Forex trading mein jahan market analysis aur timing ahem hain, traders aksar mukhtalif tools aur indicators ka istemal kar ke wazeh faislay karne ke liye rely karte hain. Aik aisi tool jo traders mein mashhoor ho gayi hai woh hai Heiken Ashi candlestick. Heiken Ashi, jo ke Japanese mein average bar ka matlab rakhta hai, aik khaas qisam ki candlestick chart hai jo market ki shorat ko filter kar ke qeemat ke rukh ka wazeh tasweer pesh karne ki koshish karta hai. Heiken Ashi ke gahak hone se pehle, traditional candlestick charts ki bunyadi maloomat samajhna zaroori hai. Forex trading mein, aik candlestick aik makhsoos waqt frame ki keemat ki harkat ko darust karti hai. Har candlestick ke chaar asooli hisse hote hain: opening price, closing price, high price, aur low price. Ye chezein market ke jazbat aur mumkinayi price reversals ke bare mein ahem maloomat farahem karti hain.

Structure of Heiken Ashi Candlesticks

Heiken Ashi candlesticks wohi structure istemal karte hain jo kay doosri candlesticks mein hota hai, bas fark itna hai ke ismein abhi aur pichli price data ko mad e nazar rakha jata hai. Traditional candlesticks ke mukabil, Heiken Ashi candles apni opening, closing, high, aur low prices tajwez karne ke liye ye formulas istemal karte hain:

Interpreting Heiken Ashi Candlesticks

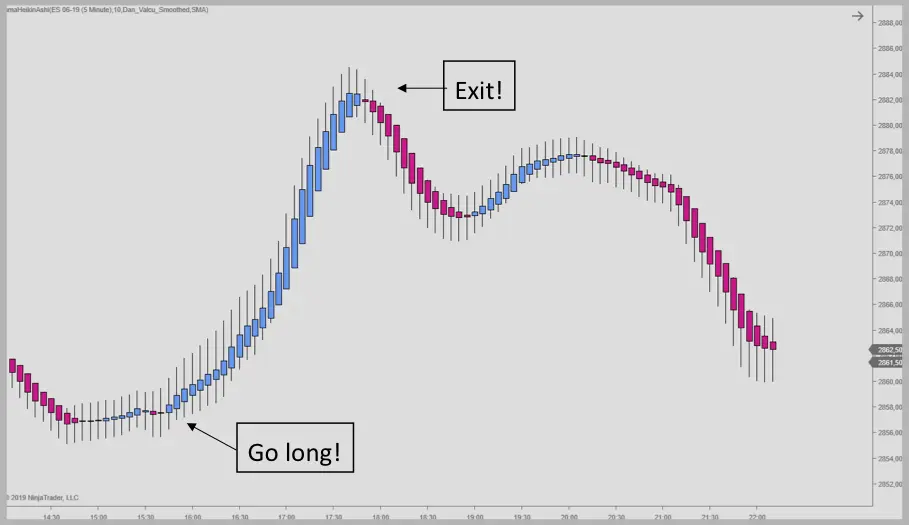

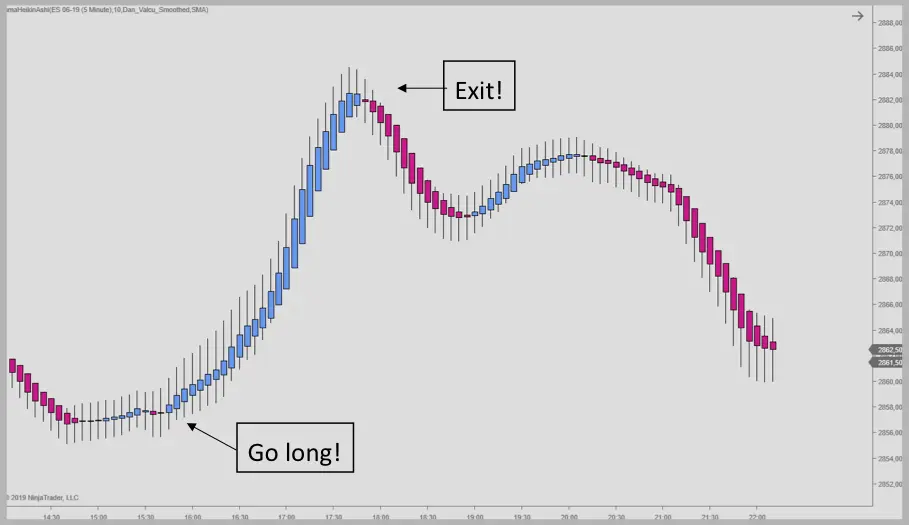

Heiken Ashi candlesticks do colours mein aati hain: green aur red. Is ranginai ki bunyad par yeh pata chalta hai ke mojud Heiken Ashi candle aur pichli candle ke darmiyan kya taluqat hain. Aik sabz Heiken Ashi candle bullish trend aur mazeed barhne ki mumkinat ko darust karta hai, jabke aik surkh candle bearish trend aur mazeed girawat ki taraf isharaat karta hai.

Advantages of Heiken Ashi Candlesticks

Structure of Heiken Ashi Candlesticks

Heiken Ashi candlesticks wohi structure istemal karte hain jo kay doosri candlesticks mein hota hai, bas fark itna hai ke ismein abhi aur pichli price data ko mad e nazar rakha jata hai. Traditional candlesticks ke mukabil, Heiken Ashi candles apni opening, closing, high, aur low prices tajwez karne ke liye ye formulas istemal karte hain:

- Heiken Ashi Close: (Open + High + Low + Close) / 4

- Heiken Ashi Open: (Previous Heiken Ashi Open + Previous Heiken Ashi Close) / 2

- Heiken Ashi High: (High, Heiken Ashi Open, Heiken Ashi Close) mein se ziyada

- Heiken Ashi Low: (Low, Heiken Ashi Open, Heiken Ashi Close) mein se kam

Interpreting Heiken Ashi Candlesticks

Heiken Ashi candlesticks do colours mein aati hain: green aur red. Is ranginai ki bunyad par yeh pata chalta hai ke mojud Heiken Ashi candle aur pichli candle ke darmiyan kya taluqat hain. Aik sabz Heiken Ashi candle bullish trend aur mazeed barhne ki mumkinat ko darust karta hai, jabke aik surkh candle bearish trend aur mazeed girawat ki taraf isharaat karta hai.

- Green Heiken Ashi Candle: Aik sabz Heiken Ashi candle banne ke liye, is waqt ki candle ki closing price pichli candle ki opening aur closing price se zyada honi chahiye. Ye bullish market sentiment aur upward trend ke potential continuation ki taraf isharaat karta hai.

- Red Heiken Ashi Candle: Aik red Heiken Ashi candle tab banti hai jab is waqt ki candle ki closing price pichli candle ki opening aur closing price se kam hoti hai. Ye bearish market sentiment aur downward trend ke potential continuation ki taraf isharaat karta hai.

Advantages of Heiken Ashi Candlesticks

- Smoothing Price Movements: Heiken Ashi candles price movements ko smooth karti hain, market noise ko filter kar ke traders ko ahem trends par tawajju dilwana asan ho jata hai. Ye feature khaas tor par Forex market mein lambay term ke trends ko pehchanna ke liye mufeed hai.

- Easy Trend Identification: Heiken Ashi candles ki ranginai ki sifat ne trend pehchanna asan kar diya hai. Traders asani se bullish aur bearish trends ko pehchankar timely decisions le sakte hain.

- Reduced False Signals: Heiken Ashi candles false signals ko kam karti hain jo aam tor par volatile ya range-bound markets mein hoti hain. Traders be zaroorat trades se bach sakte hain, jiski wajah se unki entries aur exits zyada durust hoti hain.

- Supports Multiple Timeframes: Heiken Ashi charts versatile hain aur inko mukhtalif timeframes par apply kiya ja sakta hai. Chahe traders chotay arsay mein trading kar rahe hon ya lambay arsay ke investments mein, Heiken Ashi mukhtalif time horizons par qeemati insights farahem karta hai.

- Enhanced Support and Resistance Levels: Heiken Ashi candles support aur resistance levels ki behtar nazar andaz hone mein madad farahem karte hain. Traders asani se ahem price levels ko pehchankar stop-loss aur take-profit orders set kar sakte hain.

تبصرہ

Расширенный режим Обычный режим