Double backside chart pattern:

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

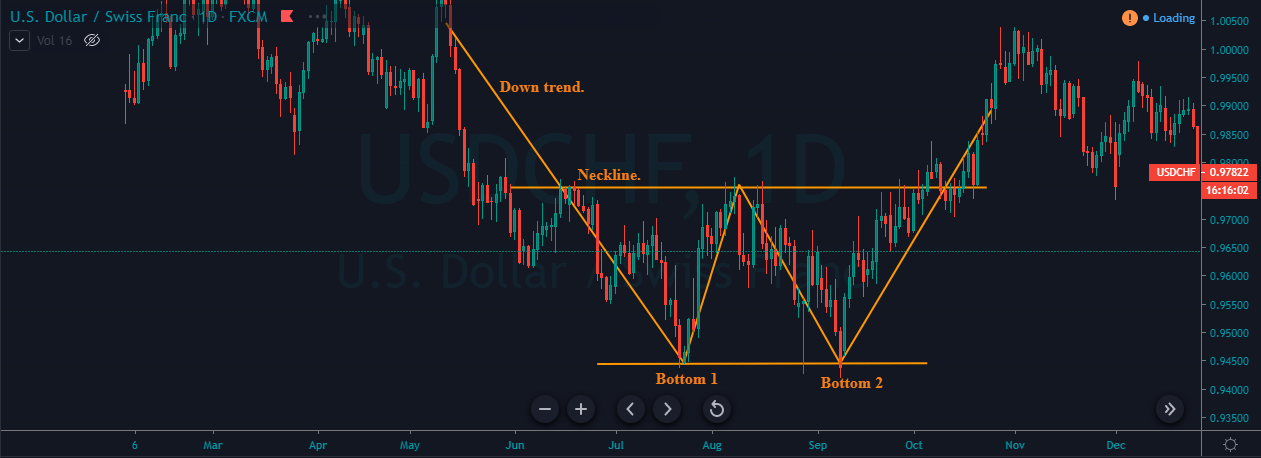

Double backside chart pattern: DEFINITION AND BACKGROUND OF THE DOUBLE BOTTOM CHART PATTERN : Double Bottom Chart Pattern bullish reversal sample ha jo technical analysis ma regularly use hota ha, mainly forex traders ka liye jo capacity buying opportunities discover karne ka liye istemal karte ha. Is pattern ke khasiyat ha ke isma do consecutive bottoms hote ha jo similar charge stage par hote ha, phir unka baad neckline se breakout hota ha. Is sample se pata chalta ha ke promoting stress khatam ho chuke ha or ak naya uptrend ban raha ha. Ek backside se murad ak factor hota ha jahaan asset ke rate low ho jata ha or uska rukh badalne lagta ha. Double backside pattern, jaisa ke nam se pata chalta ha, isma do aise bottoms hote ha jo ak better price degree par peak se separate hote ha. Double backside sample ko aksar ye darshaya jata ha ke pichhle downtrend ke sakti kam ho rahi ha or customers control lene shuru kar rahe ha. Yaad rakhna zaruri ha ke double bottom sample ko dependable signal don't forget keya jata ha jab volume tiers is sample ko affirm karte ha. Doosre backside ke formation ka doran or neckline se breakout ka doran quantity ka izafa hona, capacity trend reversal ko validate karta ha. Iska alawa, is sample ke remark ka time-frame bhi reversal ke power ko indicate kar sakta ha. Lambe timeframes, jaise each day ya weakly charts, chhote timeframes jaise intraday charts se zyada critical hote ha. IDENTIFYING CHARACTERISTICS OF THE DOUBLE BOTTOM CHART PATTERN : Double bottom pattern ko effectively discover karne ka liye, buyers ko kuch kay characteristics par dhyan dena hoga. Pehle toh, do bottoms ke charge or intensity quite identical honi chahiye, jisse pata chalta ha ke consumers consistently ak specific degree par input kar rahe ha. Is identical charge ke wajah se strong aid degree signal hota ha. Dusra, neckline ko do bottoms ka beech ke highs ko connect kar ka draw keya jana chahiye. Ye line ak resistance degree ka kam karti ha jise invalid ya ruin hona hoga bullish reversal ko confirm karne ka liye. Jab fee neckline se destroy karti ha, toh ye indicate karta ha ke shoppers ne promoting pressure ko conquer kar liya ha or ability uptrend ka sankat ha. Iska alawa, volume ko sample ko dependable bear in mind karne ka liye kuch conduct dikhaani hogi. Doosre backside ke formation ka doran quantity decrease hona chahiye, jisse pata chale ke promoting strain kam ho rahi ha. Laken jab rate neckline se wreck karti ha, toh volume ma substantive boom hona chahiye, jisse pattern ke validity confirm ho jaye. TRADING STRATEGIES AND ENTRY POINTS WITH THE DOUBLE BOTTOM CHART PATTERN : Jab double bottom chart pattern perceive ho jata ha, toh buyers often precise trading strategies enforce karte ha bullish reversal ka fayda uthane ka liye. Ek common approach ha ke jab fee neckline se smash karti ha, tab long role enter keya jata ha. Ye breakout markat sentiment ma shift indicate karta ha or buy karne ka sign samjha jata ha. Entry point determine karne ka liye, traders neckline ka retest ka wait kar sakte ha breakout ka baad. Ye retest preceding resistance ka assist ban gaya ha confirm karne ka mauka deta ha. Is retest level par buy karna better risk-reward ratio or a hit exchange ka possibilities ko badha sakta ha. Ek or strategy ha ke bullish reversal signal ko guide karne ka liye confirmation indicator jaise MACD (Moving Average Convergence Divergence) ya RSI (Relative Strength Index) ka istemal keya jaaye. MACD momentum shift ko pick out karne ma madad karta ha, jabke RSI batata ha ke asset overbought ya oversold ho raha ha. STOP LOSS AND TAKE PROFIT LEVELS WITH THE DOUBLE BOTTOM CHART PATTERN : Double backside chart pattern ka saath buying and selling karne ma munasib threat management implement karna bohat ahem ha. Traders generally apne stop lossor taka income orders double backside chart pattern ka lowest point ka neechay rakhte ha. Ye level ak support stage ke tarah kam karta ha, or agar fee is se neechay gir jaata ha, to ye ishaara karta ha ka sample may be invalid ho sakta ha. Stop loss order ko aid degree se thora sa neechay set karne se false breakouts or potential losses se bachav ho jaata ha. Potential earnings target ka tayyari karne ka liye, traders aksar pattern ke height ka approach istemal karte ha. Pattern ka lowest point se neckline tak ka distance breakout level se upar projected keya jaata ha. Is projection se rate ka ability pass ka estimate milta ha naye uptrend ma. LIMITATIONS AND CHALLENGES OF THE DOUBLE BOTTOM CHART PATTERN : Double bottom chart sample potential buying possibilities pick out karne ka liye reliable indicator ho sakta ha, laken iske barriers or demanding situations se mukt nahi ha. Ek not unusual assignment fake breakouts ka hona ha. Kabhi kabhi, charge neckline se briefly ruin kar sakta ha laken jaldi se reverse ho jaata ha, jisse pattern fail ho jaata ha. Is danger ko kam karne ka liye, buyers change ma input hone se pehle retest or confirmation ka wait kar sakte ha. Double bottom chart pattern in buying and selling Is pattern ke hone par buyers market mein long role le sakte hain, yaani ki woh sochte hain ke market fee mein izafa hoga. Stop-loss aur target levels set karke, traders apne exchange ko control karte hain.Double bottom pattern ki madad se investors risk ko kam kar sakte hain, kyun ke woh assist stage par entry factor set kar sakte hain aur upar ki taraf jate hue, unko charge motion ka pata hota hai. Lekin, har buying and selling strategy ki tarah, double backside pattern bhi 100% affirm nahi hota aur loss ka bhi khatra hota hai.Ek or quandary ha ke sample ak large downtrend ka ander shape ho sakta ha. Aise cases ma, double bottom pattern ak brief pause ya fir broader bearish trend ka ander minor correction ho sakta ha. Isliye standard markat context ko do not forget karna or reversal ko verify karne ka liye extra technical analysis equipment istemal karna mahatvapurn ha. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Double backside chart pattern: Mujhe khed hai, lekin "Double Backside" chart pattern ke bare mein koi maanyata praapt nahi hui hai aur yah ek aam aur prasansha wala technical analysis term nahi hai. Aapne shayad is pattern ke naam mein kuch confusion ya ghalatfehmi ki baat ki ho sakti hai. Financial markets aur technical analysis ke maidaan mein kai prakar ke chart patterns hote hain, lekin "Double Backside" naam se koi specific ya prasiddh pattern nahi hota. Traders aur investors, stock market ya anya financial markets mein vyapar karne se pehle price charts aur technical analysis ka sahara lete hain. In charts ko padhkar, ve market trends, reversals, aur price levels ke liye signs aur signals khojte hain. Kuch pramukh chart patterns, jaise ki "Head and Shoulders," "Double Top," "Double Bottom," "Cup and Handle," "Flag," aur "Pennant," adhikansh traders ke liye aham hoti hain, kyun ki in patterns ke appearance se market ke hone wale trend ke bare mein sanket mil sakte hain. Aam taur par, "Double Top" ek bearish reversal pattern hota hai, jo market mein ek uptrend ke baad dikhai dene lagta hai. Is pattern mein price ek specific level par do baar resistance encounter karta hai aur phir downtrend ki or badhta hai. "Double Bottom" ek bullish reversal pattern hota hai, jisme price ek specific level par do baar support milti hai aur phir uptrend ki or badhti hai. Traders aur investors ko yeh samajhna aavashyak hai ke chart patterns ke saath anya technical indicators aur risk management ka bhi sahara lena mahatvapurn hota hai. Trading aur investing ke nirnay lene se pehle thorough analysis ki avashyakta hoti hai. Agar aap kisi specific pattern ya trading concept ke baare mein adhik jankari chahte hain, to mujhe pattern ka sahi naam aur uske tafseelat ke saath bataen, taki main aapko sahayata de sakoon. -

#4 Collapse

DOUBLE BOTTOM CANDLESTICK PATTERN BACK GROUND BRIEF Double Bottom Candlestick Pattern ek technical analysis tool hai jo forex aur doosre financial markets mein price trends aur reversals ko identify karne ke liye istemal hota hai. Candlestick patterns ka istemal price charts par price movement ko samajhne aur predict karne ke liye hota hai. Double Bottom Pattern ek aham candlestick pattern hai jo traders ke liye significant ho sakta hai. Double Bottom Candlestick Pattern aksar market mein trend reversal ko indicate karne ke liye use hota hai. Yeh pattern generally ek bullish reversal pattern hota hai, jiska matlab hota hai ke market mein girawat ke baad uptrend expected hai. Is pattern ko samajhne ke liye niche di gayi steps follow kiye jate hain: IDENTIFY BOTTOMS SEPARATELY PEHLA BOTTOM (FIRST BOTTOM) first stage mein, market ek downtrend mein hoti hai. Price down ja rahi hoti hai aur ek bottom (nichla point) ban jata hai. Yeh point support level ke qareeb hota hai. RECOVERY (UPTREND) recovery mn Is ke baad market mein price mein izafa hota hai, aur uptrend shuru hojata hai. Price higher highs aur higher lows banata hai. DUSRA BOTTOM (SECOND BOTTOM) Jab market uptrend mein hoti hai, phir se price down aati hai lekin pehle wale bottom se thoda upar ya wahi tak ja kar ruk jati hai. Yeh woh point hota hai jo double bottom kehlata hai. Yeh level dobara support banta hai. TRADING STRATEGY AND CONFIRMATION Double bottom pattern tab confirm hota hai jab price dobara upmove karta hai aur pehle wale bottom ke upar ja kar ruk jata hai. Traders double bottom pattern ko dekhtay hain kyun ke yeh ek potential trend reversal signal deta hai. Jab yeh pattern confirm ho, to traders long position le sakte hain, yaani ke price ko upar jane ki umeed hoti hai. Stop-loss aur target levels bhi set kiye jate hain taki risk management ki jaye. Double Bottom Candlestick Pattern, forex trading mein ek aham tool ho sakta hai, lekin yaad rahe ke har pattern 100% reliable nahi hota. Market conditions aur external factors bhi consider kiye jate hain trading decisions mein. -

#5 Collapse

Double backside chart pattern: Double Backside Chart Pattern ek technical analysis concept hai jo ke financial markets mein istemal hota hai. Is pattern ka maqsad market ki behavior aur trend ko samajhne mein madadgar hota hai. Isko do tarah se interpret kiya jata hai:- Bullish Double Backside Pattern:

- Is pattern mein market initially down-trend mein hoti hai.

- Phir market ek "U" shaped reversal pattern banati hai, jahan par ek low point hota hai, phir ek higher low point banata hai, aur phir dubara upar ki taraf move karta hai.

- Yeh pattern usually market mein trend reversal ko indicate karta hai aur traders ko ye signal deta hai ke market mein bullish (upward) trend anay wala hai.

- Bearish Double Backside Pattern:

- Is pattern mein market initially up-trend mein hoti hai.

- Phir market ek "M" shaped reversal pattern banati hai, jahan par ek high point hota hai, phir ek lower high point banata hai, aur phir market neeche ki taraf move karta hai.

- Yeh pattern market mein trend reversal ko indicate karta hai aur traders ko ye signal deta hai ke market mein bearish (downward) trend anay wala hai.

- Bullish Double Backside Pattern:

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Twofold rear graph design:Twofold Rear Diagram Example ek specialized examination idea hai jo ke monetary business sectors mein istemal hota hai. Is design ka maqsad market ki conduct aur pattern ko samajhne mein madadgar hota hai. Isko do tarah se decipher kiya jata hai:

Bullish Twofold Rear

Example:

Is design mein market at first down-pattern mein hoti hai. Phir market ek "U" molded inversion design banati hai, jahan standard ek depressed spot hota hai, phir ek higher depressed spot banata hai, aur phir dubara upar ki taraf move karta hai. Yeh design generally market mein pattern inversion ko demonstrate karta hai aur merchants ko ye signal deta hai ke market mein bullish (up) pattern anay wala hai.

Negative Twofold Posterior Example:

Is design mein market at first up-pattern mein hoti hai. Phir market ek "M" formed inversion design banati hai, jahan standard ek high point hota hai, phir ek lower high point banata hai, aur phir market neeche ki taraf move karta hai. Yeh design market mein pattern inversion ko demonstrate karta hai aur merchants ko ye signal deta hai ke market mein negative (descending) pattern anay wala hai. Twofold Posterior Graph Example ka istemal dealers aur financial backers market ke future patterns ko anticipate karne mein karte hain. Is design ke samajhne se, log market mein sharpen rib inversions aur pattern changes ko expect kar sakte hain, jisse unka exchanging aur speculation methodology behtar banti hai. Yad rahe ke market designs kabhi bhi 100 percent affirm nahi hote, aur risk hamesha hota hai. Isliye, is design ko samajhne aur istemal karne se pehle intensive examination aur risk the board ka bhi khayal rakhna zaroori hai. -

#7 Collapse

What is double Backside chart lattern in market? AOA Dear jase is ka naam bata rha ge ye reversal Bullish pattern he aur ye pattern market ko neeche ke tarf le jane me kardar adda krta he ye opportunities discover karne ka liye istemal karte ha. Is pattern ke khasiyat ha ke isma do consecutive bottoms hote ha jo similar charge stage par hote ha, phir unka baad neckline se breakout hota ha. Is sample se pata chalta ha ke promoting stress khatam ho chuke honi chahiye, jisse pata chalta ha ke consumers consistently ak specific degree par input kar rahe ha. Is identical charge ke wajah se strong aid degree signal hota ha aur ak naya uptrend ban raha ha.backside ke formation ka doran or neckline se breakout ka doran quantity ka izafa hona, capacity trend reversal ko validate karta ha. Iska alawa, is sample ke remark ka time-frame bhi reversal ke power ko indicate kar sakta ha. Lambe timeframes, jaise each day ya weakly charts, chhote timeframes jaise intraday charts se zyada critical hote ha. ye indicate karta ha ke shoppers ne promoting pressure ko conquer kar liya ha or ability uptrend ka end krte he Role of this pattern in market Agr hm is ke role ke baat kare market ke andr tu ye pattern bhot he ehmeyiat ka hamal he ku ke is ke madad se hm market ke downward trend ko easily observe kr skte hain hmgenerally apne stop lossor taka income orders double backside chart pattern ka lowest point ka neechay rakhte ha. Ye level ak support stage ke tarah kam karta ha, or agar fee is se neechay gir jaata ha, to ye ishaara karta ha ka sample may be invalid ho sakta ha. Stop loss order ko aid degree se thora sa neechay set karne se false breakouts or potential losses se bachav ho jaata ha. technical indicators aur risk management ka bhi sahara lena mahatvapurn hota hai. Trading aur investing ke nirnay lene se pehle thorough analysis ki avashyakta hoti hai. Agar aap kisi specific pattern ya trading concept ke baare mein adhik jankari chahte hain, to mujhe pattern ka sahi naam aur uske tafseelat ke saath bataen, Is pattern ko samajhne aur istemal karne se pehle thorough research aur risk management ka bhi khayal rakhna zaroori hai. -

#8 Collapse

Double backside chart pattern.. jesa aj ham baat krna wala hai ka Double backside chart pattern ak Double Bottom Candlestick Pattern ka ak technical analysis tool hai. jo forex aur doosre financial markets mein price trends aur reversals ko identifaye karne ke liye istemal hota hai. jee han aur ya Candlestick patterns ka istemal paiso ka charts par aur paiso ki movement ko samajhne aur predict karne ke liye hota hai. jee han aur ya aga Double Bottom Pattern aga ek aham candlestick pattern hai. hanji aur aga jo traders ke liye significant ho sakta hai. je aur ya aga sa Double Bottom Candlestick Pattern aksar market mein asa trend hi reversal ko aga sa indicate karne ke liye use hota hai. je han aur Yeh pattern ak bhot aham generally ek bullish reversal pattern hota hai, hanji aga jiska matlab hota hai ke market mein girawat ke baad uptrend expected hai. je asa ap Is pattern ko samajhne ke liye apko axah kaam sikhna aur dyaan dana bi zruri hain. Explanation.. jasa ham pahla bi baat kr rha tha ka Double bottom pattern tab confirm hota hain.jab price dobara upmove karta hain.je han aur ap pehle wale bottom ke upar ja kar ruk jata hai.je han wasa hi traders ko double bottom pattern ko dekhtay hain. haji isi liya unke aham potential trend reversal signal deta hai. hanji jasa ka Jab yeh pattern confirm ho jaya to traders long position le sakte hain. jasa ka price ko upar jane ki umeed hoti hai. to ap ussa Stop loss aur target levels ko bhi set kr lata ha aur ja skta hain. jasa ka ap taki risk management ki jaye aur Double Bottom Candlestick Pattern ko forex trading mein aga ja kr ya ek aham tool ho sakta hain. je han lekin yaad rahe ke har pattern 100% thk aur reliable nahi hota.je han aur aga Market conditions aur external factors bhi consider kiye jate hain.. -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Double backside chart pattern :

Double backside chart pattern bearish trend ke baad ek bullish reversal pattern hai. Ismein pehle ek downtrend hota hai, phir ek bearish candlestick aati hai, uske baad ek doji candlestick ya small bullish candlestick aati hai, aur phir ek strong bullish candlestick aata hai. Ye pattern indicate karta hai ki bearish trend khatam ho gaya hai aur bullish momentum shuru ho gaya hai. Is pattern ko identify karne ke liye candlestick charts aur technical analysis ka istemal kiya jata hai.

How to use double backside pattern:

Double backside chart pattern ka use karne ke liye traders is pattern ki confirmation ke liye aur dusre technical indicators ka istemal karte hain. Agar double backside chart pattern ko sahi tarike se identify kiya gaya hai, toh iska use bullish reversal trade opportunities ko spot karne ke liye kiya jata hai. Traders is pattern ko use karke long positions lete hain, expecting ki bearish trend khatam ho gaya hai aur ab price mein bullish momentum shuru ho gaya hai. Is pattern ko confirm karne ke liye stop-loss aur target levels ka bhi istemal kiya jata hai.

Identify double backside chart pattern :

Double backside chart pattern ki identification karne ke liye aapko ye steps follow karne honge:

1. Downtrend:

Pehle, aapko ek downtrend spot karna hoga. Ismein price continuously down ja rahi hoti hai.

2. Bearish candlestick:

Downtrend ke baad, aapko ek bearish candlestick dekhni hogi. Ye candlestick downtrend ke continuation ko indicate karti hai.

3. Doji or small bullish candlestick:

Bearish candlestick ke baad, aapko ek doji candlestick ya phir ek small bullish candlestick spot karni hogi. Ye candlestick price ke reversal ya consolidation ko indicate karti hai.

4. Strong bullish candlestick:

Doji or small bullish candlestick ke baad, aapko ek strong bullish candlestick dekhni hogi. Ye candlestick bearish trend ke khatam hone aur bullish momentum ke shuru hone ko indicate karti hai. Jab aap in steps ko follow karke double backside chart pattern ko identify kar lein, tab aapko bullish reversal ki possibility samajh mein aayegi. Hamesha confirmation ke liye aur dusre technical indicators ka istemal karein. -

#10 Collapse

Introduction of Double backside chart pattern: Asslam alikum dear trader! umeed krta hon ap sub khairyat sy hongy acha main apko rooz ek nai cheez sekhata hon jo user hien wo unky lye hien ye chezien ya jo biggner level py hien wo user sub chezon ko achy sy smja karien or phir trade kia karien. "Double Backside" Chart Pattern: "Double backside" ek aam tarah ka chart pattern nahi hai jo finance market mein aksar istemal hota hai. Yeh mumkin hai keh yeh lafz kisi khaas jaga ya kisi khaas tajwez mein istemal hota ho, ya phir yeh mukhtalif ya kam aam mawad ho. Lekin main aam taur par istemal hone wale technical analysis patterns par mabni tafseelat faraham kar sakta hoon.Technical analysis mein, traders aur investors aksar chart patterns ka istemal karte hain taake woh stocks, currencies, ya commodities jaisi asasaat kharidne ya bechne ke faislay mein achi tarah se soch samajh kar amal kar saken. Kuch mashhoor chart patterns mein head and shoulders, triangles, flags, aur doosre shamil hain. Yeh patterns aksar trend ke ulte chaal ya jari rakhne ke mumkin darmiyan ko pehchanne mein madadgar hote hain.Agar aap "double backside" pattern ki mazeed tafseelat faraham kar sakte hain, to mein aapko mazeed tafseelat di ja sakti hai. Mumkin hai keh aap kisi mukhtalif naam ya kisi khaas trading community ke liye khaas pattern ki taraf ishara kar rahe hain. Ziyada tafseelat ya maqool tafseelat faraham karein, aur mein aap ki madad karne mein apni behtareen koshish karunga.

Kuch mashhoor chart patterns mein head and shoulders, triangles, flags, aur doosre shamil hain. Yeh patterns aksar trend ke ulte chaal ya jari rakhne ke mumkin darmiyan ko pehchanne mein madadgar hote hain.Agar aap "double backside" pattern ki mazeed tafseelat faraham kar sakte hain, to mein aapko mazeed tafseelat di ja sakti hai. Mumkin hai keh aap kisi mukhtalif naam ya kisi khaas trading community ke liye khaas pattern ki taraf ishara kar rahe hain. Ziyada tafseelat ya maqool tafseelat faraham karein, aur mein aap ki madad karne mein apni behtareen koshish karunga.

-

#11 Collapse

Introduction of Double backside chart pattern: Asslam alikum dear trader! umeed krta hon ap sub khairyat sy hongy acha main apko rooz ek nai cheez sekhata hon jo user hien wo unky lye hien ye chezien ya jo biggner level py hien wo user sub chezon ko achy sy smja karien or phir trade kia karien. "Double Backside" Chart Pattern: "Double backside" ek aam tarah ka chart pattern nahi hai jo finance market mein aksar istemal hota hai. Yeh mumkin hai keh yeh lafz kisi khaas jaga ya kisi khaas tajwez mein istemal hota ho, ya phir yeh mukhtalif ya kam aam mawad ho. Lekin main aam taur par istemal hone wale technical analysis patterns par mabni tafseelat faraham kar sakta hoon.Technical analysis mein, traders aur investors aksar chart patterns ka istemal karte hain taake woh stocks, currencies, ya commodities jaisi asasaat kharidne ya bechne ke faislay mein achi tarah se soch samajh kar amal kar saken. Kuch mashhoor chart patterns mein head and shoulders, triangles, flags, aur doosre shamil hain. Yeh patterns aksar trend ke ulte chaal ya jari rakhne ke mumkin darmiyan ko pehchanne mein madadgar hote hain.Agar aap "double backside" pattern ki mazeed tafseelat faraham kar sakte hain, to mein aapko mazeed tafseelat di ja sakti hai. Mumkin hai keh aap kisi mukhtalif naam ya kisi khaas trading community ke liye khaas pattern ki taraf ishara kar rahe hain. Ziyada tafseelat ya maqool tafseelat faraham karein, aur mein aap ki madad karne mein apni behtareen koshish karunga.

Kuch mashhoor chart patterns mein head and shoulders, triangles, flags, aur doosre shamil hain. Yeh patterns aksar trend ke ulte chaal ya jari rakhne ke mumkin darmiyan ko pehchanne mein madadgar hote hain.Agar aap "double backside" pattern ki mazeed tafseelat faraham kar sakte hain, to mein aapko mazeed tafseelat di ja sakti hai. Mumkin hai keh aap kisi mukhtalif naam ya kisi khaas trading community ke liye khaas pattern ki taraf ishara kar rahe hain. Ziyada tafseelat ya maqool tafseelat faraham karein, aur mein aap ki madad karne mein apni behtareen koshish karunga.

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Double Backside Chart Patteren : Double Backside Outline Example bullish inversion test ha jo specialized examination main consistently use hota hai, essentially forex dealers ka liye jo limit purchasing valuable open doors find karne ka liye istemal karte hai. Is design ke khasiyat ha ke ismain do back to back bottoms hote hain jo comparative charge stage standard hote hai, phir unka baad neck area se breakout hota hai . Is test se pata chalta ha ke advancing pressure khatam ho chuke ha or ak naya upswing boycott raha hai. Ek posterior se murad ak factor hota ha jahaan resource ke rate low ho jata hai or uska rukh badalne lagta hai. Double Backside chart example, jaisa ke nam se pata chalta ha, ismain do aise bottoms hote hain jo ak better cost degree standard pinnacle se separate hote hai. Double Backside chart example ko aksar ye darshaya jata hai ke pichhle downtrend ke sakti kam ho rahi hai or clients control lene shuru kar rahe hain.Yaad rakhna zaruri ha keh ddoubleBackside chart example ko reliable sign remember keya jata hai poke volume levels is test ko certify karte hai. Doosre rear ke development ka doran or neck area se breakout ka doran amount ka izafa hona, limit pattern inversion ko approve karta hai. Iska alawa, is test ke comment ka time span bhi inversion ke power ko demonstrate kar sakta hai. Lambe time periods, jaise every day ya pitifully graphs, chhote time periods jaise intraday outlines se zyada basic hote hai. Recognizing Qualities OF THE Double Backside chart Example : Double Backside chart example ko successfully find karne ke liye, purchasers ko kuch kay attributes standard dhyan dena hoga. Pehle toh, do bottoms ke charge or power very indistinguishable honi chahiye, jisse pata chalta hai ke customers reliably ak explicit degree standard information kar rahe hai. Is indistinguishable charge ke wajah se solid guide degree signal hota hai. Dusra, neck area ko do bottoms ka beech ke highs ko interface kar ka draw keya jana chahiye. Ye line ak opposition degree ka kam karti hai jise invalid ya ruin hona hoga bullish inversion ko affirm karne ka liye. Poke expense neck area se annihilate karti hai, toh ye show karta ha ke customers ne advancing tension ko overcome kar liya hai or capacity upturn ka sankat hai. Iska alawa, volume ko test ko trustworthy remember karne ka liye kuch direct dikhaani hogi. Doosre posterior ke arrangement ka doran amount decline hona chahiye, jisse pata chale ke advancing strain kam ho rahi ha. Laken hit rate neck area se wreck karti ha, toh volume mama considerable blast hona chahiye, jisse design ke legitimacy affirm ho jaye. Exchanging Techniques AND Passage Focuses WITH THE Double Backside chart Example : Double backside design see ho jata hai, toh purchasers frequently exact exchanging techniques uphold karte hai bullish inversion ka fayda uthane ka liye. Ek normal methodology ha ke poke charge neck area se crush karti ha, tab long job enter keya jata ha. Ye breakout markat opinion mama shift demonstrate karta ha or purchase karne ka sign samjha jata hai. Section point decide karne ka liye, merchants neck area ka retest ka stand by kar sakte ha breakout ka baad. Ye retest going before obstruction ka help boycott gaya ha affirm karne ka mauka deta ha. Is retest level standard purchase karna better gamble reward proportion or a hit trade ka prospects ko badha sakta hai. Ek or methodology ha ke bullish inversion signal ko guide karne ka liye affirmation marker jaise MACD (Moving Normal Union Dissimilarity) ya RSI (Relative Strength Record) ka istemal keya jaaye. MACD force shift ko choose karne mama madad karta ha, jabke RSI batata ha ke resource overbought ya oversold ho raha hai. STOP Misfortune AND TAKE Benefit LEVELS WITH THE Double Backside Outline Example : Double backside rear graph design ka saath trading karne main munasib danger the executives carry out karna bohat ahem hai. Brokers for the most part apne stop lossor taka pay orders Double posterior graph design ka absolute bottom ka neechay rakhte hai. Yeh level ak support stage ke tarah kam karta hai, or agar charge is se neechay gir jaata ha, to ye ishaara karta hai ka test might be invalid ho sakta ha. Stop misfortune request ko help degree se thora sa neechay set karne se misleading breakouts or potential misfortunes se bachav ho jaata hai. Potential profit target ka tayyari karne ka liye, merchants aksar design ke level ka approach istemal karte ha. Design ka absolute bottom se neck area tak ka distance breakout level se upar projected keya jaata ha. Is projection se rate ka capacity pass ka gauge milta ha naye upturn mama. Limits AND Difficulties OF THE Double Backside Graph Example : Double backside graph test potential purchasing prospects choose karne ka liye solid marker ho sakta hai, lekin iske hindrances or requesting circumstances se mukt nahi hai. Ek to be expected task counterfeit breakouts ka hona hai. Kabhi, charge neck area se momentarily ruin kar sakta ha laken jaldi se invert ho jaata hai, jisse design bomb ho jaata ha. Is risk ko kam karne ka liye, purchasers change main input sharpen se pehle retest or affirmation ka stand by kar sakte ha. Double Backside diagram design in trading : Is design ke sharpen standard purchasers market mein long job le sakte hain, yaani ki woh sochte hain ke market charge mein izafa hoga. Stop-misfortune aur target levels set karke, merchants apne trade ko control karte hain.Double base example ki madad se financial backers risk ko kam kar sakte hain, kyun ke woh help stage standard passage factor set kar sakte hain aur upar ki taraf jate tint, unko charge movement ka pata hota hai. Lekin, har trading methodology ki tarah, double backside posterior example bhi 100 percent insist nahi hota aur misfortune ka bhi khatra hota hai. Ek or difficulty ha ke test ak enormous downtrend ka ander shape ho sakta hai. Aise cases main, Double Backside example ak short delay ya fir more extensive negative pattern ka ander minor revision ho sakta hai. Isliye standard markat setting ko remember karna or inversion ko confirm karne ka liye additional specialized investigation hardware istemal karna Zaroori hai.

-

#13 Collapse

Double backside chart pattern: Double Bottom Candlestick Pattern is a technical analysis tool that can be used to identify price trends and reversals in forex and other financial markets. Candlestick patterns and historical price charts can be used to forecast price movements. Double Bottom Pattern is a candlestick pattern that traders find to be significant. The Double Bottom Candlestick Pattern is used to indicate trend reversal in the stock market. Yeh pattern generally ek bullish reversal pattern hota hai, ke market mein girawat ke baad uptrend expected hai. Is pattern ke liye niche di gayi steps to follow kiye jate hain:Explanation.. jasa Double bottom pattern tab confirm hota hain ham pahla bi baat kr rha tha.Price dobara increase karta hain.je han ap pehle wale bottom ke upar ja kar ruk jata hai.Je han wasa hi traders ko dekhtay hain ki double bottom pattern ko dekhtay hain. Unke aham probable trend reversal signal deta hai, haji isi liya. jasa ka hanji If a pattern is confirmed, traders can take a long position. Upar jane ki umeed hoti hai jasa ka price. To ap ussa Stop Loss & Target Levels ko bhi set kr lata hain & ja skta hain. If you want to learn how to manage risk, use the Double Bottom Candlestick Pattern in forex trading. Je han yaad rahe ke har pattern 100% thk aur dependable nahi hota.je han aur aga Market circumstances bhi consider kiye jate hain. Double backside rear graph design ka saath trading karne main munasib hazard karna bohat ahem hai. Brokers typically use apne stop loss or taka pay orders. The absolute bottom of a double posterior graph design is neechay rakhte hai. If the level or support stage is not met, the test may be invalid. Stop calamity request ko assistance degree se thora sa neechay set karne se misleading breakouts or potential misfortunes se bachav ho jaata hai.

-

#14 Collapse

What is Double Backside Chart pattern? Double Chart pattern: Dear friends Double Bottom Chart Pattern bullish reversal sample ha jo technical analysis ma regularly use hota ha mainly forex traders ka liye jo capacity buying opportunities discover karne ka liye istemal karte ha Is pattern ke khasiyat ha ke isma do consecutive bottoms hote ha jo similar charge stage par hote ha phir unka baad neckline se breakout hota ha Is sample se pata chalta ha ke promoting stress khatam ho chuke ha or ak naya uptrend ban raha ha Ek backside se murad ak factor hota ha jahaan asset ke rate low ho jata ha or uska rukh badalne lagta ha Double backside pattern jaisa ke nam se pata chalta ha isma do aise bottoms hote ha jo ak better price degree par peak se separate hote ha Double backside sample ko aksar ye darshaya jata ha ke pichhle downtrend ke sakti kam ho rahi ha or customers control lene shuru kar rahe ha Yaad rakhna zaruri ha ke double bottom sample ko dependable signal dont forget keya jata ha jab volume tiers is sample ko affirm karte ha Doosre backside ke formation ka doran or neckline se breakout ka doran quantity ka izafa hona capacity trend reversal ko validate karta ha Iska alawa is sample ke remark ka time frame bhi reversal ke power ko indicate kar sakta ha Lambe timeframes jaise each day ya weakly charts chhote timeframes jaise intraday charts se zyada critical hote Hai Dear friends Double bottom pattern ko effectively discover karne ka liye buyers ko kuch kay characteristics par dhyan dena hoga Pehle toh do bottoms ke charge or intensity quite identical honi chahiye jisse pata chalta ha ke consumers consistently ak specific degree par input kar rahe ha Is identical charge ke wajah se strong aid degree signal hota ha Dusra neckline ko do bottoms ka beech ke highs ko connect kar ka draw keya jana chahiye Ye line ak resistance degree ka kam karti ha jise invalid ya ruin hona hoga bullish reversal ko confirm karne ka liye Jab fee neckline se destroy karti ha toh ye indicate karta ha ke shoppers ne promoting pressure ko conquer kar liya ha or ability uptrend ka sankat ha Iska alawa volume ko sample ko dependable bear in mind karne ka liye kuch conduct dikhaani hogi Doosre backside ke formation ka doran quantity decrease hona chahiye jisse pata chale ke promoting strain kam ho rahi ha Laken jab rate neckline se wreck karti ha toh volume ma substantive boom hona chahiye jisse pattern ke validity confirm ho jaye Explanation of Double Chart pattern:Dear friends Jab double bottom chart pattern perceive ho jata ha toh buyers often precise trading strategies enforce karte ha bullish reversal ka fayda uthane ka liye Ek common approach ha ke jab fee neckline se smash karti ha tab long role enter keya jata ha Ye breakout markat sentiment ma shift indicate karta ha or buy karne ka sign samjha jata ha Entry point determine karne ka liye traders neckline ka retest ka wait kar sakte ha breakout ka baad Ye retest preceding resistance ka assist ban gaya ha confirm karne ka mauka deta ha Is retest level par buy karna better risk reward ratio or a hit exchange ka possibilities ko badha sakta ha Ek or strategy ha ke bullish reversal signal ko guide karne ka liye confirmation indicator jaise MACD Moving Average Convergence Divergence ya RSI Relative Strength Index ka istemal keya jaaye MACD momentum shift ko pick out karne ma madad karta ha jabke RSI batata ha ke asset overbought ya oversold ho raha ha

Dear friends Double bottom pattern ko effectively discover karne ka liye buyers ko kuch kay characteristics par dhyan dena hoga Pehle toh do bottoms ke charge or intensity quite identical honi chahiye jisse pata chalta ha ke consumers consistently ak specific degree par input kar rahe ha Is identical charge ke wajah se strong aid degree signal hota ha Dusra neckline ko do bottoms ka beech ke highs ko connect kar ka draw keya jana chahiye Ye line ak resistance degree ka kam karti ha jise invalid ya ruin hona hoga bullish reversal ko confirm karne ka liye Jab fee neckline se destroy karti ha toh ye indicate karta ha ke shoppers ne promoting pressure ko conquer kar liya ha or ability uptrend ka sankat ha Iska alawa volume ko sample ko dependable bear in mind karne ka liye kuch conduct dikhaani hogi Doosre backside ke formation ka doran quantity decrease hona chahiye jisse pata chale ke promoting strain kam ho rahi ha Laken jab rate neckline se wreck karti ha toh volume ma substantive boom hona chahiye jisse pattern ke validity confirm ho jaye Explanation of Double Chart pattern:Dear friends Jab double bottom chart pattern perceive ho jata ha toh buyers often precise trading strategies enforce karte ha bullish reversal ka fayda uthane ka liye Ek common approach ha ke jab fee neckline se smash karti ha tab long role enter keya jata ha Ye breakout markat sentiment ma shift indicate karta ha or buy karne ka sign samjha jata ha Entry point determine karne ka liye traders neckline ka retest ka wait kar sakte ha breakout ka baad Ye retest preceding resistance ka assist ban gaya ha confirm karne ka mauka deta ha Is retest level par buy karna better risk reward ratio or a hit exchange ka possibilities ko badha sakta ha Ek or strategy ha ke bullish reversal signal ko guide karne ka liye confirmation indicator jaise MACD Moving Average Convergence Divergence ya RSI Relative Strength Index ka istemal keya jaaye MACD momentum shift ko pick out karne ma madad karta ha jabke RSI batata ha ke asset overbought ya oversold ho raha ha Double bottom chart sample potential buying possibilities pick out karne ka liye reliable indicator ho sakta ha laken iske barriers or demanding situations se mukt nahi ha Ek not unusual assignment fake breakouts ka hona ha Kabhi kabhi charge neckline se briefly ruin kar sakta ha laken jaldi se reverse ho jaata ha jisse pattern fail ho jaata ha Is danger ko kam karne ka liye buyers change ma input hone se pehle retest or confirmation ka wait kar sakte hai

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Double backside chart pattern: Asslam Alikum dear trader! Double Backside Chart Pattern, jo ke mukhtalif financial markets mein istemal hota hai, traders aur investors ke liye aham hota hai. Yeh ek technical analysis ka concept hai jo price charts par adharit hota hai. Is pattern ko samajh kar, traders market mein hone wale possible reversals ko pehchan sakte hain. Double Backside Chart Pattern, asal mein ek reversal pattern hai jisme do main components hote hain: Pehla Peak (First Peak): Is pattern mein, pehla peak ya high point aik uptrend ya bullish trend ke doran hota hai. Is point ko 'left shoulder' bhi kaha jata hai. Dusra Peak (Second Peak): Dusra peak, pehle peak ke baad aata hai aur isko 'head' kaha jata hai. Head usually pehle peak se thoda yaad rehta hai. Teesra Peak (Third Peak): Teesra peak, pehle aur doosre peaks ke beech aata hai aur isko 'right shoulder' kaha jata hai. Yeh peak dobara se bearish trend ka aghaz karta hai.Double Backside Chart Pattern ko pehchanne ke liye traders ko price chart par dhyan dena hota hai, jahan yeh teen peaks aur unke beech mein price action dekha jata hai. Pattern ki pehchan karne ke baad traders bearish reversal ki sambhavna ko pehchan sakte hain. Is pattern ko samajhne ke liye khuch points hain: Volume: Volume bhi pattern ki pehchan mein madadgar hota hai. Usually, doosre peak (head) ke doran volume pehle aur teesre peaks se kam hota hai. Neckline: Double Backside pattern mein ek neckline hoti hai, jo pehle peak aur teesre peak ko join karti hai. Jab price is neckline ko break karta hai, yani ke nicha gir jata hai, to yeh pattern confirm hota hai. Stop Loss and Target: Traders ko stop loss aur target levels set karne mein bhi dhyan dena chahiye. Stop loss, head ke top se thoda upar rakha jata hai, jabki target price move ka ek estimation hota hai. Timeframe: Pattern ko samajhne ke liye traders alag-alag timeframes par dekhte hain. Chhote timeframes par pattern jaldi develop ho sakta hai, lekin bade timeframes par confirmations milti hain. Double Backside Chart Pattern, bearish reversal ko darust karne mein madadgar ho sakta hai, lekin yaad rahe ke har pattern ki tarah, yeh bhi 100% confirm nahi hota. Traders ko doosri confirmations aur risk management strategies ka bhi istemal karna chahiye.Pattern ko seekhne ke liye practice aur experience aham hota hai. Isliye, trading mein kabiliyat hasil karne ke liye demo trading ya virtual trading platforms ka istemal kar sakte hain.

Double Backside Chart Pattern, asal mein ek reversal pattern hai jisme do main components hote hain: Pehla Peak (First Peak): Is pattern mein, pehla peak ya high point aik uptrend ya bullish trend ke doran hota hai. Is point ko 'left shoulder' bhi kaha jata hai. Dusra Peak (Second Peak): Dusra peak, pehle peak ke baad aata hai aur isko 'head' kaha jata hai. Head usually pehle peak se thoda yaad rehta hai. Teesra Peak (Third Peak): Teesra peak, pehle aur doosre peaks ke beech aata hai aur isko 'right shoulder' kaha jata hai. Yeh peak dobara se bearish trend ka aghaz karta hai.Double Backside Chart Pattern ko pehchanne ke liye traders ko price chart par dhyan dena hota hai, jahan yeh teen peaks aur unke beech mein price action dekha jata hai. Pattern ki pehchan karne ke baad traders bearish reversal ki sambhavna ko pehchan sakte hain. Is pattern ko samajhne ke liye khuch points hain: Volume: Volume bhi pattern ki pehchan mein madadgar hota hai. Usually, doosre peak (head) ke doran volume pehle aur teesre peaks se kam hota hai. Neckline: Double Backside pattern mein ek neckline hoti hai, jo pehle peak aur teesre peak ko join karti hai. Jab price is neckline ko break karta hai, yani ke nicha gir jata hai, to yeh pattern confirm hota hai. Stop Loss and Target: Traders ko stop loss aur target levels set karne mein bhi dhyan dena chahiye. Stop loss, head ke top se thoda upar rakha jata hai, jabki target price move ka ek estimation hota hai. Timeframe: Pattern ko samajhne ke liye traders alag-alag timeframes par dekhte hain. Chhote timeframes par pattern jaldi develop ho sakta hai, lekin bade timeframes par confirmations milti hain. Double Backside Chart Pattern, bearish reversal ko darust karne mein madadgar ho sakta hai, lekin yaad rahe ke har pattern ki tarah, yeh bhi 100% confirm nahi hota. Traders ko doosri confirmations aur risk management strategies ka bhi istemal karna chahiye.Pattern ko seekhne ke liye practice aur experience aham hota hai. Isliye, trading mein kabiliyat hasil karne ke liye demo trading ya virtual trading platforms ka istemal kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:43 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим