Introduction

Keltner Channel forex market mein aik envelops ka channel hota hey jo keh Bollinger Band Indicator say melta julta indicator hota hey jaisa keh zail mein dekhaya ja choka hey yeh forex market mein otar charhao ka envelope hota hey yeh forex market mein bullish raftar ke movement katy gard ghomta hey

es kay elawah yeh forex market mein Bollinger Band Indicator ke moving kay sath he estamal keya jata hey jo keh otarcharhao ke pemaish kay ley aik maqbol tareen indicator hota hey channel average true range ka estamal kartay hovay indicate keya geya hey yeh forex market mei maqbol tareen indicator mein say aik hota hey

Keltner channel ka set karna:

forex market mein zyada tar indicator ko estamal karnay say pehlay es ko set karna bhe zaroore hota hey Keltnr channel ka estamal kartay time pehlay say tarteeb shodah 20 or 1 say zarb de jate hey es kay bad ap bands kay andaz ko yeh tabdel karnay kay ley estamal kar saktay hein ya ap forex market mein average reality ke limit ya ATR ya reality TR ya limit chahtay hein

ap forex market mein yeh bhe identify kar saktay hein keh ap ka action ko start ke price ya end prie par bhe lago kar saktay hein ap forex market kay apnay tarjehe standard parpora otarnay kay ley standard par pora otar saktay hein or forex market kay adad o shumar ko tabdel kar saktay hein

Keltner Channel Trading Strategy

channel kay baray mein tamam kesam kay indicator ka estamal keya ja sakta hey es kay baray mein amome asol yeh hota hey yeh forex market mein price action kay baray mein estamal keya ja sakta hey forex market mein kese bhe movement ko ghor say daikha ja sakta hey kunkeh woh bohut he low movement karta hey

es sorat mein jab price upper line kay oper break ho jate hey to woh oper ke taraf trend ke wazah strength ko zahair karte hey or forex market mein lower channel ka aik nechay ke taraf gap ho jata hey yahan par forex market kaybear zyada kamyab ho rahay hotay hein

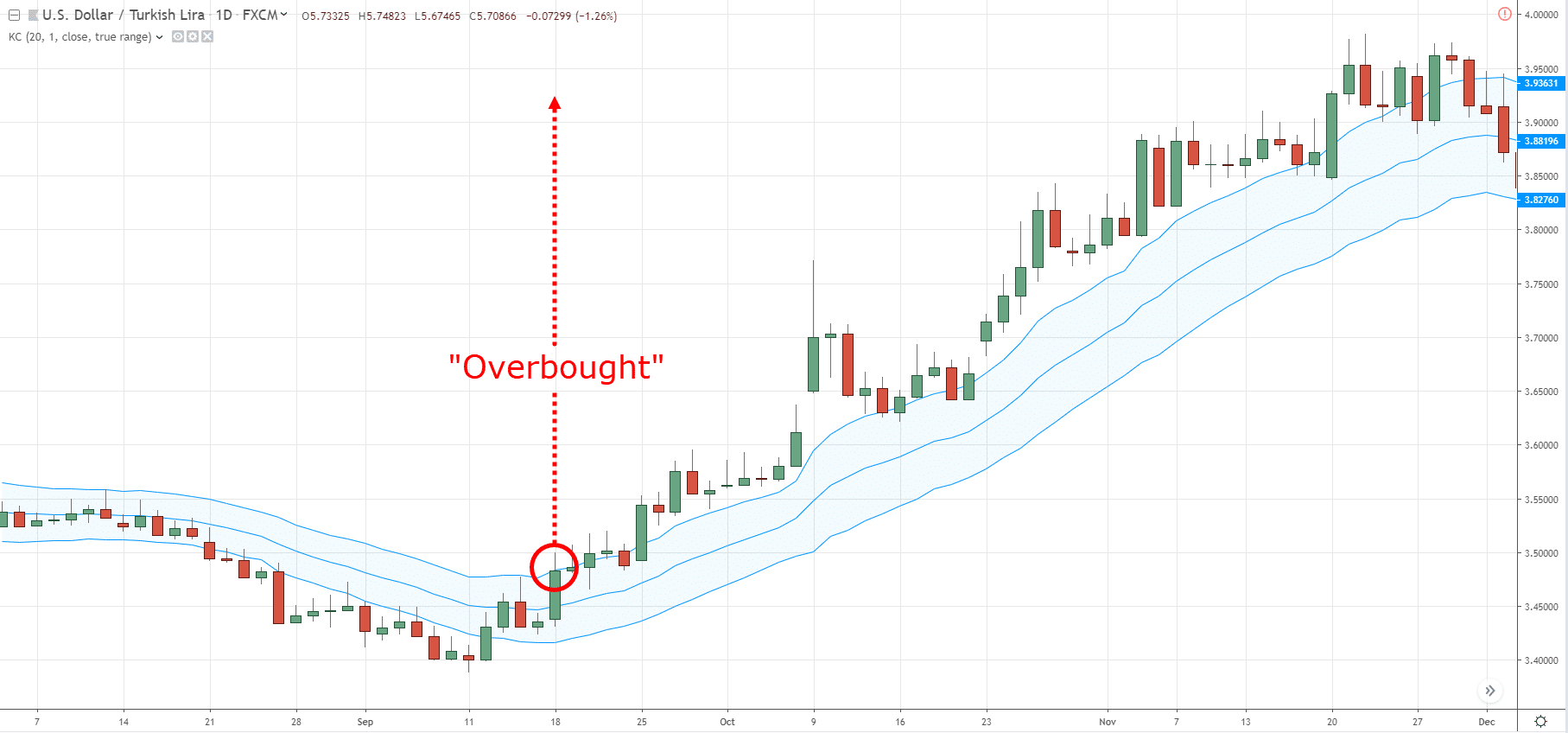

nechay de gay keltner channel ke aik ache mesal hey

jaisa keh ap oper daikh saktay hein keh ETH/USD pair ke keltner channel say oper ke movement the jab forex market mein price oper ke taraf barah rehe the to woh es kay opposite hova price keltner channel ke lower line say nechay the

conclusion

Keltner channel forex market ka aik mashhoor kesam ka trading indicator hota hey yeh MT4 or MT5 mein aik nator trading indicator estamal hota hey ap es ko forex market mein daste tor par install kar saktay hein jab yeh forex market mein ache tarah say estamal keya jay to woh kese bhe day trader kay ley mesale indicator ho sakta hey yeh forex market mein buy ya sell kay chance ko talash karnay mein madad karta hey

Keltner Channel forex market mein aik envelops ka channel hota hey jo keh Bollinger Band Indicator say melta julta indicator hota hey jaisa keh zail mein dekhaya ja choka hey yeh forex market mein otar charhao ka envelope hota hey yeh forex market mein bullish raftar ke movement katy gard ghomta hey

es kay elawah yeh forex market mein Bollinger Band Indicator ke moving kay sath he estamal keya jata hey jo keh otarcharhao ke pemaish kay ley aik maqbol tareen indicator hota hey channel average true range ka estamal kartay hovay indicate keya geya hey yeh forex market mei maqbol tareen indicator mein say aik hota hey

Keltner channel ka set karna:

forex market mein zyada tar indicator ko estamal karnay say pehlay es ko set karna bhe zaroore hota hey Keltnr channel ka estamal kartay time pehlay say tarteeb shodah 20 or 1 say zarb de jate hey es kay bad ap bands kay andaz ko yeh tabdel karnay kay ley estamal kar saktay hein ya ap forex market mein average reality ke limit ya ATR ya reality TR ya limit chahtay hein

ap forex market mein yeh bhe identify kar saktay hein keh ap ka action ko start ke price ya end prie par bhe lago kar saktay hein ap forex market kay apnay tarjehe standard parpora otarnay kay ley standard par pora otar saktay hein or forex market kay adad o shumar ko tabdel kar saktay hein

Keltner Channel Trading Strategy

channel kay baray mein tamam kesam kay indicator ka estamal keya ja sakta hey es kay baray mein amome asol yeh hota hey yeh forex market mein price action kay baray mein estamal keya ja sakta hey forex market mein kese bhe movement ko ghor say daikha ja sakta hey kunkeh woh bohut he low movement karta hey

es sorat mein jab price upper line kay oper break ho jate hey to woh oper ke taraf trend ke wazah strength ko zahair karte hey or forex market mein lower channel ka aik nechay ke taraf gap ho jata hey yahan par forex market kaybear zyada kamyab ho rahay hotay hein

nechay de gay keltner channel ke aik ache mesal hey

jaisa keh ap oper daikh saktay hein keh ETH/USD pair ke keltner channel say oper ke movement the jab forex market mein price oper ke taraf barah rehe the to woh es kay opposite hova price keltner channel ke lower line say nechay the

conclusion

Keltner channel forex market ka aik mashhoor kesam ka trading indicator hota hey yeh MT4 or MT5 mein aik nator trading indicator estamal hota hey ap es ko forex market mein daste tor par install kar saktay hein jab yeh forex market mein ache tarah say estamal keya jay to woh kese bhe day trader kay ley mesale indicator ho sakta hey yeh forex market mein buy ya sell kay chance ko talash karnay mein madad karta hey

تبصرہ

Расширенный режим Обычный режим