Information About Hikkaki Candlestick Pattern:

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Information About Hikkaki Candlestick Pattern: Dear Friends Agar hum Hakkaki CandleDear Sisters an Brothers Hikkaki Candlestick Pattern bohot zyada familiar nahi hai kyunke most member is candlestick pattern se related essential information nahi jante jiski vajah se yoh candlestick pattern bohot zyada well-known nahiJab marketplace ek uptrend mein hai aur Hikkake sample form hota hai, to ye bearish reversal ko recommend karta hai. Yani ke, market ka fashion alternate hone wala hai aur ab downward movement hone ki sambhavna hai. Isi tarah, agar marketplace downtrend mein hai aur Hikkake pattern shape hota hai, to ye bullish reversal ko indicate karta hai, jise uptrend ka begin samjha ja sakta hai.N nai jab ap market mein is candlestick pattern ko observe karte hain tou isko aap further 2 foremost categories mein divide kar sakte hain jisko ap bullish Hikkaki aur bearish Hikkaki ke sakte hain is associated primary apko kuch vital information percentage kar deta hun jo apke liye beneficial ho sakti hai aur aapki buying and selling mein apki bohot zyada help kar sakti hai.Stick Pattern ko ignore kar dety hain to humara loss increase karty karty humara account wash ho sakta hai isi liye soch samajh kar buying and selling essential access or go out bohot zaroori hota hai ap ko chahiye ke dil se kaam karain or ek acha exchange kar ke ek acchi earning ki koshish karain ta ke ap ko kamyabi mil saky ap ki mehnat or ek achi trading ap ki kamyabi hoti hai jis se ap kamyabi ke sath apna work kar sakty hain. Study of Hikkaki Candlestick Pattern: Dear Students Jab ap Hikkaki Candlestick Pattern ko have a look at kar rahe hote hain to ismein apko maximum candlestick sample long body wali milti hai jinko ap marobuzu candlestick ka naaIske alawa, HikIske alawa, Hikkake pattern ka istemal lengthy-term aur quick-term buying and selling mein dono mein kiya ja sakta hai. Ye ek flexible device hai jo different timeframes par kaam karta hai. Traders ko chahiye ke is sample ko dhyan se samjhe aur marketplace analysis mein sahayak banaye rakhe, taaki unhe behtar buying and selling selections lene mein madad mile.Kake sample ka istemal long-term aur brief-term buying and selling mein dono mein kiya ja sakta hai. Ye ek versatile tool hai jo extraordinary timeframes par kaam karta hai. Traders ko chahiye ke is sample ko dhyan se samjhe aur marketplace evaluation mein sahayak banaye rakhe, taaki unhe behtar buying and selling choices lene mein madad mile.M dete hain. Yah candlestick pattern hamesha distinct vital candlesticHikkake Candlestick Pattern ek technical analysis device hai jo marketplace tendencies ko perceive karne mein madad karta hai. Is sample ka naam Japanese phrase "hikkake," se aaya hai, jo "to entice" ya "to catch" ko symbolize karta hai. Ye sample buyers ko false breakouts ya fashion reversals ko samajhne mein madad karta hai.Okay in keeping with include hota hai jismein extraordinary critical candlestick sample of ko technical analysis ko perfect karne ke liye Kuch symptoms provide kar rahi hoti hai jab ap is candlestick pattern ko properly research karte hain aur apni trading ko follow karte hain tou aisy apko maximum blessings milane ki chances ho sakte hain isliye is candlestick pattern ko nicely learn karna aur apni trading consistent with respond karna aapke liye ideal ho sakta hai. -

#3 Collapse

Assalamu Alaikum Dosto!

Hikkaki Candlestick Pattern

Hikkake pattern ek khaas 3-bar candlestick formation hai jo aane wale trend reversal ki nishani hai. Ye Japanese rice trader Munehisa Homma ne pehchan aur wazeh kiya. Hikkake Pattern, jo "hi-ka-keh" ki tarah ada kiya jata hai, ek chart formation hai jo technical analysis mein istemal hota hai taake potential market reversals ya continuation breakouts ko pehchana ja sake.

21st century ke shuru ke volatile financial markets ka jawab dete hue, ye asani aur karagar hone ke liye waseela ban gaya hai. 2003 mein Daniel L. Chesler ne introduce kiya gaya yeh Japanese-named pattern, jo "hook, ensnare, trap" ka matlab hota hai, aksar traders ko galat positions mein daal deta hai apni deceptive setup ki wajah se jo ke series of candlestick bars ko shamil karta hai.

Pattern ka naam "Hikkake" Japani word se aata hai, jo trick, trap, ya snare ka matlab hai. Ye ek apt description hai kyunke Hikkake traders ko ghumati hai phir tezi se opposite direction mein move karti hai. Hikkake pattern ka key function traders ko aik potential sharp reversal ki taraf alert karna hai ek sustained trend ke baad. Ye traders ko emerging trend se faida uthane ka early entry opportunity deta hai.

Hikkake Pattern Formation

Structurally, Hikkake pattern teen candlesticks se milta hai:- Pehli candle ka ek bara real body hota hai jo current trend direction ko continue karta hai. Isay lead bar kehte hain.

- Doosri candle ek inside bar hota hai jo puri tarah se pehle bar ke andar hota hai. Iski real body bhi lead bar ke opposite color mein hoti hai, jo reversal ki taraf ishara karti hai.

- Teesri bar ek outside bar hoti hai jo inside bar ke upar ya niche gap karta hai aur iski close near its high/low hoti hai. Ye trend change ko confirm karta hai.

Iske ilawa, teesri candle ka color yeh bhi batata hai ke yeh bullish ya bearish pattern hai:- Bullish Hikkake: teesri bar green hoti hai, aur inside bar ke upar gap karti hai.

- Bearish Hikkake: teesri bar red hoti hai, aur inside bar ke niche gap karti hai.

Inside aur outside bars ke darmiyan ki size ya breakaway gap ahmiyat rakhti hai. Gap ko chart par saaf dikhane ke liye woh kafi bara hona chahiye.

Hikkake Pattern ke Components

Hikkake Pattern actionable information faraham karta hai, jo traders ko positions strategically dakhil ya bahar karne ki ijazat deta hai. Isay price chart par asani se pehchana ja sakta hai, ye traders ke mukhtalif experience levels ke liye mufeed hai aur alag-alag markets aur time frames par lagaya ja sakta hai, jo ke financial trading mein aik versatile tool banata hai.- Setup Bar

Hikkake pattern ka pehla component setup bar hota hai. Ye bar pattern ka initial range set karta hai ek khaas high aur low price level ke zariye. Ye period mein achieve ki gayi highest aur lowest price points hote hain, munasib tor par.

Traders in levels ko carefuly observe karte hain kyunke yeh potential resistance (high) aur support (low) zones ka kaam karte hain. Setup bar kisi bhi shape aur size ka ho sakta hai, aur isay kisi khaas trend ko indicate karne ki zaroorat nahi hoti. Ye essentially context set karta hai jismein Hikkake pattern develop ho sakta hai. - Inside Bar

Pattern ka doosra bar, jise inside bar kehte hain, Hikkake pattern ke development ke liye crucial hota hai. Ye setup bar ke range ke andar banta hai, jo ke yeh dikhata hai ke iski high aur low setup bar se kam ya zyada hai.

Ye characteristic 'inside day' ko banata hai, jo ke volatility mein contraction dikhata hai. Traders isay market mein indecision ka waqt samjhte hain, jahan na buyers na sellers puri control le sakte hain. Inside bars aam tor par consolidations ke saath jata hain, jahan market participants mazeed maloomat ka intezar karte hain pehle direction ko commit karne se pehle. - Confirmation Bar

Hikkake pattern ka final component confirmation bar hota hai. Ye pattern ko "trapping" traders ke reputation hasil karata hai. Shuru mein, confirmation bar setup bar ke high ya low ke bahar break out hota hai, traders ko potential trend mein vishwas karne ke liye majboor karta hai.

Magar, phir ye direction change karta hai aur opposite direction mein aik significant move karta hai, effectively unhe jinhe false breakout par amal kiya gaya tha ko trap karta hai.

Ye break-and-reversal action Hikkake pattern ka main characteristic hai aur potential naye trend ka shuru hone ki nishani hai. Isay "Hikkake" isliye kehte hain kyunke ye term Japanese mein "hook" ya "trap" ko darust karta hai.

Types of Hikkake Figure

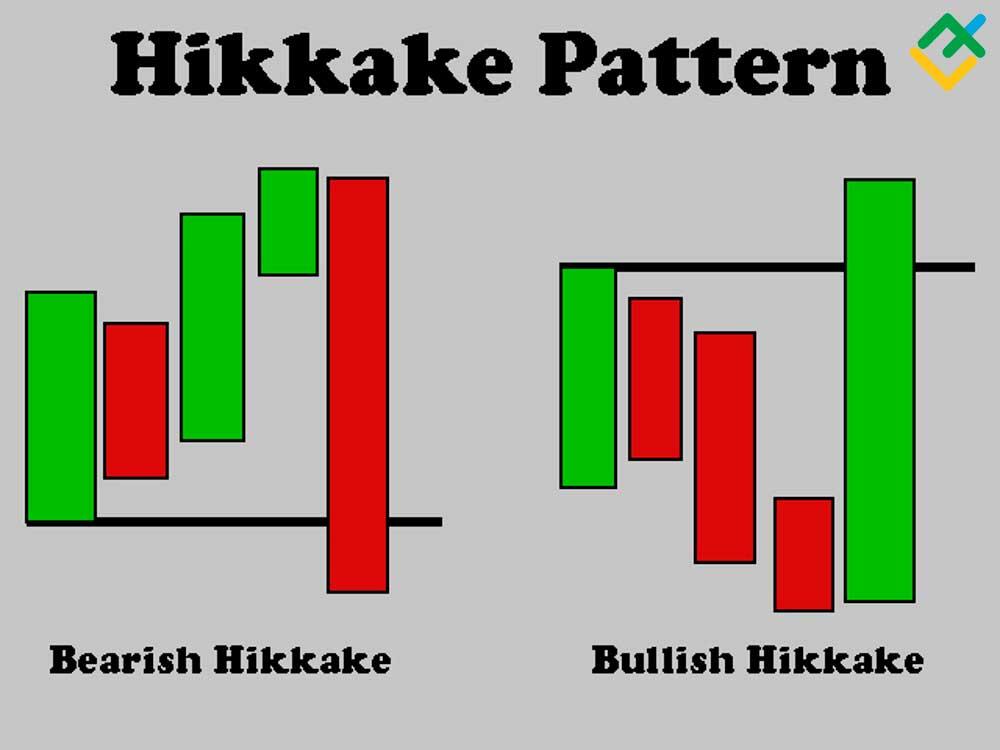

Hikkake pattern ke do main types hote hain - bullish aur bearish. Pehle trend ki direction tay karta hai ke Hikkake pattern uptrending hai ya down. Chalo dono version ko dekhte hain:

Bullish Hikkake

Bullish Hikkake aik reversal formation ke tor par aata hai aik downtrend ke end par. Yahan uski typical characteristics hain:- Pehla Trend: strong, well-defined downtrend ke saath kuch red candles jo price ko neeche le ja rahe hain.

- Lead Bar: downward direction ko continue karta hai aik long red candle aur lower low ke saath.

- Inside Bar: a small-bodied candle, often a Hammer or Doji, jo lead bar ke andar hota hai.

- Breakaway Gap: inside bar high aur outside bar low ke darmiyan chhod di gayi jagah.

- Outside Bar: a long green candle jo inside bar ke upar gap karta hai aur apni high ke qareeb close hoti hai.

Jab traders overextended drop ke baad price ko gapping dekhte hain, ye panic short-covering aur positions ko flip karne ka signal deta hai naye uptrend ko ride karne ke liye.

Bearish Hikkake

Bearish Hikkake ek established uptrend ke baad hota hai aur downside mein hone wale aane wale reversal ka izhar karta hai. Typical features include:- Pehla Trend: strong, well-defined uptrend ke saath kuch green candles jo price ko upar le ja rahe hain.

- Lead Bar: upward move ko extend karta hai aik long green bullish candle.

- Inside Bar: a small-bodied opposite-colored candle contained within the lead bar.

- Breakaway Gap: inside bar low aur outside bar high ke darmiyan chhodi gayi jagah.

Is baar, downward gap signals karta hai ke buyers jaldi se longs se bahar nikal rahe hain, sellers ko control lena shuru karne ke liye aik bearish impulse shuru karne ke liye. Jaise hum dekh sakte hain, candles ke color, order, aur relationship ki wajah se Hikkake patterns ko type aur direction mein classify karna kafi zaroori hai.

Hikkake Pattern ki Identification

Aik valid Hikkake formation detect karne ke liye kai key criteria check karna zaroori hai. Chalo unko detail mein dekhte hain.

- Pehla Trend Structure

A Hikkake ek extend price trend ke baad appear ho sakta hai - ya to bullish ya bearish. Ek pehle trend ke saath, pattern ki ahmiyat hoti hai.- Bullish Hikkake: lambi red candles dhikhai deni chahiye jo strong downtrend ko dikhate hain.

- Bearish Hikkake: kai green candles dhikhai deni chahiye jo uptrend ko dikhate hain.

Trend smooth hona chahiye aur ek direction mein consistent buying/selling pressure dikhana chahiye. - Lead Bar

Lead bar Hikkake sequence ko drive karta hai by trend's direction. Uski positioning aur size ka analyze karna zaroori hai:- Higher/lower established trend ko continue karta hai.

- Conviction ko dikhane wala long real body hota hai.

- Pehle candles se higher high ya lower low banata hai.

- Inside Bar

- Inside bar ek reversal signal hai jo trend ko briefly pause karta hai.

- Lead bar ke real body ke andar banta hai.

- Opposite color real body dikhata hai, indicating indecision.

- Lead candle ke mukable significantly smaller real body hoti hai.

- Breakaway Gap

- Ye defining gap inside aur outside bars ke darmiyan hai jo Hikkake ko alag banata hai.

- Inside aur outside candles ke darmiyan ki blank space ki size pronounced hoti hai.

- Inside aur outside candles ke darmiyan price overlap nahi hota hai.

- Outside Bar

- Outside bar naye trend direction ko reaffirm karta hai.

- Inside bar ke high/low ke bahar close hota hai.

- Lead candle ke opposite color real body hota hai.

- Ye extreme high ya low level ke near close hota hai.

- Har criteria ko methodically check karke, aap Hikkake patterns ko reliably detect kar sakte hain.

Trading

Jab aap apne charts par ek sahi se bana Hikkake dekhte hain, to aane wale trend reversal se faida uthane ke liye kuch effective tareeqe hote hain.- Pullback Entry

Aik strategy ye hai ke Hikkake complete hone ke baad throwback ya pullback ka wait karen breakaway gap tak. Ye area aksar resistance/support ke taur par kaam karta hai.

Aap improved prices par enter kar sakte hain lower risk ke saath jab price gap mein wapas correction karta hai. Protective stop orders ko blank gap space ke dono taraf wale candles ke bodies ke neeche/upper place karen. - Bullish Breakout Entry

Jab Bullish Hikkake pattern uptrend ke andar form hota hai, breakout ke baad ek buying opportunity paida hoti hai.

Ye suggest karta hai ke preceding move force ke saath resume ho raha hai, aur aap extended upside wave ko ride kar sakte hain. Hikkake ke inside candle ke low ke neeche ek stop lagayen. - Aggressive Reversal Entry

Aap Hikkake pattern ko jaldi enter kar sakte hain jab third candle inside bar ke upper/neeche close ho jaye.

Nadim entry ka nuqsan hai ke agar reversal stall ho jaye to aap ko zyada risk ka samna karna pad sakta hai. Capital ko protect karne ke liye outside bar ke high/low ke neeche/upper stop lagayen.

Yeh approach aap kaun sa choose karte hain ye aap ke risk tolerance aur pattern play hone ke mutaliq conviction par munhasir hai. Potential profits trading Hikkakes ko maximize karne ke liye strategies ko combine karen.

Hikkake Candlestick Pattern Benifits & Drawbacks

Chalo dekhte hain Hikkake formation ko apne trading mein istemal karne ke bade faiday aur nuksanat.- Benifits:

- Reliable Reversal Indicator. Hikkake trend changes ko early accurately call karne ki high probability rakhta hai. Is unique structure se impending shifts ko sahi tarah se warning di jati hai.

- Earlier Entry Opportunity. Breakaway gap ke saath, Hikkake signal aksar zyada tezi se reversals ko indicate karta hai doosre candle patterns se. Ye early entry aur zyada profit potential deta hai.

- Requires Little Confirmation. Established criteria ko check karne ke ilawa, zyada confirmation ki zaroorat nahi hoti hai. Wide gap apni marzi se conviction banata hai.

- Drawbacks:

- Strict Rules. Hikkake ke liye interpretation ke liye thori jagah hai. Agar specifications bilkul theek nahi milti to invalid signals ho sakte hain, jo ke nuqsanat ko le kar aata hai.

- Demands Caution. Ek aggressive predictor ke taur par, Hikkake false breakouts ko generate kar sakta hai, isliye caution zaroori hai jab tak naya trend progress na ho.

- Uncertain Stop Placement. Bahar high/low ke stops prone hain ke hit ho sakte hain agar signal fail ho jaye. Stop distance bhi kafi bara ho sakta hai.

Jaise ke hum dekh sakte hain, Hikkake ek leading reversal indicator ke taur par noteworthy upside laata hai magar sath hi sath navigations ke liye sizeable drawbacks bhi laata hai. In pros aur cons ko samajhna smarter applications ke liye allow karta hai.

Summary

Hikkake pattern, jo ke Hikkake ke naam se bhi jana jata hai, aik technical analysis pattern hai jo potential market reversals ko identify karne ke liye istemal hota hai. Isay aane wale trend reversal ki nishani ke tor par istemal kiya jata hai. Ye aik teen-bar formation se milta hai, jismein doosre aur teesre bars pehle bar ke high aur low ke andar hote hain, jo ke potential trend reversal ko ishaara karte ha. Hikkake pattern ka use aapke trading decisions ko informed banane ke liye kiya ja sakta hai. Hikkake pattern ko detect karne ke baad, aap trading decisions jaise ke position enter ya exit karna, ya stop-loss levels adjust karna jaise actions le sakte hain. Magar, zaroori hai yaad rakhna ke jaise hi koi technical analysis tool hota hai, Hikkake pattern hamesha accurate nahi hota aur isay doosri forms of analysis aur risk management strategies ke saath istemal karna chahiye.

-

#4 Collapse

Hikkaki Candlestick Pattern

Hikkake" ek Japanese candlestick pattern hai jo market charts par dikhai dene wala hai. Ye pattern primarily price action analysis mein istemal hota hai aur reversal signals ko identify karne ke liye use hota hai. Hikkake pattern ek bullish ya bearish reversal pattern ho sakta hai, aur ye typically range-bound markets mein dekha jata hai.

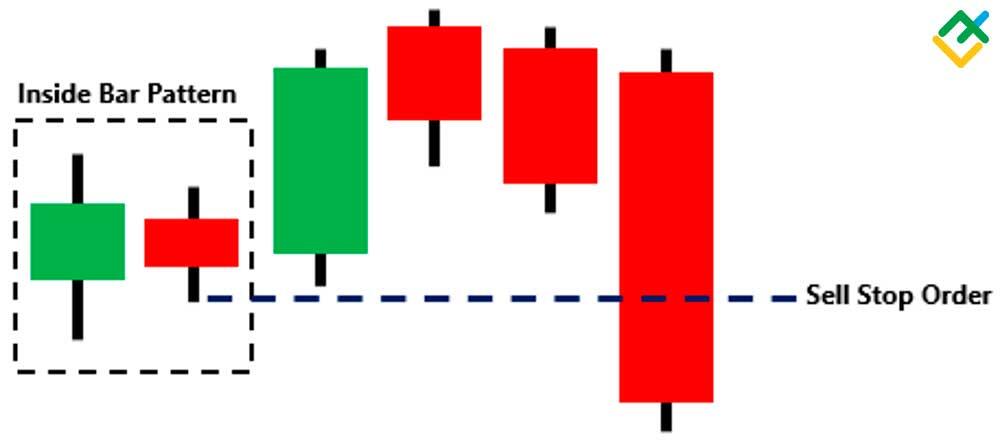

Hikkake pattern ka formation kuch is tarah hota hai:- Inside Bar:

- Pehla step mein, ek "inside bar" pattern form hota hai. Inside bar ek candlestick pattern hota hai jismein ek candlestick ka high aur low previous candlestick ke high aur low ke beech mein hota hai.

- Breakout Failure:

- Dusra step me, price initially breakout attempt karta hai lekin phir wapas inside bar ke range mein wapas aajata hai. Ye breakout failure ko darust karta hai.

- Reversal Confirmation:

- Tisra step me, ek reversal candlestick pattern form hota hai, jaise ki bullish engulfing ya bearish engulfing, inside bar ke range ke bahar. Ye candlestick pattern breakout failure ko confirm karta hai aur reversal signal provide karta hai.

Hikkake pattern traders ko ye suggest karta hai ki market direction change hone ki possibility hai. Agar ye pattern downtrend ke baad dikhai deta hai toh ye bullish reversal signal provide karta hai, jabki agar ye uptrend ke baad dikhai deta hai toh ye bearish reversal signal provide karta hai.Hikkake pattern ko confirm karne ke liye traders ko doosre technical indicators aur price action analysis ka istemal karna chahiye. Market conditions aur surrounding context ko bhi dhyan mein rakhna important hai, aur false signals ko avoid karne ke liye cautious rehna chahiye.

- Inside Bar:

-

#5 Collapse

Hikkake Candlestick Pattern: Ek Aham Price Action Pattern

Hikkake Candlestick Pattern Kya Hai? Hikkake Candlestick Pattern ek price action pattern hai jo traders aur investors ke liye ahem hota hai. Ye pattern market ki reversal ya trend change ko identify karne mein madad karta hai. Is pattern ko banane wale candles kaafi khaas hote hain aur iski pehchan karne ke liye kuch khaas rules hote hain.

Hikkake Pattern Ki Tashreeh: Hikkake pattern ko dekhne ka tareeqa aasan hai, lekin iski tashreeh samajhne mein thoda waqt lag sakta hai. Yeh pattern 3 candles se bana hota hai.- First Candle: Pehli candle ek large range candle hoti hai, jo ki trend ko indicate karti hai.

- Inside Candle: Dusri candle, jo first candle ke andar hoti hai, ki range first candle se kam hoti hai. Yeh inside candle banati hai.

- Breakout Candle: Teesri candle, jo inside candle ko follow karti hai, uske range ke bahar break hoti hai.

Hikkake Pattern Ke Niyam: Hikkake pattern ko samajhne ke liye kuch niyam hote hain:- Inside Candle: Inside candle ka range first candle ke range se kam hona zaroori hai.

- Breakout Candle: Teesri candle ki range ko inside candle ke range ke bahar break karna chahiye.

- Confirmation: Pattern ki tashreeh ke liye, traders ko breakout candle ke close ke intezaar mein rehna chahiye.

Hikkake Pattern Ka Istemal: Hikkake pattern ka istemal trend reversals ya trend changes ko identify karne ke liye hota hai. Agar pattern upar ki taraf form hota hai, to ye bearish reversal ko indicate karta hai, jabke agar pattern neeche ki taraf form hota hai, to ye bullish reversal ko indicate karta hai.

Hikkake Pattern Ke Mukhtalif Forms: Hikkake pattern kayi mukhtalif forms mein aata hai, jinmein se kuch common forms hain:- Bullish Hikkake: Ye pattern jab ban jata hai to ye bullish trend ko confirm karta hai.

- Bearish Hikkake: Ye pattern jab ban jata hai to ye bearish trend ko confirm karta hai.

- Inside Bar Hikkake: Ismein pehli candle ki range inside candle ke andar hoti hai aur teesri candle us range ke bahar break karti hai.

Hikkake Pattern Ki Ahmiyat: Hikkake pattern ki ahmiyat is baat mein hai ke ye traders aur investors ko trend reversals ya trend changes ka advance indication deta hai. Iske istemal se traders apne trading strategies ko improve kar sakte hain aur behtar trading decisions le sakte hain.

Nateeja: Hikkake Candlestick Pattern ek ahem tool hai jo market ki reversal aur trend changes ko identify karne mein madad karta hai. Traders ko is pattern ko samajhna aur istemal karna chahiye taake wo apne trading mein mufeed faisle le sakein. Is pattern ki madad se, traders apne trading performance ko behtar banane mein kamyabi hasil kar sakte hain.

- CL

- Mentions 0

-

سا0 like

-

#6 Collapse

Hikkake Candlestick PatternHikkake candlestick pattern ek technical analysis tool hai jo traders ko market trends aur reversals ko identify karne mein madad karta hai. Is pattern ko samajhne ke liye, traders ko various types aur unki identification ke techniques ki samajh honi chahiye. Yeh pattern traders ko market direction ka analysis karne aur trading strategies develop karne mein madad karta hai.

Hikkake pattern ki types aur unki identification ke techniques niche diye gaye hain:- Bullish Hikkake Pattern:

- Bullish Hikkake pattern jab market ke downtrend ke baad ek reversal signal deta hai. Is pattern ki pehli stage mein, ek small range wali inside bar formation hoti hai.

- Agar iske baad market ek false breakout ke saath opposite direction mein move karta hai, toh yeh false breakout signal provide karta hai. False breakout ke baad, ek larger range wali inside bar form hoti hai, indicating consolidation.

- Actual bullish breakout tab hota hai jab market ek significant volume ke saath previous inside bars ki range se bahar nikalta hai.

- Confirmation candle jo previous inside bars se bada hota hai aur high volume ke saath hota hai, bullish trend ko confirm karta hai.

- Bearish Hikkake Pattern:

- Bearish Hikkake pattern jab market ke uptrend ke baad ek reversal signal deta hai. Is pattern ki pehli stage mein, ek small range wali inside bar formation hoti hai.

- Agar iske baad market ek false breakout ke saath opposite direction mein move karta hai, toh yeh false breakout signal provide karta hai. False breakout ke baad, ek larger range wali inside bar form hoti hai, indicating consolidation.

- Actual bearish breakout tab hota hai jab market ek significant volume ke saath previous inside bars ki range se bahar nikalta hai.

- Confirmation candle jo previous inside bars se bada hota hai aur high volume ke saath hota hai, bearish trend ko confirm karta hai.

- Neutral Hikkake Pattern:

- Neutral Hikkake pattern market ke trend ke continuation ya reversal ke possibilities ko indicate karta hai. Is pattern mein market kisi specific direction mein breakout nahi karta, balki sideways movement ya consolidation hoti hai.

- Is pattern ki pehli stage mein bhi ek small range wali inside bar formation hoti hai.

- False breakout ke baad, ek larger range wali inside bar form hoti hai, indicating consolidation.

- Market ka actual direction tab clarify hota hai jab ek significant volume ke saath breakout hota hai.

Hikkake pattern ki types ko identify karne ke liye, traders ko candlestick charts par dhyan dena hota hai aur kuch key features ko samajhna hota hai:- Inside Bar (IB): Hikkake pattern ki pehli stage mein, ek small range wali inside bar formation hoti hai, indicating market consolidation.

- False Breakout: False breakout ek crucial element hai Hikkake pattern ki identification mein. Market ek direction mein bahar nikalne ki koshish karta hai, lekin yeh breakout asal mein ek false breakout hota hai, matlab market ka actual direction opposite hota hai.

- Inside Bar (IB) After False Breakout: False breakout ke baad, ek aur inside bar formation hoti hai, lekin is baar range ka size thoda bada hota hai compared to the initial inside bar. Yeh consolidation ko indicate karta hai.

- Breakout of Inside Bar: Actual breakout tab hota hai jab market ek significant volume ke saath previous inside bars ki range se bahar nikalta hai. Yeh breakout market ka actual direction clarify karta hai.

- Confirmation Candle: Breakout ke baad, ek confirmation candle form hoti hai jo previous inside bars se bahut zyada range mein hoti hai aur significant volume ke saath hoti hai. Yeh candle trend continuation ya reversal ko confirm karta hai.

Hikkake pattern ki identification ke baad, traders apne trading strategies ko develop karte hain. Agar bullish Hikkake pattern identify hota hai, toh traders long positions le sakte hain. Agar bearish Hikkake pattern identify hota hai, toh traders short positions le sakte hain. Neutral Hikkake pattern ke case mein, traders market direction ka wait karte hain aur breakout ke baad positions lete hain.

Is pattern ki identification traders ko market trends aur reversals ko samajhne mein madad karta hai aur unhe trading opportunities provide karta hai. Lekin, jaise har technical analysis tool ki tarah, Hikkake pattern ko bhi additional confirmatory indicators ke saath istemal kiya jana chahiye aur proper risk management ko dhyan mein rakha jana chahiye.

Hikkake pattern ka istemal karke traders market direction aur reversals ko identify kar sakte hain aur trading strategies develop kar sakte hain.

Is pattern ki kuch key advantages aur benefits include:- Identification of Market Reversals: Hikkake pattern traders ko market mein reversals ki early signs provide karta hai. False breakout followed by an inside bar aur phir actual breakout se, traders ko pata chal jata hai ki market direction change hone wala hai.

- Confirmation of Breakouts: Hikkake pattern ek strong confirmation provide karta hai breakouts ke liye. False breakout se pehle aur uske baad ke inside bars aur phir confirmation candle ke saath, traders ko confidence milta hai ki actual breakout ho chuka hai.

- Risk Management: Is pattern ko istemal karke traders apne risk ko manage kar sakte hain. False breakout ke baad, traders ko opportunity milti hai apne positions ko adjust karne ki, jisse unka risk minimize ho.

- Volume Confirmation: Hikkake pattern ke saath volume analysis bhi kiya ja sakta hai. Confirmation candle ke saath high volume hone par, traders ko aur bhi zyada confidence milta hai breakout ke saath.

- Adaptable to Multiple Time Frames: Hikkake pattern ko alag-alag time frames par bhi istemal kiya ja sakta hai, jisse traders ko short-term aur long-term trading opportunities mil sakti hain.

Hikkake pattern ke istemal se, traders apne trading strategies ko refine kar sakte hain aur market trends ko better understand kar sakte hain. Yeh ek flexible aur powerful tool hai jo traders ko market analysis mein madad karta hai. Lekin, jaise har technical analysis tool ki tarah, iska bhi proper risk management aur additional confirmatory indicators ke saath istemal kiya jana chaye.

- Bullish Hikkake Pattern:

-

#7 Collapse

Information About Hikkaki Candlestick Pattern:

Hikkake candlestick pattern ek popular technical analysis tool hai jo traders istemal karte hain price movements ka analyze karne ke liye. Ye pattern market volatility ko identify karne mein madadgar hota hai aur price reversals ko predict karne mein istemal hota hai. Hikkake pattern ka naam Japanese word "hikkake" se aaya hai, jo "to trick" ya "to entangle" ka matlab rakhta hai, iska matlab hai ke ye pattern traders ko confuse kar sakta hai, lekin sahi tajziya aur samajh ke saath, ye ek powerful trading tool ban sakta hai.

Hikkake pattern ko candlestick charts par dekha jata hai, jismein har ek candlestick ek specific time period ki price action ko represent karta hai. Hikkake pattern typically do parts mein hota hai: pehla part price action ka initial move hota hai, jo ek large candlestick se ya multiple candlesticks se represent hota hai. Dusra part hota hai jab price initially move karta hai, lekin phir reversal hota hai aur ek opposite direction mein chhota sa move hota hai, jo ki ek small candlestick ya doji se represent hota hai.

Hikkake pattern ko identify karne ke liye kuch basic rules hain:- Initial Move: Pehla step initial move ka hota hai, jismein price ek direction mein strongly move karta hai, jo ki ek large candlestick ya multiple candlesticks ke through dikhai deta hai.

- Inside Candle: Dusra step hota hai jab price initially move karta hai, lekin phir ek reversal hota hai aur price ek tight range mein consolidate hota hai. Is step mein typically ek small candlestick ya doji dikhai deta hai jo pehle candlestick ke andar hota hai (ya usse "inside" hota hai).

- Breakout: Teesra step hota hai jab price bahar nikalta hai is tight range se, indicating a potential reversal. Agar price ne pehle ki direction ko break kiya hai, to ye bullish reversal signal ho sakta hai. Agar price ne opposite direction mein break kiya hai, to ye bearish reversal signal ho sakta hai.

- Confirmation: Hikkake pattern ki confirmation ke liye, traders typically next candlestick ki price action ka wait karte hain. Agar price breakout ke opposite direction mein move karta hai, to ye pattern confirm hota hai.

Hikkake pattern ka istemal karne ke liye, traders ko sahi tajziya aur samajh ki zarurat hoti hai market conditions aur price action ke mutabiq. Ye pattern sirf ek tool hai, aur iska istemal keval iske signals par bharosa karke nahi kiya jana chahiye. Iske alawa, traders ko stop loss aur risk management strategies ka bhi dhyan rakhna chahiye.

Hikkake pattern ke kuch variations bhi hote hain, jaise ki bullish hikkake aur bearish hikkake. Bullish hikkake pattern jab price initially down move karta hai lekin phir ek bullish reversal hota hai aur vice versa bearish hikkake pattern mein.

In conclusion, Hikkake candlestick pattern ek powerful technical analysis tool hai jo traders ko market volatility ko samajhne aur price reversals ko predict karne mein madad karta hai. Isko sahi tajziya aur samajh ke saath istemal karke, traders apne trading strategies ko improve kar sakte hain. Lekin, hamesha yaad rahe ke kisi bhi pattern ya indicator ka istemal keval ek part hai trading strategy ka, aur risk management aur stop loss ka bhi dhyan rakha jana chahiye.

-

#8 Collapse

Hikkaki Candlestick Pattern ek aham technical analysis tool hai jo forex trading aur stock market mein istemal hota hai. Ye pattern traders ko market ke trends aur price movements ka insight deta hai. Is article mein, hum Hikkaki Candlestick Pattern ke bare mein mukhtasir maloomat aur uske istemal ke tareeqon par ghaur karenge.

Hikkaki Candlestick Pattern Kya Hai? Hikkaki Candlestick Pattern ek Japanese candlestick pattern hai jo market mein trend reversal ko darust karna mein madadgar hota hai. Is pattern ko do alag alag candlesticks se banaya jata hai, jinmein pehla candlestick chhota hota hai aur doosra candlestick lamba hota hai. Is pattern ko "Hikkake" ya "Hook" bhi kaha jata hai.

Hikkaki Candlestick Pattern Ki Formation: Hikkaki Candlestick Pattern ki formation mein pehle ek small candlestick aati hai, jise "inside bar" kehte hain, phir ek large candlestick aati hai, jo pehle candlestick ki range ko cross karti hai. Agar pehla candlestick downward trend ke baad aata hai aur doosra candlestick iski range ko cross kar ke upward move karta hai, to ye bullish Hikkaki pattern kaha jata hai. Agar pehla candlestick upward trend ke baad aata hai aur doosra candlestick iski range ko cross kar ke downward move karta hai, to ye bearish Hikkaki pattern kaha jata hai.

Hikkaki Candlestick Pattern Ki Tafseelat: Hikkaki Candlestick Pattern ko samajhne ke liye, traders ko doosri technical analysis tools jaise ke support aur resistance levels, moving averages, aur volume ke saath combine karna chahiye. Is pattern ki sahi tafseelat ke liye, traders ko bazaar ke tamam factors ka tajziya karna zaroori hai.

Hikkaki Candlestick Pattern Ka Istemal: Hikkaki Candlestick Pattern ka istemal trend reversal ki pehchaan karne ke liye kiya jata hai. Agar market mein strong trend hai aur Hikkaki Candlestick Pattern ban jata hai, to ye indicate karta hai ke trend khatam ho sakta hai aur naya trend shuru ho sakta hai. Traders is pattern ko istemal kar ke apni trading strategies ko confirm aur validate kar sakte hain.

Hikkaki Candlestick Pattern Ke Benefits: Hikkaki Candlestick Pattern ka istemal karne ke kuch faide hain:- Trend Reversal Identification: Ye pattern trend reversal ko detect karne mein madadgar hai.

- Trading Signals: Is pattern ke istemal se traders ko trading signals milte hain jo unhe market ke movements ke mutabiq apni trades adjust karne mein madad karte hain.

- Risk Management: Hikkaki Candlestick Pattern ke istemal se traders apne risk management strategies ko improve kar sakte hain aur nuksan se bach sakte hain.

Hikkaki Candlestick Pattern Ka Istemal Kaise Kiya Jaye: Hikkaki Candlestick Pattern ka istemal karne ke liye, traders ko market ke price movements aur candlestick formations par nazar rakhni chahiye. Jab ye pattern ban jata hai, traders ko confirmatory signals ke liye aur technical indicators ka istemal karna chahiye. Iske alawa, stop loss aur take profit levels ko bhi define karna zaroori hai taake risk ko minimize kiya ja sake.

Nateeja: Hikkaki Candlestick Pattern ek aham tool hai jo traders ko market ke trends aur price movements ka insight deta hai. Is pattern ka istemal kar ke, traders apni trading strategies ko improve kar sakte hain aur better trading decisions le sakte hain. Lekin, is pattern ko istemal karte waqt, traders ko market ki puri tafseelat ko madde nazar rakhte hue amal karna chahiye. Iske ilawa, risk management ko bhi ahmiyat di jani chahiye taake nuksan se bacha ja sake.

- CL

- Mentions 0

-

سا0 like

-

#9 Collapse

Information About Hikkaki Candlestick Pattern:

"Hikkake Candlestick Pattern" ek technical analysis pattern hai jo market trends aur reversals ko identify karne mein istemal hota hai. Ye pattern typically price action ke specific formations ko dekhta hai jo market ke potential reversals ya continuations ko indicate karte hain. Yeh pattern Japanese candlestick charting techniques ka hissa hai. Neeche di gayi hai is pattern ke kuch key points :- Formation (Banawat): Hikkake pattern typically ek sequence of candlesticks ko represent karta hai. Is pattern mein initially ek small range wala candlestick hota hai, jise "inside candle" kaha jata hai, aur fir ek subsequent candlestick jo uske range ko break karta hai.

- Identification (Pehchan): Hikkake pattern ko identify karne ke liye traders inside candlestick aur uske subsequent candlestick ko dekhte hain. Agar ek candlestick inside candle ke range ko break karta hai, aur fir next candlestick uski range ke andar re-enter karta hai, toh ye ek potential Hikkake pattern ka signal ho sakta hai.

- Bullish aur Bearish Variations (Bullish aur Bearish Tabsaray): Hikkake pattern do variations mein aata hai:

- Bullish Hikkake Pattern: Agar inside candle ke range ko break karne ke baad next candlestick inside candle ki range mein wapas aa jata hai, toh ye bullish Hikkake pattern ko indicate karta hai. Ye ek potential bullish reversal signal ho sakta hai.

- Bearish Hikkake Pattern: Agar inside candle ke range ko break karne ke baad next candlestick inside candle ki range mein wapas aa jata hai, toh ye bearish Hikkake pattern ko indicate karta hai. Ye ek potential bearish reversal signal ho sakta hai.

- Confirmation aur Entry Points (Tasdeeq aur Dakhil Ke Points): Hikkake pattern ko dekhte hue traders confirmatory signals aur entry points set karte hain. Agar ek Hikkake pattern confirm hota hai, toh traders uske hisaab se apne trading positions ko enter karte hain.

Hikkake Candlestick Pattern market analysis mein ek useful tool hai jo traders ko potential reversals aur continuations ko detect karne mein madad karta hai. Is pattern ka sahi taur par istemal karne ke liye traders ko candlestick patterns aur price action ko samajhna zaroori hota hai.

-

#10 Collapse

Hikkake Candlestick Pattern: Aik Technical Analysis Tool

Hikkake candlestick pattern ek important technical analysis tool hai jo market trends aur reversals ko identify karne mein madad karta hai. Ye pattern initially range-bound markets ko identify karne ke liye develop kiya gaya tha, lekin ab iska istemal wide range of market conditions mein hota hai.

Hikkake Pattern Ki Formation:

Hikkake pattern typically 3 candlesticks se bana hota hai, jinmein se har ek ka apna specific role hota hai:

1. Inside Bar: Pehla candlestick ek inside bar hota hai, jismein high aur low pehle candlestick ke range ke andar hota hai.

2. Fakeout Candle: Dusra candlestick, jo fakeout candle kehlata hai, typically pehle candlestick ke range se bahar nikalta hai, indicating a potential breakout. Lekin, is candle ka close inside bar ke andar hota hai.

3. Inside Bar Confirmation: Teesra candlestick, jo inside bar confirmation kehlata hai, phir se pehle candlestick ke range ke andar close hota hai, confirming ke false breakout hua hai.

Hikkake Pattern Ki Trading Strategy:

Hikkake pattern ka istemal karke traders market trends aur reversals ko identify kar sakte hain. Jab ek hikkake pattern form hota hai, traders usually wait karte hain ke confirmatory candlestick close ho jane ke baad, phir woh trade ko enter karte hain uss direction mein jise pattern indicate karta hai.

Hikkake Pattern Ki Caveats:

Hikkake pattern ki trading strategy use karte waqt kuch caveats ya dhyan rakhne wale points hain:

1. Confirmatory Candlestick: Pattern ko validate karne ke liye confirmatory candlestick ka close hone ka wait karna zaroori hai.

2. Stop-loss Placement: Trade ko enter karne se pehle stop-loss placement ka dhyan dena zaroori hai taake nuqsaan ko minimize kiya ja sake.

3. Other Technical Indicators: Hikkake pattern ke sath dusre technical indicators ka istemal karke trading decisions ko confirm karna zaroori hai.

Conclusion:

Hikkake candlestick pattern ek powerful technical analysis tool hai jo market trends aur reversals ko identify karne mein madad karta hai. Is pattern ka istemal karke traders apni trading strategies ko refine kar sakte hain aur consistent profits earn kar sakte hain. -

#11 Collapse

Hikkake Candlestick Pattern Ke Bare Mein Maloomat- Intro:

- Hikkake candlestick pattern ek mukhtasir samjha ja sakne wala technical analysis tool hai, jo market trends aur price movements ko samajhne mein madad karta hai.

- Origins:

- Yeh pattern initially Daniel L. Chesler ne 2003 mein develop kiya tha.

- Iska naam ek Japanese word "hikkake" se liya gaya hai, jo "phansana" ya "chhupana" ka matlab rakhta hai.

- Structure:

- Hikkake pattern usually do ya teen consecutive candlesticks se bana hota hai.

- Ye pattern do main parts se milta hai: inside bar aur fakeout.

- Inside Bar:

- Inside bar, pehle do candlesticks mein hota hai, jismein doosri candlestick pehli ki range ke andar hoti hai.

- Ye indicate karta hai ke market mein consolidation ho rahi hai aur ek possible trend change ka indication ho sakta hai.

- Fakeout:

- Fakeout, teesri candlestick mein hota hai, jismein market initially ek direction mein move karta hai lekin phir reversal hota hai.

- Isse traders ko false breakout ya reversal ke potential signals milte hain.

- Identification:

- Hikkake pattern ko identify karne ke liye traders ko market ki previous price action ko analyze karna hota hai.

- Inside bars aur fakeouts ko dhyan se dekhkar pattern ko recognize kiya ja sakta hai.

- Bullish Hikkake Pattern:

- Bullish hikkake pattern, jab market downtrend mein hota hai aur ek bullish reversal indicate karta hai.

- Ismein pehle do candlesticks mein low lows aur highs highs hoti hain, jabki teesri candlestick mein inside bar aur uske baad ek bullish candle hoti hai.

- Bearish Hikkake Pattern:

- Bearish hikkake pattern, jab market uptrend mein hota hai aur ek bearish reversal indicate karta hai.

- Ismein pehle do candlesticks mein high highs aur low lows hote hain, jabki teesri candlestick mein inside bar aur uske baad ek bearish candle hoti hai.

- Trading Strategies:

- Traders hikkake pattern ko trading strategies mein incorporate kar sakte hain.

- Is pattern ke signals ko confirm karne ke liye additional technical indicators ka istemal kiya ja sakta hai.

- Risk Management:

- Hikkake pattern ko trade karte waqt risk management ka dhyan rakhna zaroori hai.

- Stop-loss orders ka istemal karke potential losses ko control kiya ja sakta hai.

- Examples:

- Kuch real-life examples ke through hikkake pattern ka istemal samajhna traders ke liye helpful ho sakta hai.

- Historical price charts ko analyze karke previous instances ke patterns ko dekhna traders ko pattern recognition mein madad karta hai.

- Conclusion:

- Intro:

-

#12 Collapse

Hikkake Candlestick Pattern: Aik Technical Analysis Tool

Hikkake Candlestick Pattern forex trading mein ek ahem technical analysis tool hai jo market trends ko samajhne aur potential reversals ko identify karne mein madad karta hai. Yeh article "Hikkake Candlestick Pattern: Aik Technical Analysis Tool" is mudda par roshni daalta hai aur Hikkake pattern ka maqsad aur istemal ko samajhne mein madad karta hai.

Mukhtasar Introduction:

Hikkake Candlestick Pattern ek price action pattern hai jo market mein reversals aur trend continuations ko indicate karta hai. Is pattern ka istemal karke, traders market ke dynamics ko samajh sakte hain aur sahi trading decisions le sakte hain.

Hikkake Candlestick Pattern Ki Tafseel:

Hikkake pattern ek reversal pattern hai jo price ke inside bars aur false breakouts ko darust karta hai. Is pattern mein, price ke ek sequence ke baad, ek reversal candle dekha jata hai jise false breakout ya inside bar kehte hain.

Kaise Kaam Karta Hai:

Hikkake Candlestick Pattern ka kaam hota hai market ke false breakouts ya inside bars ko identify karna aur potential reversals ko darust karna. Jab price ek sequence ke baad inside bar banati hai, aur phir uske baad ek reversal candle dekha jata hai, toh yeh Hikkake pattern ko darust karta hai.

Identification:

Hikkake Candlestick Pattern ko identify karne ke liye traders ko price action aur candlestick formations par focus karna hota hai. Inside bars ke baad reversal candle dekhne par, traders Hikkake pattern ka existence confirm karte hain.

Mahatva:

Hikkake Candlestick Pattern market trends ko samajhne aur reversals ko identify karne mein madad karta hai. Is pattern ka istemal karke, traders apne trading strategies ko improve kar sakte hain aur market ke mukable mein behtar taur par taiyar ho sakte hain.

Trading Strategies:

Hikkake Candlestick Pattern ke appearance ke baad, traders ko confirmatory signals ke liye doosre technical indicators ka bhi istemal karna chahiye. Confirmatory signals ke saath, traders apne trading strategies ko implement karke positions le sakte hain.

Akhiri Kathan:

Hikkake Candlestick Pattern ek powerful technical analysis tool hai jo traders ko market trends aur reversals ko samajhne mein madad karta hai. Is pattern ko samajh kar, traders apne trading performance ko improve kar sakte hain aur consistent profits earn kar sakte hain.

-

#13 Collapse

Introduction

Hikkake candlestick pattern ek technical analysis tool hai jo traders ko market trends ko identify karne mein madad karta hai. Ye pattern primarily price reversal ko recognize karne ke liye use hota hai. Is pattern ka naam Japanese word "hikkake" se liya gaya hai, jo "hook" ya "to trap" ka matlab rakhta hai. Hikkake pattern ko samajhna aur istemal karna traders ke liye zaroori hai taake wo market ke movements ko samajh sakein aur trading decisions len.

1. Hikkake Pattern Ki Pehchan

Hikkake pattern, market mein price reversal ko indicate karta hai. Is pattern mein typically do ya zyada consecutive candlesticks shamil hote hain. Pehli candlestick ek choti range mein form hoti hai aur doosri candlestick, pehli candlestick ki range ke bahar move karti hai. Ye doosri candlestick pehli candlestick ko trap karta hai, jisse ek reversal pattern ban jata hai.

2. Hikkake Pattern Ke Types

Hikkake pattern do tarah ke hote hain:

a. Bullish Hikkake Pattern: Ye pattern ek downtrend ke baad aata hai aur bullish reversal ko indicate karta hai. Ismein pehli candlestick ek small range mein form hoti hai aur doosri candlestick, pehli candlestick ki range ke bahar move karta hai, indicating bullish momentum.

b. Bearish Hikkake Pattern: Ye pattern ek uptrend ke baad aata hai aur bearish reversal ko indicate karta hai. Ismein pehli candlestick ek small range mein form hoti hai aur doosri candlestick, pehli candlestick ki range ke bahar move karta hai, indicating bearish momentum.

3. Hikkake Pattern Ki Key Characteristics

Hikkake pattern ki kuch key characteristics hain:

a. Small Range: Pehli candlestick choti range mein form hoti hai, indicating market mein indecision.

b. Range Breakout: Doosri candlestick, pehli candlestick ki range ke bahar move karta hai, indicating potential reversal.

c. Confirmation: Hikkake pattern ki validity ke liye traders confirmation ka intezaar karte hain, jaise ke ek follow-up candlestick ya phir kisi aur technical indicator ki confirmation.

4. Hikkake Pattern Ka Istemal Kaise Karein

Hikkake pattern ka istemal karne ke liye traders ko ye steps follow karne chahiye:

a. Identify: Sab se pehle traders ko Hikkake pattern ko identify karna chahiye market charts par.

b. Confirmation: Pattern ko confirm karne ke liye traders ko dusri technical indicators ka istemal karna chahiye, jaise ke moving averages, RSI, ya MACD.

c. Entry Point: Pattern ko confirm karne ke baad, traders ko entry point decide karna chahiye, jismein stop-loss aur target levels shamil hote hain.

5. Hikkake Pattern Ka Risk Management

Hikkake pattern ka istemal karte waqt risk management ka khayal rakhna zaroori hai. Kuch important points hain:

a. Stop-Loss: Har trade ke liye stop-loss level set karna zaroori hai taake loss ko control kiya ja sake.

b. Position Size: Har trade mein sahi position size choose karna zaroori hai taake risk manage kiya ja sake.

c. Profit Targets: Har trade ke liye sahi profit targets set karna zaroori hai taake profits secure kiya ja sake.

6. Hikkake Pattern Ka Example Ek example ke tor par, agar ek bullish Hikkake pattern form hota hai ek downtrend ke baad, to traders bullish entry point par enter kar sakte hain. Stop-loss aur target levels ko set karke traders apne risk ko manage kar sakte hain.

Conclusion

Hikkake candlestick pattern ek powerful tool hai jo traders ko market trends ko samajhne aur reversal points ko identify karne mein madad karta hai. Is pattern ko samajh kar aur sahi tareeke se istemal karke traders apne trading strategies ko improve kar sakte hain aur consistent profits earn kar sakte hain. Magar, Hikkake pattern ka istemal karne se pehle, traders ko thorough research aur risk management ka dhyan rakhna chahiye.

-

#14 Collapse

information about hikkaki candlestick pattern:

"Hikkake Candlestick Pattern" ek technical analysis tool hai jo ki price action analysis mein istemal hota hai. Yeh ek reversal pattern hai jo market ke trend reversal points ko identify karne mein madad karta hai. Hikkake pattern mein, traders price ke behavior ko analyze karte hain aur potential trend changes ko detect karne ki koshish karte hain.

Hikkake Candlestick Pattern Kaise Kaam Karta Hai?

Hikkake pattern mein, traders specific candlestick formations ko dekhte hain jo market ke reversals ko signal karte hain. Yeh pattern typically 3 candlesticks se banta hai.

Hikkake pattern ko identify karne ke liye, traders ye steps follow karte hain:- Step 1 - Initial Inside Candle: Pehla step mein, ek "inside candle" ko identify kiya jata hai. Inside candle ka matlab hota hai ke ek candlestick dusre candlestick ke range ke andar hi form hota hai.

- Step 2 - Breakout Candle: Dusra step mein, ek breakout candle ko dekha jata hai. Breakout candle typically pehle ke inside candle ke range se bahar move karta hai.

- Step 3 - Confirmation Candle: Teesra step mein, ek confirmation candle ko dekha jata hai. Confirmation candle inside candle ke range ke andar rehta hai, indicating ke market mein kuch uncertainty hai aur potential reversal hone ki sambhavna hai.

Agar ye pattern uptrend ke dauran form hota hai, toh ye bearish reversal signal deta hai, jabki agar downtrend ke dauran form hota hai, toh ye bullish reversal signal deta hai.

Hikkake Candlestick Pattern Ka Istemal

Hikkake pattern ka istemal karne se pehle, traders ko ise pehchanne aur samajhne ki zarurat hoti hai. Iske liye, traders candlestick charts ko analyze karte hain aur Hikkake pattern ke specific candlestick formations ko dhoondhte hain. Jab ye pattern identify ho jata hai, traders uska confirmation wait karte hain aur phir uske according apne trading decisions lete hain.

Hikkake candlestick pattern ek important reversal pattern hai jo ki traders ko market trends ke reversals ko identify karne mein madad karta hai. Is pattern ko samajhne aur istemal karne ke liye, traders ko candlestick analysis aur price action ke concepts ko samajhna zaruri hai. Hikkake pattern ke sahi istemal se, traders apne trading strategies ko improve kar sakte hain aur potentially profitable trading opportunities ko recognize kar sakte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

Information about hikkaki candlestick pattern:

"Hikkake Candlestick Pattern" ek popular candlestick pattern hai jo technical analysis mein istemal hota hai, khaaskar ki forex aur stock markets mein. Yeh pattern market mein trend reversal ya trend continuation ko darust karte hue traders ko help karta hai.

Hikkake Candlestick Pattern ko dekh kar traders price action aur market sentiment ka analysis karte hain. Is pattern ko samajhne ke liye, thoda sa background knowledge candlestick charts aur market dynamics par hona zaroori hai.

Hikkake Candlestick Pattern Ki Pechan:

Hikkake pattern mein typically do ya zyada consecutive candles shamil hote hain jo ek specific formation banate hain. Ye pattern typically sideways ya choppy markets mein develop hota hai aur price ke sudden reversal ko indicate karta hai.

Is pattern ko pehchanne ke liye, traders ko ye steps follow karne chahiye:- Step 1 - Inside Bar: Pehli stage mein, ek "inside bar" formation hoti hai, yaani ki ek candlestick jo purani candle ki range ke andar develop hoti hai.

- Step 2 - Breakout: Dusri stage mein, price breakout karta hai, lekin ye breakout initial candle ke range ke opposite direction mein hota hai. Agar pehli candle bullish (upward) hai, to breakout typically low (nichla hissa) ke neeche hota hai. Agar pehli candle bearish (downward) hai, to breakout typically high (ooper hissa) ke upar hota hai.

- Step 3 - Confirmation: Tisri stage mein, ek candle develop hoti hai jo pehli do candles ke opposite direction mein move karti hai, confirming reversal.

Hikkake Candlestick Pattern Ka Istemal:

Hikkake pattern ka istemal trend reversal aur trend continuation ka pata lagane ke liye hota hai. Agar pattern bullish trend ke baad develop hota hai, toh ye bearish reversal ko darust karta hai aur traders ko sell ki taraf indicate karta hai. Agar pattern bearish trend ke baad develop hota hai, toh ye bullish reversal ko darust karta hai aur traders ko buy ki taraf indicate karta hai.

Traders ko Hikkake pattern ke istemal mein kuch zaroori points dhyan mein rakhne chahiye:- Confirmation: Pattern ko confirm karne ke liye, traders ko breakout ke baad ek confirmation candle ka wait karna chahiye. Agar confirmation candle ki high (bullish pattern ke case mein) ya low (bearish pattern ke case mein) crossed hoti hai, toh pattern confirm hota hai.

- Volume Analysis: Pattern ke saath volume analysis bhi important hai. Agar breakout high volume ke saath hota hai, toh pattern ki validity aur strength increase hoti hai.

- Stop Loss Placement: Har trading strategy mein stop loss placement zaroori hota hai. Hikkake pattern ke case mein bhi, traders ko apne positions ke liye sahi stop loss levels tay karna chahiye takay risk ko manage kiya ja sake.

Aakhir Mein:

Hikkake Candlestick Pattern ek powerful technical analysis tool hai jo trend reversal aur trend continuation ko identify karne mein madad karta hai. Lekin, jaise har trading strategy, is pattern ka bhi sahi samajh aur tajurba zaroori hai. Traders ko pattern ko confirm karne ke liye aur risk management ke saath istemal karna chahiye taake sahi trading decisions liye ja sakein.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:20 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим