Trading Best Time

Introduction

Dear Fellows,

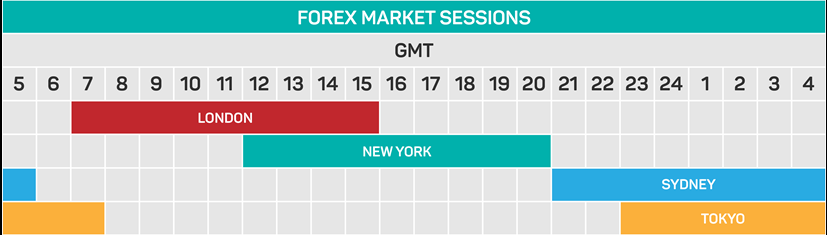

Him jaanty hain k trading ek best business ha or trading pura week monday ko start ho kar friday tak ap kisi bee time trading kar sakty hein or is liye forex mein ap apni trading kay through bohat he achi earning kar sakty hain and forex ekk life time business ha or ap is mein agar experience or knowledge kay sath work kareen to ap behtar or acha profit earn kar sakty hein is liye market kay sath touch rehna bohat he zarori ha or ap baqi din bhe kisi bhe din news pay agar ap behtar trading learn kar lein to ap behtar earning kar sakty hein or acha profit earn kar sakty hein or forex mein ap indicators use kareen to ap behtar trading daily kar sakty hain andshort term trading or achy experience kay sath ap profit he profit earn kar sakty hein or apni life change earning hasil kar sakty hein so why Jab Hame purra Yakeen Ho ke Hamare trading profit Mein Hai Jayegi Hame Aise time pe trading nahi karni chahiye Jab market bahut risky hoti hai qk us time market ka behaviour kuch bhi ho sakta hai aur traders ko trading Karke loss bhi ho sakta hai isliye hundred percent profit Ke Jab chances Hota tab hamen kis waqat karni chahiay trading to main ap ko bata don kay ap wesy to har waqat traTrading Best Timeding kar sakty hain but kuch khayal karna chahiay special us waqat jab market kisi aik point pa na stay karen ya phir jab currency ki qeemat iup aur down ho rahi ho aur apko month kay ends pa khayal karna chahiay trading karty waqat overall movements daikhni chahiay apko wesy to 24 hours market open hi hoti hay laikin ap ko soch samajh kay karni chahiay record check karna chahiay aur daikhna chahiay kay kis waqt ya kis kis din ya days main market up down ho rahi hay aur kin dinu main stay hain ya aik sequence ma ja rahi hay is liay apko ye sab kuch note kar kay tab apko trading karni chahiay is say ap ko loss kay chances bahut kam ho jaty hain aur ap profit ki tarf jatay hain ess liay overview daikh kay ap trading kua kary.

Overview

Fellows

Yaha py trading tab kary jab aap k pas time ho trading 24 hours open hoti hai lekin trading har waqt open hai to is ka matlab ye nahi k ap ko har waqt profit hoga agar ap profit lena chahty hai to apko market k analysis karny pary gy so why for that k apko dekhna hoga k market ki movement kis tarf hai pehly kis tarf thi or next kis tarf ho sakti hai or ap ko dekhna hoga kis time market ki movement slow hogi or kis time fast ye sab dekh kar hain. apko pata lagy ga k kis time trading karni hai or kis time apko ap ki trade mily gi or jab ap trading kary to take profit or stop loss zaroor use kary is sy ap ki trade or account safe rahy gy or time to apko tab hi pata chaly ga jab ap analysis kary gy bgair analysis k apko andaza nahi hoga k kab ap ny trading karni hain or kab nahi.

Conclusion

Fellows,

Last main hum conclude karty chaly k forex aik bahot hi zyada acha online buisness hy. Jiss k through hum currency ko buy and sale kar k un sa earning matllab k proffit hasil karty hain. Main apko aik choti c example dyta hoon jaisy k ham koi cheez 10$ ki buy karty hain and us ko kuch days ya kuch time apny pass rakhty hain and phir ham us cheez ko 15$ or 12$ main sale kar dyty hain to hamain faida hi to hota hy. And ya bhi ho skta hy k ham wo cheez 8$ ya phir 9$ main sale kar dain. Jis sa hamain loss hota hy so isi trha ya forex bee hain.hamain tuesday ko tradding karni chaheye. Wesy jaisa k ap na kaha hy m friday and monday ko tradding mushkil hoti hy to mera khiyal ya hy k ager koi best tradder and expert tradder friday ko ya phir monday ko tradde open kry to wo success ho skta hain awar achi trading kar sakt hain.

Thanks

Introduction

Dear Fellows,

Him jaanty hain k trading ek best business ha or trading pura week monday ko start ho kar friday tak ap kisi bee time trading kar sakty hein or is liye forex mein ap apni trading kay through bohat he achi earning kar sakty hain and forex ekk life time business ha or ap is mein agar experience or knowledge kay sath work kareen to ap behtar or acha profit earn kar sakty hein is liye market kay sath touch rehna bohat he zarori ha or ap baqi din bhe kisi bhe din news pay agar ap behtar trading learn kar lein to ap behtar earning kar sakty hein or acha profit earn kar sakty hein or forex mein ap indicators use kareen to ap behtar trading daily kar sakty hain andshort term trading or achy experience kay sath ap profit he profit earn kar sakty hein or apni life change earning hasil kar sakty hein so why Jab Hame purra Yakeen Ho ke Hamare trading profit Mein Hai Jayegi Hame Aise time pe trading nahi karni chahiye Jab market bahut risky hoti hai qk us time market ka behaviour kuch bhi ho sakta hai aur traders ko trading Karke loss bhi ho sakta hai isliye hundred percent profit Ke Jab chances Hota tab hamen kis waqat karni chahiay trading to main ap ko bata don kay ap wesy to har waqat traTrading Best Timeding kar sakty hain but kuch khayal karna chahiay special us waqat jab market kisi aik point pa na stay karen ya phir jab currency ki qeemat iup aur down ho rahi ho aur apko month kay ends pa khayal karna chahiay trading karty waqat overall movements daikhni chahiay apko wesy to 24 hours market open hi hoti hay laikin ap ko soch samajh kay karni chahiay record check karna chahiay aur daikhna chahiay kay kis waqt ya kis kis din ya days main market up down ho rahi hay aur kin dinu main stay hain ya aik sequence ma ja rahi hay is liay apko ye sab kuch note kar kay tab apko trading karni chahiay is say ap ko loss kay chances bahut kam ho jaty hain aur ap profit ki tarf jatay hain ess liay overview daikh kay ap trading kua kary.

Overview

Fellows

Yaha py trading tab kary jab aap k pas time ho trading 24 hours open hoti hai lekin trading har waqt open hai to is ka matlab ye nahi k ap ko har waqt profit hoga agar ap profit lena chahty hai to apko market k analysis karny pary gy so why for that k apko dekhna hoga k market ki movement kis tarf hai pehly kis tarf thi or next kis tarf ho sakti hai or ap ko dekhna hoga kis time market ki movement slow hogi or kis time fast ye sab dekh kar hain. apko pata lagy ga k kis time trading karni hai or kis time apko ap ki trade mily gi or jab ap trading kary to take profit or stop loss zaroor use kary is sy ap ki trade or account safe rahy gy or time to apko tab hi pata chaly ga jab ap analysis kary gy bgair analysis k apko andaza nahi hoga k kab ap ny trading karni hain or kab nahi.

Conclusion

Fellows,

Last main hum conclude karty chaly k forex aik bahot hi zyada acha online buisness hy. Jiss k through hum currency ko buy and sale kar k un sa earning matllab k proffit hasil karty hain. Main apko aik choti c example dyta hoon jaisy k ham koi cheez 10$ ki buy karty hain and us ko kuch days ya kuch time apny pass rakhty hain and phir ham us cheez ko 15$ or 12$ main sale kar dyty hain to hamain faida hi to hota hy. And ya bhi ho skta hy k ham wo cheez 8$ ya phir 9$ main sale kar dain. Jis sa hamain loss hota hy so isi trha ya forex bee hain.hamain tuesday ko tradding karni chaheye. Wesy jaisa k ap na kaha hy m friday and monday ko tradding mushkil hoti hy to mera khiyal ya hy k ager koi best tradder and expert tradder friday ko ya phir monday ko tradde open kry to wo success ho skta hain awar achi trading kar sakt hain.

Thanks

تبصرہ

Расширенный режим Обычный режим