Inverted hammer and hammer candlestick:

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

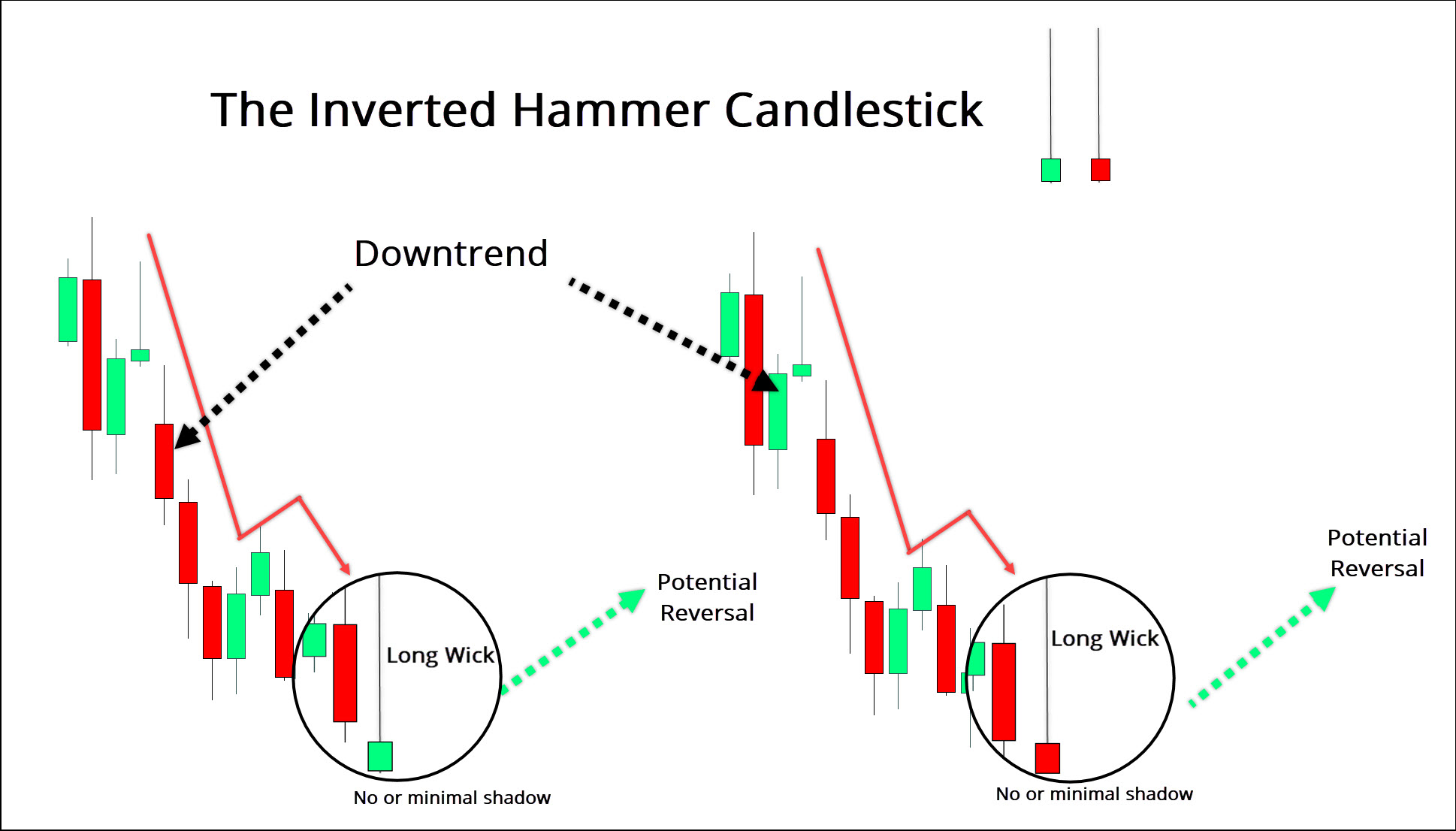

Inverted Hammer aur Hammer candlestick patterns Japanese candlestick charting analysis mein istemal hone wale bullish reversal patterns hai. 1. Inverted Hammer: Inverted Hammer pattern ek single candlestick pattern hai, jismein price action bearish trend ke end mein dikhta hai. Is pattern ko identify karne ke liye ye characteristics dekhe:- Body: Inverted Hammer ki body chhoti hoti hai ya bilkul nahi hoti hai. Open aur close price body ke upper end par hote hain.- Shadow: Inverted Hammer ki upper shadow body se bahut badi hoti hai, jabki lower shadow ki length zero ya bahut choti hoti hai.Inverted Hammer pattern bullish reversal signal provide karta hai. Ye pattern indicate karta hai ki bearish pressure kam ho rahi hai aur bullish momentum shuru ho sakta hai. Confirmation ke liye traders ko next candlestick ki price action aur market context ko bhi consider karna chahiye. 2. Hammer: Hammer pattern bhi ek single candlestick pattern hai aur bullish reversal signal provide karta hai. Ye pattern bearish trend ke end mein dikhta hai. Is pattern ko identify karne ke liye ye characteristics dekhe:- Body: Hammer ki body chhoti hoti hai ya bilkul nahi hoti hai. Open aur close price body ke upper end par hote hain.- Shadow: Hammer ki upper shadow ki length zero ya bahut choti hoti hai, jabki lower shadow body se bahut badi hoti hai.Hammer pattern bhi indicate karta hai ki bearish pressure kam ho rahi hai aur bullish momentum shuru ho sakta hai. Is pattern ko confirm karne ke liye traders ko next candlestick ki price action aur market context ko bhi consider karna chahiye.Inverted Hammer aur Hammer patterns ko samajhna aur istemal karna traders ke liye practice aur experience ki zaroorat hoti hai. Is pattern ko samajhne ke liye historical price data aur backtesting ka istemal kiya ja sakta hai. -

#3 Collapse

Assalamu Alaikum Dosto!

Hammer / Inverted Hammer Candlestick Patterns

Hammer candlestick pattern aksar mukhtalif markets mein pai jati hai aur yeh kisi mumkin trend reversal ke bare mein ahem malumat farahem karti hai. Isay chart par pehchanne ke sath-sath is malumat ko mufeed taur par istemal karna bhi behad zaroori hai.

Hammer Pattern Kya Hai Aur Iske Types Kya Hain

Visually, yeh candlestick woh hamar ki tarah dikhti hai jo daste (handle) ke sath neeche latki hui hai: neeche ka shadow - dasta, body - zor daar hissa, upar ka shadow - daste ke anayat se bahar nikalne wala hissa.

Hammer pattern chart par ulta bhi dikhai ja sakta hai – jaise ke dasta aur zor daar hissa neeche ki taraf latak raha ho. Inverted hammer regular hammer ki wohi shiraa'it mein pai jati hai aur ismein bhi (ajeeb baat hai) hammer pattern ki tarah hi signals milte hain. Is liye, inverted hammer ko aam hammer ka variant samjha jata hai.

Hammer candlestick aur iske types sirf ek downtrend mein hi aate hain. Ye pattern dono tarah ke candlesticks, yani ke upar ja rahe (halki rangat wale body ke sath) aur neeche ja rahe (gehri rangat wale body ke sath) ke zariye ban sakta hai.- Intraday aur short-term trading mein, hammer pattern ki halki rangat zyada asarat ya taasir rakhti hai.

- Long-term trading mein, hammer candle ki body ki color value ya maayne nahi rakhti.

Hammer candlestick pattern ki psychology asaan hai – neeche ka shadow behtar taqat ke sellers ki taraf ishara karta hai ke wo neeche jaane wale movement ko control kar rahe hain, lekin ek moqa par buyers ki taqat unse zyada ho gayi, aur wo trend ko ulta kar diye.

Hammer pattern aam technical analysis mein bhi istemal hota hai. Iski madad se market mein oversold hone ki tasdeeq hoti hai aur support levels aur trend reversal points maloom kiye ja sakte hain.

Hammer Candlestick

Hammer aik candle ko darust karta hai jo choti si square body ke sath aati hai, upper shadow mojood nahi hota ya bohat chhota hota hai (body ke 10% se zyada nahi) aur lower shadow bara hota hai (body ke 2 guna se zyada).

Ye candlestick pattern sirf downtrend ke neeche hi aata hai aur movement ka end/uptrend ka shuru hota hai. Ye sirf upar jane ki soorat mein kisi bhi halat mein bearish trend ko signal nahi kar sakta.

Dhyan rahe, agar growing market mein hammer jaise candlestick pattern dikhai de, to yeh Hanging Man hai – Japanese candlestick analysis ka bilkul alag pattern jo doosre signals deta hai.

Hammer candlestick bullish hai, jo ek upar jaane ki movement ya phir downtrend ki tabdili ko predict karta hai, bulls ke bears ke mukablay mein jeetne ko.

Is pattern ki khasusiyat yeh hain:- Candlestick ki body square aur choti hoti hai.

- Figure ka neeche ka hissa extend hota hai aur body ke do guna se zyada lamba hota hai.

- Upar ka shadow ya to mojood nahi hota ya bohat chhota hota hai.

- Sirf downtrend ke sath hi aata hai.

- Daily price maximums/minimums ki spread neighboring candlesticks se zyada hoti hai.

Inverted Hammer Candlestick

Inverted hammer Japanese candlestick ek choti si square body ke sath hoti hai, jo kisi bhi rangat ki ho, bara upper shadow (body ke 2 ya zyada guna) aur na mojood ya bohat chhota lower shadow (body ke 10% se zyada nahi).

Ye pattern, jaise ke original variant, sirf downtrend ke end par aata hai, ye reversal pattern hai aur uptrend ka shuru hone ki taraf ishara karta hai. Dhyaan rahe ke agar uptrend mein aise hi pattern dikhe to yeh doosra pattern hai – shooting star.

Inverted hammer pattern ki khasusiyat yeh hain:- Candlestick ki body square aur choti hoti hai.

- Pattern ka upper hissa body ke do guna se zyada extend hota hai.

- Lower shadow mojood nahi hota ya bohat chhota hota hai.

- Sirf downtrend ke doraan banta hai.

- Daily price maximums/minimums ki spread neighboring candlesticks se zyada hoti hai.

Hammer Aur Inverted Hammer Candlesticks Se Trade Kaise Karein

Jaise ke humne kaha, candlestick analysis mein hammer pattern ek bullish signal hai. Agar yeh candlestick pattern price chart par dikhai de, to trader ko long position khulne ka tawajjo dena chahiye. Order place karne se pehle, yeh mashwara hai ke pattern signal ki muta'addi tasdeeq ki jaye, masalan MACD indicator ne bhi buy signal diya ho, figure banne ke baad aik bari roshni wale candlestick ke sath, intraday prices mein zyada izafa hota hai.

Hammer pattern ke signals ki taqat aur bharosa in alamat se mutala kia ja sakta hai:- Halki color ki candlestick (rising candlestick) dark rangat ki candlestick (falling candlestick) se zyada taqatwar hoti hai.

- Candlestick ne chart ki support line ko chhua/cross kiya ho, aur candlestick ka band hona line ke level se oopar ho.

- Light hammer candlestick ki body jitni badi ho, utna behtar hai.

- Dark-colored hammer candlestick ki body utni chhoti ho jitna ke aik Doji-cross ban jaye.

- Candlestick ka upper shadow jitna chhota ho, utna behtar hai (ideal hammer pattern mein upper shadow bilkul nahi hota).

- Candlestick ka lower shadow jitna lamba ho, utna behtar hai (lekin is case mein bhi lambi candlestick ki length market ki zyada instability ko darust karti hai).

Hammer pattern dikhai de deta hai, to behtar hai ke long position na khula jaye agar isse pehle bearish patterns bani hui hain (masalan, Marubozo closing) ya agar dark body wale hammer candlestick support level ko cross karke ise neeche band hoti hai.

Amuman, jab hammer pattern dikhai de raha hai, trading ki kamyabi mojood market ki halat par mabni hoti hai. Agar downward movement significant tha aur market oversold hai, to signal ki tasdeeq ke baad long positions kholne ki mashwara di jati hai.

Hammer Pattern Ka Istemal Ke Liye Tips

Hammer aur inverted hammer patterns ko chart par pehchanne mein asaan hai. Lekin, inka joda hota hai aur hanging man aur shooting star candlestick patterns ke sath mawafiq hota hai.

In patterns ko galatfehmi se bachne ke liye hum ek bar phir aik asaan lekin behad ahem qaidah dohrayenge - hammer aur inverted hammer candlesticks sirf aur sirf girte hue (bearish) trend mein hi bante hain, inki pehchan sirf aur sirf downtrend ko uptrend mein tabdil hone ka ishara karti hai, inka signal sirf long position khulne ki mumkinat ko darust karti hai, aur kuch nahi.

Yeh kehne ke bawajood ke candlestick signals ko taqatwar samjha jata hai, trading ke doran inko kisi asaan technical indicator (RSI, MACD, Volumes, etc.) ki tasdeeq se confirm karne ki koshish karni chahiye.

Nuksan mein trading karna se bachne ke liye stop loss ka istemal kiya jana chahiye. Stop Loss pattern ke shadow ke thode se neeche set kiya jata hai, aur Take Profit uske thode se upar last local maximum ke.

Signal ki tasdeeq ka intezaar karte waqt, trader ko signals ke baad light-colored candlestick ki muntazir hawas rakhna chahiye, taki market mein dakhil hone ke liye unko kaafi waqt mile.

Tajaweez rakhte hue jo tajaweez hai, keh hammer ko ek majboot reversal formation mana jata hai, woh sach hai sirf garam (active) market mein jahan assets clearly oversold hain.

Conclusion

Japanese candlesticks taqatwar reversal patterns hain, jo downtrend se uptrend ki taraf tabdil hone ki nishani dete hain. Patterns ki taqat mukhtalif factors par mabni hoti hai (body color, shadow length, aur peechle aur aane wale patterns ka fitrat).

Is liye candlesticks se trading karte waqt, ek ko indicators ki tasdeeq se mukhalif signals ka istemal karna chahiye, trend ki taraf mutala aur stop orders ka istemal karna chahiye.

Yaad rahe ke hammer ke appearance ke baad market mein aksar thoda izafa hota hai, jise ek pullback support level tak hota hai, jise candlestick pass karta hai. Agar level toota nahi, to price us se bounce hoti hai aur ek naye impulse ko upar jaane ka milta hai.

-

#4 Collapse

Inverted hammer and hammer candlestick:Inverted Hammer aur Hammer Candlestick Patterns, technical analysis mein istemal hone wale do aham patr hain jo market trends aur price reversals ko samajhne mein madad karte hain. Ye candlestick patterns traders ko market ke future movements ke bare mein malumat hasil karne mein madad dete hain.

Hammer Candlestick, market mein bearish trend ke bad aane wale price reversal ko darust karne mein istemal hota hai. Iska shape ek chhota sa body aur lambi lower shadow se hota hai, jo market mein selling pressure ko darust karta hai. Is pattern ke appearance ke bad, market mein buyers ka dominance dikhai dene lagta hai aur prices mein tezi se izafa hota hai. Hammer candlestick ko dekhte hue traders ko ye signal milta hai ke bearish trend ke bad ab bullish trend shuru hone wala hai.

Inverted Hammer Candlestick bhi ek reversal pattern hai, lekin iska shape Hammer se thoda alag hota hai. Isme bhi chhota sa body hota hai, lekin iske upper shadow lambi hoti hai aur lower shadow chhoti hoti hai. Inverted Hammer market mein bearish trend ke bad aane wale bullish reversal ko represent karta hai. Is pattern ki appearance ke bad, buyers market mein control hasil karte hain aur prices mein izafa hota hai.

In dono candlestick patterns ka istemal traders apne trading decisions mein karte hain. Agar market mein Hammer ya Inverted Hammer dikhe, to traders apne positions ko adjust kar sakte hain aur naye trend ke sath trading karne ka faisla kar sakte hain. Ye patterns market sentiment ko samajhne mein madad karte hain aur traders ko future price movements ke liye tayyari karne mein madadgar sabit ho sakte hain.

In summary, Inverted Hammer aur Hammer Candlestick Patterns technical analysis mein ahmiyat rakhte hain aur traders ko market trends aur price reversals ke bare mein malumat hasil karne mein madad karte hain. Inka istemal sahi tarah se kiya gaya to traders ko behtar trading decisions lene mein madad mil sakti hai.

-

#5 Collapse

Inverted Hammer aur Hammer candlestick patterns technical analysis mein aham istemaal hoti hain jisse ke traders market ke future movements ka andaza lagane mein madad lete hain. Ye patterns candlestick charts par nazar aate hain aur market sentiment ko samajhne mein madad karte hain.

Hammer candlestick pattern ek bullish reversal pattern hai jo downtrend ke baad aata hai. Iska appearance market mein buyers ki strong comeback ko darust karti hai. Iski pehchan ek lambi lower shadow se hoti hai jo ke price decline ko represent karta hai. Upper shadow choti hoti hai, aur real body small hoti hai, jo ke bottom par hoti hai. Ye pattern market mein selling pressure ke baad buyers ke control ko dikha sakta hai.

Inverted Hammer bhi ek reversal pattern hai, lekin ye uptrend ke baad aata hai. Iski pehchan bhi lambi lower shadow se hoti hai, jo ke price decline ko darust karti hai. Upper shadow choti hoti hai, aur real body small hoti hai, jo ke top par hoti hai. Inverted Hammer bhi market mein buying interest ko darust karta hai.

Dono hi patterns ka main maqsad market ke trend reversal ko darust karna hai. Inverted Hammer uptrend ke baad aane wale potential downtrend ko indicate karta hai, jabke Hammer downtrend ke baad aane wale potential uptrend ko darust karta hai. Traders in patterns ko samajh kar apne trading decisions ko improve kar sakte hain aur market ke trend changes ko pehle se anticipate kar sakte hain.

Yaad rahe ke candlestick patterns ke istemal mein hamesha risk management ka khayal rakhna zaroori hai, aur doosre technical indicators ke saath combine karke hi trading decisions leni chahiye.

-

#6 Collapse

INVERTED HAMMER AND HAMMER CANDLESTICK DEFINITION

Ek inverted hammer Ek single Japanese candlestick pattern hai down trend mein open lower hota hai FIR price yah higher trade karti hai but open ke kareeb closes hoti hai inverted hammer ka bearish version shooting star Hai Jo uptrend ke bad Hota Hai yah Ek Bullish ya bearish pattern hai inverted hammer candlestick pattern black ya white per consist hota hai jo inverted hammer ki position Hota Hai lower Shadow ya To exist Hona chahie ya bahut Small Hona chahie candle down Trend ke after honi chahie upper shadow candle body ki height se least Two Times Hona chahie body trading range ke lower end per locate honi chahie small body ka color important isn' t hai though yah color slightly More Bullish ya Bearish ka bias Suggest kar sakta hai

HOW TO TRADE THE INVERTED HAMMER

Inverted hammer candlestick ke formation mainly down Trend ke bottom hoti hai and potential Trend ke reversal ki warning ke Taur per work kar sakti hai previous candle ke kareeb se down ka gape Ek stronger reversal set karta hai session ka large volume Jo inverted hammer hota hai jo is likelihood increase karta hai ke blowoff top occured Hua Hai Ek white body jismein zyada bullish Ka bias Hota Hai Ek black body mein more Bearish Ka Bias Hota Hai upper Shadow Jitna longar hoga reversal hone ka likeli utna hi zyada hoga trend potential price Mein change ka ek warning hai na ke Ek single itself Mein and buy ke liye

TRADING INVERTED HAMMER PATTERN

Apne stop per rakhne ke liye support ka nearby area look Karen and resistance level joke profit ke target ke Taur per work kar sakti hai and Hamesha is baat ki confirm Karenge Ek trend Chal Raha Hai isase Pahle ke aap apni position per fully commit Karen is point per aap bhi check karna Chahenge ke aapane Jin exit point ki identified ki hai vah aapke choosen risk reward ratio ke mutabik hai inverted hammer and standard hammer donon ek hi price action ka signal Dete Hain lihaza aap usually Inki trade exactly Usi Tarah Karenge

- CL

- Mentions 0

-

سا0 like

-

#7 Collapse

What is hammer candlestick:

forex trading mein, hammer candlestick aik bullish reversal pattern hai jo neechay ke rujhan ke ekhtataam par zahir hota hai. is ki khasusiyat is ki shakal se hai, jo aik hammer se mushaba hai, jis mein shama ke oopri hissay ke qareeb aik chhota sa jism aur aik l long lower wick par mushtamil hai yeh hai jo hammer candlestick ki shama ko banata hai

aik hammer candlestick forex aur deegar maliyati mandiyon mein aik maqbool candle stuck patteren hai jo potential price reversals mein tabdeeli ke baray mein baseerat faraham karta hai. yeh is ki makhsoos shakal ki taraf se khususiyaat hai aur aik taizi ulat patteren samjha jata hammer candlestick aik wahid shama daan par mushtamil hai jis mein darj zail ahem khususiyaat hain

Small Body:

candle stick ka body aam tor par is muddat ke liye trading range ke oopri siray par hota hai, jo iftitahi aur band honay wali qeematon ke darmiyan aik chhota sa farq zahir karta hai .

Long Lower Wick:

candle stick ka shadow, or wick, body se numaya tor par lamba hota hai aur trading ki muddat ke douran low point se high point tak qeemat ki harkat ki numaindagi karta hai .

Why are hammer candlesticks important?- aik leading indicator ke tor par kaam kar sakta hai jo bullish/bearish momentum mein tabdeeli ki tajweez karta hai

- Completed hammers ya to either confirm, or negate, a potential significant high or low kar satke hain, ya is ki nifi kar satke hain ke mumkina ahem oonchai ya kam waqay hui hai - price drives higher or lower “hammering” out a top or bottom se bahar le jati hai

- Significance increases ( (ideally 2-3 times ke size se 2-3 body ) ke sath sath time frame ke sath ahmiyat barh jati hai .

- Hammers dosray ulat jane walay isharay ki strengthen, ya reversal indicators karne mein bhi madad kar satke hain ( yani, chimti ki tashkeel ke hissay ke tortweezer formation, next to doji, etc )

- aik hammer " fails" hojata hai jab achieved honay ke foran baad nai immediately haasil ki jati hai ( Candle), aur agar candle batii nai kam haasil karti hai to hammer bottom “fails” hojata hai

hammer pattern batata hai ke initially tor par sellers walay control mein thay lekin session ke ekhtataam tak buyers ke liye control kho baithy. raftaar mein yeh tabdeeli rujhan mein mumkina ulat pair ki nishandahi kar sakti hai. tajir aksar hathoray ko taizi ke signal se tabeer karte hain, especially tor par jab yeh downtrend ke rujhan ke baad hota hai .

yeh note karna zaroori hai ke, kisi bhi takneeki tajzia ke alay ki terhan, hathora patteren faul proof nahi hota hai, aur tajir aksar usay ziyada qabil aetmaad signals ke liye deegar isharay aur tajzia ke tareeqon ke sath mil kar istemaal karte hain. mazeed bar-aan, mom batii ke namonon ki taseer mukhtalif ho sakti hai, aur tijarti faislay karte waqt market ke wasee tanazur par ghhor karna zaroori hai.

-

#8 Collapse

Hammer vs Inverted Hammer

inverted hammer Ek single Japanese candlestick pattern hai down trend mein open lower hota hai FIR price yah higher trade karti hai but open ke kareeb closes hoti hai inverted hammer ka bearish version shooting star Hai Jo uptrend ke bad Hota Hai yah Ek Bullish ya bearish pattern hai inverted hammer candlestick pattern black ya white per consist hota hai jo inverted hammer ki position Hota Hai lower Shadow ya To exist Hona chahie ya bahut Small Hona chahie candle down Trend ke after honi chahie upper shadow candle body ki height se least Two Times Hona chahie body trading range ke lower end per locate honi chahie small body ka color important isn' t hai though yah color slightly More Bullish ya Bearish ka bias Suggest kar sakta hai.

