Introduction:

smooth moving average forex market mein aik mashhoor kesam ke moving average hote hey yeh forex arket mein aik tevhnical trend indicator hota hey jaisay Bollinger band indicator envelope indicator kay sath kam karnay mein madad kar sakta hey yeh forex market kay important blocks kay sath kam karta hey

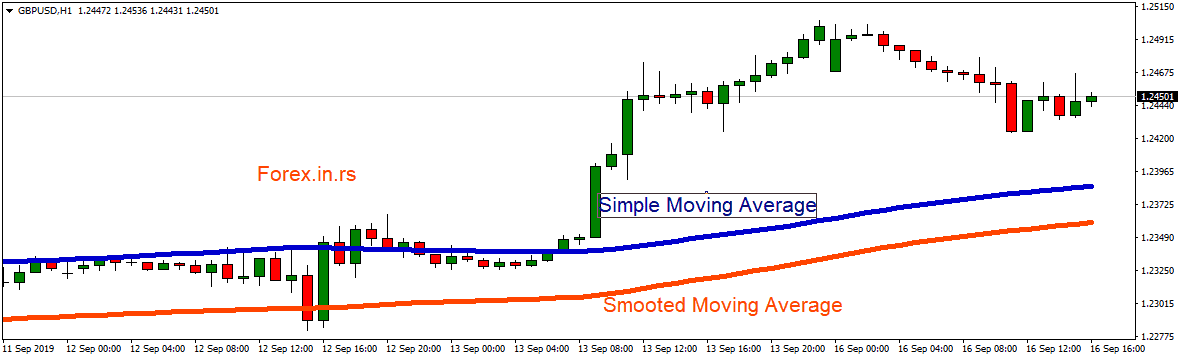

forex market mein moving average ke kai kesmen hote hein jaisa keh simple moving average wazan ke moving average exponential moving average ese tarah smooth moving average bhe forex arket ke moving average ke he aik kesam hey

smooth moving average bhe basic simple moving average mein say aik hote hey yeh forex market mein aik assert keprice ka analysis dekhata hey or es ke zair e study session mein taqseem keya ja sakta hey or yeh forex market mein aik jaisa he layta hey jes ka forex market mein hesab lagaya ja sakta hey

moving average ke dosreetypes ka maksad yeh hota hey on mein forex market kay gap ko door karna shamel hota hey laken yeh forex marketkay hal he kay data par zyada zoor dayta hey

dosree taraf smooth moving average tamam kesam kay period ko aik jaisa he layte hey yeh forex market kay trend ko zyada asane say daikhnay mein madad kar sakte hey

Smooth Moving Average ke calculation:

smooth moving average ke calculation aik forula ke madad say he ke jate hey or es indicator ke calculation aik den kay chart say he ke ja sakte hey formula ke madad say asane say he ke ja sakte hey or yeh indicator zyada tar trading platforms mein default frahm kea jata hey formula nechay deya geya hey

es sorat mrin raqam tamam prices ka overall hote hey jabkeh forex market mein N period ke tadad par he hota hey price dosree taraf say kese bhe period ke makhaz prie he hote hey jo keh forex market kay period mein hesa lay rehe hote hey

Smooth Moving Average trend following strategy

forex market mein trend ko follow karna bhe aik kesam ke trading strategy hote hey jo keh forex assert kay buy kay irad gerd ghomte hote hey jes ke price forex market mein pehlay he barah rehe hote hey or forex market mein es ke rice kam kar rehe hote hey jo keh forex market mein pehlay ger rehe hote hey yeh forex market mein aik kesam ke maqbol trading strategy hote hey jo kam karte hey

es sorat mein smooth moving average forex market kay aik tradr ke renomai kay ley leya jata hey keh ap forex market mein es position ko kaim rakhna chahtay hein ya nahi rakhna chahtay hein

mesal kay tor par jab price overall level kay tor par trend kar rehe hote hey jaisay jaisay forex market ka trend kay end kay belkul qareeb ban jata hey ap ko forx market ka indicator ko estamal karnaykay ley trend ko bhe pehchan karna chihay

smooth moving average forex market mein aik mashhoor kesam ke moving average hote hey yeh forex arket mein aik tevhnical trend indicator hota hey jaisay Bollinger band indicator envelope indicator kay sath kam karnay mein madad kar sakta hey yeh forex market kay important blocks kay sath kam karta hey

forex market mein moving average ke kai kesmen hote hein jaisa keh simple moving average wazan ke moving average exponential moving average ese tarah smooth moving average bhe forex arket ke moving average ke he aik kesam hey

smooth moving average bhe basic simple moving average mein say aik hote hey yeh forex market mein aik assert keprice ka analysis dekhata hey or es ke zair e study session mein taqseem keya ja sakta hey or yeh forex market mein aik jaisa he layta hey jes ka forex market mein hesab lagaya ja sakta hey

moving average ke dosreetypes ka maksad yeh hota hey on mein forex market kay gap ko door karna shamel hota hey laken yeh forex marketkay hal he kay data par zyada zoor dayta hey

dosree taraf smooth moving average tamam kesam kay period ko aik jaisa he layte hey yeh forex market kay trend ko zyada asane say daikhnay mein madad kar sakte hey

Smooth Moving Average ke calculation:

smooth moving average ke calculation aik forula ke madad say he ke jate hey or es indicator ke calculation aik den kay chart say he ke ja sakte hey formula ke madad say asane say he ke ja sakte hey or yeh indicator zyada tar trading platforms mein default frahm kea jata hey formula nechay deya geya hey

| SMMAi=(Sum-SMMAi-1)/2 |

Smooth Moving Average trend following strategy

forex market mein trend ko follow karna bhe aik kesam ke trading strategy hote hey jo keh forex assert kay buy kay irad gerd ghomte hote hey jes ke price forex market mein pehlay he barah rehe hote hey or forex market mein es ke rice kam kar rehe hote hey jo keh forex market mein pehlay ger rehe hote hey yeh forex market mein aik kesam ke maqbol trading strategy hote hey jo kam karte hey

es sorat mein smooth moving average forex market kay aik tradr ke renomai kay ley leya jata hey keh ap forex market mein es position ko kaim rakhna chahtay hein ya nahi rakhna chahtay hein

mesal kay tor par jab price overall level kay tor par trend kar rehe hote hey jaisay jaisay forex market ka trend kay end kay belkul qareeb ban jata hey ap ko forx market ka indicator ko estamal karnaykay ley trend ko bhe pehchan karna chihay

تبصرہ

Расширенный режим Обычный режим