Position Trading Technique in Forex Trading.

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Position Trading. Position Trading ek aisa trading tareeqa hai jis mein traders apni trades ko kuch din ya hafton tak hold karte hain. Is tareeqe mein traders long-term trend ko follow karte hain aur market mein fluctuations ko ignore karte hain. Position Trading Important. Position Trading ke liye traders ko market ke long-term trend ke baare mein pata hona zaroori hai. Iske saath hi traders ko apni trades ko hold karne ki capacity honi chahiye. Position Trading Analysis. Position Trading ke liye traders ko fundamental aur technical analysis dono ki zaroorat hoti hai. Fundamental analysis se traders ko market mein kya ho raha hai aur kya ho sakta hai, iske baare mein pata chalta hai. Technical analysis se traders ko long-term trend ke baare mein pata chalta hai. Position Trading mein traders ko long-term trades ki jaati hain. Ismein traders ek trade ko kuch din ya hafton tak hold karte hain.Position Trading ka sabse bada faida hai ki ismein traders ko market fluctuations se koi farq nahi padta hai. Iske saath hi, ismein traders ko long-term trend ke baare mein pata chalta hai, jisse unki trades successful hone ke chances badh jaate hain. Checkouts. Position Trading ek aisa trading tareeqa hai jis mein traders apni trades ko kuch din ya hafton tak hold karte hain. Is tareeqe mein traders long-term trend ko follow karte hain aur market mein fluctuations ko ignore karte hain. Position Trading ke liye traders ko market ke long-term trend ke baare mein pata hona zaroori hai. Iske saath hi traders ko apni trades ko hold karne ki capacity honi chahiye. Position Trading ka sabse bada faida hai ki ismein traders ko market fluctuations se koi farq nahi parta hai. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Position trading, Forex trading mein aik aham technique hai jo investors apni long-term trading strategies mein istemal karte hain. Is trading technique mein traders positions ko aik lambay muddat tak hold karte hain, jo aksar mahinon ya saalon tak ja sakti hain. Position trading ka maqsad market ki long-term trends ko capture karna hota hai. Position traders, market analysis ke liye kai tarah ke tools aur indicators ka istemal karte hain, taake woh market ke future trends ko sahi taur par samajh saken. Ismein technical aur fundamental analysis dono ahem hoti hain. Technical analysis se traders market ke price charts aur patterns ki taraf tawajjo dete hain, jabke fundamental analysis mein economic, geopolitical, aur monetary factors ka bhi khassa hissa hota hai. Position Trading Technique in Forex Trading. Is trading technique ke zariye, traders long-term trends ke saath chalne ka maqsad rakhte hain, jaise ke ek currency pair ya commodity ke lambay muddat tak ke trend ko follow karna. Position trading mein stop-loss aur take-profit levels ko tay karke traders apne positions ko manage karte hain, lekin unka focus generally long-term hai. Position trading ke kuch faiday hain, jaise ke investors ko market ki short-term volatility se bachaya ja sakta hai. Ismein trading ki frequently ki zaroorat nahi hoti, jisse trading costs kam hote hain. Is tareeqe mein trading karne wale traders market ke fluctuations ko ignore karke long-term trends par tawajjo dete hain. Lekin, position trading ke bhi kuch challenges hain. Market trends ke long-term hone ki wajah se, traders ko positions ko hold karte waqt market ke reversals se samjhota karna hota hai. Yeh bhi yaad rakhna zaroori hai ke market trends ke change hone ke baare mein advance information nahi hoti, aur is tareeqe se trading mein nuksan bhi ho sakta hai. Position trading, Forex market mein ek valuable technique ho sakti hai agar sahi tarah se samjha jaye aur experience ke saath istemal ki jaye. Traders ko apni risk management aur analysis skills ko mazeed behtar karne ke liye constant learning aur practice ki taraf tawajjo deni chahiye. -

#4 Collapse

Assalamu Alaikum Dosto!

Position Trading

Position Trading ek tareeqa hai jis mein traders ko long term ke liye market mein khareed-o-farokht ke faislon ko lete huye apni position banani hoti hai. Yeh tareeqa traders ko chhoti muddat ke tareeqon ke mukabley lambi muddat ke tareeqe par kam karne ka mauka deta hai. Position Trading ki aham khasiyat yeh hai ke is mein traders ke pass lambi muddat ke liye maujood ho kar market ki movement ko samajhne ka mauka hota hai. Yeh un logon ke liye behtar tareeqa hai jo zyada busy hote hain aur trading ko apne free time ke sath sambhalna chahte hain. Position Trading ki madad se traders market mein achi tarah se position le sakte hain aur phir unhain un positions par thori dair tak rakhne se faida hasil kar sakte hain.

Position Trading Strategy mein traders ko market ki movement ko dekhne ke liye technical analysis ka istemal karna hota hai. Is tarah traders ko chart patterns, moving averages, oscillators aur other technical indicators ka istemal karna hota hai. Yeh indicators traders ko market ki movement ki samajh mein madad karte hain aur unhain sahi waqt par apni position lete hue khud ko secure rakhne mein madad dete hain.

Explaination

Position Trading ke liye traders ko market mein kisi aik stock ya commodity ko nishana banakar us stock ya commodity par focus rakhna hota hai. Jab traders ko aik stock ya commodity ki movement samajh mein aa jati hai to unhain us stock ya commodity ko khareedne ya bechne ka faisla karna hota hai. Is tarah traders market ki movement ke hisab se apni position bana lete hain aur phir unhain thori dair tak hold karne se faida hasil hota hai.

Position Trading mein traders ko market ki movement ko dekhne ke liye technical analysis ka istemal karna hota hai. Technical analysis mein traders ko chart patterns, moving averages, oscillators aur other technical indicators ka istemal karna hota hai. Yeh indicators traders ko market ki movement ki samajh mein madad karte hain aur unhain sahi waqt par apni position lete hue khud ko secure rakhne mein madad dete hain.

Benifits of Position Trading

- Time Management: Position Trading traders ke liye behtar tareeqa hai jo busy hote hain aur trading ko apne free time ke sath sambhalna chahte hain. Position Trading mein traders ko market ki movement ko dekhne ke liye zyada waqt nahi dena parta aur is tarah traders ko apne busy schedule ke sath bhi trading karne ka mauka milta hai.

- Long-term Profit: Position Trading mein traders ko lambi muddat ke liye maujood ho kar market ki movement ko samajhne ka mauka hota hai. Is tarah traders ko market ke long-term movement ko samajhne ka mauka milta hai aur unhain apni position thori dair tak hold karne se faida hasil hota hai.

- Risk Management: Position Trading mein traders ko apni position ko thori dair tak hold karne se faida hasil hota hai. Is tarah traders apni position ko long-term hold karne ke sath sath apni risk ko bhi kam kar sakte hain.

- Emotional Control: Position Trading mein traders ko market ki movement ke hisab se apni position lete hue khud ko secure rakhna hota hai.

Position Trading Drawbacks

"Position Trading" ke kuch nuqsanat bhi hain. Position Trading mein traders ko apni position ko long-term hold karne ki zaroorat hoti hai. Is tarah traders ko market ki sudden movement se bhi deal karna parta hai. Position Trading mein traders ko apni position ko hold karne ke sath sath market ki news aur events par bhi nazar rakhna hota hai. Is tarah traders ko market ki sudden movement ke sath sath market ki news aur events se bhi deal karna parta hai. Position Trading mein traders ko zyada patience aur discipline ki zaroorat hoti hai. Is tarah traders ko market ki sudden movement se deal karna aur apni position ko hold karne ke sath sath discipline aur patience ka khayal rakhna bhi zaroori hota hai.

-

#5 Collapse

Position trading aik lambi muddat ka investment strategy hai jismein ek security ko kaafi arsey tak hold kiya jata hai, jo aksar kai maheenon se lekar saalon tak hota hai. Yeh technique day trading, swing trading aur scalping se mukhtalif hai, jo choti muddat par focus karti hain. Position traders fundamental analysis, technical indicators aur macroeconomic factors par bharosa karte hain taake lambi muddat ke market trends ko pehchaan kar unka faida utha sakein.

Fundamentals of Position Trading

Position trading ka bunyadi maqsad ek extended period ke dauran significant price movements ko capture karna hota hai. Is strategy ko istemaal karne walay traders short-term price fluctuations ki parwaah nahi karte balkay broader market trends par zyada focus karte hain. Yeh approach us asset ke bare mein gehri samajh ka mutalba karta hai jo trade kiya ja raha hai, jismein uska historical performance, future growth potential aur overall market environment shaamil hain.

Key Characteristics- Long-term Horizon: Position traders apni investments ko aksar maheenon ya saalon tak hold karte hain. Yeh extended timeframe unhein short-term volatility ko ignore karne aur long-term trends ka faida uthane ka moka deta hai.

- Fundamental Analysis: Ek asset ki intrinsic value ko samajhne ke liye thorough analysis zaroori hai. Ismein financial statements, industry conditions, economic indicators aur dusray factors ka jaiza lena shamil hai jo asset ki price ko asar daal sakte hain.

- Technical Analysis: Jabke fundamental analysis buniyad banta hai, technical indicators jaise moving averages, trend lines aur chart patterns entry aur exit points ko fine-tune karne ke liye istemaal hote hain.

- Low Trading Frequency: Position traders day traders ya swing traders ke muqable mein kam trades karte hain. Yeh lower frequency transaction costs ko reduce karti hai aur short-term market noise ka asar kam karti hai.

- Patience aur Discipline: Kamyab position trading ke liye patience aur discipline zaroori hain. Traders ko apni strategy par qayam rehna hota hai chaahe price movements adverse bhi kyu na hon.

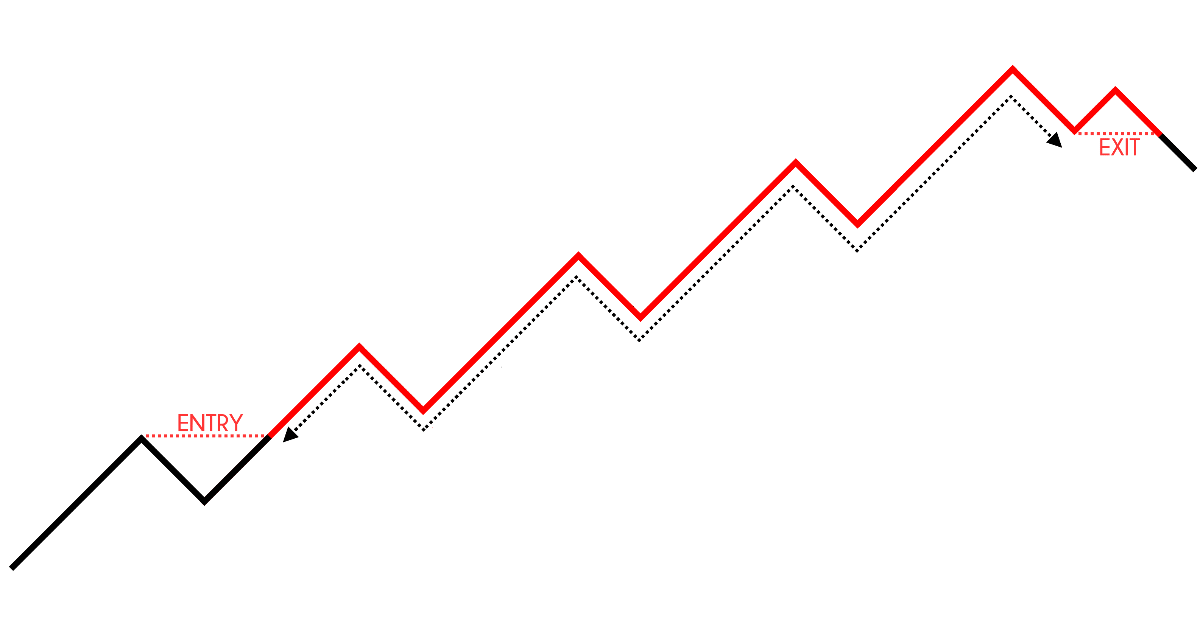

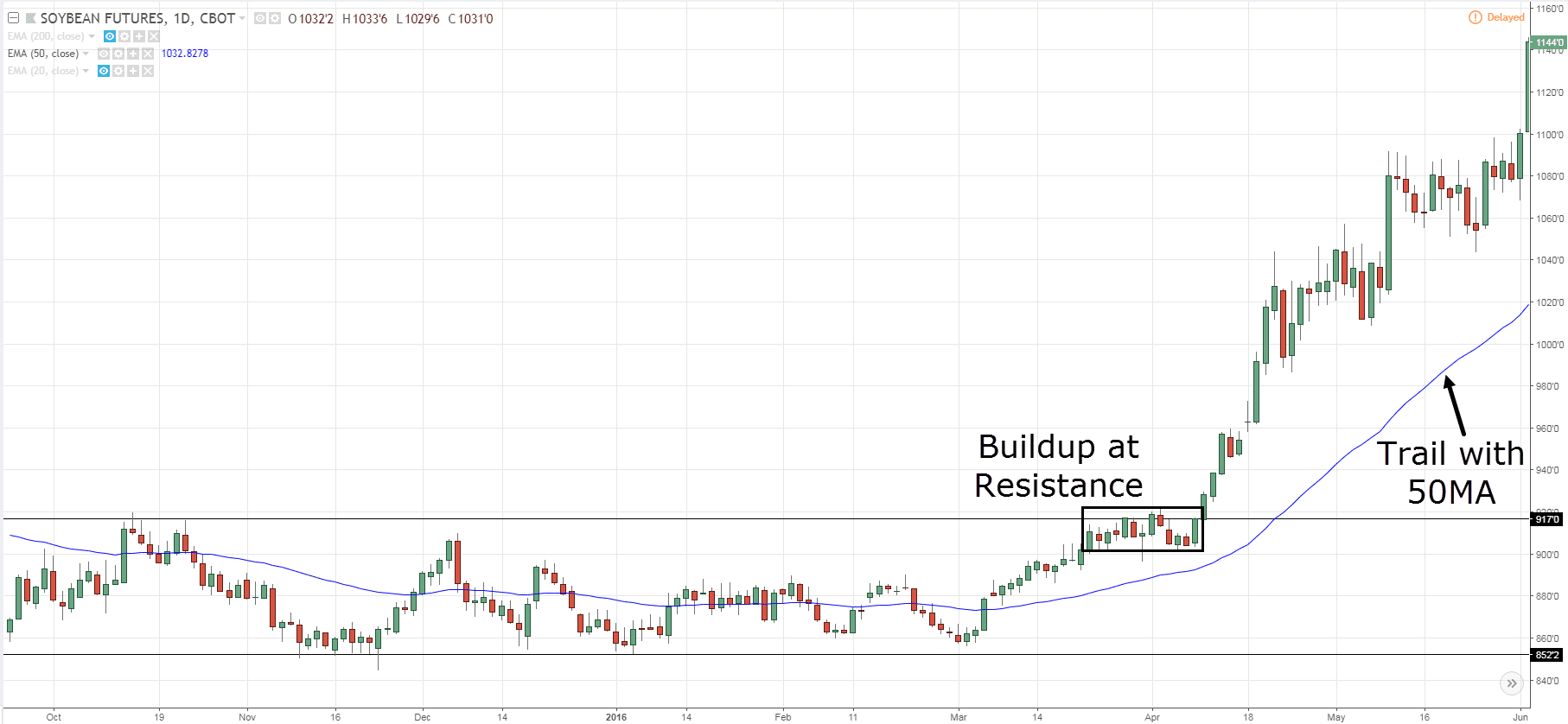

Position traders mukhtalif strategies istemaal karte hain taake long-term trends ko identify aur exploit kar sakein. Yeh strategies broadly trend-following, contrarian aur fundamental-driven approaches mein divide hoti hain. Trend-following position trading mein sabse aam strategy hai. Is idea ka madad yeh hota hai ke primary market trend ke direction ko pehchana jaye. Yeh upward (bullish) trend ho sakti hai ya downward (bearish) trend ho sakti hai.- Identifying Trends: Traders moving averages, trend lines aur Average Directional Index (ADX) jaise tools ka istemaal karte hain taake trend ke direction aur strength ko pehchaan sakein.

- Entering the Trade: Jab ek trend identify ho jaye, traders trend ke direction mein position lete hain. Misal ke taur par, agar ek bullish trend hai, trader asset ko buy kar sakta hai, aur agar bearish trend hai, to sell ya short kar sakta hai.

- Exiting the Trade: Traders tab tak trade mein rehte hain jab tak trend barkarar rahe. Woh trailing stops ya dusri exit strategies ka istemaal karte hain taake profits lock in aur losses minimize kiye ja sakein.

Contrarian Strategy

Contrarian trading prevailing market trends ke khilaf jaane par mabni hoti hai. Idea yeh hai ke jab log sell kar rahe hain tab buy karna aur jab log buy kar rahe hain tab sell karna, taake market overreactions aur reversals ka faida uthaya ja sake.- Identifying Overbought/Oversold Conditions: Contrarian traders indicators jaise Relative Strength Index (RSI) aur Bollinger Bands ka istemaal karte hain taake overbought ya oversold conditions ko pehchaan sakein.

- Entering the Trade: Jab ek asset oversold hota hai, ek contrarian trader usay buy kar sakta hai, anticipating a price rebound. Isi tarah agar ek asset overbought hai, to woh sell ya short kar sakta hai.

- Patience for Reversal: Is strategy ke liye patience zaroori hoti hai, kyunki market ko correct hone mein waqt lag sakta hai aur price ko anticipated direction mein move karne mein bhi.

Yeh strategy fundamental analysis par heavily rely karti hai taake ek asset ke long-term potential ko determine kiya ja sake. Traders asset ki intrinsic value aur underlying economic factors par focus karte hain jo uski price ko drive kar sakte hain.- In-depth Research: Traders financial statements, industry trends, economic indicators aur dusri relevant data ka analysis karte hain taake asset ki value assess kar sakein.

- Valuation Metrics: Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio aur Dividend Yield jaise metrics ka istemaal asset ko undervalued ya overvalued determine karne ke liye hota hai.

- Investing in Value: Traders un assets mein invest karte hain jo unke mutabiq undervalued hain aur strong growth potential rakhte hain. Woh yeh positions tab tak hold karte hain jab tak market asset ki true value ko recognize nahi karta, jiska natija price appreciation mein nikalta hai.

Position Trading ke Risks aur Challenges

Iske faiday hone ke bawajood, position trading risks aur challenges se khali nahi hai. Inhein samajhna kamyabi ke liye zaroori hai. Har trading strategy mein market risk hota hai aur position trading bhi koi exception nahi hai. Significant market downturns ya adverse economic events ka natija substantial losses mein nikal sakta hai, khaas taur par agar trader leveraged positions hold kar raha ho. Position trading mein lambi muddat tak assets hold karne ki wajah se traders doosri profitable opportunities se mehroom ho sakte hain. Jo capital long-term positions mein tied up hota hai usse doosri investments mein istemaal nahi kiya ja sakta. Extended holding period patience aur discipline ka mutalba karta hai. Traders ko short-term market movements par react karne se parheiz karna aur apni long-term strategy par qayam rehna hota hai. Unexpected changes ek asset ke fundamentals mein, jaise earnings reports, management changes ya industry disruptions, uski long-term outlook ko impact kar sakte hain. Position traders ko aise developments ke bare mein informed rehna aur apni strategies accordingly adjust karna hota hai.

Implementing Position Trading

Kamyab position trading ka implementation ek structured approach ka mutalba karta hai, jo fundamental aur technical analyses ko combine karke informed decisions lene mein madad karta hai. Kisi bhi position mein enter hone se pehle, traders ko clear investment goals set karne chahiye. Inmein specific return targets, time horizons aur risk tolerance levels shaamil ho sakte hain. Well-defined goals hona focus aur discipline maintain karne mein madadgar hota hai. Research position trading ka cornerstone hai. Traders ko thorough research karni chahiye taake asset ke fundamentals, industry conditions aur macroeconomic factors ko samajh sakein. Reliable sources of information mein financial reports, industry publications aur economic forecasts shaamil hain.

Using Technical Indicators

Technical indicators fundamental analysis ko complement karte hain market trends aur entry aur exit points ke timing ke bare mein insights provide karte hain. Position traders ke liye popular indicators mein moving averages, MACD (Moving Average Convergence Divergence) aur RSI (Relative Strength Index) shaamil hain. Diversification ek key risk management strategy hai. Mukhtalif assets, industries aur geographies mein investments ko spread karke, traders kisi single asset ya market ke adverse developments ke impact ko mitigate kar sakte hain. Jabke position trading ek long-term strategy hai, regular review aur adjustment positions ka naya information aur market developments ki buniyad par zaroori hai. Yeh investment goals ke sath aligned rehne aur changing market conditions ke sath adapt hone mein madadgar hota hai.

Position Trading ke Examples

Position trading mukhtalif asset classes mein apply kiya ja sakta hai, jismein stocks, commodities, forex aur cryptocurrencies shaamil hain. Yeh kuch examples hain jo concept ko illustrate karte hain. Ek position trader aik technology company ke stocks mein invest kar sakta hai financial health, growth prospects aur industry trends ko analyze karne ke baad. Agar analysis strong future performance ko suggest karta hai, to trader stocks ko kai saalon tak hold karke price appreciation aur dividends ka faida utha sakta hai. Commodities market mein, ek trader gold mein long position le sakta hai, anticipating ke economic uncertainty aur inflation prices ko agle kuch saalon mein barhaayegi. Market fluctuations ke dauran position hold karke, trader long-term upward trend se profit kamane ka aim rakhta hai. Forex market mein, ek position trader EUR/USD currency pair mein long position le sakta hai, based on economic outlook aur interest rate differentials between Eurozone aur United States. Trader position ko hold karta hai, taake currency appreciation over time ka faida utha sake. Volatile cryptocurrency market mein, ek position trader Bitcoin mein invest kar sakta hai, expecting ke adoption barhne aur supply limited rehne ki wajah se iski value barhegi. Short-term price swings ke bawajood, trader long-term ke liye position hold karta hai, substantial gains ka aim rakhte hue.

Position trading ek powerful strategy hai long-term market trends ko capture karne aur significant returns hasil karne ke liye. Fundamental aur technical analyses ko combine karke, traders informed decisions le sakte hain aur market fluctuations ke dauran apni strategy par qayam reh sakte hain. Magar, position trading mein kamyabi ke liye patience, discipline aur assets aur markets ki thorough understanding zaroori hai. Jabke strategy ke risks hain, jismein market downturns aur opportunity costs shaamil hain, potential rewards isse un traders ke liye ek attractive option banate hain jo long-term ke liye wealth build karna chahte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

- Bitcoin

- Mentions 0

-

سا0 like

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

POSITION TRADING TECHNIQUE IN FOREX

Position Trading ek long-term trading strategy hai jo traders ko bade price movements aur long-term trends se faida uthane ka moka deti hai. Is technique mein, traders positions ko weeks, months, ya hatta ke years tak hold karte hain, taake significant market trends se profit generate kar sakein.Position traders long-term trends par focus karte hain aur short-term price fluctuations ko nazarandaz karte hain. Fundamental analysis ka extensive use hota hai, jaise economic indicators, interest rates, political events, aur global economic conditions. Long-term charts (daily, weekly, monthly) aur major technical indicators ka use hota hai taake entry aur exit points identify kiye ja sakein.

BENEFITS OF POSITION TRADING

LESS TIME-SENSITIVE:

Position trading short-term trading ke mukable kam time-intensive hota hai, kyun ke trades ko frequently monitor nahi karna padta.

REDUCED TRANSACTION COSTS:

Kam trades ki wajah se transaction costs bhi kam hoti hain.

PROFITING FROM MAJOR TRENDS:

Bade price movements aur major trends se profit gain karne ka moka milta hai.

RISKS OF POSITION TRADING

MARKET REVERSALS:

Long-term market reversals ki wajah se losses ho sakte hain.

SWAP RATES:

Overnight positions hold karne ki wajah se swap rates (interest) lag sakte hain, jo profits ko affect kar sakte hain.

LONG-TERM COMMITMENT:

Positions ko lambe waqt tak hold karne ki commitment hoti hai, jo sab traders ke liye suitable nahi hoti.

FUNDAMENTAL ANALYSIS:

ECONOMIC INDICATORS:

GDP, unemployment rates, inflation, etc.

INTEREST RATES:

Central bank policies aur interest rate decisions.

GEOPOLITICAL EVENTS:

Political stability, elections, international trade policies.

TECHNICAL ANALYSIS:

TREND LINES:

Long-term trend lines draw karke market direction identify karna.

MOVING AVERAGES:

50-day, 100-day, 200-day moving averages use karna.

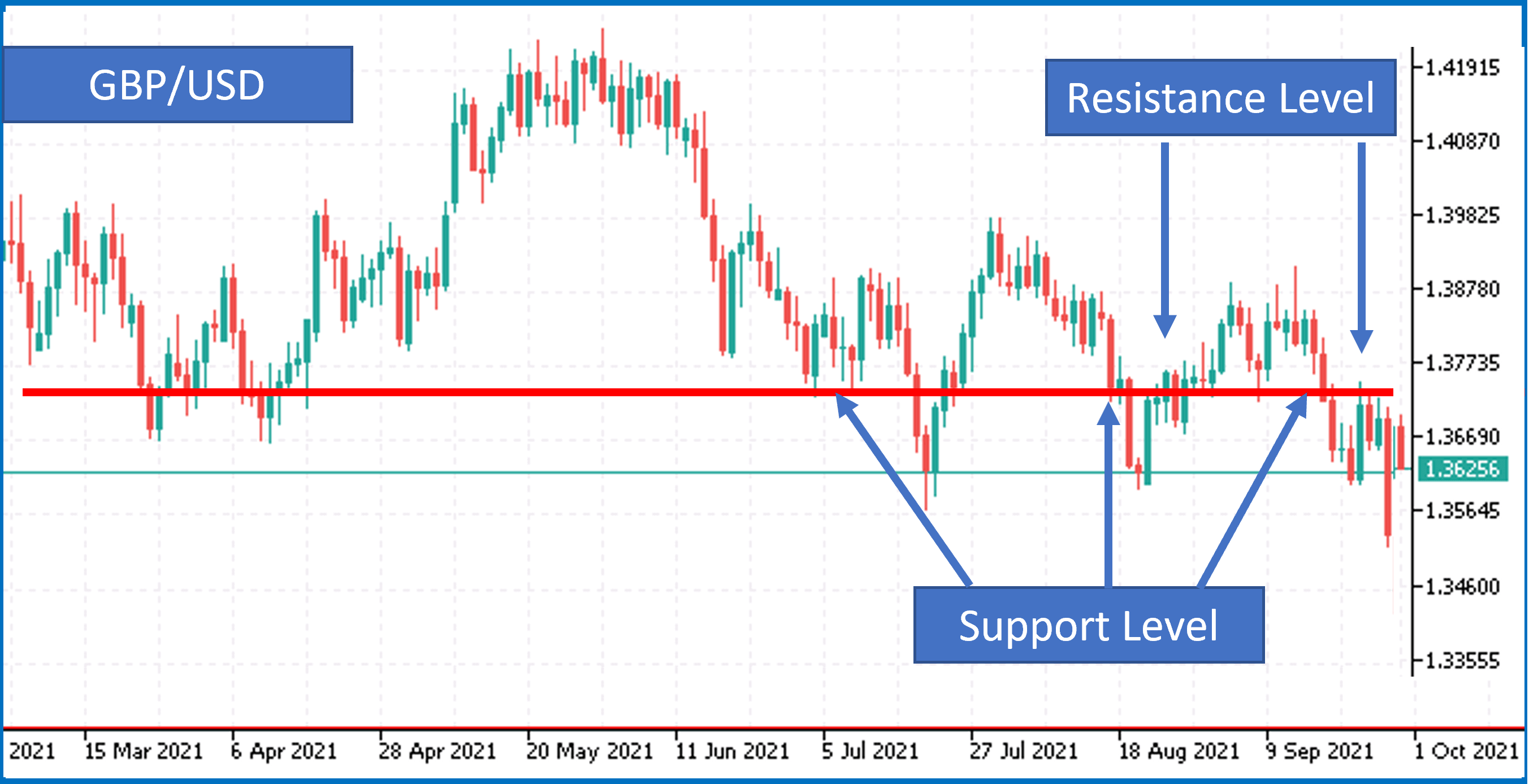

SUPPORT AND RESISTANCE LEVELS:

Major support aur resistance levels ko identify karna.

TECHNICAL STRATEGIES OF POSITION TRADING

IDENTIFY TREND:

Pehle market trend ko identify karna, chahe woh bullish ho ya bearish.

FUNDAMENTAL ANALYSIS:

Economic aur geopolitical factors ko analyze karna jo trend ko support karte hain.

TECHNICAL ANALYSIS:

Long-term technical indicators aur charts ka use karna taake best entry aur exit points find kiye ja sakein.

RISK MANAGEMENT:

Proper risk management strategies apply karna, jaise ke stop loss orders lagana aur position sizing.

SIGNIFICANT SUPPORT

Position Trading technique Forex trading mein long-term trends aur major price movements se profit generate karne ka ek effective tareeqa hai. Yeh strategy un traders ke liye suitable hai jo long-term focus rakhte hain aur short-term market noise se distract nahi hote. Fundamental aur technical analysis ka combination use kar ke, position traders apni strategies ko enhance kar sakte hain aur significant profits gain kar sakte hain. -

#7 Collapse

Position Trading Technique in Forex Trading

Introduction

Forex trading duniya ka sab se bara financial market hai. Har roz trillion dollars ki trading hoti hai. Is market mein mukhtalif trading techniques use ki jaati hain, jin mein se aik hai "Position Trading." Aaj hum Roman Urdu mein Position Trading technique ka tafsili jaiza lenge.

Position Trading Kya Hai?

Position Trading aik aisi technique hai jismein trader long-term positions hold karta hai. Ye technique un logon ke liye best hai jo forex market ko achi tarah analyze kar sakte hain aur market trends ko samajh sakte hain. Position traders ko apni positions ko weeks, months, ya kabhi kabhi saalon tak hold karna parta hai.

Position Trading Ki Khasiyat- Long-Term Focus: Position trading mein trader long-term trends pe focus karta hai. Is liye short-term market fluctuations unhe zyada effect nahi karte.

- Low Trading Frequency: Position traders kam trades karte hain, lekin jab karte hain to significant size ki positions hold karte hain. Yeh log day traders ki tarah daily trading nahi karte.

- Fundamental Analysis: Position traders usually fundamental analysis pe focus karte hain. Ismein economic indicators, interest rates, GDP growth, aur political stability jaise factors ko analyze kiya jata hai.

- Technical Analysis: Iske ilawa, technical analysis bhi use hoti hai jismein charts, trend lines, support aur resistance levels dekhe jate hain.

- Less Stressful: Kyun ke aapko din bhar screen pe nazar nahi rakhni padti, is liye yeh technique kam stressful hoti hai.

- Potential for High Profits: Long-term trends ko capture kar ke position traders achi profits kama sakte hain.

- Lower Transaction Costs: Kam trades karne ki wajah se transaction costs bhi kam hoti hain.

- Patience Required: Is technique mein patience zaroori hai. Aapko apni positions ko hold karne ke liye sabr rakhna parta hai.

- Market Risk: Long-term positions hold karne ki wajah se market risk zyada hota hai. Unexpected economic events aapki trade ko negative affect kar sakti hain.

- Capital Requirement: Is technique mein aapko zyada capital ki zaroorat hoti hai, taake aap market fluctuations ko absorb kar sakein.

- Market Research: Pehle market research karen. Economic indicators aur market trends ko samjhen.

- Plan Banayen: Apni trading strategy aur plan tayar karen. Entry aur exit points define karen.

- Risk Management: Proper risk management techniques ko follow karen. Stop-loss orders lagayen aur apni risk tolerance ko define karen.

- Monitor and Adjust: Regularly apni positions ko monitor karen aur zaroori ho to adjustments karen.

Position trading aik powerful technique hai jo experienced traders ke liye best hai. Yeh technique patience, market knowledge aur strong analysis skills demand karti hai. Agar aap forex trading mein long-term success hasil karna chahte hain to position trading ko apni strategy mein zaroor include karen.

Note

Forex trading mein risk hota hai, aur zaroori hai ke aap proper knowledge aur training hasil kar ke hi trading karein. Always trade responsibly!

-

#8 Collapse

Position Trading Technique in Forex Trading

Forex trading mein kai tarike hotay hain, jin mein se ek muhim aur maqbool tareeqa "Position Trading" hai. Is article mein hum Position Trading ke tareeke ko Roman Urdu mein samjhenge aur iske mukhtalif pehluon ko explore karenge.

Position Trading Kya Hai?

Position Trading ek aisa tareeqa hai jismein trader lambe arse tak apni trades ko hold karta hai. Yani yeh ek aisa style hai jismein trades kuch hafton se le kar kai mahine tak, aur kabhi kabhi saalon tak bhi hold ki jaati hain. Position traders ka maqasad chhote chhote price movements se faida uthana nahi hota, balki lambe arse ke liye major market trends ka faida uthana hota hai.

Position Trading ke Fayde- Kam Time Commitment: Position trading mein har roz market ko monitor karne ki zaroorat nahi hoti. Yeh un logon ke liye mufeed hai jo full-time trading nahi kar sakte.

- Psychological Stress Kam: Chhote time frame ke traders aksar psychological stress ka shikar hote hain lekin position traders ko yeh masla kam hota hai kyunki unki trades lambe arse ke liye hoti hain.

- Trend Following: Position traders market ke bade trends ko follow karte hain jo unhein zyada potential profit kama kar de sakte hain.

- Fundamental Analysis: Ismein economic indicators, political events, aur financial statements ko analyze kiya jata hai. Position traders in factors ko dekh kar decide karte hain ke kis currency pair mein invest karna chahiye.

- Technical Analysis: Charts aur historical data ka istemal karte hue future price movements ko predict karna. Common tools mein moving averages, trend lines, aur support/resistance levels shamil hain.

- Sentiment Analysis: Market ka overall sentiment samajhne ke liye news, reports aur trader behavior ko study karna. Yeh analysis help karta hai trend direction ko samajhne mein.

- Economic Calendar: Economic calendar important events aur releases ko highlight karta hai jo market ko affect kar sakte hain.

- Trading Platforms: Advanced trading platforms jaise MetaTrader 4 aur MetaTrader 5 traders ko technical analysis karne aur trades place karne mein madad dete hain.

- Risk Management Tools: Stop-loss aur take-profit orders ka istemal karte hue apne risk ko manage karna zaroori hai.

Position trading mein risk management bohot important hai. Market ki volatility aur unexpected events kabhi kabhi lambe arse ke traders ke liye bhi mushkilat paida kar sakti hain. Kuch common risk management techniques yeh hain:- Stop-Loss Orders: Stop-loss orders lagana zaroori hai taake aap apne potential losses ko minimize kar saken.

- Diversification: Apni investments ko diversify karna yani alag alag currency pairs mein invest karna taake ek currency pair par zyada depend na karna pade.

- Regular Monitoring: Bhale hi aap lambe arse ke liye trade kar rahe hain, lekin market ko time to time monitor karna zaroori hai taake agar koi significant change aaye toh uska timely response diya ja sake.

- Overleveraging: Zyada leverage ka istemal karna ek badi ghalti ho sakti hai. Yeh aapke losses ko amplify kar sakti hai.

- Ignoring Fundamentals: Sirf technical analysis par rely karna bhi ek ghalti hai. Market ki fundamental factors ko ignore nahi karna chahiye.

- Emotional Trading: Market ki short-term movements se ghabrana aur apni strategy ko be-wajah change karna bhi ek common mistake hai.

Position trading ek powerful technique hai jo forex trading mein lambe arse ke trends ka faida uthane ke liye use hoti hai. Iska sahi tarike se istemal karne ke liye aapko market ka thorough understanding aur strong risk management strategy ki zaroorat hoti hai. Agar aap ek aise trader hain jo lambe arse ke liye invest karna chahte hain aur daily trading ka time nahi nikal sakte toh Position Trading aapke liye ek ideal technique ho sakti hai.

- CL

- Mentions 0

-

سا0 like

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Position Trading Technique in Forex Trading

### Forex Trading Mein Position Trading Technique: Roman Urdu Mein Tafseel

Forex trading mein position trading ek long-term trading strategy hai jo un traders ke liye suitable hoti hai jo apne trades ko dinon, hafton, ya mahino tak hold karna pasand karte hain. Is technique ka aim long-term trends ko capture karna aur significant price movements se fayda uthana hota hai. Aayein position trading technique ko detail mein samajhte hain.

#### Position Trading Kya Hai?

Position trading ek trading style hai jahan traders market ke long-term trends ko follow karte hain. Yeh strategy short-term price fluctuations ki bajaye broader market trends par focus karti hai. Position traders ko macroeconomic factors, fundamental analysis, aur technical analysis ka mix use karke apni trades ko identify aur manage karte hain.

#### Position Trading Ke Ahem Components

1. **Fundamental Analysis**:

Position trading mein fundamental analysis ek key role play karta hai. Traders economic indicators, interest rates, political events, aur other macroeconomic factors ko analyze karte hain taake market ke long-term direction ko samajh sakein.

*Example*: Agar US Federal Reserve interest rates ko increase karne ka plan announce karti hai, to USD ki demand badhne ke chances hote hain. Position trader is information ko use karke USD ke against ek long position hold kar sakta hai.

2. **Technical Analysis**:

Technical analysis bhi position trading mein important hoti hai. Long-term charts, support aur resistance levels, moving averages, aur other technical indicators ka use karke traders apne entry aur exit points identify karte hain.

*Example*: Agar EUR/USD pair ne 200-day moving average ko cross kiya hai, to yeh trend reversal ka indication ho sakta hai. Position trader is signal ko use karke apni position establish kar sakta hai.

3. **Risk Management**:

Position trading mein proper risk management zaroori hai. Stop-loss orders aur take-profit levels set karke traders apne risk ko control karte hain. Risk-reward ratio ka dhyan rakhna aur position size ko manage karna bhi important hai.

*Example*: Agar ek trader EUR/USD pair mein long position hold kar raha hai, to wo apna stop-loss recent swing low ke neeche aur take-profit previous high ke upar set kar sakta hai.

#### Position Trading Ki Strategy

1. **Trend Identification**:

Position trading ka pehla step market trend ko identify karna hai. Long-term charts (daily, weekly, monthly) ko analyze karke traders market ke overall direction ko samajhte hain. Uptrend, downtrend, ya sideways market ka analysis karke trades ko plan kiya jata hai.

2. **Entry Points**:

Entry points ko identify karne ke liye fundamental aur technical analysis ka combination use kiya jata hai. Economic news, interest rate decisions, aur other macroeconomic events ke saath technical indicators ko use karke entry points determine kiye jate hain.

3. **Holding Period**:

Position trading ka holding period long-term hota hai. Ek dafa trade enter karne ke baad, traders us position ko dinon, hafton, ya mahino tak hold karte hain jab tak unka target achieve na ho jaye ya market ke conditions change na ho jayein.

4. **Exit Points**:

Exit points ko bhi fundamental aur technical analysis ke basis par determine kiya jata hai. Stop-loss aur take-profit levels set karke exit points define kiye jate hain. Yeh ensure karta hai ke trades disciplined tarike se execute ho aur unnecessary losses se bacha ja sake.

#### Practical Tips for Position Trading

1. **Patience Aur Discipline**:

Position trading mein patience aur discipline bohot zaroori hai. Long-term trades mein short-term price fluctuations ko ignore karna aur apni strategy par focused rehna important hai.

2. **Regular Analysis**:

Market ki regular analysis karna aur economic news ko follow karna zaroori hai. Yeh aapko market ke changing conditions ke sath updated rakhta hai aur timely decisions lene mein madad karta hai.

3. **Diversification**:

Diversification bhi position trading mein important hai. Apne capital ko multiple currency pairs mein distribute karke risk ko reduce kiya jata hai. Yeh ensure karta hai ke ek single market movement se significant losses na ho.

4. **Continuous Learning**:

Forex market dynamic hai aur continuously change hoti rehti hai. Continuous learning aur market trends ko study karna aapki trading skills ko enhance karta hai aur aapko successful position trader banne mein madad karta hai.

In conclusion, position trading ek powerful technique hai jo long-term market trends ko capture karne mein madadgar hoti hai. Fundamental aur technical analysis ka combination, proper risk management, aur disciplined approach se position trading ko effectively implement karke aap apni trading performance ko significantly improve kar sakte hain.

-

#10 Collapse

Position trading Forex market mein ek aisi technique hai jisme traders apni positions ko lambe samay tak hold karte hain, jo kuch hafton se lekar kai mahine ya kai saalon tak ho sakti hain. Is technique ka maksad market ke broader trends ka faayda uthana hota hai, aur ye fundamental analysis aur technical analysis ka combination hota hai. Iska focus short-term fluctuations par nahi hota, balki long-term trends par hota hai. Chaliye, iske key aspects ko detail mein samjhte hain:

### **Fundamental Analysis (Moolbhut Vishleshan)**

Fundamental analysis ke zariye position traders ek economy ke health aur future direction ko samajhne ki koshish karte hain. Isme kai important factors shamil hote hain:

#### **Economic Indicators (Arthik Suchank)**

- **GDP Growth Rates (JDP Vridhi Dar):** GDP growth rate ek country ki economic health ko measure karta hai. High growth rates generally strong economy ka indication dete hain, jo currency ko appreciate kar sakti hain.

- **Employment Data (Rojgar Data):** Low unemployment rates ek strong labor market aur economic stability ka sanket hain, jo currency value ko positively influence karte hain.

- **Inflation Rates (Mahengaai Dar):** Moderate inflation healthy economic growth ka indication hoti hai, jabki high inflation currency ki value ko degrade kar sakti hai.

#### **Political Events (Rajnaitik Ghatnayein)**

- **Political Stability (Rajnaitik Sthirta):** Stable governments aur predictable policies investors ke liye attractive hoti hain, jo currency strength ko support karti hain.

- **Geopolitical Events (Bhoogolik Ghatnayein):** Wars, elections aur international treaties jaise events ka significant impact hota hai currencies par.

#### **Interest Rates (Byaaj Dar)**

- **Central Bank Policies (Kendra Bank Niti):** Central banks ka interest rates ko adjust karna currency values ko directly affect karta hai. High interest rates foreign investments ko attract karte hain, leading to currency appreciation.

### **Technical Analysis (Takneeki Vishleshan)**

Technical analysis ke zariye traders price movements aur market trends ko analyze karte hain:

#### **Trend Analysis (Trend Vishleshan)**

- **Moving Averages (Moving Averages):** Simple aur exponential moving averages ko trends identify karne aur trade signals generate karne ke liye use kiya jata hai.

- **Trend Lines (Trend Lines):** Trend lines market ki direction aur strength ko indicate karne mein madad karti hain.

#### **Support and Resistance Levels (Samarthan aur Pratirodh Stara)**

- **Support Levels (Samarthan Stara):** Levels jahan price repeatedly support paati hai aur wahan se bounce back karti hai.

- **Resistance Levels (Pratirodh Stara):** Levels jahan price repeatedly resistance face karti hai aur niche girti hai.

#### **Chart Patterns (Chart Patterns)**

- **Head and Shoulders:** Trend reversal ka indication deti hai.

- **Double Tops and Bottoms:** Potential trend reversals ko indicate karte hain.

- **Triangles:** Continuation patterns hain jo trend ka continuation indicate karte hain.

### **Risk Management (Risk Prabandhan)**

Risk management position trading ka ek important aspect hai:

#### **Stop-Loss Orders (Stop-Loss Orders)**

- **Stop-Loss Placement:** Adverse market movements se bachav ke liye stop-loss orders ko strategic levels par place kiya jata hai.

#### **Position Sizing (Position Ka Size)**

- **Position Size Calculation:** Position size ko risk tolerance aur account size ke aadhar par determine kiya jata hai.

#### **Diversification (Vividhikaran)**

- **Diversified Portfolio:** Different currency pairs mein positions hold karna overall risk ko kam karta hai.

### **Patience and Discipline (Dhairya aur Anushasan)**

Position trading patience aur discipline ki demand karta hai:

#### **Long-Term Holding (Lambe Samay Tak Holding)**

- **Holding Period:** Positions ko lambe samay tak hold karna hota hai, short-term fluctuations ke dauran.

#### **Emotional Control (Bhavnatmak Niyantran)**

- **Avoiding Emotional Decisions:** Market noise ke beech mein calm rahna aur impulsive decisions se bachna zaroori hai.

### **Psychological Factors (Manovaigyanik Tathya)**

Trading psychology ko samajhna bhi zaroori hai:

#### **Emotional Resilience (Bhavnatmak Sahanshilta)**

- **Handling Market Stress:** Market stress aur fluctuations ko handle karna traders ke liye important hai.

#### **Long-Term Perspective (Lambe Samay Ka Drishti)**

- **Staying Focused:** Long-term outlook par focus rakhna aur short-term volatility se sway na hona zaroori hai.

### **Example of Position Trading (Position Trading ka Udaharan)**

Maan lijiye, ek trader ko lagta hai ki U.S. economy strong ho rahi hai GDP growth, low unemployment aur rising interest rates ki wajah se. Wo USD ko EUR ya JPY ke against long position le sakta hai. Trader tab tak position hold karega jab tak economic indicators positive direction mein hain aur U.S. central bank ki policies supportive hain.

Position trading profitable ho sakta hai unke liye jo patience aur discipline rakhte hain, aur effectively risk manage karte hain. Iske liye thorough understanding of both fundamental and technical analysis aur long-term volatility ko withstand karne ki ability ki zaroorat hoti hai. -

#11 Collapse

Position Trading Technique in Forex Trading

Position trading forex trading ki aik aisi technique hai jisme traders long-term market trends ko identify karke unhe capitalize karne ki koshish karte hain. Yeh technique un traders ke liye best hoti hai jo market ke short-term fluctuations se pareshaan nahi hotay aur apne trades ko mahino ya saal tak hold kar sakte hain.

Position Trading Ki Pehchan

Position trading ko pehchanna aur samajhna thoda mushkil ho sakta hai agar aap forex trading mein naye hain. Yeh technique long-term approach par mabni hoti hai aur isme market ke fundamental aur technical analysis ko integrate kiya jata hai.

Key Characteristics- Long-Term Horizon: Position trading mein trades ko weeks, months, hatta ke years tak hold kiya jata hai.

- Focus on Major Trends: Yeh technique market ke major trends ko identify karke unhe capitalize karne par zyada focus karti hai.

- Minimal Trading Activity: Is approach mein frequent trading nahi hoti, balki major market moves ka intezar kiya jata hai.

- Fundamental Analysis: Economic indicators, geopolitical events aur central bank policies ko samajhna is technique ka integral part hota hai.

- Technical Analysis: Long-term chart patterns, support and resistance levels aur trend indicators ka istemal kiya jata hai.

- Fundamental Analysis

Fundamental analysis position trading ka aik aham hissa hai. Is analysis ka maqsad market ke underlying economic factors ko samajhna hota hai jo currency values ko influence karte hain.- Economic Indicators: GDP growth rates, employment data, inflation rates, aur interest rates jaise indicators ko analyse kiya jata hai.

- Geopolitical Events: Political stability, elections, aur international relations jaise factors ko consider kiya jata hai.

- Central Bank Policies: Interest rate decisions, quantitative easing, aur monetary policies ko closely monitor kiya jata hai.

- Technical Analysis

Technical analysis mein historical price data aur chart patterns ko study kiya jata hai taake future price movements ko predict kiya ja sake.- Trend Analysis: Long-term trends ko identify karne ke liye moving averages, trend lines aur other trend-following indicators ka istemal kiya jata hai.

- Support and Resistance Levels: Key price levels jahan market historically react karti hai unhe identify kiya jata hai.

- Chart Patterns: Head and shoulders, triangles, aur double tops/bottoms jaise patterns ko use kiya jata hai taake potential trend reversals ya continuations ko identify kiya ja sake.

Position trading technique ko forex trading mein istemal karne ke kai tareeqe hain. Aayiye isko ek practical approach se dekhte hain.

Identification of Trends- Long-Term Charts: Weekly aur monthly charts ka analysis kiya jata hai taake major trends ko identify kiya ja sake.

- Moving Averages: 50-day, 100-day, aur 200-day moving averages ko use kiya jata hai taake long-term trend direction ko confirm kiya ja sake.

- Fundamental Analysis: Economic indicators aur central bank policies ko monitor kar ke long-term market direction ko understand kiya jata hai.

- Entry Points: Jab market ek clear trend mein hoti hai aur fundamental aur technical analysis us trend ko support kartay hain, to trader trend direction mein position enter karta hai.

- Stop Loss: Risk management ke liye stop loss set karna zaroori hota hai. Yeh stop loss aksar key support ya resistance levels ke thoda neeche ya upar set kiya jata hai.

- Take Profit: Profit targets set karne ke liye long-term support aur resistance levels ko reference banaya jata hai.

Ek trader ne EUR/USD ka chart analyse kiya aur identify kiya ke market ek long-term uptrend mein hai.- Chart Analysis: Trader ne weekly aur monthly charts ka analysis kiya aur dekha ke EUR/USD 200-day moving average ke upar trade kar raha hai, jo ek bullish signal hai.

- Fundamental Analysis: Trader ne eurozone aur US ke economic indicators ko analyse kiya aur dekha ke eurozone ki GDP growth rate positive hai aur ECB (European Central Bank) ne interest rates ko increase karne ka plan announce kiya hai.

- Entry: Trader ne EUR/USD pair ko buy karne ka faisla kiya jab pair 200-day moving average ke pass trade kar raha tha.

- Stop Loss and Target: Trader ne stop loss EUR/USD ke key support level ke thoda neeche set kiya aur profit target previous high ke pass set kiya.

- Outcome: Market ne trader ki analysis ko support kiya aur EUR/USD pair ne upward trend continue rakha. Trader ne apna target achieve kar liya aur profit book kiya.

Advantages:- Less Time-Consuming: Frequent trading nahi hoti, is liye daily market monitoring ki zaroorat kam hoti hai.

- Potential for Larger Profits: Long-term trends ko capture karne ki wajah se potential profits zyada hote hain.

- Reduced Transaction Costs: Kam trades hone ki wajah se transaction costs aur commissions kam hote hain.

Limitations:- Market Volatility: Long-term trades mein market volatility ke exposure zyada hota hai.

- Patience Required: Yeh approach patience aur discipline demand karti hai kyun ke trades ko long periods tak hold karna padta hai.

- Fundamental Analysis Dependency: Accurate fundamental analysis karna mushkil ho sakta hai aur galat analysis nuqsan deh ho sakti hai.

Position trading technique forex trading mein aik powerful approach hai jo long-term market trends ko identify karke unhe capitalize karne ka moka deti hai. Is technique ka sahi istemal karne ke liye technical aur fundamental analysis ki samajh aur experience zaroori hai. Agar traders is approach ko discipline aur proper risk management ke sath use karein to yeh unhe profitable trading decisions lene mein madadgar sabit ho sakta hai. Trading mein hamesha risk management aur disciplined approach zaroori hoti hai, chahe kitna hi reliable indicator kyun na ho. -

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Position Trading Techniques in forex:

Position trading forex trading ka aik technique hai jo traders ko lambe arsay tak apni investments ko hold karne ki ijazat deti hai. Yeh strategy un logon ke liye behtareen hai jo market ke short-term fluctuations ke bajaye, long-term trends par focus karte hain. Niche Roman Urdu main is technique ki tafseelat di gayi hain:

Position Trading Kiya hai:

Position trading ek aisi technique hai jisme traders currency pairs ko mahino ya kai dafa salon tak hold karte hain. Iska maqsad market ke bare trends ko identify karna aur un trends ka fayda uthana hota hai.

Kaisay kaam karti hai:

1. Market Analysis:

Position traders fundamental analysis ka istimal karte hain. Isme countries ki economic indicators, interest rates, political stability, aur financial reports ko analyze kiya jata hai. Yeh analysis madad karta hai long-term trends ko samajhne main.

2. Technical Analysis:

Iske ilawa technical analysis bhi use hoti hai. Charts aur technical indicators, jaise moving averages, Fibonacci retracement, aur support/resistance levels, madad karte hain entry aur exit points ko determine karne main.

3. Risk Management:

Position trading main risk management bohot zaroori hai. Stop-loss aur take-profit levels ko define karna har trader ka zaroori kaam hota hai, taa ke unexpected market moves se bacha ja sake.

4. Patience aur Discipline:

Yeh trading style bohot patience aur discipline mangti hai, kyunki aapko apni position ko kai mahine ya kabhi kabhi salon tak hold karna parta hai.

Fayde:

1. Less Stressful:

Position trading short-term trading ki tarah stressful nahi hoti. Aapko har roz market ko closely monitor karne ki zaroorat nahi hoti.

2. Potential for Larger Gains:

Long-term trends ko capture karna kaafi profitable ho sakta hai, agar aapki analysis sahi hai.

3. Less Time Consuming:

Yeh strategy un logon ke liye behtareen hai jo apni daily jobs ke sath trading karte hain, kyunki isme kam time invest karna parta hai.

Nuksaan:

1. Large Capital Requirement:

Position trading mein aapko bade capital ki zaroorat hoti hai, kyunki aapki trades long-term ke liye hain aur aapko margin calls se bachne ke liye acche funds chahiye hote hain.

2. Overnight Risks:

Isme aap overnight aur weekend risks ke exposed hote hain, jaise economic news ya political events jo market ko drastically move kar sakte hain.

3. Swap Fees:

Long-term positions hold karte waqt aapko swap fees ya rollover fees deni part sakti hai, jo aapki profits ko kam kar sakti hain.

Conclusion:

Position trading forex trading ki aik ahem strategy hai jo long-term investors ke liye suitable hai. Yeh technique sabar, knowledge aur strong analytical skills ki demand karti hai. Agar aap yeh sab attributes rakhte hain, to yeh strategy aapke liye profitable sabit ho sakti hai.

Is technique ko apne trading plan ka hissa banane se pehle, zaroori hai ke aap poori research karain aur demo account par practice karain taa ke aap market ke dynamics ko achi tarah samajh saken.

- CL

- Mentions 0

-

سا1 like

-

#13 Collapse

**Forex Trading Mein Position Trading Technique**

Forex trading duniya bhar mein bohot se logon ka pasandida business hai. Ismein alag alag trading techniques hoti hain jo traders apni strategy ke mutabiq use karte hain. Unmein se ek mashhoor technique hai "Position Trading". Yeh technique long-term trading ka ek tareeqa hai jo aapki trading journey ko profitable bana sakta hai.

**Position Trading Kya Hai?**

Position trading ek aisi strategy hai jahan trader ek currency pair ko weeks, months, ya hatta ke years tak hold karke rakhta hai. Yeh technique short-term price movements par focus nahi karti balki long-term trends par nazar rakhti hai. Position traders ka maqsad major trends ko identify karna aur unhein capitalize karna hota hai. Yeh traders typically fundamental analysis aur long-term chart patterns ka sahara lete hain.

**Position Trading Ke Fayde**

1. **Kam Stress**: Kyunki trades long-term ke liye open hoti hain, position traders ko rozana market fluctuations ke stress se bachna milta hai.

2. **Kam Time Commitment**: Position trading ke liye aapko rozana screen ke samne ghanton bethe rehne ki zaroorat nahi hoti. Sirf major economic events aur fundamental changes ko monitor karna hota hai.

3. **Trend Following**: Long-term trends ko follow karna is technique ka buniyadi maqsad hai, jo ke stable aur consistent profits de sakta hai.

**Position Trading Mein Analysis**

1. **Fundamental Analysis**: Position traders fundamental factors jese ke economic indicators, central bank policies, geopolitical events, aur global market trends ko study karte hain. Yeh sab factors ek currency ki long-term value ko affect karte hain.

2. **Technical Analysis**: Long-term charts aur patterns ko dekh kar major trends aur price levels identify karna hota hai. Support aur resistance levels ko mark karna bhi zaroori hota hai.

**Risk Management**

Position trading mein risk management bohot important hai. Stop-loss orders aur proper position sizing ka istemaal zaroori hai taake unexpected market moves se apni capital ko protect kiya ja sake.

**Conclusion**

Position trading un traders ke liye best hai jo market ko samajhne aur uski direction ko predict karne ka skill rakhte hain. Yeh technique patience aur discipline ka talabgar hai. Forex market ki volatility ke bawajood, agar aap sahi approach aur analysis ke sath trading karte hain, to position trading aapko significant profits de sakti hai. Long-term perspective aur consistent monitoring se aap forex trading mein successful ho sakte hain.

-

#14 Collapse

**Position Trading Technique in Forex Trading in Roman Urdu**

1. **Position Trading Ka Ta'aruf**

Position trading aik long-term trading strategy hai jismein traders market trends ko follow karte hain aur apne positions ko lambe arsay tak hold karte hain. Yeh strategy short-term fluctuations se kam mutasir hoti hai aur market ke bara trends se fayda uthanay par focus karti hai.

2. **Long-Term Trend Analysis**

Position trading mein traders lambe arsay ke trend analysis par focus karte hain. Is technique mein monthly, weekly, aur daily charts ka istimaal hota hai taake major trends ko identify kiya ja sake. Yeh analysis fundamental factors jaise economic indicators aur interest rates par bhi mabni hoti hai.

3. **Entry Points Ka Intikhab**

Entry points ka intikhab karte waqt, position traders major support aur resistance levels ko dekhte hain. Yeh levels wahan hotay hain jahan se price history mein wapas hui hoti hai. Traders breakout ya trend reversal ke confirmation ka intezar karte hain aur phir apne positions ko enter karte hain.

4. **Risk Management**

Risk management position trading ka aik aham hissa hai. Kyunki yeh long-term strategy hai, traders ko apne positions par large stop losses set karne hotay hain. Risk management ke liye, position size ko theek tarah se manage karna aur total capital ka ek chhota percentage risk karna zaroori hai.

5. **Fundamental Analysis Ka Role**

Position traders ke liye fundamental analysis bohot zaroori hoti hai. Economic indicators, geopolitical events, aur central bank policies ka forex markets par gehra asar hota hai. Yeh factors long-term trends ko influence karte hain aur traders ko apni trading decisions mein inka khayal rakhna hota hai.

6. **Patience aur Discipline**

Position trading mein patience aur discipline zaroori hai. Kyunki positions lambe arsay tak hold ki jaati hain, traders ko short-term price movements se affect nahi hona chahiye. Yeh technique un traders ke liye munasib hai jo long-term perspective rakhte hain aur daily price fluctuations par itna focus nahi karte.

7. **Portfolio Diversification**

Position traders aksar apne portfolio ko diversify karte hain taake risk ko kum kar sakein. Forex pairs ke ilawa, woh commodities, indices, aur other asset classes mein bhi invest karte hain. Is diversification se market volatility ka asar kam hota hai.

8. **Review aur Adjustment**

Position traders apni positions ko regularly review karte hain aur agar zaroorat ho to adjustments karte hain. Market conditions ke badalne par, positions ko exit ya adjust karna pad sakta hai. Iske ilawa, nayi information ya analysis ke mutabiq apne strategies ko update karna bhi zaroori hai.

Position trading forex trading ki aik reliable technique hai jo major trends ko capture karne par focus karti hai. Yeh strategy long-term investors ke liye munasib hai jo market ki badi movements se fayda uthana chahte hain aur short-term noise se door rehna chahte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Position Trading Technique in Forex Trading

Forex trading mein kai tarah ke trading techniques hoti hain, jinmein se aik buhat important technique hai Position Trading. Ye technique un traders ke liye hai jo lambi muddat tak market mein rehnay ka irada rakhte hain aur short-term fluctuations par itna focus nahi karte.

Position Trading Kya Hai?

Position trading ek aisi technique hai jisme trader apni trade ko dinon, hafton, ya hatta ke months aur saalon tak hold kar sakta hai. Is tarah ke traders ko market ke chote-mote movements se farq nahi parta, balki woh lambi muddat ke trends aur fundamental analysis par zyada focus karte hain.

Fundamental Analysis ka Role

Fundamental analysis position trading mein buhat important role play karta hai. Forex market mein, fundamental factors jese ke economic indicators, political stability, aur interest rates buhat significant hote hain. Position traders in tamam factors ko madde nazar rakhte hue apni trades plan karte hain. Unka maqsad ye hota hai ke wo aise currencies mein investment karein jinka future stable aur strong ho.

Technical Analysis ka Istemaal

Hala ke position traders zyada tar fundamental analysis par rely karte hain, lekin technical analysis bhi zaroori hai. Technical analysis se yeh pata lagana asaan hota hai ke market ke major support aur resistance levels kaha hain. Is tarah ke analysis se traders ko apni entry aur exit points decide karne mein madad milti hai.

Risk Management

Risk management position trading mein bhi buhat zaroori hai. Kyunki trades lambi muddat ke liye hold ki jati hain, isliye market ki volatility ka khatra bhi rehta hai. Position traders apne risk ko manage karne ke liye stop-loss orders aur proper position sizing ka istimaal karte hain. Yeh tactics unhe unexpected market movements se bacha sakti hain.

Advantages of Position Trading

Position trading ke kai advantages hain. Pehla, ye stress-free hota hai kyunki trader ko roz roz ke market fluctuations ka tension nahi hota. Dusra, isme time management asaan hota hai kyunki trader ko har waqt market ko monitor karne ki zaroorat nahi hoti. Teesra, is tarah ke trading se transaction costs bhi kam hoti hain kyunki kam trades ki jati hain.

Conclusion

Position trading un traders ke liye ek buhat effective technique hai jo lambi muddat ke trends ko follow karte hain aur fundamental factors par zyada rely karte hain. Is technique se trader ko steady aur significant profits mil sakte hain, lekin risk management aur proper analysis buhat zaroori hai. Forex trading mein har technique ka apna maza aur challenges hain, aur position trading bhi unmein se aik hai jo discipline aur patience ka talabgaar hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:41 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим