aik maqbol cheez hote hey yeh estamal karna nesbatan assan amal hota hey or sab say zyada sahi mein say aik hota hey tahum forex market mein kamtyab honay kay ley ap ko thora bohut es par amal karnay ke zaroorat hote hey

تبصرہ

Расширенный режим Обычный режим