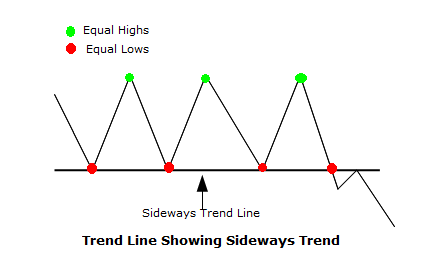

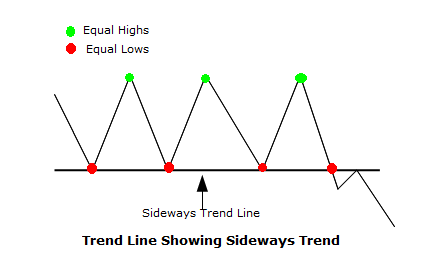

Forex market mein ek sideways trend tab hota hai jab kisi currency pair ki keemat mehaz hadood mein tezi ya mandi mein fluctuate hoti hai. Is tarah ke trend mein, keemat ka andaruni range ya channel ban jaata hai, jahan upper aur lower boundaries resistance aur support levels ki tarah kaam karti hain. Forex market mein sideways trend ka banne ka kai reasons ho sakte hain. Aik sab se ahem wajah hai market ki uncertainty. Jab traders currency pair ki direction mein uncertain hote hain, toh woh balanced taur par khareedari aur farokht mein mubtala ho jaate hain, jo ke kisi bhi wazi aur mazboot price movement ki kami mein mubtila ho sakta hai. Maali data releases, geopolitical events ya market sentiment mein tabdeeli bhi aisi atmosphere paida kar sakte hain jahan traders wait-and-see approach apnaate hain, jis se sideways trend banta hai.

Consolidation after Strong Trending Movements

Ek aur wajah sideways trend ka banne ki ho sakti hai market consolidation ke baad, jab ek mazboot trending movement ke baad market relax ho jaata hai. Lambi uptrend ya downtrend ke baad, traders apni positions close karte hain ya profit booking karte hain, jo ke market ko pause karne par majboor kar deta hai aur consolidation phase mein dakhil kar deta hai. Is consolidation daur mein, keemat aam taur par sideways move karti hai jab tak ke buyers aur sellers apni positions ko dobara evaluate nahi karte aur naye catalysts ka intezaar nahi karte jo market ko clear direction mein le jaaye.

Role of Technical Analysis in Identifying Sideways Trends

Technical analysis sideways trends ko pehchanne aur samajhne mein ahem kirdar ada karta hai forex market mein. Traders period of consolidation aur potential breakout points ko pehchanne ke liye various technical indicators aur chart patterns ka istemaal karte hain. Sideways trends ko pehchane mein istemaal hone wale aam technical indicators mein Bollinger Bands, Moving Averages aur Relative Strength Index (RSI) shamil hain. Bollinger Bands for example, traders ko contracting price ranges pehchane mein madad karti hain, jo sideways trend ki possibility ko darust karti hain. Is ke alawa, chart patterns jaise ke rectangles, flags aur triangles aam taur par consolidation ko indicate karte hain aur market direction ke liye ahem insights provide kar sakte hain jab pattern resolve hota hai.

Trading Strategies in Sideways Markets

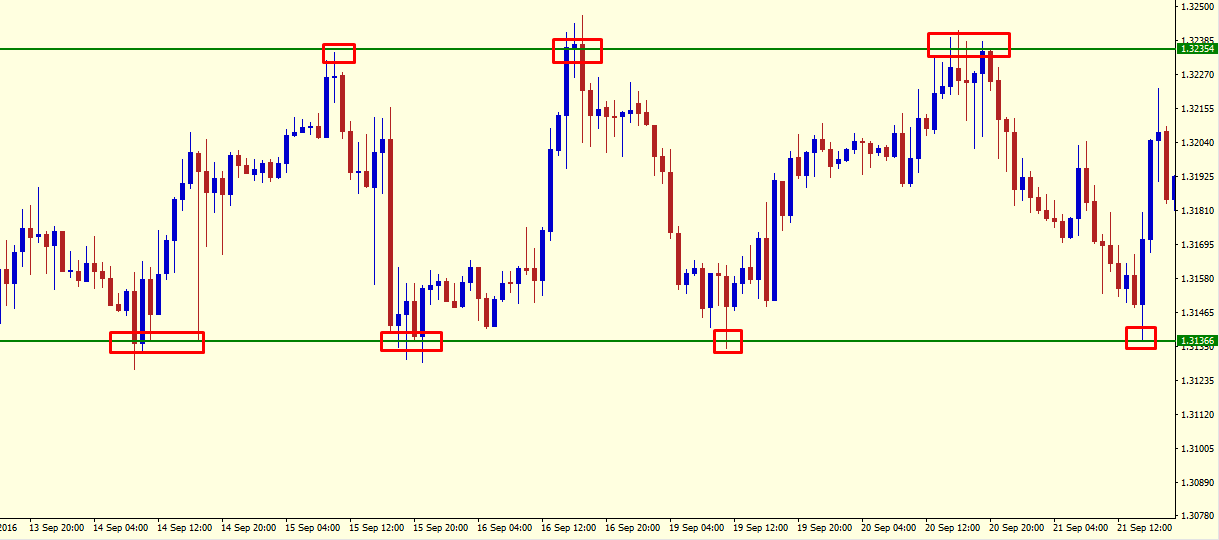

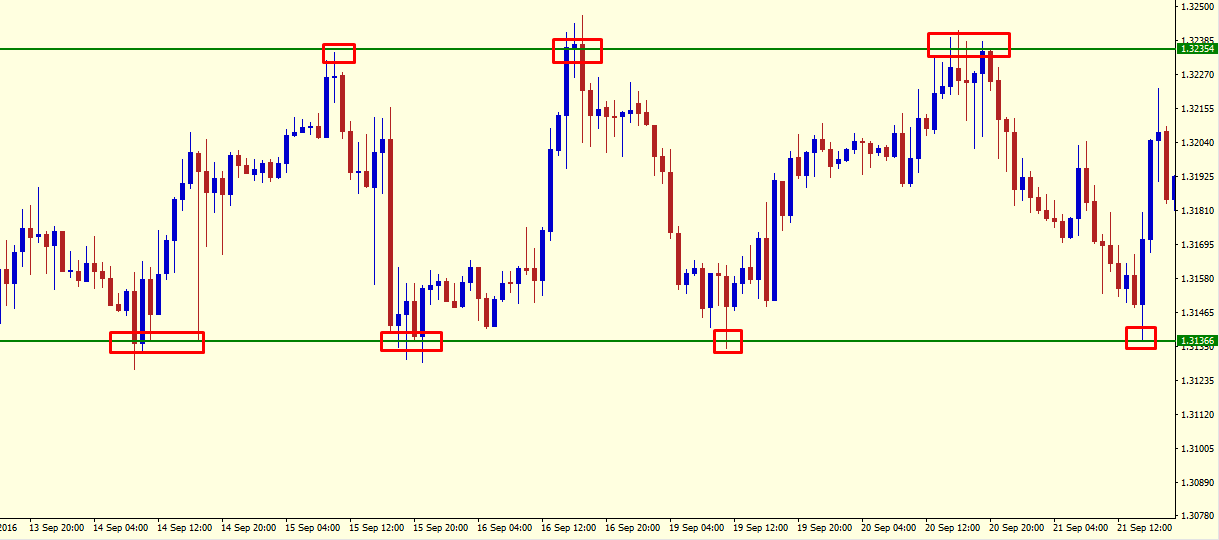

Sideways trend mein trading karne ke liye traders alag alag strategies istemaal karte hain taa ke woh established range ke andar hone wali price fluctuations se faida utha saken. Ek popular approach range trading hai, jisme traders support level ke qareeb khareedari karte hain aur resistance level ke qareeb farokht karte hain, established range ke andar hone wale predictable price movements ka faida uthate hain. Range trading mein keemat ke levels ko careful taur par monitor karna zaroori hai aur sahi entry aur exit points par trades execute karne ke liye tezi se faisla karna bhi important hai. Ek aur strategy jo sideways markets mein istemaal hoti hai, woh hai breakout trading. Breakout traders wohi waqt ka intezaar karte hain jab ke keemat established range ke upper ya lower boundary ko breach kare, jo ke potential market direction ke change ki taraf ishara karta hai. Jab breakout hota hai, toh aksar woh breakout direction mein strong price movement create karta hai, jis se traders momentum ke saath positions enter kar sakte hain.

Breakout Trading Strategies

Sideways market mein trading karna mushkil ho sakta hai, kyun ke false breakouts aur whipsaw movements aam hote hain. False breakouts tab hoti hain jab ke keemat briefly established range ke bahar move karte hain lekin jaldi se wapas range mein reverse ho jaati hai. Traders ko false signals ko filter karne ke liye aur successful trades ki probability ko increase karne ke liye additional technical indicators aur analysis ka istemaal karna zaroori hota hai. Sideways market mein trading karte waqt risk management ka bohot zyada khayal rakhna chahiye. Wazeh trend ki kami ki wajah se, price movements unpredictable ho sakte hain. Traders ko potential nuksan ko limit karne ke liye tight stop-loss orders set karni chahiye aur apni risk ko effectively manage karne ke liye sahi position sizing ka istemaal karna chahiye. Is ke alawa, traders ko sabr aur disipline banaye rakhna chahiye, taake woh minor price fluctuations par impulsive trades se bach sakein jo established range mein hone wale volatile movements ki wajah se nuksan pahuncha sakti hain.

Consolidation after Strong Trending Movements

Ek aur wajah sideways trend ka banne ki ho sakti hai market consolidation ke baad, jab ek mazboot trending movement ke baad market relax ho jaata hai. Lambi uptrend ya downtrend ke baad, traders apni positions close karte hain ya profit booking karte hain, jo ke market ko pause karne par majboor kar deta hai aur consolidation phase mein dakhil kar deta hai. Is consolidation daur mein, keemat aam taur par sideways move karti hai jab tak ke buyers aur sellers apni positions ko dobara evaluate nahi karte aur naye catalysts ka intezaar nahi karte jo market ko clear direction mein le jaaye.

Role of Technical Analysis in Identifying Sideways Trends

Technical analysis sideways trends ko pehchanne aur samajhne mein ahem kirdar ada karta hai forex market mein. Traders period of consolidation aur potential breakout points ko pehchanne ke liye various technical indicators aur chart patterns ka istemaal karte hain. Sideways trends ko pehchane mein istemaal hone wale aam technical indicators mein Bollinger Bands, Moving Averages aur Relative Strength Index (RSI) shamil hain. Bollinger Bands for example, traders ko contracting price ranges pehchane mein madad karti hain, jo sideways trend ki possibility ko darust karti hain. Is ke alawa, chart patterns jaise ke rectangles, flags aur triangles aam taur par consolidation ko indicate karte hain aur market direction ke liye ahem insights provide kar sakte hain jab pattern resolve hota hai.

Trading Strategies in Sideways Markets

Sideways trend mein trading karne ke liye traders alag alag strategies istemaal karte hain taa ke woh established range ke andar hone wali price fluctuations se faida utha saken. Ek popular approach range trading hai, jisme traders support level ke qareeb khareedari karte hain aur resistance level ke qareeb farokht karte hain, established range ke andar hone wale predictable price movements ka faida uthate hain. Range trading mein keemat ke levels ko careful taur par monitor karna zaroori hai aur sahi entry aur exit points par trades execute karne ke liye tezi se faisla karna bhi important hai. Ek aur strategy jo sideways markets mein istemaal hoti hai, woh hai breakout trading. Breakout traders wohi waqt ka intezaar karte hain jab ke keemat established range ke upper ya lower boundary ko breach kare, jo ke potential market direction ke change ki taraf ishara karta hai. Jab breakout hota hai, toh aksar woh breakout direction mein strong price movement create karta hai, jis se traders momentum ke saath positions enter kar sakte hain.

Breakout Trading Strategies

Sideways market mein trading karna mushkil ho sakta hai, kyun ke false breakouts aur whipsaw movements aam hote hain. False breakouts tab hoti hain jab ke keemat briefly established range ke bahar move karte hain lekin jaldi se wapas range mein reverse ho jaati hai. Traders ko false signals ko filter karne ke liye aur successful trades ki probability ko increase karne ke liye additional technical indicators aur analysis ka istemaal karna zaroori hota hai. Sideways market mein trading karte waqt risk management ka bohot zyada khayal rakhna chahiye. Wazeh trend ki kami ki wajah se, price movements unpredictable ho sakte hain. Traders ko potential nuksan ko limit karne ke liye tight stop-loss orders set karni chahiye aur apni risk ko effectively manage karne ke liye sahi position sizing ka istemaal karna chahiye. Is ke alawa, traders ko sabr aur disipline banaye rakhna chahiye, taake woh minor price fluctuations par impulsive trades se bach sakein jo established range mein hone wale volatile movements ki wajah se nuksan pahuncha sakti hain.

تبصرہ

Расширенный режим Обычный режим