Envelopes channel ek technical analysis tool hai jo market price ke upar aur niche do alag alag lines se bani hoti hai. In lines ko aam tor par upper aur lower envelopes ke naam se jana jata hai, jo ke market price se musallas zarfati doori par bani hoti hain. Envelopes ke asal maqsad yeh hai ke market mein mumkinat ke overbought aur oversold levels ka visual representation banaya jaye. Traders is information ka istemal apni trades ke liye dakhilay aur nikalne ke maqamat ki pehchan ke liye karte hain. Envelopes channel aam tor par market price ke simple moving average (SMA) par mabni hota hai. Is calculation mein SMA ke upar aur niche aik muqarar percentage ya points ka istemal hota hai, jis se upper aur lower envelopes banai jati hain. For example, agar aik trader ne 1% envelope choose kiya hai aur 20-period SMA ke liye, to upper envelope 1% SMA ke upar rakhi jayegi, aur lower envelope 1% SMA ke niche rakhi jayegi.

Interpretation of Envelopes Channel

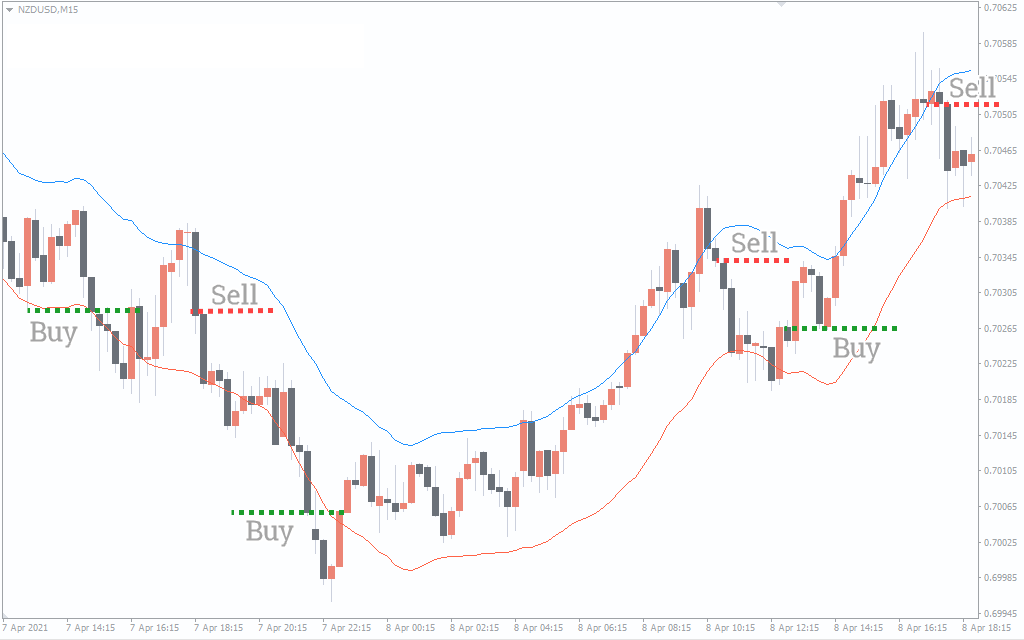

Envelopes channel ki samajh ke liye zaroori hai ke is ke harkaton ko market price ke nisbat mein sahih tarah se samjha jaye. Jab price upper envelope ko chhoo jati hai ya guzar jati hai, to yeh ishara karta hai ke market mumkinan overbought hai, jisse ke selling opportunity ban sakti hai. Barabar yehi, jab price lower envelope ko chhoo jati hai ya is se nichla chala jata hai, to yeh ishara karta hai ke market mumkinan oversold hai, jisse ke buying opportunity ban sakti hai. Lekin, traders ko chahiye ke isharaat ke tasdeeq ke liye caution istemal karein aur Envelopes channel ke ke through generate hone wale signals ko tasdeeq karne ke liye mazeed technical analysis tools ya indicators ka istemal karein, kyun ke koi bhi indicator puri tarah se reliable nahi hota.

Uses In Forex Trading

Interpretation of Envelopes Channel

Envelopes channel ki samajh ke liye zaroori hai ke is ke harkaton ko market price ke nisbat mein sahih tarah se samjha jaye. Jab price upper envelope ko chhoo jati hai ya guzar jati hai, to yeh ishara karta hai ke market mumkinan overbought hai, jisse ke selling opportunity ban sakti hai. Barabar yehi, jab price lower envelope ko chhoo jati hai ya is se nichla chala jata hai, to yeh ishara karta hai ke market mumkinan oversold hai, jisse ke buying opportunity ban sakti hai. Lekin, traders ko chahiye ke isharaat ke tasdeeq ke liye caution istemal karein aur Envelopes channel ke ke through generate hone wale signals ko tasdeeq karne ke liye mazeed technical analysis tools ya indicators ka istemal karein, kyun ke koi bhi indicator puri tarah se reliable nahi hota.

Uses In Forex Trading

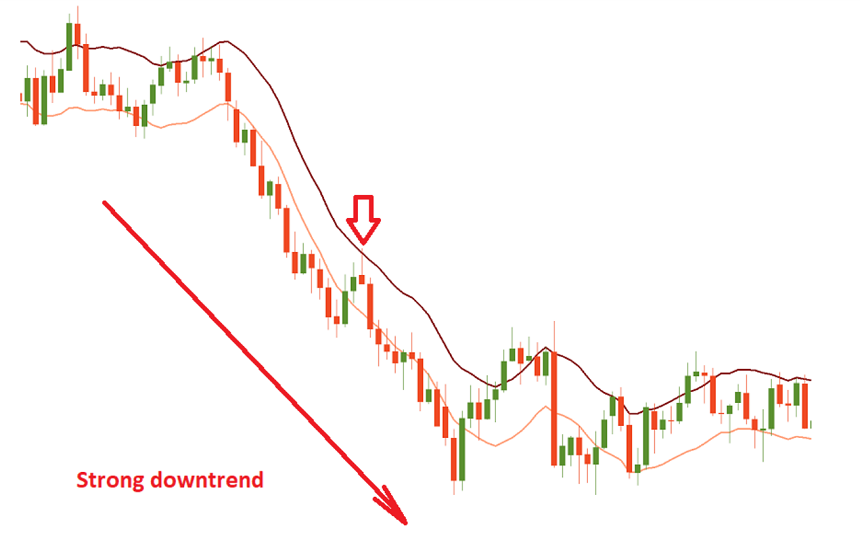

- Trend Identification: Envelopes traders ko market mein mojood trend ka pata lagane mein madadgar sabit ho sakta hai. Jab price upper envelope ke upar consistent tarah se trade karti hai, to yeh ek strong uptrend ko indicate karta hai, jab ke prices consistent tarah se lower envelope ke niche trade karte hain to yeh ek strong downtrend ko indicate karte hain. Traders is information ka istemal karke apni trades ko market ke mojood direction ke mutabiq adjust kar sakte hain.

- Volatility Assessment: Envelopes channel ka width market ki volatility ke baray mein malumat faraham kar sakta hai. Aik barhne wala channel zayada volatility ko indicate karta hai, jisse ke potential trading opportunities create hoti hain. Barabar yehi, aik kam hone wala channel kamzor volatility ko indicate karta hai aur is se kisi arsey ki consolidation ya aik significant price movement ke doran hone wale periods ke pesh khidmati ho sakta hai. Traders Envelopes channel ke volatility signals ke mutabiq apni strategies ko adjust kar sakte hain.

- Support and Resistance Levels: Envelopes dynamic support aur resistance levels ke tarah kaam kar sakte hain. Jab price lower envelope ke upar se approach karti hai aur phir se mudamad hoti hai, to lower envelope ek support level ka kaam karta hai. Isi tarah, jab price upper envelope ke niche se approach karti hai aur bounce back hoti hai, to upper envelope ek resistance level ka kaam karta hai. Traders in levels ka istemal apni stop-loss aur take-profit orders set karne ke liye kar sakte hain, apni risk management strategy ko behtar banane ke liye.

- Confirmation of Reversal Signals: Envelopes channel ko doosre technical indicators ke saath combine karke reversal signals ki tasdeeq ke liye istemal kiya ja sakta hai. For example, agar aik trader ko koi candlestick pattern nazar aata hai jo ek potential reversal ko indicate karta hai aur sath hi price upper ya lower envelope ko touch kar rahi hai, to yeh reversal signal ki validity ko barhata hai. Traders multiple indicators ek hi direction mein align hone par ziada confidence ke saath trades enter kar sakte hain.

- Divergence Analysis: Envelopes channel ko divergence analysis mein istemal kiya ja sakta hai, jahan price ke movements aur Envelopes channel ke movements ke darmiyan taqat mein farqat ko tajziya kiya jata hai. For example, agar price ek new high banati hai lekin upper envelope naye high tak nahi pohanchti, to yeh ek kamzor uptrend ko indicate karta hai. Barabar yehi, agar price ek new low banati hai lekin lower envelope naye low tak nahi pohanchti, to yeh ek kamzor downtrend ko indicate karta hai. Envelopes channel ke istemal se divergence analysis kiya ja sakta hai, jo potential trend reversals ya continuations ke baray mein malumat faraham kar sakta hai.

تبصرہ

Расширенный режим Обычный режим