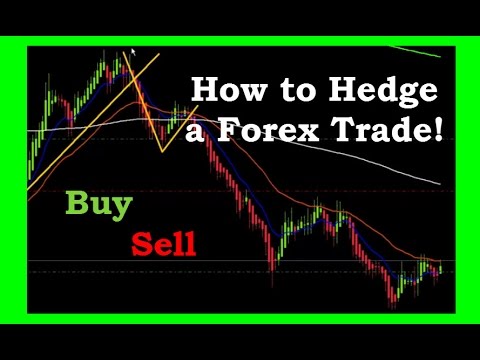

Hedging in forex trading

Forex trading mein hedging aik risk management technique hai jisme traders apne positions ko protect karne ke liye istemal karte hain. Hedging ka maqsad market volatility ya adverse price movements se apne portfolio ko bachana hota hai. Yeh technique traders ko nuqsaan se bachane aur potential profits ko secure karne mein madadgar hoti hai.

Hedging ka amal yeh hota hai ke ek trader apni existing position ko opposite direction mein ek aur position lekar cover karta hai. Yani agar kisi trader ka yakin hai ke uski existing position ko nuqsaan ho sakta hai, to wo us nuqsaan ko hedge karne ke liye doosri position le leta hai. Is tareeqe se, agar pehli position nuqsaan mein jaati hai, to doosri position us nuqsaan ko compensate kar leti hai.

Yeh kuch common hedging techniques hain jo forex traders istemal karte hain:

Forex trading mein hedging aik risk management technique hai jisme traders apne positions ko protect karne ke liye istemal karte hain. Hedging ka maqsad market volatility ya adverse price movements se apne portfolio ko bachana hota hai. Yeh technique traders ko nuqsaan se bachane aur potential profits ko secure karne mein madadgar hoti hai.

Hedging ka amal yeh hota hai ke ek trader apni existing position ko opposite direction mein ek aur position lekar cover karta hai. Yani agar kisi trader ka yakin hai ke uski existing position ko nuqsaan ho sakta hai, to wo us nuqsaan ko hedge karne ke liye doosri position le leta hai. Is tareeqe se, agar pehli position nuqsaan mein jaati hai, to doosri position us nuqsaan ko compensate kar leti hai.

Yeh kuch common hedging techniques hain jo forex traders istemal karte hain:

- Simple Hedging: Ismein trader apni existing position ko ek opposite position mein le leta hai. For example, agar ek trader EUR/USD pair par long position le rakha hai (yani usne Euro kharida hai aur Dollar becha hai), to wo phir se EUR/USD pair par short position le sakta hai (yani Euro bech kar Dollar kharid sakta hai).

- Multiple Currency Pairs Hedging: Kabhi kabhi traders ek currency pair ki position ko doosre currency pairs ke sath hedge karte hain. For example, agar trader EUR/USD pair par long position le rakha hai, to wo phir se USD/CHF pair par short position le sakta hai, kyun ke USD/CHF pair ki movement USD/EUR ki movement ke opposite hoti hai.

- Options Hedging: Options hedging mein traders options contracts ka istemal karte hain apne positions ko hedge karne ke liye. Yeh unko nuqsaan se bachane aur limited risk mein rehne ka aik tareeqa deta hai.

- Forward Contracts Hedging: Forward contracts ek specific future date par ek currency exchange rate ko lock karne ki ijaazat dete hain. Traders forward contracts ka istemal karke apni positions ko future price movements se hedge karte hain.

Hedging ka maqsad nuqsaan se bachana hai, lekin yeh technique bhi apne apne challenges ke sath aati hai. Jaise ke kuch brokers hedging ko allow nahi karte ya phir additional costs ka samna karna pad sakta hai. Is liye, har trader ko apne specific trading circumstances ke mutabiq hedging ka istemal karna chahiye aur iske fawaid aur nuqsaan ko samajh kar hi is tareeqe ka istemal karna chahiye.

تبصرہ

Расширенный режим Обычный режим