Treading Strategy and Analysis

Hammer candlestick ke formation mainly down Trend ke bottom hoti hai and potential Trend ke reversal ki warning ke Taur per work kar sakti hai previous candle ke kareeb se down ka gape Ek stronger reversal set karta hai session ka large volume Jo inverted hammer hota hai jo is likelihood increase karta hai ke blowoff top occured Hua Hai Ek white body jismein zyada bullish Ka bias Hota Hai Ek black body mein more Bearish Ka Bias Hota Hai upper Shadow Jitna longar hoga reversal hone ka likeli utna hi zyada hoga trend potential price Mein change ka ek warning hai na ke Ek single itself Mein and buy ke liye Apne stop per rakhne ke liye support ka nearby area look Karen and resistance level joke profit ke target ke Taur per work kar sakti hai and Hamesha is baat ki confirm Karenge Ek trend Chal Raha Hai isase Pahle ke aap apni position per fully commit Karen is point per aap bhi check karna Chahenge ke aapane Jin exit point ki identified ki hai vah aapke choosen risk reward ratio ke mutabik hai inverted hammer and standard hammer donon ek hi price action ka signal Dete Ha -

#9 Collapse

Inverted Hammer aur Hammer Candlestick: Ek Tafreeqi Jaiza

1. Mukadma

Candlestick charts trading ki duniya mein bohot hi ahmiyat rakhte hain. Inka istemal traders ko market ki psychological state samajhne mein madad karta hai. Is article mein, hum inverted hammer aur hammer candlestick patterns ko tafseeli tor par samjhenge, unki pehchaan aur trading strategy mein inka kya role hai.

2. Candlestick Kya Hai?

Candlestick ek visual representation hai jo price movement ko ek specific time period ke liye dikhata hai. Har candlestick mein four key elements hote hain: opening price, closing price, high price, aur low price. Ye elements milkar candlestick ke shape aur size ko tay karte hain.

3. Hammer Candlestick Ka Taaruf

Hammer candlestick ek bullish reversal pattern hai jo price ke downward trend ke baad banta hai. Iski khas pehchaan ye hai ke ismein choti body hoti hai jo ke upar ke taraf hoti hai aur ek lambhi lower shadow hoti hai. Ye pattern traders ko ye signal deta hai ke market mein demand barh rahi hai.

4. Hammer Candlestick Ka Tajziya

Hammer candlestick ka shape ye darust karta hai ke price ne pehle niche ki taraf move kiya lekin baad mein buyers ne control hasil kar liya. Agar ye pattern kisi support level ke paas banta hai, to ye ek strong bullish signal hota hai. Iske baad agar price closing price opening price se zyada hoti hai, to ye bullish reversal ki tasdeeq karta hai.

5. Inverted Hammer Candlestick Ka Taaruf

Inverted hammer candlestick bhi ek reversal pattern hai, lekin ye bearish trend ke baad banta hai. Iski khas pehchaan ye hai ke iski body choti hoti hai aur upper shadow zyada lambi hoti hai. Ye pattern ye darust karta hai ke market mein buyers ne control hasil karne ki koshish ki hai, lekin wo ismein puri tarah se kamiyab nahi hue.

6. Inverted Hammer Candlestick Ka Tajziya

Inverted hammer candlestick ka shape ye darust karta hai ke price ne pehle upar ki taraf move kiya lekin phir sellers ne control hasil kar liya. Ye pattern jab kisi resistance level ke paas banta hai to ye ek potential reversal signal hota hai. Agar price is pattern ke baad niche jati hai, to ye bearish trend ko darust karta hai.

7. Hammer Aur Inverted Hammer Candlesticks Mein Farq

Hammer aur inverted hammer candlesticks mein sabse bara farq unka context hai. Hammer bullish reversal ko darust karta hai jab ke inverted hammer bearish reversal ka signal hota hai. Iske ilawa, inka shape aur price action bhi alag hota hai.

8. Hammer Candlestick Ki Pehchan

Hammer candlestick ko pehchannay ke liye aapko dekhnay ki zaroorat hai ke ye pattern kahan banta hai. Iski body choti hoti hai aur lower shadow ka length body ke do guna ya us se zyada hota hai. Is pattern ka formation bullish trend reversal ka darust karta hai.

9. Inverted Hammer Ki Pehchan

Inverted hammer ko pehchannay ke liye ye zaroori hai ke aap iska shape dekhein. Iski body choti hoti hai lekin upper shadow ka length body ke do guna ya us se zyada hota hai. Agar ye pattern resistance level ke paas banta hai to ye bearish reversal ka signal hota hai.

10. Trading Strategy: Hammer Candlestick

Hammer candlestick ko trade karne ke liye sabse pehle confirmatory signals ka intezar karna chahiye. Jab aap hammer candlestick dekhte hain, to agla candle closing price ko opening price se upar hona chahiye. Isse bullish momentum ka signal milta hai. Aap stop-loss ko recent low ke neeche rakh sakte hain.

11. Trading Strategy: Inverted Hammer

Inverted hammer ke sath trading karte waqt bhi confirmation ka intezar karna zaroori hai. Agar inverted hammer ke baad bearish candle banta hai, to ye confirmation hota hai ke price niche ki taraf jaa rahi hai. Aap is pattern ko trade karte waqt stop-loss ko recent high ke upar rakh sakte hain.

12. Volume Ka Role

Volume trading mein ek important factor hai. Hammer ya inverted hammer candlestick ke sath high volume ka hona in patterns ki tasdeeq karta hai. Agar volume high hai, to ye signal hota hai ke price movement strong hai aur trend reversal ka zyada chance hai.

13. Market Context Ka Ahmiyat

Hammer aur inverted hammer candlesticks ka analysis karte waqt market context ka khayal rakhna bohot zaroori hai. Agar aap kisi strong trend ke against trade kar rahe hain, to ye risk ko barha sakta hai. Isliye, market ke overall trend aur support/resistance levels ka analysis zaroor karein.

14. Khatima

Hammer aur inverted hammer candlesticks trading ki duniya mein bohot hi ahmiyat rakhte hain. In patterns ko samajhna aur inhe apne trading strategy mein istemal karna aapko better trading decisions lene mein madad kar sakta hai. Hamesha confirmation signals aur market context ka khayal rakhein taake aapke trades successful ho sakein.

Is article ke zariye aapne hammer aur inverted hammer candlesticks ko samjha, unki pehchaan ki, aur trading strategies ka jaiza liya. Ye patterns aapke trading toolkit mein bohot valuable addition ban sakte hain.

-

#10 Collapse

Inverted Hammer aur Hammer Candlestick Pattern ka Tafseeli Jaiza

Candlestick patterns stock market aur financial trading mein aik aham tool hain jo trader ko market ki direction aur sentiment ko samajhne mein madad deti hain. In patterns mein se do aham aur mashhoor patterns Hammer aur Inverted Hammer hain. Yeh dono patterns market ke trend reversal ka ishara dete hain, aur agar inhein sahi samjha jaye to profitable trading decisions leye ja sakte hain. Is article mein hum Hammer aur Inverted Hammer ke mutaliq tafseel se baat karenge.

1. Hammer Candlestick Pattern Kya Hai?

Hammer candlestick pattern aik bullish reversal signal hota hai jo kisi downtrend ke akhir mein dikhai deta hai. Is pattern ka aik khas dhanchah hota hai jisme aik chhoti body hoti hai aur lambi lower shadow. Body ka rang kabhi kabhi green hota hai jo zyada bullish sign hota hai, lekin red body bhi reversal ka ishara de sakti hai.

Hammer pattern tab banta hai jab price action trading session mein neeche chali jati hai lekin session ke akhir mein price phir se recover karke opening ke aas paas ya us se thoda ooper close hoti hai. Yeh is baat ka signal hai ke buyers market mein wapas aa gaye hain aur sellers ka pressure kam ho gaya hai. Is pattern ke baad market mein reversal ki ummed hoti hai.

2. Hammer Pattern ko Pehchanay ka Tariqa

Hammer candlestick ko pehchanay ka sab se asan tareeqa yeh hai ke iski lower shadow uski body se kam az kam 2 guna badi hoti hai. Body chhoti hoti hai aur oopar ki taraf shadow ya bilkul nahi hoti, ya phir bohat chhoti hoti hai. Yeh is baat ka sign hota hai ke trading ke doran bohot zyada selling pressure tha, magar buyers ne akhir mein price ko wapas barhawa diya.

Agar Hammer green ho, iska matlab yeh hota hai ke buyers ne zyada aggressive tariqay se action liya aur price ko apni opening price se bhi upar le gaye. Is case mein yeh pattern aur bhi zyada bullish hota hai.

3. Inverted Hammer Candlestick Pattern Kya Hai?

Inverted Hammer candlestick bhi aik bullish reversal pattern hota hai, lekin iska structure Hammer se bilkul ulta hota hai. Is pattern mein ek chhoti body hoti hai lekin shadow oopar ki taraf hoti hai, aur lower shadow ya to bilkul nahi hoti ya phir bohat chhoti hoti hai. Yeh pattern bhi downtrend ke baad dikhai deta hai aur yeh is baat ka signal hai ke sellers ka pressure kam ho raha hai aur buyers ab market mein interest dikhana shuru kar rahe hain.

Inverted Hammer tab banta hai jab trading session ke dauran price pehle ooper chali jati hai lekin uske baad selling pressure ki wajah se wapas niche a jati hai, lekin phir bhi price thoda ooper close hoti hai.

4. Hammer aur Inverted Hammer mein Farq

Hammer aur Inverted Hammer mein aik bunyadi farq yeh hai ke Hammer ki shadow neeche ki taraf hoti hai jab ke Inverted Hammer ki shadow oopar ki taraf hoti hai. Hammer us waqt banta hai jab price neeche jaane ke baad recover kar jaye, jab ke Inverted Hammer us waqt banta hai jab price ooper jaane ke baad phir niche aa jaye, lekin phir bhi buyers ka control zyada hota hai.

Hammer mein buyers ka pressure zyada clear hota hai jab ke Inverted Hammer mein pehle sellers dominate karte hain lekin akhir mein buyers ko control mil jata hai. Dono patterns reversal ka ishara dete hain, lekin Inverted Hammer mein confirmation ke liye agli candlestick ka dekha jaana zaroori hota hai.

5. Hammer aur Inverted Hammer ko Trading mein Istemaal Karna

In dono candlestick patterns ko trading mein sahi tareeqe se istemal karne ke liye kuch points ko mad e nazar rakhna zaroori hai:- Trend ka Jaiza: Yeh patterns aksar downtrend ke akhir mein bante hain, is liye pehle yeh dekhna zaroori hai ke market consistent downtrend mein hai ya nahi. Agar market pehle se hi sideways ya bullish trend mein ho, to yeh patterns itne reliable nahi hote.

- Confirmation ka Intezaar: Inverted Hammer ke case mein agli candle ka bullish hona confirmation deta hai ke reversal hone wala hai. Yeh confirmation Hammer ke case mein bhi madadgar hota hai lekin Hammer akela bhi zyada reliable hota hai.

- Support Levels ka Jaiza: In patterns ka support aur resistance levels ke qareeb aana bhi ek bara signal ho sakta hai. Agar yeh patterns kisi ahem support level ke qareeb bante hain, to inke bullish reversal hone ke chances zyada hote hain.

Trading mein koi bhi pattern 100% accurate nahi hota. Hammer aur Inverted Hammer ke signals kabhi kabhi false bhi ho sakte hain, is liye risk management bohot zaroori hai. Stop-loss lagana ek acha tareeqa hai taake agar market aapke khilaf jaye to aapke nuksan ko limit kiya ja sake.

False signals aksar us waqt bante hain jab market mein volume kam hoti hai ya jab kisi aur strong trend ka asar ho. Is liye sirf in patterns par inhesar karna theek nahi, balke technical indicators, jaise ke RSI (Relative Strength Index) aur Moving Averages ka istemal karna bhi madadgar ho sakta hai taake decision sahi tareeqa se liya ja sake.

Conclusion

Hammer aur Inverted Hammer candlestick patterns trading mein bohot useful tools hain, jo market ka trend samajhne aur reversal ko pehchanne mein madadgar sabit ho sakte hain. Lekin in patterns ko doosray technical analysis tools ke sath istemal karna aur risk management ko dhyan mein rakhna bhi zaroori hai. Agar in patterns ko theek tareeqa se samajh ke use kiya jaye, to yeh aapko profitable trading decisions lene mein madad de sakte hain.

- CL

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

### Inverted Hammer Aur Hammer Candlestick

Trading ke duniya mein candlestick patterns bohot ahmiyat rakhte hain, aur in mein se do mashhoor patterns hain: inverted hammer aur hammer candlestick. Ye dono patterns market ke reversal ya trend continuation ki nishani de sakte hain, lekin inka maqsad aur ma'na alag hai.

**Hammer Candlestick**: Hammer candlestick aksar downtrend ke dauran banta hai. Iska body chhota hota hai aur shadow lamba hota hai, jo is baat ki taraf ishara karta hai ke sellers ne price ko neeche khinchne ki koshish ki, lekin buyers ne wapas price ko upar le aaya. Ye pattern is baat ki nishani hai ke market ne support pa liya hai aur reversal ki sambhavna hai. Is pattern ka confirm hona is waqt hota hai jab agla candlestick hammer ke upar close hota hai, jo bullish momentum ko darshata hai.

**Inverted Hammer**: Inverted hammer bhi downtrend ke dauran banta hai, lekin iski shakal hammer se bilkul mukhtalif hoti hai. Isme body chhoti hoti hai aur upper shadow lambi hoti hai. Ye pattern market ke reversal ki taraf ishara karta hai. Inverted hammer ki khasiyat ye hai ke ye market ki potential reversal ko darshata hai, lekin ye bhi zaroori hai ke iske agle candlestick ka analysis bhi kiya jaye. Agar agla candlestick inverted hammer ke upar close hota hai, to ye bullish trend ki nishani hoti hai.

Dono patterns ko samajhne ke liye market ki context ko dekhna bohot zaroori hai. Ye sirf ek signal nahi, balke ek trend ki tafteesh ka zariya hain. Jab bhi aap in patterns ka istemal karein, to volume ko bhi madde nazar rakhein, kyunki volume ka izafa hone se reversal ki confirmation hoti hai.

Aakhir mein, hammer aur inverted hammer candlestick patterns trading ke liye behtareen tools hain. Inhe samajhkar aur unka sahi istemal karke aap market ki behter samajh haasil kar sakte hain. Ye patterns aapko price action ke bare mein insights dete hain, jo aapke trading decisions ko behtar bana sakte hain. Trading mein discipline aur patience bohot zaroori hain, to in patterns par dhyan dekar apne trading strategy ko mazid mazboot karein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:55 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим