Financial markets mein, diamonds patterns aik aala darjay ki chart ki shakal hai. takneeki taajiron aur sarmaya karon ke darmiyan yeh aik kam Maroof option hai. nateejay ke tor par, bohat se tajir is ki saakht aur tijarti software se waaqif hain. hum is sabaq mein diamonds patterns ka pata laganay aur is ki tijarat karne ki tafseelaat dekhen ge .

What is Diamond Chart Pattern?

Diamonds chart patterns riwayati chart patterns ke khandan se talluq rakhta hai. taham, jhanday, paint, sir aur kaandhon aur mustateel patterns ke bar aks, diamond ke chart ka patterns qeemat ke chart par kam kasrat se hota hai. nateejay ke tor par, diamonds chart patterns ki tijarat deegar patterns ke muqablay mein kam aam hai. bahar haal, takneeki taajiron ko yeh namona seekhna chahiye kyunkay agar jald pata chal jaye to yeh aik manoos tijarti mauqa paish kar sakta hai .

Head and shoulder ke chart ka patterns baaz auqaat diamonds chart patterns se ulajh jata hai. agarchay dono dhanchay ke darmiyan kuch hain, kuch ahem amtyazat hain .

Hum baad mein diamond ke patterns ke dhanchay ki tafseelaat mein jayen ge, lekin abhi ke liye, yeh baat zehen mein rakhen ke diamond ka patterns ulat khususiyaat ke sath ziyada paicheeda chart patterns hai. diamond ka namona rujhan ke taweel arsay ke baad sab se ziyada aam hai. bahar haal, takneeki taajiron ko yeh namona seekhna chahiye kyunkay agar jald pata chal jaye to yeh aik manoos tijarti mauqa paish kar sakta hai .

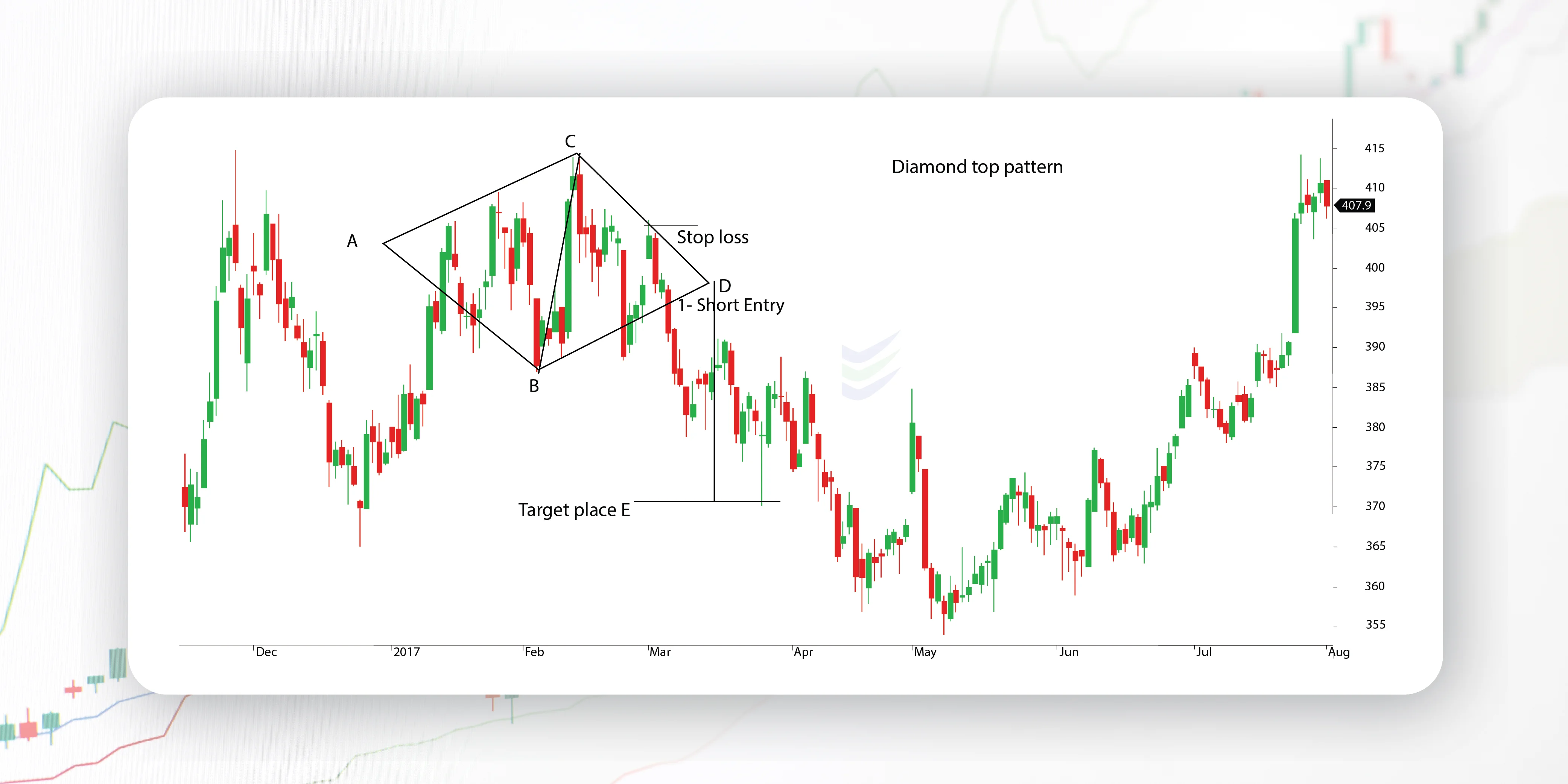

Oopar di gayi misaal mein, hum diamonds top ka mushahida kar satke hain. diamond ki saakht par nigah rakhen. market ki reliyan phir nichli satah par wapas aati hain. market is ke baad aik aala oonchai ka taayun karta hai. phir qeematein pichli jholi se neechay gir jati hain, jis se aik naya swing lo bantaa hai .

Qeematein phir onche ho jati hain, jis se dhanchay ki chouti banti hai. qeemat ki karwai is ke baad kam hoti hai lekin pehlay walay swing lo se neechay nahi. qeematein dobarah barheen lekin apni pehli chouti se neechay rahen. qeemat dobarah girty hai lekin pichlle jhulay se oopar rehti hai .

Qeemat ke is amal ke baad, hum dhanchay ke jhulay ki bulandiyon aur ko jornay walay aik jaisay size ki chaar trained linen khech satke hain. yeh aik diamond ki shakal banata hai, lehaza patterns ka naam. kabhi kabhar, hum diamond ke dhanchay ke andar har qeemat taang ko mehsoos nahi kar saktay hain. yeh diamonds patterns ke tor par dhanchay ke ohda ko baatil nahi karta hai. sab se ahem baat, hum dhanchay ke ird gird aik jaisi lambai ki chaar trained linen bana satke hain .

What is a Bearish Diamond Pattern?

Bearish diamonds patterns, jo aksar diamonds taap ke naam se jana jata hai, pehlay bayan kya gaya tha. aik baar phir, patterns qeemat ke jhoolon ka aik silsila hai jo sir aur kaandhon ki saakht se milta jalta hai. baen kandhay aur sir ko jor kar aik trained line banai jaye gi, aur doosri trained line sir aur dayen kandhay se banai jaye gi. bearish diamonds ki tashkeel ke oopri hissay ke liye trained lines ab mukammal ho chuki hain. phir hum ke andar swing lovs ko jorhte hain taakay v shakal ban sakay .

Bearish diamonds patterns oopar ki tasweer mein aik baar phir dekha ja sakta hai. yeh khaka saakht ki tijarat ke liye break out entry signal bhi dekhata hai, jaisa ke patterns ka hadaf ki satah. mukhtasir indraaj ka signal waqfay par mutharrak ho jaye ga aur oopar ki taraf neechay dayen haath ki dhalwan line ke neechay band ho jaye ga. kuch tajir baghair band kiye is line ke neechay break out ka intzaar karna pasand karte hain. yeh aik acha entry point bhi hai, lekin zehen mein rakhen ke is ke nateejay mein break out aur qareebi sorat e haal ka intzaar karne se ziyada ghalat signals ayen ge .

Saakht ki qeemat ke hadaf ka hisaab laganay ke liye aik pemaiesh shuda iqdaam ki hikmat e amli istemaal ki jati hai. hum dhanchay ke andar chouti se waadi ke faaslay ka andaza lagana chahtay hain aur break out point se neechay ki taraf faasla tay karna chahtay hain. yeh is satah ki nishandahi kere ga jis par hum tawaqqa kar satke hain ke break out khatam ho jaye ya makoos ho jaye. is terhan, yeh aik zabardast take praft aur trade aygzt level hai .

What is a Bullish Diamond Pattern?

Bullish diamonds patterns bearish diamonds patterns ka ulta hai. aik taiz diamond ka namona, jisay diamonds bottom bhi kaha jata hai, kami ke douran hota hai. qeemat kam honay ke baad aik mazbooti ka marhala aata hai jo diamond ke neechay ke jhulay ke points ko hai. is soorat e haal mein, yeh aik ulti sir aur kaandhon ki terhan ho jaye ga. isi terhan, hum dhanchay ki chotyon aur ko jorhin ge. aik baar jab hum is ke ird gird chaar trained lines tayyar kar letay hain to hum is ki saakht ko taizi se diamond ke patterns ke tor par tasdeeq kar satke hain .

Jaisa ke oopar diamond ke neechay ki tasweer mein dekhaya gaya hai, tashkeel ke baad qeemat mein kami waqay hoti hai. diamond ke dhanchay ke oopar neechay ki tarteeb ko neechay ki taraf ishara karne wali do oopri trained lines aur oopar ki taraf ishara karne wali do nichli trained linon se bayan kya jata hai. oopri dayen haath ki dhalwan line ke oopar tootna aur band karna taweel indraaj signal ko mutharrak karta hai .

Aik baar phir, is trained line ke oopar mehez break out ke bajaye break out aur band honay ka intzaar karna behtar hai ke ghalat signals aur mumkina وہپساونگ qeemat ki sargarmi se bachchen. oopri qeemat ka maqsad dhanchay ke andar aala aur kam ka mawazna karkay shumaar kya jata hai. chart par tay honay aur plot karne ke baad, break out point se isi faaslay ko muntakhib hadaf ki satah tak pounchanay ke liye oopar ki taraf paish kya jata hai. qeemat is satah tak pounchanay ke baad poori position ya is ke ahem hissay se bahar nikleen .

Trading Strategy with Diamond Patterns

Aayiyae ab aik tijarti hikmat e amli tayyar karne par tawajah markooz karen jis mein diamonds patterns shaamil ho. hum ne dekha hai ke diamonds technical patterns up trained aur down trained dono mein ho sakta hai. jab qeemat ki aik mazboot harkat diamond ke patterns se pehlay hoti hai, to usay diamonds taap kaha jata hai, aur is ki aik bearish tashreeh hoti hai. diamonds bottom is waqt hota hai jab qeemat mein mandi ki harkat diamond ke patterns se pehlay hoti hai aur is ki taiz tashreeh hoti hai .

Diamond ki tijarat ki yeh hikmat e amli sirf qeemat ke amal ko istemaal kere gi. hum samajte hain ke market mein diamond ka namona aam nahi hai. nateejatan, hum hikmat e amli mein bohat ziyada shaamil nahi karna chahtay, jo basorat deegar achay set up ko flutter kar day ga .

The rules for trading the diamond top chart pattern are as follows:

1.Diamond ki chouti ki tashkeel se pehlay aik numaya izafah hona zaroori hai .

? Diamonds taap farmission ko chaar trained lines ke sath pehchanana aasaan hona chahiye jo aapas mein jari hon aur lambai mein bohat qareeb hon .

? Jab patterns toot jaye to market mein sale order lagayen aur aakhir mein oopar ki taraf dhalwan trained line ke neechay band kar den .

? stop loss ko swing high par set karen jo break out point se pehlay ho .

? Hadaf ki satah ka taayun motion ka istemaal karte hue kya jaye ga. saakht ke sab se ziyada aur sab se kam ? nichale ke darmiyan faaslay ka hisaab lagaya jaye ga aur break out point se neechay ki taraf paish kya jaye ga. munafe ka ikhraj is pehlay se tay shuda satah par hoga .

? 50 candles ke baad, agar qeemat ne hamaray stop las ya hadaf ki satah ko mutharrak nahi kya hai, to hum fori tor par market mein tijarat se bahar nikal jayen ge .

Diamonds bottom chart patterns ki tijarat ke qawaid darj zail hain :

? Diamonds bottom honay se pehlay aik wazeh neechay ka rujhan darkaar hai .

? Diamond ke neechay ki tashkeel chaar qareebi faaslay wali trained linon ke sath shanakht karne ke qareeb honi chahiye .

? break par market mein khareed order den aur neechay ki taraf dhalwan trained line ke oopar band karen .

?Stop loss break out point se pehlay swing lo par set hona chahiye .

? Hadaf ki satah ka taayun motion ka istemaal karte hue kya jaye ga. dhanchay ke sab se ziyada aur sab se kam nichale ke darmiyan faaslay ka hisaab lagaya jaye ga aur break out point se oopar ki taraf paish kya jaye ga. munafe ka ikhraj is pehlay se tay shuda satah par hoga .

? Tijarat par, aik izafi time stop jazo hoga. agar qeemat 50 candles ke baad stop loss ya hadaf ki satah ko mutharrak nahi karti hai, to hum fori tor par market mein tijarat se bahar ho jayen ge .

تبصرہ

Расширенный режим Обычный режим