Dynamic Momentum index

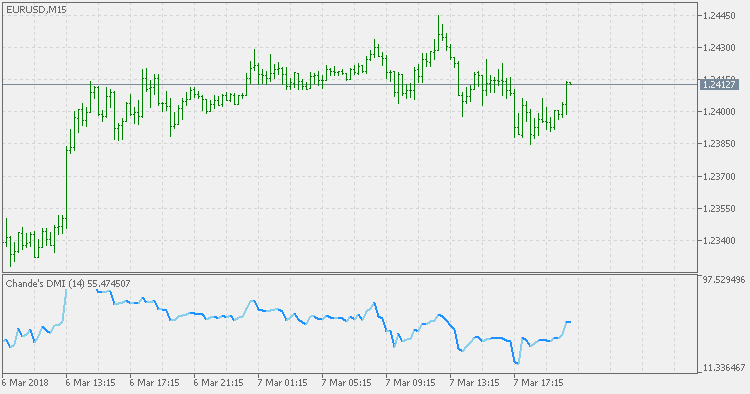

Dynamic Momentum Index forex mein ek ahem technical indicator hai jo trading analysis mein istemal hota hai. Ye indicator market ki momentum ko measure karta hai aur traders ko potential trend changes ke baare mein malumat farahem karta hai. DMI ka basic concept hai ke jab market mein tezi hoti hai, yaani ke prices mein barh charh hoti hai, ya jab market mein rukawat aati hai aur prices mein girawat hoti hai, toh iska asar DMI par hota hai. Is indicator ki madad se traders market ke future trends ka andaza lagate hain. DMI ka ek ahem hissa Wilder's Relative Strength Index (RSI) aur Average True Range (ATR) hai. DMI ke calculation mein past prices aur unke movements ka bhi madad liya jata hai. Iske through, traders ko pata chalta hai ke market mein kis qisam ka momentum hai aur kya wo trend continue hoga ya nahi. Is indicator ko samajhne ke liye, traders ko DMI ke do parts, Positive Directional Indicator (+DI) aur Negative Directional Indicator (-DI), ko samajhna zaroori hai. +DI, buyers ki strength ko measure karta hai jabke -DI, sellers ki strength ko represent karta hai. Agar +DI -DI se zyada hota hai, toh iska matlab hai ke buyers ki strength zyada hai aur market mein tezi ho sakti hai. Wahi agar -DI +DI se zyada hota hai, toh iska matlab hai ke sellers ki strength zyada hai aur market mein girawat ho sakti hai. Dynamic Momentum Index ka istemal market ke turning points ko predict karne ke liye hota hai. Agar DMI ki value zyada hoti hai, toh iska matlab hai ke market mein strong trend hai. Jab ye value kam hoti hai, toh iska matlab hai ke market mein sidha-sada movement ho rahi hai. Traders is indicator ko istemal kar ke apni trading strategies ko refine karte hain. DMI ke istemal se wo market trends ko behtar taur par samajh sakte hain aur apne trades ko usi ke mutabiq adjust kar sakte hain. In sabhi factors ki roshni mein, Dynamic Momentum Index ek powerful tool hai jo traders ko market ke dynamics ko samajhne mein madad karta hai. Lekin yaad rahe ke koi bhi indicator 100% accurate nahi hota, is liye prudent trading ke liye, dusre technical aur fundamental factors ko bhi madadgar samajhna zaroori hai.

Dynamic Momentum Index forex mein ek ahem technical indicator hai jo trading analysis mein istemal hota hai. Ye indicator market ki momentum ko measure karta hai aur traders ko potential trend changes ke baare mein malumat farahem karta hai. DMI ka basic concept hai ke jab market mein tezi hoti hai, yaani ke prices mein barh charh hoti hai, ya jab market mein rukawat aati hai aur prices mein girawat hoti hai, toh iska asar DMI par hota hai. Is indicator ki madad se traders market ke future trends ka andaza lagate hain. DMI ka ek ahem hissa Wilder's Relative Strength Index (RSI) aur Average True Range (ATR) hai. DMI ke calculation mein past prices aur unke movements ka bhi madad liya jata hai. Iske through, traders ko pata chalta hai ke market mein kis qisam ka momentum hai aur kya wo trend continue hoga ya nahi. Is indicator ko samajhne ke liye, traders ko DMI ke do parts, Positive Directional Indicator (+DI) aur Negative Directional Indicator (-DI), ko samajhna zaroori hai. +DI, buyers ki strength ko measure karta hai jabke -DI, sellers ki strength ko represent karta hai. Agar +DI -DI se zyada hota hai, toh iska matlab hai ke buyers ki strength zyada hai aur market mein tezi ho sakti hai. Wahi agar -DI +DI se zyada hota hai, toh iska matlab hai ke sellers ki strength zyada hai aur market mein girawat ho sakti hai. Dynamic Momentum Index ka istemal market ke turning points ko predict karne ke liye hota hai. Agar DMI ki value zyada hoti hai, toh iska matlab hai ke market mein strong trend hai. Jab ye value kam hoti hai, toh iska matlab hai ke market mein sidha-sada movement ho rahi hai. Traders is indicator ko istemal kar ke apni trading strategies ko refine karte hain. DMI ke istemal se wo market trends ko behtar taur par samajh sakte hain aur apne trades ko usi ke mutabiq adjust kar sakte hain. In sabhi factors ki roshni mein, Dynamic Momentum Index ek powerful tool hai jo traders ko market ke dynamics ko samajhne mein madad karta hai. Lekin yaad rahe ke koi bhi indicator 100% accurate nahi hota, is liye prudent trading ke liye, dusre technical aur fundamental factors ko bhi madadgar samajhna zaroori hai.

تبصرہ

Расширенный режим Обычный режим