Drawdown in Forex Trading

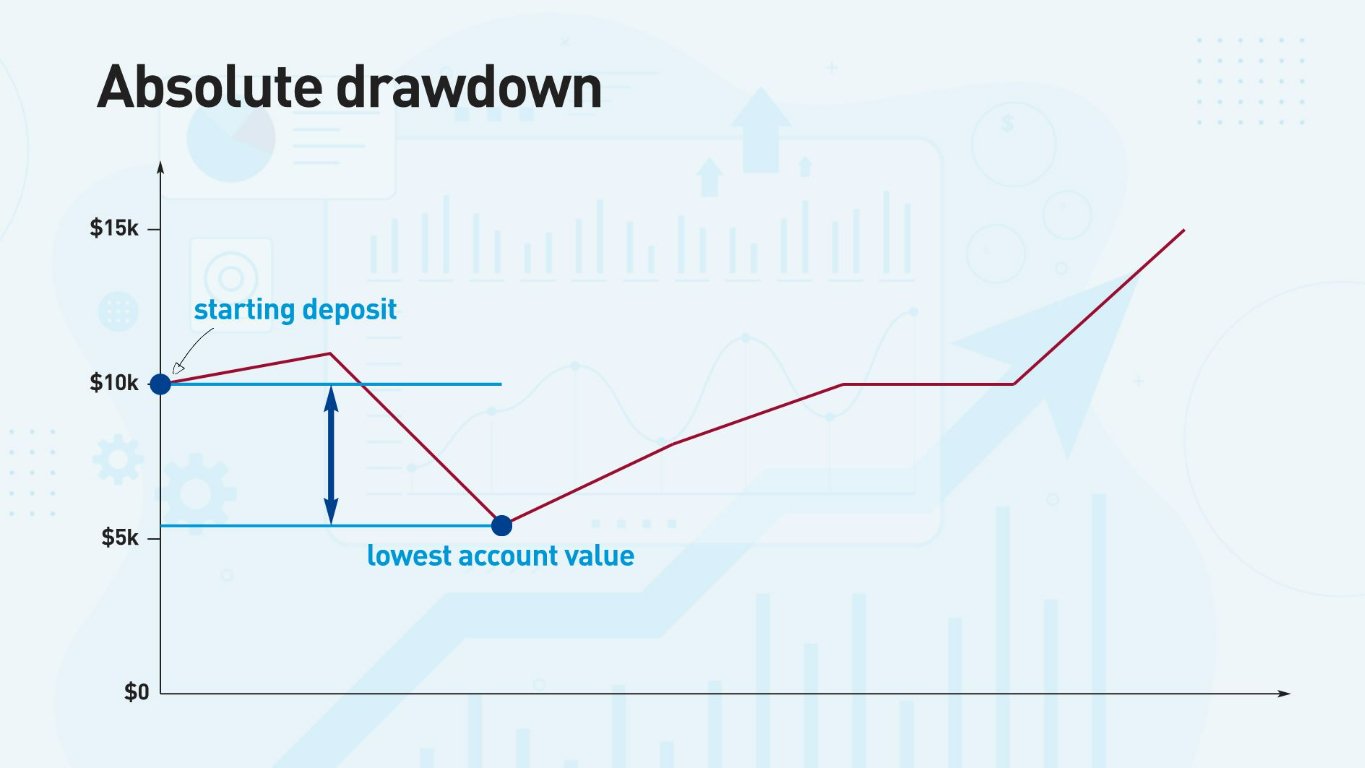

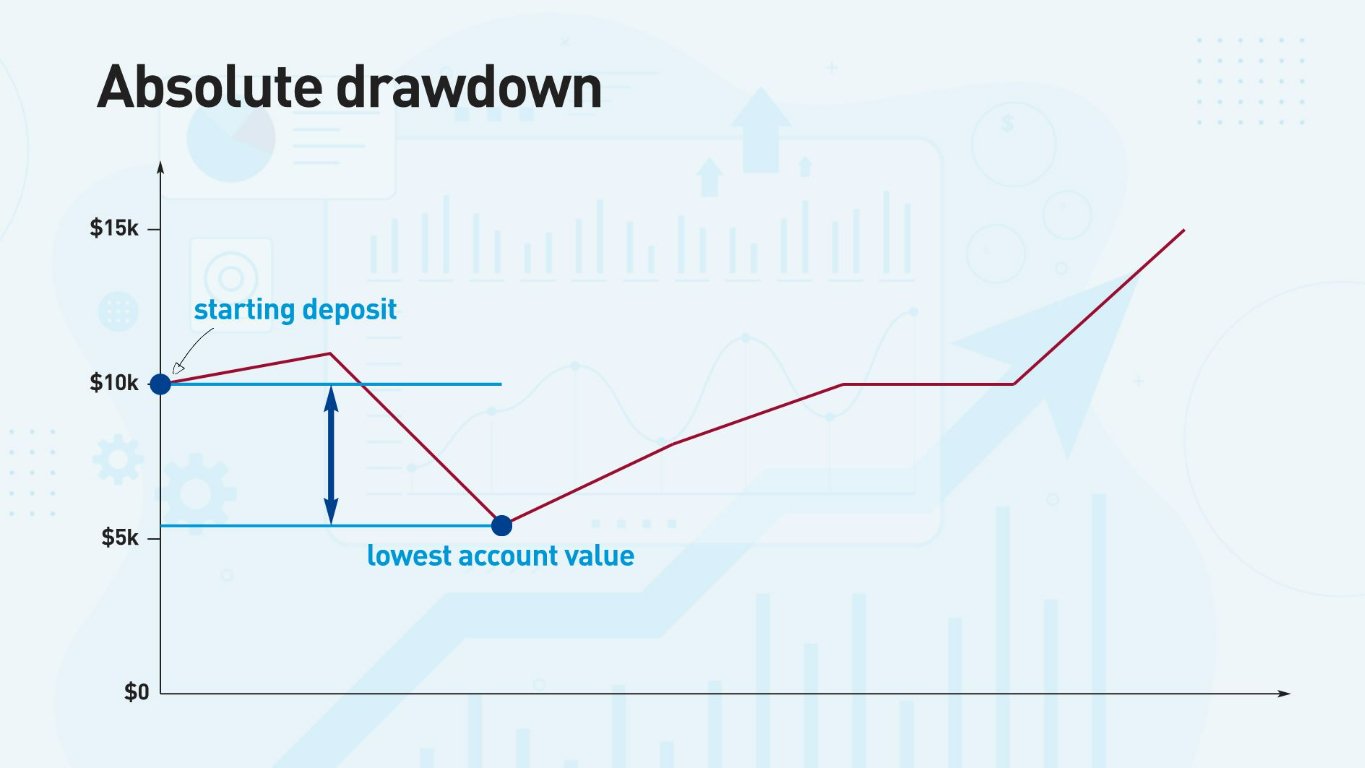

Drawdown forex trading mein aik ahem tasawur hai aur isay samajhna har trader ke liye zaroori hai jo foreign exchange ke is jazbay se guzarna chahta hai. Forex mein drawdown aik khaas arsa mein invest kiye gaye waqt mein peak se le kar bottom tak hone wali kami ko darust karta hai. Ye dikhata hai ke investor kitni percentage loss uthata hai apni pichli peak value se. Asaan alfaz mein kaha jaye to ye darust karta hai ke account ne apne uchayi se kitna girawat kiya hai. Drawdowns forex trading mein napaksh hai aur har trader ko kisi na kisi waqt in se do-char hona parta hai. Iska asal mudda drawdown ko karar dene mein hai takay ye trading account ka aham hissa zaya na karde. Forex trading khud mein zyada risk rakhti hai kyun ke market mein buland itminan aur nihayat daam mein tabdiliyan hoti rehti hain. Bade tajziyaat aur maharat rakne wale traders bhi drawdowns ka samna karte hain. Ye sawal nahi hai ke drawdown hota hai ya nahi, balkay ye hai ke jab hota hai to trader us ka kaise jawab deta hai. Drawdown ko durust tareeqay se manage karna itna zaroori hai kyun ke bari nuqsanat trader ke confidenece, jazbati sthirta aur amli trading strategy par asar andaz ho sakti hain.

Managing Drawdown

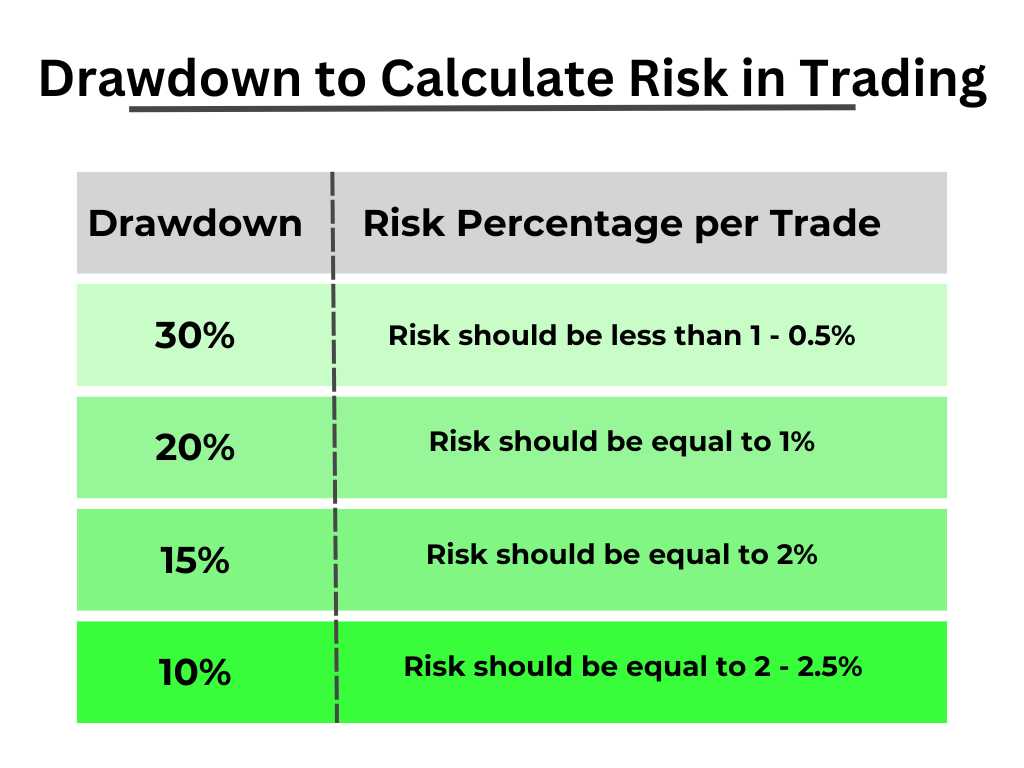

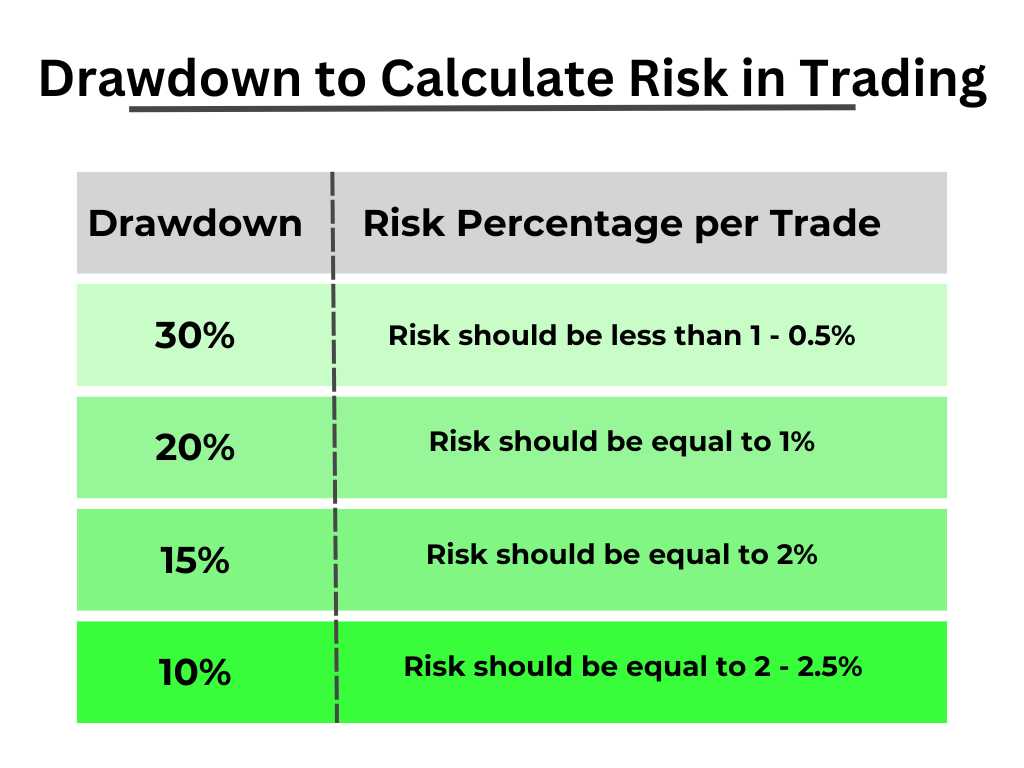

Drawdown ko moassar tareeqon se manage karne ke liye kai techniques aur tajziyay hain. Aik aam tareeqa apni trading capital ke aik khas hissay ke tor par maximum drawdown had muqarar karna hai. Maslan, aik trader yeh faisla kar sakta hai ke wo apne account ki 20% se ziada risk nahi lega kisi bhi aik trade par. Is kaiday ko laagu karna is liye zaroori hai ke ye potential nuqsanat had mein rakhta hai aur trader ko isey asaabi hoti hui faislay nahi karne par majboor karta hai. Drawdown ko manage karne ka aik tareeqa diversification hai. Apni trading portfolio ko different currency pairs ya doosre maali asbaab se karne se risk baant jata hai. Agar aik trade mein drawdown hota hai to doosri trades us nuqsanat ko kum kar sakti hain, jis se account balance par kaafi asar nahi padta. Lekin, diversification samajhdari se ki jani chahiye, takay alag alag asbaabon ke darmiyan ta'alluqat ko madde nazar rakha jaye aur zyada risk ka izhar na ho.

Stop-loss Orders and Position Sizing

Is ke ilawa traders drawdown ko control karne ke liye stop-loss orders aur position sizing jese risk management strategies istemaal kar sakte hain. Stop-loss order wo pehla point hai jahan se trader apni losing trade se bahar nikal jayega. Stop-loss orders set kar ke traders aik single trade par nuqsanat ka had muqarar kar lete hain, jis se drawdown bari nuqsanat mein tabdeel nahi ho sakta. Position sizing bhi isay control karne ka aham tareeqa hai. Is mein ye tay karna shamil hai ke trader kitne units ya lots trade karega, isey account size aur wo risk jo trader uthana chahta hai, ke hisaab se tay kiya jata hai. Sahi position sizing se ye ensure hota hai ke aik single losing trade account par bara asar nahi dalta. Is ke ilawa traders drawdown se bachne ke liye technical analysis aur fundamental analysis ka istemaal kar sakte hain. Technical analysis mein historical price data ki tajziyaat ki jati hai aur future price movements predict karne ke liye mukhtalif indicators aur chart patterns ka istemaal hota hai. Doosri taraf, fundamental analysis mein aarzi, siyasi aur samaji asraat ka tajziya kiya jata hai jo currency values ko asar andaz hote hain. In dono analysis ko jama kar ke, traders ziada sahi predictions kar sakte hain, jis se drawdown hone ki imkan kam hoti hai.

Ye yaad rakhna mushkil hai ke drawdowns forex trading ka lazmi hissa hain, lekin unko zaroori taur par control kiya ja sakta hai sahi risk management strategies, diversification, technical aur fundamental analysis, trading plan ki itteba aur mustaqil taleem ke zariye. Drawdown ki asal tabiyat ko samajhna aur theek trading amal se amal dalne se traders mushkil market conditions mein asani se guzar sakte hain aur un ki lambe arzi munafaat ke imkanat barh sakte hain. Yaad rakhen, drawdown ko poori tarah se khatam karne ka koi yaqeeni tareeqa nahi hai, lekin sahi soch aur approach ke sath, traders is ke asar ko kam kar sakte hain aur forex market mein kamiyabi hasil kar sakte hain.

Drawdown forex trading mein aik ahem tasawur hai aur isay samajhna har trader ke liye zaroori hai jo foreign exchange ke is jazbay se guzarna chahta hai. Forex mein drawdown aik khaas arsa mein invest kiye gaye waqt mein peak se le kar bottom tak hone wali kami ko darust karta hai. Ye dikhata hai ke investor kitni percentage loss uthata hai apni pichli peak value se. Asaan alfaz mein kaha jaye to ye darust karta hai ke account ne apne uchayi se kitna girawat kiya hai. Drawdowns forex trading mein napaksh hai aur har trader ko kisi na kisi waqt in se do-char hona parta hai. Iska asal mudda drawdown ko karar dene mein hai takay ye trading account ka aham hissa zaya na karde. Forex trading khud mein zyada risk rakhti hai kyun ke market mein buland itminan aur nihayat daam mein tabdiliyan hoti rehti hain. Bade tajziyaat aur maharat rakne wale traders bhi drawdowns ka samna karte hain. Ye sawal nahi hai ke drawdown hota hai ya nahi, balkay ye hai ke jab hota hai to trader us ka kaise jawab deta hai. Drawdown ko durust tareeqay se manage karna itna zaroori hai kyun ke bari nuqsanat trader ke confidenece, jazbati sthirta aur amli trading strategy par asar andaz ho sakti hain.

Managing Drawdown

Drawdown ko moassar tareeqon se manage karne ke liye kai techniques aur tajziyay hain. Aik aam tareeqa apni trading capital ke aik khas hissay ke tor par maximum drawdown had muqarar karna hai. Maslan, aik trader yeh faisla kar sakta hai ke wo apne account ki 20% se ziada risk nahi lega kisi bhi aik trade par. Is kaiday ko laagu karna is liye zaroori hai ke ye potential nuqsanat had mein rakhta hai aur trader ko isey asaabi hoti hui faislay nahi karne par majboor karta hai. Drawdown ko manage karne ka aik tareeqa diversification hai. Apni trading portfolio ko different currency pairs ya doosre maali asbaab se karne se risk baant jata hai. Agar aik trade mein drawdown hota hai to doosri trades us nuqsanat ko kum kar sakti hain, jis se account balance par kaafi asar nahi padta. Lekin, diversification samajhdari se ki jani chahiye, takay alag alag asbaabon ke darmiyan ta'alluqat ko madde nazar rakha jaye aur zyada risk ka izhar na ho.

Stop-loss Orders and Position Sizing

Is ke ilawa traders drawdown ko control karne ke liye stop-loss orders aur position sizing jese risk management strategies istemaal kar sakte hain. Stop-loss order wo pehla point hai jahan se trader apni losing trade se bahar nikal jayega. Stop-loss orders set kar ke traders aik single trade par nuqsanat ka had muqarar kar lete hain, jis se drawdown bari nuqsanat mein tabdeel nahi ho sakta. Position sizing bhi isay control karne ka aham tareeqa hai. Is mein ye tay karna shamil hai ke trader kitne units ya lots trade karega, isey account size aur wo risk jo trader uthana chahta hai, ke hisaab se tay kiya jata hai. Sahi position sizing se ye ensure hota hai ke aik single losing trade account par bara asar nahi dalta. Is ke ilawa traders drawdown se bachne ke liye technical analysis aur fundamental analysis ka istemaal kar sakte hain. Technical analysis mein historical price data ki tajziyaat ki jati hai aur future price movements predict karne ke liye mukhtalif indicators aur chart patterns ka istemaal hota hai. Doosri taraf, fundamental analysis mein aarzi, siyasi aur samaji asraat ka tajziya kiya jata hai jo currency values ko asar andaz hote hain. In dono analysis ko jama kar ke, traders ziada sahi predictions kar sakte hain, jis se drawdown hone ki imkan kam hoti hai.

Ye yaad rakhna mushkil hai ke drawdowns forex trading ka lazmi hissa hain, lekin unko zaroori taur par control kiya ja sakta hai sahi risk management strategies, diversification, technical aur fundamental analysis, trading plan ki itteba aur mustaqil taleem ke zariye. Drawdown ki asal tabiyat ko samajhna aur theek trading amal se amal dalne se traders mushkil market conditions mein asani se guzar sakte hain aur un ki lambe arzi munafaat ke imkanat barh sakte hain. Yaad rakhen, drawdown ko poori tarah se khatam karne ka koi yaqeeni tareeqa nahi hai, lekin sahi soch aur approach ke sath, traders is ke asar ko kam kar sakte hain aur forex market mein kamiyabi hasil kar sakte hain.

تبصرہ

Расширенный режим Обычный режим