Forex trading mein bilateral chart patterns aham tools hain jo technical analysis mein istemal hoti hain aur traders ko historical price data ke basis par anay walay price movements ka andaza lagane mein madad karti hain. Ye patterns tab banti hain jab kisi currency pair ki keemat aik khas range mein chalti hai, jiski wajah se chart par aik pehchani ja sakti shakal ban jati hai. Continuation ya reversal patterns ki tarah, bilateral patterns future price movements ke liye kisi khaas direction ka nishan nahi deti is liye inhen bilateral kaha jata hai.

Symmetrical Triangle

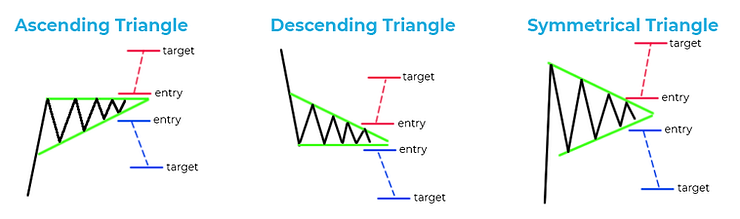

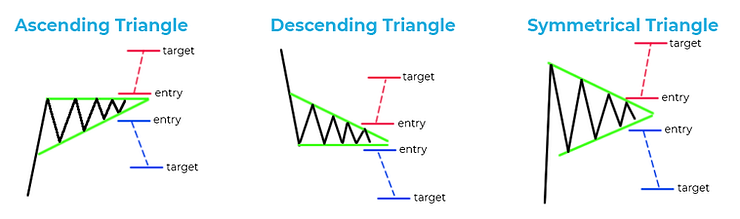

Symmetrical triangle aik aam bilateral chart pattern hai. Ye pattern tab banta hai jab price converging trendlines ke darmiyan oscillate hoti hai, jo aik triangle ki shakal banati hai. Upper trendline woh series of lower highs ko jorta hai, jabke lower trendline higher lows ko connect karti hai. Jab price triangle ke apex tak pohanchti hai, to yeh darshata hai ke ek aise moqaat ka dor hai jahan buyers aur sellers barabari mein hain. Traders aksar upper trendline ke upar ya lower trendline ke neeche breakout ki taraf dekhte hain taake potential trend reversal ya continuation ko confirm kiya ja sake.

Ascending Triangle

Ascending triangle dusra bilateral pattern hai, jahan upper trendline flat hoti hai, indicating a strong resistance level, jabke lower trendline upar ki taraf slope karti hai, jo higher lows ko dikhata hai. Ye pattern yeh suggest karta hai ke buyers zyada aggressive ho rahe hain, price ko resistance level ke qareeb le ja rahe hain. Traders ka intezar hota hai ke price flat trendline ke upar breakout kare, indicating a potential bullish move.

Descending Triangle

Descending triangle ek bearish pattern hai jahan lower trendline flat hoti hai, indicating strong support, jabke upper trendline neeche ki taraf slope karti hai, indicating lower highs. Ye pattern yeh suggest karta hai ke sellers zyada dominant ho rahe hain, price ko support level ke qareeb le ja rahe hain. Traders flat trendline ke neeche breakout ki taraf dekhte hain, indicating a potential bearish move. Rectangle pattern bhi aik dosra bilateral formation hai jo parallel horizontal trendlines se characterize hota hai, indicating a period of consolidation. Ye pattern supply aur demand ke darmiyan balance ko darust karta hai, jahan traders upper trendline ya lower trendline ke breakout ka intezar karte hain taake potential price movement ko confirm kiya ja sake.

Bilateral patterns ki aik bari fehrist mein yeh hai ke inka istemal mukhtalif timeframes par kiya ja sakta hai. Chahe aap chhotay arsay ke din trader hain ya lambay arsay ke investor, ye patterns minutes se le kar months tak ki charts par identify kiye ja sakte hain. Chotay arsay ke traders jaldi price movements ko capture karne ke liye chhotay timeframes par tawajju dete hain jabke lambay arsay ke investors bara timeframes ka istemal zyada significant trading decisions ke liye karte hain.

Bilateral chart patterns trading karte waqt, future price movements ki taraf ishara karne ke liye aur bhi technical indicators aur fundamental analysis ka khayal rakhna bohot zaroori hai. Traders aksar apne trading decisions ko tasdeeq dene ke liye moving averages, relative strength index (RSI), aur Fibonacci retracement levels jese tools ka istemal karte hain. Is ke ilawa, economic indicators, geopolitical events, aur central bank policies par nazr rakhna bhi market sentiment ke liye valuable insights provide kar sakta hai, jiski wajah se traders informe decisions le sakte hain. Risk management bhi trading ke liye aik ahem aspect hai jab aap bilateral chart patterns ka istemal kar rahe hain. Ye patterns achi entry aur exit points provide kar sakte hain, lekin koi bhi trading strategy 100% foolproof nahi hoti. Isliye, zaroori hai ke aap stop-loss orders set karein takay aap apni nuksan ko limit mein rakh sakein aur aik hi trade par apne capital ka zyada se zyada aik muqarrar percentage ko risk na karein. Risk ko effectively manage kar ke, traders apne investments ko protect kar sakte hain aur market mein lambe arsay tak reh sakte hain.

Symmetrical Triangle

Symmetrical triangle aik aam bilateral chart pattern hai. Ye pattern tab banta hai jab price converging trendlines ke darmiyan oscillate hoti hai, jo aik triangle ki shakal banati hai. Upper trendline woh series of lower highs ko jorta hai, jabke lower trendline higher lows ko connect karti hai. Jab price triangle ke apex tak pohanchti hai, to yeh darshata hai ke ek aise moqaat ka dor hai jahan buyers aur sellers barabari mein hain. Traders aksar upper trendline ke upar ya lower trendline ke neeche breakout ki taraf dekhte hain taake potential trend reversal ya continuation ko confirm kiya ja sake.

Ascending Triangle

Ascending triangle dusra bilateral pattern hai, jahan upper trendline flat hoti hai, indicating a strong resistance level, jabke lower trendline upar ki taraf slope karti hai, jo higher lows ko dikhata hai. Ye pattern yeh suggest karta hai ke buyers zyada aggressive ho rahe hain, price ko resistance level ke qareeb le ja rahe hain. Traders ka intezar hota hai ke price flat trendline ke upar breakout kare, indicating a potential bullish move.

Descending Triangle

Descending triangle ek bearish pattern hai jahan lower trendline flat hoti hai, indicating strong support, jabke upper trendline neeche ki taraf slope karti hai, indicating lower highs. Ye pattern yeh suggest karta hai ke sellers zyada dominant ho rahe hain, price ko support level ke qareeb le ja rahe hain. Traders flat trendline ke neeche breakout ki taraf dekhte hain, indicating a potential bearish move. Rectangle pattern bhi aik dosra bilateral formation hai jo parallel horizontal trendlines se characterize hota hai, indicating a period of consolidation. Ye pattern supply aur demand ke darmiyan balance ko darust karta hai, jahan traders upper trendline ya lower trendline ke breakout ka intezar karte hain taake potential price movement ko confirm kiya ja sake.

Bilateral patterns ki aik bari fehrist mein yeh hai ke inka istemal mukhtalif timeframes par kiya ja sakta hai. Chahe aap chhotay arsay ke din trader hain ya lambay arsay ke investor, ye patterns minutes se le kar months tak ki charts par identify kiye ja sakte hain. Chotay arsay ke traders jaldi price movements ko capture karne ke liye chhotay timeframes par tawajju dete hain jabke lambay arsay ke investors bara timeframes ka istemal zyada significant trading decisions ke liye karte hain.

Bilateral chart patterns trading karte waqt, future price movements ki taraf ishara karne ke liye aur bhi technical indicators aur fundamental analysis ka khayal rakhna bohot zaroori hai. Traders aksar apne trading decisions ko tasdeeq dene ke liye moving averages, relative strength index (RSI), aur Fibonacci retracement levels jese tools ka istemal karte hain. Is ke ilawa, economic indicators, geopolitical events, aur central bank policies par nazr rakhna bhi market sentiment ke liye valuable insights provide kar sakta hai, jiski wajah se traders informe decisions le sakte hain. Risk management bhi trading ke liye aik ahem aspect hai jab aap bilateral chart patterns ka istemal kar rahe hain. Ye patterns achi entry aur exit points provide kar sakte hain, lekin koi bhi trading strategy 100% foolproof nahi hoti. Isliye, zaroori hai ke aap stop-loss orders set karein takay aap apni nuksan ko limit mein rakh sakein aur aik hi trade par apne capital ka zyada se zyada aik muqarrar percentage ko risk na karein. Risk ko effectively manage kar ke, traders apne investments ko protect kar sakte hain aur market mein lambe arsay tak reh sakte hain.

تبصرہ

Расширенный режим Обычный режим