Intraday Trading Kia Hai.

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Intraday trading, jise bhi day trading ke naam se jaana jaata hai, ek trading strategy hai jismein traders ek din mein multiple trades karte hain aur positions ko same trading day mein close karte hain. Ismein traders short-term price movements aur market volatility ka fayda uthate hain. Intraday trading ki kuch key characteristics hain: 1. Short-term Trading: Intraday trading mein traders apne positions ko same trading day mein open aur close karte hain. Positions usually minutes se hours tak hold kiye jaate hain, lekin overnight positions nahi rakhe jaate hain. 2. High Frequency Trading: Intraday traders multiple trades karte hain, jahan wo positions ko kuch minutes ya seconds tak bhi hold kar sakte hain. Ismein traders market volatility aur price fluctuations ka fayda uthate hain. 3. Technical Analysis: Intraday traders technical analysis ka istemal karte hain jaise ki candlestick patterns, chart patterns, indicators aur oscillators. Technical analysis ke saath, traders price trends, support/resistance levels, aur entry/exit points ko identify karte hain. 4. Risk Management: Intraday trading mein risk management bahut important hota hai. Traders apne trades ke liye stop-loss aur target levels set karte hain taki losses ko control kar sake aur profits ko protect kar sake. 5. Monitoring Market: Intraday traders market ko closely monitor karte hain aur price movements, news, aur market sentiment ki analysis karte hain. Real-time data aur market news ka upyog karke traders apne trading decisions ko support karte hain. Intraday trading ke advantages hain ki traders short-term profits bana sakte hain, quick returns milte hain, aur overnight market risks se bach sakte hain. Lekin ismein risk bhi hota hai, jaise ki high market volatility, quick decision-making, aur emotional trading.Intraday trading mein traders ko market mein hone wale price fluctuations aur liquidity ko samajhna hota hai. Iske liye traders ko market trends, technical analysis, aur risk management ka acche se istemal karna hota hai. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!

Forex Intraday Trading

Forex market mein intraday trading ka matalab hota hai ki ek trader ek hi din ke bhitar trade kare aur uss din ke ant mein uske trade ko band kare. Yeh tarika traders ke liye bahut hi popular hai kyunki ismein kam samay mein jyada munafa kamaya ja sakta hai. Lekin yeh bahut hi risky bhi ho sakta hai, kyunki forex market bahut hi volatile hota hai aur koi bhi news ya ghatna market ko badal sakti hai. Forex intraday trading ke liye sabse mahatvapurn cheez hai ek trader ke liye khud ki knowledge aur experience. Ek trader ko hamesha market ke baare mein jankari rakhni chahiye aur experience ke sath sath khud ko improve karte rahna chahiye.

Intraday Trading Techniques

Forex intraday trading technique forex currencies me ziada mozon hota hai, jiss mw mukhtalif qisam k trading indicator ka istemal karte howe hum market me achah result hasil kar sakte hen. Intraday trading k leye kuch darjazel techniques ka istemal hota hai;

- Plan Banayein: Ek trader ko hamesha plan banane ki jarurat hoti hai. Plan ke andar stop loss, target aur entry point ke baare mein sochana hota hai. Plan ko follow karne se trader ko aage badhne mein madad milegi.

- Technical Analysis: Technical analysis ke jariye trader market ke trend, support aur resistance ke baare mein jaan sakta hai. Technical analysis mein chart patterns, indicators aur oscillators ka upyog hota hai.

- News: Forex market bahut hi sensitive hota hai news ke prati. Kisi bhi ghatna ka asar market mein dekhne ko mil sakta hai. News ke jariye trader market ke mustaqbil mein hone wali ghatnaon ko predict kar sakta hai.

- Risk Management: Forex Intraday Trading mein risk management bahut hi mahatvapurn hota hai. Ek trader ko apne trade ke liye risk ka level set karna hoga. Agar trader ko apne trade ke risk ke baare mein pata nahi hoga toh woh kabhi bhi market mein khoya ho sakta hai.

- Discipline: Intraday trading mein discipline bahut hi mahatvapurn hota hai. Ek trader ko apne plan ko follow karna hoga aur hamesha risk ke baare mein sochna hoga. Agar trader apne plan se bhatakta hai toh woh loss kar sakta hai.

Explanation

Forex intraday trading strategy ka maqsad kisi bhi din ke dauran forex market ke andar trade karnay ka tareeqa hota hai. Yeh strategy short term traders aur scalpers ke liye achi hoti hai jo kuch ghantay ya minute ke andar apne trades close karna chahtay hain. Is strategy ke istemaal ke liye aapko market ke andar kaafi active rehna hoga, isliye agar aapko day trading ke liye time nahin hai toh yeh strategy aapke liye sahi nahin hogi.

Forex intraday trading strategy ki sab se bari baat yeh hai ke isme aapko long term market trends ya fundamental analysis ke baare mein zyada sochnay ki zarurat nahin hoti. Is strategy ke mutabiq aapko market ke andar price movement ko predict karna hota hai. Isliye ismein technical analysis ki madad se entry aur exit points tay karte hain.

Forex intraday trading strategy ke liye aapko kuch basic cheezon ki zarurat hogi. Sab se pehle aapko trading platform ki zarurat hogi jismein aap apne trades execute kar saken. Trading platform ke sath sath aapko ek reliable data feed ki zarurat hogi jismein market ke andar ki updated price information shamil ho. Iske alawa aapko charting software ki bhi zarurat hogi jis ki madad se aap technical analysis kar saken. Yeh sabhi cheezen online brokers aur trading firms provide karte hain.

Forex intraday trading strategy ka sab se pehla step hota hai apne trading ka time frame decide karna. Yeh aapke trade ka time duration hota hai jis mein aap apna trade open aur close karenge. Is strategy ke mutabiq scalpers kuch minute ke liye apne trades open karte hain aur short term traders kuch ghantay ke liye. Aap apni marzi ke mutabiq trading ka time frame decide kar sakte hain.

Forex intraday trading strategy ke mutabiq aapko charting software ki madad se technical analysis karni hogi. Iske liye aapko charting software ki madad se kuch indicators aur oscillators ka istemaal karna hoga jaise ki moving averages, Bollinger bands, RSI, MACD, aur Stochastics. In sabhi indicators ki madad se aap market ke andar ka trend determine kar sakte hain aur entry aur exit points tay kar sakte hain.

Forex intraday trading strategy ke liye aapko kuch rules follow karne hote hain. Sab se pehle, aapko apne trades ke liye stop loss aur target price tay karna hoga. Stop loss ki madad se aap apne trade ko close kar sakte hain agar market aapke favor mein nahin ja raha hai. Iske alawa target price tay karna bhi zaruri hai taaki aap profits ko lock kar saken.

Trading

Forex intraday trading forex ki dunya ka ek popular tareeqa hai jisme traders din bhar ke andar he apne positions open and close karke paisay kama saktay hain. Agar aap bhi forex intraday trading karna chahtay hain toh is article mein diye gaye steps aap ke liye bohat faida mand sabit ho saktay hain.

- Market ki analysis: Sab se pehlay aap ko market ki analysis karni hogi. Aap ko pata hona chahiye ke aap kis currency pair pe trade karna chahtay hain aur us ka trend kia hai. Aap ko market ki news aur economic calendar ka bhi khaas khayal rakhna chahiye.

- Trading Plan: Apna trading plan banayen jis mein aap ki entry aur exit points clear hon. Aap ko yeh bhi decide karna chahiye ke aap kitnay paise invest karna chahtay hain aur kitnay paise risk kar saktay hain.

- Entry point: Jab aap market ki analysis kar lein aur apna trading plan bhi banayein toh agla step aap ka entry point hona chahiye. Aap ko yeh decide karna chahiye ke kis price level pe aap apni position open karna chahtay hain.

- Stop loss: Stop loss aap ke liye bohat important hai. Is se aap apnay positions ko loss se bacha saktay hain. Aap ko yeh bhi decide karna chahiye ke aap kis price level pe apna stop loss rakhna chahtay hain.

- Target point: Aap ko yeh bhi decide karna chahiye ke aap kis price level pe apni position ko close karna chahtay hain. Is se aap apnay positions se profit hasil kar saktay hain.

Intraday trading ki dunya mein entry karna bohat mushkil ho sakta hai, lekin agar aap in steps ko follow karein toh aap ko successful trading karne mein madad milegi. Aap ko patience aur discipline rakhna hoga aur apne trading plan ko follow karte rehna hoga. Risk management bohat important hai forex intraday trading mein. Aap ko apnay trading plan mein yeh bhi decide karna chahiye ke aap kitnay paise risk kar saktay hain. Aap ko apni positions pe hamesha stop loss rakhna chahiye aur zyada risky trades se bachna chahiye.

-

#4 Collapse

Intraday Trading: Roman Urdu Mein Samjhayen

Intraday trading, ya day trading, ek tijarat hai jisme bechne aur khareedne ka amal aik hi din mein pura hota hai. Yeh ek aisi trading hai jisme investors ya traders apne shares, stocks, ya anya maal ko aik din ke andar khareedte hain aur phir usay wahi din bechte hain. Is tarah ka trading market mein bahut hi tezi aur tijarat bhari hoti hai, aur isme chand ghanton ya minutes mein bhi faisle liye ja sakte hain.

Kyun Intraday Trading?

Intraday trading ka maqsad aksar tezi aur girawat mein moujood market trends ka faida uthana hota hai. Isme investors roz marra ke karobar mein mawafiqat aur nuksanat ko tajaweez ke taur par dekhte hain, aur apne faislay usi din mein amal mein late hain. Is tarah ke trading ka ek faida yeh hai ke investors apne paisay kam waqt mein barhane ka maqsad pura kar sakte hain.

Kaise Karte Hain Intraday Trading?

Intraday trading mein, investors ko market ke tezi ya mandi ke trends ko samajhna zaroori hai. Market mein hone wale tezi aur girawat ko analyze kar ke, traders apne faislay tay karte hain. Yeh trading aksar short-term hoti hai, aur isme chand ghanton ya minutes mein bhi positions close ki ja sakti hain.

Khatraat Aur Imkanaat:

Intraday trading mein khatraat aur imkanaat dono mojood hote hain. Tezi aur girawat mein aksar bari si raftar hoti hai, aur is wajah se investors ko chand ghanton mein apne paisay barhane ya nuksanat bardasht karne ka samna karna padta hai. Lekin, is tarah ki trading mein ager tajaweezat sahi taur par ki jaayein toh isme zyada munafa bhi ho sakta hai.

Intraday Trading Ke Liye Zaroori Chezein:- Market Ki Samajhdari: Intraday trading mein market trends ko samajhna zaroori hai. Tezi ya girawat ke indicators ko theek taur par interpret karna bahut zaroori hai.

- Technical Analysis: Technical analysis ka istemal kar ke market ke historical data ko dekha ja sakta hai, jo ke traders ko future ke faisle mein madadgar sabit ho sakta hai.

- Risk Management: Kisi bhi tarah ki trading mein risk management ka khayal rakhna bahut zaroori hai. Aapko apne paisay ko barbad hone se bachane ke liye apne trades ko chand had tak mehdood rakhna chahiye.

Naseehat Aur Ikhtiyaarat:

Intraday trading ek mahirana amal hai jo tajwez aur ikhtiyaarat ke saath kiya jana chahiye. Agar kisi shakhs ko is trading ki shuruaat karni hai toh usay pehle market ki samajhdari aur basic trading concepts par ghaur karna chahiye. Hamesha yeh yaad rakhna chahiye ke tezi aur girawat market ka hissa hain, aur har faisla soch samajh kar lena chahiye.

Toh, agar aap tijarat mein dilchaspi rakte hain aur tezi aur girawat mein paisay kamana chahte hain, toh Intraday trading aapke liye ek rasta ho sakta hai. Lekin, yaad rahe ke isme khatraat bhi hote hain, aur aapko apne faislay ko soch samajh kar lena chahiye.

-

#5 Collapse

Intraday trading, jo kay din bhar ke trading kehlati hai, aik trading style hai jahan financial instruments jese ke stocks, forex, ya commodities ki positions ek hi trading din mein kholein aur band karein. Intraday traders ka maqsad short-term price movements se faida uthana hota hai, jo ke market mein volatility aur liquidity ka faida uthane ka tarika hai. Ye trading style tezi se faislay lene, technical analysis ka maharat se kaam lena, risk management strategies ka istemal aur market dynamics ka gehra samajh lena shamil hai.

Advantages of Intraday Trading- Potential for High Returns: Intraday trading zyada munafa kamane ki imkan deta hai chand ghanton mein. Traders din bhar ke small price movements se faida utha sakte hain, aur leverage ke zariye apne munafe ko barha sakte hain.

- No Overnight Risk: Swing ya position trading ke muqablay mein, jahan positions raat bhar kholdi jati hain, intraday traders apni sari positions trading din ke end tak band kar lete hain. Ye overnight market events ya price gaps ke risk ko khatam karta hai.

- Liquidity: Intraday traders un highly liquid assets par focus karte hain jo quick entry aur exit ko allow karte hain. Zyada liquidity slippage ka khatra kam karti hai aur ye ensure karta hai ke orders desired prices par execute ho.

- Flexibility: Intraday traders ke paas changing market conditions ke mutabiq apni strategies ko adapt karne ka flexibility hota hai. Wo dono upar aur niche wale markets se faida utha sakte hain long aur short positions ka istemal karke.

- Reduced Exposure: Kyunke positions din bhar mein close ho jati hain, intraday traders ko prolonged market exposure ke risks se bachaya jata hai, jese ke geopolitical events, earnings reports, ya overnight price fluctuations.

Challenges of Intraday Trading- High Volatility: Intraday trading tezi se price movements aur zyada volatility ke saath wazeh hoti hai. Jabke volatility munafe ke liye opportunities deti hai, ye bhi nuqsan ke risks ko barha sakti hai agar trades ko effectively manage nahi kia jaye.

- Emotional Discipline: Intraday traders ko strict emotional discipline maintain karna parta hai taake wo fear ya greed se driven impulsive decisions se bach saken. Emotion-driven trading irrational choices aur nuqsan le jane ka khatra bana sakta hai.

- Time Commitment: Intraday trading active monitoring ki zaroorat hoti hai markets ki din bhar. Traders ko sufficient time dena parta hai charts ko analyze karne, trades ko execute karne aur positions ko effectively manage karne ke liye.

- Costs: Frequent trading brokerage fees, spreads, aur slippage jese costs ka samna karwata hai. Ye costs khas kar traders ke liye jo chote capital ya low-margin accounts ke sath hote hain, munafe ko kha sakti hain.

- Technical Skills: Successful intraday trading strong technical analysis skills par rely karta hai, jese ke chart patterns, indicators, aur price action analysis. Traders ko apni technical knowledge ko improve karte rehna chahiye taake informed trading decisions liya ja sake.

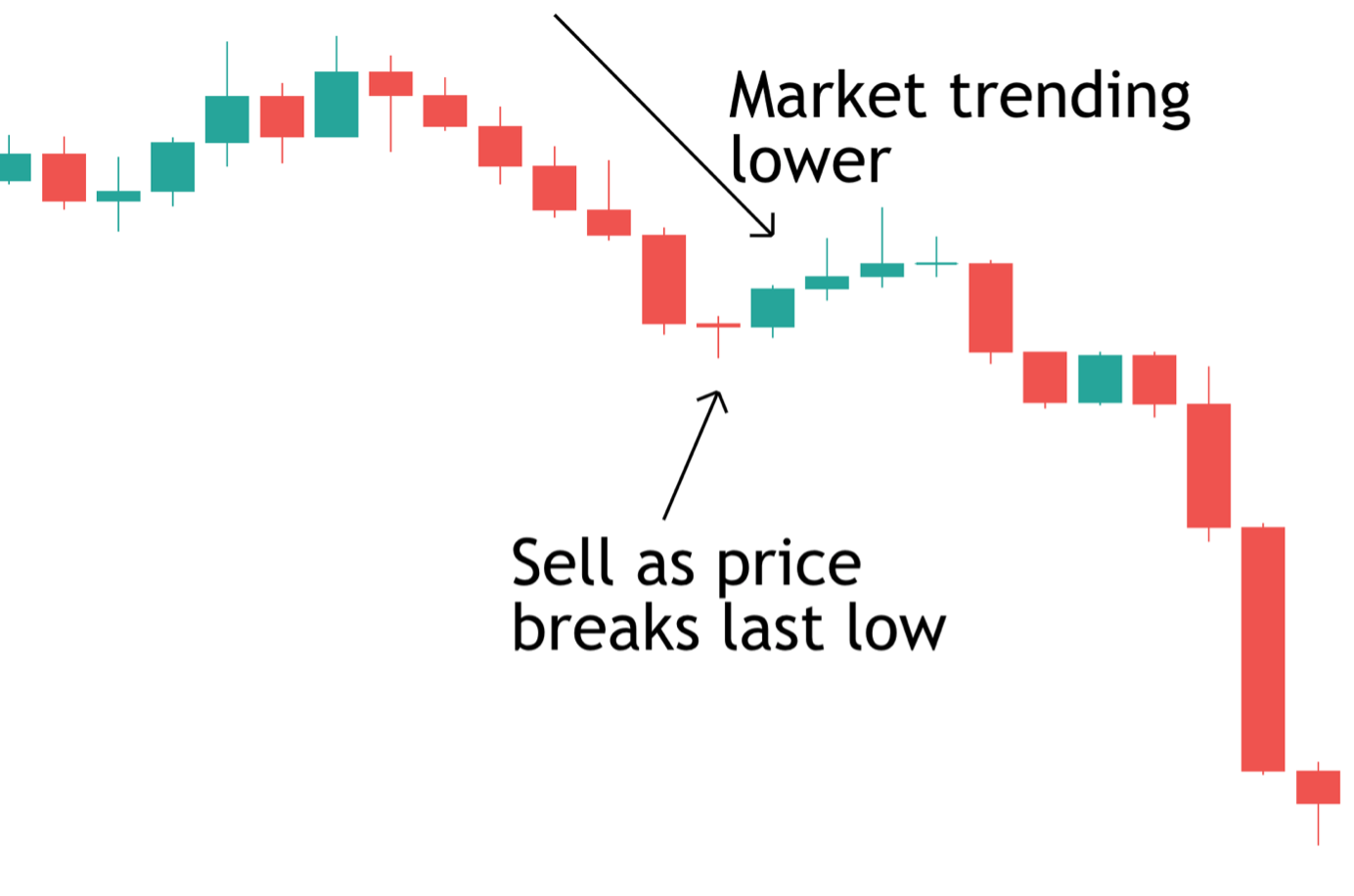

- Trend Following: Intraday traders established trends ko follow kar sakte hain higher highs aur higher lows ko uptrends mein identify karke ya lower highs aur lower lows ko downtrends mein. Wo positions enter karte hain trend ke direction mein, indicators jese ke moving averages ya trendlines ka istemal confirmation ke liye karte hain.

- Breakout Trading: Breakout strategies mein traders trades enter karte hain jab price resistance ko uptrends mein break karta hai ya support ko downtrends mein. Traders increased volume aur momentum ko confirm karne ke liye dekhte hain breakouts ko, stop-loss orders ka istemal risk ko manage karne ke liye karte hain.

- Range Trading: Range-bound markets range trading ke liye opportunities deti hain, jahan traders buy karte hain near support levels aur sell karte hain near resistance levels. Ye strategy price oscillations ke faida uthati hai defined range ke andar, jo patience aur quick decision-making ko require karti hai.

- Scalping: Scalping aik high-frequency trading strategy hai jahan traders small price movements se faida uthane ki koshish karte hain. Scalpers positions ko rapidly enter aur exit karte hain, aksar seconds ya minutes ke andar, tight spreads aur quick execution par rely karte hain.

- Contrarian Trading: Contrarian traders prevailing market sentiment ke khilaf jate hain, overbought ya oversold conditions ko dhundh kar counter-trend trades enter karte hain. Ye strategy careful risk management aur a contrarian mindset ko require karti hai.

- Risk Management: Effective risk management intraday traders ke liye crucial hai taake wo capital preserve kar sake aur losses ko minimize kar sakein. Traders ko stop-loss orders, position sizing techniques, aur risk-reward ratios ka istemal risk ko effectively manage karne ke liye karna chahiye.

- Leverage: Jabke leverage intraday trading mein munafe ko amplify kar sakta hai, ye bhi significant losses ka khatra barha deta hai. Traders ko leverage ko cautious istemal karna chahiye, apne risk tolerance aur account size ko consider karte hue.

- Market Analysis: Intraday traders technical analysis, fundamental analysis, aur market sentiment par rely karte hain taake informed trading decisions liya ja sake. Wo price charts, economic data, news events, aur market trends ko analyze karte hain trading opportunities ko identify karne ke liye.

- Trading Plan: A well-defined trading plan intraday traders ke liye essential hai. Ye plan entry aur exit criteria, risk management rules, trading strategies, aur goals ko outline karta hai. Traders ko apne plan ko adhere karna chahiye aur impulsive decisions se bachna chahiye.

- Psychological Factors: Intraday trading psychological demanding ho sakta hai rapid price fluctuations aur quick decisions ke pressure ke wajah se.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Intraday Trading:

Intraday trading ek aise tareeqa hai jisme traders ek din ke andar market mein kuch samay tak apne stocks ko kharidte hain aur unhe bechte hain, taki wo ek din ke andar hi munafa kamayein. Ye trading strategy kaafi popular hai, khaaskar un logon ke darmiyan jo short-term gains hasil karna chahte hain. Lekin, intraday trading ke kya faide hain? Chaliye dekhte hain.

1. Tehqeeqat aur Tajarba:

Intraday trading karne se traders ko mahatvapurn tajarba aur tehqeeqat hasil hoti hai. Har din market mein hone wale chhote mote badlav ko observe karna aur un par trading karna, unki samajh aur tajurba ko behtar banata hai. Is tareeqe se traders market ki dynamics ko samajhte hain aur trading ke maidaan mein apni pehchan banate hain.

2. High Returns Potential:

Intraday trading mein high returns potential hota hai, khaaskar agar trader sahi tareeqe se stock ka chayan karta hai aur samay par usko bech kar munafa kamata hai. Kyunki isme stocks ko ek hi din mein kharida aur becha jata hai, isliye ismein munafa adhik hone ka bhi zyada chance hota hai.

3. Quick Profits:

Intraday trading mein traders ko jaldi munafa milta hai. Agar unka trade din bhar mein achha chal raha hai, toh wo ek hi din mein munafa hasil kar sakte hain. Ye un logon ke liye khaas hai jo turant paisa kamana chahte hain.

4. No Overnight Risk:

Ek aur bada faida intraday trading ka ye hai ke traders ko kisi bhi raat ko koi risk nahi hota hai. Kyunki unka trade ek hi din mein settle ho jata hai, isliye overnight risk ka khatra nahi hota. Ye traders ko aram se neend sovane deta hai.

5. Liquidity:

Intraday trading ke stocks generally highly liquid hote hain, yaani unmein trade karne ki flexibility hoti hai. Iska matlab hai ki traders ko stocks ko kharidne ya bechne mein koi pareshani nahi hoti, aur wo apne trades ko asani se execute kar sakte hain.

Intraday trading ke ye faide un logon ko khaas tor par attract karte hain jo short-term gains hasil karna chahte hain aur market ke chhote mote badlavon ka faida uthana chahte hain. Lekin, ismein khatre bhi hote hain, isliye zaroori hai ke traders apni trading strategy ko samajh kar hi ismein shamil ho. Samajhdaari se aur sahi tajurba ke saath, intraday trading ek kaafi faida mand tareeqa ho sakta hai paisa kamane ka.

-

#7 Collapse

Intraday Trading: Aik Chhoti Arsey Mein Paisay Kamane Ka Tareeqa

Intraday trading ya din bhar ki trading, maali markets ke andar aik dilchasp lekin paicheeda amal hai. Is qisam ki trading mein maali asbaab ko ek hi trading din ke andar khareedna aur baichna shamil hai, jahan asal maqsad chhoti arsay ke qeemat ke harkaat se faida uthana hota hai. Stocks aur currencies se lekar commodities aur derivatives tak, intraday trading duniya bhar ke markets mein mukhtalif assets ko shaamil karti hai. Is mukammal rehnuma mein, hum intraday trading ke tabaahiyon, khatron aur imkano ko daryaft karne ka ghoor karenge.

Intraday Trading Kya Hai?

Apne bunyadi tor par, intraday trading assets ke qeemat mein paida hone wali chhoti arsay ke harkaat se faida uthana hai. Riwayati sarmayakari ke mukhaalif tareeqon ke mukhtalif honay ke bajaaye, intraday traders ka maqsad trading session ke andar market ki choti arsay ke harkaat se faida uthana hota hai. Intraday trading ka asal maqsad waqt se pehle kharid o farokht ke orderat ko waqt par karke qeemat ke chhoti arsay ke rujhanat se faida uthana hota hai.

Intraday Trading ke Tareeqay

Kamyab intraday trading ke liye chalaaki ke tajziya, mazboot amal aur khatarnaak ihtiyaat ki mishkalat ka aik izhaar lazim hai. Kuch tareeqay aam tor par intraday traders dwara istemaal kiye jate hain:- Scalping: Ye tareeqa din bhar mein chhoti chhoti trades karke faida uthane ko shamil karta hai, scalpers aksar qeemat mein ghaat aur sawari ke darwazon wale mukhtalif assets par tawajju dain, chand o taqarruban jaldi farokht karne ke zariye faida haasil karte hain.

- Momentum Trading: Momentum traders assets ke qeemat ke trends se faida uthate hain, jo prevailing market momentum ki taraf entry karte hain. Ye tareeqa aise stocks ya dusre asbaab ke pehchanne ka shamil hai jo taizi se upar ya neeche ki taraf harkat kartay hain aur is harkat ko short-term faida ke liye istemal karte hain.

- Range Trading: Range traders asli trading range ke andar qeemat ki oscillations se faida uthate hain. Unhon ne support aur resistance ke levels ko pehchan karne aur in borders ke qareeb buy aur sell orders execute karne ke liye entry ki hoti hai, maqsad yeh hota hai ke qeemat range ke andar chalate hue faida haasil karein.

- Breakout Trading: Breakout traders qeemat ko mukhtalif levels of support ya resistance ke pehlaas ke doran aam hone wale significant harkat se faida uthate hain. Ye tareeqa trading range se bahar nikalne wale prices par positions lete hain, breakout ki harkat ki taraf jaari rahne ki umeed ke sath.

- Mean Reversion: Mean reversion strategies asbaab ko pehchanne ke shamil hain jo apne aam qeemat se nichi ya unchi hui hain aur maqsad aam ki taraf wapas palatne ki umeed hai. Ye tareeqa overbought ya oversold shuroo'at ko dhoondne aur is harkat ke opposite positions lekar aage ki qeemat ke liye umeed hai.

Jabke intraday trading buland faida dene ka imkan faraham karti hai, is ke sath hi ismein mawjooda khatron ka bhi imkan hota hai jo traders ko samajhna zaroori hai:- Market Volatility: Intraday trading taizi se waqif mahaul mein hoti hai jo tezi se qeemat ki harkaton aur ziada volatility ke sath hoti hai. Achanak market ki hilchalein bade faiday ya nuqsanat ka sabab ban sakti hain, jiski wajah se intraday traders ke liye risk management ahem hai.

- Leverage: Bohat se intraday traders apne trading capital ko barhane ke liye leverage ka istemal karte hain, jo unhe chhoti shuruati invest ki madad se zyada barahne wale positions ko control karne ki izazat deta hai. Jabke leverage faida afroz ho sakta hai, lekin yeh bhi nuqsan ko barha sakta hai, khaas karke agar trades umeed se mukhalif hui.

- Liquidity Risks: Illiquid assets ki trading karne ke liye traders ke liye mushkilat paida ho sakti hain, kyunke dafaatil orders ko desired qeemat par execute karna mushkil ho sakta hai. Kam liquidity slippage ko barha sakta hai aur trading ke intizamati kharchon ko zyada kar sakta hai, jo overall faida pradaan kar sakti hai.

- Emotional Bias: Intraday trading ko khaamiyon, lalach aur be sabri jaise emosional jawabat dhoond sakte hain, jo faislon ko ghulaab banate hain aur be amal faislon ko wazahat kar sakte hain. Emosional bias ko door karne ke liye discipline aur trading strategies par amal zaroori hai.

- Overtrading: Intraday trading ke tez tareen fitrat ka mutasir hone se traders ko overtrade karne par majboor kar sakta hai, jaldi faiday hasil karne ki khawahish mein zyada se zyada trades execute karne ki koshish karte hain. Overtrading transaction ke kharchon ko barha sakta hai aur returns ko kum kar sakta hai, jo trading decisions par quality ki ahmiyat ko zyada darust banata hai.

-

#8 Collapse

Intraday Trading Kia Hai: Ek Aam Sawal

Intraday trading, ya day trading, ek khas tarah ka share market ka tajurba hai jahan traders din ke doran share kharidte aur bechte hain, unhein wahi din mein un shares ko kharidte aur bechte hue profit kamana hota hai. Yeh trading form short-term mein hoti hai aur traders ki mukhtalif strategies aur tajurbaat par mabni hoti hai. Ismein traders shares ko kuch ghanton ya minuteon ke liye hi retain karte hain aur phir unhein wahi din mein bechte hain.

Intraday trading ki ek khasiyat yeh hai ke ismein traders ko shares ko retain karne ki zarurat nahi hoti, jo ke long-term investments mein hoti hai. Isi wajah se ismein market ki short-term harkat se faida uthaya ja sakta hai. Lekin ismein risk bhi hota hai, kyun ke market ki chhoti moti harkaton se traders ke positions par asar hota hai.

Intraday Trading Ki Mukhtasir Tareef

Intraday trading mein traders ek din ke andar shares ko kharidte hain aur unhein wahi din mein bechte hain, taki unhein short-term profit mil sake. Yeh trading form market ki harkaton aur shares ki qeemat par mabni hoti hai. Traders ismein mukhtalif shares, jaise ki stocks, currencies, commodities, aur derivatives, jese futures aur options, par trade karte hain.

Ismein trading ka maqsad hota hai shares ki short-term harkaton se faida uthana, jiske liye traders market ki analysis aur technical tools ka istemal karte hain. Intraday trading mein profit kamane ke liye traders ko shares ko kuch ghanton ya minuteon ke liye hi retain karna hota hai, aur phir unhein wahi din mein bech dena hota hai jab unka target price achieve ho.

Intraday Trading Ka Maqsad

Intraday trading ka maqsad hota hai chand ghanton ya minuteon mein shares ki qeemat mein izafa kar ke munafa kamana. Is trading form mein traders ki strategy hoti hai shares ko short-term mein kharidna aur bechna, taake market ki short-term harkaton se faida uthaya ja sake. Ismein traders ki technical analysis aur market ki samajh ka bara kirdar hota hai, taake sahi waqt par sahi shares ko kharida aur becha ja sake.

Intraday trading ka maqsad hota hai short-term profit kamana, lekin ismein risk bhi hota hai kyun ke market ki short-term harkaton mein volatility hoti hai, jo ke traders ke liye nuksan deh ho sakti hai. Isliye traders ko market ko acche se samajhna aur sahi tareeqay se analyze karna zaroori hota hai taake sahi waqt par sahi faislay liye ja sakein.

Mukaami Faida Aur Nuqsan

Intraday trading mukaami faida aur nuqsan dono ke liye wafar hai, kyun ke market ki harkat aur shares ki qeemat mein tezi se izafa aur giravat hoti rehti hai. Traders jo ke sahi waqt par sahi shares ko kharidte aur bechte hain, unhein short-term mein achi munafa hasil hoti hai.

Mukaami faida hasil karne ke liye traders ko market ki harkaton ka acche se analysis karna hota hai aur sahi tareeqay se entry aur exit points set karna hota hai. Iske sath hi risk management bhi zaroori hoti hai taake nuksan se bacha ja sake. Lekin ismein nuksan bhi ho sakta hai agar traders sahi tareeqay se market ki harkaton ko samajh na sakein aur ghalat faislay karain.

Tehqiq Aur Taaleem Ki Ahmiyat

Intraday trading mein kamyabi ke liye tehqiq aur taaleem ki bohot ahmiyat hai, jaise market ki samajh, technical analysis aur risk management. Traders ko market ki harkaton ko samajhne ke liye taaleem hasil karna zaroori hai aur saath hi technical tools ka istemal bhi achi tarah se aana chahiye.

Tehqiq aur taaleem ke baghair traders ko market ki harkaton ka pata nahi chalta aur unhein sahi faislay lene mein mushkil hoti hai. Isliye traders ko market ki analysis ke liye mukhtalif tools ka istemal karna chahiye aur saath hi trading strategies ko bhi samajhna zaroori hai.

Intraday Trading Ke Tareeqay

Intraday trading ke liye kuch mukhtalif tareeqay hote hain, jaise ki scalping, momentum trading aur range trading. Har ek tareeqay ka apna tareeqa hota hai shares ko analyze aur trade karne ka, aur traders apne pasandida tareeqay ke mutabiq trading karte hain.

Scalping mein traders short-term mein chhotay profits kamate hain, jabke momentum trading mein market ki trend par trading ki jati hai aur range trading mein traders market ke range mein trade karte hain. Har tareeqay ka apna risk aur reward hota hai, aur traders apne trading style aur risk tolerance ke mutabiq tareeqay ka intikhab karte hain.

Risk Aur Reward Ka Taalluq

Intraday trading mein risk aur reward ka taalluq mukhtalif factors par mabni hota hai, jaise market volatility, shares ki qeemat aur trading strategy. Traders ko apne trades ko analyze karte waqt risk aur reward ka tafseeli jaiza lena chahiye taake sahi tareeqay se trading ki ja sake.

Market volatility ke doran risk bhi barh jata hai, lekin iske sath hi reward bhi barh jata hai agar traders sahi tareeqay se trading karein. Lekin ismein traders ko apni trading strategy ko sahi tareeqay se implement karna zaroori hai taake nuksan se bacha ja sake aur munafa hasil kiya ja sake.

Margin Trading Ki Ahmiyat

Intraday trading mein margin trading bhi aham kirdar ada karta hai, jisme traders apne broker se paisay udhaar le kar trading karte hain. Margin trading mein traders ko apne trading capital ka zyada hissa istemal karne ki ijaazat hoti hai, jo ke unhein zyada profits kamane ka mauka deta hai.

Lekin margin trading mein risk bhi hota hai, kyun ke agar traders ka trade loss mein chala gaya to unhein apne broker ko paisay wapis karna hota hai sath hi margin call ka bhi samna karna pad sakta hai. Isliye traders ko margin trading ko samajh kar hi istemal karna chahiye aur saath hi risk management bhi zaroori hai.

Trading Platform Ka Intikhab

Intraday trading ke liye sahi trading platform ka intikhab karna bhi zaroori hai, jo traders ko sahi tools aur analytics faraham karta hai. Trading platform ka intikhab karte waqt traders ko platform ki speed, usability aur features ko dekha jata hai.

Sahi trading platform ka intikhab karne se traders ko apne trades ko execute karne mein asani hoti hai aur saath hi market ki harkaton ko bhi monitor karne mein madad milti hai. Isliye traders ko apne trading style aur requirements ke mutabiq trading platform ka intikhab karna chahiye.

Timing Ka Kirdar

Intraday trading mein sahi waqt ka intikhab karna bohot zaroori hai, jaise ki market opening aur closing times par trading karne ka faida hota hai. Market opening aur closing times par market ki harkaton mein tezi hoti hai aur traders ko zyada opportunities milte hain.

Sahi timing par trading karne se traders ko zyada chances milte hain shares ko sahi waqt par kharidne aur bechne ke. Isliye traders ko market ki timing ko samajhna aur sahi waqt par trading karne ka tareeqa apnana chahiye.

Stop Loss Aur Target Ke Tareeqay

Intraday trading mein stop loss aur target ko sahi tareeqay se set karna zaroori hai taake nuksan se bacha ja sake aur munafa kamaya ja sake. Stop loss ko set karne se traders apne trades ko nuksan se bacha sakte hain agar market against direction mein chali gayi.

Iske sath hi target ko set karne se traders apne trades ko sahi waqt par band kar sakte hain aur munafa hasil kar sakte hain. Stop loss aur target ko set karte waqt traders ko apne risk aur reward ko bhi dhyan mein rakhna chahiye.

Psikolojik Tawazon

Intraday trading mein psikolojik tawazon bhi bohot zaroori hai, taake trader apne emotions ko control kar sake aur sahi faislay kar sake. Market ki harkaton mein asar hone par traders ko ghabrane ki bajaye sabar aur istiqamat se kaam lena chahiye.

Iske sath hi greed aur fear ko control karna bhi zaroori hai, taake traders apne trades ko sahi tareeqay se manage kar sakein aur nuksan se bacha sakein. Psikolojik tawazon ko maintain karne ke liye traders ko apne trading plan ko follow karna chahiye aur apne emotions ko control mein rakhna chahiye.

Economic Indicators Aur Market Analysis

Intraday trading mein economic indicators aur market analysis ka bara kirdar hota hai, jaise ki news, events aur economic data ka asar shares ki qeemat par. Traders ko market ki harkaton ko samajhne ke liye economic indicators aur market analysis ka istemal karna chahiye.

Iske sath hi traders ko market mein hone wale events aur news ko bhi monitor karna chahiye taake unhein market ki harkaton ka pata chale aur sahi tareeqay se trading ki ja sake. Economic indicators aur market analysis ke baghair traders ko market ki harkaton ka pata nahi chalta aur unhein sahi trading ka faisla lene mein mushkil hoti hai.

Trading Plan Banayein

Intraday trading mein trading plan banana bohot zaroori hai, jismein entry aur exit points, risk aur reward ratio aur trading strategy shamil hoti hai. Trading plan banane se traders apne trades ko sahi tareeqay se manage kar sakte hain aur apne trading goals ko achieve kar sakte hain.

Iske sath hi trading plan banane se traders ko apne risk ko bhi control karne mein madad milti hai aur unhein sahi tareeqay se trading karne mein asani hoti hai. Trading plan banate waqt traders ko apne trading style aur risk tolerance ko bhi dhyan mein rakhna chahiye.

Sabar Aur Istiqamat

Intraday trading mein sabar aur istiqamat bohot ahmiyat rakhta hai, kyun ke market mein harkat har waqt hoti rehti hai aur asani se ghabrana ya jaldi faisla karna nuksan deh ho sakta hai. Traders ko apne trades ko manage karte waqt sabar aur istiqamat se kaam lena chahiye aur ghabrane ki bajaye sahi faislay lena chahiye.

Iske sath hi traders ko apne trading plan ko follow karna chahiye aur apne emotions ko control mein rakhna chahiye. Sabar aur istiqamat ke baghair traders ko apne trades ko manage karna mushkil ho sakta hai aur nuksan ka samna karna pad sakta hai.

Mazid Tadrees Aur Amal

Intraday trading ko samajhne aur kamyabi hasil karne ke liye mazid tadrees aur amal zaroori hai, taake traders apni skills ko behtar banayein aur maharat hasil kar sakein. Traders ko market ki harkaton ko samajhne ke liye mukhtalif resources ka istemal karna chahiye aur saath hi apne trading strategies ko bhi improve karna chahiye.

Iske sath hi traders ko apne trading plan ko bhi regularly update karna chahiye taake unhein market ki harkaton ka pata chale aur sahi tareeqay se trading ki ja sake. Mazid tadrees aur amal ke baghair traders ko market ki harkaton ka pata nahi chalta aur unhein trading mein kamyabi hasil karne mein mushkil hoti hai. -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Intraday trading ek trading strategy hai jisme traders din ke andar hi positions open karte hain aur unhein wahi din ke andar close karte hain. Ismein traders stocks, currencies, commodities ya anya financial instruments par short-term movements par trade karte hain. Chaliye is trading strategy ke bare mein maze tafseelat samajhte hain:

Intraday Trading Kaam Kaise Karta Hai?

Intraday traders market ke short-term movements ko analyze karte hain aur un movements ke basis par trading decisions lete hain. Yeh traders ek trading session ke Lauren multiple trades karte hain aur positions ko typically wahi din ke end tak close kar dete hain.

Intraday Trading Ke Faida:

Quick Profits:

Intraday trading Mein traders ko quick profits milte hain kyunki wo short-term movements par focus karte hain aur positions ko wahi din ke end tak close kar dete hain.

Low Overnight Risk:

Kyunki intraday traders positions ko wahi din ke end tak close kar dete hain, isliye unka overnight risk kam hota hai. Unhein kisi bhi overnight market gap ka dar nahi rehta.

Intraday Trading Ka Istemal:

Technical Analysis:

Intraday traders technical analysis ka istemal karte hain jaise ki chart patterns, indicators, aur price action analysis, taki short-term movements ko predict kiya ja sake.

Risk Management:

Intraday trading mein risk management ka bahut ahem role hota hai. Traders ko apne positions ke liye stop loss aur target levels set karna zaroori hota hai taki unka risk manage ho sake aur profit maximize ho sake.

Intraday Trading Ke example: Maan lijiye aap ek forex trader hain aur EUR/USD currency pair par intraday trading kar rahe hain. Aap price charts aur technical indicators ka istemal karke short-term price movements ko analyze karte hain aur trading decisions lete hain.

Nukta-e-Nazar: Intraday trading ek risky strategy hai aur ismein traders ko market ke short-term fluctuations ko samajhne ki zaroorat hoti hai. Iske alawa, traders ko apne positions ko closely monitor karna aur trading plan ko strict follow karna zaroori hai.

-

#10 Collapse

Intraday Trading kya Hai ?

Intraday trading, jo kay rozmarra ke khareed-o-farokht ke daira mein aata hai, ek tarah ka trading hai jahan investors ya traders ek din mein hi mukhtalif securities, currencies, ya commodities ko khareedte aur bechte hain. Ye trading strategy jald-baazi aur tezi se tabdeeliyon ko samajhne ki zaroorat ko zahir karta hai. Is mein samay ka bohot ahem kirdar hota hai, kyun ke traders ko chand ghanton ya minuteon mein faislay karna hota hai.

Intraday trading karne wale log chand zaroori points ko madde nazar rakhte hain:

1. **Technical Analysis:** Is trading mein technical analysis ka istemal bohot ahem hai. Candlestick charts, moving averages, RSI (Relative Strength Index), aur MACD (Moving Average Convergence Divergence) jese tools ka istemal hota hai taake securities ke qeemat mein hone wale tabdeeliyon ko samjha ja sake.

2. **Volatility:** Intraday trading mein josh aur garam joshi ka izafa hota hai. Securities ki qeemat mein tezi se tabdeeliyan aksar hoti hain, jo traders ko faida ya nuqsan dono mein mubtala kar sakti hain.

3. **Leverage:** Kuch traders leverage ka bhi istemal karte hain, jo unhe kam paison mein zyada securities khareedne ki ijaazat deta hai. Lekin, leverage ka istemal karne ke saath saath zyada zimmedari aur savdhani ka hona bhi zaroori hai.

4. **Risk Management:** Intraday trading mein risk management ka bohot ahem kirdar hota hai. Traders ko apne capital ko barbaad hone se bachane ke liye stop-loss orders ka istemal karna chahiye.

Intraday trading karne ke fawaid aur nuqsanat bhi hote hain:

**Fawaid:**

- Jald-baazi se paisa kamana: Intraday trading mein jald-baazi se paisa kamaya ja sakta hai agar traders ko sahi samay par faisle lena aata ho.

- Chhote moolyon mein shiraaqat: Is tarah ke trading mein chhote moolyon mein bhi shiraaqat ki ja sakti hai.

**Nuqsanat:**

- Zyada risk: Intraday trading mein zyada risk hota hai kyun ke securities ki qeemat mein jald-baazi se tabdeeliyan aati rehti hain.

- Stress aur pressure: Traders ko rozmarra ke tabdeeliyon aur tezi se qeemat ke tabadlayon se jang karna padta hai, jo stress aur pressure ka bais ban sakta hai.

Intraday trading mein kamiyabi hasil karne ke liye kuch mushkilat ka samna karna parta hai. Yeh shamil hai:

1. **Market Knowledge:** Market ki gehrai se waqif hona zaroori hai. Securities ke maamlaat, industries ki halat, aur global events ka impact samajhna zaroori hai.

2. **Emotional Control:** Trading mein emotions ko control karna mushkil ho sakta hai. Ghabrahat ya josh mein aakar faisle lene se nuqsaan ho sakta hai.

3. **Strategy:** Ek mazboot aur mufeed trading strategy banana zaroori hai. Ye strategy market ki halat aur apne risk tolerance ke mutabiq honi chahiye.

4. **Patience:** Intraday trading mein patience bohot zaroori hai. Kabhi kabhi behtar faida hasil karne ke liye intezar karna parta hai.

Intraday trading, jaise ke har trading strategy, apne faide aur nuqsanat ke saath aata hai. Isme kamiyabi hasil karne ke liye traders ko mehnat, ilm aur samajhdari ka istemal karna parta hai.

- Mentions 0

-

سا0 like

-

#11 Collapse

Intraday Trading Kia Hai information

Intraday trading ek trading strategy hai jisme traders ek trading session ke andar hi positions enter aur exit karte hain, matlab ke woh ek din ke andar hi apne trades ko close kar dete hain. Ismein traders stocks, commodities, currencies, ya anya financial instruments ko short-term price movements ke liye trade karte hain.

Yahan kuch key points hain jo intraday trading ke bare mein samajhne mein madad karte hain:

Short-Term Trading

Intraday trading ka maqsad short-term price movements se profit kamana hota hai. Traders typically kuch minutes, ghante, ya ek din ke time frame mein positions enter aur exit karte hain.

Volatility ka Fayda Uthana

Intraday traders volatility ka faida uthate hain kyunki volatile markets mein price movements zyada hote hain aur trading opportunities milte hain.

Technical Analysis ka Istemal

Intraday trading mein technical analysis ka zyada istemal hota hai. Traders price charts, indicators, aur price patterns ka istemal karte hain taake short-term price movements ko predict kar sakein.

Risk Management

Risk management intraday trading mein ahem hota hai. Traders apni positions ke liye stop-loss orders aur profit targets set karte hain taake potential losses ko control kar sakein aur profit ko maximize kar sakein.

Liquidity

Intraday traders liquidity ko bhi dhyan mein rakhte hain. Liquid markets mein traders apni positions ko jaldi enter aur exit kar sakte hain bina significant price impact ke.

Time Management

Intraday trading mein time management bhi zaroori hai. Traders ko trading session ke doran market mein active rehna hota hai aur trading opportunities ko miss nahi karna chahiye.

Psychological Factors

Intraday trading mein psychological factors bhi important hote hain. Traders ko apne emotions ko control karna hota hai aur discipline maintain karna hota hai taake unki trading decisions rational aur consistent rahein.

Intraday trading high-risk hoti hai aur traders ke liye challenging ho sakti hai, lekin sahi knowledge, skills, aur discipline ke saath ki gayi practice se traders short-term profits earn kar sakte hain.

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Intraday Trading Kia Hai: Ek Mukammal Jaiza**

Intraday trading, jo aksar day trading ke naam se bhi jana jata hai, ek aisi trading strategy hai jisme traders ek hi trading day ke andar stocks, forex, ya other financial instruments ko buy aur sell karte hain. Iska maqsad short-term price movements se faida uthana hota hai, aur ismein traders apni positions ko din ke andar hi close kar dete hain, bina raat bhar position hold kiye.

**Intraday Trading Ki Basic Principles**

Intraday trading ka core idea yeh hai ke aap market ke short-term fluctuations se profit kamayein. Traders usually market ke open aur close hone ke waqt ke darmiyan price movements ka faida uthate hain. Intraday trading mein, traders multiple trades kar sakte hain ek din mein, aur har trade ka duration minutes se lekar hours tak ho sakta hai.

**Intraday Trading Kaise Kaam Karta Hai**

Intraday trading mein, traders ko market ki timely analysis aur decision making ki zaroorat hoti hai. Yeh traders technical analysis tools, jaise charts aur indicators, ko use karke market trends aur potential entry aur exit points identify karte hain. Popular technical indicators jise intraday traders use karte hain, unmein moving averages, Relative Strength Index (RSI), aur Bollinger Bands shamil hain.

**Intraday Trading Ke Faidaat**

1. **High Profit Potential**: Intraday trading mein market ke small price movements ka faida uthaya ja sakta hai, jo high profit potential ko create karta hai. Jab aap bar-bar trading karte hain, to aap multiple opportunities se faida utha sakte hain.

2. **Liquidity Aur Flexibility**: Intraday trading mein traders ko market ke high liquidity periods ka faida milta hai, jahan trades aasani se execute ho sakti hain. Is flexibility ke zariye, traders market ke changes ke sath adapt kar sakte hain.

3. **No Overnight Risk**: Intraday traders apni positions din ke andar close kar dete hain, isliye raat bhar market ki fluctuations aur overnight risks se bacha ja sakta hai.

**Intraday Trading Ke Challenges**

1. **High Stress Aur Fast Decision Making**: Intraday trading fast

-

#13 Collapse

Intraday Trading Kia Hai

1. Tتعریف

Intraday trading aik aise trading ka tareeqa hai jismein traders ek hi din ke andar stocks ya financial instruments ko kharidte aur bechte hain. Is trading ki khasiyat ye hai ke positions ko ek din ke andar khula aur band kiya jata hai. Intraday trading ka maqsad chhoti price movements se faida uthana hota hai, jo ke din bhar market ki volatility ki wajah se hoti hai.

2. Intraday Trading ki Tareekh

Intraday trading ka silsila 20th century ke aakhir se shuru hua jab electronic trading platforms ne market ko zyada accessible bana diya. Is ne investors aur traders ko ye mauqa diya ke wo asani se shares kharid aur bech sakain. Aaj kal, is ka maqsad na sirf profit banana balki market ki rapid changes se faida uthana bhi hai.

3. Intraday Trading ki Ahamiyat

Intraday trading ka apna ek aham maqam hai. Ye investors ko market ki short-term fluctuations ka faida uthana ka mauqa deta hai. Is ke ilawa, intraday trading ka ek faida ye bhi hai ke traders ko kisi bhi share ki long-term position ki wajah se hone wale risk se door rehna padta hai.

4. Intraday Trading ki Strategies

Intraday trading mein mukhtalif strategies istemal ki jati hain. In mein sab se aam strategies hain scalping, momentum trading, aur swing trading. Scalping mein traders chhoti price movements se faida uthate hain, jabke momentum trading un stocks ko target karti hai jo kisi news ya event ki wajah se tezi se upar ya neeche jate hain.

5. Market Ki Analysis

Intraday trading ke liye market ki analysis bohot zaroori hai. Technical analysis aur fundamental analysis dono ka istemal kiya jata hai. Technical analysis mein charts aur indicators ka istemal hota hai taake price patterns aur trends ko samjha ja sake, jabke fundamental analysis mein company ki financial health aur market conditions ko dekhna hota hai.

6. Risk Management

Intraday trading mein risk management ka khayal rakhna bohot zaroori hai. Is mein stop-loss orders ka istemal hota hai, jo traders ko loss se bachane mein madad karte hain. Yeh orders automatically trade ko band karte hain jab price ek certain level tak girti hai, is tarah se traders apne losses ko limit kar sakte hain.

7. Trading Tools aur Platforms

Intraday trading ke liye trading platforms aur tools ka istemal bohot zaroori hai. Aaj kal market mein bohot se platforms available hain jo real-time data, charts, aur technical indicators provide karte hain. In tools ki madad se traders ko decisions lene mein asani hoti hai.

8. Time Management

Intraday trading mein time management bhi ek aham factor hai. Traders ko market ke khulne aur band hone ka waqt yaad rakhna chahiye. Is ke ilawa, kisi bhi news ya announcement ka waqt bhi samajhna zaroori hai, kyunke yeh market ki volatility ko badha sakti hai.

9. Emotions ka Control

Emotional control bhi intraday trading mein ek aham hissa hai. Traders ko apne emotions ko control mein rakhna chahiye taake wo impulsive decisions na lein. Stress aur anxiety ko handle karna bohot zaroori hai, kyunki ye factors trading decisions par asar dal sakte hain.

10. Capital Management

Intraday trading ke liye capital management ka khayal rakhna bohot zaroori hai. Traders ko ye samajhna chahiye ke unhe kitna capital invest karna hai aur kitna risk lene ke liye tayaar hain. Yeh strategy unhein long-term success ke liye tayyar karegi.

11. Education aur Training

Aik successful intraday trader banne ke liye education aur training ki zaroorat hai. Yeh market ke trends, trading strategies, aur risk management techniques ko samajhne mein madad karte hain. Online courses, webinars, aur trading seminars se bhi faida uthaya ja sakta hai.

12. Regulatory Environment

Intraday trading karne se pehle regulatory environment ka khayal rakhna zaroori hai. Har mulk mein trading ke liye kuch rules aur regulations hoti hain. Traders ko yeh pata hona chahiye ke kis tarah ke rules un par apply hote hain taake wo kisi bhi legal issue se bach sakein.

13. Mistakes se Seekhna

Har trader ko kabhi na kabhi mistakes hoti hain. Intraday trading mein bhi ye sach hai. Lekin ye mistakes seekhne ka mauqa hoti hain. Traders ko apni galtiyon ko samajhna chahiye aur unse seekhna chahiye taake wo behtar trader ban sakein.

14. Conclusion

Aakhir mein, intraday trading ek exciting aur rewarding activity hai lekin is ke liye knowledge, skills, aur patience ki zaroorat hai. Agar aap in sab chizon ka khayal rakhte hain, to aap intraday trading mein successful ho sakte hain. Yeh trading ka tareeqa na sirf aapko financial rewards de sakta hai balki market ko samajhne ka bhi mauqa deta hai. Is liye, agar aap intraday trading mein interest rakhte hain, to is ke liye tayyar ho jayein aur apni skills ko develop karne par focus karein.

-

#14 Collapse

Intraday Trading kia hai

Introduction

Intraday trading, jise hum "day trading" bhi kehte hain, aik aisa trading style hai jis mein aap ek hi din ke andar kharidari aur farokht karte hain. Is tarah ke trading mein aap ko stocks ya financial assets kharidna aur ussi din unhain farokht karna hota hai. Intraday trading ka maqsad short-term price movements se faida uthana hota hai. Yeh trading style aksar professionals aur un logon ke liye hoti hai jo jaldi jaldi price changes ka faida utha sakte hain.

Intraday Trading Ka Maqsad

Intraday trading ka maqsad yeh hota hai ke aap din ke andar andar price ke chhote-mote utar chadhav ko track karen aur in movements se profit earn karen. Jab aap koi stock ya asset kharidte hain, to aap ka objective yeh hota hai ke uska price din ke andar barh jaye taake aap woh stock mehngi qeemat par bech kar munafa kama sakein. Is mein market ke short-term trends ko samajhna aur un trends ke mutabiq decisions lena bohat zaroori hota hai.

Intraday Trading Ke Liye Important Tools

Intraday trading mein successful hone ke liye kuch important tools aur strategies ko samajhna bohat zaroori hai:- Technical Analysis: Ismein charts, patterns aur indicators ka istemal hota hai taake aap price movements ka tajziya kar saken. Ismein moving averages, RSI (Relative Strength Index), aur Bollinger Bands jaise indicators ka bohat bara kirdar hota hai.

- Candlestick Patterns: Yeh aik mashhoor technical analysis tool hai jo price ke trend ko identify karne mein madad karta hai. Candlestick patterns aap ko batate hain ke market ka mood bullish hai ya bearish.

- Support aur Resistance Levels: Intraday trading mein yeh identify karna ke kis qeemat par support ya resistance hai, aap ko buy ya sell decisions lene mein madad deta hai. Support ka matlab hai ke aik aisi qeemat jahan se asset ka price wapas oopar ja sakta hai, jabke resistance woh level hai jahan price neeche ja sakta hai.

- Risk Management: Intraday trading mein risk management kaafi important hai. Stop loss aur target setting ke through aap apne potential losses ko limit kar sakte hain. Yeh zaroori hai ke har trade ke liye aap pehle se maximum risk ko define karen.

Advantages of Intraday Trading- Leverage: Aksar brokers intraday traders ko leverage provide karte hain, jiska matlab hai ke aap kam paisay invest karke zyada bara position hold kar sakte hain. Yeh aap ko short-term mein zyada munafa kamane ka moka deta hai.

- No Overnight Risk: Intraday trading mein aap ko apne positions ko raat bhar hold nahi karna parta, is liye aap overnight market risk se bach jate hain. Yeh un logon ke liye faidemand hai jo sirf ek din ke andar andar trade karna chahte hain.

- Quick Profits: Intraday trading mein, agar aap sahi decision lete hain, to aap ko din ke andar andar profits mil sakte hain. Aap price ke chhote se move ka faida utha ke jaldi profit kama sakte hain.

Disadvantages of Intraday Trading- High Risk: Intraday trading mein high risk hota hai kyun ke market ke short-term movements ko predict karna mushkil hota hai. Agar aap galat direction mein trade karte hain, to aap ko substantial loss ho sakta hai.

- High Transaction Costs: Har buy aur sell ke transaction ke saath brokerage fees bhi hoti hai. Aksar traders ko is cheez ka khayal nahi hota aur unke profits brokerage fees mein nikal jate hain.

- Stressful: Intraday trading ko manage karna stressful hota hai kyun ke aap ko har waqt market ko closely monitor karna padta hai. Ek chhoti si galti aap ka bara nuksan karwa sakti hai.

Intraday Trading Strategies- Scalping: Is strategy mein aap chhoti chhoti price movements ka faida uthate hain. Aap din ke andar kayi trades karte hain aur har trade se chhota profit kama kar overall profit barhate hain.

- Momentum Trading: Is strategy mein aap us waqt buy karte hain jab market ka trend strong hota hai aur ussi direction mein move karta hai. Jaise hi momentum weak hota hai, aap apni position close kar lete hain.

- Breakout Trading: Is mein aap wait karte hain ke jab stock support ya resistance ko break kare, to aap ussi direction mein trade kar lete hain. Agar support break ho, to short position; agar resistance break ho, to long position open kar lete hain.

- Reversal Trading: Ismein aap trade us waqt lete hain jab market ka trend reverse hota hai. Aap support ya resistance ke break hone ka intezar karte hain aur jab price wapas apni direction change karta hai, to aap trade lete hain.

Key Risks in Intraday Trading

Intraday trading mein kuch khas risks bhi hote hain jo har trader ko samajhna chahiye:- Market Volatility: Market volatility se price rapid aur unexpected movements kar sakti hai, jo losses ka sabab ban sakti hai. Intraday traders ko hamesha market ki volatility ko madde nazar rakhna chahiye.

- Emotional Trading: Intraday trading mein jab traders overconfident ya fear mein aake impulsive decisions lete hain, to bohat nuksan uthate hain. Isliye ek proper plan aur discipline ka hona zaroori hai.

- Leverage Risk: Leverage aap ke profits ko barha sakta hai, lekin yeh aap ke losses ko bhi barha sakta hai. Agar market aap ke against jata hai, to leverage ki wajah se losses bhi zyada ho jate hain.

Risk Management Tips- Stop Loss Lagana: Har trade ke liye pehle se stop loss lagana chahiye taake agar market aap ke against jaye, to aap ko baray losses na hoon. Yeh risk ko manage karne ka sab se aasaan tareeqa hai.

- Position Size Control: Hamesha apne capital ke mutabiq position size control karna chahiye. Bara leverage aur bara position size high risk ko janam deta hai.

- Discipline aur Planning: Intraday trading mein sab se zaroori cheez discipline hai. Aap ko apne trading plan par stick karna chahiye aur impulsive trades se bachna chahiye.

Conclusion

Intraday trading aik challenging lekin profitable trading style hai. Yeh short-term price movements ka faida uthane par focus karta hai. Is mein faida uthana unhi traders ke liye mumkin hota hai jo technical analysis samajhte hain aur proper risk management karte hain. Aap ke paas aik solid plan hona chahiye aur har trade ke liye disciplined approach adopt karna chahiye. Leverage, volatility, aur transaction costs ka dhyan rakhte hue, agar aap apni strategy ko theek se implement karte hain, to intraday trading se achha munafa kama sakte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

### Intraday Trading Kya Hai?

Intraday trading, jise day trading bhi kaha jata hai, ek aisi trading strategy hai jisme traders apne positions ko ek hi trading day ke andar kholte aur band karte hain. Iska maqsad short-term price movements ka faida uthana hota hai. Is post mein hum intraday trading ki tafseel, iski khasiyat, faide, aur challenges par baat karenge.

#### Intraday Trading Ki Pehchaan

Intraday trading mein traders apne trades ko ek din ke andar hi execute karte hain. Yeh strategy aksar stock, forex, commodities, aur other financial markets mein istemal hoti hai. Intraday traders kisi bhi asset ki price movements ko dekhte hain aur unhe analyze karte hain taake unhe entry aur exit points mil saken.

#### Intraday Trading Ki Khasiyat

1. **Short-Term Focus**: Intraday trading ka focus short-term price movements par hota hai. Traders chand minutes se lekar kuch ghanton ke liye trades rakhte hain, lekin kabhi bhi overnight position nahi rakhte.

2. **High Volatility**: Intraday traders zyada volatile markets ko pasand karte hain, kyunki in markets mein price movements zyada hoti hain, jo unhe profit kamane ka mauqa deti hain.

3. **Technical Analysis**: Is strategy mein technical analysis ka bohot bada kirdar hota hai. Traders price charts, patterns, aur indicators ka istemal karte hain taake market ki direction ka andaza lagayen.

#### Intraday Trading Ke Faide

1. **Quick Profits**: Intraday trading mein traders quick profits kama sakte hain, agar wo sahi time par sahi decision lein.

2. **No Overnight Risk**: Is strategy mein traders ko overnight risk nahi hota, kyunki wo positions ko din ke andar hi close kar dete hain. Yeh unhe unexpected market movements se bachata hai.

3. **Flexibility**: Intraday trading se traders ko flexibility milti hai. Wo apne trading hours aur strategies ko customize kar sakte hain apne convenience ke hisaab se.

#### Challenges of Intraday Trading

1. **High Stress**: Intraday trading bohot stressful hota hai kyunki traders ko fast decision-making karna padta hai. Ismein patience ki zaroorat hoti hai, jo har kisi ke liye asan nahi hota.

2. **Transaction Costs**: Intraday trading mein multiple trades ki wajah se transaction costs zyada ho sakti hain. Yeh profits ko kam kar sakta hai, isliye traders ko is baat ka khayal rakhna chahiye.

3. **Market Knowledge**: Intraday trading ke liye traders ko market ki bohot achi knowledge honi chahiye. Unhe technical analysis aur market sentiment ko samajhna aana chahiye.

#### Conclusion

Intraday trading ek exciting aur profitable trading strategy hai, lekin ismein risks bhi hain. Is strategy ko adopt karne se pehle, traders ko apni trading style, risk tolerance, aur market ki knowledge par ghor karna chahiye. Agar aap sahi approach aur discipline ke saath intraday trading karte hain, to aap is field mein kamiyab ho sakte hain. Hamesha yaad rahe ke proper risk management zaroori hai, taake aap apne capital ko protect kar saken. Is tarah, aap successful intraday trading ka safar tay kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:57 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим