MACD Indicator:

MACD aik popular technical indicator hai jo Forex trading mein istemal hota hai. Is se traders trend reversals, momentum changes aur overbought/oversold conditions ko pehchan sakte hain.

MACD Ke Hissaat Samajhna:

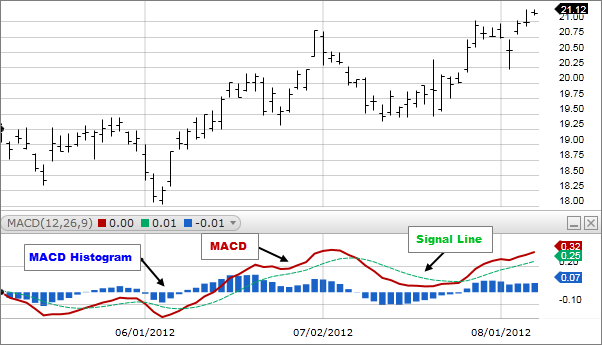

1. MACD Line: MACD line tezi se move karti hai aur isko calculate karne ke liye 26-period Exponential Moving Average (EMA) ko 12-period EMA se minus kiya jata hai.

2. Signal Line: Signal line MACD line par apply ki jane wali 9-period EMA hai. Isse trading signals generate hote hain.

3. Histogram: Histogram MACD line aur signal line ke darmiyan farq ko represent karta hai. Isse traders momentum changes ko visualize kar sakte hain.

MACD Signals:

1. MACD Crossovers: Buy signals tab aate hain jab MACD line signal line ke upar cross karti hai. Sell signals tab aate hain jab ye signal line ke neeche cross karti hai.

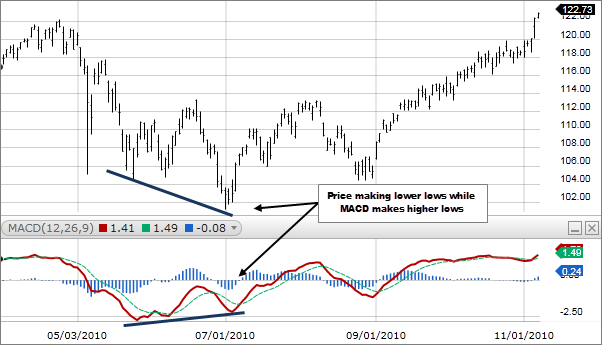

2. Divergence: Jab price aur MACD indicator opposite directions mein move karte hain, to ye potential trend reversal ko indicate kar sakta hai.

MACD Ko Trading Mein Istemal Karna:

1. Trend Ki Tasdeeq: MACD trend ki strength aur direction ko tasdeeq karne ke liye istemal kiya ja sakta hai. Jab MACD signal line ke upar hoti hai, to ye bullish trend ko darust karti hai, aur ulte case mein bhi.

2. Overbought/Oversold Conditions: MACD histogram overbought (jab ye zero ke upar hoti hai) ya oversold (jab ye zero ke neeche hoti hai) conditions ko pehchanne mein madadgar ho sakti hai.

3. Risk Management: Apni trades ko mehfooz rakhne ke liye stop-loss orders ka istemal karen aur MACD signal ko reverse hone par profit le len.

MACD Tips:

1. Doosre Indicators Ke Sath Combine Karein: Behtar faisalon ke liye MACD ko doosre technical indicators ke sath istemal karen.

2. Amaliyat Aur Sabr: MACD ke sath demo trade karen taki experience hasil ho aur wazeh signals ke liye sabr rakhen.

3. Ma'loom Rahein: Forex news aur events ko tawajjo se dekhte rahein kyunki ye market conditions aur MACD signals par asar dal sakte hain.

Conclusion:

MACD indicator Forex trading mein trends ko analyze karna, potential reversals ko pehchanna aur risk ko manage karna ke liye aik ahem tool hai. Lekin, isko doosri analysis methods ke sath istemal karna aur zimmedar risk management ka amal karna bhi zaroori hai taake aapki trading mein kamyabi hasil ho sake.

MACD aik popular technical indicator hai jo Forex trading mein istemal hota hai. Is se traders trend reversals, momentum changes aur overbought/oversold conditions ko pehchan sakte hain.

MACD Ke Hissaat Samajhna:

1. MACD Line: MACD line tezi se move karti hai aur isko calculate karne ke liye 26-period Exponential Moving Average (EMA) ko 12-period EMA se minus kiya jata hai.

2. Signal Line: Signal line MACD line par apply ki jane wali 9-period EMA hai. Isse trading signals generate hote hain.

3. Histogram: Histogram MACD line aur signal line ke darmiyan farq ko represent karta hai. Isse traders momentum changes ko visualize kar sakte hain.

MACD Signals:

1. MACD Crossovers: Buy signals tab aate hain jab MACD line signal line ke upar cross karti hai. Sell signals tab aate hain jab ye signal line ke neeche cross karti hai.

2. Divergence: Jab price aur MACD indicator opposite directions mein move karte hain, to ye potential trend reversal ko indicate kar sakta hai.

MACD Ko Trading Mein Istemal Karna:

1. Trend Ki Tasdeeq: MACD trend ki strength aur direction ko tasdeeq karne ke liye istemal kiya ja sakta hai. Jab MACD signal line ke upar hoti hai, to ye bullish trend ko darust karti hai, aur ulte case mein bhi.

2. Overbought/Oversold Conditions: MACD histogram overbought (jab ye zero ke upar hoti hai) ya oversold (jab ye zero ke neeche hoti hai) conditions ko pehchanne mein madadgar ho sakti hai.

3. Risk Management: Apni trades ko mehfooz rakhne ke liye stop-loss orders ka istemal karen aur MACD signal ko reverse hone par profit le len.

MACD Tips:

1. Doosre Indicators Ke Sath Combine Karein: Behtar faisalon ke liye MACD ko doosre technical indicators ke sath istemal karen.

2. Amaliyat Aur Sabr: MACD ke sath demo trade karen taki experience hasil ho aur wazeh signals ke liye sabr rakhen.

3. Ma'loom Rahein: Forex news aur events ko tawajjo se dekhte rahein kyunki ye market conditions aur MACD signals par asar dal sakte hain.

Conclusion:

MACD indicator Forex trading mein trends ko analyze karna, potential reversals ko pehchanna aur risk ko manage karna ke liye aik ahem tool hai. Lekin, isko doosri analysis methods ke sath istemal karna aur zimmedar risk management ka amal karna bhi zaroori hai taake aapki trading mein kamyabi hasil ho sake.

تبصرہ

Расширенный режим Обычный режим