Bearish Kicker Pattern ka asal kam

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

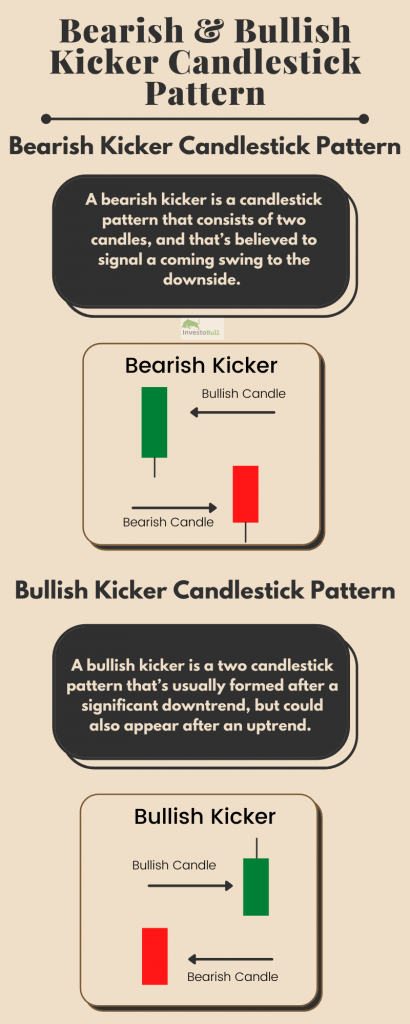

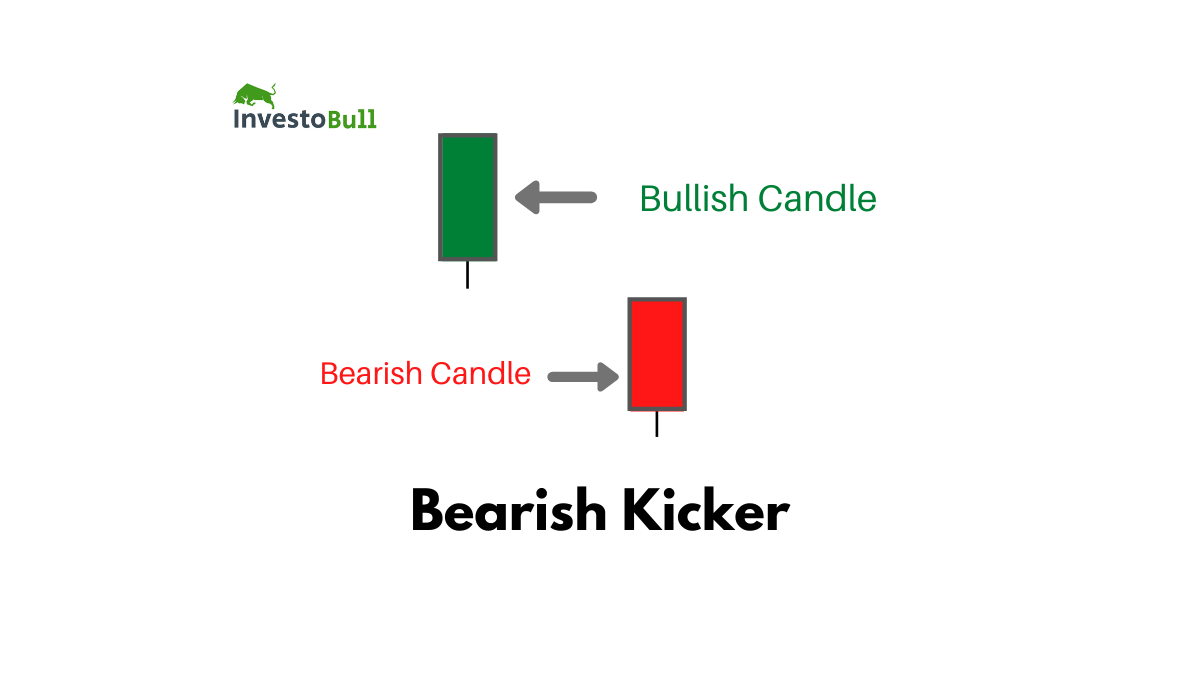

Bearish Kicker Pattern ek bearish reversal pattern hai, jo candlestick charts mein istemal kiya jata hai. Is pattern mein ek bullish candlestick (upward movement) ke baad ek larger bearish candlestick (downward movement) appear hota hai, jise "bearish kicker" kehte hain. Bearish Kicker Pattern ki wazahat kuch is tarah hoti hai: Bearish Kicker Pattern ka ahim hona 1. Bullish Candlestick: Pattern ka pehla step ek bullish (upward movement) candlestick hota hai. Yeh candlestick typically ek uptrend ke hisse mein appear hota hai aur positive sentiment ko indicate karta hai. 2. Bearish Candlestick: Pattern ka doosra step ek larger bearish (downward movement) candlestick hota hai. Yeh candlestick pehle bullish candlestick ko engulf (cover) kar leta hai, yani ki uski range ko poora capture kar leta hai. 3. Reversal Signal: Bearish Kicker Pattern bearish reversal ko indicate karta hai. Yeh pattern price action mein selling pressure aur bearish sentiment ki increase ko represent karta hai. Bullish trend ke baad bearish trend ka potential reversal point samjha jata hai. 4. Gap: Bearish Kicker Pattern mein bearish candlestick gap down open karta hai, yani ki previous bullish candlestick ke close price se neeche open hota hai. Yeh gap bearish momentum aur selling pressure ko indicate karta hai. 5. Confirmation: Pattern ki wazahat aur validity ke liye, surrounding price action aur volume ka bhi dhyan rakha jata hai. Agar bearish kicker candlestick ke baad price levels aur volume dono decrease karte hain, toh pattern ki validity aur reversal signal ko confirm karta hai. 6. Entry and Stop-Loss: Pattern ke appearance ke baad traders entry aur stop-loss levels ko identify karte hain. Entry typically bearish kicker candlestick ke low price level ke neeche liya jata hai, jabki stop-loss previous swing high price ke above set kiya jata hai. 7. Target Price: Pattern ke target price ko calculate karne ke liye, previous swing low price level ko reference liya jata hai. Bearish kicker candlestick ke breakout point se target price level ko calculate kiya jata hai. Bearish Kicker Pattern ka istemal short-term aur long-term trading mein kiya jata hai. Traders is pattern ko confirmatory indicators aur technical analysis tools ke saath combine karke entry aur exit points ko identify karte hain.Pattern ki tafseel aur trading strategies ko samajhne ke liye, additional candlestick patterns aur technical indicators ka istemal kiya jata hai. -

#3 Collapse

Assalamu Alaikum Dosto!Bearish Kicking Pattern

Bearish Kicker Pattern ek do-bar candlestick pattern hai jo kisi aset ki keemat ke trend mein aik ahem tabdeeli ko set karti hai, jo ke market mein aik group ki trend reversal ka ishara deta hai. Bearish Kicker aik aisi structure hai jo ke finansiyal modeling mein pehchaani gayi hai jahan par aik khaas do-bar candlestick formation ke doran keemat mein tezi se kami hoti hai. Traders isey samajhte hain ke kon sa market segment play mein hai.

Bearish Kicker pattern Japanese candlestick charting ke pehle dinon se mojood hai, jo ke 1990s mein Western dunya mein pehli martaba mutarif kiya gaya tha. Jab yeh pattern pehli martaba introduce kiya gaya tha, to ise "abandoned baby" pattern kehte thay, lekin baad mein ise "bearish kicker" pattern keh diya gaya.

Bearish Kicker ka asal faida yeh hai ke yeh keemat ke trend mein tabdeeli ka saaf ishara deta hai. Traders jo ke lambi positions se nikalna ya market ko aur niche giraane se pehle shorting karna chahte hain, wo is maloomat se faida uthate hain.

