Assalamualaikum!

Dear friend kia hal han main umeed krta hon k ap sab kheriat sy hon gy our forex market mn acha kam kr rhe hon gy dosto aj ka hmara topic relative strength index per h aj hm rsi indicator k bary mn Jane gy k ye kia hota h our ye market mn kasy use hota hai.

What is Relative Strength Index RSI:

RSI (Relative Strength Index) ek technical indicator hai jo stock market mein istemal hota hai taa'ki traders aur investors ko stocks ke price trends aur potential reversals ka andaza lagaya ja sake. RSI ek ahem tool hai jo market analysis mein istemal hota hai. Is article mein hum RSI ke baray mein Roman Urdu mein tafseel se baat karenge.RSI ek momentum oscillator hai jo stocks ke price movements ko measure karta hai. Iska main maqsad ye hota hai ke samjhna ke kisi stock ke price mein kis tarah ke changes aur reversals hone ke imkanat hain. RSI ki calculation market ki recent price changes ko dekhte hue hoti hai. Is indicator ka use mainly short-term aur mid-term trading ke liye hota hai.

RSI Ki Calculation

RSI ki calculation ke liye aam taur par 14 dinon ke price changes ka istemal hota hai. Neeche di gayi formula RSI ko calculate karne ke liye istemal hoti hai:

RSI = 100 - [100 / (1 + RS)]

Yahan, RS (Relative Strength) ko calculate karne ke liye ye formula istemal hota hai:

RS = Average Gain / Average Loss

Average Gain (AG):

Average Gain, 14 dinon ke gain (jab stock price barhti hai) ka average hota hai.

Average Loss (AL):

Average Loss, 14 dinon ke loss (jab stock price kam hoti hai) ka average hota hai.

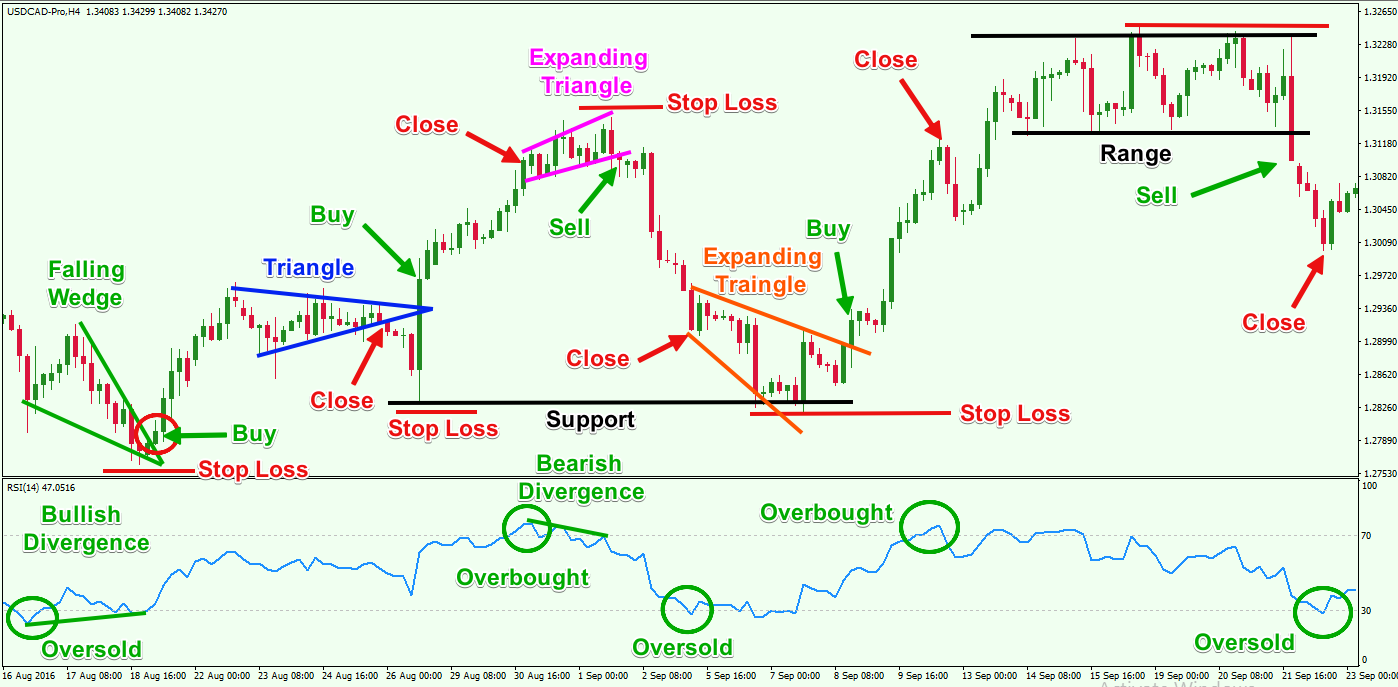

RSI ki value 0 se 100 tak hoti hai. RSI ki value 70 se upar aane par stock overbought ho sakta hai, jiska matlab hai ke stock ka price zyada upar gaya hai aur ismein reversal hone ke chances hain. Jab RSI 30 se neeche aata hai, to yeh indicate karta hai ke stock oversold ho sakta hai, jiska matlab hai ke stock ka price zyada neeche gaya hai aur ismein reversal hone ke chances hain.

RSI Ka Istemal Kaise Hota Hai?

RSI ka istemal trading decisions ke liye hota hai. Aam taur par traders RSI ko niche di gayi tareeqon se istemal karte hain:

Overbought and Oversold Levels:

RSI ke overbought (70) aur oversold (30) levels ko dekhte hue traders stocks ke buy aur sell decisions lete hain. Agar RSI 70 ke upar hai, to yeh ek sell signal ho sakta hai. Agar RSI 30 ke neeche hai, to yeh ek buy signal ho sakta hai.

Divergence:

RSI ki divergence traders ke liye ahem ho sakti hai. Agar stock ka price naye high par ja raha hai lekin RSI kam ho raha hai, to yeh bearish divergence ho sakti hai aur price reversal ki taraf ishara kar sakti hai. Isi tarah se, agar stock ka price naye low par ja raha hai lekin RSI barh raha hai, to yeh bullish divergence ho sakti hai.

RSI Ke Crossovers:

Kuch traders RSI ke moving averages (e.g., 14-day RSI aur 9-day RSI) ki crossovers par bhi amal karte hain. Jab 9-day RSI 14-day RSI ko upar se crossover karta hai, to yeh ek buy signal ho sakta hai, aur jab 9-day RSI 14-day RSI ko neeche se crossover karta hai, to yeh ek sell signal ho sakta hai.

RSI Ka Istemal Kiun Hota Hai?

RSI ka istemal trading strategies ko improve karne aur market trends ko samajhne ke liye hota hai. Kuch ahem faide RSI ka istemal karne se aate hain:

Price Reversals Ka Pata Lagana:

RSI traders ko price reversals ka pata lagane mein madadgar hota hai. Isse unhe ye pata chalta hai ke kis tarah ke changes aa rahe hain aur kya stock overbought ya oversold ho sakta hai.

Short-term Aur Mid-term Trading:

RSI mainly short-term aur mid-term trading ke liye istemal hota hai. Isse traders ko market ke short-term trends ko samajhne mein madad milti hai.

Risk Management:

RSI ke istemal se traders apni trading positions ko better manage kar sakte hain. Isse unhe pata chalta hai ke kis waqt entry aur exit karna behtar hoga.

RSI Ke Limitations

RSI ek powerful indicator hai, lekin iske bhi kuch limitations hain:

False Signals:

RSI kabhi-kabhi false signals generate kar sakta hai, iska matlab hai ke ye galat information de sakta hai. Isliye, RSI ko dusre indicators aur technical analysis tools ke sath istemal karna behtar hota hai.

Volatility Ka Impact:

RSI ki calculation mein volatility ka asar hota hai. Bahut zyada volatile markets mein RSI ke signals kam reliable ho sakte hain.

Time Frame Par Depend Karega:

RSI ke effectiveness time frame par bhi depend karti hai. Different time frames par RSI ka value alag ho sakta hai, aur isse different signals bhi aate hain.

Zameeni Sabqat:

Har market aur har stock different hota hai, aur RSI ke signals sabqat se kam karte hain. Isliye, RSI ka istemal kisi specific stock par karne se pehle thorough research karna zaruri hai.

Conclusion

RSI ek ahem tool hai jo traders aur investors ko market trends aur price reversals ka pata lagane mein madadgar hota hai. Iska istemal short-term aur mid-term trading ke liye hota hai, lekin iske limitations ko bhi yaad rakhna zaruri hai. RSI ke signals ko samajhna aur uska sahi istemal karke traders apni trading strategies ko improve kar sakte hain. Isliye, market mein safar karne wale traders aur investors ke liye RSI ka ilm hona ahem hai.

Thanks for Attention

Dear friend kia hal han main umeed krta hon k ap sab kheriat sy hon gy our forex market mn acha kam kr rhe hon gy dosto aj ka hmara topic relative strength index per h aj hm rsi indicator k bary mn Jane gy k ye kia hota h our ye market mn kasy use hota hai.

What is Relative Strength Index RSI:

RSI (Relative Strength Index) ek technical indicator hai jo stock market mein istemal hota hai taa'ki traders aur investors ko stocks ke price trends aur potential reversals ka andaza lagaya ja sake. RSI ek ahem tool hai jo market analysis mein istemal hota hai. Is article mein hum RSI ke baray mein Roman Urdu mein tafseel se baat karenge.RSI ek momentum oscillator hai jo stocks ke price movements ko measure karta hai. Iska main maqsad ye hota hai ke samjhna ke kisi stock ke price mein kis tarah ke changes aur reversals hone ke imkanat hain. RSI ki calculation market ki recent price changes ko dekhte hue hoti hai. Is indicator ka use mainly short-term aur mid-term trading ke liye hota hai.

RSI Ki Calculation

RSI ki calculation ke liye aam taur par 14 dinon ke price changes ka istemal hota hai. Neeche di gayi formula RSI ko calculate karne ke liye istemal hoti hai:

RSI = 100 - [100 / (1 + RS)]

Yahan, RS (Relative Strength) ko calculate karne ke liye ye formula istemal hota hai:

RS = Average Gain / Average Loss

Average Gain (AG):

Average Gain, 14 dinon ke gain (jab stock price barhti hai) ka average hota hai.

Average Loss (AL):

Average Loss, 14 dinon ke loss (jab stock price kam hoti hai) ka average hota hai.

RSI ki value 0 se 100 tak hoti hai. RSI ki value 70 se upar aane par stock overbought ho sakta hai, jiska matlab hai ke stock ka price zyada upar gaya hai aur ismein reversal hone ke chances hain. Jab RSI 30 se neeche aata hai, to yeh indicate karta hai ke stock oversold ho sakta hai, jiska matlab hai ke stock ka price zyada neeche gaya hai aur ismein reversal hone ke chances hain.

RSI Ka Istemal Kaise Hota Hai?

RSI ka istemal trading decisions ke liye hota hai. Aam taur par traders RSI ko niche di gayi tareeqon se istemal karte hain:

Overbought and Oversold Levels:

RSI ke overbought (70) aur oversold (30) levels ko dekhte hue traders stocks ke buy aur sell decisions lete hain. Agar RSI 70 ke upar hai, to yeh ek sell signal ho sakta hai. Agar RSI 30 ke neeche hai, to yeh ek buy signal ho sakta hai.

Divergence:

RSI ki divergence traders ke liye ahem ho sakti hai. Agar stock ka price naye high par ja raha hai lekin RSI kam ho raha hai, to yeh bearish divergence ho sakti hai aur price reversal ki taraf ishara kar sakti hai. Isi tarah se, agar stock ka price naye low par ja raha hai lekin RSI barh raha hai, to yeh bullish divergence ho sakti hai.

RSI Ke Crossovers:

Kuch traders RSI ke moving averages (e.g., 14-day RSI aur 9-day RSI) ki crossovers par bhi amal karte hain. Jab 9-day RSI 14-day RSI ko upar se crossover karta hai, to yeh ek buy signal ho sakta hai, aur jab 9-day RSI 14-day RSI ko neeche se crossover karta hai, to yeh ek sell signal ho sakta hai.

RSI Ka Istemal Kiun Hota Hai?

RSI ka istemal trading strategies ko improve karne aur market trends ko samajhne ke liye hota hai. Kuch ahem faide RSI ka istemal karne se aate hain:

Price Reversals Ka Pata Lagana:

RSI traders ko price reversals ka pata lagane mein madadgar hota hai. Isse unhe ye pata chalta hai ke kis tarah ke changes aa rahe hain aur kya stock overbought ya oversold ho sakta hai.

Short-term Aur Mid-term Trading:

RSI mainly short-term aur mid-term trading ke liye istemal hota hai. Isse traders ko market ke short-term trends ko samajhne mein madad milti hai.

Risk Management:

RSI ke istemal se traders apni trading positions ko better manage kar sakte hain. Isse unhe pata chalta hai ke kis waqt entry aur exit karna behtar hoga.

RSI Ke Limitations

RSI ek powerful indicator hai, lekin iske bhi kuch limitations hain:

False Signals:

RSI kabhi-kabhi false signals generate kar sakta hai, iska matlab hai ke ye galat information de sakta hai. Isliye, RSI ko dusre indicators aur technical analysis tools ke sath istemal karna behtar hota hai.

Volatility Ka Impact:

RSI ki calculation mein volatility ka asar hota hai. Bahut zyada volatile markets mein RSI ke signals kam reliable ho sakte hain.

Time Frame Par Depend Karega:

RSI ke effectiveness time frame par bhi depend karti hai. Different time frames par RSI ka value alag ho sakta hai, aur isse different signals bhi aate hain.

Zameeni Sabqat:

Har market aur har stock different hota hai, aur RSI ke signals sabqat se kam karte hain. Isliye, RSI ka istemal kisi specific stock par karne se pehle thorough research karna zaruri hai.

Conclusion

RSI ek ahem tool hai jo traders aur investors ko market trends aur price reversals ka pata lagane mein madadgar hota hai. Iska istemal short-term aur mid-term trading ke liye hota hai, lekin iske limitations ko bhi yaad rakhna zaruri hai. RSI ke signals ko samajhna aur uska sahi istemal karke traders apni trading strategies ko improve kar sakte hain. Isliye, market mein safar karne wale traders aur investors ke liye RSI ka ilm hona ahem hai.

Thanks for Attention

تبصرہ

Расширенный режим Обычный режим