Hikkake Candlestick Pattern in forex

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

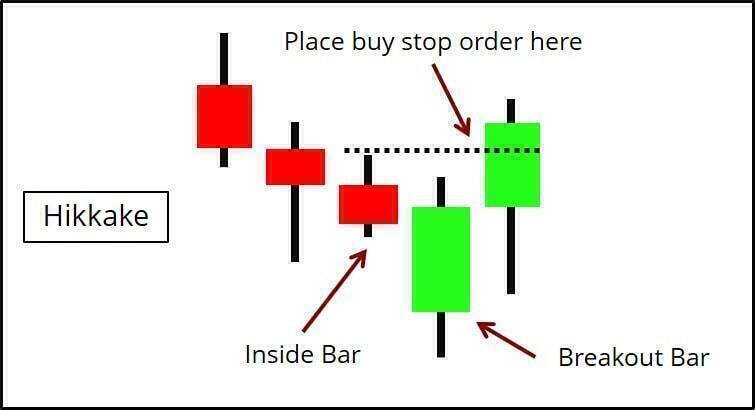

Introduction: Hikkake Candlestick Pattern, ya Hikkake Pattern, forex trading mein ek aham candlestick pattern hai. Yeh pattern traders ko market ke reversals aur trend changes ko samajhne mein madadgar hota hai. Hikkake Pattern ek price action pattern hai jiska maqsad hota hai trend reversals aur trend extensions ko pehchan'na. Formation Hikkake Pattern, kisi candlestick ka formation hota hai jo do chhote candlesticks aur phir ek large candlestick se banta hai. 1st Step: Market mein ek "inside bar" yaani aik candlestick jo pehle wale candlestick ke andar hota hai, ban jata hai. 2nd Step: Phir, ek doosra inside bar, pehle wale candlestick ke andar hota hai. 3rd Step: Akhri step mein, ek large candlestick jo pehle ke do inside bars ko break karta hai, banta hai. Is large candlestick ka direction trend reversal ya extension darust karta hai. Bullish Hikkake Pattern : Bullish Hikkake pattern jab market reversal ko darust karta hai: Inside candle down trend ke baad aati hai. Hikkake candle first candle ki range mein rehti hai. Fakey candle market ko opposite direction mein dikhata hai. Confirmation candle up trend ki surat mein close hoti hai. . Bearish Hikkake Pattern : Bearish Hikkake pattern jab market reversal ko darust karta hai: Inside candle up trend ke baad aati hai. Hikkake candle first candle ki range mein rehti hai. Fakey candle market ko opposite direction mein dikhata hai. Confirmation candle down trend ki surat mein close hoti hai. . Details Hikkake Pattern, market ki indecision ko darust karta hai jab price inside bars mein ghira hota hai. Isse traders ko samajhne mein madad milti hai ke market kis tarah move kar sakta hai. . Trading Strategy Hikkake Pattern ko trading strategy mein istemal karne ke liye traders ko market entry aur exit points tay karne mein madad milti hai. Agar trend reversal signal milti hai, to traders long ya short positions le sakte hain. . Caution and Skill Hikkake Pattern ke istemal mein maharat aur tehqiqat ki zarurat hoti hai. Market analysis aur risk management ko madde nazar rakhte hue is pattern ko samajhna aur istemal karna zaroori hai. . Canculsion: Is tarah se, Hikkake Candlestick Pattern forex trading mein ek ahem tool hai jo traders ko market trends aur reversals ko samajhne mein madadgar hota hai. Iska istemal achi tarah se karne ke liye amli tor par tajaweezat aur mehnat ki zarurat hoti hai. -

#3 Collapse

Hikkake Candlestick Pattern forex trading ke duniya mein aik kam mashhoor lekin ahem technical analysis ka zareya hai. Ye pattern market ki mogheera ulat pher aur traders ko maalomati faislay karne mein madad kar sakta hai. Hikkake Candlestick Pattern mein dakhil hone se pehle, candlestick charting ke bunyadi tareeqon ko samajhna zaroori hai. Candlestick charts finance markets mein qeemat ke harkaat ka mashhoor tajziya hai, jo Japan se shuru hua. Ye charts mukhtalif waqt ke liye aam tor par aik ghanta ya aik din khulne, band hone, unchaai aur neechai ke daam dikhate hain.

Candlestick patterns ye candles ke jor se hoti hain jo mogheera daam ka mukhtalif rukh ya jari rehne ki nishandahi karti hain. Traders ye patterns tajziya karke mustaqbil ke market trends ka andaza lagate hain aur munafa mand trading faislay karte hain.

Hikkake Candlestick Pattern Ki Samajh

Hikkake Candlestick Pattern, jo ke phansa ya phansaya gaya candle bhi kehlaya jata hai, aik teen-candle formation hai jo aik mumkinah trend ka ulta seedha hone ka ishara deta hai. Ye tab hota hai jab market mein aik taraf taqatwar momentum mehsoos hota hai, sirf aik counter-trend harkat ke zor se palat jata hai. Ye pattern aik bullish ya bearish candle Hikkake candle ke darmiyan phans gaya hota hai jo do mukhtalif rukh mein chal rahe taqatwar candles ke darmiyan hota hai.

Hikkake Candlestick Pattern Ka Banawat

Hikkake Candlestick Pattern ko pehchane ke liye, ye steps follow karen:

Step 1: Taqatwar trend ki mojudgi ko pehchane. Pattern aam tor par aik mazboot up-trend ya down-trend mein banata hai, jahan market ek lamba arsa ke liye aik rukh mein ja raha hota hai.

Step 2: Hikkake candle ko talash karen. Ye pattern ka teesra candle hota hai, jo pehle do candles ke darmiyan phansa hota hai. Hikkake candle ka aik chhota asli jism hona chahiye (khulne aur band hone mein kam farq) aur aik lamba shadow (ooper ya neechay) mukhtalif trend ki taraf.

Step 3: Pehle aur doosre candles ka tajziya karen. Ye candles ahem hajoom mein honi chahiye aur taqatwar trend ke khilaf chalne chahiye. Pehla candle doosre candle ke qareeb bund hona chahiye, jo aik mumkinah trend palat ki taraf ishara karta hai.

Hikkake Candlestick Pattern Ki Ahmiyat

Hikkake Candlestick Pattern ye ishara deta hai ke ibtedai taqatwar trend khatam ho sakta hai aur aik palat qareeb hai. Phansa Hikkake candle ye dikhata hai ke kharidari ya farokht karne walay market mein dakhil ho chuke hain, taqatwar trend ki taraf daam ko mazeed barhane ki koshish kar rahe hain. Magar, un ki koshish nakam hoti hai, aur market palat jati hai, Hikkake candle ko mukhtalif candles ke darmiyan phansa deti hai.

Hikkake Candlestick Pattern Par Mushtamil Trading Strategies

Hikkake Candlestick Pattern par trading ke doran, ye strategies ka tawazo rakhen:

Strategy 1: Chhoti Muddat Ki Palat

Hikkake Candlestick Pattern ko pehchane ke baad, traders taqatwar trend ke ulte rukh mein chhoti muddat ki palat trade mein dakhil ho sakte hain. Maslan, agar pattern ek up-trend ke doran banta hai, to traders ko (short jaane) farokht karne ka tawazo rakna chahiye, jismein Hikkake candle ke daam se ooper ek stop-loss order lagaya gaya ho.

Strategy 2: Mazeed Isharon Ke Sath Taeed

Hikkake Candlestick Pattern ki itminan dene ke liye, traders isey doosre technical indicators jaise ke moving averages, relative strength index (RSI), ya MACD ke saath mila sakte hain. In indicators ke sath pattern ko taeed dene se aik mazeed mazboot dakhil signal mil sakta hai palat trade ke liye.

Strategy 3: Breakout Ka Intezar

Hikkake Candlestick Pattern ko pehchane ke baad foran trade mein dakhil hone ke bajaye, traders pattern ka breakout ka intezar kar sakte hain taake palat ko tasdeeq kar sakein. Breakout tab hota hai jab market price Hikkake candle ke ooper ya neechay chalti hai, taqatwar trend palat ki taraf ishara karte hue.

Hikkake Candlestick Pattern Ki Hadood

Hikkake Candlestick Pattern forex traders ke liye aik qeemti tool ho sakti hai, lekin iski hadood nahi hai. In mein se kuch shamil hain:- Wrong Signal: Jaise ke kisi bhi technical analysis tool, Hikkake Candlestick Pattern ghalat isharay dene ka samna kar sakta hai, agar sahi tarah se nahi manage kiya gaya.

- Market Volatility: Zayada ghurbat wale markets pattern ke banne ko bigar sakti hain ya kam bharose mand bana sakti hain.

- Market Noise: Baahar ki factors, jaise ke khabron ka akhraj ya achanak market ke tabadlaat, pattern ki kargarangi par asar daal sakti hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

- Mentions 0

-

سا1 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

# Hikkake Candlestick Pattern in Forex

Forex trading mein candlestick patterns ka istemal karke market ke trends aur reversal points ko samajhna bohot ahem hai. In patterns mein se ek hai "Hikkake" candlestick pattern, jo traders ke liye valuable signals provide kar sakta hai.

Hikkake pattern do tarah se banta hai: bullish aur bearish. Is pattern ka asli maqsad price action ki confirmation ko dikhana hota hai, jo traders ko ek strong entry ya exit point dene mein madad karta hai.

### Bullish Hikkake Pattern

Bullish Hikkake pattern tab banta hai jab market pehle se downtrend mein hota hai. Is pattern ke liye, pehle ek bearish candlestick hoti hai, jiske baad ek bullish candlestick aati hai jo pehli candlestick ke high ko break karti hai. Ye bullish candlestick ek strong upward movement ka indication hoti hai. Is pattern ko dekhnay par agar volume bhi zyada ho, toh ye signal aur bhi strong hota hai.

### Bearish Hikkake Pattern

Bearish Hikkake pattern downtrend ke baad banta hai. Ismein pehle ek bullish candlestick hoti hai, jo market ke upward movement ko dikhati hai, lekin agla bearish candlestick is bullish candle ke high ko break karne ke baad neeche chala jata hai. Iska matlab hai ke market mein bearish sentiment hai, aur traders ko yahan se short position lene ka sochna chahiye.

### Hikkake Pattern ka Istemal

Hikkake pattern ko identify karne ke liye, traders ko price action, volume aur other indicators ko dekhnay ki zaroorat hoti hai. Ye pattern ek clear entry point deta hai, lekin isay use karte waqt stop-loss ka istemal karna nahi bhoolna chahiye. Isse aap apne losses ko control mein rakh sakte hain agar market aapki prediction ke khilaf chala jata hai.

### Conclusion

Hikkake candlestick pattern forex trading mein ek powerful tool hai. Isse samajh kar aur sahi tarike se istemal karke, traders apne trading decisions ko improve kar sakte hain. Lekin hamesha yaad rakhein ke kisi bhi pattern ka istemal karne se pehle market ki overall conditions ko samajhna bhi zaroori hai. Trading mein discipline aur patience ka hona bohot zaroori hai, kyunki ye factors aapki long-term success ke liye ahem hain. Hamesha research karein aur practice karein takay aap Hikkake pattern ko effectively use kar sakein.

- CL

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:51 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим