DEFINITION AND PURPOSE OF TOWER BOTTOM PATTERN :

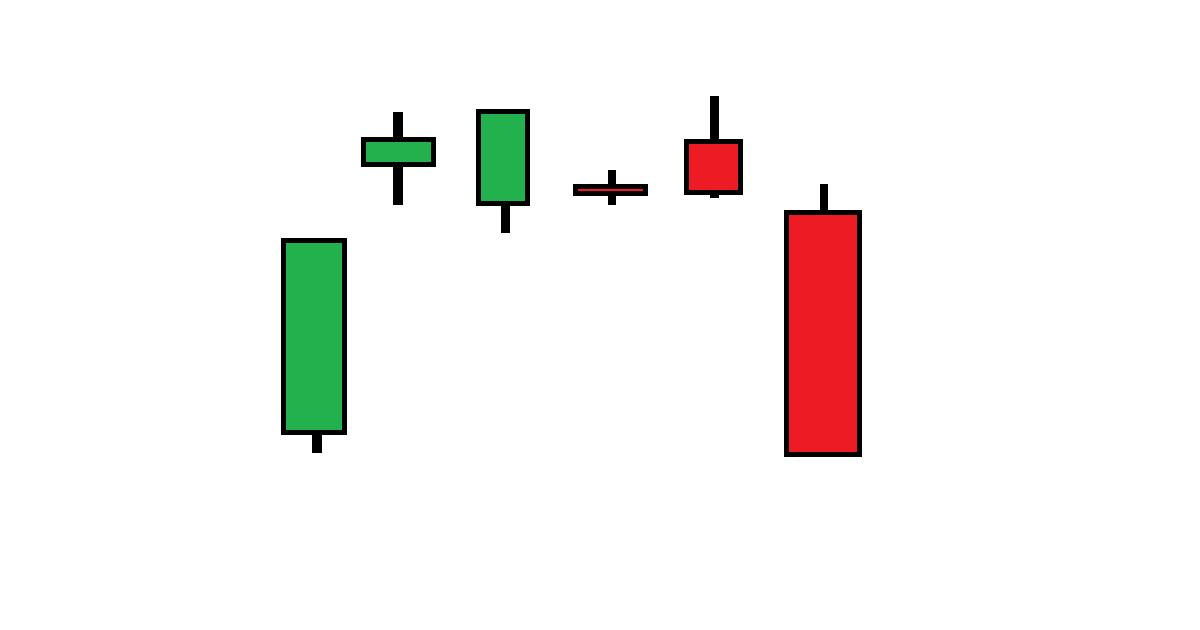

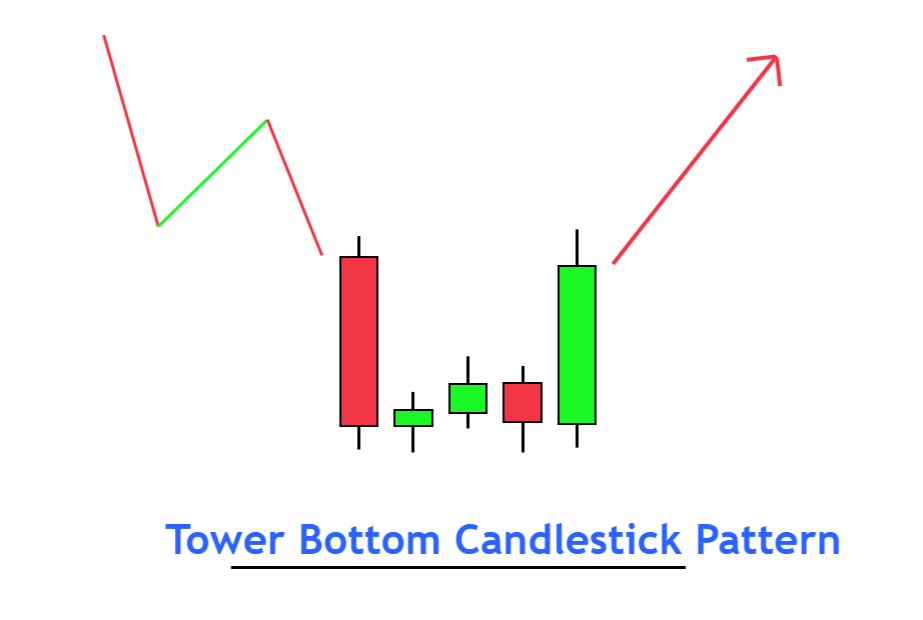

Tower Bottom pattern ak bullish reversal pattern ha jo Forex charts ma dakha ja sakta ha. Ye pattern do consecutive candlesticks se banta ha, jahan pehla candlestick lamba, bearish candle hota ha, or dusra candlestick chota hota ha, jisme ak bullish candle hote ha jiska body chote hote ha. Ye pattern is liye ahmiyat rakhta ha kyunke yeh markat sentiment ma bearish se bullish ke taraf shift hone ke soorat ha. Tower Bottom pattern aksar trend reversal ka indication deta ha or Forex traders ka liye buying opportunities identify karne ma madadgar sabit ho sakta ha.

CHARACTERISTICS OF TOWER BOTTOM PATTERN :

Tower Bottom pattern ko identify karne ka liye traders ko do khasiyat par tawajja deni hote ha. Pehle, pattern ko shuru karte hue lambi bearish candle ho, jo markat ma strong selling pressure indicate karta ha. Is candle ke body lambi hote ha or upper or lower shadow relatively chote hote ha. Dusra, pattern ko neechey ak chote bullish candle follow karti ha, jo pehle bearish pressure ka bullish response ha. Is candle ke body chote hote ha or ideally bearish candle ke body ma hi open hote ha. Tower Bottom pattern tab zyada reliable consider keya jata ha jab bullish candle bearish candle ko poora engulf kar leti ha.

CONFIRMATION OF TOWER BOTTOM PATTERN :

Tower Bottom pattern ke maujoodgi trend reversal ke potential indication ho sakti ha, laken is pattern ke tasdeeq karne se pehle trading actions lena zaroori ha. Iske tasdeeq dusre bullish signals ya factors ke madad se ke ja sakti ha jo bullish bias ko support karte ha. Traders, is pattern ke tasdeeq ka liye technical indicators jaise moving averages, trendlines, ya oscillators ka istemal kar sakte ha. For example, short-term moving average ko long-term moving average se upar cross karna bullish reversal ke potential tasdeeq kar sakta ha.

TRADING STRATEGIES USING TOWER BOTTOM PATTERN :

Jab ak Tower Bottom pattern identify or tasdeeq ho jata ha, traders is bullish reversal ko capitalize karne ka liye kuch trading strategies ka istemal kar sakte ha. Ek strategy ye ha ka jab markat price bullish candle ke high ko break kare, tab long position enter karna. Ye breakout entry strategy traders ko trend reversal ka potential upside momentum ko capture karne ke ijazat deta ha. Dusra strategy ha ka breakout ka baad pullback ka wait karna or kam price par enter karna, stop loss Tower Bottom pattern ka low ka neechey rakh kar risk management karna.

LIMITATIONS OF TOWER BOTTOM PATTERN :

Tower Bottom pattern bullish reversals identify karne ka liye powerful tool ho sakta ha, laken ye foolproof nahi ha or kabhi kabhi false signals bhi de sakta ha. Traders ko is pattern ke mehdoodiyat ka ahtiyaat rakna chahiye or ise dusre technical tools or analysis ka saath istemal karna chahiye. False signals tab ho sakte ha jab bullish candle pehle bearish candle ko poora engulf nahi karti ha ya phir subsequent price action bullish momentum ko sustain nahi kar pata ha. Tower Bottom pattern par trading decisions lene se pehle overall markat context, trend direction, or dusre technical factors ko consider karna zaroori ha.

Tower Bottom pattern ak bullish reversal pattern ha jo Forex charts ma dakha ja sakta ha. Ye pattern do consecutive candlesticks se banta ha, jahan pehla candlestick lamba, bearish candle hota ha, or dusra candlestick chota hota ha, jisme ak bullish candle hote ha jiska body chote hote ha. Ye pattern is liye ahmiyat rakhta ha kyunke yeh markat sentiment ma bearish se bullish ke taraf shift hone ke soorat ha. Tower Bottom pattern aksar trend reversal ka indication deta ha or Forex traders ka liye buying opportunities identify karne ma madadgar sabit ho sakta ha.

CHARACTERISTICS OF TOWER BOTTOM PATTERN :

Tower Bottom pattern ko identify karne ka liye traders ko do khasiyat par tawajja deni hote ha. Pehle, pattern ko shuru karte hue lambi bearish candle ho, jo markat ma strong selling pressure indicate karta ha. Is candle ke body lambi hote ha or upper or lower shadow relatively chote hote ha. Dusra, pattern ko neechey ak chote bullish candle follow karti ha, jo pehle bearish pressure ka bullish response ha. Is candle ke body chote hote ha or ideally bearish candle ke body ma hi open hote ha. Tower Bottom pattern tab zyada reliable consider keya jata ha jab bullish candle bearish candle ko poora engulf kar leti ha.

CONFIRMATION OF TOWER BOTTOM PATTERN :

Tower Bottom pattern ke maujoodgi trend reversal ke potential indication ho sakti ha, laken is pattern ke tasdeeq karne se pehle trading actions lena zaroori ha. Iske tasdeeq dusre bullish signals ya factors ke madad se ke ja sakti ha jo bullish bias ko support karte ha. Traders, is pattern ke tasdeeq ka liye technical indicators jaise moving averages, trendlines, ya oscillators ka istemal kar sakte ha. For example, short-term moving average ko long-term moving average se upar cross karna bullish reversal ke potential tasdeeq kar sakta ha.

TRADING STRATEGIES USING TOWER BOTTOM PATTERN :

Jab ak Tower Bottom pattern identify or tasdeeq ho jata ha, traders is bullish reversal ko capitalize karne ka liye kuch trading strategies ka istemal kar sakte ha. Ek strategy ye ha ka jab markat price bullish candle ke high ko break kare, tab long position enter karna. Ye breakout entry strategy traders ko trend reversal ka potential upside momentum ko capture karne ke ijazat deta ha. Dusra strategy ha ka breakout ka baad pullback ka wait karna or kam price par enter karna, stop loss Tower Bottom pattern ka low ka neechey rakh kar risk management karna.

LIMITATIONS OF TOWER BOTTOM PATTERN :

Tower Bottom pattern bullish reversals identify karne ka liye powerful tool ho sakta ha, laken ye foolproof nahi ha or kabhi kabhi false signals bhi de sakta ha. Traders ko is pattern ke mehdoodiyat ka ahtiyaat rakna chahiye or ise dusre technical tools or analysis ka saath istemal karna chahiye. False signals tab ho sakte ha jab bullish candle pehle bearish candle ko poora engulf nahi karti ha ya phir subsequent price action bullish momentum ko sustain nahi kar pata ha. Tower Bottom pattern par trading decisions lene se pehle overall markat context, trend direction, or dusre technical factors ko consider karna zaroori ha.

تبصرہ

Расширенный режим Обычный режим