what is price action in forex?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

"Price action," jise price action bhi kehte hain, takneekiy tahlil mein sab se bharosa mand aur asar andaz tareeqay mein se aik hai. Jabkay shuru mein yeh mushkil lag sakti hain, lekin isay neem tajarba rakhne wale aur mahir tajir dono ko ahem taur par istemal kiya ja sakta hai. Wazeh misalon aur wazeh tashreehat ke zariye, yeh mukhtasar mazmoon aap ko price action trading ke bare mein har cheez sikhayega aur yeh kaise aap ki investement portfolio ko waqt ke sath barha sakta hai. What is price action? Price action asal mein pesh o tehmaat ka aina hoti hai. Isay sirf keemat kay movement ko chart par darj kar ke ya toonmaanay wali keemat ko hissa karte hue samjha ja sakta hai. Price action ko samajhne aur is paragh ki maahir bannay ka sab se aasan tareeqa OHLC charts ko mahir karna hai. Jab aap inn charts ko aasani se parh sakte hain, to phir bars aur candlesticks par jayein. Har ek chart qisam ko poori tarah samajhne ka waqt nikal kar aap ko insights faraham karenge jo tajarba tajir bannay mein madadgar sabit honge. The concepts behind price action trading? Price action ek takneekiy tahlil ki aik saakht hai jo keemat ke charts par mabni hai, bina maqooliyat ke, us idea par jis ke mutabiq market kay hilat-o-rasayel zayada tar pesh o tehmaat ki muddat par tay hoti hain. Is liye yeh khayaal kia jata hai ke tareekhi keematain mojooda aur mustaqbil ki kharch par sahi tasveer paish karti hain. With price action trading? Sab se pehle, aap ko kuch price action ke tareeqay pehchane ki zaroorat hogi. Hamara rehnuma aap ki is mein madad kar sakta hai. Mumkin hai candlestick patterns mein trend pehchane ke do buniyadi tareeqay hain: Aap ya to takneekiy ishaaray istemal kar sakte hain ya phir ye kaam khud se kiya ja sakta hai. Ek bar jab aap ne ek mumkin trend pehchana hai, to apni pasandida position ke liye aik order lagain. Aap ko bus baith kar intezar karna hai ke aap ke munafa aye. Final though on price action trading? "Price action" ko tijarat karne ke liye kai mukhtalif tareeqay hain, lekin hum ne kuch mashhoor tareeqon ko mukammal taur par cover kiya hai. Un sab mein faide aur nuksan hote hain, lekin koi bhi ek tareeqa "price action" mein dusre se behtar nahi hai. Aap ko apni shakhsiyat aur halaat ke mutabiq behtareen tareeqa khud tajwez karna hoga. Forex tijarat mein jeetne ka koi tayyari tarika nahi hai, is liye in sab qisasat ko apne tijarat ke karobar mein tawanai ke tor par shamil karen, jab aap apni tajir ki career mein taraqqi kar rahe hain. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex Mein Keemat Karwai (Price Action) Kya Hai? Forex, ya foreign exchange market, dunia ke sab se bari aur sab se popular trading markets mein se aik hai. Is market mein mukhtalif currencies ya muddat ke badle mein khareed-o-farokht (buying and selling) ki jati hain. Traders is market mein tijarat karte hain taa ke wo faida hasil kar saken, lekin is mein kamyabi hasil karne ke liye ahem hota hai ke traders price action (keemat karwai) ka sahi tarika samjhein. Price Action Kya Hai? Price action, ya keemat karwai, forex market mein mukhtalif currency pairs ki qeemat ki taqat, kamzori, aur trends ko samajhne ka tareeqa hai. Iska matlab hai ke traders ko market ke current aur past price movements ko dekh kar faisla karna hota hai, beghair kisi mazboot ya jadoo mantar ke. Price action traders ye mantay hain ke market mein chal rahe tamam news, economic indicators, aur events market ke current price mein pehle se shamil hoti hain. Is liye, wo market mein hone wale changes ko samajhne ke liye sirf price charts aur price movements par yaqeen rakhte hain. Price Action Ka Istemal Kaise Kiya Jata Hai? Price action ko forex trading mein istemal karne ke liye traders ko mukhtalif price patterns, candlestick patterns, aur technical indicators par tawajjo deni hoti hai. Yahan kuch ahem price action patterns aur concepts hain:- Candlestick Patterns: Candlestick patterns, jinmein doosri candles ki shakal aur color ko dekha jata hai, traders ke liye ahem hote hain. In patterns se traders price reversals aur trends ko pehchan sakte hain.

- Support Aur Resistance Levels: Price action traders market mein support (neechay se) aur resistance (upar se) levels ko dekhte hain. In levels se traders ko ye samajhne mein madad milti hai ke kis qadar aik currency pair neechay ya upar jasakti hai.

- Price Patterns: Price patterns, jaise ke head and shoulders, double top, aur double bottom, traders ke liye market ke future movements ke liye sochne mein madadgar hote hain.

- Trend Analysis: Price action traders trend analysis ka istemal karke samajhte hain ke market kis direction mein ja raha hai. Isse unko trading opportunities aur risk management ka acha andaz milta hai.

- Simplicity: Price action trading asan hai aur traders ko market ko samajhne mein madadgar hota hai.

- Lagataar Taqat: Price action traders market ke changes ko taqat se samajh sakte hain aur jald az jald decisions le sakte hain.

- Risk Management: Is tareeqe se traders risk ko kam kar sakte hain aur trading strategies ko behtar bana sakte hain.

- Complexity: Price action analysis ko samajhna aur istemal karna kuch traders ke liye mushkil ho sakta hai.

- No Guarantees: Price action analysis bhi koi jadoo mantar nahi hai, aur kamyabi ya nakami market ke natural fluctuations par depend karti hai.

- Emotions: Kuch traders apni hawas aur jazbaat par amal karke ghalat decisions le sakte hain.

-

#4 Collapse

Price Action:ghair mulki currency ke tabadlay mein laagat ki sargarmi aik ahem khayaal hai, aur yeh tabadlay ke intikhab ko agay badhaane ke liye naqad matchon ke qabil tasdeeq aur mojooda qader ki taraqqi ke imthehaan ki taraf ishara karta hai. yeh is imkaan par munhasir hai ke tamam mozoon data, jaisay maali maloomat, khabron ke mawaqay, aur market ka ehsas, fi al haal laagat mein zahir hota hai. brokrz jo laagat ki sargarmi ke markaz ko sirf laagat ke khakay ke ird gird istemaal karte hain aur riwayati makhsoos isharay ya zaroori imthehaan par inhisaar nahi karte hain. yahan laagat ki sargarmi ke tabadlay ke ahem hissay hain : Candlestick Patterns: mom batii ke khakay laagat ki sargarmi ke tabadlay mein istemaal honay wali laagat ki sab se mashhoor qisam hain. brokrz mom batii ke wazeh design talaash karte hain, misaal ke tor par, dogi, hathora, girta sun-hwa sitara, aur zabardast misalein, mumkina ulat ya talaash ke tasalsul mein farq karne ke liye . Support and Resistance: pusht panahi aur rukawat ki satah laagat ke graph par woh ilaqay hain jahan qader aam tor par sust ya is ke bar aks hogi. brokrz un sthon ka istemaal ikhtiyarat ke tabadlay par tay karne ke liye karte hain, misaal ke tor par, stap bad qismati aur take binift orders . 3. patteren imthehaan : namonon mein farq karne ke liye brokrz qader ki taraqqi ke umomi unwan ka jaiza letay hain. woh yeh faisla karne ke liye trained lines ya moving mid points jaisay alaat ka istemaal kar satke hain ke aaya market mein utaar charhao, neechay ka rujhan, ya chal raha hai . Trend Analysis: laagat ki sar garmion ke tajir mustaqbil ki laagat mein honay wali pishrft ka andaza laganay ke liye, sir aur kaandhon ki terhan, do gina tops, aur banners ke khakay ki talaash karte hain. yeh misalein mumkina patteren ke ulat ya break out ko zahir kar sakti hain .:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Price_Action_Definition_Oct_2020-01-8364bfa9d55d4e8fbaf360c3b0252cc2.jpg) Price Patterns: tajir wazeh laagat ki sthon ke baray mein soch samajh kar baat karte hain jo aam tor par taaqat ke barray shobo ke tor par ya rukawat ke liye gaye hain. un sthon se break out ya بوبز khulay darwazon ke tabadlay ko numaya kar satke hain . Confluence: laagat ki sargarmi ke tajir aksar jor talaash karte hain, jahan mutadid mutaghiyirat tabadlay ke intikhab mein madad ke liye adjust hotay hain. misaal ke tor par, aik bohat barri madad ki satah par aik ulta mom batii ka design ziyada ground exchange signal day sakta hai . Risk Management: taaqatwar juaa board laagat ki sargarmi ke tabadlay mein ahem hai. tajir apni position ke size ka faisla karte hain aur mumkina bad qismati ko mehdood karne ke liye qader ki sargarmi ke imthehaan ki roshni mein stop musebat ke ehkamaat muratab karte hain . Time Frames: laagat ki sargarmi ke brokrz mukhtalif time spain ki chhaan bain kar satke hain, minute ki khaka se le kar din se din tak ya haftay ke baad haftay ke graph tak. mukhtalif time period market ke anasir mein ilm ke mukhtalif buts day satke hain . Patience and Discipline laagat ki sargarmi ke tabadlay ke liye istiqamat aur nazam o zabt ki zaroorat hoti hai. brokrz kasrat se mazbooti ke sakht ilaqon ko latka dete hain aur over trading ya ghair mohtaat intikhab par tay karne se daur rehtay hain . Continuous Learning: muaser laagat ki sargarmi brokrz mustaqil tor par seekhnay hain aur bdalty hue muashi halaat ko adjust karte hain. woh –apne muqablon aur taraqqi Pazeer laagat ki sargarmi ke paish e nazar –apne tareeqa car ko behtar bana satke hain . khulasa mein, laagat ki sargarmi ka tabadlah ghair mulki currency ke tabadlay ka aik mashhoor tareeqa car hai jo bakhabar tabadlay ke intikhab ko tay karne ke liye qabil tasdeeq aur mojooda qader ki taraqqi ke imthehaan par roshni dalta hai. is hikmat e amli ko istemaal karne walay tajir mustaqbil ki laagat mein paish Raft ki tawaqqa karne ke liye khusoosi imthehaan, khakay ki misalon aur market dimaghi tehqeeq par inhisaar karte hain, is ke ilawa aygziktoz aur nazam o zabt ke khatray ki ahmiyat par zor dete hain .

Price Patterns: tajir wazeh laagat ki sthon ke baray mein soch samajh kar baat karte hain jo aam tor par taaqat ke barray shobo ke tor par ya rukawat ke liye gaye hain. un sthon se break out ya بوبز khulay darwazon ke tabadlay ko numaya kar satke hain . Confluence: laagat ki sargarmi ke tajir aksar jor talaash karte hain, jahan mutadid mutaghiyirat tabadlay ke intikhab mein madad ke liye adjust hotay hain. misaal ke tor par, aik bohat barri madad ki satah par aik ulta mom batii ka design ziyada ground exchange signal day sakta hai . Risk Management: taaqatwar juaa board laagat ki sargarmi ke tabadlay mein ahem hai. tajir apni position ke size ka faisla karte hain aur mumkina bad qismati ko mehdood karne ke liye qader ki sargarmi ke imthehaan ki roshni mein stop musebat ke ehkamaat muratab karte hain . Time Frames: laagat ki sargarmi ke brokrz mukhtalif time spain ki chhaan bain kar satke hain, minute ki khaka se le kar din se din tak ya haftay ke baad haftay ke graph tak. mukhtalif time period market ke anasir mein ilm ke mukhtalif buts day satke hain . Patience and Discipline laagat ki sargarmi ke tabadlay ke liye istiqamat aur nazam o zabt ki zaroorat hoti hai. brokrz kasrat se mazbooti ke sakht ilaqon ko latka dete hain aur over trading ya ghair mohtaat intikhab par tay karne se daur rehtay hain . Continuous Learning: muaser laagat ki sargarmi brokrz mustaqil tor par seekhnay hain aur bdalty hue muashi halaat ko adjust karte hain. woh –apne muqablon aur taraqqi Pazeer laagat ki sargarmi ke paish e nazar –apne tareeqa car ko behtar bana satke hain . khulasa mein, laagat ki sargarmi ka tabadlah ghair mulki currency ke tabadlay ka aik mashhoor tareeqa car hai jo bakhabar tabadlay ke intikhab ko tay karne ke liye qabil tasdeeq aur mojooda qader ki taraqqi ke imthehaan par roshni dalta hai. is hikmat e amli ko istemaal karne walay tajir mustaqbil ki laagat mein paish Raft ki tawaqqa karne ke liye khusoosi imthehaan, khakay ki misalon aur market dimaghi tehqeeq par inhisaar karte hain, is ke ilawa aygziktoz aur nazam o zabt ke khatray ki ahmiyat par zor dete hain .

-

#5 Collapse

Asslam alikum dear trader! i hope you are all good. aj hum khuch nai chzien dhiekhty hien jisky bary mien logon ko bhut kam knowledge he or jabky market mien bhut bara role he price action ka to aye hum isky bary mien compelety detail sy phrty hien. Forex Mein price action Kya Hai? Forex trading, jahan currencies ko khareedna aur bechna hota hai, duniya ka sab se bada aur sab se tez paisay ka bazaar hai. Keemat amal ek ahem tijarat mein tareekhi keematoun ki tafseelat ko tajziyah karne par mabni ek asli concept hai. Ismein keemat ki raw data ki tehqiqat karke tijarat ke faislay lene par zor diya jata hai. Ye aik technical analysis ka tareeqa hai jo riwayati indicators ko nazar andaz karta hai aur keemat data par ghor karta hai. Keemat Amal in Forex (Forex Mein Keemat Amal):

Keemat Amal in Forex (Forex Mein Keemat Amal): - Candlestick Patterns (Mombati Ki Shakle):Candlestick patterns keemat amal ki ahem bunyad hain. Tijarat karne wale candlesticks ki shaklon ka jaeza laga kar future keemat amal ko peshgoi karne mein madad hasil karte hain. Aam shakle mein doji, hammer, shooting star, aur engulfing shakle shamil hain.

- Support aur Resistance (Madad aur Muhavira):Support ek keemat satah ko darust karta hai jahan currency pair keemat amal aksar khareedne ki rozi paata hai aur isay mazeed girne se bachata hai. Resistance iska ulta hai aur isay woh satah darust karti hai jahan bechna aksar hota hai aur keemat ko mazeed barhne se rokti hai.

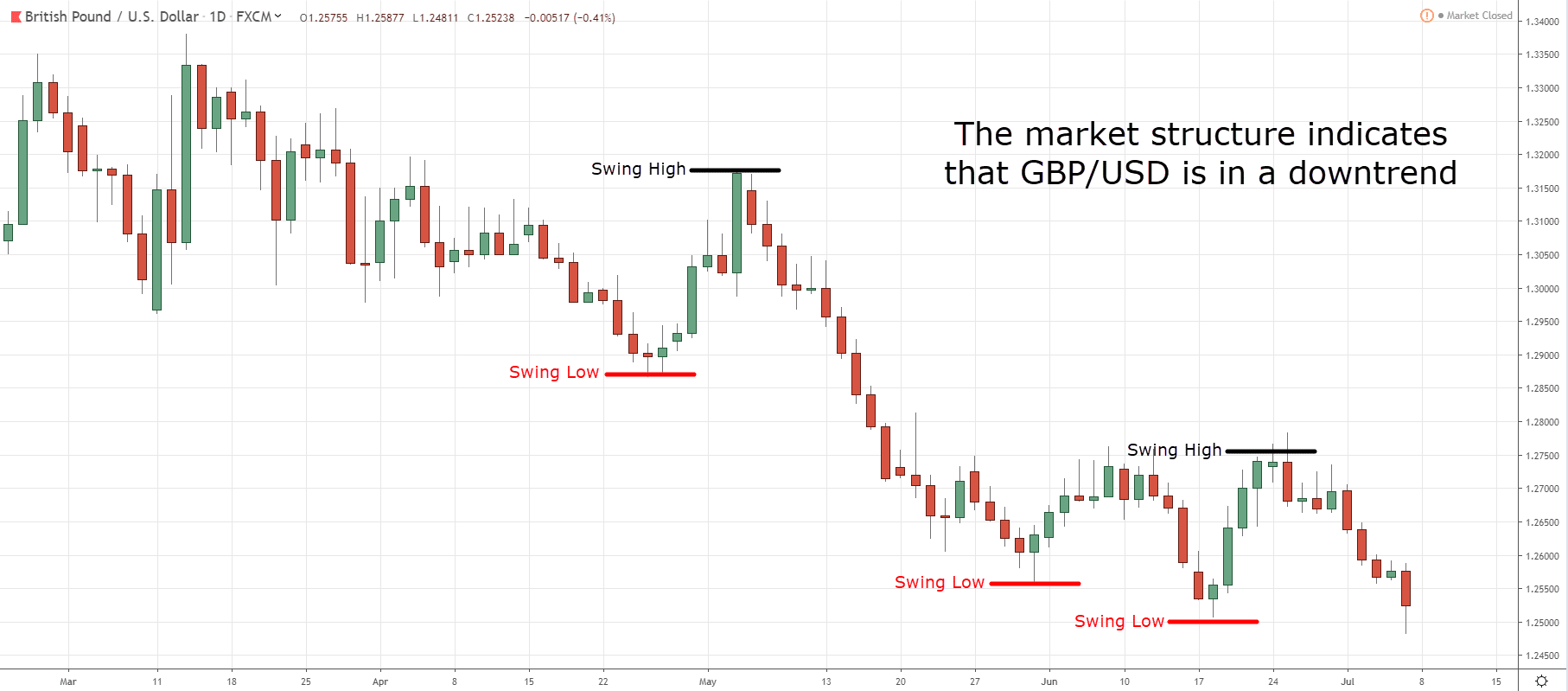

- Trend Analysis (Rujhan Ka Tijarat Mein Jaiza):Tijarat karne wale aksar market mein rujhan ki tafseelat karke aqwaam ki keemat data ko tajziyah karte hain. Woh dekhte hain ke keemat kaise barhti ya girti hai, jaise uptrends (jab keematain barqarar tar par barh rahi hain) ya downtrends (jab keematain barqarar tar par gir rahi hain).

- Price Patterns (Keemat Ke Paton Ki Shakle):Mukhtalif price patterns, jaise head and shoulders, double tops, aur double bottoms, ko peshgoi karne ya keemat ko aage barhne ya ulte jane ka tajziyah karne ke liye dekha jata hai.

- Market Structure (Market Ka Banawat):Market ki banawat ko samajhna market ke halat, jaise range-bound markets (sideways movement) aur trending markets (tez rujhan wali movement), ko pehchanna mein madadgar hota hai.

- Volume Analysis (Miqdar Ka Tijarat Mein Jaiza):Miqdar ya aik muddat mein mua'malat ki tadad, kabhi-kabhi keemat amal analysis mein shamil hoti hai. Isse keemat ke harkatoun ki quwati tehqiqat mein mazeed maloomat milti hai.

- Tareekhi Data Ki Tehqiqat (Historical Data Analysis):Keemat amal tijarat karne wale tareekhi keemat data ko charts par dekhte hain. Is data ki tehqiqat karke woh potential mustaqbil ke harkatoun ko pehchante hain.

- Pattern Recognition (Shaklon Ka Pehechaan):Tijarat karne wale candlestick shaklon, support aur resistance satahain, trend lines, aur doosre keemat amal elements ko peshgoi karne ki koshish karte hain.

- Faislay Lene (Decision-Making):Tajziyah ke baaad, tijarat karne wale aqwaam keemat amal karne ya band karne ke faislay lete hain. Misal ke tor par, agar unhe bullish rujhan nazar aata hai aur kisi khaas satah par madad milti hai, to woh khareedne ka irada kar sakte hain.

- Khatra Ka Naiz Tanzeem (Risk Management):Khatra ka moassar tanzeem keemat amal tijarat mein ahem hai. Tijarat karne wale stop-loss orders set karte hain taake nuksan ko had se ziada nahi hone diya jaye aur take-profit orders set karte hain taake faida hasil kya ja sake.

- Mustamir Nazar (Continuous Monitoring):Keemat amal tijarat karne wale apni tijarat aur market ko mustamir nazar rakhte hain taake zaroorat par tijarat ko adjust kya ja sake.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

what is price action in forex?

Forex Mein price action Kya Hai? Forex trading, jahan currencies ko khareedna aur bechna hota hai, duniya ka sab se bada aur sab se tez paisay ka bazaar hai. Keemat amal ek ahem tijarat mein tareekhi keematoun ki tafseelat ko tajziyah karne par mabni ek asli concept hai. Ismein keemat ki raw data ki tehqiqat karke tijarat ke faislay lene par zor diya jata hai. Ye aik technical analysis ka tareeqa hai jo riwayati indicators ko nazar andaz karta hai aur keemat data par ghor karta hai. Keemat Amal in Forex (Forex Mein Keemat Amal):

Keemat Amal in Forex (Forex Mein Keemat Amal): - Candlestick Patterns (Mombati Ki Shakle):Candlestick patterns keemat amal ki ahem bunyad hain. Tijarat karne wale candlesticks ki shaklon ka jaeza laga kar future keemat amal ko peshgoi karne mein madad hasil karte hain. Aam shakle mein doji, hammer, shooting star, aur engulfing shakle shamil hain.

- Support aur Resistance (Madad aur Muhavira):Support ek keemat satah ko darust karta hai jahan currency pair keemat amal aksar khareedne ki rozi paata hai aur isay mazeed girne se bachata hai. Resistance iska ulta hai aur isay woh satah darust karti hai jahan bechna aksar hota hai aur keemat ko mazeed barhne se rokti hai.

- Trend Analysis (Rujhan Ka Tijarat Mein Jaiza):Tijarat karne wale aksar market mein rujhan ki tafseelat karke aqwaam ki keemat data ko tajziyah karte hain. Woh dekhte hain ke keemat kaise barhti ya girti hai, jaise uptrends (jab keematain barqarar tar par barh rahi hain) ya downtrends (jab keematain barqarar tar par gir rahi hain).

- Price Patterns (Keemat Ke Paton Ki Shakle):Mukhtalif price patterns, jaise head and shoulders, double tops, aur double bottoms, ko peshgoi karne ya keemat ko aage barhne ya ulte jane ka tajziyah karne ke liye dekha jata hai.

- Market Structure (Market Ka Banawat):Market ki banawat ko samajhna market ke halat, jaise range-bound markets (sideways movement) aur trending markets (tez rujhan wali movement), ko pehchanna mein madadgar hota hai.

- Volume Analysis (Miqdar Ka Tijarat Mein Jaiza):Miqdar ya aik muddat mein mua'malat ki tadad, kabhi-kabhi keemat amal analysis mein shamil hoti hai. Isse keemat ke harkatoun ki quwati tehqiqat mein mazeed maloomat milti hai.

- Tareekhi Data Ki Tehqiqat (Historical Data Analysis):Keemat amal tijarat karne wale tareekhi keemat data ko charts par dekhte hain. Is data ki tehqiqat karke woh potential mustaqbil ke harkatoun ko pehchante hain.

- Pattern Recognition (Shaklon Ka Pehechaan):Tijarat karne wale candlestick shaklon, support aur resistance satahain, trend lines, aur doosre keemat amal elements ko peshgoi karne ki koshish karte hain.

- Faislay Lene (Decision-Making):Tajziyah ke baaad, tijarat karne wale aqwaam keemat amal karne ya band karne ke faislay lete hain. Misal ke tor par, agar unhe bullish rujhan nazar aata hai aur kisi khaas satah par madad milti hai, to woh khareedne ka irada kar sakte hain.

- Khatra Ka Naiz Tanzeem (Risk Management):Khatra ka moassar tanzeem keemat amal tijarat mein ahem hai. Tijarat karne wale stop-loss orders set karte hain taake nuksan ko had se ziada nahi hone diya jaye aur take-profit orders set karte hain taake faida hasil kya ja sake.

- Mustamir Nazar (Continuous Monitoring):Keemat amal tijarat karne wale apni tijarat aur market ko mustamir nazar rakhte hain taake zaroorat par tijarat ko adjust kya ja sake.

-

#7 Collapse

what is price action in forex? Forex market, yaani foreign exchange market, duniya ke sabse bade aur taqatwar financial markets mein se ek hai. Yahan rozana karoron dollars ki trading hoti hai, aur traders yahan keeamaat ki tijarat karke faida kamate hain. Forex trading mein mukhtalif tareeqay aur tools istemal kiye jate hain taaki behtareen faislay liye ja saken. Price action, jise forex market mein keemat ka amal kehte hain, yeh ek ahem tareeqa hai jise traders apni trading strategies ko behtar banane ke liye istemal karte hain. Price action ka matlab hota hai ke forex market mein currency pairs ki keemat ki tijarat karne walon ko keemat ke asal amal aur us ke historical patterns par ghor karke trading faislay lene mein madadgar hota hai. Isme traders indicators ya oscillators ki bajaye haqiqi keemat ki movement aur us movement ke saath woh maaloomat istemal karte hain jo woh trading faislon mein istemal karte hain. Price action analysis ki buniyad par keemat ki movement aur us ke patterns ko samajhna hota hai, jo aksar candles ke roop mein dikhai dete hain. Price action analysis ke doran traders neeche diye gaye mukhtalif pehluon par tawajjo dete hain:- Candlestick Patterns (Mombattiyon Ke Pattern): Candlestick patterns, ya mombattiyon ke patterns, market ki jazbat aur sentiment ko samajhne ke liye ahem hoti hain. In patterns mein alag-alag mombattiyon ke shapes aur unki positions ko padhkar traders samjh sakte hain ke market mein bullish (tezi), bearish (mandi), ya range-bound (flat) mizaj hai.

- Support aur Resistance Levels (Support aur Rukawat Darjat): Price action analysis mein, traders keemat ki movements ko support (madad) aur resistance (rukawat) levels par dekhte hain. Support levels par keemat girne se rokti hai aur resistance levels par keemat barhti hai. In levels ki pehchan karne se traders keemat ki tarah aur behas ko samajh sakte hain.

- Trend Analysis (Tezi aur Mandi Ka Taqaza): Price action traders trend analysis ke zariye market mein mojud tezi (bullish) aur mandi (bearish) ko pehchantay hain. Isme market ke patterns, jaise ke higher highs aur lower lows, dekhe jate hain taaki trend ko samjha ja sake.

- Price Patterns (Keemat Ke Patterns): Traders price action analysis mein aksar alag-alag keemat ke patterns par ghor karte hain, jaise ke head and shoulders, double tops, aur double bottoms. Ye patterns market ke future ki taraf ishara kar sakte hain.

-

#8 Collapse

Forex mein Price Action: Tehqiqat aur Amal Forex, aik online currency exchange market hai jahan traders duniya bhar mein mukhtalif currencies ko khareedte hain aur bechtay hain. Is market mein trading karne ke liye, traders ko mukhtalif analysis techniques aur tools ka istemal karna parta hai, jinmein "Price Action" aik aham hota hai. Price Action, traders ko currency pairs ki keematon ki taqat aur kamzori ko samajhne mein madadgar hota hai. Is article mein hum Forex mein Price Action ke hawale se mukhtasar maloomat aur uske istemal ki ahmiyat par baat karenge. Price Action Kya Hai? Price Action, aik trading technique hai jahan traders market ke mukhtalif patterns aur price movements ko samajhne ki koshish karte hain. Is technique mein traders sirf currency pairs ki qeemat ya "price" par amal karte hain aur kisi bhi technical indicator ya chart pattern ka istemal nahi karte. Price Action trading, trader ke liye market ki asal halat ko samajhne mein madadgar hoti hai. Price Action Ki Ahmiyat- Mukhtalif Price Patterns: Price Action, mukhtalif price patterns ko samajhne mein madadgar hoti hai. Traders market ke patterns ko dekhte hain aur unka andaza lagate hain ke market kis tarah move kar sakta hai. Is tarah se woh trading decisions banate hain.

- Real-Time Information: Price Action trading, traders ko real-time information deti hai. Ismein traders market ke halat ko live dekhte hain aur trading decisions us waqt lete hain jab market ki asal tabdeeliyan hoti hain.

- Risk Management: Price Action trading, risk management ke liye aik ahem zaria hai. Traders market ke price movements ko dekhte hain aur stop loss aur take profit levels tay karne mein madadgar hoti hai.

- Simplicity: Price Action trading aam taur par simple hoti hai. Ismein traders ko complicated technical indicators aur charts ki zarurat nahi hoti. Isliye, beginners bhi asani se Price Action ka istemal kar sakte hain.

- Candlestick Patterns: Candlestick patterns, Price Action trading ke aham hisse hain. In patterns ko samajhna aur pehchanna traders ke liye zaroori hai.

- Support aur Resistance: Price Action traders support aur resistance levels ko dekhte hain, jo market mein aksar key points hote hain.

- Price Reversals: Price Action trading mein traders price reversals ko samajhte hain, jaise ke trend change hone ke signs.

- Price Breakouts: Traders price breakouts ko bhi observe karte hain, jo market mein significant movements ki taraf ishara dete hain.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex market mein "price action" ek ahem concept hai, jo traders ke liye market ke behavior aur future price movements ka analysis karne mein madadgar hota hai. Price action ka matalab hota hai ki traders market ki behavior ko uske price charts aur candlestick patterns ke madhyam se samajhte hain, bina kisi technical indicator ya oscillators ke istemal kiye. Yani, traders price action se market ke past price movements ko dekhte hain taki woh future ki price movements ko samajh sakein.

Price action trading mein traders market ke behavior ko analyze karke trading decisions lete hain. Isme kuch mukhya components hote hain:- Candlestick Patterns: Candlestick patterns, jaise ki doji, engulfing patterns, aur hammers, price action ka mahatvapurn hissa hote hain. In patterns ke madhyam se traders market ke sentiment aur reversal points ko samajhte hain.

- Support aur Resistance Levels: Price action traders support aur resistance levels ko dekhte hain, jo market mein price movements ko rokne ya reverse karne mein madadgar hote hain.

- Trends: Price action traders trend analysis ke through market ke direction ko samajhte hain, jaise uptrend, downtrend, ya sideways trend.

- Price Bars: Price action analysis me traders kisi specific time frame ke price bars (candles) ko dekhte hain taki woh price ka movement aur volatility samajh sakein.

- Price Patterns: Traders price action ke jariye price patterns, jaise ki head and shoulders, triangles, aur flags, ko recognize karte hain.

Price action trading mein traders ka dhyan market ke "naked" aspects (technical indicators ke bina) par hota hai, aur woh price charts aur patterns ko padhkar trading decisions lete hain. Iska uddeshya yeh hota hai ki traders market ke natural behavior ko samajh sakein aur accurate predictions karke profit kama sakein.

Price action trading ek mahatvapurn tarike se forex market ko analyze karne ka ek sadhe-sadhe aur aam tarike hain. Isme traders ko market ke price movements ko depth me samajhne ke liye practice aur experience ki zarurat hoti hai.

-

#10 Collapse

Price Action Kya Hai Forex Mein?

Forex trading mein "price action" ek ahem concept hai, jo traders ko market ki movement aur price ke behavior ko samajhne mein madad deta hai. Yeh ek tarika hai jisse traders market ke charts par price ki movement ka jaiza lete hain, bina kisi technical indicator ke. Is article mein, hum price action ke ma'ani, iski ahmiyat aur isay kaise istemal kiya jata hai, par detail mein baat karenge.

Price Action Ka Matlab

Price action ka asal matlab hai price ka movement aur yeh kaise time ke sath badalta hai. Forex market mein, traders price action ko analyze karke yeh jaanne ki koshish karte hain ke price kab aur kahan move karega. Yeh analysis mainly candlestick charts par hota hai, jahan price ke movements ko visual form mein dekha ja sakta hai.

