Muqarrar trading market mein mukhtalif indicators hain aur her trader apni trading strategy aur pasand par mabni apna pasandida indicator rakhta hai. Ek aam indicator jo traders mein pasand kiya jata hai, wo hai Moving Average (MA). Moving Average trend-following indicator hai jo traders ko market trend ki taraf ishara karne aur mojooda entry aur exit points ka pata lagane mein madad karta hai. Ye security ka average price specific time period mein calculate karta hai aur chart par plot karta hai. Moving Averages ke mukhtalif qisam hote hain, jaise Simple Moving Average (SMA) aur Exponential Moving Average (EMA). SMA har data point ko barabar wazan deta hai, jabke EMA haal ki data ko zyada wazan deta hai, jis se ye price ke tabdeel hone par zyada jald jawab deta hai. Traders Moving Averages ko mukhtalif maqsadon ke liye istemal karte hain. Sab se pehle, ye trend ki taraf ishara karne mein madad karta hai. Jab price MA ke upar hota hai, to ye ek uptrend ko zahir karta hai, aur jab price MA ke neeche hota hai, to ye ek downtrend ko zahir karta hai. Traders is information ka istemal sahi trading strategy tayyar karne ke liye kar sakte hain, jaise uptrend mein kharidari karna ya downtrend mein bechna. Dusra, Moving Averages dynamic support aur resistance levels ki tarah kaam karte hain. Ek uptrend mein, MA support level ke taur par kaam karta hai, jahan price MA se takra kar apna uparward movement jari rakhta hai. Isi tarah, ek downtrend mein, MA resistance level ke taur par kaam karta hai, jahan price ko MA ke upar jane mein mushkil hoti hai. Is ke ilawa, Moving Averages do ya zyada MAs ke cross hone par trading signals bhi generate kar sakte hain. Misal ke taur par, jab ek chota time period wala MA lamba time period wale MA se upar cross karta hai, to ek bullish signal generate hota hai, jis se kharidari ka mauqa ban sakta hai. Ulta, jab chota time period wala MA lamba time period wale MA se neeche cross karta hai, to ek bearish signal generate hota hai, jis se bechna ka mauqa ban sakta hai. Aur iss ke ilawa, Moving Averages potential entry aur exit points ka pata lagane mein bhi istemal kiye ja sakte hain. Traders uptrend mein price ko MA tak wapis aane ka intezar kar sakte hain aur kharidari ki trade mein dakhil ho sakte hain, ya phir downtrend mein price ko MA se neeche break hone ka intezar kar sakte hain aur bechna ki trade mein dakhil ho sakte hain. Yeh yaad rakhna zaroori hai ke Moving Averages lagging indicators hote hain, jis ka matlab hai ke ye peechle price data par mabni hote hain. Isliye, ye hamesha future price movements ko sahi tareeqe se predict nahi kar sakte hain. Traders aksar Moving Averages ko dusre indicators aur tools ke saath istemal karte hain taake unki trading decisions mein izafa ho sake. Akhri taur par, Moving Average trading market mein pasand kiya jane wala popular indicator hai apni asan aur asar andaz mein trend, support aur resistance levels ka pata lagane aur trading signals generate karne ke liye. Lekin traders ko isko dusre indicators aur tools ke saath istemal karne ke liye samjha jana chahiye taake wo apni trading decisions ko behtar bana saken.

`

X

new posts

-

#1 Collapse

Favorite Indicator in Trading Market

Muqarrar trading market mein mukhtalif indicators hain aur her trader apni trading strategy aur pasand par mabni apna pasandida indicator rakhta hai. Ek aam indicator jo traders mein pasand kiya jata hai, wo hai Moving Average (MA). Moving Average trend-following indicator hai jo traders ko market trend ki taraf ishara karne aur mojooda entry aur exit points ka pata lagane mein madad karta hai. Ye security ka average price specific time period mein calculate karta hai aur chart par plot karta hai. Moving Averages ke mukhtalif qisam hote hain, jaise Simple Moving Average (SMA) aur Exponential Moving Average (EMA). SMA har data point ko barabar wazan deta hai, jabke EMA haal ki data ko zyada wazan deta hai, jis se ye price ke tabdeel hone par zyada jald jawab deta hai. Traders Moving Averages ko mukhtalif maqsadon ke liye istemal karte hain. Sab se pehle, ye trend ki taraf ishara karne mein madad karta hai. Jab price MA ke upar hota hai, to ye ek uptrend ko zahir karta hai, aur jab price MA ke neeche hota hai, to ye ek downtrend ko zahir karta hai. Traders is information ka istemal sahi trading strategy tayyar karne ke liye kar sakte hain, jaise uptrend mein kharidari karna ya downtrend mein bechna. Dusra, Moving Averages dynamic support aur resistance levels ki tarah kaam karte hain. Ek uptrend mein, MA support level ke taur par kaam karta hai, jahan price MA se takra kar apna uparward movement jari rakhta hai. Isi tarah, ek downtrend mein, MA resistance level ke taur par kaam karta hai, jahan price ko MA ke upar jane mein mushkil hoti hai. Is ke ilawa, Moving Averages do ya zyada MAs ke cross hone par trading signals bhi generate kar sakte hain. Misal ke taur par, jab ek chota time period wala MA lamba time period wale MA se upar cross karta hai, to ek bullish signal generate hota hai, jis se kharidari ka mauqa ban sakta hai. Ulta, jab chota time period wala MA lamba time period wale MA se neeche cross karta hai, to ek bearish signal generate hota hai, jis se bechna ka mauqa ban sakta hai. Aur iss ke ilawa, Moving Averages potential entry aur exit points ka pata lagane mein bhi istemal kiye ja sakte hain. Traders uptrend mein price ko MA tak wapis aane ka intezar kar sakte hain aur kharidari ki trade mein dakhil ho sakte hain, ya phir downtrend mein price ko MA se neeche break hone ka intezar kar sakte hain aur bechna ki trade mein dakhil ho sakte hain. Yeh yaad rakhna zaroori hai ke Moving Averages lagging indicators hote hain, jis ka matlab hai ke ye peechle price data par mabni hote hain. Isliye, ye hamesha future price movements ko sahi tareeqe se predict nahi kar sakte hain. Traders aksar Moving Averages ko dusre indicators aur tools ke saath istemal karte hain taake unki trading decisions mein izafa ho sake. Akhri taur par, Moving Average trading market mein pasand kiya jane wala popular indicator hai apni asan aur asar andaz mein trend, support aur resistance levels ka pata lagane aur trading signals generate karne ke liye. Lekin traders ko isko dusre indicators aur tools ke saath istemal karne ke liye samjha jana chahiye taake wo apni trading decisions ko behtar bana saken.ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Trading aur investing ki duniya mein, indicators bohot important tools hain jo traders aur investors ko market trends aur price movements ko analyze karne mein madad karte hain. Indicators se traders ko market ke behavior aur potential future movements ka andaza hota hai, jis se unhein apni trading strategies ko formulate karne mein madad milti hai. Trading indicators bohot types ke hote hain, magar har trader ka ek favorite indicator hota hai jo unki trading style aur market approach ke sath suit karta hai. Mera favorite indicator Moving Average Convergence Divergence (MACD) hai. MACD ek versatile aur widely used indicator hai jo price trends aur momentum ko measure karta hai.

MACD: Moving Average Convergence Divergence

MACD ek trend-following momentum indicator hai jo do moving averages ke beech ke relationship ko analyze karta hai. MACD ki simplicity aur effectiveness ki wajah se yeh bohot popular hai among traders.

Components of MACD- MACD Line: Yeh line fast (short-term) aur slow (long-term) Exponential Moving Averages (EMAs) ke difference ko represent karti hai.

- Signal Line: Yeh MACD line ka 9-day EMA hota hai, jo MACD line ke upar plot hota hai aur trading signals generate karta hai.

- Histogram: Yeh MACD line aur Signal line ke beech ke difference ko represent karta hai aur isay bars ke form mein plot kiya jata hai.

MACD ko calculate karne ke liye, hum pehle do EMAs calculate karte hain aur phir unka difference nikalte hain:

MACD Line=12-day EMA−26-day EMA\text{MACD Line} = 12 \text{-day EMA} - 26 \text{-day EMA}MACD Line=12-day EMA−26-day EMA

Signal line ko calculate karne ke liye, MACD line ka 9-day EMA calculate kiya jata hai:

Signal Line=9-day EMA of MACD Line\text{Signal Line} = 9 \text{-day EMA of MACD Line}Signal Line=9-day EMA of MACD Line

Histogram ko calculate karne ke liye, MACD line aur Signal line ke beech ka difference nikalte hain:

Histogram=MACD Line−Signal Line\text{Histogram} = \text{MACD Line} - \text{Signal Line}Histogram=MACD Line−Signal Line

Interpretation of MACD

MACD ke through market trends aur momentum ko interpret karne ke multiple ways hain. Sabse common interpretations kuch is tarah hain:- MACD Line and Signal Line Crossovers:

- Bullish Crossover: Jab MACD line Signal line ko upar cross karti hai, to yeh bullish signal hota hai. Iska matlab hai ke price upward trend ki taraf move kar sakta hai.

- Bearish Crossover: Jab MACD line Signal line ko neeche cross karti hai, to yeh bearish signal hota hai. Iska matlab hai ke price downward trend ki taraf move kar sakta hai.

- MACD Histogram:

- Positive Histogram: Jab histogram bars positive (above zero) hain aur barh rahi hain, to yeh bullish momentum ko indicate karta hai.

- Negative Histogram: Jab histogram bars negative (below zero) hain aur gir rahi hain, to yeh bearish momentum ko indicate karta hai.

- Divergence:

- Bullish Divergence: Jab price lower lows bana raha hota hai aur MACD higher lows bana raha hota hai, to yeh bullish divergence hoti hai jo potential trend reversal ko indicate karti hai.

- Bearish Divergence: Jab price higher highs bana raha hota hai aur MACD lower highs bana raha hota hai, to yeh bearish divergence hoti hai jo potential trend reversal ko indicate karti hai.

MACD ko use karne ke multiple strategies hain jo traders ki trading style aur risk tolerance ke sath align hoti hain. Kuch common MACD trading strategies hain:- MACD Crossover Strategy

Example- Buy Signal: Assume karein ke ek stock ka price $50 per hai. Jab MACD line Signal line ko upar cross karti hai, to yeh indication hoti hai ke price increase ho sakta hai. Is point par, trader stock ko buy kar sakta hai.

- Sell Signal: Jab MACD line Signal line ko neeche cross karti hai, to yeh indication hoti hai ke price decline ho sakta hai. Is point par, trader stock ko sell kar sakta hai.

- MACD Divergence Strategy

Example- Bullish Divergence: Assume karein ke stock ka price $45 se $40 tak gir raha hai, lekin MACD higher lows bana raha hai. Yeh bullish divergence hai jo indicate karti hai ke price upward trend mein reverse ho sakta hai. Is point par, trader stock ko buy kar sakta hai.

- Bearish Divergence: Assume karein ke stock ka price $60 se $65 tak barh raha hai, lekin MACD lower highs bana raha hai. Yeh bearish divergence hai jo indicate karti hai ke price downward trend mein reverse ho sakta hai. Is point par, trader stock ko sell kar sakta hai.

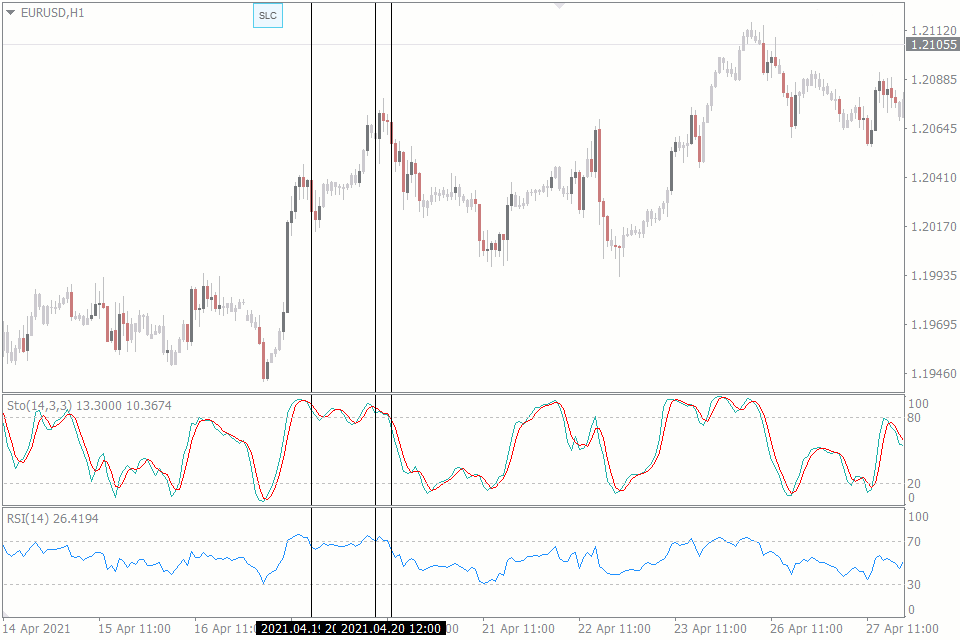

- MACD and RSI Combination

Example- Buy Signal: Jab MACD bullish crossover indicate kare aur RSI oversold condition (below 30) ko indicate kare, to yeh strong buy signal ho sakta hai.

- Sell Signal: Jab MACD bearish crossover indicate kare aur RSI overbought condition (above 70) ko indicate kare, to yeh strong sell signal ho sakta hai.

- Versatility: MACD ko multiple time frames aur markets mein use kiya ja sakta hai, chahe wo stocks, forex, commodities, ya cryptocurrencies hon.

