Saucer Bottom Chart Pattern jo ke rounding bottom ya rounding bottom reversal pattern ke naam se bhi jana jata hai, forex trading mein istemal hone wala aham technical analysis pattern hai. Ye ek lambi muddat tak chalne wale trend mein se palatne ki mumkin nishan dahi karta hai, jiska matlab hota hai ke mojooda trend mein se badalawat hone ki chances hai, jo ke bearish se bullish ki taraf jane ki isharaat deti hai. Traders aur investors is pattern ka istemal forex market mein potensial buying opportunities pehchanne ke liye karte hain.

Characteristics of the Saucer Bottom Chart Pattern

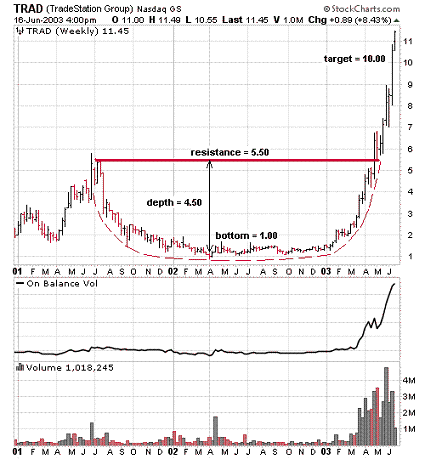

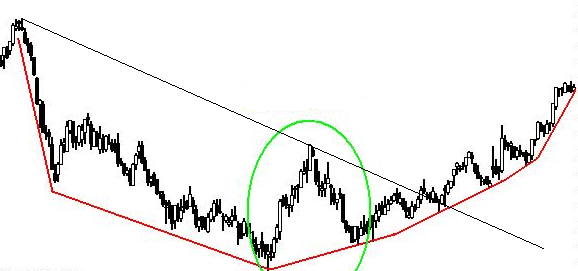

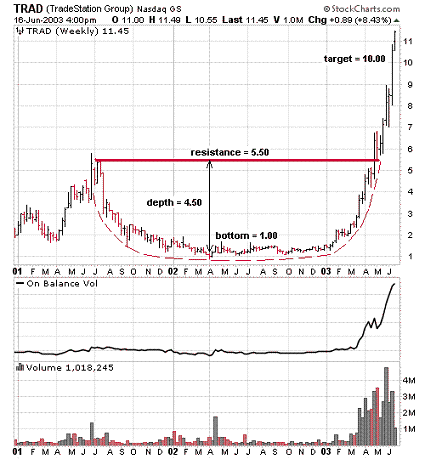

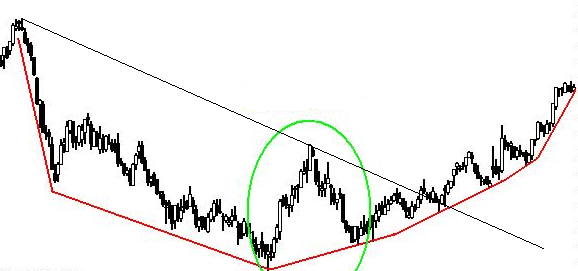

Gradual Transition: Saucer Bottom pattern ki aik ahmiyat angaiz baat ye hai ke is mein bearish trend se sideways ya consolidate hone ki taraf dheerey dheerey transition hoti hai. Ye dikhata hai ke buyers dheerey dheerey control mein aa rahe hain.

Volume Analysis: Volume analysis Saucer Bottom pattern ki tasdeeq ke liye ahamiyyat rakhta hai. Is pattern ki formation ke doran, trading volumes mein kami hoti hai jab market consolidate hoti hai. Lekin jab price saucer bottom bana kar upar jaane lagta hai, toh trading volume mein izafah hone chahiye, jo ke strong buying interest ko darust karta hai.

Round Shape: Saucer Bottom pattern ki pehchan uske round shape mein hai, jo isay doosre chart patterns se alag karta hai. Ye smooth, round formation dikhata hai, jo market sentiment mein dheerey dheerey tabdeeli aur bearish trend ki bullish mein muntaqil hone ki mumkin nishan dahi karta hai.

Significance of the Saucer Bottom Pattern

Saucer Bottom pattern ka bohot bara maqam is liye hai ke ye market dynamics mein tabdeeli ki taraf isharaat deta hai. Lambi muddat tak chalne wale downtrend ke baad, ye pattern ye signal deta hai ke buyers ki taqat barh rahi hai, aur bearish trend ki bullish mein muntaqil hone ki chances hai. Traders is pattern ko strong buy signal ke tor par consider karte hain, jisay ye dikhata hai ke ab mojooda waqt mein long positions enter karne ka moqa ho sakta hai jahan price ki mazeed izafah ki tawakul ki ja sakti hai.

Trading Strategies Based on the Saucer Bottom Pattern

Confirmation: Saucer Bottom pattern pe trade karnay se pehle tasdeeq ka intezaar karna bohot zaroori hai. Tasdeeq saucer ke rim ya neckline ke upar decisive breakout ke sath aane par hoti hai, jise significant trading volume ke izafay ke sath sath confirm hoti hai. Ye breakout pattern ki tasdeeq karta hai aur traders ko long trade enter karne ka strong signal deta hai.

Stop Loss and Take Profit Levels: Saucer Bottom pattern ka istemal karne wale traders ko sahi risk management techniques implement karni chahiye. Saucer bottom ke niche ek stop-loss order set karna zaroori hai, taki is surat e haal mein protection ho sake agar pattern materialize na ho. Iske ilawa, traders historical price data, support/resistance levels ya Fibonacci retracement levels ke basis par take-profit levels set kar sakte hain, taki price upar jaate waqt profit secure ki ja sake.

Volume Confirmation: Trading volumes par qareebi tawajjah dena zaroori hai. Saucer Bottom ke rim ke upar breakout ke doran volume mein izafah hone par pattern ki tasdeeq hoti hai, jo traders ko unke trading decision mein confidence deta hai.

Additional Technical Indicators: Traders Saucer Bottom pattern ko doosre technical indicators jaise ke moving averages, Relative Strength Index (RSI), ya Moving Average Convergence Divergence (MACD) ke sath combine karte hain, taake unke trading signals ki accuracy ko barhaya ja sake. Ye indicators pattern ki strength aur potential bullish momentum ki additional tasdeeq provide kar sakte hain.

Jabke Saucer Bottom pattern forex trading mein aik taqatwar tool hai, lekin ye puri tarah bharosemand nahi hota aur traders ko ihtiyat se kaam lena chahiye. Jaise ke tamam technical analysis patterns, saucer bottom bhi historical price data par mabni hota hai aur is se future price movements ko sahi tarah se predict karne ki guarantee nahi hoti.

False Signals: Kabhi kabhi Saucer Bottom pattern ghalat signals de sakta hai, jis se traders aise trades mein dakhil ho sakte hain jo unki expectations ke mutabiq nahi hoti. Is risk ko kam karne ke liye, ye zaroori hai ke breakout aur volume analysis ke liye tasdeeq ka intezaar kiya jaye trading decisions se pehle.

Market Conditions: Market shara'it aur baazari factors is pattern ki effectiveness par asar dal sakte hain. Achanak aane wale khabron, geopolitical developments, ya economic data releases ke asarat, pattern ke signals ko override kar sakte hain. Is liye, traders ko hamesha saqafati baazari context mein amoor ki izafat aur ma'amool par qareebi nazar rakhni chahiye.

Practice and Experience: Saucer Bottom pattern ki pehchan aur iska sahih tarjuma karne ke liye amal aur tajribah bohot zaroori hai. Traders ko mustaqbil ke chand currency pairs aur timeframes mein is pattern ko apply kar ke iski behavior ko samajhna chahiye, taki wo iski behavior ke baray mein practical malumat hasil kar sakein.

Characteristics of the Saucer Bottom Chart Pattern

Gradual Transition: Saucer Bottom pattern ki aik ahmiyat angaiz baat ye hai ke is mein bearish trend se sideways ya consolidate hone ki taraf dheerey dheerey transition hoti hai. Ye dikhata hai ke buyers dheerey dheerey control mein aa rahe hain.

Volume Analysis: Volume analysis Saucer Bottom pattern ki tasdeeq ke liye ahamiyyat rakhta hai. Is pattern ki formation ke doran, trading volumes mein kami hoti hai jab market consolidate hoti hai. Lekin jab price saucer bottom bana kar upar jaane lagta hai, toh trading volume mein izafah hone chahiye, jo ke strong buying interest ko darust karta hai.

Round Shape: Saucer Bottom pattern ki pehchan uske round shape mein hai, jo isay doosre chart patterns se alag karta hai. Ye smooth, round formation dikhata hai, jo market sentiment mein dheerey dheerey tabdeeli aur bearish trend ki bullish mein muntaqil hone ki mumkin nishan dahi karta hai.

Significance of the Saucer Bottom Pattern

Saucer Bottom pattern ka bohot bara maqam is liye hai ke ye market dynamics mein tabdeeli ki taraf isharaat deta hai. Lambi muddat tak chalne wale downtrend ke baad, ye pattern ye signal deta hai ke buyers ki taqat barh rahi hai, aur bearish trend ki bullish mein muntaqil hone ki chances hai. Traders is pattern ko strong buy signal ke tor par consider karte hain, jisay ye dikhata hai ke ab mojooda waqt mein long positions enter karne ka moqa ho sakta hai jahan price ki mazeed izafah ki tawakul ki ja sakti hai.

Trading Strategies Based on the Saucer Bottom Pattern

Confirmation: Saucer Bottom pattern pe trade karnay se pehle tasdeeq ka intezaar karna bohot zaroori hai. Tasdeeq saucer ke rim ya neckline ke upar decisive breakout ke sath aane par hoti hai, jise significant trading volume ke izafay ke sath sath confirm hoti hai. Ye breakout pattern ki tasdeeq karta hai aur traders ko long trade enter karne ka strong signal deta hai.

Stop Loss and Take Profit Levels: Saucer Bottom pattern ka istemal karne wale traders ko sahi risk management techniques implement karni chahiye. Saucer bottom ke niche ek stop-loss order set karna zaroori hai, taki is surat e haal mein protection ho sake agar pattern materialize na ho. Iske ilawa, traders historical price data, support/resistance levels ya Fibonacci retracement levels ke basis par take-profit levels set kar sakte hain, taki price upar jaate waqt profit secure ki ja sake.

Volume Confirmation: Trading volumes par qareebi tawajjah dena zaroori hai. Saucer Bottom ke rim ke upar breakout ke doran volume mein izafah hone par pattern ki tasdeeq hoti hai, jo traders ko unke trading decision mein confidence deta hai.

Additional Technical Indicators: Traders Saucer Bottom pattern ko doosre technical indicators jaise ke moving averages, Relative Strength Index (RSI), ya Moving Average Convergence Divergence (MACD) ke sath combine karte hain, taake unke trading signals ki accuracy ko barhaya ja sake. Ye indicators pattern ki strength aur potential bullish momentum ki additional tasdeeq provide kar sakte hain.

Jabke Saucer Bottom pattern forex trading mein aik taqatwar tool hai, lekin ye puri tarah bharosemand nahi hota aur traders ko ihtiyat se kaam lena chahiye. Jaise ke tamam technical analysis patterns, saucer bottom bhi historical price data par mabni hota hai aur is se future price movements ko sahi tarah se predict karne ki guarantee nahi hoti.

False Signals: Kabhi kabhi Saucer Bottom pattern ghalat signals de sakta hai, jis se traders aise trades mein dakhil ho sakte hain jo unki expectations ke mutabiq nahi hoti. Is risk ko kam karne ke liye, ye zaroori hai ke breakout aur volume analysis ke liye tasdeeq ka intezaar kiya jaye trading decisions se pehle.

Market Conditions: Market shara'it aur baazari factors is pattern ki effectiveness par asar dal sakte hain. Achanak aane wale khabron, geopolitical developments, ya economic data releases ke asarat, pattern ke signals ko override kar sakte hain. Is liye, traders ko hamesha saqafati baazari context mein amoor ki izafat aur ma'amool par qareebi nazar rakhni chahiye.

Practice and Experience: Saucer Bottom pattern ki pehchan aur iska sahih tarjuma karne ke liye amal aur tajribah bohot zaroori hai. Traders ko mustaqbil ke chand currency pairs aur timeframes mein is pattern ko apply kar ke iski behavior ko samajhna chahiye, taki wo iski behavior ke baray mein practical malumat hasil kar sakein.

تبصرہ

Расширенный режим Обычный режим