Stick Sandwich Pattern

Forex trading ek chalti-phirti maaliyati market hai, aur traders aksar ta'atil tijarat karnay ke liye mukhtalif takneeki analisis auzaron ka istemal kartay hain. Aik aisa pattern jise traders trend ulatny ya jari rakhny ke liye pehchan'nay ke liye istemal kartay hain woh "Stick Sandwich Pattern" hai. Is article mein, hum is pattern ko samjhain gay aur dekhein gay ke Forex trading ke context mein isy kis tarah istemal kiya ja sakta hai.

Understanding

Stick Sandwich Pattern ek candlestick pattern hai jo teen musalsal candles se mil kar banta hai. Aam taur par, yeh aik reversal pattern hota hai, aur isay market ke jazbat ka pata lagane mein madadgar hota hai. Chaliye is pattern ke ahem hissay ko tafseel se samjhain:

Interpreting

Traders Stick Sandwich Pattern ko market mein mukhalif ulatny ke potentiayl signals pehchan'nay ke liye istemal kartay hain. Is pattern se yeh samjha jata hai ke aam taur par prevailing bearish trend ke baad, aik bullish koshish ki gai hai (dusri candle ya "stick" ki shakal). Lekin yeh bullish lihaz short time ke liye hota hai, kyun ke isay aksar doosri bearish candle milti hai.

Yeh hai traders ke liye is pattern ko tawil karne ka tariqa:

Trading Strategies

Stick Sandwich Pattern ka istemal karke Forex tijarat karte waqt, traders in strategies ko mad e nazar rakhte hain:

Conclusion

Stick Sandwich Pattern, Forex trading mein potentiayl trend reversal pehchannay ke liye aik ahem auzar hai. Traders ko yaad rakhna chahiye ke koi bhi pattern pur-proof nahi hota, aur successful trading ke liye mazeed analisis aur risk management zaroori hai. Is pattern ko samajh kar aur isay mustafeed tariqay se istemal karke, traders apnay takneeki analisis toolkit mein aik aur dimension shamil kar sakte hain.

Forex trading ek chalti-phirti maaliyati market hai, aur traders aksar ta'atil tijarat karnay ke liye mukhtalif takneeki analisis auzaron ka istemal kartay hain. Aik aisa pattern jise traders trend ulatny ya jari rakhny ke liye pehchan'nay ke liye istemal kartay hain woh "Stick Sandwich Pattern" hai. Is article mein, hum is pattern ko samjhain gay aur dekhein gay ke Forex trading ke context mein isy kis tarah istemal kiya ja sakta hai.

Understanding

Stick Sandwich Pattern ek candlestick pattern hai jo teen musalsal candles se mil kar banta hai. Aam taur par, yeh aik reversal pattern hota hai, aur isay market ke jazbat ka pata lagane mein madadgar hota hai. Chaliye is pattern ke ahem hissay ko tafseel se samjhain:

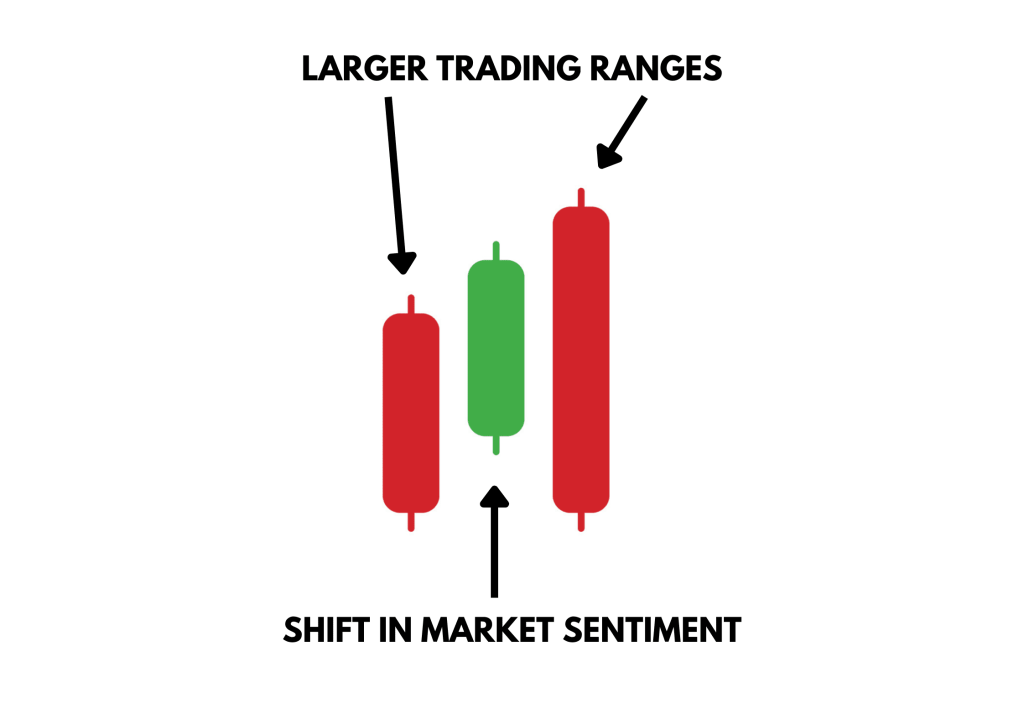

- First Candle (Bearish): Pattern ek bearish candle se shuru hota hai, jo ke neechay ki taraf price movement ko darust karti hai. Is candle mein mojood bearish jazbat ko darust karti hai.

- Second Candle (Bullish): Foran pehli bearish candle ke baad, aik bullish candle hoti hai. Yeh candle "stick" ke liye ahem hai. Is candle ka opening pehli candle ke close se ziada hota hai aur iska close pehli candle ke open se kam hota hai. Is tarah "stick" banti hai jo pehli candle ko gher leti hai.

- The Third Candle (Bearish): Pattern akhri bearish candle se khatam hota hai. Yeh candle bearish jazbat ko tasdeeq karti hai aur aksar neechay ki taraf ta'atil raah mein izafa kar deti hai.

Interpreting

Traders Stick Sandwich Pattern ko market mein mukhalif ulatny ke potentiayl signals pehchan'nay ke liye istemal kartay hain. Is pattern se yeh samjha jata hai ke aam taur par prevailing bearish trend ke baad, aik bullish koshish ki gai hai (dusri candle ya "stick" ki shakal). Lekin yeh bullish lihaz short time ke liye hota hai, kyun ke isay aksar doosri bearish candle milti hai.

Yeh hai traders ke liye is pattern ko tawil karne ka tariqa:

- Pehli bearish candle market mein mojood bearish jazbat ko zahir karti hai.

- Bullish "stick" temporary sentiment shift ko darust karti hai, aksar profit lenay ya short-covering ke bais hota hai.

- Teenwi bearish candle bearish jazbat ko tasdeeq karti hai aur shayad pehli downtrend jari rahe.

Trading Strategies

Stick Sandwich Pattern ka istemal karke Forex tijarat karte waqt, traders in strategies ko mad e nazar rakhte hain:

- Reversal Signal: Traders Stick Sandwich Pattern ko potentiayl reversal signal ke tor par dekhte hain. Is pattern ko pehchanna ke baad, woh trading faislay karne se pehle mazeed tasdeeq signals ko dekhte hain, jaise ke support aur resistance levels ya doosre takneeki auzar.

- Risk Management: Is pattern ko istemal karte waqt mukhlis risk management aham hai. Traders ko potential nuksan ko roknay ke liye stop-loss orders set karne chahiye agar expected reversal na ho.

- Confirmation Tools:Stick Sandwich Pattern ko doosre takneeki indicators jaise RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence) ke saath mila kar istemal karke trading signals ki reliableiayt barha sakte hain.

Conclusion

Stick Sandwich Pattern, Forex trading mein potentiayl trend reversal pehchannay ke liye aik ahem auzar hai. Traders ko yaad rakhna chahiye ke koi bhi pattern pur-proof nahi hota, aur successful trading ke liye mazeed analisis aur risk management zaroori hai. Is pattern ko samajh kar aur isay mustafeed tariqay se istemal karke, traders apnay takneeki analisis toolkit mein aik aur dimension shamil kar sakte hain.

تبصرہ

Расширенный режим Обычный режим