Trading on Margin

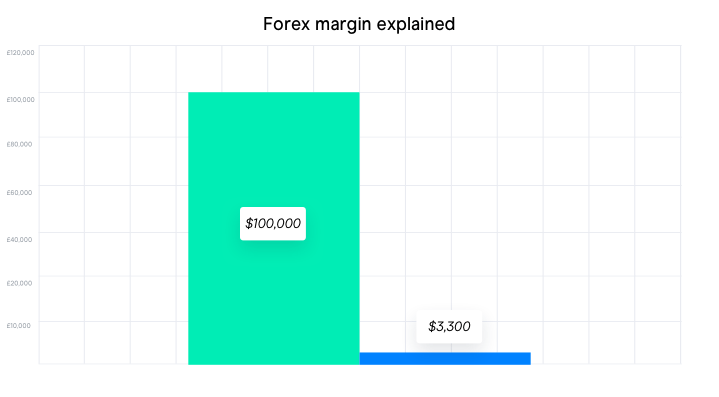

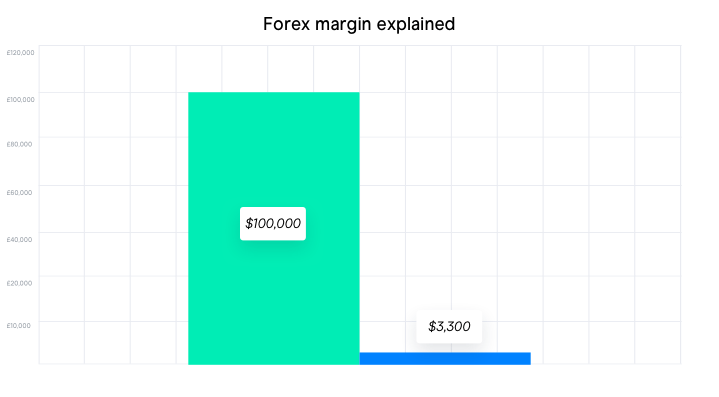

Trading par margin use karna ek aam amal hai jisme investors ko broker se funds udhaar lenay ki ijazat hoti hai taa ke woh apni account balance se zyada bari positions trade kar sakein jo ke unki asal balance se mumkin nahi hoti. Is taur par, yeh unko trading position ko leverage denay ke liye udhaar liye hue paisay istemal karne ki anumati deta hai. Jab ek investor margin par trade karta hai, to usay apne broker ke saath kuch paisay jama karne hote hain, jo ke margin requirement ke naam se jaani jaati hai. Margin requirement amuman trade ki total value ka kuch percent hoti hai. Margin par trading se investors apni munafa ko zyada kar sakte hain agar market unki taraf jaye. Lekin, agar market unke khilaf chali jaye to nuqsaan ka khadsha bhi zyada ho jata hai.

Leveraging Trading Positions

Margin par trading ka aik bara faida yeh hai ke yeh potential munafa ko barha sakta hai. Misal ke taur par, agar kisi investor ke pass unki trading account mein $1,000 hai aur woh 2:1 leverage istemal karta hai, to woh asal mein $2,000 ke trading position ko control kar sakta hai. Agar traded asset ki keemat 10% barh jaye to investor ko unki $1,000 ki investment par $200 ka munafa ho sakta hai, jo ke unki asal raqm ko double kar deta hai. Bina margin ke, wohi keemat barhne par munafa sirf $100 hota. Apni positions ko leverage karnay ki yeh salahiyat woh traders ke liye khaas tor par attractive hoti hai jo apne munafa ko kam waqt mein zyada karna chahte hain. Lekin margin par trading ke saath saath kuch bara risks bhi aate hain. Aik sab se bari khatraat mein se aik hai margin call ka khatra. Margin call tab hoti hai jab investor ki trading positions ki qeemat woh level tak gir jaati hai jo ke maintenance margin kehlaya jata hai. Jab yeh hota hai, to broker margin call jari kar sakta hai, jo ke investor ko zaroorat hoti hai mazeed funds jama karne ki takmeel ke liye apne account mein taa ke woh nuqsaan ko cover kar sakein aur account ko initial margin level tak pohnchayein.

Risks Associated with Margin Trading

Margin calls asal mein potential nuqsaanat ko cover karne ke liye mazeed funds ya securities ke liye darkhwastat hain. Agar investor margin call ki darkhwastat poori nahi karta, to broker ko haq hota hai ke woh investor ki positions ko liquidate kar de taa ke nuqsaanat ko cover kiya ja sake. Yeh investor ke liye bari nuqsaanat ka bais ban sakta hai, kyun ke broker nuqsaanat ko cover karne se pehle market ki shara'it behtar hone ka intezaar nahi karta. Investor ko apni initial raqm ya to significantly kam hui account balance mil sakti hai ya phir broker ke liye qarz ka bojh uthana par sakta hai agar liquidation se hasil hone wale paisay nuqsaanat ko cover nahi karte. Aik margin call ka waqiya aksar buray market movements ke asarat mein hota hai. Agar market investor ki positions ke khilaf chali jaye to nuqsaanat jald hi account balance ko ghata sakti hain. Yeh khaas tor par wahi hota hai jab prices mein tezi se tabdili hoti hai jahan prices mein tezi se tabdili ho sakti hai. Aise surat e haal mein, choti se bhi buray price movement se bhi margin call ka waqiya ho sakta hai agar investor ki positions zyada leverage par hain.

Margin Calls Mechanism

Margin call ek scenario hai jahan ek investor ne apne margin account mein $10,000 jama kiye hain aur decide kia hai ke woh broker se mazeed $10,000 udhaar lekar apni trading positions ko leverage dena chahte hain, jiski wajah se unki total trading capital $20,000 ho jati hai. Broker ka maintenance margin requirement 25% hai, jiski matlab hai ke investor ke account mein kam se kam $5,000 ki qeemat rakhni hoti hai (total leverage position ka 25%) margin call se bachne ke liye. Agar investor ne $20,000 istemal kar ke kisi stock ki shares khareedi hain, to agar stock ki keemat girne lagti hai to investor ki position ki qeemat mein kami aati hai. Agar position ki qeemat $15,000 se kam ho jaye (initial $20,000 position minus 25% maintenance margin), to margin call jari ho jati hai. Investor ko phir apne account mein mazeed funds jama karne ke liye darkhwastat hoti hai taa ke account balance ko initial margin level yani $10,000 tak pohnchaya ja sake. Agar investor margin call ki darkhwastat poori nahi karta, to broker position ko liquidate kar sakta hai takay nuqsaanat ko cover kiya ja sake, jis se investor ko kafi kam hui account balance ya phir broker ke liye qarz ka bojh uthana par sakta hai.

Risk Management Strategies in Margin Trading

Yeh samajhna zaroori hai ke traders ko trading par margin istemal karne ke sath risk management strategies istemal karni chahiye. Ek tareeqa nuqsaanat ko manage karne ka yeh hai ke stop-loss orders set kiye jayein, jo ke automatically ek sell order ko trigger kar deti hain agar kisi asset ki keemat kisi pehle tay kiye hue level tak pohnch jaye. Stop-loss orders nuqsaanat ko had mein rakhte hain aur margin call ka khatra kam kar deti hain. Is ke ilawa traders ko sirf us waqt margin istemal karni chahiye jab unko market aur is trading ke risk ka thek se andaza ho. Yeh un ke liye munasib nahi hai jo trading ke complexities ko puri tarah samajhne mein qabil nahi hain. Education aur research wo chezein hain jo har kisi ke liye zaroori hain jo margin trading ki soch rahe hain, sath hi sath unke pass apne financial goals aur risk tolerance ka clear understanding ho. Agar koi shakhs margin trading ki surat mein invest karna chahta hai, to usay pehle market trends, economic indicators aur trading strategies ke bare mein detailed research karni chahiye. Is knowledge ke bina, margin trading ek high-risk activity ban jaati hai, jisme investors apni investments ko kho sakte hain.

Trading par margin use karna ek aam amal hai jisme investors ko broker se funds udhaar lenay ki ijazat hoti hai taa ke woh apni account balance se zyada bari positions trade kar sakein jo ke unki asal balance se mumkin nahi hoti. Is taur par, yeh unko trading position ko leverage denay ke liye udhaar liye hue paisay istemal karne ki anumati deta hai. Jab ek investor margin par trade karta hai, to usay apne broker ke saath kuch paisay jama karne hote hain, jo ke margin requirement ke naam se jaani jaati hai. Margin requirement amuman trade ki total value ka kuch percent hoti hai. Margin par trading se investors apni munafa ko zyada kar sakte hain agar market unki taraf jaye. Lekin, agar market unke khilaf chali jaye to nuqsaan ka khadsha bhi zyada ho jata hai.

Leveraging Trading Positions

Margin par trading ka aik bara faida yeh hai ke yeh potential munafa ko barha sakta hai. Misal ke taur par, agar kisi investor ke pass unki trading account mein $1,000 hai aur woh 2:1 leverage istemal karta hai, to woh asal mein $2,000 ke trading position ko control kar sakta hai. Agar traded asset ki keemat 10% barh jaye to investor ko unki $1,000 ki investment par $200 ka munafa ho sakta hai, jo ke unki asal raqm ko double kar deta hai. Bina margin ke, wohi keemat barhne par munafa sirf $100 hota. Apni positions ko leverage karnay ki yeh salahiyat woh traders ke liye khaas tor par attractive hoti hai jo apne munafa ko kam waqt mein zyada karna chahte hain. Lekin margin par trading ke saath saath kuch bara risks bhi aate hain. Aik sab se bari khatraat mein se aik hai margin call ka khatra. Margin call tab hoti hai jab investor ki trading positions ki qeemat woh level tak gir jaati hai jo ke maintenance margin kehlaya jata hai. Jab yeh hota hai, to broker margin call jari kar sakta hai, jo ke investor ko zaroorat hoti hai mazeed funds jama karne ki takmeel ke liye apne account mein taa ke woh nuqsaan ko cover kar sakein aur account ko initial margin level tak pohnchayein.

Risks Associated with Margin Trading

Margin calls asal mein potential nuqsaanat ko cover karne ke liye mazeed funds ya securities ke liye darkhwastat hain. Agar investor margin call ki darkhwastat poori nahi karta, to broker ko haq hota hai ke woh investor ki positions ko liquidate kar de taa ke nuqsaanat ko cover kiya ja sake. Yeh investor ke liye bari nuqsaanat ka bais ban sakta hai, kyun ke broker nuqsaanat ko cover karne se pehle market ki shara'it behtar hone ka intezaar nahi karta. Investor ko apni initial raqm ya to significantly kam hui account balance mil sakti hai ya phir broker ke liye qarz ka bojh uthana par sakta hai agar liquidation se hasil hone wale paisay nuqsaanat ko cover nahi karte. Aik margin call ka waqiya aksar buray market movements ke asarat mein hota hai. Agar market investor ki positions ke khilaf chali jaye to nuqsaanat jald hi account balance ko ghata sakti hain. Yeh khaas tor par wahi hota hai jab prices mein tezi se tabdili hoti hai jahan prices mein tezi se tabdili ho sakti hai. Aise surat e haal mein, choti se bhi buray price movement se bhi margin call ka waqiya ho sakta hai agar investor ki positions zyada leverage par hain.

Margin Calls Mechanism

Margin call ek scenario hai jahan ek investor ne apne margin account mein $10,000 jama kiye hain aur decide kia hai ke woh broker se mazeed $10,000 udhaar lekar apni trading positions ko leverage dena chahte hain, jiski wajah se unki total trading capital $20,000 ho jati hai. Broker ka maintenance margin requirement 25% hai, jiski matlab hai ke investor ke account mein kam se kam $5,000 ki qeemat rakhni hoti hai (total leverage position ka 25%) margin call se bachne ke liye. Agar investor ne $20,000 istemal kar ke kisi stock ki shares khareedi hain, to agar stock ki keemat girne lagti hai to investor ki position ki qeemat mein kami aati hai. Agar position ki qeemat $15,000 se kam ho jaye (initial $20,000 position minus 25% maintenance margin), to margin call jari ho jati hai. Investor ko phir apne account mein mazeed funds jama karne ke liye darkhwastat hoti hai taa ke account balance ko initial margin level yani $10,000 tak pohnchaya ja sake. Agar investor margin call ki darkhwastat poori nahi karta, to broker position ko liquidate kar sakta hai takay nuqsaanat ko cover kiya ja sake, jis se investor ko kafi kam hui account balance ya phir broker ke liye qarz ka bojh uthana par sakta hai.

Risk Management Strategies in Margin Trading

Yeh samajhna zaroori hai ke traders ko trading par margin istemal karne ke sath risk management strategies istemal karni chahiye. Ek tareeqa nuqsaanat ko manage karne ka yeh hai ke stop-loss orders set kiye jayein, jo ke automatically ek sell order ko trigger kar deti hain agar kisi asset ki keemat kisi pehle tay kiye hue level tak pohnch jaye. Stop-loss orders nuqsaanat ko had mein rakhte hain aur margin call ka khatra kam kar deti hain. Is ke ilawa traders ko sirf us waqt margin istemal karni chahiye jab unko market aur is trading ke risk ka thek se andaza ho. Yeh un ke liye munasib nahi hai jo trading ke complexities ko puri tarah samajhne mein qabil nahi hain. Education aur research wo chezein hain jo har kisi ke liye zaroori hain jo margin trading ki soch rahe hain, sath hi sath unke pass apne financial goals aur risk tolerance ka clear understanding ho. Agar koi shakhs margin trading ki surat mein invest karna chahta hai, to usay pehle market trends, economic indicators aur trading strategies ke bare mein detailed research karni chahiye. Is knowledge ke bina, margin trading ek high-risk activity ban jaati hai, jisme investors apni investments ko kho sakte hain.

تبصرہ

Расширенный режим Обычный режим