Simple Strategy in Forex Trading

Introduction

Dear Fellows,

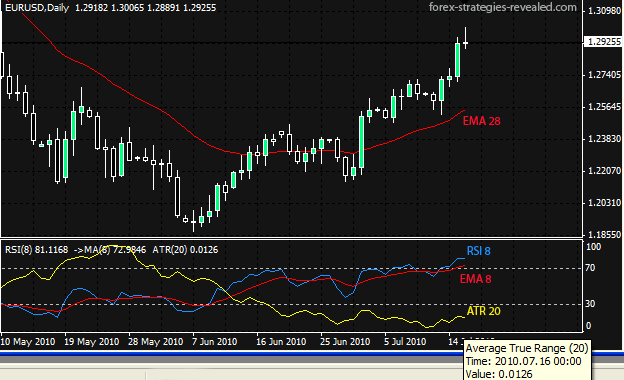

Jaisa k as a trader hum sab jaanty hain k forex trading main jo sb say simple indicator awar stragty hai wo RSI (Relative Strength Index) jo kk new members k samjhna bahoot asaan hain q k new banda jo trading ki abc tak nai janta agr wo start say he mushkil indicators k chakron men pray ga to usko samkh nai ay gi ulta confused ho ga so meray khiayal men agar RSI ko samjha jaye to ye sab say simple ha aur commnon bhi ha. New trader MT4 pay jb account login kray to baqi indicators ki selection khatam kr k sirf RSI ko slect kr lay aur RSI ko live market men daikhnay ka simple tareeqa ha k jb bhi RSI 20 say necahy a jaye to iska mtlb ha market bahut ziyada oversold ho gae ha aur ab mazid market k nechay janay k chance kam hain aur market ab up jaye gi so buy ki trade wahan put krnay say aksar profit aata hain. Same jb RSI 80 say oper chali jaye to yeh zahir krti ha market overbought ho gai hain. Traders ki simple trading strategies bahot si hey jes ka ham jaiza lengey jo key beginners ko use karny bahot zarori hey, kesi ekk trading strategy ko trading me apply karna beginners ko kamyabi ki taraf le kar ja sakta hay, day trading strategy beginners key ley complicated ho sakti hay es ley day trading expernice hasil karny key bad ki strategy honi chaye beginners stage me nahi, trend line ko follow karna sab se best aur simple trading main jo sb say simple indicator awar stragty ha wo ha RSI (Relative Strength Index) jo k new members k samjhna bahut asan ha kyun k new banda jo trading ki abc tak nai janta agr wo start say he mushkil indicators k chakron men pray ga to usko samkh nai ay gi ulta confused ho ga so meray khiaal men agr RSI ko samjha jaye to yeh sb say simple ha aur commnon bhi ha. New trader MT4 pay jb account login kray to baqi indicators ki selection khatam kr k sirf RSI ko slect kr lay aur RSI ko live market men daikhnay ka simple tareeqa ha k jb bhi RSI 20 say necahy a jaye to iska mtlb ha market bahut ziyada oversold ho gae ha aur ab mazid market k nechy janay k chance kam hain awar market ab up jayegi so buy ki trade wahan put krnay say aksar profit aata hain. Same jb RSI 80 say oper chali jaye to yeh zahir krti ha market overbought ho gaei hain.

Importance

Fellows,

Esski trading main bahoot ehmiaat hain. forex mai streteg k baahot ehmiatat hain humko ache strategy banane hoge awar hamy isy test karna ho gaa phir he hum kam kar ky paisa kamaa saky gy forex kabe be band na hony wala business hain hum ess main simple strategy bana kar use kar ky be kamyab ho sakty hain forex aik international business hain hum is mai part time be kam kar sakty hain hum is mai full time be kam kar sakty hain hum is mai agar greedy ban jald baze mai kam kary gy to hamy loss ho jy ga is mai market ka balm nahi hota forex mai hum apny trading ko kamyab bana sakty hain.

Conclusion

Fellows,

Last main hum ye conclude karty hain k forex mai stretegy ke bohat ehmeiat hain to hamy ache strategy banane ho ge awar hamy aisy test karna ho ga pher he hum kam kar ky paisa kama saky gy forex kabe be band na hony wala business hain So why hum is mai simple strategy bana kar use kar ky be kamyab ho sakty hain forex aik international business hain hum is mai part time be kam kar sakty hain hum is mai full time be kam kar sakty hain hum is mai agar greedy ban jald baze mai kam kary gy to hamy loss ho jaay ga. So in last hum eskka khiaal rkhna chiahy k trading main kisi indicator ko naxar andaaz nahi krna chahiay.

Thanks

Introduction

Dear Fellows,

Jaisa k as a trader hum sab jaanty hain k forex trading main jo sb say simple indicator awar stragty hai wo RSI (Relative Strength Index) jo kk new members k samjhna bahoot asaan hain q k new banda jo trading ki abc tak nai janta agr wo start say he mushkil indicators k chakron men pray ga to usko samkh nai ay gi ulta confused ho ga so meray khiayal men agar RSI ko samjha jaye to ye sab say simple ha aur commnon bhi ha. New trader MT4 pay jb account login kray to baqi indicators ki selection khatam kr k sirf RSI ko slect kr lay aur RSI ko live market men daikhnay ka simple tareeqa ha k jb bhi RSI 20 say necahy a jaye to iska mtlb ha market bahut ziyada oversold ho gae ha aur ab mazid market k nechay janay k chance kam hain aur market ab up jaye gi so buy ki trade wahan put krnay say aksar profit aata hain. Same jb RSI 80 say oper chali jaye to yeh zahir krti ha market overbought ho gai hain. Traders ki simple trading strategies bahot si hey jes ka ham jaiza lengey jo key beginners ko use karny bahot zarori hey, kesi ekk trading strategy ko trading me apply karna beginners ko kamyabi ki taraf le kar ja sakta hay, day trading strategy beginners key ley complicated ho sakti hay es ley day trading expernice hasil karny key bad ki strategy honi chaye beginners stage me nahi, trend line ko follow karna sab se best aur simple trading main jo sb say simple indicator awar stragty ha wo ha RSI (Relative Strength Index) jo k new members k samjhna bahut asan ha kyun k new banda jo trading ki abc tak nai janta agr wo start say he mushkil indicators k chakron men pray ga to usko samkh nai ay gi ulta confused ho ga so meray khiaal men agr RSI ko samjha jaye to yeh sb say simple ha aur commnon bhi ha. New trader MT4 pay jb account login kray to baqi indicators ki selection khatam kr k sirf RSI ko slect kr lay aur RSI ko live market men daikhnay ka simple tareeqa ha k jb bhi RSI 20 say necahy a jaye to iska mtlb ha market bahut ziyada oversold ho gae ha aur ab mazid market k nechy janay k chance kam hain awar market ab up jayegi so buy ki trade wahan put krnay say aksar profit aata hain. Same jb RSI 80 say oper chali jaye to yeh zahir krti ha market overbought ho gaei hain.

Importance

Fellows,

Esski trading main bahoot ehmiaat hain. forex mai streteg k baahot ehmiatat hain humko ache strategy banane hoge awar hamy isy test karna ho gaa phir he hum kam kar ky paisa kamaa saky gy forex kabe be band na hony wala business hain hum ess main simple strategy bana kar use kar ky be kamyab ho sakty hain forex aik international business hain hum is mai part time be kam kar sakty hain hum is mai full time be kam kar sakty hain hum is mai agar greedy ban jald baze mai kam kary gy to hamy loss ho jy ga is mai market ka balm nahi hota forex mai hum apny trading ko kamyab bana sakty hain.

Conclusion

Fellows,

Last main hum ye conclude karty hain k forex mai stretegy ke bohat ehmeiat hain to hamy ache strategy banane ho ge awar hamy aisy test karna ho ga pher he hum kam kar ky paisa kama saky gy forex kabe be band na hony wala business hain So why hum is mai simple strategy bana kar use kar ky be kamyab ho sakty hain forex aik international business hain hum is mai part time be kam kar sakty hain hum is mai full time be kam kar sakty hain hum is mai agar greedy ban jald baze mai kam kary gy to hamy loss ho jaay ga. So in last hum eskka khiaal rkhna chiahy k trading main kisi indicator ko naxar andaaz nahi krna chahiay.

Thanks

تبصرہ

Расширенный режим Обычный режим