- Simplicity: MACD easily interpretable hai aur beginners aur experienced traders dono ke liye useful hai.

- Effective Trend Following: MACD trend-following indicator hai jo trends aur momentum ko accurately capture karta hai.

- Divergence Detection: MACD divergences potential trend reversals ko early stage mein detect karne mein madadgar hoti hain.

- Lagging Indicator: MACD ek lagging indicator hai jo past price movements par base karta hai. Is liye, kabhi-kabhi late signals generate kar sakta hai.

- False Signals: Kabhi-kabhi MACD false signals bhi generate kar sakta hai, specially in choppy or sideways markets.

- Not Suitable for All Market Conditions: MACD trending markets mein zyada effective hota hai, lekin range-bound ya volatile markets mein kam effective ho sakta hai.

MACD ek powerful aur versatile trading indicator hai jo traders ko market trends aur momentum ko analyze karne mein madad karta hai. Iski simplicity aur effectiveness ki wajah se yeh bohot popular hai among traders. MACD ke different interpretations aur trading strategies use karte hue, traders apni trading decisions ko enhance kar sakte hain aur potential profits maximize kar sakte hain.

Lekin, traders ko yeh bhi yaad rakhna chahiye ke MACD ek lagging indicator hai aur iski limitations bhi hain. Is liye, MACD ko other technical indicators aur analysis techniques ke sath combine karna better trading results generate karne mein madadgar ho sakta hai.

Trading mein success ke liye zaroori hai ke aap apni trading strategies ko continuously test aur refine karein, market conditions ko samjhein, aur risk management techniques ko implement karein. MACD jaise indicators ka effective use karte hue, aap apni trading journey ko successful aur profitable bana sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 Collapse

Favorite Indicator in Trading Market

Trading market mein indicators ka use bohot zaroori hota hai. Ye indicators traders ko market trends aur price movements samajhne mein madad karte hain. Har trader ka apna favorite indicator hota hai, magar kuch indicators aise hain jo aam tor par bohot popular hain.

Moving Average (MA)

Moving Average (MA) trading market mein sabse zyada use hone wala indicator hai. Ye indicator stock ke average price ko calculate karta hai aik specific time period mein. Ye trend following indicator hai jo price trends ko identify karne mein madad karta hai.

Types of Moving Averages:

1. Simple Moving Average (SMA):

SMA stock ke past prices ka average hota hai. Agar 10-day SMA dekhen, to ye last 10 dinon ke closing prices ka average hoga.

2. Exponential Moving Average (EMA):

EMA SMA se zyada sensitive hota hai recent prices ke changes ke liye. Ye recent prices ko zyada weightage deta hai.

Fayde:

1. Trend Identification:

Moving Averages se long-term aur short-term trends ko identify karna asaan hota hai.

2. Support and Resistance:

Ye indicator support aur resistance levels ko identify karne mein madad karta hai.

3. Easy to Use:

Moving Averages use karna asaan hai aur almost har trading platform par available hai.

Relative Strength Index (RSI)

RSI aik momentum oscillator hai jo 0 se 100 tak scale par trade karta hai. Ye indicator market ke overbought aur oversold conditions ko identify karta hai.

RSI ki Calculation:

RSI = 100 - (100 / (1 + RS))

Jahan RS (Relative Strength) hota hai average gain divided by average loss over a certain period.

Fayde:

1. Overbought/Oversold Signals:

Jab RSI 70 se upar hota hai, to market overbought condition mein hota hai. Jab RSI 30 se neeche hota hai, to market oversold condition mein hota hai.

2. Reversal Identification:

RSI se potential price reversals ko identify karna asaan hota hai.

Moving Average Convergence Divergence (MACD)

MACD aik trend-following momentum indicator hai jo do moving averages ke beech ke difference ko show karta hai.

MACD ki Calculation:

MACD Line = 12-day EMA - 26-day EMA

Signal Line = 9-day EMA of MACD Line

Jab MACD Line Signal Line ko cross karti hai, to trading signals generate hote hain.

Fayde:

1. Trend Reversals:

MACD trend reversals ko identify karne mein madad karta hai.

2. Momentum Measurement:

Ye indicator market momentum ko measure karta hai aur strong trends ko identify karta hai.

Conclusion

Trading market mein har indicator ka apna importance hai. Moving Averages, RSI, aur MACD kuch aise indicators hain jo har trader ke toolkit mein hone chahiye. Har indicator ko sahi tareeke se use karke market trends aur price movements ko sahi tarah se samjha ja sakta hai. Ye indicators trading strategies ko enhance karne aur profitable trades karne mein madadgar hote hain.

- CL

- Mentions 0

-

سا4 likes

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:26 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим