Stick Sandwich Candlesticks Pattern kaya hai ?

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Stick Sandwich Candlesticks Pattern kaya hai ?ٹیگز: کوئی نہیں

-

سا0 like

-

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

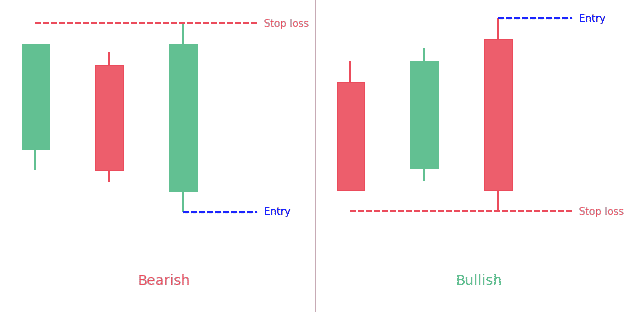

Definition Of Stick Sandwich Candlesticks: Dear friends Stick Sandwich Candlesticks Pattern ek technical analysis tool hai jo stock market ya financial markets mein istemal hota hai. Is pattern ka maqsad market trend ko samajhna aur future price movement predict karna hota hai. Stick Sandwich Candlesticks Pattern mein Two candlesticks shamil hote hain. 1. Pehla candlestick: Is candlestick ko "bearish candlestick" kehte hain, aur yeh typically ek downtrend ke beech aata hai. Is candlestick ka closing price lower hota hai. 2. Dusra candlestick: Is candlestick ko "bullish candlestick" kehte hain, aur yeh pehle candlestick ke upper aata hai. Is candlestick ka opening price lower hota hai, lekin closing price pehle candlestick ke closing price se higher hota hai. Stick Sandwich Candlesticks Pattern: Stick Sandwich Candlesticks Pattern tab samjha jata hai jab yeh do candlesticks ek saath aate hain. Is pattern ki pehchan karne ke baad traders ko yeh samjhna hota hai ke market mein bearish trend ke baad bullish reversal hone ke chances hain. pattern ki madad se traders market ko analyze karke trading decisions lete hain, jaise ke buy positions lene ka faisla ya stop-loss orders set karne ka faisla. Lekin, yaad rahe ke Stick Sandwich Candlesticks Pattern ek indicator hai, aur isay doosre market analysis tools aur information ke saath istemal karna behtar hota hai. Is pattern ko samjhte waqt traders ko do baton par ghor karna hota hai. 1. Pehle candlestick ka bearish nature jo downtrend ko indicate karta hai. 2. Dusra candlestick jo bullish nature mein aata hai aur uptrend ki shuruaat ko signal deta hai. Trading on Stick Sandwich Candlesticks: Stick Sandwich Candlesticks Pattern par trading karne ka tariqa traders ko market mein potential reversals ya price movements ko samjhne mein madadgar hota hai. Yeh pattern bearish trend ke baad bullish reversal ko indicate karta hai. Is pattern par trading karne ke liye neeche diye gaye steps follow kiye ja sakte hain: 1. Pattern Ki Pehchan: First think to yeh hai ke aapko market chart par Stick Sandwich Candlesticks Pattern ko pehchan na hoga. Yeh pattern do candlesticks se banta hai, jinmein se pehla bearish candlestick hota hai aur dusra bullish candlestick. 2. Confirmation: Stick Sandwich Candlesticks Pattern ko pehchan karne ke baad, aapko market mein reversal ke confirmation ke liye aur indicators aur tools ka istemal karna hoga. Yeh confirmation ko strong banata hai. 3. Entry Point: Jab aapko pattern aur confirmation samajh mein aa gaya ho, to entry point decide karna hoga. Entry point typically doosre candlestick (bullish) ke opening price par kiya jata hai, ya fir aap stop order ya limit order use kar sakte hain. 4. Stop-Loss Aur Take-Profit: Har trading strategy mein risk management ahem hota hai. Isliye, stop-loss order lagana bhut zaroori hai. Stop-loss order aapko protect karega agar trade aapke khilaf chala jaye. Take-profit level bhi set karna important hota hai, jisse aap profits ko secure kar sakte hain. 5. Risk Management: Trading mein risk management ka khayal rakhna bohot zaroori hai. Aap apne total trading capital ka ek hissa (jaise 1-2%) ek trade par lagayen, taake aap nuksan ko control kar saken. 6. Monitoring: Trade enter karne ke baad, market ko regular basis par monitor karte rahen. Agar market conditions change hoti hain, to aap apne trade ko adjust kar sakte hain ya exit kar sakte hain. 7. Learning And Improvement: Har trade se kuch seekhna important hai. Trading mein experience aur knowledge barhane ke liye trading ki performance ka analysis karein, aur apne mistakes se seekh kar future trades ko improve karein. Yad rahe ke kisi bhi trading strategy par amal karne se pehle, aapko market analysis aur risk management ko samajhna zaroori hai. Market mein trading karne se pehle, demo account par practice karke apni skills ko improve karna bhi behtar hai. Trading risky hoti hai, aur aapko apni financial situation aur risk tolerance ke mutabik decisions lena chahiye. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Stick Sandwich Candlestick Pattern kia hota hy

Stick Sandwich candlestick pattern ek unique technical analysis tool hai jo traders aur investors ke liye market analysis mein istemal hota hai. Yeh pattern market mein hone wale reversals ya trend changes ko detect karne mein madadgar hota hai. Aaiye, is pattern ko detail mein samajhte hain.Stick Sandwich candlestick pattern ek continuation pattern hota hai jo market sentiment ko indicate karta hai. Is pattern mein ek bullish candlestick, us ke baad ek bearish candlestick, aur phir ek dobara bullish candlestick aati hai. Bearish candlestick dono bullish candlesticks ke darmiyan hoti hai jaise ke "sandwich" mein fillings hote hain. Pattern Ki Tafseelat:

1. **Pehli Bullish Candlestick:** Pehli candlestick ek bullish candlestick hoti hai jo market mein price increase ko represent karti hai. 2. **Bearish Candlestick:** Doosri candlestick ek bearish candlestick hoti hai jo market mein price decrease ko darust karti hai. 3. **Doosri Bullish Candlestick:** Teesri candlestick fir se bullish hoti hai aur pehli bullish candlestick ki range mein aati hai. Stick Sandwich Pattern Ka Istemal

Stick Sandwich pattern traders ko suggest karta hai ke market mein existing trend continue ho sakta hai. Jab ek bullish candlestick ke baad bearish candlestick aati hai aur phir dobara bullish candlestick aati hai, toh yeh indicate karta hai ke market mein sellers ki temporarily dominance hai lekin fir se buyers ka control aa raha hai. Traders is pattern ko dekhte hain aur iska istemal karke long (buy) positions le sakte hain, ummid karte hain ke market mein price increase hone ka chance hai. Lekin yaad rahe ke candlestick patterns ko confirm karne ke liye aur trading decisions lene ke liye, aapko doosri technical indicators aur market analysis bhi karni chahiye. Pattern Ki Pehchan

Stick Sandwich pattern ko confirm karne ke liye aapko doosre technical indicators ka bhi istemal karna zaroori hai. Aap RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur volume analysis ka istemal karke pattern ko verify kar sakte hain.Trading mein successful hone ke liye, aapko stop-loss aur take-profit orders ka bhi istemal karna chahiye taki aap apne trades ko manage kar saken. Risk management ka dhyan rakhna bhi ahem hai. Stick Sandwich candlestick pattern ek powerful tool hai jo market analysis mein madadgar ho sakta hai. Lekin, iska istemal samajhdari aur experience ke sath karna chahiye. Market volatility aur risk ko samajh kar trading decisions lena zaroori hai. Agar aap is pattern ko sahi tarah se samajh lete hain aur use karne mein maharat hasil karte hain, toh aap apne trading skills ko improve kar sakte hain aur market mein safalta pa sakte hain. -

#4 Collapse

Aslamoalekum kesay hein ap sab members. Main umed krti hon ap sab thek hongay or apki posting behtreen ja rhi hogi isky sath apka trading session bhe acha ja raha hoga. Aj ka hmara discussion ka jo topic hay woh stick sandwiche candlestick pattern ky baray mein hey isy dekhty hein ky yh kia hy or hmen kia malomat faraham karta hai. Stick sandwich candlestick pattern Stick Sandwich Candlesticks Pattern ek tachniqi tajziyati tool hai jo forex trading mein istemal hota hai. Yeh pattern tab hota hai jab ek downtrend ke baad ek bearish candle aata hai, phir ek small bullish candle, aur fir ek aur bearish candle. Yeh neshandahi karta hai ki market mein reversal ho sakta hai.Stick Sandwich Candlesticks Pattern ki pehchan karne ke liye, aapko kuch steps pr amal karne parte hain. Pehle, ek downtrend ke baad aata hai ek bada bearish candle, phir ek chhota bullish candle, aur fir ek aur bearish candle. Agar aap ye pattern dekhte hain toh yeh haqeeqat neshandahi ho sakta hai ki market mein reversal hone ke bhe sat chances hain. Is pattern ko shanakht karna market analysis aur jesay he candlestick patterns ki samajh bojh par inhasar karta hai.Stick Sandwich Candlesticks Pattern ka istemal traders ko market ke mumkina reversal points ko shanakht karne mein madad karta hai. Jab yeh pattern dikhta hai, toh yeh tajweez karta hai ki bearish trend ke baad bullish trend aa sakta hai. explanation Traders ise market entry points ya exit points decide karne ke liye istemal kar sakte hain. Hamesha yaad rakhein ki kisi bhi pattern ko sirf ek neshandahi ke shakal mein dekha jana chahiye aur doosre awamil ke saath milakar analysis karna zaroori hai. Yeh Stick Sandwich Candlesticks Pattern baki patterns se is tareeke se alag hota hai ki ismein ek makhsos sequence hoti hai. Is pattern say mein pehle ek baraa bearish candle aata hai, phir ek chhota bullish candle, aur fir ek aur bearish candle. Yeh saray awamil yeah he zahir karta hai ki market mein reversal hone ke chances hain.Baaki candlestick patterns, jaise ki Doji, Hammer, ya Engulfing yaa jo patterns, alag alag conditions aur shakal mein aate hain. Har ek pattern apne apne context mein istemal hota hai aur traders ko he makhsos information muhaya karta hai, jise tajded karke woh trading decisions le sakte hain.Stick Sandwich Candlesticks Pattern ki kuch fawaid hain jaise ki Yeh pattern market mein reversal hone ke mumkina ko neshandahi karta hai, jiski madad se traders sy apne trading strategies adjust kar sakte hain. Is pattern ko samajh kar traders entry aur exit points decide kar sakte hain jisse unka trading kay tajarbat ko behtar ho sakta hai.Stick Sandwich Candlesticks Pattern market sentiment ko zahir karta hai, aur bhe or traders ko market ke mood ke bare mein insights deta hai.Hamesha yaad rakhein ki kisi bhi single indicator par pura bharosa na karein aur market analysis ke liye doosre awamil ko bhi gor karein. -

#5 Collapse

Stick sandwich Candlesticks pattern: Dear forex members Stick sandwich aik trading pattern hy jis main 3 candlestick banti hain jo ky is tarha sy show hoti hy jesay trader screen per sandwich ho. Stick sandwich mein middle wali candlestick hoti hai jiska colour stick sandwich mein mojud sides wali candle sticks sy opposite hota hai or ye dono side wali candle stick ki trading range mid wali candlestick ki range sy ziada hoti hy.Stick sandwich bullish or bearish indicators main pai jati hai. Bullish stick sandwich Candlesticks pattern: Dear forex traders Bullish Sandwich Candlesticks pattern mein ap ko strong downtrend ky last mein mily ga or is pattern ki shape kuch aisi hoti hai kay strong bearish movement hoti hai market mein aur strong bearish candle form hony ky baad ap ko aik bullish candle dekhny ko mily ga Lekin us ky baad strong bearish candle form hoti hai jis ky foren baad ap ko market mein bullish movement nazar aye gi toh ye market mein reversal hota hain lekin last candle main bohot movement hoti hai jesy ky last two candles ko up and down side dono tarf sy cover karti hai Bearish stick sandwich Candlesticks pattern: Dear my friends Bearish sandwich Candlesticks pattern mein bhi kuch aisa he hota hy ap ko bearish sandwich candlesticks pattern market ky strong bullish trend mein Dekhny ko mily ga aur is ky baad market Strong bearish movement karti hy is mein be strong bullish candle form hoti hai or second candles strong bearish movement hoti hai lekin third candle main aap ko market mein bohot ziada bullish Or bearish movement dekhny ko Mily ge is waqat aap ko market bullish ho jati hy aur bearish ho jati hy aur nazar ati hai jis mein last two candles proper cover ho jati hein aur candle bullish close hoti hy aur is ky baad market strong bearish movement karti hai. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Stick Sandwich Candlesticks Pattern Kya Hai? "Stick Sandwich Candlestick Pattern," technical analysis mein ek aham candlestick pattern hai jo traders aur investors istemal karte hain taake price trends aur reversals ko samajh saken. Yeh pattern do aham candlesticks se banta hai aur ek trend reversal ko darust karne ki salahiyat rakhta hai. Is pattern ko samajhna traders ke liye zaroori hota hai taake woh behtar trading decisions le saken. Candlestick Patterns Ki Ahmiyat. Candlestick patterns, stock market analysis ke aik ahem hisse hain jinse traders aur investors price trends aur reversals ko samajh sakte hain. Stick Sandwich pattern bhi is category mein aata hai. Stick Sandwich Kaise Kaam Karta Hai. Stick Sandwich pattern kaam is tarah karta hai ke pehle bearish candlestick se market mein girawat aati hai, phir bullish candlestick se market mein izafa hota hai, aur phir dobara bearish candlestick aati hai. Bullish candlestick do bearish candlesticks ke beech aata hai, jaise ke sandwich ki filling do pieces of bread ke beech hoti hai.Stick Sandwich pattern, do bearish (girawat ki taraf le jana wala) candlesticks ke beech ek bullish (bharpoor ki taraf le jana wala) candlestick ke hone ki soorat mein hota hai. Isme pehle aur teesre candlesticks negative aur doosre (beech wala) candlestick positive hota hai. Stop-Loss Aur Entry Points. Traders Stick Sandwich pattern ko apni trading strategies mein istemal karke entry aur stop-loss points tay kar sakte hain. Is pattern ko dekhte hue traders entry point decide karte hain aur stop-loss point tay karte hain taake nuksan se bacha ja sake. Stick Sandwich pattern, price reversal signal provide karta hai. Jab yeh pattern market mein dikhata hai, to yeh indicate karta hai ke bearish trend khatam ho sakta hai aur bullish trend shuru ho sakta hai. Is pattern ki samajh se traders trend reversal pe trade kar sakte hain. Stick Sandwich Candlestick Pattern ek ahem tool hai stock market analysis mein. Yeh pattern market trends ko samajhne mein madadgar hota hai aur traders ko price reversals ko anticipate karne mein madad deta hai. Lekin yaad rahe ke kisi bhi pattern ki puri tarah se bharosa na karna behtar hota hai aur dusri technical analysis tools aur risk management bhi ahem hoti hain trading mein safalta pane ke liye. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

Stick Sandwich Candlesticks Pattern kaya hai ? Stick Sandwich Candlesticks Pattern, ek popular technical analysis tool hai jo financial markets mein price action ki analysis mein istemal hota hai. Yeh pattern trading decisions ko samajhne aur market trends ko predict karne mein madadgar hota hai. Is pattern ka main maqsad price reversals ko identify karna hai. Stick Sandwich Pattern Kaise Banta Hai: Stick Sandwich Candlesticks Pattern do candlesticks se banta hai, aur iske primary components hain: 1. Pehla Candlestick: Yeh bearish candlestick hota hai, jo market mein selling pressure ko darust karta hai. Iska matlab hai ke pehla candlestick price down ja raha hota hai. 2. Dusra Candlestick: Dusra candlestick bullish candlestick hota hai, jo market mein buying pressure ko darust karta hai. Iska matlab hai ke dusra candlestick price up ja raha hota hai. 3. Teesra Candlestick: Teesra candlestick phir se bearish candlestick hota hai. Yani ke price girne lagta hai. Stick Sandwich Candlesticks Pattern Ki Tafseelat: Is pattern ko samajhne ke liye, aapko pehle bearish trend mein ek bearish candlestick dekhna hoga, jo market mein selling pressure ko dikha raha hai. Uske baad, dusra candlestick aata hai, jo bullish hai, aur yeh market mein buying interest ko darust karta hai. Is bullish candlestick ke baad, teesra candlestick phir se bearish hota hai, jisse price down ja raha hota hai. Yeh pattern market mein price reversals ko indicate karta hai, lekin yeh kisi ek candlestick pattern ki tarah strong nahi hota. Iska matlub hai ke, is pattern ki sahiyat aur iske predictions par bharosa karna akele mein risky ho sakta hai. Traders aur investors ko is pattern ke saath aur bhi technical analysis tools aur indicators ka istemal karke trading decisions lene chahiye.Stick Sandwich Pattern Trading Strategy:Stick Sandwich pattern ko trading strategy ke roop mein istemal karne ke liye, aapko is pattern ke baad aur bhi confirmatory signals dhundhne honge. Aap is pattern ke sath dusre technical indicators jaise ki RSI, MACD, aur moving averages ka istemal kar sakte hain, taaki aapki trading decisions aur bhi mazboot ho. Is pattern ko samajhna aur sahi se interpret karna technical analysis ki practice aur experience ke sath hota hai. Isiliye, traders ko market ki samajh aur analysis ke liye mehnat aur tajurba jama karne ki zarurat hoti hai. Yad rahe ke financial markets mein trading aur investment hamesha risk ke saath aata hai, isliye hamesha apne risk tolerance ke hisab se trading karein, aur agar aap is pattern ko istemal kar rahe hain toh apne trading decisions ko acchi tarah se plan karein.

Stick Sandwich Pattern Kaise Banta Hai: Stick Sandwich Candlesticks Pattern do candlesticks se banta hai, aur iske primary components hain: 1. Pehla Candlestick: Yeh bearish candlestick hota hai, jo market mein selling pressure ko darust karta hai. Iska matlab hai ke pehla candlestick price down ja raha hota hai. 2. Dusra Candlestick: Dusra candlestick bullish candlestick hota hai, jo market mein buying pressure ko darust karta hai. Iska matlab hai ke dusra candlestick price up ja raha hota hai. 3. Teesra Candlestick: Teesra candlestick phir se bearish candlestick hota hai. Yani ke price girne lagta hai. Stick Sandwich Candlesticks Pattern Ki Tafseelat: Is pattern ko samajhne ke liye, aapko pehle bearish trend mein ek bearish candlestick dekhna hoga, jo market mein selling pressure ko dikha raha hai. Uske baad, dusra candlestick aata hai, jo bullish hai, aur yeh market mein buying interest ko darust karta hai. Is bullish candlestick ke baad, teesra candlestick phir se bearish hota hai, jisse price down ja raha hota hai. Yeh pattern market mein price reversals ko indicate karta hai, lekin yeh kisi ek candlestick pattern ki tarah strong nahi hota. Iska matlub hai ke, is pattern ki sahiyat aur iske predictions par bharosa karna akele mein risky ho sakta hai. Traders aur investors ko is pattern ke saath aur bhi technical analysis tools aur indicators ka istemal karke trading decisions lene chahiye.Stick Sandwich Pattern Trading Strategy:Stick Sandwich pattern ko trading strategy ke roop mein istemal karne ke liye, aapko is pattern ke baad aur bhi confirmatory signals dhundhne honge. Aap is pattern ke sath dusre technical indicators jaise ki RSI, MACD, aur moving averages ka istemal kar sakte hain, taaki aapki trading decisions aur bhi mazboot ho. Is pattern ko samajhna aur sahi se interpret karna technical analysis ki practice aur experience ke sath hota hai. Isiliye, traders ko market ki samajh aur analysis ke liye mehnat aur tajurba jama karne ki zarurat hoti hai. Yad rahe ke financial markets mein trading aur investment hamesha risk ke saath aata hai, isliye hamesha apne risk tolerance ke hisab se trading karein, aur agar aap is pattern ko istemal kar rahe hain toh apne trading decisions ko acchi tarah se plan karein.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:07 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим