UNDERSTANDING THE THREE RIVER PATTERN IN FOREX TRADING :

Trading mein three river ka tariqa ak aesa unique or advanced tariqa ha jis se darja se trade karne mein madad karti ha. Ye pattern three lagatar candlesticks se banata ha or am tor par trend karne wale markat mein dakha jata ha. Isko "Three River" pattern isliye kaha jata ha kyunke iska banavat three river ke tarah dikhta ha jo ak hi disha mein beh rahi ha.

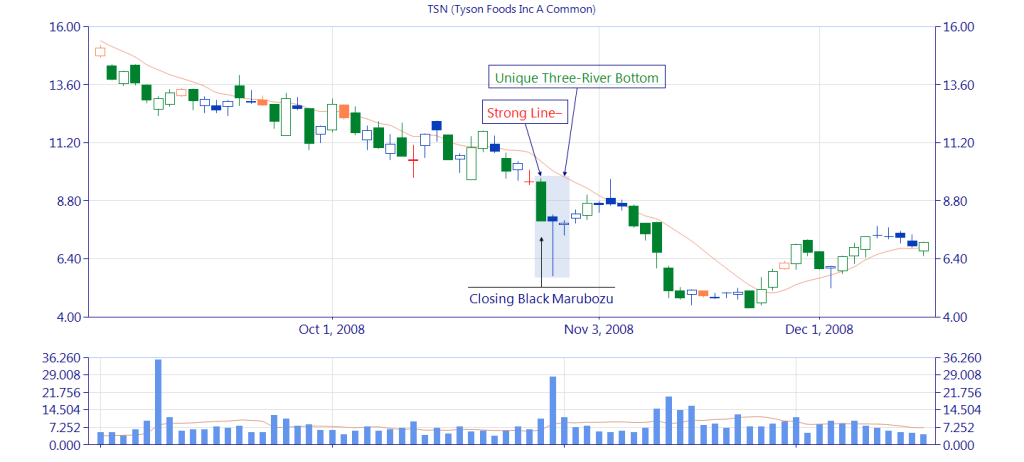

Three River pattern ko pehchanne ka liye, traders ko three lagatar candlesticks ke khoobiyon par dhyan dena hota ha. Pehli candlestick ak lambi bullish (hara) candlestick honi chahiye, jo markat mein majboot upwards momentum ko darshata ha. Dusri candlestick chhote bearish (lal) candlestick honi chahiye, jo temporary pullback ya bullish trend mein hichkechaahat ko darshati ha. Ant mein, teesri candlestick ak or lambi bullish candlestick honi chahiye, jo pehli candlestick ke high ko todti ha or upwards momentum ka jari rakhne ke soochna karte ha.

ANALYSIS OF THE THREE RIVER PATTERN :

Three River pattern ka tafsili jaiza karna markat participants ke psychology or unke bhavnao ko samajhne par tika hota ha, jab pattern ban raha hota ha. Pehli lambi bullish candlestick majboot kharidari dabao or bullish momentum ko darshati ha. Laken, doosri chhote bearish candlestick yeh sankat deti ha ke kuch traders apna munafa lena shuru kar rahe ha ya bullish movement mein hichkechaahat mahsoos kar rahe ha. Yeh temporary pullback naye buyers ka liye mauka banata ha ke woh markat mein nichle price par enter kar saka. Teesri lambi bullish candlestick ye dikhata ha ke kharidari wale punah control mein aa gaye ha or price pehle candlestick ke high ko tod kar trend ko jari rakh rahe ha.

Traders Three River pattern ke strength ko validate karne ka liye alag alag technical indicators or analysis tools ka istemal kar sakte ha. For example, woh volume indicators ka istemal kar sakte ha take pattern banne ka samay increased buying pressure ko confirm kar saka. Iska saath hi momentum indicators ka istemal bullish trend ke strength or potential reversals ka andaza lagane ka liye keya jaa sakta ha.

TRADING STRATEGIES USING THE THREE RIVER PATTERN :

Three River pattern ka istemal karka trading karne ke strategies trader ka risk appetite, timeframes or markat conditions par depend karti ha. Ek am tariqa ha ke jab teesri bullish candlestick pehli candlestick ke high ka upar bandh ho jaaye, tab ak long trade enter keya jaaye. Ye entry strategy bullish trend ka jari rakhne ke koshish karti ha. Traders stop loss ko dusri candlestick ke low ka neeche set kar sakte ha, take trend reversal ka case mein potential nuksan ko seemit kar saka.

Ek or strategy ha ke pattern banne ka baad jab pullback ho, tab trade ko ak adhik favourable price par enter keya jaaye. Ye strategy traders ka risk-reward ratio ko badhane mein madad karti ha laken entry ka samay adhik dheeraj or dhyan ke zaroorat hote ha.

RISK MANAGEMENT IN TRADING THE THREE RIVER PATTERN :

Jaise ke kesi bhi trading strategy mein, risk management Three River pattern mein bhi mahatvapurna ha. Traders ko apne risk tolerance ko define karna chahiye or apne capital ko bachane ka liye seemit samay par sahi stop-loss level set karna chahiye. Stop loss orders ka saath saath, traders trailing stop orders ka bhi istemal kar sakte ha take profit ko protect kar saka or trend ka jari rahne par gains ko secure kar saka.

Three river pattern par trading decisions lene ka liye sirf pattern par nirbhar na hona zaroori ha. Markat conditions, news events, or dusre technical factors ko bhi madde nazar rakhte hue trading ka faisle lena chahiye, jisse galat signals or potential nuksan se bacha ja saka.

ADVANTAGES AND LIMITATIONS OF THE THREE RIVER PATTERN :

Three river pattern ka ak fayda ye ha ka ye traders ko potential trend reversals ko pehchanne ka liye saaf visual signal provide karta ha. Ye traders ko markat pullbacks ka fayda uthane or trend abhi bhi jari rahe tab trade enter karne mein madad karta ha. Iska alawa, ye pattern samajhna relatively aasan ha or isse saath hi dusre technical indicators ka saath istemal karka accuracy ko badhaya ja sakta ha.

Halaanke, Three river pattern behtareen nahi ha or kabhi kabhi galat signals bhi de sakta ha. Traders ko trading decisions lene se pehle additional technical analysis or confirmatory indicators ka istemal karna chahiye pattern ko verify karne ka liye. Iska alawa, ye pattern range-bound ya choppy markats mein itni effective nahi ho sakta ha, kyun ke ye primarily trending conditions ka liye hi suited ha.

Trading mein three river ka tariqa ak aesa unique or advanced tariqa ha jis se darja se trade karne mein madad karti ha. Ye pattern three lagatar candlesticks se banata ha or am tor par trend karne wale markat mein dakha jata ha. Isko "Three River" pattern isliye kaha jata ha kyunke iska banavat three river ke tarah dikhta ha jo ak hi disha mein beh rahi ha.

Three River pattern ko pehchanne ka liye, traders ko three lagatar candlesticks ke khoobiyon par dhyan dena hota ha. Pehli candlestick ak lambi bullish (hara) candlestick honi chahiye, jo markat mein majboot upwards momentum ko darshata ha. Dusri candlestick chhote bearish (lal) candlestick honi chahiye, jo temporary pullback ya bullish trend mein hichkechaahat ko darshati ha. Ant mein, teesri candlestick ak or lambi bullish candlestick honi chahiye, jo pehli candlestick ke high ko todti ha or upwards momentum ka jari rakhne ke soochna karte ha.

ANALYSIS OF THE THREE RIVER PATTERN :

Three River pattern ka tafsili jaiza karna markat participants ke psychology or unke bhavnao ko samajhne par tika hota ha, jab pattern ban raha hota ha. Pehli lambi bullish candlestick majboot kharidari dabao or bullish momentum ko darshati ha. Laken, doosri chhote bearish candlestick yeh sankat deti ha ke kuch traders apna munafa lena shuru kar rahe ha ya bullish movement mein hichkechaahat mahsoos kar rahe ha. Yeh temporary pullback naye buyers ka liye mauka banata ha ke woh markat mein nichle price par enter kar saka. Teesri lambi bullish candlestick ye dikhata ha ke kharidari wale punah control mein aa gaye ha or price pehle candlestick ke high ko tod kar trend ko jari rakh rahe ha.

Traders Three River pattern ke strength ko validate karne ka liye alag alag technical indicators or analysis tools ka istemal kar sakte ha. For example, woh volume indicators ka istemal kar sakte ha take pattern banne ka samay increased buying pressure ko confirm kar saka. Iska saath hi momentum indicators ka istemal bullish trend ke strength or potential reversals ka andaza lagane ka liye keya jaa sakta ha.

TRADING STRATEGIES USING THE THREE RIVER PATTERN :

Three River pattern ka istemal karka trading karne ke strategies trader ka risk appetite, timeframes or markat conditions par depend karti ha. Ek am tariqa ha ke jab teesri bullish candlestick pehli candlestick ke high ka upar bandh ho jaaye, tab ak long trade enter keya jaaye. Ye entry strategy bullish trend ka jari rakhne ke koshish karti ha. Traders stop loss ko dusri candlestick ke low ka neeche set kar sakte ha, take trend reversal ka case mein potential nuksan ko seemit kar saka.

Ek or strategy ha ke pattern banne ka baad jab pullback ho, tab trade ko ak adhik favourable price par enter keya jaaye. Ye strategy traders ka risk-reward ratio ko badhane mein madad karti ha laken entry ka samay adhik dheeraj or dhyan ke zaroorat hote ha.

RISK MANAGEMENT IN TRADING THE THREE RIVER PATTERN :

Jaise ke kesi bhi trading strategy mein, risk management Three River pattern mein bhi mahatvapurna ha. Traders ko apne risk tolerance ko define karna chahiye or apne capital ko bachane ka liye seemit samay par sahi stop-loss level set karna chahiye. Stop loss orders ka saath saath, traders trailing stop orders ka bhi istemal kar sakte ha take profit ko protect kar saka or trend ka jari rahne par gains ko secure kar saka.

Three river pattern par trading decisions lene ka liye sirf pattern par nirbhar na hona zaroori ha. Markat conditions, news events, or dusre technical factors ko bhi madde nazar rakhte hue trading ka faisle lena chahiye, jisse galat signals or potential nuksan se bacha ja saka.

ADVANTAGES AND LIMITATIONS OF THE THREE RIVER PATTERN :

Three river pattern ka ak fayda ye ha ka ye traders ko potential trend reversals ko pehchanne ka liye saaf visual signal provide karta ha. Ye traders ko markat pullbacks ka fayda uthane or trend abhi bhi jari rahe tab trade enter karne mein madad karta ha. Iska alawa, ye pattern samajhna relatively aasan ha or isse saath hi dusre technical indicators ka saath istemal karka accuracy ko badhaya ja sakta ha.

Halaanke, Three river pattern behtareen nahi ha or kabhi kabhi galat signals bhi de sakta ha. Traders ko trading decisions lene se pehle additional technical analysis or confirmatory indicators ka istemal karna chahiye pattern ko verify karne ka liye. Iska alawa, ye pattern range-bound ya choppy markats mein itni effective nahi ho sakta ha, kyun ke ye primarily trending conditions ka liye hi suited ha.

تبصرہ

Расширенный режим Обычный режим