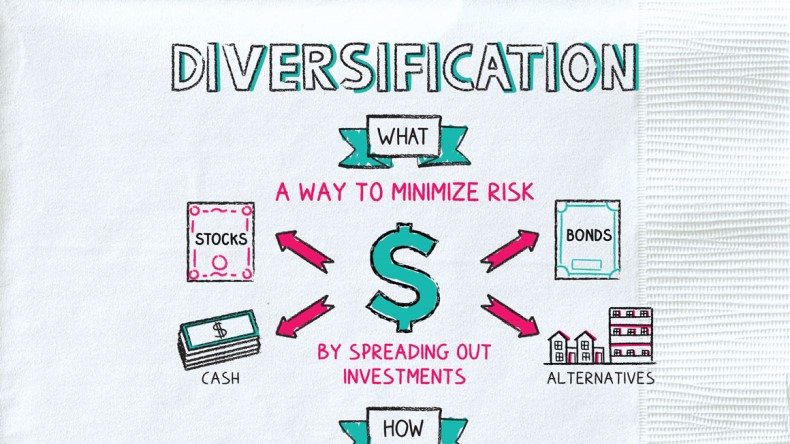

Diversification ek risk management strategy hai jismein investors apne investments ko mukhtalif asset classes mein baant dete hain taki ek hi type ke asset ki negative impact se bacha ja sake. Trading portfolio mein diversification ka istemal karke investors apne overall risk ko kam karte hain. Yahan, main is concept ko explain karne ki koshish kar raha hoon:

- Diversification ka Matlab:

- Diversification ka asal maqsad hai apne portfolio mein mukhtalif tarah ke investments shamil karke risk ko spread karna. Agar aap sirf ek hi type ya ek hi sector ke investments mein hain, toh agar us sector mein kisi negative event ya market downturn ka asar hua, toh aapka poora portfolio uss se mutasir ho sakta hai. Diversification se aap apne eggs ko alag-alag baskets mein rakh rahe hote hain.

- Mukhtalif Asset Classes:

- Diversification mein mukhtalif asset classes shamil kiye jate hain jaise ke stocks, bonds, commodities, aur real estate. Har asset class apne taur par react karta hai economic conditions aur market changes par, is liye inko milakar rakhna portfolio ke liye faydemand hota hai.

- Sectoral Diversification:

- Stocks mein sectoral diversification ka bhi khayal rakha jata hai. Agar aapke portfolio mein mukhtalif sectors ke stocks hain, toh agar kisi sector mein loss hua, toh doosre sectors ke strong performance se nuksan kam ho sakta hai.

- Geographical Diversification:

- Geographical diversification bhi ek ahem hissa hai. Agar aap sirf ek hi region ke market mein invest kar rahe hain, toh regional economic conditions ya political instability ka asar aapke portfolio par bhaari ho sakta hai. Diversification se aap apne investments ko various regions mein distribute kar sakte hain.

- Risk Reduction:

- Diversification se portfolio ke overall risk ko kam kiya ja sakta hai. Jab ek investment mein loss hota hai, toh doosri investments ke asar ko compensate kiya ja sakta hai. Isse overall portfolio ka risk kam hota hai.

- Returns ka Balance:

- Diversification se nukta chini tarah se kaam hota hai aur yeh koshish karta hai ke portfolio ka overall return barqarar rahe. Agar kisi ek investment mein zyada profit ho, toh doosre investments ka asar bhi mehsoos hota hai.

Diversification ke zariye, investors apne investments ko samajhdar taur par manage kar sakte hain, aur market ke fluctuations se kam nuksan utha sakte hain. Yeh ek prudential approach hai jo long-term financial stability ke liye ahem hai.

https://www.google.com/imgres?imgurl...oQMygFegQIARA3

تبصرہ

Расширенный режим Обычный режим