1. Three Black Crows Pattern Ki Understanding:

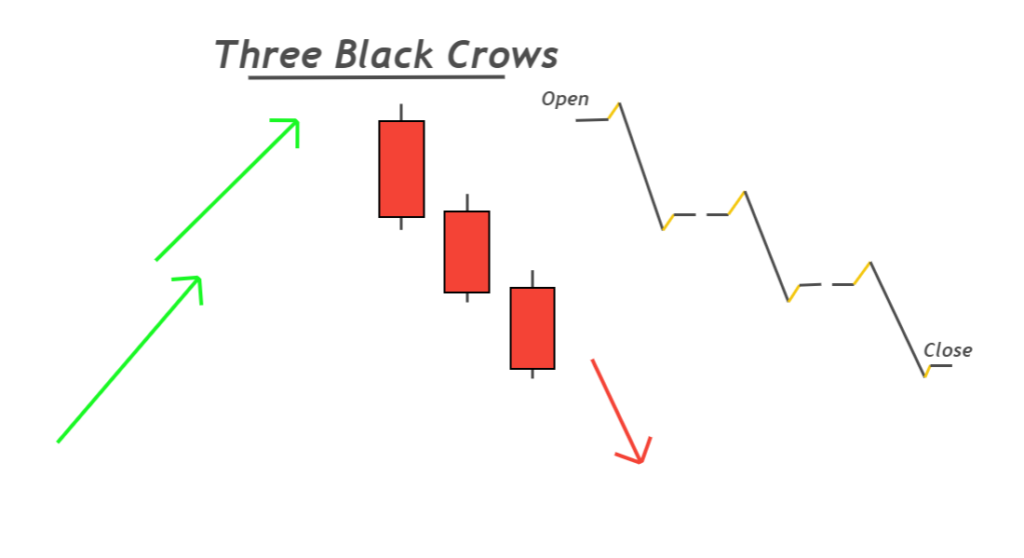

Three Black Crows ek bearish candlestick pattern hai jo teen mazidar surkhi (ya siyah) candles se bana hota hai. Ye candles aik dusre ki real body ke andar khulte hain aur apni low ke qareeb band hote hain. Is pattern se market mein taqatwar bearish reversal ka andaza lagaya jata hai.

2. Pattern Ko Pehchan'na:

Is pattern ko asar se istemal karne ke liye, sab se pehle apne Forex charts par isko pehchan'na zaroori hai. Teen mazidar surkhi candles dhoondhein, har candle pehli candle ki opening ke neeche khulti hai aur apni low ke qareeb band hoti hai.

3. Signal Tasdeeq Karna:

Three Black Crows pattern khud mein to aik taqatwar bearish signal hai, lekin ye zyada yaqeeni ho sakta hai jab ise doosre technical indicators aur analysis ke sath istemal kiya jaye. Overbought conditions, trend analysis, ya support aur resistance levels ki tarah mazeed tasdeeqen dhoondein.

4. Entry Aur Stop-Loss:

Jab aap Three Black Crows pattern ko pehchan'lain, to short position mein dakhil hone ka tasavvur karein. Apna stop-loss order third candle ki high ke ooper rakhain taake nuksan ko had se zyada na hone dein agar reversal na ho.

5. Target Price:

Apna target price tay karne ke liye pehli candle ki high aur teesri candle ki low ke darmiyan ki fasla nap karain. Is se aapko potential neeche ki taraf movement ka aik andaza mil jayega, lekin doosri market conditions ke hisab se apna target mukarar karnay ki taiyari rakhein.

6. Risk Management:

Forex trading mein hamesha munasib risk management techniques istemal karein. Kabhi bhi aik hi trade par zyada nuksan uthane se bachain aur apna risk munasib tareeqe se manage karne ke liye position sizing istemal karain.

7. Trade Ki Nazar Rakhein:

Apni trade ko barqarar dekhte rahein aur taiyari rakhein ke agar market conditions tabdeel ho jayein ya aapki analysis bearish reversal ko na dikhaye, to trade se bahir nikal jayein.

8. Explanation :

Three Black Crows pattern ko live trading mein istemal karne se pehle, demo account par amaliyat karein aur iski efektivness ko tareekhi data ke bary mein dhang se analyze karein.

9. Conclusion:

Forex trading mein kisi bhi trading strategy ko istemal karne se pehle, peshevar Forex mashwara denay wale se mashwara lain ya tafseel se research karein. Forex market khud mein khatra rakhti hai, aur aik soch samajh kar amal karna ahem hai.

Yaad rakhein ke Three Black Crows pattern bearish reversal ke liye taqatwar signal ho sakta hai, lekin ye 100% kaamyaab nahi hota, aur trading hamesha khatray aur nuksanat se wabasta hoti hai. Hamesha ihtiyat se trading karein aur apni investements ko hoshiyarana tareeqe se manage karein.

Three Black Crows ek bearish candlestick pattern hai jo teen mazidar surkhi (ya siyah) candles se bana hota hai. Ye candles aik dusre ki real body ke andar khulte hain aur apni low ke qareeb band hote hain. Is pattern se market mein taqatwar bearish reversal ka andaza lagaya jata hai.

2. Pattern Ko Pehchan'na:

Is pattern ko asar se istemal karne ke liye, sab se pehle apne Forex charts par isko pehchan'na zaroori hai. Teen mazidar surkhi candles dhoondhein, har candle pehli candle ki opening ke neeche khulti hai aur apni low ke qareeb band hoti hai.

3. Signal Tasdeeq Karna:

Three Black Crows pattern khud mein to aik taqatwar bearish signal hai, lekin ye zyada yaqeeni ho sakta hai jab ise doosre technical indicators aur analysis ke sath istemal kiya jaye. Overbought conditions, trend analysis, ya support aur resistance levels ki tarah mazeed tasdeeqen dhoondein.

4. Entry Aur Stop-Loss:

Jab aap Three Black Crows pattern ko pehchan'lain, to short position mein dakhil hone ka tasavvur karein. Apna stop-loss order third candle ki high ke ooper rakhain taake nuksan ko had se zyada na hone dein agar reversal na ho.

5. Target Price:

Apna target price tay karne ke liye pehli candle ki high aur teesri candle ki low ke darmiyan ki fasla nap karain. Is se aapko potential neeche ki taraf movement ka aik andaza mil jayega, lekin doosri market conditions ke hisab se apna target mukarar karnay ki taiyari rakhein.

6. Risk Management:

Forex trading mein hamesha munasib risk management techniques istemal karein. Kabhi bhi aik hi trade par zyada nuksan uthane se bachain aur apna risk munasib tareeqe se manage karne ke liye position sizing istemal karain.

7. Trade Ki Nazar Rakhein:

Apni trade ko barqarar dekhte rahein aur taiyari rakhein ke agar market conditions tabdeel ho jayein ya aapki analysis bearish reversal ko na dikhaye, to trade se bahir nikal jayein.

8. Explanation :

Three Black Crows pattern ko live trading mein istemal karne se pehle, demo account par amaliyat karein aur iski efektivness ko tareekhi data ke bary mein dhang se analyze karein.

9. Conclusion:

Forex trading mein kisi bhi trading strategy ko istemal karne se pehle, peshevar Forex mashwara denay wale se mashwara lain ya tafseel se research karein. Forex market khud mein khatra rakhti hai, aur aik soch samajh kar amal karna ahem hai.

Yaad rakhein ke Three Black Crows pattern bearish reversal ke liye taqatwar signal ho sakta hai, lekin ye 100% kaamyaab nahi hota, aur trading hamesha khatray aur nuksanat se wabasta hoti hai. Hamesha ihtiyat se trading karein aur apni investements ko hoshiyarana tareeqe se manage karein.

تبصرہ

Расширенный режим Обычный режим