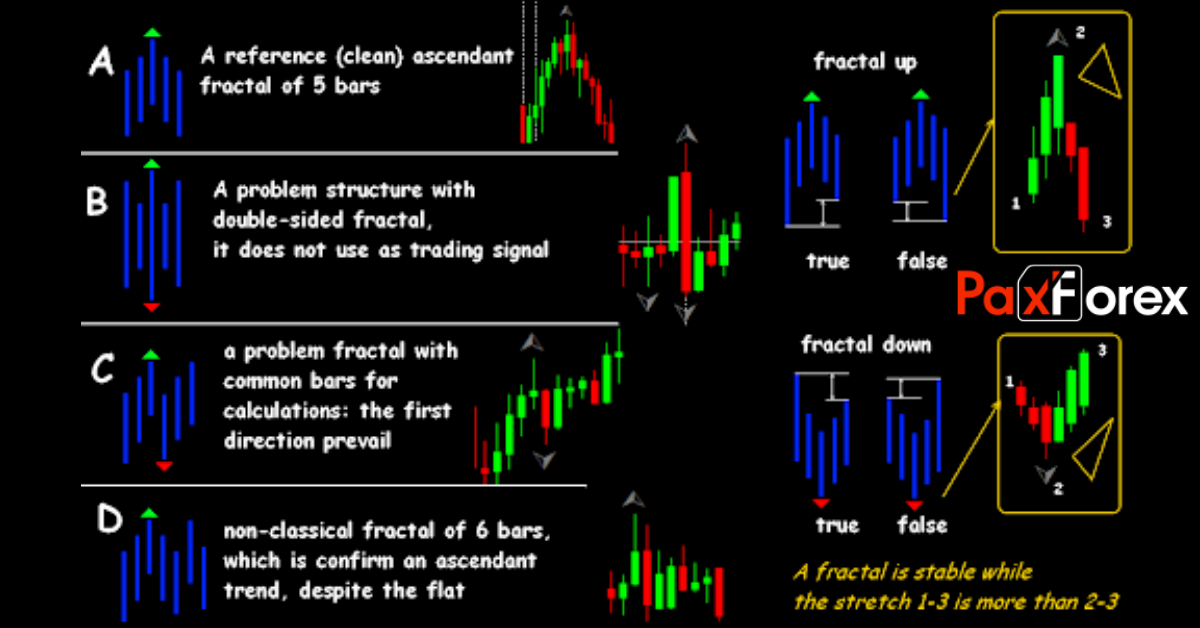

Fractal indicators forex trading mein aam istemal hone wala aik tool hai, jiska istemal price movements mein mukhalif tawajjah ke mumkin reversal points ko pehchanne ke liye kia jata hai. Yeh indicator Bill Williams, aik mashhoor trader aur musannif, ne develop kia tha, aur fractals ek mukammal trading system ka hissa hain jo mukhtalif indicators ko jama karke aik tawaja wala trading strategy banata hai. Forex trading ke context mein fractals, aik series ko refer karte hain jisme kam az kam paanch musalsal price bars shamil hote hain, jahan sab se zyada uncha high darmiyan mein hota hai, jiske do neeche ke highs us ke dono janib hote hain. Isi tarah, bullish fractal tab hota hai jab paanch musalsal bars hoti hain jisme kam az kam lowest low darmiyan mein hota hai, jise dono taraf se do zyada lows flank karte hain. Ye fractal patterns market mein mumkin reversal points ko highlight karte hain, jatate hue ke naye trend direction ka aghaz hone wala hai.

Construction of Fractal Indicators

Fractal indicators forex charts par aksar arrows ke roop mein darust kiye jate hain, jo ke price bars ke upar ya neeche nazar aate hain. Aik up arrow aik bullish fractal ko darust karta hai, jo ke potential buying opportunity ko zahir karta hai, jabke aik down arrow aik bearish fractal ko darust karta hai, jise ke potential selling opportunity ko ishara karta hai. Traders aksar in fractal signals ko apni trading decisions confirm karne ke liye dusre technical indicators aur chart patterns ke saath istemal karte hain.

Application of Fractals in Forex Trading

Identification of Reversal Points: Fractals ko primarily market mein key reversal points ko pehchanne ke liye istemal kia jata hai. Jab aik downtrend ke baad aik bullish fractal nazr aata hai, to ye aik potential bullish reversal ko indicate karta hai, jatate hue ke yeh aik long trade ke liye munasib waqt ho sakta hai. Barabar ke sath, uptrend ke baad aik bearish fractal hone ka matlab hai ke aik potential bearish reversal hone wala hai, jo ke aik suitable entry point ko ishara karta hai short trade ke liye.

Setting Stop Loss and Take Profit Levels: Traders fractals ko apni stop loss aur take profit levels tayin karne ke liye istemal karte hain. A bullish fractal ko stop loss tayin karne ke liye fractal ke low ke neeche rakh sakte hain, taki agar market trade ke khilaf chala jaye to nuksan se bacha ja sake. Isi tarah, bearish fractal ko stop loss tayin karne ke liye fractal ke high ke upar rakh sakte hain. Take profit levels entry point aur opposite direction mein najdeek fractal ke darmiyan ki doori par based kiye ja sakte hain.

Confirmation of Other Indicators: Fractals ko trading signals ko confirm karne ke liye dusre technical indicators ke saath istemal kia jata hai, jaise ke moving averages ya oscillators. For example, agar aik bullish fractal aik moving average ke bullish crossover ke saath milti hai, to ye buy signal ko strengthen karta hai, traders ko apni decision par ziada bharosa hasil hota hai.

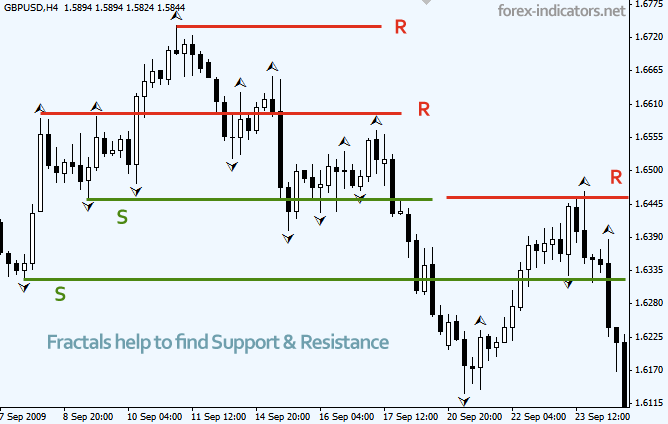

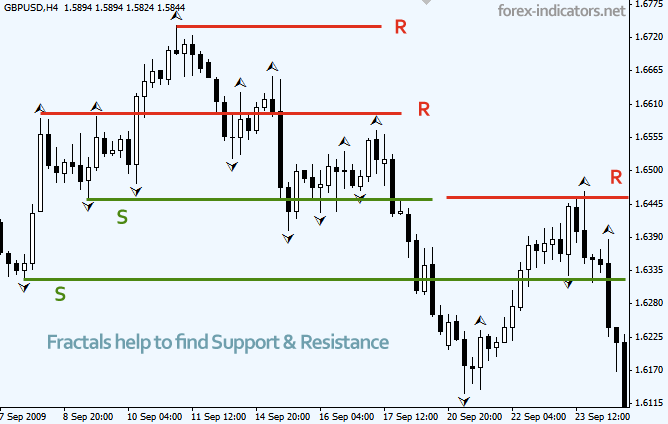

Spotting Breakout Opportunities: Fractals potential breakout points ko identify karne ke liye istemal kiya ja sakta hai. Jab aik significant support ya resistance level ke baahar aik fractal banta hai, to ye indicate karta hai ke potential breakout hone wala hai corresponding direction mein. Traders aksar fractal level ko breach hone ka wait karte hain pehle se enter karne se pehle trade mein, confirming the breakout.

Limitations and Considerations

Jabke fractal indicators market ke reversals aur breakout points mein qeemat milti hai, ye foolproof nahi hote aur ehtiyaat ke sath istemal kiye jaana chahiye. Traders ko inko apne trading strategies mein shamil karte waqt iske limitations aur factors ko ghor mein lena chahiye:

Whipsaw Movements: Fractals false signals produce kar sakte hain, khaas kar jab market mein kam liquidity ya consolidation periods mein hota hai. Traders ko whipsaw movements ka khayal rakhna chahiye, jahan price briefly fractal dwara indicate kiye gaye direction mein move karta hai lekin phir reverse ho jata hai, potential nuksan ke liye.

Confirmation with Other Indicators: Fractal signals ki reliability ko barhane ke liye, traders ko inko dusre technical indicators aur chart patterns ke saath istemal karna chahiye. Alag alag sources se aane wali multiple confirmations accuracy ko barhate hain.

Timeframe Consideration: Fractal signals analysis ke liye istemal hone wale timeframe par based ho sakte hain. Shorter timeframe par dekhi gayi fractal pattern, jaise ke 15-minute chart par, itna wazeh nahi hota jitna ke daily ya weekly chart par dekha gaya fractal. Traders ko fractal signals evaluate karte waqt timeframe relevance ka khayal rakhna chahiye.

Market Volatility: Highly volatile markets fractal formations ko frequently produce kar sakte hain, jo genuine reversal points ko noise se distinguish karna mushkil bana dete hain. Traders ko market ki volatility ko factor mein lena chahiye aur apni trading parameters ko accordingly adjust karna chahiye.

Construction of Fractal Indicators

Fractal indicators forex charts par aksar arrows ke roop mein darust kiye jate hain, jo ke price bars ke upar ya neeche nazar aate hain. Aik up arrow aik bullish fractal ko darust karta hai, jo ke potential buying opportunity ko zahir karta hai, jabke aik down arrow aik bearish fractal ko darust karta hai, jise ke potential selling opportunity ko ishara karta hai. Traders aksar in fractal signals ko apni trading decisions confirm karne ke liye dusre technical indicators aur chart patterns ke saath istemal karte hain.

Application of Fractals in Forex Trading

Identification of Reversal Points: Fractals ko primarily market mein key reversal points ko pehchanne ke liye istemal kia jata hai. Jab aik downtrend ke baad aik bullish fractal nazr aata hai, to ye aik potential bullish reversal ko indicate karta hai, jatate hue ke yeh aik long trade ke liye munasib waqt ho sakta hai. Barabar ke sath, uptrend ke baad aik bearish fractal hone ka matlab hai ke aik potential bearish reversal hone wala hai, jo ke aik suitable entry point ko ishara karta hai short trade ke liye.

Setting Stop Loss and Take Profit Levels: Traders fractals ko apni stop loss aur take profit levels tayin karne ke liye istemal karte hain. A bullish fractal ko stop loss tayin karne ke liye fractal ke low ke neeche rakh sakte hain, taki agar market trade ke khilaf chala jaye to nuksan se bacha ja sake. Isi tarah, bearish fractal ko stop loss tayin karne ke liye fractal ke high ke upar rakh sakte hain. Take profit levels entry point aur opposite direction mein najdeek fractal ke darmiyan ki doori par based kiye ja sakte hain.

Confirmation of Other Indicators: Fractals ko trading signals ko confirm karne ke liye dusre technical indicators ke saath istemal kia jata hai, jaise ke moving averages ya oscillators. For example, agar aik bullish fractal aik moving average ke bullish crossover ke saath milti hai, to ye buy signal ko strengthen karta hai, traders ko apni decision par ziada bharosa hasil hota hai.

Spotting Breakout Opportunities: Fractals potential breakout points ko identify karne ke liye istemal kiya ja sakta hai. Jab aik significant support ya resistance level ke baahar aik fractal banta hai, to ye indicate karta hai ke potential breakout hone wala hai corresponding direction mein. Traders aksar fractal level ko breach hone ka wait karte hain pehle se enter karne se pehle trade mein, confirming the breakout.

Limitations and Considerations

Jabke fractal indicators market ke reversals aur breakout points mein qeemat milti hai, ye foolproof nahi hote aur ehtiyaat ke sath istemal kiye jaana chahiye. Traders ko inko apne trading strategies mein shamil karte waqt iske limitations aur factors ko ghor mein lena chahiye:

Whipsaw Movements: Fractals false signals produce kar sakte hain, khaas kar jab market mein kam liquidity ya consolidation periods mein hota hai. Traders ko whipsaw movements ka khayal rakhna chahiye, jahan price briefly fractal dwara indicate kiye gaye direction mein move karta hai lekin phir reverse ho jata hai, potential nuksan ke liye.

Confirmation with Other Indicators: Fractal signals ki reliability ko barhane ke liye, traders ko inko dusre technical indicators aur chart patterns ke saath istemal karna chahiye. Alag alag sources se aane wali multiple confirmations accuracy ko barhate hain.

Timeframe Consideration: Fractal signals analysis ke liye istemal hone wale timeframe par based ho sakte hain. Shorter timeframe par dekhi gayi fractal pattern, jaise ke 15-minute chart par, itna wazeh nahi hota jitna ke daily ya weekly chart par dekha gaya fractal. Traders ko fractal signals evaluate karte waqt timeframe relevance ka khayal rakhna chahiye.

Market Volatility: Highly volatile markets fractal formations ko frequently produce kar sakte hain, jo genuine reversal points ko noise se distinguish karna mushkil bana dete hain. Traders ko market ki volatility ko factor mein lena chahiye aur apni trading parameters ko accordingly adjust karna chahiye.

تبصرہ

Расширенный режим Обычный режим