INTRODUCTION TO THE CRAB HARMONIC CHART PATTERN :

Crab Harmonic chart pattern, Gartley ya Butterfly jaise dusre harmonic patterns ka muqablay ma zyada mushkel or kam paya jane wala formation ha. Isko Scott Carney ne apni ketab "Harmonic Trading: Volume Two" ma pehchana. Crab pattern ak reversal pattern ha jo har time frame or currency pair ma paya ja sakta ha. Iske khaas pehchaan Fibonacci ratios or specific price structure se hote ha. Is pattern ka shape crab ke tarah hota ha, isliye iska nam Crab ha.

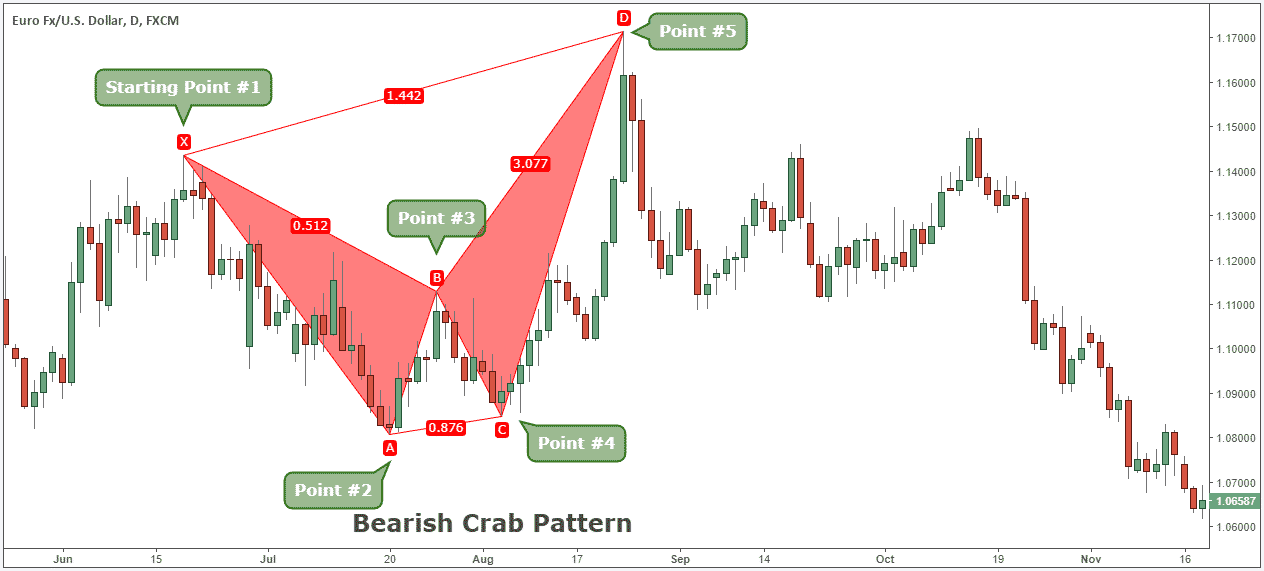

STRUCTURE OF THE CRAB HARMONIC CHART PATTERN :

Crab pattern ke tashkael char price swings se bani hote ha, jinhe XA, AB, BC or CD kahte ha. In price swings ko Fibonacci ratios se define keya jata ha, khas kar 0.382 or 0.618 retracement levels se. Pattern XA leg se shuru hota ha, jo am tor par ak direction ma taiz or lamba movement hota ha. AB leg XA leg ka retracement ha, jo 0.382 or 0.618 Fibonacci ratios ka darmiyan hota ha. BC leg AB leg ka extension hota ha, jo 2.24 ya 3.618 Fibonacci extension tak pahunchta ha. Ant ma, CD leg BC leg ko retraces karta ha or XA leg ka 0.618 ya 0.786 Fibonacci retracement level par complete hota ha.

POTENTIAL REVERSAL ZONES OF THE CRAB HARMONIC CHART PATTERN :

Crab pattern ma, jab XA, AB, BC or CD legs complete ho jate ha, toh zaroori ha ka hum mumken reversal zones ko pehchanen jahan price ko mukhtalif hona mumken ha. Bunyadi reversal zone CD leg ka 0.618 ya 0.786 Fibonacci retracement level par XA leg or BC leg ka 1.618 ya 2.618 Fibonacci extension ka convergence se banta ha. Yeh zone pattern ke direction ka mutabik strong resistance ya support ka kam karta ha. Iska alawa, traders trendlines, moving averages ya support/resistance levels jaise doosre technical indicators ka saath confluence bhi dakh sakte ha, taake trade ke kamyabi ka chances badh sakain.

ENTRY AND STOP LOSS PLACEMENT FOR THE CRAB HARMONIC CHART PATTERN :

Traders Crab pattern ka basis par trade enter kar sakte ha jab price mumken reversal zone tak pahunch jaye. Is level par buy ya sell order place kar sakte ha, pattern bullish ya bearish hone par depend karta ha. Risk ko manage karne ka liye, stop loss orders CD leg ka completion se thoda bahar place kar sakte ha, jisse agar price opposite direction ma move karti ha toh trade invalidate ho jaye. Crab pattern ke success rate thodi kam hote ha, isliye sahi risk management or conservative position sizing crucial hote ha.

TARGET OR TAKE Profit LEVELS FOR THE CRAB HARMONIC CHART PATTERN :

Crab pattern ka target ya taka profit levels Fibonacci extensions ka use karka determine keye ja sakte ha. Traders CD leg ke 0.382 or 0.618 Fibonacci extensions ko project karka price ka potential reversal ya stall hone wale areas ko identify kar sakte ha. Iska alawa, pehle ka support ya resistance levels ko bhi target ka tor par consider keya ja sakta ha. Salahiyat ka liye mashroota ha ka yahan pe hisse ma profit li jaye or stop loss ko trail keya jaye, jisse price desired direction ma move karti rahe.

Crab Harmonic chart pattern, Gartley ya Butterfly jaise dusre harmonic patterns ka muqablay ma zyada mushkel or kam paya jane wala formation ha. Isko Scott Carney ne apni ketab "Harmonic Trading: Volume Two" ma pehchana. Crab pattern ak reversal pattern ha jo har time frame or currency pair ma paya ja sakta ha. Iske khaas pehchaan Fibonacci ratios or specific price structure se hote ha. Is pattern ka shape crab ke tarah hota ha, isliye iska nam Crab ha.

STRUCTURE OF THE CRAB HARMONIC CHART PATTERN :

Crab pattern ke tashkael char price swings se bani hote ha, jinhe XA, AB, BC or CD kahte ha. In price swings ko Fibonacci ratios se define keya jata ha, khas kar 0.382 or 0.618 retracement levels se. Pattern XA leg se shuru hota ha, jo am tor par ak direction ma taiz or lamba movement hota ha. AB leg XA leg ka retracement ha, jo 0.382 or 0.618 Fibonacci ratios ka darmiyan hota ha. BC leg AB leg ka extension hota ha, jo 2.24 ya 3.618 Fibonacci extension tak pahunchta ha. Ant ma, CD leg BC leg ko retraces karta ha or XA leg ka 0.618 ya 0.786 Fibonacci retracement level par complete hota ha.

POTENTIAL REVERSAL ZONES OF THE CRAB HARMONIC CHART PATTERN :

Crab pattern ma, jab XA, AB, BC or CD legs complete ho jate ha, toh zaroori ha ka hum mumken reversal zones ko pehchanen jahan price ko mukhtalif hona mumken ha. Bunyadi reversal zone CD leg ka 0.618 ya 0.786 Fibonacci retracement level par XA leg or BC leg ka 1.618 ya 2.618 Fibonacci extension ka convergence se banta ha. Yeh zone pattern ke direction ka mutabik strong resistance ya support ka kam karta ha. Iska alawa, traders trendlines, moving averages ya support/resistance levels jaise doosre technical indicators ka saath confluence bhi dakh sakte ha, taake trade ke kamyabi ka chances badh sakain.

ENTRY AND STOP LOSS PLACEMENT FOR THE CRAB HARMONIC CHART PATTERN :

Traders Crab pattern ka basis par trade enter kar sakte ha jab price mumken reversal zone tak pahunch jaye. Is level par buy ya sell order place kar sakte ha, pattern bullish ya bearish hone par depend karta ha. Risk ko manage karne ka liye, stop loss orders CD leg ka completion se thoda bahar place kar sakte ha, jisse agar price opposite direction ma move karti ha toh trade invalidate ho jaye. Crab pattern ke success rate thodi kam hote ha, isliye sahi risk management or conservative position sizing crucial hote ha.

TARGET OR TAKE Profit LEVELS FOR THE CRAB HARMONIC CHART PATTERN :

Crab pattern ka target ya taka profit levels Fibonacci extensions ka use karka determine keye ja sakte ha. Traders CD leg ke 0.382 or 0.618 Fibonacci extensions ko project karka price ka potential reversal ya stall hone wale areas ko identify kar sakte ha. Iska alawa, pehle ka support ya resistance levels ko bhi target ka tor par consider keya ja sakta ha. Salahiyat ka liye mashroota ha ka yahan pe hisse ma profit li jaye or stop loss ko trail keya jaye, jisse price desired direction ma move karti rahe.

تبصرہ

Расширенный режим Обычный режим