Explaination

Bearish Kicker ek candlestick pattern hai jo ke do candlesticks ke doran hota hai ek keemat ke uptrend mein. Bearish Kicker pattern tab pehchana jata hai q ke is khaas do-bar candlestick formation mein keemat mein tezi se tabdeeli hoti hai. Traders ko bearish kicker pattern par ziada itminan hota hai ek bearish trend ke indicator ke tor par, jo unhein assets khareedne ya bechne ke baray mein maloomat hasil karne mein qabil banata hai.

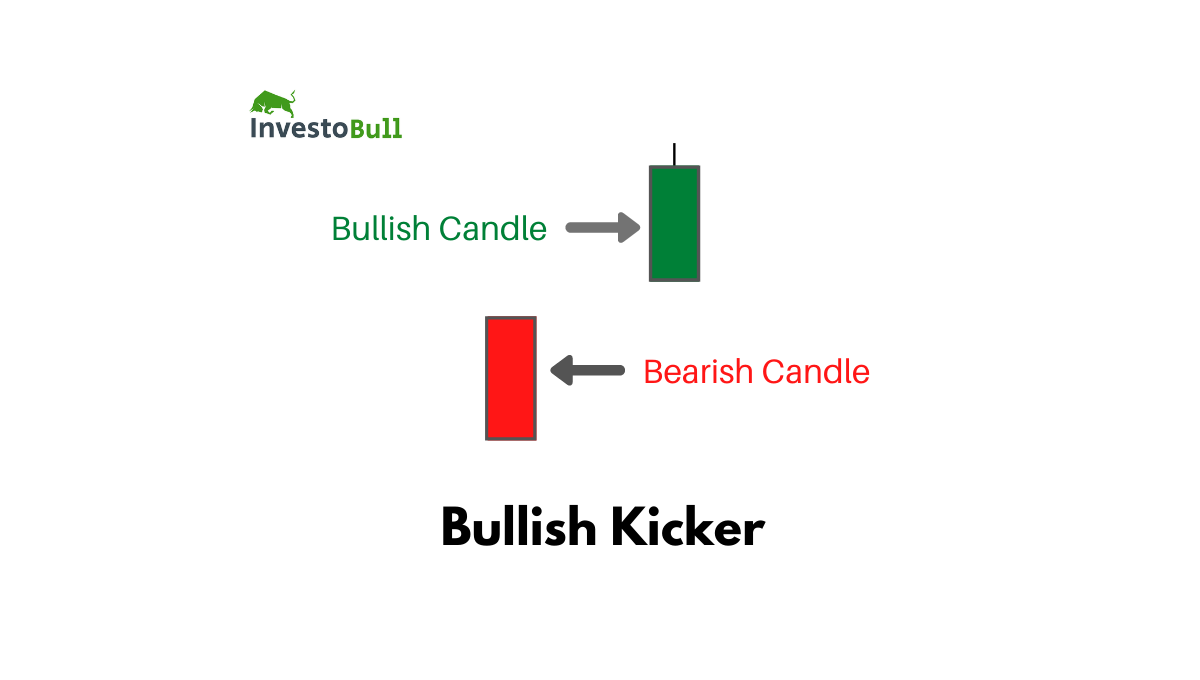

Yeh pattern tab hota hai jab aik lamba white ya green candlestick ke baad aik gap up hota hai aur phir doosri black ya red candlestick hoti hai jo pehle din ke high ke ooper open hoti hai lekin pehle din ke low ke neechay close hoti hai. Dusra candlestick pehli ko poori tarah se gher leta hai, ek bearish engulfing pattern banate hue.

Bearish Kicker pattern ka maqam ko wazeh karne ka aham tareeqa yeh hai ke jab yeh overbought ya oversold territories mein hota hai, to is ka ahmiyat barh jati hai. Yeh ishara karta hai ke market ne ek intehai ko chhoo liya hai aur ek reversal karwaah hone wala hai. Yeh daleelon ki taraf ishara karta hai ke market participants ne control hasil kiya hai, aur jab aise market shorowat mein aata hai, to yeh ek strong bearish momentum ki zyada shiddat ki indication deta hai. Traders is pattern ko ek confirmation signal ke tor par istemal karte hain short positions mein dakhil hone ke liye, as further decline in asset price ki tawaqqu me rakhte hue.

Bearish Kicker candlestick pattern ek munasib risk-to-reward ratio established karta hai jab yeh kisi ahem level ke qareeb ek palat mein ishara karta hai. Kyunki Bearish Kicker candlestick pattern aksar ek lambi downtrend ya uptrend ki zaroorat nahi hoti hai, isey bearish tasawwur karna chahiye agar haal ki chat apni buland, neechi ya mustaqil taur par hai.

Bearish Kicker Pattern ki Hososeyat

Bearish Kicker pattern ek tezi se palat mein ishara hai ek uptrend mein. Is mein do candlesticks shamil hote hain, pehla lamba white ya green candlestick hota hai, aur doosra lamba black ya red candlestick hota hai jo pehle candlestick ke high ke ooper open hota hai aur pehle candlestick ke low ke neechay close hota hai.

Yeh pattern aksar ek mazboot uptrend ke baad hota hai aur iski pehchan yeh hoti hai ke pehle aur doosre candlesticks ke darmiyan aik gap hota hai, jo ke ek sudden market sentiment ka tabadla darust karta hai. Dono candlesticks lambi hote hain, jo ke mazboot farokht dabao ko darust karte hain, aur doosri candlestick pehle din ke low ke neechay band hoti hai, jo ke yeh darust karta hai ke bear market ne market ka control hasil kiya hai. Iske ilawa, yeh pattern munsil farokht volume ke sath hota hai, jo ke mazboot market shirkat ko darust karta hai. Halankeh traders bearish kicker pattern ko aam tor par aik mazboot farokht ya short positions mein dakhil hone ka ishara samajhte hain, lekin trading faislay se pehle is pattern ko doosri technical indicators aur analysis ke sath tasdeeq karna zaroori hai.

Bearish ki Explaination

"Bearish" ko forex market mein ek neechay ki trend ya jazbat ka ishara samjha jata hai. Bearish jazbat ko kisi khaas stock ya security ki keemat mein kami ko laata hai. Yeh bearish jazbat ek khaas stock ya market se jude hote hain. Yeh darust karta hai ke investors ko market par ek manfi nazar hai aur woh yeh tawaqo rakhte hain ke bearish trends jari rahenge. "Bearish" market, prices mein ek kami ka ishara karta hai.

"bear" ka lafz pehli martaba stock market mein 18th century mein aaya jab isey stock jobbers ke amal ko bayaan karne ke liye istemal kiya gaya tha jahan par apni hisse ko faqa hone ke tawaqo se bechna. Stock jobbers pairs mein kaam karte thay, jin ka rawiya bear apne shikaar ko kaise girta hai us ki tarah tasweer kiya gaya tha. Bearish jazbat mein izafa hone ke sath sath stock market mein bear lafz nichli keemat ko darust karta tha. "Bearish" aur "bullish" lafz trading business ke mukhtalif sectors mein istemal kiye jaate hain market ke halat aur investors ke jazbat ko darust karne ke liye.

Bearish kicker sirf mazeed bearish patterns mein se ek hai. Neeche panch main bearish patterns ke baare mein maloomat di gayi hai bearish kicker ke ilawa.- Hanging Man: Hanging Man pattern aik bearish candlestick pattern hai jo ke ek uptrend ke peak par nazar aata hai. Hanging Man aksar trend ka palat hone ka ishara deta hai. Hanging Man candlestick mein aik choti haqiqi body hoti hai jo ke choti hoti hai, lambi lower shadow hoti hai, aur kisi upper shadow ki kami hoti hai. Pattern ek choti body ko lambi patli line se latka hua dikhta hai. Pattern dikhata hai ke buyers pehle mein control mein thay lekin baad mein sellers unhein maat de gaye, jo ke keemat ko neeche daba gaye, aur ho sakta hai ke koi bhi maayne ki keemat nahin dikhayi gayi ho.

- Dark Cloud Cover: Dark Cloud Cover aik bearish reversal candlestick pattern hai jo ke ek uptrend ke akhir mein hota hai. Dark Cloud Cover do alag alag candlesticks se mushtamil hota hai: pehla aik lamba bullish candlestick hota hai, aur doosra aik lamba bearish candlestick hota hai jo pehle candlestick ke high ke ooper open hota hai lekin dono candlesticks ke darmiyan close hota hai. Ye do candlesticks pattern ko banate hain. Pattern dikhata hai ke bullish momentum ka dabao kam ho gaya hai, aur bear market control hasil kar raha hai. Traders is pattern ko mukhtalif tareeqon se istemal kar sakte hain jaise ke unhein market mein jo lambi positions hain unhein hold kar sakte hain aur wo doosre traders ke signals ko tasdeeq kar sakte hain.

- Bearish Engulfing: Bearish Engulfing pattern aik bearish candlestick pattern hai jo ke ek choti bullish candlestick se musalsal ek bara bearish candlestick ke baad hota hai jo ke pehle candlestick ko poori tarah se gher leta hai. Ye pattern aam tor par bullish se bearish trend mein palat ka darust ishara ke tor par liya jata hai. Bearish Engulfing pattern tab hota hai jab market pehle din ke close ke ooper open hota hai lekin phir din ke doran bohot zyada farokht dabao hota hai jo ke keemat ko neeche daba deta hai. Yeh tab hota hai jab aik bearish candlestick candlestick chart par pehle candlestick ko poori tarah gher leti hai. Traders aur investors aksar is pattern ko istemal karte hain, short selling opportunities dhoondhte hue, kyunke yeh ishara deta hai ke trend mein badalne ke imkaanat bohot zyada hain.

- The Evening Star: The Evening Star pattern yeh dikhata hai ke ek uptrend khatam ho gaya hai. The Evening Star teen candlesticks se mushtamil hota hai: pehla ek bara bullish candlestick hota hai, doosra aik choti candlestick gap ke saath hoti hai, aur teesra aik bara bearish candlestick hota hai jo ke gap ke saath neeche hota hai. Pehla candlestick dikhata hai ke bohot zyada farokht dabao hai, ishara karte hue ke bulls market control mein hain. Dusra candlestick dikhata hai ke market mein indecision hai, jahan par bulls aur bears ek doosre se ladh rahe hain. Teesra candlestick saaf tor par yeh dikhata hai ke palat ka darust hone wala hai, jahan par bulls market ka control chhod rahe hain aur keemat ko neeche daba rahe hain. Traders is pattern ko istemal karte hain apne lambi positions ko exit karne ke liye ya short positions mein dakhil hone ke liye. Wo apni position establish karte hain is pattern ko doosre bullish momentum ko dobara samajhne ke liye.

- The Three Black Crows: The Three Black Crows ek bearish candlestick pattern hai jo ke ek uptrend mein palat ka ishara deta hai. Pattern teen musalsal black candlesticks se mushtamil hota hai jinmein har candlestick ka lamba body hota hai, aur har candlestick mein bohot hi kam ya koi bhi upper wick nahin hoti. Yeh pattern tab hota hai jab har candlestick ka opening price pehle din ke close ke ooper hota hai, aur jab har candlestick ka closing price pehle din ke opening price ke neeche hota hai. The Three Black Crows pattern ek mazboot bearish palat ka saaf ishara hai aur isey usi tarah samjha jana chahiye. Traders aksar is pattern ko ek stock ko bechne ya short positions mein dakhil hone ke liye istemal karte hain. Kyunki pattern dikhata hai ke stock ko neeche jaane ka imkaan hai, isey aksar downtrend ka intezar karne ke liye istemal kiya jata hai.

Traders bearish patterns ko samajhne ke liye mukhtalif technical analysis tools ka istemal karte hain. Magar yaad rakhen ke trading ke kisi bhi faislay se pehle, pattern ko hamesha doosre indicators ke saath tasdeeq kiya jana chahiye.

Bearish Kicker Pattern ka Kaam

Bearish kicker patterns darust karte hain ke market sentiment mein achanak tabdeeli aayi hai, jahan par bears ne keemat ko neeche daba diya hai. Pattern tab hota hai jab aik lamba bullish candlestick ko ek lamba bearish candlestick follow karta hai jo pehle din ke high ke ooper open hota hai lekin pehle din ke low ke neeche close hota hai. Traders aksar is pattern ko ek mazboot bearish signal ke tor par samajhte hain aur isey lambi positions mein bechna ya short positions mein dakhil hone ke liye istemal kar sakte hain mazeed kami ki tawaqqu.

Bearish Kicker pattern aik do-candlestick pattern hai jo ke market mein aik bearish palat ko darust karta hai. Is pattern mein, aik lambi safed ya green candlestick pehle aati hai, jo ke mazboot khareedari ki lehar ko darust karti hai. Phir, kala candlestick ooper pehle din ke high ke ooper open hota hai. Kala candlestick phir neeche jaata hai, do candlesticks ke darmiyan ek gap paida karte hue. Ye gap achanak market sentiment mein tabdeeli ka ishara hai, jahan par bears ka control ban gaya hai.

Bearish Kicker pattern ko pehchanne ke liye, keemat ke chart par do candlestick pattern ko dekhein. Pehli candlestick aik safed (bullish) candlestick honi chahiye, jo mazboot khareedari ki raftar ko dikhata hai. Dusra candlestick aik kaala (bearish) candlestick hona chahiye jo pehle candlestick ke high ke ooper open hota hai, chart par ek bara gap banate hue. Kaale candlestick ka opening price pehle din ke closing price ke neeche hona chahiye. Ye darust karta hai ke pehle din dekhi gayi mazboot khareedari daba di gayi hai mazboot farokht dabao ne, bearish palat ka ishara dete hue.

Trading

Bearish kicker pattern market mein bearish jazbat ko darust karta hai. Yahan do mukhya strategies hain jo investors ko maloom faislay karne aur unke kamiyabi ke chances barhane mein madad karti hain.- Short Selling: Short selling mein, investors umeed karte hain ke share keemat mein kami hone ki umeed hai. Investors phir share ko bechne ki umeed rakhte hain, jahan par share keemat mein kami hone ki umeed hai. Investors phir share keemat mein kami ki umeed rakhte hain. Phir wo umeed rakhte hain ke share ki keemat mein kami hogi. Phir wo share ko sasta karidna chahte hain aur broker ko share waapis kar dete hain. Bechne aur khareedne ke beech ka farq investor ke liye munafa hota hai, koi bhi fees ya biaaj ke saath.

- Analysis : Analysis bhi trading mein risk kam karne ka asar daar tareeqa hai. Investors apni psychological aspects ko kisi khaas company ya market ke exposure ko kam kar ke alag alag asset classes aur sectors mein taqseem karte hain.

- Stop-loss: Stop-loss orders lagane ka maqsad nuqsanain mehdood karna hota hai. Investor apne stock ko ek pehle tay ki gayi keemat par mehfooz karta hai. Wo ek pehle tay ki gayi keemat par apne stock ko mehfooz karne ka ek pehle tay ki gayi keemat tay karte hain taake wo kisi bhi ziada situation se mehfooz rahein, aur yeh bhi khaas situation ko zyada hone se pehle tay ki gayi hoti hai. Expert traders ko bearish market mein is tarah ki trading challenging lagti hai, lekin jab yeh trading strategy yaad rakhi jati hai to yeh nihayat munafa bakhsh hoti hai.

-

#4 Collapse

Bearish Kicker Pattern: Ek Tafseeli Jaiza

Introduction: Bearish Kicker Pattern ek ahem technical analysis tool hai jo kisi security ya market trend ko analyze karne ke liye istemal hota hai. Ye pattern traders ko market ke bearish momentum ka pata lagane mein madad deta hai. Is article mein, hum Bearish Kicker Pattern ke asal kam aur iske tafseelat par ghaur karenge.

Bearish Kicker Pattern Kya Hai? Bearish Kicker Pattern ek candlestick pattern hai jo typically downtrend ke doran dekha jata hai aur ye indicate karta hai ke market ke bearish trend mein taizi aane wali hai. Is pattern ko dekh kar traders apni trading strategies ko adjust karte hain ya phir existing positions ko hedge karte hain.

Bearish Kicker Pattern Ka Asal Kam: Bearish Kicker Pattern ka asal kam market sentiment ko interpret karna hai, khas tor par downtrend ke doran. Is pattern mein do candles shamil hote hain: pehla candle bullish hota hai aur doosra candle bearish hota hai. Pehle candle ka range doosre candle ke range se bara hota hai, jo ke bullish momentum ko darust karta hai. Lekin doosre candle mein bearish reversal hota hai jo ke market ki bullish momentum ko khatam kar deta hai aur bearish trend ka aghaz hota hai.

Bearish Kicker Pattern Ki Pehchan: Bearish Kicker Pattern ki pehchan karna traders ke liye ahem hai taake wo sahi waqt par apni positions ko adjust kar sakein. Is pattern ko pehchanne ke liye traders ko do candles par tawajju deni hoti hai. Pehla candle bullish hota hai aur doosra candle ise neeche gap down karta hai, jisse ke ek "kicking" effect create hota hai, jisse Bearish Kicker Pattern kehlaya jata hai.

Bearish Kicker Pattern Ka Istemal: Bearish Kicker Pattern ka istemal karke traders market ke bearish momentum ko pehchante hain aur apni trading strategies ko us ke mutabiq adjust karte hain. Jab ye pattern dekha jata hai, traders apni long positions ko hedge kar sakte hain ya phir short positions le sakte hain taake wo market ke neeche jaane ke samay faida utha sakein.

Usool-e-Amal: Bearish Kicker Pattern ki asal taqat uske sahi istemal mein hai. Traders ko is pattern ko dusre technical indicators aur market analysis ke saath combine karna chahiye taake wo sahi faislay kar sakein. Iske ilawa, risk management bhi ahem hai, kyun ke har trading position mein khatra hota hai.

Mukhtasir Mukhtasir: Bearish Kicker Pattern ek ahem tool hai jo traders ko market ke bearish momentum ko pehchane mein madad deta hai. Is pattern ki sahi pehchan aur istemal se traders apni trading strategies ko optimize kar sakte hain aur market ke fluctuations ka behtareen jawab de sakte hain. Lekin, jaise har technical indicator ki taraf, is pattern ko bhi dusre indicators ke saath combine karke istemal karna chahiye aur risk management ko mad e nazar rakha jana chahiye. -

#5 Collapse

Bearish Kicker Pattern ka asal kam.

Bearish Kicker Pattern:

Bearish Kicker Pattern ek technical analysis pattern hai jo market mein bearish reversal ko darust karta hai. Yeh pattern candlestick charts par dekha ja sakta hai aur traders ke liye ek mukhya tool hai market direction ko samajhne ke liye.

1. Asal Maqsad: Bearish Kicker Pattern ka asal maqsad market mein bearish reversal ko pehchan'na hai. Yeh pattern ek uptrend ke doran hota hai aur yeh is baat ki nishandahi karta hai ke buyers ke control weaken ho raha hai aur sellers ka dominance barh raha hai.

2. Pehchan: Bearish Kicker Pattern ko pehchanne ke liye do candles ki zarurat hoti hai. Pehla candle ek uptrend ke doran hota hai jo buland volume ke sath shuru hota hai. Dusra candle bhi uptrend mein shuru hota hai lekin sudden ghatayi ki taraf move karta hai aur pehle candle ke neeche close hota hai.

3. Key Features:- Pehla candle buland volume aur positive momentum ke sath shuru hota hai.

- Dusra candle bhi buland volume ke sath shuru hota hai lekin sudden reversal aur neeche ki taraf move karta hai.

- Dusra candle ka close pehle candle ke neeche hota hai, indicating a strong bearish sentiment.

4. Samajhne ka Tareeqa: Bearish Kicker Pattern ko samajhne ka tareeqa straightforward hai. Jab aap do candles ko dekhte hain aur doosri candle pehli candle ke neeche close karti hai, to yeh bearish reversal ka strong signal hai.

5. Trading Strategy: Bearish Kicker Pattern dekhte waqt traders ko short positions enter karne ka mauqa milta hai. Stop loss ko pehli candle ke high ke upar set kiya ja sakta hai aur target price ko previous support level ke qareeb rakha ja sakta hai.

6. Conclusion: Bearish Kicker Pattern ek powerful bearish reversal signal hai jo traders ko market mein bearish movement ka pata lagane mein madad karta hai. Is pattern ko samajhna aur istemal karna traders ke liye zaroori hai taake wo market trends ko samajh sakein aur munafa kam sakein.

-

#6 Collapse

Bearish Kicker Pattern: Ek Tafseeli Jaiza

Bearish Kicker Pattern ek pramukh candlestick chart pattern hai jo market mein bearish reversals ko darust karta hai. Yeh article "Bearish Kicker Pattern: Ek Tafseeli Jaiza" is mudda par roshni daalta hai aur bearish kicker pattern ka asal kam samajhne mein madad karta hai.

Mukhtasar Introduction:

Bearish Kicker Pattern ek bearish reversal pattern hai jo ek uptrend ke baad dekha jata hai. Yeh pattern ek strong bearish signal hai jo market sentiment ko darust karta hai aur bearish trend ki shuruat hone ki sambhavna ko darust karta hai.

Bearish Kicker Pattern Ki Tafseel:

Bearish Kicker Pattern mein, pehle ek bullish candle hota hai jo ek uptrend ko darust karta hai. Iske baad, doosre candle mein ek gap down ke baad price neeche jaata hai, jisse ek bearish kicker pattern ban jata hai.

Kaise Kaam Karta Hai:

Bearish Kicker Pattern ka kaam hota hai bullish trend ke exhaustion ko indicate karna aur potential bearish reversal ko darust karna. Jab doosre candle ka open pehle candle ke close ke neeche hota hai, toh yeh bearish pressure ko signal karta hai.

Identification:

Bearish Kicker Pattern ko pehchane ke liye traders ko do candles par focus karna hota hai. Pehle candle ek uptrend ko darust karta hai jabki doosra candle ek gap down ke saath open hota hai aur pehle candle ke close ke neeche close hota hai.

Mahatva:

arish Kicker Pattern bearish reversal ko darust karta hai aur traders ko warn karta hai ki uptrend khatam ho sakta hai aur market mein bearish trend shuru hone wala hai. Is pattern ke appearance ke baad, traders short positions lete hain ya long positions ko close karte hain.

Trading Strategies:

Bearish Kicker Pattern ke appearance ke baad, traders short positions le sakte hain aur stop-loss orders ko set karke apne risk ko manage kar sakte hain. Confirmatory signals ke liye, volume aur doosre technical indicators ka istemal bhi kiya ja sakta hai.

Akhiri Kathan:

Bearish Kicker Pattern ek mahatvapurna bearish reversal indicator hai jo forex traders ko market ke potential trend reversals ke bare mein agah karta hai. Is pattern ko samajh kar, traders apne trading strategies ko improve kar sakte hain aur market ke mukable mein behtar taur par taiyar ho sakte hain.

-

#7 Collapse

Bearish Kicker Candlestick PatternBearish Kicker Candlestick Pattern ek technical analysis tool hai jo stock market mein istemal hota hai. Ye pattern price action ka ek important indicator hai jo traders ko market trends aur possible reversals ke bare mein peshgoyi karta hai. Yeh pattern ek bearish reversal signal deta hai, yaani ke uptrend ya sideway trend ke baad downward movement ki shuruwat hone ki soorat mein istemal hota hai.

Identification Characteristics (Pehchan Ke Khasiyat):- Do Candlesticks: Bearish Kicker Candlestick Pattern do candlesticks se bana hota hai. Pehla candlestick bullish hota hai aur doosra candlestick bearish hota hai.

- Pehla Candle (Bullish): Pehla candle uptrend ya sideway trend mein hota hai. Iski body long hoti hai aur iski closing price higher hoti hai compared to opening price.

- Doosra Candle (Bearish): Doosra candlestick, jo ke pehle candlestick ke opposite direction mein hota hai, ki opening price pehle candlestick ki body ke andar ya us se neeche hoti hai.

- Size (Hadsay): Doosra candle pehle candle se zyada bara hota hai, jo ke bearish momentum ki strong indication hai.

- No Overlap (Koi overlap nahi): Doosra candlestick pehle candlestick ki body mein overlap nahi karta, jo ke clear indication hai ke trend reverse ho raha hai.

- Volume (Hajm): Ideally, bearish kicker pattern ke sath high volume hona chahiye, jo ke reversal ke strength ko confirm karta hai.

Types (Qisam):

Bearish Kicker Candlestick Pattern ke do types hote hain:- Regular Bearish Kicker: Ismein pehla candle bullish trend mein hota hai aur doosra candle usse opposite direction mein bearish trend start karta hai.

- Strong Bearish Kicker: Ismein doosra candle pehle candle se zyada bara hota hai aur reversal ke liye zyada powerful signal deta hai.

Explanation (Wazahat):

Bearish Kicker Candlestick Pattern ek reversal pattern hai jo market trends ke reversal ko signal karta hai. Jab ek uptrend ya sideway trend ke baad ye pattern appear hota hai, toh yeh indicate karta hai ke bullish momentum khatam ho raha hai aur bearish momentum shuru ho raha hai. Pehla candle bullish hota hai, jo ke existing trend ko represent karta hai, lekin doosra candle jo ke bearish hota hai, uski opening price pehle candlestick ki body ke andar ya us se neeche hoti hai, indicating ke bears ne control lena shuru kar diya hai.

Ye pattern market sentiment ko reflect karta hai aur traders ko future price movement ke bare mein alert karta hai. Agar ye pattern high volume ke sath dikhta hai, toh iska significance aur zyada barh jata hai. Traders ko ye pattern dekh kar apne positions ko adjust karne ka mauka milta hai ya fir naye positions lete hain.

Benefits (Faida):- Reversal Signal: Bearish Kicker Candlestick Pattern ek powerful reversal signal hai jo traders ko market trends ke change hone ki early indication deta hai.

- Clear Identification: Is pattern ki pehchan asani se hoti hai, jisse traders ko reversals ko detect karne mein madad milti hai.

- High Probability: Agar ye pattern high volume ke sath dikhta hai, toh iska probability zyada hota hai aur traders ko reliable signal milta hai.

- Risk Management: Is pattern ko samajh kar, traders apne positions ko manage kar sakte hain aur risk ko minimize kar sakte hain.

- Entry aur Exit Points: Ye pattern traders ko entry aur exit points provide karta hai, jisse unka trading strategy improve hota hai.

Trading Strategy (Trading Policy):

Bearish Kicker Candlestick Pattern ko samajh kar traders apni trading strategy ko improve kar sakte hain. Kuch important points jo is pattern ke sath trading karte waqt yaad rakhe ja sakte hain:- Confirmation: Always ek confirmatory signal ka wait karein, jaise ke doosri technical indicators ya fir next candlestick pattern, before entering a trade.

- Risk Management: Always apne positions ko manage karein aur stop-loss orders lagayein taki loss ko control kiya ja sake.

- Volume Analysis: High volume ke sath ye pattern zyada reliable hota hai, isliye volume analysis bhi consider karein.

- Trend Analysis: Ye pattern trend reversal ko indicate karta hai, isliye trend analysis bhi important hai trading ke liye.

- Patience: Kabhi bhi trade karne se pehle market conditions ko dhyan se analyze karein aur hamesha patience maintain karein.

Bearish Kicker Candlestick Pattern ek powerful tool hai jo traders ko market trends ke reversal ke bare mein alert karta hai. Isko samajh kar aur sahi tarah se istemal karke traders apni trading strategy ko improve kar sakte hain aur better returns generate kar sakte hain.

Conclusion:

-

#8 Collapse

Bearish Kicker Pattern ek technical analysis tool hai jo forex trading, stocks aur other financial markets mein istemal hota hai. Yeh pattern usually price trend ko reverse karne ki nishandahi karta hai. Is article mein, hum Bearish Kicker Pattern ke asal kam aur uske istemal ke tareeqon par ghaur karenge.

1. Bearish Kicker Pattern kya hai?

Bearish Kicker Pattern ek Japanese candlestick pattern hai jo usually uptrend ya sideways trend ke baad aata hai aur downward trend ki shuruwat ki nishandahi karta hai. Yeh pattern do consecutive candles se bana hota hai, jinme se pehla candle bullish hota hai aur doosra candle bearish hota hai. Doosre candle ka opening price pehle candle ke closing price se neeche hota hai, jo ki ek strong reversal signal hai.

2. Bearish Kicker Pattern ke features

Bearish Kicker Pattern ke kuch mukhya features hain jo ise dusre patterns se alag banate hain:- Ek bullish trend ke baad ata hai.

- Do consecutive candles se bana hota hai.

- Doosra candle pehle candle ke closing price se neeche open hota hai.

- Volume ki strong increase hoti hai doosre candle ke sath.

3. Bearish Kicker Pattern ki pehchan

Bearish Kicker Pattern ko pehchanne ke liye traders ko do consecutive candles par nazar rakhni hoti hai. Pehla candle bullish hota hai aur doosra candle bearish hota hai, jisme doosre candle ka opening price pehle candle ke closing price se neeche hota hai. Volume ki bhi strong increase hoti hai doosre candle ke sath.

4. Bearish Kicker Pattern ka asal kam

Bearish Kicker Pattern ka asal kam market sentiment ko represent karna hai. Jab yeh pattern ban jata hai, to yeh indicate karta hai ke bulls ka dominance khatam ho chuka hai aur bears ka dominance shuru ho gaya hai. Iska matlab hai ke market ka trend reverse hone wala hai aur downward movement shuru hone wala hai.

5. Bearish Kicker Pattern ki confirmation

Bearish Kicker Pattern ki confirmation ke liye traders ko aur bhi technical indicators ka istemal karna chahiye jaise ke volume, moving averages, aur support/resistance levels. Agar doosre candle ke sath volume ki bhi strong increase hoti hai, to yeh pattern aur bhi reliable ho jata hai.

6. Bearish Kicker Pattern ka istemal

Bearish Kicker Pattern ka istemal karne ke liye traders ko cautious hona chahiye. Is pattern ki confirmation ke baad, traders short positions le sakte hain ya existing long positions ko close kar sakte hain. Stop loss aur take profit levels ko set karna bhi zaroori hai taake risk ko manage kiya ja sake.

7. Bearish Kicker Pattern ka istemal ke examples

Ek example ke tor par, agar ek stock ka price uptrend mein hai aur phir ek Bearish Kicker Pattern ban jata hai, to yeh indicate karta hai ke uptrend ka khatam ho gaya hai aur downward movement shuru hone wala hai. Traders is signal ko dekh kar apne positions ko adjust kar sakte hain ya naye positions le sakte hain.

In conclusion, Bearish Kicker Pattern ek powerful reversal signal hai jo traders ko market ke trend change hone ki early indication deta hai. Is pattern ko pehchanne aur samajhne ke liye practice aur technical analysis ka hona zaroori hai. Traders ko is pattern ke sath aur bhi technical indicators ka istemal karna chahiye taake unki trading decisions ko validate kiya ja sake. -

#9 Collapse

Forex trade mein Pakistan mein taraqqi karne ke liye, traders ko naye aur mufeed trading strategies aur patterns ko samajhna zaroori hai. Ek aham pattern jise traders istemal karte hain woh hai "Bearish Kicker Pattern". Yeh pattern market ki downward trend ko darust karnay ka mojuda tareeqa hai. Is article mein, hum Bearish Kicker Pattern ke bare mein mazeed tafseelat se guftagu karenge, is ke faide aur kaise is ko forex trade mein istemal kiya ja sakta hai, khaas tor par Pakistan ke traders ke liye.

1. Bearish Kicker Pattern: Tareef aur Asal Kam

Bearish Kicker Pattern ek reversal pattern hai jo bearish trend ko indicate karta hai. Is pattern mein do candles shamil hote hain. Pehla candle bullish trend ko dikhata hai jabke doosra candle isay khatam karta hai aur ek naye bearish trend ko shuru karta hai. Is pattern ko asal kam se pehchanne ka tareeqa yeh hai ke doosre candle ka open price pehle candle ke close price se ziada hota hai.

2. Bearish Kicker Pattern Ka Tafseeli Mutala

Bearish Kicker Pattern ko samajhne ke liye, zaroori hai ke traders is ki tafseelat ko samajhain. Jab ek bullish trend mein pehla candle ban jata hai, jo ke upward move ko dikhata hai, aur phir doosra candle yeh trend khatam karke ek naye bearish trend ko shuru karta hai, tab Bearish Kicker Pattern complete hota hai. Doosre candle ka open price pehle candle ke close price se ziada hota hai, iski wajah se yeh pattern bearish reversal ko darust karta hai.

3. Bearish Kicker Pattern Ki Ahmiyat

Bearish Kicker Pattern ka istemal karke traders ko market ke trend ki reversal ki pehchan karna asaan ho jata hai. Is pattern ki madad se traders market mein aane wale bearish trend ko pehle hi detect kar sakte hain, jo unhe loss se bachane mein madad karta hai. Pakistan ke forex traders ke liye, yeh pattern ek aham tool ho sakta hai taake woh apne trades ko behtar tareeqay se manage kar sakein.

4. Bearish Kicker Pattern Ka Istemal

Bearish Kicker Pattern ka istemal karne ke liye, traders ko market ke charts ko regularly monitor karna zaroori hai. Jab ek potential Bearish Kicker Pattern detect hota hai, traders ko entry aur exit points tay karna chahiye. Is pattern ko confirm karne ke liye, traders ko doosre technical indicators aur tools ka bhi istemal karna chahiye taake woh apni trades ko confirm aur successful bana sakein.

5. Bearish Kicker Pattern Ka Istemal Forex Trade Mein

Forex trade mein Bearish Kicker Pattern ka istemal karne ka tareeqa aam hai. Pakistan ke traders ko is pattern ko samajhna aur istemal karna zaroori hai taake woh market ke fluctuations ko sahi tareeqay se samajh sakein aur apne trades ko sahi waqt par execute kar sakein. Is pattern ki madad se traders apni trading strategies ko improve kar sakte hain aur market mein behtar tareeqay se perform kar sakte hain.

6. Bearish Kicker Pattern Ki Mazid Tafseelat

Bearish Kicker Pattern ke istemal se pehle, traders ko iski mazid tafseelat ko samajhna zaroori hai. Is pattern ko samajhne ke liye, traders ko market ke trends aur price action ko ghaur se dekhna chahiye. Iske alawa, traders ko technical analysis ke concepts ko bhi samajhna zaroori hai taake woh Bearish Kicker Pattern ko sahi tareeqay se identify kar sakein.

7. Bearish Kicker Pattern: Akhri Guftagu

Pakistan mein forex trade ka shauq rakhne walay traders ke liye, Bearish Kicker Pattern ek mufeed tool ho sakta hai. Is pattern ki madad se traders market ke reversals ko pehchan sakte hain aur apne trades ko behtar tareeqay se manage kar sakte hain. Yeh pattern trading strategies ko improve karne mein madadgar sabit ho sakta hai aur traders ko market ke movements ko samajhne mein madad karta hai. Is liye, Bearish Kicker Pattern ko samajhna aur istemal karna har trader ke liye zaroori hai jo forex trade mein kamiyabi hasil karna chahta hai.

Naseehat: Yeh article sirf taaleem o ma'arif ke maqsad ke liye hai aur kisi bhi tarah ki tijarat ya maal ki khareed o farokht ke liye sahoolat nahi pesh karta. Forex trade mein invest karne se pehle, zaroori hai ke traders apne maali ma'ashiyat ko ghor se dekhein aur maharatmand mashwara lain. -

#10 Collapse

Bearish Kicker Pattern

Bearish Kicker Pattern ek bearish reversal candlestick pattern hai jo typically uptrend ke baad dekha jata hai aur bearish trend ke shuru hone ka indication deta hai. Yeh pattern ek strong selling pressure ko darust karta hai aur traders ko potential downtrend ke bare mein alert karta hai.

Neeche diye gaye points Bearish Kicker Pattern ko samajhne mein madad karenge:- Appearance:

- Bearish Kicker Pattern do candlesticks se banta hai.

- Pehla candlestick ek uptrend ke doran dekha jata hai aur typically bullish hota hai.

- Dusra candlestick pehle candlestick ke upper range mein open hota hai aur pehle candlestick ki body ko completely cover karta hai.

- Dusra candlestick ki body typically pehle candlestick ki body se neeche open hoti hai aur neeche close hoti hai.

- Interpretation:

- Bearish Kicker Pattern ek strong bearish reversal signal hai jo uptrend ke khatam hone ya trend reversal ke possibility ko darust karta hai.

- Dusra candlestick pehle candlestick ki range ko puri tarah se cover karta hai, jo bearish momentum ki strength ko darust karta hai.

- Is pattern mein sellers ne control hasil kiya hota hai aur bullish sentiment ko overwhelm kar diya jata hai, jisse price ka reversal hota hai.

- Confirmation:

- Bearish Kicker Pattern ko confirm karne ke liye, traders ko dusri candlestick ke closing price ko closely monitor karna chahiye.

- Agar dusri candlestick ke closing price pehli candlestick ke opening price se zyada nichayi hoti hai, toh ye pattern ki validity ko strengthen karta hai.

- Volume bhi ek important factor hai confirmation ke liye. Agar dusri candlestick ke volume zyada hai, toh pattern ki strength aur bhi zyada hoti hai..

Overall, Bearish Kicker Pattern ek powerful bearish reversal signal hai jo traders ko uptrend ke potential khatam hone ke bare mein alert karta hai. Is pattern ko samajhne ke liye, traders ko candlestick ke formations ko closely observe karna chahiye aur dusri technical indicators ke sath bhi combine karke istemal karna chahiye trading decisions ke liye.

- Appearance:

-

#11 Collapse

Bearish Kicker Pattern ka asal kam:

bearish kicker patteren aik candle stuck patteren hai jo up trained mein taizi se ulat jane ki nishandahi karta hai. yeh do mom btyon par mushtamil hai, pehli lambi safaid ya sabz mom batii hai, aur doosri lambi siyah ya surkh mom batii hai jo pichlle din ki oonchai se oopar khulti hai aur pichlle din ki kam se neechay band hoti hai .

kicker patteren aik do baar wala candle stuck patteren hai jo kisi asasay ki qeemat ke rujhan ki simt mein tabdeeli ki paish goi karta hai. yeh namona do mom btyon ke doraniye mein qeemat mein taizi se ulat phair ki khasusiyat rakhta hai. tajir is ka istemaal is baat ka taayun karne ke liye karte hain ke market ke shurka ka kon sa group simt ke control mein hai .

patteren security ke hawalay se sarmaya karon ke rawaiyon mein mazboot tabdeeli ki taraf ishara karta hai. simt mein tabdeeli aam tor par company, sanat, ya maeeshat ke baray mein qeemti maloomat ke ajra ke baad hoti hai .

ahem nakaat :

kicker patteren candle stick patteren ki aik qisam hai jo kisi asasay ki qeemat ke rujhan ki simt mein tabdeeli ki pishin goi karti hai .

yeh namona do mom btyon ke doraniye mein qeemat mein taizi se ulat phair ki khasusiyat rakhta hai .

tajir is baat ka taayun karne ke liye kukkar patteren ka istemaal karte hain ke market ke shurka ka kon sa group simt ke control mein hai .

patteren security ke hawalay se sarmaya karon ke rawaiyon mein mazboot tabdeeli ki taraf ishara karta hai jo aam tor par kisi company, sanat ya maeeshat ke baray mein qeemti maloomat ke ajra ke baad hota hai .

kicker patteren ya to taizi ya mandi ke hotay hain .

kicker patteren ko samjhna

stock market musabiqati kharidaron ( bail ) aur baichnay walay ( balow ) ki khasusiyat rakhti hai. un khiladion ke darmiyan jung ki musalsal kashmakash wohi hai jo mom btyon ke namoonay banati hai. candle stuck charting ki ibtida Japan mein 1700 ki dahai mein tayyar ki gayi aik taknik se hui jis mein chawal ki qeemat ka pata lagaya gaya. mom batian kisi bhi maya maliyati asasay jaisay stock, future aur ghair mulki currency ki tijarat ke liye aik mozoon taknik hain .

kicker patteren ko sab se ziyada qabil aetmaad reversal patteren mein se aik samjha jata hai aur aam tor par company ke bunyadi usoolon mein dramayi tabdeeli ki nishandahi karta hai. kukkar patteren aik ulat palat patteren hai, aur yeh aik gape patteren se mukhtalif hai, jo oopar ya neechay ke farq ko zahir karta hai aur is rujhan mein rehta hai. patteren aik jaisay nazar atay hain, lekin har aik ka matlab kuch mukhtalif hota hai .

kicker patteren ya to taizi ya mandi ke hotay hain. blush kukkar bearish candle ke sath shuru karte hain aur phir taizi ka farq dikhata hain. bearish kickers taizi se mom batii se shuru karte hain aur phir bearish gape neechay dikhata hain .

kicker patteren kaisay kaam karta hai .

kicker patteren ka mushahida karne walay taajiron ko, aisa lagta hai ke qeemat bohat taizi se barh gayi hai, aur woh wapsi ka intzaar kar satke hain. taham, woh tajir –apne aap ko yeh khwahish mehsoos kar satke hain ke woh is position mein daakhil hotay jab unhon ne asal mein kukkar patteren ki nishandahi ki ho .

agarchay kicker patteren mazboot bail ya reechh ke jazbati isharay mein se aik hai, patteren nayaab hai. ziyada tar pesha war tajir kisi nah kisi simt mein taizi se ziyada radd amal zahir nahi karte hain. taham, agar aur jab kukkar patteren khud ko paish karta hai, to money manager fori notice letay hain .

kicker patteren takneeki tajzia karon ke liye dastyab sab se taaqatwar signals mein se aik hai. is ki mutabqat is waqt barh jati hai jab yeh ziyada kharidi hui ya ziyada farokht shuda marketon mein hoti hai. patteren ke peechay do mom batian nazar anay wali ahmiyat rakhti hain. pehli mom batii khulti hai aur mojooda rujhan ki simt chalti hai aur doosri mom batii pichlle din ke isi khulay par khulti hai ( aik khalaa khula sun-hwa ) aur phir pichlle din ki mom batii ke mukhalif simt mein jata hai .

mom btyon ke jism bohat se tijarti plate forms par mukhalif rang ke hotay hain, jo sarmaya karon ke jazbaat mein dramayi tabdeeli ka aik rangeen display banatay hain. kyunkay kukkar patteren sarmaya karon ke ravayye mein numaya tabdeeli ke baad hi hota hai. isharay ka aksar market psycology ya ravayye ki maalyaat ke deegar iqdamaat ke sath mutalea kya jata hai .

bearish kicker candle stuck patteren ki misaal

bearish kicker candle stuck chart patteren ki wishosneta is waqt ziyada hoti hai jab yeh up trained par bantaa hai ya ziyada khareeday hue ilaqay mein bantaa hai .

din 1 par, aik candle stuck oopar ka rujhan jari rakhti hai aur is wajah se fitrat mein taizi hai. jab up trained mein bantaa hai to is ki apni koi ahmiyat nahi hoti .

din 2 par, aik bearish candle stuck namodaar hoti hai. candle stick isi qeemat par khulti hai jis qeemat par pichlle din ( ya aik waqfa neechay ) aur phir din 1 candle ki mukhalif simt ki taraf jata hai. is patteren ke durust honay ke liye, dosray din ki mom batii pehlay din ki mom batii se ya is se neechay khlni chahiye. tajir aam tor par tawaqqa karte hain ke dosray din ki mom batii se pehlay aik waqfa kam honay se dosray din honay ke baad qeematon mein kami ke imkanaat barh jayen ge .

bearish kukkar patteren aik do baar wala candle stuck patteren hai jo kisi asasay ki qeemat ke rujhan ki simt mein aik ahem tabdeeli ki nishandahi karta hai, jo market ke shurka ke aik group ko control karne ki akkaasi karta hai. bearish kukkar maliyati madlng mein aik aisa intizam hai jo apni makhsoos do baar candle stuck ki tashkeel ke douran qeemat mein zabardast kami se pehchana jata hai. tajir is ka istemaal yeh maloom karne ke liye karte hain ke market ka kon sa tabqa simt ka incharge hai .

bearish kicker patteren japani candle stuck charting ke ibtidayi dinon se hi hai, jisay pehli baar 1990 ki dahai mein maghribi duniya mein laya gaya tha. patteren ko jab pehli baar release kya gaya tha to usay" chore diya gaya bacha" patteren ka naam diya gaya tha, lekin baad mein release mein usay" bearish kicker" patteren ke tor par dobarah brand kya gaya tha .

bearish kicker ka bunyadi faida yeh hai ke yeh is simt mein tabdeeli ka wazeh ishara paish karta hai jis mein qeemat ka rujhan barh raha hai. woh tajir jo qeemat mein mazeed kami se pehlay market ko mukhtasir karne ya lambi pozishnon se bahar niklny mein dilchaspi rakhtay hain. yeh maloomat mufeed hai .

bearish kicker patteren kya hai ?

bearish kicker aik candle stuck patteren hai jo do mom btyon par mushtamil hota hai jo qeemat mein izafay ke douran hoti hai. bearish kukkar patteren ko qeemat mein achanak aur dramayi tabdeeli se pehchana jata hai jo ke is ke paas mojood do baar candle stuck ki makhsoos tashkeel ke douran hota hai. tajir aksar mandi ke rujhan ke isharay ke tor par bearish kukkar patteren par inhisaar karte hain, jo inhen asason ki khareed o farokht ke baray mein taleem Yafta faislay karne ke qabil banata hai .

patteren is waqt hota hai jab aik lambi safaid ya sabz candle stick ke baad aik gape up hota hai aur doosri siyah ya surkh candle stick jo pichlle din ki oonchai se oopar khulti hai lekin phir pichlle din ki kam se neechay band hojati hai. doosri candle stuck pehlay wali ko poori terhan lapait layte hai, jis se bearish inglifing patteren bantaa hai. neechay di gayi tasweer dekhen .

bearish kicker patteren ki ahmiyat is waqt barh jati hai jab yeh ziyada khareeday ya ziyada farokht honay walay ilaqon mein hota hai. is se zahir hota hai ke market intehai had tak pahonch chuki hai aur is ka ulat phair qareeb aa sakta hai. is se pata chalta hai ke market ke shurka ne control haasil kar liya hai, aur market ke is terhan ke halaat mein jab taizi se kicker patteren zahir hota hai to aik mazboot oopar ki taraf bherne ka imkaan hota hai, tajir aksar is patteren ko lambi pozishnon mein daakhil honay ke liye tasdeeqi signal ke tor par istemaal karte hain, is mein mazeed taizi ki tawaqqa rakhtay hue asasa ki qeemat .

bearish kicker patteren ki khususiyaat kya hain ?

bearish kicker patteren aik candle stuck patteren hai jo up trained mein taizi se ulat jane ki nishandahi karta hai. yeh do mom btyon par mushtamil hai, jis mein pehli lambi safaid ya sabz mom batii hai, aur doosri lambi siyah ya surkh mom batii hai jo pichlle din ki oonchai se oopar khulti hai aur pichlle din ki kam se neechay band hoti hai .

Akhri alfaaz :

bearish kicker candle stuck patteren khatray se inaam ka behtar tanasub banata hai jab ke yeh buland qeematon ke qareeb chart par ulat palat dekhata hai. is ki wajah yeh hai ke bearish kicker candle stuck patteren ko qeemat mein barray neechay ke rujhan ya oopar ke rujhan ke baad tashkeel nahi dena parta hai. is baat se koi farq nahi parta hai ke mojooda chart oopar ki taraf, neechay ki taraf, ya kinare ki taraf barh raha hai, is signal ki mojoodgi ko mandi se tabeer kya jana chahiye .aayiyae aik misaal dekhte hain. farz karen ke tata motors ke stak ki qeemat kuch arsay se aik taraf ya is se bhi thori oopar ki taraf barh rahi hai. achanak bearish kukkar candle stuck patteren ubhar sakta hai, jo is baat ki nishandahi karta hai ke market ka control sambhaal liya hai aur taizi se neechay ka rujhan ho sakta hai. is patteren ki zahiri shakal taajiron ko short positions mein daakhil honay aur stock ki qeemat mein kami se mumkina tor par munafe haasil karne ka mauqa faraham kar sakti hai .

-

#12 Collapse

Bearish Kicker Pattern ek candlestick pattern hai jo price action analysis mein istemal hota hai aur typically bearish reversal ke indication ke liye dekha jata hai. Ye pattern bullish trend ke doran form hota hai aur ek potential trend reversal ko signal karta hai.

Bearish Kicker Pattern ka formation kaise hota hai:- Pehla Candlestick: Pehla candlestick ek uptrend ke doran form hota hai aur typically ek long green (bullish) candle hota hai.

- Dusra Candlestick: Dusra candlestick, jo pehle candlestick ke opposite direction mein form hota hai, ek long red (bearish) candle hota hai. Iska open price pehle candlestick ke close price ke above hota hai aur close price pehle candlestick ke low price ke below hota hai.

- Bearish Reversal Signal: Bearish Kicker Pattern ek potential bearish reversal signal provide karta hai. Is pattern ka formation bullish trend ke doran hota hai aur ek sudden shift in sentiment ko indicate karta hai, jahan bulls se bears ki dominance ho jati hai.

- Confirmation: Bearish Kicker Pattern ko confirm karne ke liye, traders doosre technical indicators aur price action signals ka istemal karte hain. Agar pattern ke reversal ke baad price mein further downward movement hota hai, toh ye confirmatory signal hai.

- Entry aur Exit Points: Traders Bearish Kicker Pattern ko dekhkar trading decisions lete hain. Agar pattern confirm hota hai, toh traders short positions lete hain aur stop-loss aur target levels ko set karte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#13 Collapse

**Bearish Kicker Pattern Ka Asal Kam**

**1. Pehchaan:**

- Bearish Kicker pattern ek candlestick pattern hai jo market mein bearish reversal signal deta hai. Yeh pattern trend ke badalne aur price ki downward movement ke indication ke liye use hota hai.

**2. Banawat:**

- **Candlestick Formation:** Bearish Kicker pattern do candlesticks se mil kar banta hai. Pehli candlestick ek strong bullish candle hoti hai jo previous trend ko continue karti hai. Doosri candlestick ek strong bearish candle hoti hai jo pehli candle ke open price se gap down ke sath open hoti hai.

- **Gap:** Is pattern ka core element gap hota hai. Doosri candle pehli candle ke open price ke niche gap down ke sath open hoti hai, jo bearish sentiment ko indicate karta hai.

**3. Characteristics:**

- **Bearish Reversal:** Bearish Kicker pattern ek strong bearish reversal signal hota hai. Yeh pattern uptrend ke baad banta hai aur iske baad market mein downward trend shuru hota hai.

- **Gap Down:** Gap down ki wajah se market mein bearish pressure ka indication milta hai. Is gap ke saath open hone se sellers ka dominance clear hota hai.

**4. Interpretation:**

- **Trend Reversal:** Jab Bearish Kicker pattern form hota hai, to yeh indicate karta hai ke current bullish trend ka end ho gaya hai aur market mein downward movement shuru ho sakti hai.

- **Confirmation:** Pattern ko confirm karne ke liye, traders ko second bearish candlestick ke baad price movement aur volume ko observe karna chahiye. Agar price ne lower levels test kiye aur volume increase hua, to signal strong hota hai.

**5. Trading Strategy:**

- **Entry Points:** Traders Bearish Kicker pattern ke formation ke baad sell orders place karte hain. Yeh sell order tab place kiya jata hai jab pattern complete hota hai aur bearish confirmation milti hai.

- **Stop-Loss:** Stop-loss ko pehli bullish candlestick ke high ke thoda sa upar rakha jata hai, taake agar market trend reversal nahi hota to loss minimize ho sake.

- **Take-Profit:** Take-profit levels ko bearish target levels ke hisaab se set kiya jata hai, jo support levels aur previous price action par base hota hai.

**6. Importance:**

- **Reversal Signal:** Bearish Kicker pattern ek reliable reversal signal hai jo traders ko market trend ke badalne ke indication se aware karta hai.

- **Trend Analysis:** Yeh pattern market ke overall trend analysis aur future price movements ko predict karne mein madad karta hai.

**7. Limitations:**

- **False Signals:** Bearish Kicker pattern kabhi-kabhi false signals bhi de sakta hai, especially volatile markets mein. Isliye, pattern ko other technical indicators aur market analysis ke sath confirm karna zaroori hai.

- **Gap Filling:** Kabhi-kabhi, market gap ko fill karne ke liye price temporarily upar ja sakti hai. Yeh traders ko false signals de sakta hai, isliye cautious approach zaroori hai.

In points ke zariye, aap Bearish Kicker pattern ko forex trading mein samajh kar effective trading decisions le sakte hain aur market trends ko accurately analyze kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:06 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим