Risk in Single Trading

Introduction

Dear Fellows,

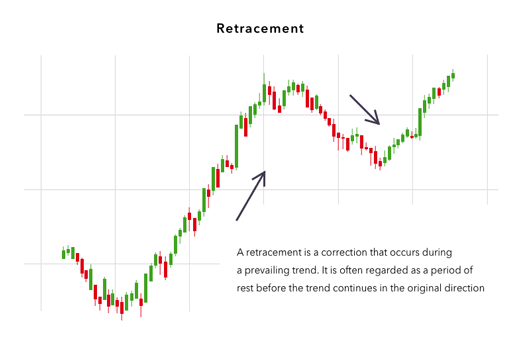

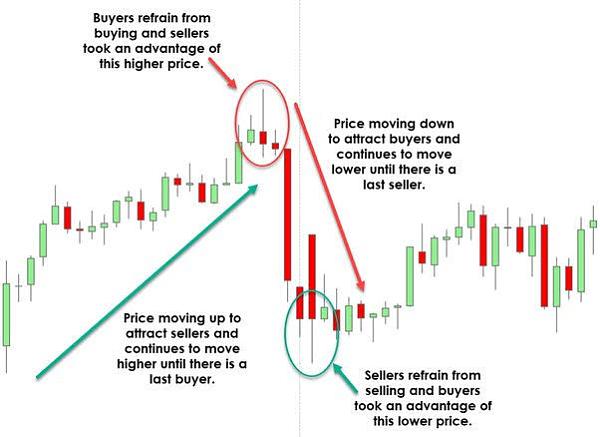

Trading market main sirf ekk trade laga rahy ho ya ais mai zayda trades laga rahy ho to ess main aap nay risk to apny plan k hisab se lena hai agar ap sirf aik hi trade laga rahy hai aor aus mai ap risk bahot zayda le rahy hai to aus mai ho sakta hai k market ap ko bahot zayda loss dy jaye ais liay jab bee koi trade lagani hai aus mai ap ne ye lazmi dekha hai k ess mai ap ne kitna risk lia hai aor ais trade mai kaha se exit hona hai ap ne agar ap nay ais market mai koi trade lagai hai aor aus mai stop loss ni lagaya to aus mai ho sakta hain k ap ka account wash ho jaye ais liay ais mai ap ne risk sirf tab lena hota hai jab ap k account phansa hoa ho aor ap aus mai trade laga rahy ho aor account bachany k liay apni Har single trade ko importance deni chahiay and ziada alnahi Lena chahiyay. agar aap ki date mein bahut jyada risk involved hoga to aap market ki big movement Se Apna account MP karwa sakte hain Kisi bhi single side mein lot size key element that determine karne sey pehle market condition to check Karle aur Mere Khiayal mein agar aap small Lords betrayed Karengy to aap ziaada der tak photo setting mein de sakte hain Apne Ek target set kare is target ke Pura hone ke baad apni tahdco closed today or analyse hamen aik single trade karnay k liay bee risk ko samnay rakhna chahiay ku kay agar aik big lot laga len to us say hi hamra account wash ho sakta hay aur ham doob saktay hain is liay risk management me sab cheezy aati hai market reversal trend change news ye sab dekhty huwy ap trading kary ta k ap ko loss na ho or agar ap ko loss ho to apko pata ho k next what karna hai or market main ab kesy trading karni hai is liye market me trading karty huwy risk ko zroor mind me rakhy or agar ap risk ko nahi dekhy gy to ap ki trade sahi nahi hogi zara sa b loss huwa to ap ko smajh nahi aaye gee.

Importance

Fellows,

Aam tawar par Aisa Bee Smjha Jata Hain K Single Trade Ki Koi Importance Nai Janke Bohat Important Hy Jab Key Trade Single Ho Ya Multiple Risk Lazmi Involve Hta Hain. Trade Lete time Market Ko Lazmi Smjhna Chaiye Hain Aur Achi Tarhan Analyze Karein Then Faisla Karein Ke Trade Leni Hy Ya Nai Zarrori Nai Ke Trade Lein Agr Market Against Jati Ya Lehrati Hui Nazr Aye Ke Na Up Ja Rai Ho Na Down Sirf Lehra Rai Ho Tou Bhtr Hy Trade Na Leni Q Ke Market Ka Trend Nai Pta Chal Skte Ke Trade Konsi Leni Hy Sell Ya Buy awar Sub Se Important Market Je Aisk Speed Wale Move Up Ya Down Se Bhi Hamey Faisal Nai Karna Yani Ke Lalach Me Ajein Aur Lot Size Ziada Me Trade Open Karelin Q Ke Ye Au Achi Baat Ke Hum Lalach Karte Hain Ya Ziada Profit Ka Socha karty Hain Mgr Yad Rahe Ke Profit Na Hone Ki Traders ko Jayega Jab Woh trading kar rahe ho basic or single treadmill aa gaye toh unko fast karne ka trading nahi karni chahiye kyu Aakar traders trading karte huye Jyada risk Lenge to hone ke liye bahut jyada dangerous ho jayegi aur unko bahut jyada loss bhi ho sakta hai isliye traders ko Jyada risk nahi Lena chahiiay

Conclusion

Fellows,

U to trading ekk risk ko kam kar k trading krna boht zarori hai q k jitna hum apni trading main risk ko invlve rakhty hain otna he hmain loss hony ka khtra hota hai es lye zarori hai k apni trading main risk ka margin kam rakhy q k aik tu hmara ccount save rahta hai or aik hmain loss hony se loss ko recover karny ka moka bhi milta hai ess k liaye zarori hai k hum apni trading main lot size ko kam se kam set karay lot size say hum apni trading main risk ka margin low rkh skty hain jo k hmari trading main profitable fact hai tu aisay trading achi hogi.

Thanks

Introduction

Dear Fellows,

Trading market main sirf ekk trade laga rahy ho ya ais mai zayda trades laga rahy ho to ess main aap nay risk to apny plan k hisab se lena hai agar ap sirf aik hi trade laga rahy hai aor aus mai ap risk bahot zayda le rahy hai to aus mai ho sakta hai k market ap ko bahot zayda loss dy jaye ais liay jab bee koi trade lagani hai aus mai ap ne ye lazmi dekha hai k ess mai ap ne kitna risk lia hai aor ais trade mai kaha se exit hona hai ap ne agar ap nay ais market mai koi trade lagai hai aor aus mai stop loss ni lagaya to aus mai ho sakta hain k ap ka account wash ho jaye ais liay ais mai ap ne risk sirf tab lena hota hai jab ap k account phansa hoa ho aor ap aus mai trade laga rahy ho aor account bachany k liay apni Har single trade ko importance deni chahiay and ziada alnahi Lena chahiyay. agar aap ki date mein bahut jyada risk involved hoga to aap market ki big movement Se Apna account MP karwa sakte hain Kisi bhi single side mein lot size key element that determine karne sey pehle market condition to check Karle aur Mere Khiayal mein agar aap small Lords betrayed Karengy to aap ziaada der tak photo setting mein de sakte hain Apne Ek target set kare is target ke Pura hone ke baad apni tahdco closed today or analyse hamen aik single trade karnay k liay bee risk ko samnay rakhna chahiay ku kay agar aik big lot laga len to us say hi hamra account wash ho sakta hay aur ham doob saktay hain is liay risk management me sab cheezy aati hai market reversal trend change news ye sab dekhty huwy ap trading kary ta k ap ko loss na ho or agar ap ko loss ho to apko pata ho k next what karna hai or market main ab kesy trading karni hai is liye market me trading karty huwy risk ko zroor mind me rakhy or agar ap risk ko nahi dekhy gy to ap ki trade sahi nahi hogi zara sa b loss huwa to ap ko smajh nahi aaye gee.

Importance

Fellows,

Aam tawar par Aisa Bee Smjha Jata Hain K Single Trade Ki Koi Importance Nai Janke Bohat Important Hy Jab Key Trade Single Ho Ya Multiple Risk Lazmi Involve Hta Hain. Trade Lete time Market Ko Lazmi Smjhna Chaiye Hain Aur Achi Tarhan Analyze Karein Then Faisla Karein Ke Trade Leni Hy Ya Nai Zarrori Nai Ke Trade Lein Agr Market Against Jati Ya Lehrati Hui Nazr Aye Ke Na Up Ja Rai Ho Na Down Sirf Lehra Rai Ho Tou Bhtr Hy Trade Na Leni Q Ke Market Ka Trend Nai Pta Chal Skte Ke Trade Konsi Leni Hy Sell Ya Buy awar Sub Se Important Market Je Aisk Speed Wale Move Up Ya Down Se Bhi Hamey Faisal Nai Karna Yani Ke Lalach Me Ajein Aur Lot Size Ziada Me Trade Open Karelin Q Ke Ye Au Achi Baat Ke Hum Lalach Karte Hain Ya Ziada Profit Ka Socha karty Hain Mgr Yad Rahe Ke Profit Na Hone Ki Traders ko Jayega Jab Woh trading kar rahe ho basic or single treadmill aa gaye toh unko fast karne ka trading nahi karni chahiye kyu Aakar traders trading karte huye Jyada risk Lenge to hone ke liye bahut jyada dangerous ho jayegi aur unko bahut jyada loss bhi ho sakta hai isliye traders ko Jyada risk nahi Lena chahiiay

Conclusion

Fellows,

U to trading ekk risk ko kam kar k trading krna boht zarori hai q k jitna hum apni trading main risk ko invlve rakhty hain otna he hmain loss hony ka khtra hota hai es lye zarori hai k apni trading main risk ka margin kam rakhy q k aik tu hmara ccount save rahta hai or aik hmain loss hony se loss ko recover karny ka moka bhi milta hai ess k liaye zarori hai k hum apni trading main lot size ko kam se kam set karay lot size say hum apni trading main risk ka margin low rkh skty hain jo k hmari trading main profitable fact hai tu aisay trading achi hogi.

Thanks

تبصرہ

Расширенный режим Обычный режим