Hormonic Price Chart pattern kia hy

traders aur investors ko price charts par patterns ke liye search karna hota hai. Ye patterns, price movements aur Fibonacci ratios ke correlation ke basis par create kie jate hain aur price movements ko predict karne ke liye use kie jate hain.Hormonic Price Chat Pattern, trading mein bohat ahem rol ada karta hai. Iss pattern ko samajhna traders kay liye zaroori hai, kyunki iss say unko market trend ka pata chalta hai aur woh trading decisions bhi sahi tareeqay se le saktay hain.Hormonic Price Chat Pattern mein, prices aik specific sequence mein move kartay hain, jis kay baad woh phir se wohi sequence repeat kartay hain. Iss pattern ko samajhna traders ke liye bohat zaroori hai, kyunki iss say unko market trend ka pata chalta hai aur woh trading decisions bhi sahi tareeqay se le saktay hain.Hormonic Price Chat Pattern ki alamaat mein kuch specific shapes aur ratios shaamil hotay hain, jaisay ke Gartley, Butterfly, Crab aur Bat. In shapes aur ratios ko samajhna traders ke liye zaroori hai,

Understanding of chart pattern

Price chart patterns are visual representations of historical price movements in the forex market. (Keemat chart patterns forex market mein tareekhi keemat ki harkaton ka tasawwur darust karte hain.)

Working of harmonic price chart patterns

Harmonic Price Chart Patterns, technical analysis mein use kie jane wale price patterns hai, jo price action analysis ko incorporate karte hain. Ye patterns, price charts ke shapes aur price movements ko observe karke banaye jate hain aur ye shapes Fibonacci ratios ke saath bhi correlate karte hain. In patterns ko identify karne se traders aur investors price movements ko predict kar sakte hain aur trading decisions lena sikh sakte hain.Harmonic Price Chart Patterns ka main kaam, market trends aur price movements ko predict karna hota hai. Ye patterns, price movements aur Fibonacci ratios ke correlation ke basis par banaye jate hain aur ye patterns, price movements ko predict karne ke liye use kie jate hain. Ye patterns, bullish aur bearish dono forms mein aate hain aur ye patterns ka use, market mein trend ko samajhne aur trading decisions lena ke liye kia jata hai.Harmonic Price Chart Patterns ka use, traders aur investors ke liye bahut important hai, kyunki ye patterns market movements aur trend ko samajhne mein madad karte hain. In patterns ko identify karne se, traders aur investors price movements ko predict kar sakte hain aur trading decisions lena sikh sakte hain. Iske alava, traders aur investors ko Harmonic Price Chart Patterns ke saath risk management ke concept ko bhi acche se samajhna hota hai, jisse unhe trading losses ko minimize karne mein help milti

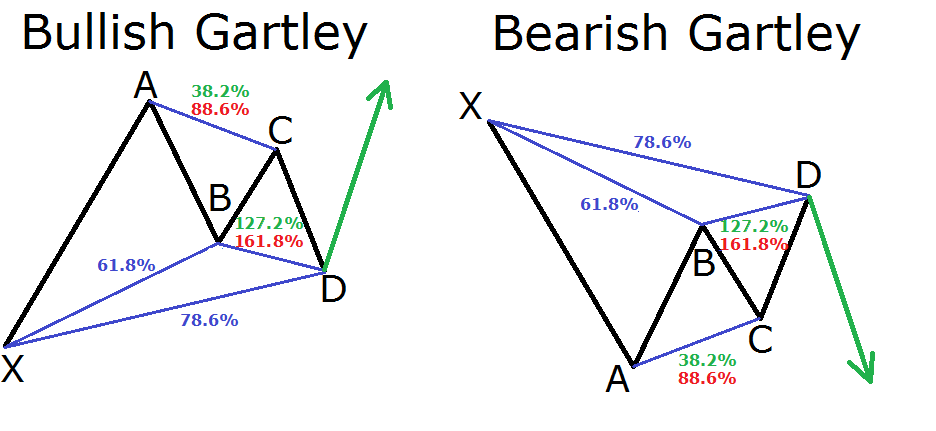

Example of harmonic price chart patterns

harmonic patteren set up mein, trade ki shanakht is waqt hoti hai jab pehli 3 tangen mukammal ho jati hain ( 5 point patteren mein ). misaal ke tor par, gartili blush patteren mein, xa, ab aur bc tangen mukammal ho jati hain aur yeh cd taang ban-na shuru kar deti hain, aap is baat ki nishandahi karen ge ke mumkina tijarat ho sakti hai .

Trend line of harmonic price chart pattern

Dear Sisters and Brothers Market mein analysis karne ke liye hamein harmonic price chart pattern ko analyse karne ke liye trendline ko use karna parta hai aur agar hum harmonic pattern ke liye trendline ko theek tarike se use kar lete hain to hum market mein easily harmonic pattern ko analyse kar sakte hain aur market se good benefits le sakte hain isliye hamein zaruri hai ke hum trendline ka using hamein aana chahiye tab hi hum easily harmonic pattern ko analyse kar sakenge otherwise market mein kisi bhi channel yah pattern pe analyzed karna possible nahin hoga so hamein struggle karna chahiye aur daily bhejte practice karni chahiye ta ke hum harmonic pattern se fayda utha

traders aur investors ko price charts par patterns ke liye search karna hota hai. Ye patterns, price movements aur Fibonacci ratios ke correlation ke basis par create kie jate hain aur price movements ko predict karne ke liye use kie jate hain.Hormonic Price Chat Pattern, trading mein bohat ahem rol ada karta hai. Iss pattern ko samajhna traders kay liye zaroori hai, kyunki iss say unko market trend ka pata chalta hai aur woh trading decisions bhi sahi tareeqay se le saktay hain.Hormonic Price Chat Pattern mein, prices aik specific sequence mein move kartay hain, jis kay baad woh phir se wohi sequence repeat kartay hain. Iss pattern ko samajhna traders ke liye bohat zaroori hai, kyunki iss say unko market trend ka pata chalta hai aur woh trading decisions bhi sahi tareeqay se le saktay hain.Hormonic Price Chat Pattern ki alamaat mein kuch specific shapes aur ratios shaamil hotay hain, jaisay ke Gartley, Butterfly, Crab aur Bat. In shapes aur ratios ko samajhna traders ke liye zaroori hai,

Understanding of chart pattern

Price chart patterns are visual representations of historical price movements in the forex market. (Keemat chart patterns forex market mein tareekhi keemat ki harkaton ka tasawwur darust karte hain.)

Working of harmonic price chart patterns

Harmonic Price Chart Patterns, technical analysis mein use kie jane wale price patterns hai, jo price action analysis ko incorporate karte hain. Ye patterns, price charts ke shapes aur price movements ko observe karke banaye jate hain aur ye shapes Fibonacci ratios ke saath bhi correlate karte hain. In patterns ko identify karne se traders aur investors price movements ko predict kar sakte hain aur trading decisions lena sikh sakte hain.Harmonic Price Chart Patterns ka main kaam, market trends aur price movements ko predict karna hota hai. Ye patterns, price movements aur Fibonacci ratios ke correlation ke basis par banaye jate hain aur ye patterns, price movements ko predict karne ke liye use kie jate hain. Ye patterns, bullish aur bearish dono forms mein aate hain aur ye patterns ka use, market mein trend ko samajhne aur trading decisions lena ke liye kia jata hai.Harmonic Price Chart Patterns ka use, traders aur investors ke liye bahut important hai, kyunki ye patterns market movements aur trend ko samajhne mein madad karte hain. In patterns ko identify karne se, traders aur investors price movements ko predict kar sakte hain aur trading decisions lena sikh sakte hain. Iske alava, traders aur investors ko Harmonic Price Chart Patterns ke saath risk management ke concept ko bhi acche se samajhna hota hai, jisse unhe trading losses ko minimize karne mein help milti

Example of harmonic price chart patterns

harmonic patteren set up mein, trade ki shanakht is waqt hoti hai jab pehli 3 tangen mukammal ho jati hain ( 5 point patteren mein ). misaal ke tor par, gartili blush patteren mein, xa, ab aur bc tangen mukammal ho jati hain aur yeh cd taang ban-na shuru kar deti hain, aap is baat ki nishandahi karen ge ke mumkina tijarat ho sakti hai .

Trend line of harmonic price chart pattern

Dear Sisters and Brothers Market mein analysis karne ke liye hamein harmonic price chart pattern ko analyse karne ke liye trendline ko use karna parta hai aur agar hum harmonic pattern ke liye trendline ko theek tarike se use kar lete hain to hum market mein easily harmonic pattern ko analyse kar sakte hain aur market se good benefits le sakte hain isliye hamein zaruri hai ke hum trendline ka using hamein aana chahiye tab hi hum easily harmonic pattern ko analyse kar sakenge otherwise market mein kisi bhi channel yah pattern pe analyzed karna possible nahin hoga so hamein struggle karna chahiye aur daily bhejte practice karni chahiye ta ke hum harmonic pattern se fayda utha

تبصرہ

Расширенный режим Обычный режим