Forex market mein pivot points par trading karna ek popular strategy hai jo ke bohot se traders istemal karte hain taake potential entry aur exit points ka andaza lagaya ja sake. Pivot points woh significant price levels hote hain jo ke previous day ki high, low, aur close prices se calculate kiye jate hain. Ye levels support aur resistance areas ke taur par kaam karte hain, traders ko potential price movements ke bare mein maloomat faraham karte hain. Pivot point strategy implement karna matlab hai ke aapko samajhna hoga ke ye levels kaise calculate hote hain aur unka istemal sahi trading decisions ke liye kaise kiya jata hai.

Calculation and Significance of Pivot Points

Pivot points ko calculate karne ke liye aik asaan formula istemal hota hai jo ke previous day ki high, low, aur close prices ko shamil karta hai. Central pivot point (PP) woh average hota hai jo ke previous day ki high, low, aur close ki values ka hota hai. Central pivot point ke basis par, traders kuch support aur resistance levels calculate kar sakte hain. Pehla support level (S1) aur resistance level (R1) is tareeqe se calculate kiye ja sakte hain.

Support 1 (S1)=(2×PP)−High

Resistance 1 (R1) = (2×PP)−Low

Isi tarah doosra support level (S2) aur resistance level (R2) calculate kiye ja sakte hain:

Support 2 (S2)=PP−(High−Low)

Resistance 2 (R2)=PP+(High−Low)

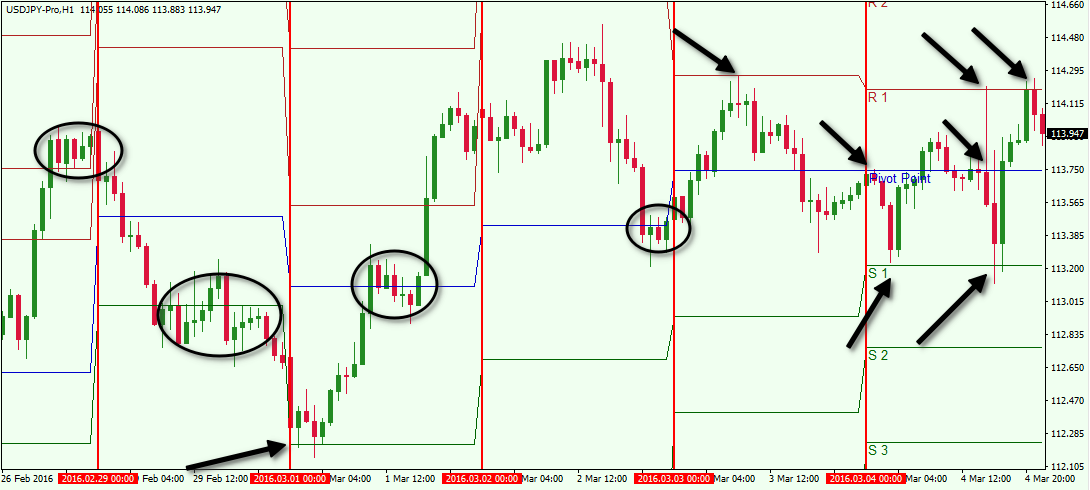

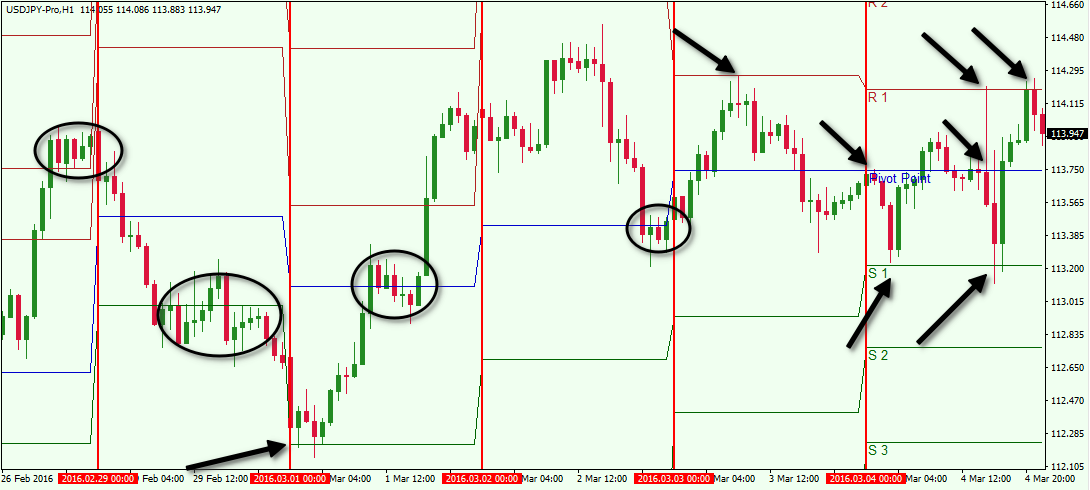

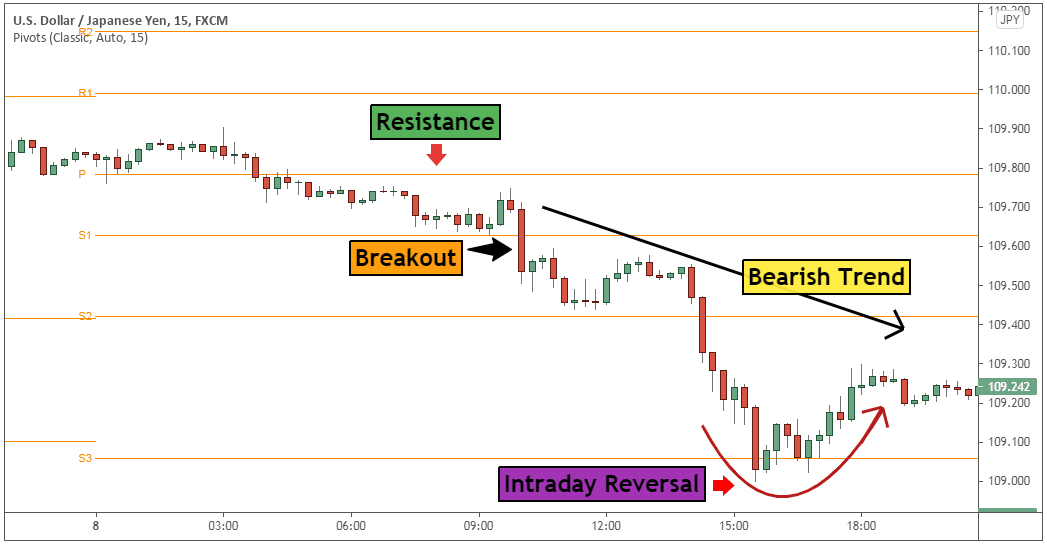

Pivot Point Breakout Strategy

Pivot points, woh traders ke liye khaas tor par faida-mand hote hain jo ke short-term price movements par fakhar uthana chahte hain. Traders pivot points ka istemal kar ke potential reversal ya breakout levels ko pehchante hain. Agar price kisi pivot point level ke qareeb aati hai, to market ki behavior ko observe karna bohot zaroori hai. Agar price kisi pivot point level se bounce hoti hai aur reversal ke signs dikhata hai, to is se yeh samajhna mumkin hota hai ke woh level strong support ya resistance hai, bounce ki direction ke mutabiq. Traders often additional technical indicators ya candlestick patterns ka istemal karte hain apne trading decisions confirm karne ke liye jab price pivot points ke saath interact karta hai.

Aik common trading strategy jo pivot points par mabni hoti hai, woh hai pivot point bounce strategy. Is approach mein, traders wait karte hain ke price kisi pivot point level ke qareeb aaye aur dekhte hain ke market ka reaction kaise hota hai. Agar price kisi pivot point level se bounce hoti hai aur reversal ke signs dikhata hai, to traders us direction mein trade enter kar sakte hain jis direction mein bounce hota hai. For example, agar price kisi support level (S1, S2, etc.) se bounce hoti hai, to traders long (buy) position consider kar sakte hain. Ulta, agar price kisi resistance level (R1, R2, etc.) se bounce hoti hai, to traders short (sell) position consider kar sakte hain. Ek aur strategy hai pivot point breakout strategy. Is approach mein, traders pivot point levels ko monitor karte hain potential breakouts ke liye. Jab price kisi resistance level ke upar ya kisi support level ke neeche significant volume aur momentum ke saath break hoti hai, to yeh indicate karta hai ke potential trend continuation ho sakti hai. Traders us breakout ke direction mein trade enter kar sakte hain, expecting ke aik sustained price movement hone wala hai.

Market Conditions and Pivot Point Effectiveness

Pivot points par trading karte waqt, dusre factors ko bhi ghor se consider karna zaroori hai, jese ke market trends, economic news, aur overall market sentiment. Pivot points zyada effective hotay hain ranging markets mein, jahan prices ek horizontal range mein move hoti hain. Strong trends ke doran, pivot points reliable signals provide nahi kar sakti, kyun ke prices aik direction mein move hoti hain bina significant pullbacks ke. Risk management ka istemal karte waqt caution zaroori hai jab pivot points par trading ki ja rahi hoti hai. Traders ko stop-loss orders set karna chahiye takay potential nuqsaan ko limit kiya ja sake aur sahi risk-reward ratios ka khayal rakha ja sake. Iske alawa, pivot points ko doosre technical indicators jese ke moving averages ya oscillators ke saath combine kar ke trading signals ki accuracy ko barha sakte hain.

Calculation and Significance of Pivot Points

Pivot points ko calculate karne ke liye aik asaan formula istemal hota hai jo ke previous day ki high, low, aur close prices ko shamil karta hai. Central pivot point (PP) woh average hota hai jo ke previous day ki high, low, aur close ki values ka hota hai. Central pivot point ke basis par, traders kuch support aur resistance levels calculate kar sakte hain. Pehla support level (S1) aur resistance level (R1) is tareeqe se calculate kiye ja sakte hain.

Support 1 (S1)=(2×PP)−High

Resistance 1 (R1) = (2×PP)−Low

Isi tarah doosra support level (S2) aur resistance level (R2) calculate kiye ja sakte hain:

Support 2 (S2)=PP−(High−Low)

Resistance 2 (R2)=PP+(High−Low)

Pivot Point Breakout Strategy

Pivot points, woh traders ke liye khaas tor par faida-mand hote hain jo ke short-term price movements par fakhar uthana chahte hain. Traders pivot points ka istemal kar ke potential reversal ya breakout levels ko pehchante hain. Agar price kisi pivot point level ke qareeb aati hai, to market ki behavior ko observe karna bohot zaroori hai. Agar price kisi pivot point level se bounce hoti hai aur reversal ke signs dikhata hai, to is se yeh samajhna mumkin hota hai ke woh level strong support ya resistance hai, bounce ki direction ke mutabiq. Traders often additional technical indicators ya candlestick patterns ka istemal karte hain apne trading decisions confirm karne ke liye jab price pivot points ke saath interact karta hai.

Aik common trading strategy jo pivot points par mabni hoti hai, woh hai pivot point bounce strategy. Is approach mein, traders wait karte hain ke price kisi pivot point level ke qareeb aaye aur dekhte hain ke market ka reaction kaise hota hai. Agar price kisi pivot point level se bounce hoti hai aur reversal ke signs dikhata hai, to traders us direction mein trade enter kar sakte hain jis direction mein bounce hota hai. For example, agar price kisi support level (S1, S2, etc.) se bounce hoti hai, to traders long (buy) position consider kar sakte hain. Ulta, agar price kisi resistance level (R1, R2, etc.) se bounce hoti hai, to traders short (sell) position consider kar sakte hain. Ek aur strategy hai pivot point breakout strategy. Is approach mein, traders pivot point levels ko monitor karte hain potential breakouts ke liye. Jab price kisi resistance level ke upar ya kisi support level ke neeche significant volume aur momentum ke saath break hoti hai, to yeh indicate karta hai ke potential trend continuation ho sakti hai. Traders us breakout ke direction mein trade enter kar sakte hain, expecting ke aik sustained price movement hone wala hai.

Market Conditions and Pivot Point Effectiveness

Pivot points par trading karte waqt, dusre factors ko bhi ghor se consider karna zaroori hai, jese ke market trends, economic news, aur overall market sentiment. Pivot points zyada effective hotay hain ranging markets mein, jahan prices ek horizontal range mein move hoti hain. Strong trends ke doran, pivot points reliable signals provide nahi kar sakti, kyun ke prices aik direction mein move hoti hain bina significant pullbacks ke. Risk management ka istemal karte waqt caution zaroori hai jab pivot points par trading ki ja rahi hoti hai. Traders ko stop-loss orders set karna chahiye takay potential nuqsaan ko limit kiya ja sake aur sahi risk-reward ratios ka khayal rakha ja sake. Iske alawa, pivot points ko doosre technical indicators jese ke moving averages ya oscillators ke saath combine kar ke trading signals ki accuracy ko barha sakte hain.

تبصرہ

Расширенный режим Обычный режим