Bollinger Bands forex trading mein kayi maqsad serve karte hain. Middle band average price ko represent karta hai specific period mein, jo price movements ke liye aik base provide karta hai. Upper aur lower bands, jo middle band se standard deviations ke doori par hoti hain, dynamic support aur resistance levels ka kaam karti hain. Jab price upper band ke qareeb aata hai, ye ishara karta hai ke market shayad overbought hai, jabke lower band ke qareeb aana oversold conditions ko indicate karta hai.

Identifying Volatility

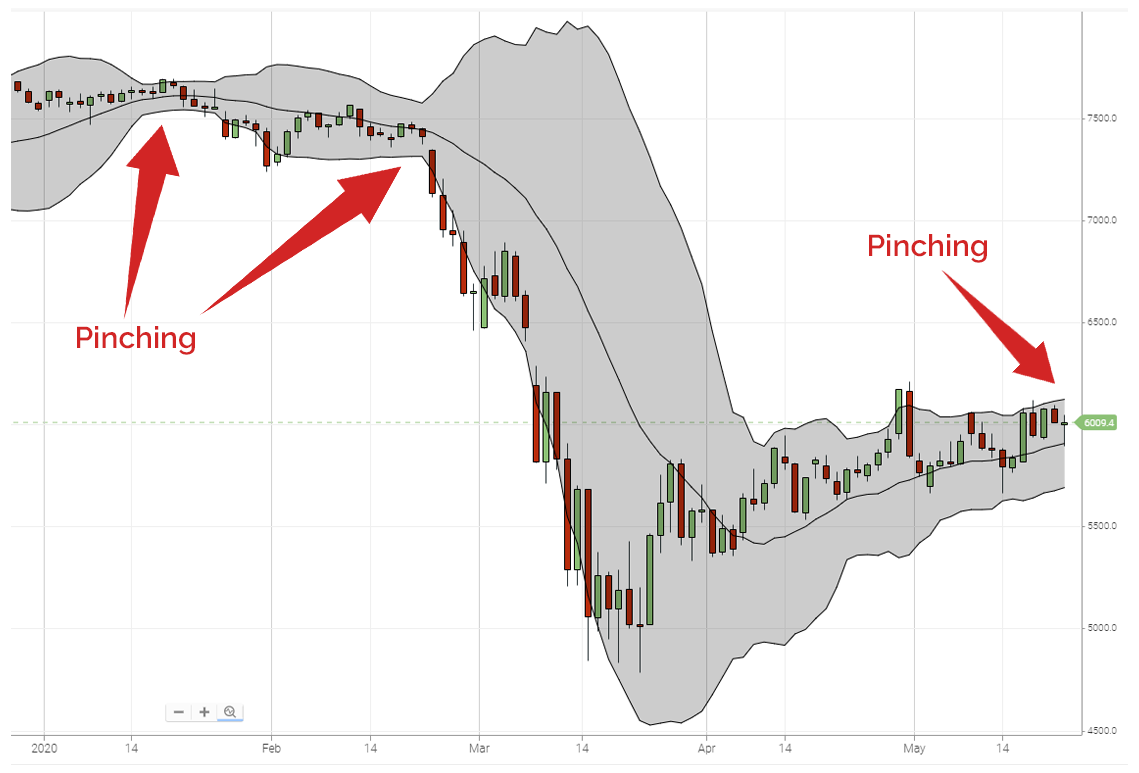

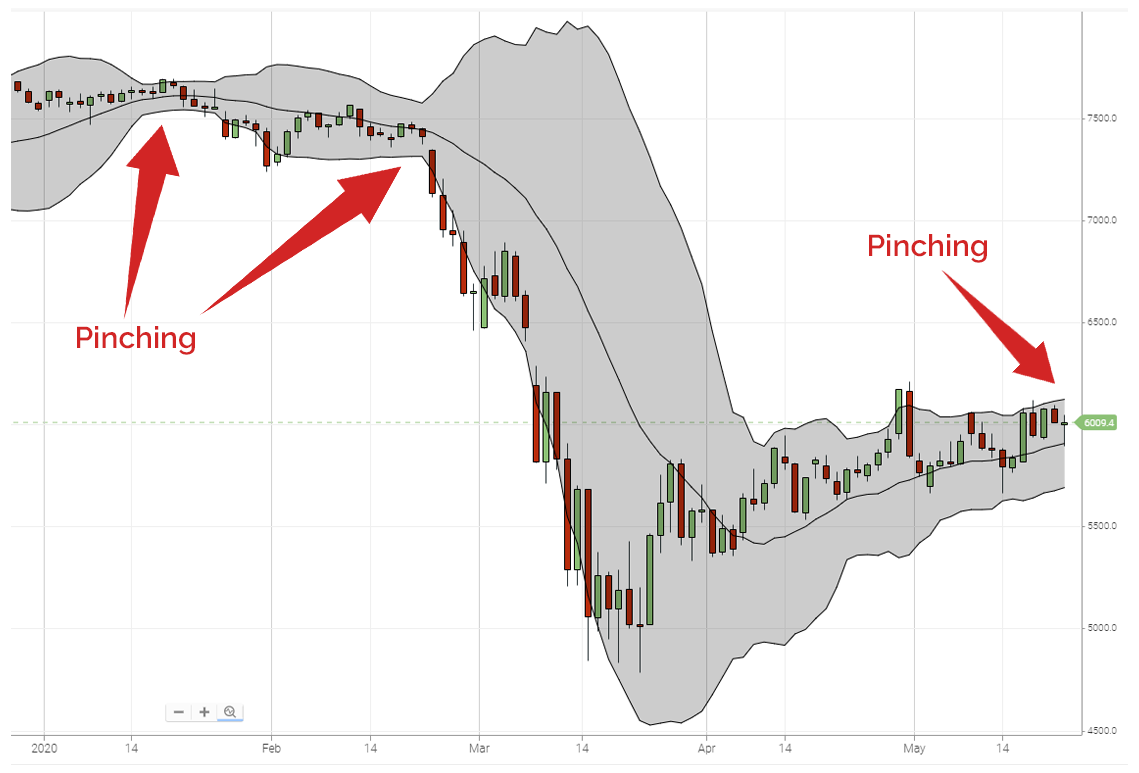

Bollinger Bands ka aik primary istemal volatility measure karne ke liye hai. High volatility ke doran bands widen hoti hain, aur low volatility ke doran bands contract hoti hain. Traders bands ke width ko interpret kar ke market ki volatility levels ka andaza laga sakte hain. Wider bands zyada volatility aur potential trading opportunities indicate karte hain, jabke narrower bands aik shaant market ko suggest karte hain. Bollinger Bands reversal aur continuation patterns ko identify karne mein effective hote hain. For example, reversal pattern jaise ke double top tab hota hai jab price upper band ko touch karta hai aur usay break nahi karta. Isi tarah, double bottom pattern tab ban sakta hai jab price lower band ko touch karta hai aur usay penetrate nahi karta. Traders in patterns ko Bollinger Bands ke saath combine kar ke trading decisions le sakte hain.

Identifying Overbought and Oversold Conditions

Jab price upper band ko touch karta hai ya usse cross karta hai, ye ishara karta hai ke market overbought hai, potential reversal ya pullback ko indicate karte hue. Mutabiq, jab price lower band ko touch karta hai ya usse nichay jaata hai, ye oversold conditions ko indicate karta hai, potential upside reversal ko suggest karte hue. A Bollinger Band squeeze tab hota hai jab volatility historically low level par chali jaati hai, leading to a potential explosive price movement. Traders aksar ek squeeze ke liye wait karte hain, jo ke bands ke andar move hone ki wajah se characterize hota hai. Jab bands phir se expand hone lagte hain, ye aik significant price trend ka aaghaz hone ki nishani ho sakti hai. Bollinger Band divergence tab hoti hai jab price naya high ya low banata hai, lekin Bollinger Bands move confirm nahi karte hain by widening. Ye indicate kar sakta hai ke current trend mein potential reversal ho sakti hai, traders ko opposite direction mein trade karne ka opportunity dene ke liye.

Combining Bollinger Bands with Other Indicators

Bollinger Bands ki effectiveness ko barhane ke liye, traders often inko doosre technical indicators ke saath combine karte hain. Mashhoor choices mein shaamil hain Relative Strength Index (RSI) aur Moving Average Convergence Divergence (MACD). Ye indicators Bollinger Bands ke saath use hone par additional confirmation signals provide kar sakte hain. Sahi risk management forex trading mein ahem hai. Bollinger Bands traders ko stop-loss levels set karne aur potential price targets determine karne mein madadgar ho sakte hain. For example, jab long trade enter ki jaati hai, to stop-loss lower band ke neeche place kiya ja sakta hai, jo ke logical level provide karta hai agar trade expectations ke khilaf jaati hai.Bollinger Bands ke saath sahi tarike se trading karne se pehle, historical data par based strategies ko backtest karna zaroori hai. Ye traders ko samajhne mein madad karta hai ke unka approach various market conditions ke neeche kitni effective hai. Iske ilawa, demo account ke saath practice karke bina real money risk kiye valuable experience gain ki ja sakti hai.

Identifying Volatility

Bollinger Bands ka aik primary istemal volatility measure karne ke liye hai. High volatility ke doran bands widen hoti hain, aur low volatility ke doran bands contract hoti hain. Traders bands ke width ko interpret kar ke market ki volatility levels ka andaza laga sakte hain. Wider bands zyada volatility aur potential trading opportunities indicate karte hain, jabke narrower bands aik shaant market ko suggest karte hain. Bollinger Bands reversal aur continuation patterns ko identify karne mein effective hote hain. For example, reversal pattern jaise ke double top tab hota hai jab price upper band ko touch karta hai aur usay break nahi karta. Isi tarah, double bottom pattern tab ban sakta hai jab price lower band ko touch karta hai aur usay penetrate nahi karta. Traders in patterns ko Bollinger Bands ke saath combine kar ke trading decisions le sakte hain.

Identifying Overbought and Oversold Conditions

Jab price upper band ko touch karta hai ya usse cross karta hai, ye ishara karta hai ke market overbought hai, potential reversal ya pullback ko indicate karte hue. Mutabiq, jab price lower band ko touch karta hai ya usse nichay jaata hai, ye oversold conditions ko indicate karta hai, potential upside reversal ko suggest karte hue. A Bollinger Band squeeze tab hota hai jab volatility historically low level par chali jaati hai, leading to a potential explosive price movement. Traders aksar ek squeeze ke liye wait karte hain, jo ke bands ke andar move hone ki wajah se characterize hota hai. Jab bands phir se expand hone lagte hain, ye aik significant price trend ka aaghaz hone ki nishani ho sakti hai. Bollinger Band divergence tab hoti hai jab price naya high ya low banata hai, lekin Bollinger Bands move confirm nahi karte hain by widening. Ye indicate kar sakta hai ke current trend mein potential reversal ho sakti hai, traders ko opposite direction mein trade karne ka opportunity dene ke liye.

Combining Bollinger Bands with Other Indicators

Bollinger Bands ki effectiveness ko barhane ke liye, traders often inko doosre technical indicators ke saath combine karte hain. Mashhoor choices mein shaamil hain Relative Strength Index (RSI) aur Moving Average Convergence Divergence (MACD). Ye indicators Bollinger Bands ke saath use hone par additional confirmation signals provide kar sakte hain. Sahi risk management forex trading mein ahem hai. Bollinger Bands traders ko stop-loss levels set karne aur potential price targets determine karne mein madadgar ho sakte hain. For example, jab long trade enter ki jaati hai, to stop-loss lower band ke neeche place kiya ja sakta hai, jo ke logical level provide karta hai agar trade expectations ke khilaf jaati hai.Bollinger Bands ke saath sahi tarike se trading karne se pehle, historical data par based strategies ko backtest karna zaroori hai. Ye traders ko samajhne mein madad karta hai ke unka approach various market conditions ke neeche kitni effective hai. Iske ilawa, demo account ke saath practice karke bina real money risk kiye valuable experience gain ki ja sakti hai.

تبصرہ

Расширенный режим Обычный режим