Price Action Aur Technical Indicators

Bohat se traders price action ko technical indicators ke sath mila kar istemal karte hain, magar asal mein price action ek aise approach hai jisme indicators ka istemal nahi hota. Is tarah se traders sirf price ke behavior ko dekhte hain aur usi ke zariye trading decisions lete hain. Is ka matlab hai ke price ki history par hi focus hota hai.

Price Action Trading Ki Ahmiyat

Price action trading ki ahmiyat is liye hai ke yeh market ki real-time conditions ko samajhne mein madad karta hai. Is tarah traders market sentiment ko behtar samajh sakte hain. Jab traders price action ko samajhte hain, to unhe market ke trends aur reversals ka pata chal sakta hai, jo trading decisions lene mein bohat madadgar hota hai.

Candlestick Patterns

Price action trading mein candlestick patterns bohat ahmiyat rakhte hain. Yeh patterns price ki movement aur market sentiment ko darshate hain. Kuch mashhoor candlestick patterns hain, jaise ke Doji, Hammer, aur Engulfing patterns. In patterns ko samajh kar traders yeh jaan sakte hain ke market ka mood kya hai aur aage kya hone wala hai.

Support Aur Resistance Levels

Support aur resistance levels price action ka ek aur important aspect hain. Support level wo price point hota hai jahan price ne pehle girne se pehle support paya hota hai, jab ke resistance level wo price point hai jahan price ne girne se pehle resistance paya hota hai. Traders in levels ko identify karke entry aur exit points decide karte hain.

Trend Analysis

Trend analysis price action trading ka ek important hissa hai. Traders yeh dekhte hain ke market upward, downward ya sideways trend mein hai. Jab market upward trend mein hota hai, to traders buy karte hain, jab downward trend mein hota hai, to wo sell karte hain. Sideways trend mein trading zyada mushkil hoti hai, lekin kuch traders is mein bhi opportunities dekhte hain.

Market Sentiment Ka Asar

Market sentiment price action trading mein bohat ahmiyat rakhta hai. Agar market mein bullish sentiment hai, to price upar ja sakta hai, jab ke bearish sentiment ke case mein price niche aa sakta hai. Traders price action ko dekh kar market sentiment ka andaza laga sakte hain aur apne trading decisions ko is hisaab se adjust kar sakte hain.

Risk Management

Price action trading mein risk management bhi bohat zaroori hai. Kyunki price kabhi kabhi unpredictable hoti hai, is liye traders ko apne losses ko control karne ke liye stop-loss orders ka istemal karna chahiye. Yeh unhe unexpected market movements se bacha sakta hai aur unki capital ko protect karne mein madadgar hota hai.

Price Action Strategy Tayar Karna

Price action strategy tayar karte waqt, traders ko apne trading goals aur risk tolerance ko madde nazar rakhna chahiye. Har trader ki strategy alag hoti hai, lekin price action analysis ka istemal karna har strategy ka hissa hota hai. Is tarah traders market ke behavior ko samajh kar behtar decisions le sakte hain.

Psychological Factors

Price action trading mein psychological factors bhi bohot important hain. Market participants ka behavior bhi price movement ko affect karta hai. Jab traders emotional decisions lete hain, to is se market ki volatility badh sakti hai. Is liye, traders ko apne emotions ko control mein rakhna chahiye aur rational decisions lene ki koshish karni chahiye.

Backtesting Aur Analysis

Price action trading ki effectiveness ko jaanchne ke liye backtesting zaroori hai. Is process mein traders apni strategies ko historical data par test karte hain. Is se unhe pata chalta hai ke unki strategy kitni effective hai aur is mein kya behtari ki zarurat hai. Yeh ek valuable exercise hai jo traders ko unki trading skills ko behtar banane mein madad karta hai.

Conclusion

Price action forex trading ka ek fundamental element hai jo traders ko market ki real-time behavior ko samajhne mein madad karta hai. Is approach ke zariye traders price ki movement ko analyze karte hain aur behtar trading decisions lete hain. Candlestick patterns, support aur resistance levels, aur market sentiment price action trading ke key components hain.

Traders ko risk management aur psychological factors ko bhi madde nazar rakhte hue apne strategies tayar karni chahiye. Backtesting se wo apni strategies ko improve kar sakte hain. Price action ke through traders ko market mein opportunities dhoondne ka mauka milta hai, jo unki trading success ka raaz ban sakta hai.

-

#11 Collapse

### What is Price Action in Forex?

Forex trading mein price action ek ahem concept hai jo traders ko market ki movement ko samajhne aur trading decisions lene mein madad karta hai. Is post mein hum price action ki definition, iske faide, aur trading strategies par baat karenge.

#### Price Action Kya Hai?

Price action asal mein market ki price movements ka analysis hai. Yeh ek technique hai jisme traders sirf price data ka istemal karte hain, bina kisi additional indicators ya tools ke. Price action ko samajhne se traders ko market ki current sentiment, trends, aur reversals ka andaza lagta hai. Ismein candlestick patterns, support and resistance levels, aur chart formations ki analysis shamil hoti hai.

#### Price Action Ki Khasiyat

1. **Market Sentiment**: Price action traders ko market ki sentiment ko samajhne mein madad karta hai. Agar price upar ja rahi hai, to yeh bullish sentiment ka indication hota hai, jabke price neeche ja rahi hai, to bearish sentiment ko darshata hai.

2. **Simplicity**: Price action ka istemal karne mein simplicity hoti hai. Traders ko sirf price movements aur candlestick patterns ko samajhna hota hai, jisse decision-making process asaan hota hai.

3. **Flexibility**: Price action ko kisi bhi time frame mein istemal kiya ja sakta hai, chahe wo short-term scalping ho ya long-term trading. Yeh versatility traders ko alag-alag trading styles ke hisaab se adapt karne ki suvidha deti hai.

#### Price Action Kaise Istemal Kiya Jaye?

1. **Support and Resistance Levels**: Traders price action ke zariye support aur resistance levels identify karte hain. Yeh levels market ki turning points ko darshate hain, jahan price reverse ya breakout kar sakti hai.

2. **Candlestick Patterns**: Candlestick patterns jaise bullish engulfing, bearish engulfing, aur pin bars ko samajhna price action trading ka hissa hai. In patterns se traders ko entry aur exit points milte hain.

3. **Trend Analysis**: Price action ka istemal trend analysis ke liye bhi hota hai. Traders market ki higher highs aur lower lows ko dekhte hain taake yeh samajh saken ke market kis taraf ja raha hai.

#### Price Action Trading Strategy

1. **Entry Points**: Jab price support level ko test karti hai aur bullish reversal pattern banta hai, to yeh buy signal hota hai. Usi tarah, jab price resistance level ko test karti hai aur bearish reversal pattern banta hai, to yeh sell signal hota hai.

2. **Stop-Loss Placement**: Stop-loss ko recent swing low ya high ke thoda neeche ya upar rakhna chahiye, taake unexpected market movements se bach sakein.

3. **Profit Targets**: Profit targets ko previous support ya resistance levels ke hisaab se set karein. Yeh realistic profit levels provide karte hain.

#### Aakhir Mein

Price action Forex trading mein ek powerful tool hai jo market ki real-time movement ko samajhne mein madad karta hai. Is technique ko samajhne aur effectively istemal karne se traders apni profitability ko barha sakte hain. Lekin, hamesha yaad rahe ke kisi bhi trading decision se pehle proper analysis aur risk management zaroor karein. Is tarah, aap successful trading ka safar tay kar sakte hain.

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

# Price Action Kya Hai Forex Mein?

Forex trading mein "price action" ka concept ek aham role ada karta hai. Yeh ek trading strategy hai jo sirf market ki price movements par focus karti hai, bina kisi technical indicators ke. Is ka matlab hai ke traders sirf price charts ka jaiza lete hain aur market ki current situation ka andaza lagate hain, jo unhe decision lene mein madad karta hai.

## Price Action ki Bunyadi Baaten

Price action ka asal maqsad market ki psychology ko samajhna hai. Jab koi trader kisi currency pair ki trading karta hai, to wo samajhta hai ke price kis tarah se move karegi. Yeh traders ko yeh samajhne mein madad karta hai ke market ke participants kaise react kar rahe hain, jab price kisi specific level par pohanchti hai.

Is approach ke tehat, traders support aur resistance levels ko identify karte hain. Support level wo point hota hai jahan price niche nahi jaati, jabke resistance level wo point hai jahan price ooncha nahi jaati. In levels ko samajhna zaroori hai kyunke yeh traders ko entry aur exit points determine karne mein madad dete hain.

## Candlestick Patterns

Price action ka ek aur aham hissa candlestick patterns hain. Candlesticks price ki movements ko represent karte hain aur inki analysis se traders ko potential reversals aur continuations ke signals milte hain. Kuch mashhoor candlestick patterns mein Doji, Hammer, aur Engulfing patterns shamil hain. Har pattern ki apni significance hoti hai aur inhe samajhne se traders ko market ki direction ka andaza hota hai.

## Market Sentiment

Price action analysis ka ek aur key aspect market sentiment hai. Jab traders market ki price movements ko observe karte hain, wo yeh bhi samajhte hain ke dusre traders kis tarah ka reaction de rahe hain. Agar price kisi specific level par barh rahi hai aur zyada volume ke sath, to iska matlab yeh ho sakta hai ke market bullish hai. Waqt ke sath, traders market sentiment ko analyze karte hain aur yeh unki trading strategies par asar dalta hai.

## Advantages of Price Action Trading

Price action trading ka ek faida yeh hai ke yeh traders ko technical indicators ke faaslon se azaad karta hai. Is tarah, traders bina kisi complex analysis ke sirf price movements par focus kar sakte hain. Yeh strategy un logon ke liye bhi behtar hai jo trading ke liye minimal tools istemal karna pasand karte hain.

Is ke ilawa, price action trading ka ek aur advantage yeh hai ke yeh short-term aur long-term dono trading strategies ke liye istemal kiya ja sakta hai. Chahe aap scalping kar rahe ho ya swing trading, price action aapko effective decision lene mein madad de sakta hai.

## Conclusion

Aakhir mein, price action ek valuable tool hai jo forex traders ko market ki actual conditions samajhne aur sahi decisions lene mein madad karta hai. Yeh strategy price movements, support and resistance levels, aur market sentiment par focus karti hai, jo traders ko unki trading performance behtar karne ka moka deti hai. Agar aap forex trading mein naya hai, to price action ka concept samajhna aapko market ke dynamics ko behter samajhne mein madad karega. Is se aap trading ki duniya mein behtar faislay kar sakte hain aur apne profits ko badha sakte hain.

-

#13 Collapse

### Forex Mein Price Action Kya Hai?

Forex trading mein "price action" ka concept bohot ahmiyat rakhta hai. Yeh technique traders ko market ki movements ko samajhne aur analyze karne mein madad karti hai, bina kisi complex indicators ya tools ke. Is post mein hum dekhenge ke price action kya hai aur yeh forex trading mein kaise istemal hota hai.

Price action asal mein market ke price movements ka study hai. Traders yeh dekhtay hain ke price kis tarah se time ke sath badal rahi hai. Is approach ka maksad yeh hota hai ke traders historical price data ka istemal karte hue future price movements ka andaza lagain. Is tarah se wo trends, reversals, aur key support-resistance levels ko identify kar sakte hain.

Price action trading ka sabse bara faida yeh hai ke yeh simplicity par mabni hai. Traders ko sirf price charts ki taraf dekhna hota hai, jahan wo candlestick patterns aur price levels ko analyze karte hain. Yeh patterns market ki psychology aur participants ki sentiment ka izhar karte hain. Jaise, agar ek strong bullish candle banti hai, to iska matlab hota hai ke buyers ka control zyada hai. Iske baraks, agar bearish candles zyada hain, to sellers ka control samjha jata hai.

Ek aur ahem concept jo price action ke sath jura hai, wo hai support aur resistance levels. Support wo level hai jahan price neechay nahi jaati, jabke resistance wo level hai jahan price upar nahi jaati. Traders in levels ka istemal karte hain entry aur exit points determine karne ke liye. Agar price support level ko todti hai, to yeh bearish signal hota hai, aur agar resistance level todti hai, to bullish signal hota hai.

Price action trading ke liye kuch key candlestick patterns bhi hain, jaise "pin bar," "engulfing," aur "inside bar." Ye patterns traders ko potential reversals aur trend continuations ka pata dete hain. Har pattern ki apni specific meaning hoti hai, aur traders inhe samajh kar apne trades plan karte hain.

Price action trading mein discipline aur patience ka bohot bada role hota hai. Aapko market ki movements ka patiently intezar karna hota hai aur sirf tab hi trade karna chahiye jab aapko clear signals milen. Yahan tak ke seasoned traders bhi kabhi-kabhi emotional decisions le lete hain, isliye risk management bhi zaroori hai.

Akhir mein, price action forex trading ka ek powerful tool hai. Yeh traders ko market ki asal halat samajhne ka mauqa deta hai aur unhe informed decisions lene mein madad karta hai. Agar aap forex trading mein naye hain, to price action ka istemal aapko market ki dynamics ko samajhne mein madad karega.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#14 Collapse

Price Action Forex Mein:

Price action trading Forex mein aik bohot mashhoor aur samajhdar traders ke darmiyan widely adopted technique hai. Is mein trader market ke historical price movements ko dekh kar trading decisions leta hai, aur koi doosray technical indicators ya oscillators ko use nahi karta. Price action ke zariye traders market ke pure price data ko samajhne ki koshish karte hain, taake wo is se future price movements ka andaza laga saken. Yeh aik simple lekin powerful strategy hai, jo mostly short-term traders ke liye bohot faidemand hoti hai.

Aayein, ab hum price action ko tafseel se samajhte hain.

Price Action Kya Hai?

Price action trading ka matlab hai ke trader sirf price ke movement ko dekh kar trade karta hai, bina kisi doosray complex technical indicator ke. Yeh aik direct aur raw form hoti hai market ke data ko samajhne ki, jahan trader market ke charts aur price patterns ko dekh kar apne trading decisions banata hai.

Is technique mein traders primarily **candlestick patterns**, **support and resistance levels**, aur **trendlines** ka istimal karte hain. Price action trading mein yeh samajhna hota hai ke market ke price movements kis tarah se demand aur supply ko reflect kar rahe hain. Traders is information ko use karte hue market mein future trends ko predict karne ki koshish karte hain.

Price Action Ke Ahem Elements

Price action ko samajhne ke liye kuch ahem elements hain jo traders ko dekhne hote hain. Yeh elements traders ko madad karte hain market ki halat ka andaza lagane aur potential trade opportunities ko identify karne mein.

1. Candlestick Patterns

Candlestick patterns price action trading mein ek bohot ahem kirdar ada karte hain. Har candlestick market ka aik specific time period ka high, low, open aur close price show karta hai. In patterns ko dekh kar traders market ka mood samajhte hain. Kuch mashhoor candlestick patterns ye hain:

- Doji

Jab open aur close price almost barabar hote hain, is se market ki confusion ya indecision ka pata chalta hai.

- Engulfing Patterns:

Jab ek candlestick previous candlestick ko poori tarah engulf kar le, tou yeh trend reversal ka ishara hota hai.

- Hammer aur Shooting Star:

Yeh patterns bhi trend reversal ka signal dete hain, khas tor par jab market bohot overbought ya oversold ho.

2. Support aur Resistance Levels

Support aur resistance levels price action ka ek aur important hissa hain. Support level wo point hota hai jahan price girti hui rukti hai, kyun ke demand barh jati hai. Wahan se price upar ja sakti hai. Resistance level wo point hota hai jahan price barh kar rukti hai, kyun ke wahan supply zyada hoti hai aur price wapas neeche aati hai.

Support aur resistance levels ko identify karna price action traders ke liye bohot zaroori hota hai, kyun ke yeh unhein trade enter aur exit karne mein madad dete hain.

3. Trendlines

Trendlines market ke trend ko samajhne ke liye use ki jati hain. Yeh lines price ke highs aur lows ko connect karte hue draw ki jati hain, aur is se market ke overall trend ka andaza hota hai. Trendlines ke zariye traders ko yeh samajhne mein madad milti hai ke market abhi bullish (upar jaane wali) hai ya bearish (neeche jaane wali).

- Uptrend:

Jab market consistently higher highs aur higher lows bana rahi hoti hai.

- Downtrend:

Jab market consistently lower highs aur lower lows bana rahi hoti hai.

Price Action Trading Ke Faide

Price action trading ke kaafi faide hain, jo ise beginners aur experienced traders dono ke liye faidemand banate hain:

1. Simplicity

Price action ka sab se bara faida iska simple aur clear hona hai. Is mein koi complicated indicators ya mathematical calculations nahi hoti. Trader sirf price movements ko dekh kar apna decision leta hai. Yeh un logon ke liye behtareen strategy hai jo market ka asan tareeqay se analysis karna chahte hain.

2. Flexibility

Price action ko kisi bhi timeframe mein use kiya ja sakta hai. Chahey aap short-term scalping kar rahe ho ya long-term trading, price action her type ke trader ke liye useful hai. Aap 1-minute se lekar daily charts tak price action ka istimal kar sakte hain.

3. Quick Decision-Making

Price action trading mein, traders ko tezi se decision lena hota hai, kyun ke yeh market ke raw price data par base karta hai. Koi bhi extra indicators ka intezar nahi hota. Is se aap fast-moving markets mein better opportunities ko grab kar sakte hain.

4. Market Behavior Ko Samajhna

Price action trading traders ko market ke asli behavior ko samajhne ka moka deti hai. Indicators aksar past data ke upar base karte hain, jab ke price action current market sentiments ko capture karta hai. Yeh trader ko better understanding deta hai ke market kis direction mein ja sakta hai.

Price Action Trading Ki Strategies

Price action trading mein kai mukhtalif strategies ko apnaya ja sakta hai. Aayein kuch common strategies ka zikar karte hain:

1. Breakout Trading

Is strategy mein trader support ya resistance levels ke break hone ka intezar karta hai. Jab price ek important level ko break karti hai, tou yeh signal hota hai ke market ek nayi direction mein move karne wali hai. Breakout trading price action trading ki ek popular strategy hai.

2. Trend Following

Trend following strategy mein trader price ke trend ko follow karta hai. Agar market uptrend mein hai tou trader buy karta hai, aur agar downtrend mein hai tou sell karta hai. Is strategy mein trendlines ka zyada istimal hota hai.

3. L*Reversal Trading

Reversal trading mein traders trend ke reversal ka intezar karte hain. Jab market ka trend change hone wala hota hai, tou trader us waqt apna trade place karta hai. Reversal patterns, jese ke engulfing candles ya double top/bottom patterns, is strategy mein madadgar hote hain.

Natija

Price action trading ek simple, lekin bohot powerful technique hai jo Forex traders ko market ke asli price movements ke zariye trading decisions lene mein madad deti hai. Candlestick patterns, support aur resistance levels, aur trendlines ke zariye, traders market ke trends ko samajhte hain aur apni strategies banate hain. Is technique ka simplicity aur flexibility iska sab se bara faida hai, jo ise her level ke traders ke liye ek faidemand tool banata hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:09 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим