Round Trip Trading in Forex

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Round Trip Trading in Forex -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Forex duniya bhar mein mukhtalif currencies ki khareed-o-farokht ka global marketplace hai. Ye duniya ki sab se bari aur liquid maali market hai. Forex trading mein ek currency ki khareed aur doosri currency ki farokht aik saath hoti hai, jaise ke EUR/USD ya USD/JPY. Forex trading ka maqsad currencies ke exchange rates mein hone wali tabdeeliyon se munafa kamana hota hai. Round trip trading Forex mein aik aesi surat-e-haal ko refer karta hai jahan ek trader aik position kholta hai aur phir usay band karta hai, jis se puri trading cycle complete hoti hai. Is mein aik khaas currency pair ki khareed aur farokht dono shamil hain. Ye concept trading ki dynamics samajhne ke liye bunyadi hai aur traders ke liye zaroori hai takay woh apne munafa, nuqsaan aur overall performance ko sahi tarah se calculate kar sakein.Components of Round Trip Trading Opening a Position

- Jab aik trader Forex market mein dakhil hota hai, to woh aik position shuru karta hai jis mein woh kisi currency pair ki khareed ya farokht karta hai.

- Misal ke tor par agar aik trader ko lagta hai ke EUR/USD pair ki qeemat barhne wali hai, to woh Euros (EUR) khareed kar US Dollars (USD) bechega.

- Traders market ko nazar andaaz karte hain aur price movements ka analysis karne ke liye mukhtalif tools aur techniques ka istemal karte hain.

- Technical analysis, fundamental analysis aur sentiment analysis trading ke faislay mein inform taur par istemal hone wale tareeqay hain.

- Apni analysis ke mutabiq traders apni position band karne ka faisla karte hain taake munafa ya nuqsaan mein kami ho sake.

- Position band karna shuru ki gayi currency bechna ya wapis khareedna shamil hota hai, jis se trading cycle complete hoti hai.

- Agar aik trader aik currency pair ko 1.2000 par khareedta hai aur use 1.2050 par bechta hai, to iska matlab hai ke usne 50 pips ka munafa kamaya.

- Barabar ke taur par agar woh 1.2000 par farokht karta hai aur 1.1950 par wapis khareedta hai, to iska matlab hai ke usne bhi 50 pips ka munafa kamaya hai.

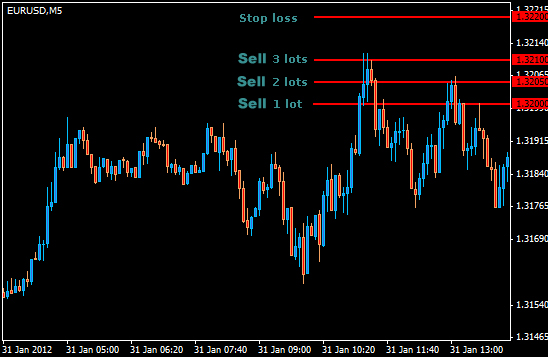

Risk Management and Round Trip Trading Risk management Forex trading ka aham hissa hai. Traders apne risk exposure ko control karne ke liye mukhtalif techniques ka istemal karte hain, jaise ke stop-loss aur take-profit orders lagana. Stop-loss order woh price hoti hai jo position ko otomatik taur par band kar deti hai takay nuqsaan ko had se zyada na hone diya jaye, jabke take-profit order position ko band karke munafa hasil kar leti hai jab price aik makhsoos level tak pohanch jati hai. Round Trip Trading Strategies Day Trading

Risk Management and Round Trip Trading Risk management Forex trading ka aham hissa hai. Traders apne risk exposure ko control karne ke liye mukhtalif techniques ka istemal karte hain, jaise ke stop-loss aur take-profit orders lagana. Stop-loss order woh price hoti hai jo position ko otomatik taur par band kar deti hai takay nuqsaan ko had se zyada na hone diya jaye, jabke take-profit order position ko band karke munafa hasil kar leti hai jab price aik makhsoos level tak pohanch jati hai. Round Trip Trading Strategies Day Trading- Day traders ek hi trading din mein mukhtalif positions kholte hain aur band karte hain taake choti price movements se faida utha sakein.

- Unka maqsad ek din mein kai round trip trades complete karna hota hai, jisse ke woh short-term market fluctuations se munafa kamate hain.

- Swing traders apni positions ko kuch din ya hafton ke liye hold karte hain aur medium-term price movements se faida uthane ki koshish karte hain.

- Woh trends ka analysis karte hain aur technical indicators ka istemal karke potential entry aur exit points ko pehchanne ki koshish karte hain.

- Scalpers din bhar mein chand chote trades execute karte hain take choti price movements se munafa kamaya ja sake.

- Unka maqsad har trade mein chand pips ka chota munafa hasil karna hota hai lekin trades ki taadad se overall munafa hasil hota hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

- Mentions 0

-

سا2 likes

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Saya setuju bahwa ini sangat nyaman. Faktanya, akun seperti inilah yang membuka potensi bagi Anda jika Anda baru belajar trading. Ini sangat ideal bagi pemula yang sudah ingin menghasilkan uang, dan tidak hanya menggunakan versi demo kering. Namun alangkah baiknya jika Anda tetap mendapat untung kecil. Saya pikir ini adalah kesempatan yang ideal. yang tidak bisa diabaikan. Jadi di sini putuskan sendiri mana yang paling cocok untuk Anda. Mungkin di sini di page Anda akan menemukan jawaban yang tepat untuk diri Anda sendiri. -

#4 Collapse

Round Trip Trading :

Round Trip trading Aik strategy hai jahan pehle hum kisi security ya financial instrument ko khareedte hain aur phir usko bechte hain, wapis original position par aate hain. Is strategy mein, traders short-term price movements ka faida uthate hain. Round Trip Trading ka matlab hota hai ki aap ek trade ko enter karke usko profit ya loss ke baad exit kar dete hain. Yani, aap ek trade ko enter karke usko close karne tak ka pura process complete kar dete hain.

Ye strategy day trading mein commonly istemal hoti hai jahan traders ek din mein multiple trades karte hain. Round Trip trading mein, traders ko market ke volatility aur short-term trends ko dhyan mein rakhna hota hai taki unko sahi samay par khareedna aur bechna ho sake.

Characteristics of Round Trip trading :

Round Trip trading ke kuch characteristics hain:

1. Short-term Trading: Round Trip trading short-term price movements ka faida uthata hai.

2. Multiple Trades: Is strategy mein traders ek din mein multiple trades karte hain.

3. Volatility: Traders ko market ke volatility ko dhyan mein rakhna hota hai.

4. Timing: Sahi samay par khareedna aur bechna Round Trip trading mein bahut important hai.

5. Risk Management: Traders ko apni positions ko manage karne ke liye risk management par focus karna chahiye.

6. Technical Analysis: Round Trip trading mein technical analysis ka istemal hota hai trend aur entry/exit points ko determine karne ke liye.

7. Discipline: Discipline Round Trip trading mein bahut zaroori hai, jaise trading plan follow karna aur emotions par control rakhna. -

#5 Collapse

Round Trip Trading in Forex

Introduction

Round trip trading forex ka aik ahem concept hai jo investors aur traders ko market mein trading strategies develop karne mein madad karta hai. Is technique ka maqsad profit kamana hai jab ke risk ko control karna bhi hai. Is article mein, hum round trip trading ke concepts, advantages, disadvantages aur is se faida uthane ke tarikon par roshni daalenge.

Round Trip Trading Kya Hai?

Round trip trading ka matlab hai ek asset ko khareedna aur phir se bechna, aksar ek hi price par. Forex market mein, traders currencies ko ek waqt par khareedte hain aur phir unhein kuch waqt baad bechte hain. Is technique ka istemal aksar market ki volatility se faida uthane ke liye hota hai.

Round Trip Trading Ki Importance

Is technique ki importance is wajah se hai ke ye traders ko choti choti price movements se faida uthane ka mauqa deti hai. Forex market bahut zyada volatile hota hai, aur round trip trading is volatility ko exploit karne ka ek acha tareeqa hai.

Round Trip Trading Kaise Kaam Karta Hai?

Round trip trading kaise kaam karta hai, is samajhne ke liye, humein ye samajhna hoga ke traders kis tarah se currencies ko buy aur sell karte hain. Jab koi trader kisi currency ka buy order place karta hai, to wo market price ke mutabiq currency ko kharidta hai. Uske baad, jab price increase hoti hai, to wo sell order place karke profit kamane ki koshish karta hai.

Round Trip Trading Ke Advantages

Round trip trading ke kuch khaas advantages hain. Pehla, ye traders ko quick profits kamane ka mauqa deti hai. Dusra, is technique se risk ko control kiya ja sakta hai. Traders ko apne positions ko quickly adjust karne ka mauqa milta hai, jisse unhein market ke badalte halat se faida uthane ka mauqa milta hai.

Round Trip Trading Ke Disadvantages

Lekin, round trip trading ke kuch disadvantages bhi hain. Is technique ko use karte waqt high transaction costs ho sakte hain, jo profits ko khatam kar dete hain. Dusra, agar market price fluctuate hoti hai, to traders ko loss ka samna karna pad sakta hai. Isliye, ye zaroori hai ke traders apne strategies ko ache se samjhein.

Round Trip Trading Aur Technical Analysis

Round trip trading mein technical analysis ka istemal bahut zaroori hai. Traders ko charts aur indicators ka istemal karke market ki trends ko samajhna hota hai. Isse unhein ye andaza hota hai ke kab buy aur sell karna hai. Technical analysis se traders ko market ki movements ka pata chalta hai, jo round trip trading mein madadgar hota hai.

Fundamental Analysis Ka Role

Round trip trading mein fundamental analysis ka bhi important role hai. Currencies ke price movements par economic factors ka asar hota hai. Isliye, traders ko economic news aur events ka khayal rakhna chahiye. Isse unhein market ki direction ka andaza hota hai aur wo apne round trip trading decisions ko behtar bana sakte hain.

Risk Management Strategies

Round trip trading karte waqt risk management strategies ka istemal zaroori hai. Traders ko stop-loss aur take-profit orders set karne chahiye. Isse wo apne losses ko control kar sakte hain aur profits ko secure kar sakte hain. Risk management ka behtar istemal karne se traders ko round trip trading se zyada faida hoga.

Round Trip Trading Strategies

Traders ke paas round trip trading ke liye kuch strategies hain. Ek strategy hai scalping, jisme traders choti choti price movements se profit kamate hain. Dusri strategy hai day trading, jisme traders ek hi din mein multiple trades karte hain. Har trader ko apni trading style aur risk tolerance ke mutabiq strategy choose karni chahiye.

Trading Platforms Aur Tools

Round trip trading ke liye trading platforms aur tools bhi important hain. Aksar brokers advanced trading platforms offer karte hain jo traders ko real-time market data, charts, aur indicators provide karte hain. Ye tools traders ko behtar decisions lene mein madad karte hain aur round trip trading ko aasaan banate hain.

Round Trip Trading Ke Liye Psychology

Traders ki psychology bhi round trip trading mein important hoti hai. Traders ko market ki volatility ko samajhna chahiye aur panic nahi karna chahiye. Discipline aur patience rakhna zaroori hai taake traders apne emotions ko control kar sakein aur apne trading strategies par amal kar sakein.

Conclusion

Round trip trading forex market mein ek effective strategy hai jo traders ko quick profits kamane ka mauqa deti hai. Lekin, is technique ko istemal karne se pehle, traders ko advantages aur disadvantages ka khayal rakhna chahiye. Iske alawa, risk management, technical aur fundamental analysis ka behtar istemal karna bhi zaroori hai. Agar traders in sab baaton ka khayal rakhein to wo round trip trading se behtar results hasil kar sakte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

### Round Trip Trading in Forex

Forex market mein round trip trading ek aisi strategy hai jisme trader ek currency pair ko kharidta hai aur phir usi currency pair ko bechta hai, yaani buy and sell ka complete cycle. Is post mein, hum round trip trading ki definition, advantages, disadvantages, aur isay kaise implement kiya jata hai, par baat karenge.

#### Round Trip Trading Kya Hai?

Round trip trading ka matlab hai ek complete trade cycle, jisme pehle ek position khari di jati hai (buy) aur phir us position ko close kiya jata hai (sell). Yeh strategy aksar short-term traders aur scalpers ke liye use hoti hai jo quick profits hasil karna chahte hain. Is trading approach ka maqsad market ki chhoti fluctuations ka faida uthana hai.

#### Round Trip Trading Kaise Kiya Jata Hai?

1. **Market Analysis**:

Sabse pehle, trader ko market ka analysis karna hota hai. Technical analysis, chart patterns, aur indicators ka istemal karke trader yeh tay karta hai ke kab buy ya sell karna hai.

2. **Position Opening**:

Jab trader ko lagta hai ke market bullish hai, to wo currency pair ko kharidta hai. Misaal ke taur par, agar EUR/USD par buy position kholte hain, to trader ko ummeed hoti hai ke price barhegi.

3. **Monitoring**:

Position kholne ke baad, trader price movements ko closely monitor karta hai. Agar price trader ke favor mein move karti hai, to trader profit book karne ka sochta hai.

4. **Position Closing**:

Jab trader ko lagta hai ke price target achieve ho gaya hai ya market reverse ho raha hai, to wo position ko close kar deta hai. Isay round trip complete hota hai.

#### Advantages of Round Trip Trading

1. **Quick Profits**:

Round trip trading se traders ko short-term price movements ka faida uthane ka mauka milta hai. Agar aap timely entry aur exit karte hain, to aap jaldi profits hasil kar sakte hain.

2. **Market Volatility Ka Faida**:

Yeh strategy market ki volatility ka faida uthati hai. Jab market mein tezi se price changes aate hain, to traders isay leverage kar sakte hain.

3. **Flexibility**:

Round trip trading kisi bhi currency pair par ki ja sakti hai. Traders multiple pairs par round trips kar ke apni earnings ko diversify kar sakte hain.

#### Disadvantages of Round Trip Trading

1. **Transaction Costs**:

Har buy aur sell par transaction costs ya spreads hoti hain. Frequent trading se yeh costs barh jati hain, jo profits ko kha jati hain.

2. **Emotional Stress**:

Round trip trading fast-paced hota hai, jo emotional stress aur decision-making errors ka sabab ban sakta hai. Traders ko hamesha focused aur disciplined rehna padta hai.

3. **Time-Intensive**:

Is strategy mein traders ko continuously market ko monitor karna padta hai, jo time-consuming ho sakta hai. Agar aap full-time job karte hain, to yeh strategy aap ke liye challenging ho sakti hai.

#### Conclusion

Round trip trading forex market mein ek effective strategy hai jo quick profits hasil karne ka mauka deti hai. Isay successfully istemal karne ke liye aapko market analysis, emotional control, aur risk management par focus karna hoga. Jab aap in sab cheezon ka khayal rakhte hain, to aap round trip trading se profitable outcomes hasil kar sakte hain. Lekin, hamesha yaad rakhein ke kisi bhi trading strategy ko samajh kar hi istemal karna chahiye, taake aap losses se bach sakein. Regular practice aur experience ke sath aap is strategy ko behtar tarike se samajh sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:59 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим