STOP LOSS & Trailing STOP LOSS

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Assalam alaikum dear members! umeed ha ap sb thk hon gy.Aj hum stop loss or trailing stop loss k difference ko discuss karen or ye h dekhen gy k in dono ko kaisy use kia jata ha. STOP LOSS: Dear members stopp loss 1 limit hoti ha jo k apko zyada loss se bachati ha.Ye limit ap trade lgaty wqt bhi set jr skty hain or trade lgany k bad order modify kr k bhi lga skty hain. Agr ap sell ki trade lety hain to ap k entry point se opr stop loss hota ha or agr ap buy ki trade lety hain to apka stop loss ap ki entry point se nechy ho ga. Benifits of stop loss: Dear members agr ap trade krty hovy stop loss ko use karty hain to es se apki tensioj bht km ho jygi or apka risk bhi km ho jyga. agr ap stop loss lgay baghair trade lgaeb gy to ap tqrbn apni sari equity ko risk kr rhy hain thory se profit k lye jo k 1 bewaqofi wala kam ha. es lye apko chahye bary loss se bachny k lye or apni equity ko secure krny k lye stop loss use krn how to use stop loss: Dear members jb ap trade lgaty hain to us se phly apko market ki support or resistance ko dekh lena chahye ta k ap apna stop loss or profit target set kr skn. jis jgha ap entry lety hain us k nechy koe strong support dekhen or us support py ya us k thora nechy apka stop loss hona chahye. What is Trailing Stop loss: Dear members trailing stop loss bhi dosry simple stop loss ki 1 linit ha frq itna ha k wo simple stop loss apko zada nuqsan se bachata ha. jb k trailing stop loss ap k profit ko secure karta ha. Bht bar ap k sth aisa hota ho ga ka apki orofit wali trade loss main chli jati ho ge or ap ptofit k bjay usy loss main close krty hn gy.Es situation se bachny k lye apko trailing stop loss use karna chahye. How to use Trailing Stop loss: Dear members trailing stop loss ko use karny ka treka ye ha k jb ap koe trade lgaen to us k profit main any k bad apna stop loss entry point se agy kr dn taa k jb market agr reverse b ho jy to apki trade profit main close ho. jesy jesy apki trade chlti jy agy barhti jy profit main ap apna stop loss opr karty jaen. agr ap desktop py trade karty hain to wahan py esko use karna zada asan ha wahan py pip k hisab se stop loss set kr skty hain. jes k agr ap 100 pip ka trailing stop loss lgaen gy to apki trade k barhny k sth sth apka trailing stop loss opr barhta jyga or trade or stop loss main 100 pip ka difference rhy ge or agr market trailing stop loss ko hit kry ge to apki trade profit main close ho ge. -

#3 Collapse

Assalamu Alaikum Dosto!Stop Loss

Protective stops ya hifazati stops woh pehle se tay kiya gaya point hai jo ek trader ek single position ya kisi bhi trade par bardasht karne ko tayyar hai ke uska zyada nuksan hoga. Ye trading ke nuksan ko control karne ke liye hota hai aur kuch ise "money-management stop" bhi kehte hain kyunki ye poora nuksan-e-capital se bachata hai. Ye risk-to-reward ratio se ta'alluq rakhta hai, yaani trader ko apne capital ke saath kitna risk uthana hai jab woh ek position mein enter hota hai.

Protective stops stop loss order ka istemal karke lagaye jate hain trading platform mein. Ye ek order hai jo automatically aapki position ko band kar deta hai, agar asset ki keemat ulte rukh mein chali jati hai aur ek mukarrar level tak gir jati hai, jo aap chahte hain ke us se zyada na ho. Isliye, stop losses aapke invest kiye hue paise ko bachane mein bahut zaroori hain aur zyadatar professional traders is baat par muttafiq hain ke har entry ke sath ek pakki hifazati stop hona chahiye, har surat mein.

Forex trading aur doosri assets mein trading karte waqt sab se mushkil cheezon mein se ek ye hota hai ke aapka stop loss order kahan lagana hai. Ismein bhi ek high level ki discipline shamil hai ke jab trade aapke liye kaam na kare to apna stop na hilayein aur zyada risk na uthayein. Misal ke taur par, agar aapne ek long position mein enter kiya hai aur keemat girne lagti hai, to aapko apna stop kam na karna chahiye taake market ko recover karne ke liye waqt de sakein aur zyada risk mein na par jaayein. Aisa karke, aap apni emotions ko control karne dete hain, isliye stops ko position mein enter karte waqt set kiya jana chahiye aur jab tak keemat unhe trigger karne wali ho, tab tak unhe badalna nahi chahiye, chahe keemat unhe kuch hi paise mein trigger hone wali ho.

New traders ke liye bohut important hai

Protective stops bohot zaroori hain, khaaskar naye traders ke liye. Jab professionals ke paas kafi tajurba hota hai aur woh waqt ke sath test kiye gaye advanced systems ka istemal karke munafa kamate hain, tab naye currency trading ke liye traders ke paas ek hi maqsad hota hai - zinda rehna aur tajurba haasil karna. Jitna lamba waqt woh game mein rahenge, utna hi zyada woh seekhenge aur apne hunar mein behtar honge. Isliye stop loss orders naye traders ke liye ek zaroori tool hain.

Nuksan ko kam karne aur trading mein zyada waqt tak rehne ki anumati dene ke alawa, stops trading mein stress ko bhi kam karte hain. Bina kisi hifazati stop ke ek nuksan mein position rakhna stress ke level ko kaafi badha deta hai, jo khaaskar unexperienced traders ke liye irratioanl thinking ka sabab ban jata hai. Iske alawa, jitna zyada keemat ulte rukh mein jaati hai, utna hi zyada stress barh jata hai aur aapke dimaag ko dominate karne lagta hai.

Yani, stop-loss protection ka istemal karke aap nuksan uthane wali positions se jaldi bahar nikal sakte hain, kam nuksan ke sath, aur unhe tezi se dusre achhi mauke par entry karke kafi jaldi khatam kar sakte hain, us nuksan mein dinon tak rahein aur keemat ko recover karne ki dua karte rahein.

Stops lagana

Har trader ka apna ek system hota hai jab baat aati hai ke protective stops kahan lagane hain. Log jo technical analysis pasand karte hain woh levels jaise support aur resistance ka istemal karte hain aur suitable point ko lagane ke liye stop loss order ka istemal karte hain, jabke doosre sirf trade ke khuli rehne ka waqt dekhte hain. Aise bhi traders hote hain jo technical levels ya time frames ka istemal nahi karte aur unhe sirf ek muqarrar rakam ka nuksan uthana hai, jo aksar stock trading mein istemal hota hai.

Technical levels

Support aur resistance

Market players bohot baar support aur resistance ke maamle ko dekhte hain jab stops lagate hain. Ye levels woh waqt batate hain jab keemat ka ulta rukh mutma'inan hone wala hai. Neeche di gayi chart mein dikhaya gaya hai ke ek hifazati stop kahan lagana chahiye jab humne ek long position mein enter kiya hai.

Support level aur stop loss

Kyunki ek support keemat ko rebound karne aur aage badhne ka sabab banata hai, isliye ek hifazati stop ko uske neeche lagana chahiye. Hamare case mein, jaise screenshot mein dikhaya gaya hai, humne (1) par ek long position enter ki hai aur sab se haal hi mein giraavat ka sab se neeche wala point ek support level banata hai (jo ki black line se mark kiya gaya hai), isliye ye hume hint deta hai ke hifazati stop kahan lagana chahiye. Yaad rahe ke stop ko support level ke kuch pips neeche lagana chahiye taake support level ko tootne ki koshishon ya random noise se trigger na ho. Laal line ek munasib keemat ka mark karti hai jahan hume apna stop lagane chahiye.

Ulte rukh mein chalne ke liye bhi yahi logic hota hai. Agar keemat ke levels neeche ki taraf badh rahe hain aur aapne ek short position mein enter kiya hai, to aapko apna hifazati stop resistance level ke kuch pips upar lagana chahiye. Exclamation-iconYe bhi kehna zaroori hai ke puri sankhyaen, jaise EUR/USD 1.3000, 1.3200, 1.3500, wagaira, bohot zyada tar support aur resistance levels ke tor par tasleem kiye jate hain. Iska matlab hai ke in keemat ke neeche aur upar hifazati stops lagana bohot kaam ka aur zyada istemal hota hai. Aapko yaad rakhna chahiye ke in levels ko tootne se bohot se market players ke stop-loss orders trigger ho jaate hain aur keemat mein fluctuations aati hain.

Moving averages

Bohot saare traders moving averages (MAs) ko support aur resistance levels ke tor par istemal karte hain aur moving averages crossovers par trade karte hain. Isliye ye logical lagta hai ke hifazati stops moving average ke doosri taraf lagaye jayein. Neeche di gayi screenshot aise lagane ka illustration deti hai.

SMA support aur stop loss

Aam tor par, jab keemat ek moving average ko choo kar rebound karti hai, to agar keemat ka movement uparward hai, to ye ek khareed signal banata hai, aur vice versa. Jab signal aata hai to long position mein enter kiya jata hai, to aapko moving average ke kuch pips neeche ek hifazati stop lagana chahiye, bilkul waise hi jaise hamne pehle baat kiye hue basic support level ke neeche laga tha.

Di gayi misaal mein, humne (1) par long entry ki thi, seedha us waqt jab keemat ka rebound ek khareed signal banata tha jabke hamne ek hifazati stop bhi kuch pips moving average ke neeche lagaya tha, taake woh random movement se trigger na ho. Jaise hum kuch der baad dekhte hain, moving average ko tootne ki koshish hui, jo ke nakam rahi aur keemat baad mein tezi se badhti rahi. Agar humne apna hifazati stop bohot paas ya moving average par laga diya hota, to woh chua jata aur hum position ko nuksan mein band karna padta.

Bilkhul usi logic ke tor par, ulte rukh mein chalne ke liye bhi yahi logic hota hai. Agar current keemat moving average se neeche hai aur keemat moving average ko neeche se chho jati hai aur fir upar rebound karti hai, to aapko ek short position mein enter karna chahiye aur ek hifazati stop kuch pips upar moving average ke lagana chahiye.

Channels ka istemal

Market players alag alag trading ranges ka istemal karte hain, jaise ke channels, bands ya envelopes, jinke borders support aur resistance levels ke tor par kaam karte hain. Aam tor par, prices jab bhi in boundaries ko chhu kar rebound karte hain, to unhe channels ya bands mein rakhte hain. Magar ye breakout ka imkaan bhi nahi karte. Apne aap ko bachane ke liye, aapko hifazati stop ko neeche lower band ke ya upar upper band ke lagana chahiye, phir se - long ya short position ke mutabiq.

SMA envelope aur stop loss

Di gayi screenshot mein aap dekh sakte hain ke keemat lower boundary se rebound kar rahi hai jo ke ek signal deta hai long entry ke liye, (1) par. Trade mein enter karte waqt, aap apni position ko neeche lower boundary ke neeche ek hifazati stop se bacha sakte hain, jo ke agar keemat ek unexpected taur par gir jaye aur channel ya band ko tode to aapke nuksan ko kam kardega. Jaise pehle ke cases mein, borders aur hifazati stops ke darmiyan thodi si jagah chhod deni chahiye taake breakout ke nakam attempts ya random noise unhe trigger na karein.

Ek aam kaidah jab hifazati stop lagane ka faisla karte waqt ye hota hai ke aap ek muqarrar point ko dekhte hain jo nichayein diye gaye mawad par mabni hai:- Market ne ek level tak pahuncha hai jo aapki pehle se planning aur reasoning ko challenge kar raha hai

- Ye zyada zyada mumkin hai ke market aapki position ke khilaaf chali jaye aur isliye behtar hai ke trade se bahar nikle

Kai factors hain jo ko hifazati stop lagane ke waqt dyan mein rakhne chahiye, magar inka interpretation shakhsi hai aur har kisi ke trading ke shaili par mabni hota hai. Aise guidelines hain:- Risk ye define karta hai ke ek shakhs ek trade mein kitna nuksan uthana chahta hai. Zyadatar professional traders naye market players ko mashwara dete hain ke ek single position mein unke capital ka 1-2% zyada se zyada risk na lein.

- Risk-to-reward ratio ye trader ke istemal hone wale trading style aur market ki conditions par mabni hota hai. Behtar conditions aapko apni position ko zyada waqt dena allow karte hain, jabke risky assets tight stops ki zaroorat hoti hai.

- Volatility ye asset ki keemat ka range hai jisme fluctuate hota hai. Hifazati stop ko nuksan ko kam karne ke liye istemal kiya jata hai, magar agar aap apna stop bahut paas current keemat ke rakhte hain khaaskar zyadatar volatility ke waqt, to woh random noise se trigger ho sakta hai. Yahan ek aur risk bhi hai, jise mukammal taur par samjha gaya tha "What to Look for in a Trading Platform" article mein.

- Position size agar aapne ek position mein invest kiye hue paise zyada rakhe hain, to har ek pip ka movement total dene wale paise ke muqabil mein kaafi bara ho jayega. Ye risk exposure se mutalliq hai. Is case mein ek tight stop suggest kiya jata hai, lekin logic ye kehta hai ke woh aasan ho jata hai, hatta ke random movement se bhi trigger ho sakta hai.

- Trading capital position size trading capital ke saath link hota hai jo aapke paas hai. Agar aapka trading account under-capitalized hai, to aapko ek single trade mein apne funds ka bara hissa khona bachane ke liye tight stop-loss protection ka istemal kharna padega. Iska matlab hai ke woh traders jo bade positions mein dakhil hona chahte hain unhe ek achhe tarah se capital ke saath shuru karna hoga.

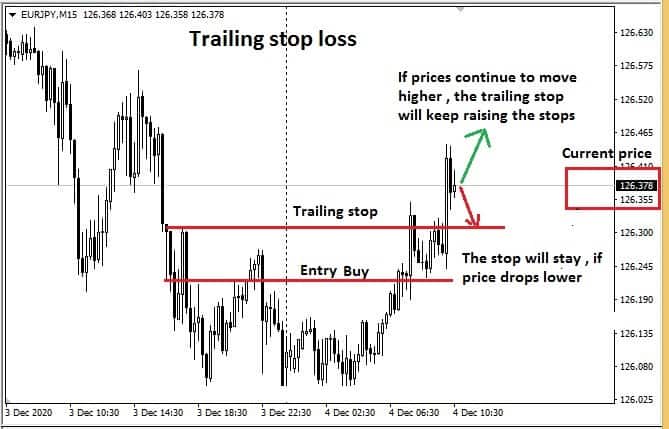

Trailing Stop Loss

Trailing stops hifazati stop loss orders hote hain, jo trade ke rukh ke sath chalte hain aur traders ke liye ya to long ya short position mein zyada nafa dene ke liye move karte hain. Ye fixed stop loss se zyada flexible hota hai, kyunki ye currency pairs ki keemat ke rukh ka picha karta hai aur fixed stop loss ki tarah manually reset ki zaroorat nahi hoti.

Trailing stop ko ek mukarrar percentage se door ek currency pairs ki current market value se set kiya ja sakta hai. Agar ek investor long position mein dakhil hota hai, to trailing stop ko currency pairs ki current market value ke neeche set kiya jaana chahiye. Agar ek investor short position mein dakhil hota hai, to trailing stop ko currency pairs ki current market value ke upar set kiya jaana chahiye. Ye stop aksar istemal kiya jaata hai takay jo hasil kiya gaya hai usko secure kiya ja sake aur trade ko khuli aur nafa hasil karne diya ja sake jab tak currency pair ki keemat sahi rukh mein hai (investor ne kis position ko liya hai ke mutabiq). Agar currency pair ki keemat achanak se apna rukh badal deti hai aur mukarrar percentage se move karti hai, to trade band ho jayegi, nuksan ko rok kar.

Ek misaal de lein. Ek trader USD/JPY pair par 5,000 units ke sath long position lena decide karta hai 104.00 par aur apni position ko secure karne ke liye 2% trailing stop order (ya Good Til Cancelled order) set karta hai. Ye matlab hai ke agar USD/JPY 2% ya us se zyada gir jaye, to trailing stop order trigger ho jayega, nuksan ko rok kar. Aglay mahine mein pair ki keemat barh jati hai, 105.50 tak pahunch kar, is tarah se 1.44% hasil hoti hai. Trader behtareen tor par munafa hasil kar raha hai, lekin wo pareshani zahir karta hai ke pair apne faida wapas le sakta hai. Jab tak uska trailing stop apni jagah par hai, agar currency pair 2% ya us se zyada gir jata hai, to agle haftay ke andar trailing stop trigger ho jayega. Trader apni trading position ko zyada chalne ki jagah dena chaahta hai, isliye wo apna trailing stop 1.50% tak tight karne ka faisla karta hai.

Kuch agle trading sessions mein, USD/JPY aur bhi zyada qeemat barhati hai, 106.00 tak pahunchti hai, magar phir ek trading din mein achanak 1.50% gir jati hai aur 104.40 par pohanch jati hai. Ye 1.50% giravat trailing stop ko trigger kar deti hai aur agar order 104.40 par execute hota hai, to trader 40 pips ka munafa lock kar leta hai.

Yaad rahe ke agar pair ne usi din 0.55% ki kami ki hoti, to trailing stop trigger nahi hota, kyunki wo 1.50% par set kiya gaya tha. Isliye zaroori hai ke trailing stop percentage ko aise set kiya jaye jo na zyada tight ho aur na zyada wide. Agar stop mojooda market price se zyada qareeb set kiya gaya hai, to trade develop hone ka mauka nahi milta. Agar stop mojooda market price se zyada door set kiya gaya hai, to agar trigger hota hai, to trader zyada nafa chhod dene ka khatra uthata hai.

Trailing stops ko technical indicators jaise ke moving averages, channels ya trend lines ki madad se bhi manual taur par adjust kiya ja sakta hai.

Agar ek trader long position mein dakhil hota hai, to jab currency pair ka value moving average se support milta hai, to wo apna stop loss moving average ke neeche adjust kar sakta hai jab trade develop hoti hai. Magar ye ek shakhsiyat ka mamla hai ke kab aur kaise moving average ka istemal kar ke stop loss ko move karna hai. Trader ko stage mein stop loss ko move karne ka intezar bhi kar sakta hai. Dusri taraf, wo har naye candle ka shuru hone par stop loss ko move karne ka faisla kar sakta hai.

Ye ek wazeh stop indication hai. Signal stop aam tor par tab hota hai jab system ko ek signal deta hai ke ek position mein dakhil hone ka waqt hai, jo mojooda position ke mukhalif disha mein hota hai. Ye stop-and-reverse system ka hissa hota hai.

Time stop

Jab time, reward to risk aur muwafiqiat ka maamla hai, to short-term trading mein ek time stop istemal kiya ja sakta hai jab time, paisay ka nuqsan aur moqa ka nuqsan relevant hote hain. Ye stop aksar ek trader ko uski position ko ek mukarrar waqt ke baad band karne ki ijazat deta hai jab ek dakhli entry hoti hai. Agar time window ke andar koi faida nahi hota, to iska future mein hone ki sambhavna kam ho jati hai. Isliye, position ko band kar dena zaroori hai, agar trader ko additional risk se bachna hai. Is strategy ka zyada istemal kiya jata variation hai ke ek mukarrar waqt ke baad position ka size kam kar dena. Ye risk ko kam karne ke liye hota hai aur position ko thoda nafa hasil karne ki ijazat deta hai.

Targets

Ek target price par exit karna bhi ek exit strategy ke taur par istemal kiya ja sakta hai. Short-term trading ke case mein, paise ke targets aam tor par istemal kiye jaate hain. "Agar main is trade par $250 ka munafa hasil karoon, to main exit karunga" ek aam scenario hai. Traders apne targets ko test kar sakte hain, jab tak target calculation method ko aasani se quantified kiya ja sakta hai. Ek lambi muddat ke target par, position ka size kam kiya ja sakta hai ya trailing stops ko paise ke stops ya volatility adjustment ke saath tight kiya ja sakta hai. Ek combination target aur time stop ka istemal karke target prices ko time ke saath badal diya ja sakta hai. Ye ye sabab ko kam kar deta hai ke profits par time ka asar hota hai. Target levels ko trailing stop ke saath set kiya jana chahiye, agar koi nafa jo pehle hasil kiya gaya hai, wo khoya na jaye, agar target level price action dwara nahi paunchta. -

#4 Collapse

Stock market mein invest karte waqt ek aham masla hai ke humein apni invest ki hifazat ka tareeqa dhundhna hota hai. Stop Loss aur Trailing Stop Loss yeh dono techniques hain jo investors ko apne investments ki hifazat mein madad deti hain. Is article mein hum dekhein ge ke Stop Loss aur Trailing Stop Loss kya hain aur kaise inka istemal kiya ja sakta hai.

1. Stop Loss:

Stop Loss ek risk management technique hai jo investors apne investments ki hifazat ke liye istemal karte hain. Jab koi investor kisi stock mein invest karta hai, to wo us stock ko ek specific price par khareedta hai. Stop Loss ka maqsad yeh hota hai ke agar stock ki keemat neeche gir jaaye to investor ka nuksan kam ho. Is tareeqe mein investor apne liye ek nuqta tay karta hai, jahan par wo apni share ko bech de ga agar uski keemat us nuqte tak gir jaati hai.

2. Stop Loss ka Istemal Kaise Karein:

Stop Loss ka istemal karne ke liye investor ko pehle apne risk tolerance level ka andaza lagana zaroori hai. Phir usay decide karna hota hai ke wo kitna nuksan bardasht kar sakta hai. Us ke baad, wo apni investment ki keemat se kuch percent neeche ek stop price tay karta hai. Agar stock ki keemat us stop price tak gir jaati hai, to usay automatic taur par bech diya jata hai, jis se investor ka nuksan kam ho jata hai.

3. Trailing Stop Loss:

Trailing Stop Loss bhi ek risk management technique hai, lekin yeh Stop Loss se thori mukhtalif hai. Trailing Stop Loss mein stop price ko update kiya jata hai jab stock ki keemat barhti hai. Is tareeqe mein, jab stock ki keemat barhti hai, to stop price bhi sath sath barhti hai, lekin jab keemat neeche girne lagti hai to stop price freeze ho jati hai.

4. Trailing Stop Loss ka Istemal Kaise Karein:

Trailing Stop Loss ka istemal karne ke liye bhi pehle investor ko apne risk tolerance level ka andaza lagana zaroori hai. Phir usay decide karna hota hai ke wo kitna percent profit ko nuksan mein bardasht kar sakta hai. Phir wo apni investment ki keemat se kuch percent upar ek trailing stop price tay karta hai. Jab stock ki keemat barhti hai, to trailing stop price bhi sath sath barhti hai, lekin agar keemat neeche girne lagti hai to trailing stop price freeze ho jati hai aur share bech diya jata hai.

5. Stop Loss aur Trailing Stop Loss ka Faida:

Stop Loss aur Trailing Stop Loss ka faida yeh hai ke investors apni investments ko hifazat mein rakh sakte hain. Agar market mein kisi wajah se sudden dip aaye to yeh techniques unko nuksan se bacha sakti hain. Is tareeqe se investors apne nuksan ko control mein rakh sakte hain aur apni investments ko long term tak hold kar sakte hain.

6. Stop Loss aur Trailing Stop Loss ka Istemal ke Nuqsanat:

Stop Loss aur Trailing Stop Loss ka istemal karne ke bawajood, kuch nuqsanat bhi hain. Kabhi kabhi market mein volatility zyada hoti hai aur stocks ki keemat tezi se upar neeche hoti rehti hai, jis se stop price ya trailing stop price frequently update hoti rehti hai, jo investors ko confusion mein daal sakta hai.

7. Conclusion:

Stop Loss aur Trailing Stop Loss dono hi ahem tareeqay hain investors ke liye apni investments ki hifazat mein. In techniques ka istemal kar ke investors apne nuksan ko kam kar sakte hain aur apni investments ko long term tak hold kar sakte hain. Lekin yeh zaroori hai ke investors apne risk tolerance level ko samajh kar aur market ki conditions ko dekhte hue in techniques ka sahi istemal karein. -

#5 Collapse

STOP LOSS & Trailing STOP LOSS

- Stop Loss (SL): Stop Loss ya SL ek tarah ka order hai jo traders apni positions mein lagate hain taake agar market against direction mein chalay, to unka nuksan control mein rahe. SL ko lagane ka maqsad yeh hai ke trader apne maximum loss ko limit mein rakhe aur emotional decisions se bach sake.

Jab trader apni position khareedta hai, to wo us position mein ek SL level set karta hai. Agar market us level tak pohanch jata hai, to uski position automatically close ho jati hai aur nuksan minimize ho jata hai. SL ko lagane se trader apni risk ko manage karta hai aur trading plan ke mutabiq decisions leta hai. - Trailing Stop Loss (TSL): Trailing Stop Loss ya TSL ek dynamic form of SL hai. Ismein SL level ko position ke favor mein move karte jate hain jab market direction mein favorable move karti hai. Iska maqsad yeh hai ke agar market position ke favor mein chal rahi hai, to trader apne profit ko lock kar sakein.

Jab market position ke favor mein chalti hai, to TSL level ko position ke aas pass set kiya jata hai. Agar market TSL level tak pohanch jata hai, to SL level ko update kar diya jata hai taake profit ko lock kiya ja sake. Lekin agar market direction change ho jati hai aur TSL level tak pohanch jata hai, to position automatically close ho jati hai

Stop Loss aur Trailing Stop Loss istemal karke traders apne nuksan ko kam kar sakte hain aur apni investments ko protect kar sakte hain.

Yahan kuch tariqay bayan kiye gaye hain jin se aap Stop Loss aur Trailing Stop Loss se bach sakte hain:- Tight Stop Loss Ka Istemal: Jab aap apne positions mein Stop Loss set karte hain, to dhyan dein ke aapka Stop Loss level bohot tight na ho jaye. Agar aap bohot tight Stop Loss set karte hain, to market ki normal volatility se aapka position jaldi close ho sakta hai, jis se aapko nuksan ho sakta hai. Isliye, apne trading plan ke mutabiq reasonable aur strategically set Stop Loss ka istemal karein.

- Risk-Reward Ratio Ka Madde-Nazar Rakhein: Stop Loss aur Trailing Stop Loss ko set karte waqt apne risk-reward ratio ka bhi khayal rakhein. Agar aapka Stop Loss level zyada hai aur target profit kam hai, to aapko zyada risk ho sakta hai. Isliye, apne trades mein risk-reward ratio ko balance mein rakhein taake aapko nuksan se bachne mein madad mile.

- Emotional Trading Se Bachain: Stop Loss aur Trailing Stop Loss ka istemal karke aap apne trades ko emotional decisions se bacha sakte hain. Jab market against direction mein chalti hai, to traders ko emotions mein aakar wrong decisions lene ka khatra hota hai. Stop Loss lagakar, aap apne trading plan ke mutabiq decision le sakte hain aur emotions se door rahein.

- Market Analysis Ka Mahir Banein: Market analysis kar ke aap apne trades ko better manage kar sakte hain aur Stop Loss aur Trailing Stop Loss ko sahi jagah set kar sakte hain. Technical aur fundamental analysis ka istemal karke aap market trends aur price movements ko samajh sakte hain, jis se aapko Stop Loss aur Trailing Stop Loss ka sahi istemal karne mein madad milegi.

- Stop Loss Aur Trailing Stop Loss Ko Update Rakhein: Market ke dynamics mein tabdeeliyon ke sath aapko apne Stop Loss aur Trailing Stop Loss levels ko bhi update karna zaroori hai. Agar market mein major changes aayein ya volatility barh jaye, to apne SL aur TSL levels ko adjust karein taake aap apne positions ko effectively manage kar sakein.

In tariqon ka istemal karke aap Stop Loss aur Trailing Stop Loss se nuksan se bach sakte hain aur apne trading experience ko behtar bana sakte hain.

- Stop Loss (SL): Stop Loss ya SL ek tarah ka order hai jo traders apni positions mein lagate hain taake agar market against direction mein chalay, to unka nuksan control mein rahe. SL ko lagane ka maqsad yeh hai ke trader apne maximum loss ko limit mein rakhe aur emotional decisions se bach sake.

-

#6 Collapse

Stop Loss

Forex trading mein stop loss ek risk management tool hai jo traders istemal karte hain apne nuqsanat ko had mein rakne ke liye. Yeh ek tarah ka order hota hai jo traders lagate hain takay agar market unke favor mein nahi chal rahi to unka nuqsan control mein rahe. Stop loss order un traders ke liye especially useful hota hai jo high volatility wale markets mein trade karte hain, jaise ke forex market.

Stop loss ka istemal karte waqt traders ek specific price set karte hain jahan par wo apne trade ko automatically close karwana chahte hain agar market us price tak pohanch jaye. Agar trade ki direction unke favor mein nahi chal rahi hoti hai, to stop loss order execute ho jata hai aur trader ko nuqsan se bachane ka mouqa milta hai.

Yeh ek essential component hota hai har trading strategy ka, kyun ke isse traders apne nuqsanat ko control mein rakhte hain aur unki trading discipline maintain hoti hai. Stop loss lagane se traders apne emotions se dur reh kar objective trading decisions le sakte hain.

Stop loss ka istemal karte waqt traders ko kuch important factors ka khayal rakhna zaroori hai:- Risk Tolerance: Har trader ka risk tolerance level alag hota hai. Stop loss set karte waqt, traders ko apni risk tolerance ke mutabiq ek munasib stop loss level set karna chahiye.

- Market Volatility: Market ki volatility ko samajhna zaroori hai stop loss level set karte waqt. Agar market zyada volatile hai, to stop loss level ko adjust karna pad sakta hai.

- Technical Analysis: Technical analysis ki madad se traders stop loss level set karte hain. Support aur resistance levels, trend lines, aur technical indicators ka istemal karke traders stop loss level tay karte hain.

- Trade Size: Trade ka size bhi stop loss level tay karte waqt mad e nazar rakha jata hai. Bade trades ke liye zyada stop loss lagaya jata hai taake nuqsan ko control kiya ja sake.

Stop loss ka istemal karne ke kuch benefits hain:

- Risk Management: Stop loss ka sabse bara faida yeh hai ke isse traders apne nuqsanat ko control mein rakhte hain. Agar trade unke favor mein nahi ja rahi hai, to stop loss order execute ho jata hai aur nuqsan kam ho jata hai.

- Emotional Control: Stop loss lagane se traders apne emotions se dur reh kar objective trading decisions le sakte hain. Emotionally trading karne se bachne ke liye stop loss ka istemal zaroori hai.

- Discipline: Stop loss lagane se traders apni trading discipline maintain kar sakte hain. Stop loss ke bina traders aksar apne trades ko zyada time tak chalate hain, jo ke nuqsanat ko barhata hai.

- Protecting Profits: Stop loss lagane se traders apne profits ko protect kar sakte hain. Agar trade unke favor mein hai aur phir market direction change ho jati hai, to stop loss order execute ho kar unke profits ko secure kar leta hai.

Stop Loss Ka Istemal Kaise Karein:- Technical Analysis: Stop loss levels ko set karne se pehle traders technical analysis ka istemal karte hain. Woh support aur resistance levels ko identify karte hain, along with other technical indicators, jisse unhein pata chalta hai ki kahan stop loss lagana chahiye.

- Volatility Consideration: Volatility ko consider karna bhi zaroori hai stop loss levels set karte waqt. Highly volatile markets mein stop loss levels ko wider rakhna pad sakta hai, jabki low volatility mein narrow stop loss levels ka istemal kiya ja sakta hai.

- Risk-Reward Ratio: Stop loss levels ko set karte waqt traders apne risk-reward ratio ko bhi consider karte hain. Woh apne stop loss level ko apne target profit level ke sath match karte hain, jisse unka risk reward ratio balance rahe.

- Market Conditions: Market conditions ko analyze karna bhi zaroori hai stop loss levels set karte waqt. Agar market mein uncertainty hai ya major news event hone wala hai, to stop loss levels ko adjust karna pad sakta hai.

- Trailing Stop Loss: Kuch traders trailing stop loss ka istemal karte hain, jo unhein flexibility provide karta hai apne profit ko lock karne mein. Jab trade in favor move karta hai, to trailing stop loss automatically adjust hota hai, allowing traders to capture more profits.

Stop Loss Ka Mazbootiyan Aur Kamzoriyan:

Mazbootiyan:- Risk Management: Stop loss ka sabse bada fayda hai risk management mein. Ye traders ko protect karta hai excessive losses se.

- Emotional Control: Stop loss lagane se traders apni emotions ko control kar sakte hain aur impulsive decisions se bach sakte hain.

- Consistency: Stop loss lagane se traders apni trading strategy ko consistent banate hain.

- Reduced Stress: Stop loss lagane se traders ka stress kam hota hai, kyunki unhein constant monitoring ki zaroorat nahi hoti hai.

- Capital Protection: Stop loss lagane se traders apne trading capital ko protect kar sakte hain.

Kamzoriyan:- Whipsaws: Market mein sudden volatility ya false breakouts ki wajah se stop loss hit ho sakta hai, jo trader ko nuksan pahuncha sakta hai.

- Slippage: Jab market mein liquidity kam hoti hai, tab stop loss order execution mein slippage ho sakta hai, jisse trader ko expected se zyada loss ho sakta hai.

- Over-reliance: Kuch traders stop loss par itna depend karte hain ki woh apne trades ko monitor karna bhool jate hain, jisse unhein opportunity loss ho sakta hai.

Conclusion:

Stop loss forex trading mein ek zaroori risk management tool hai jo traders ko excessive losses se bachata hai aur unhein apni trading strategy ko implement karne mein madad karta hai. Stop loss lagane se traders apne trading capital ko protect kar sakte hain aur emotional control bhi maintain kar sakte hain. However, traders ko stop loss ka istemal karte waqt market conditions, volatility, aur risk-reward ratio ka bhi dhyan rakhna zaroori hai, taaki unka stop loss effectively work kar sake aur unhein desired results provide kar sake.

-

#7 Collapse

STOP LOSS & Trailing STOP LOSS

STOP LOSS aur Trailing STOP LOSS

Forex trading mein stop loss aur trailing stop loss do ahem risk management tools hote hain jo traders ko losses se bachane mein madad dete hain aur unke profits ko secure karte hain. Ye tools traders ko apne trades ko manage karne mein flexibility aur control provide karte hain. Chaliye dekhte hain ke stop loss aur trailing stop loss kya hote hain aur inka istemal kaise kiya jata hai.

Stop Loss Ki Tareef:

Stop loss ek risk management tool hai jo traders ko apne trades ko control karne mein madad karta hai. Ye ek predefined level hai jahan par traders apne positions ko automatically band kar dete hain agar market unke favour mein nahi chal rahi hai. Stop loss ka istemal losses ko minimize karne aur capital ko protect karne ke liye kiya jata hai.

Trailing Stop Loss Ki Tareef:

Trailing stop loss bhi ek risk management tool hai jo traders ko profits ko protect karne mein madad deta hai. Ismein stop loss level ko trade ke favour mein chalte hue update kiya jata hai. Agar price trade ke favour mein move karta hai, to trailing stop loss level bhi move karta hai. Lekin agar price opposite direction mein move karta hai, to trailing stop loss level apne current level par lock hota hai.

Stop Loss aur Trailing Stop Loss Ka Istemal:

Stop loss aur trailing stop loss ka istemal karne ke liye traders ko kuch important factors ko dhyan mein rakhna chahiye:- Risk Tolerance: Har trader ka risk tolerance level alag hota hai. Traders ko apne trading plan ke mutabiq stop loss aur trailing stop loss levels tay karna chahiye jo unke risk tolerance level ke mutabiq ho.

- Market Volatility: Market volatility ko samajhna bhi stop loss aur trailing stop loss levels ko tay karne mein madadgar hota hai. Zyada volatile markets mein stop loss levels ko wider rakhna zaroori hota hai.

- Trade Analysis: Har trade ko pehle achhe se analyse karna zaroori hai. Traders ko entry point, target levels,

-

#8 Collapse

STOP LOSS aur Trailing STOP LOSS: Ek Tafseeli Jaiza

STOP LOSS aur Trailing STOP LOSS forex trading mein do ahem risk management tools hain jo traders ko apne positions ko protect karne aur potential losses ko minimize karne mein madad karte hain. Yeh article "STOP LOSS aur Trailing STOP LOSS: Ek Tafseeli Jaiza" is mudda par roshni daalta hai aur in do tools ka maqsad aur istemal ko samajhne mein madad karta hai.

Mukhtasar Introduction:

STOP LOSS aur Trailing STOP LOSS dono hi tools hain jo traders ko market mein protect karte hain jab unki positions open hoti hain. Inka istemal karke, traders apne trades ko manage kar sakte hain aur apni capital ko protect kar sakte hain.

STOP LOSS Ki Tafseel:

STOP LOSS ek predetermined price level hai jahan par traders apne positions ko close karte hain agar market unke favor mein nahi chal raha hota hai. Yeh tool traders ko excessive losses se bachata hai.

Trailing STOP LOSS Ki Tafseel:

Trailing STOP LOSS bhi ek STOP LOSS technique hai lekin yeh dynamic hai aur price ke sath move karta hai. Jab market trader ke favor mein move karta hai, toh Trailing STOP LOSS bhi apne position ko adjust karta hai taake traders maximize profits kar sakein.

Kaise Kaam Karte Hain:

STOP LOSS ka kaam hota hai traders ko protect karna agar market unke favor mein nahi chal raha hota hai. Trailing STOP LOSS ka kaam hota hai traders ko profits lock karne aur potential losses ko minimize karne mein madad karna.

Identification:

Traders ko apne trading strategies ke hisaab se STOP LOSS aur Trailing STOP LOSS levels set karna hota hai. STOP LOSS level ko identify karne ke liye traders ko market analysis aur risk tolerance ko dhyan mein rakhna hota hai.

Mahatva:

STOP LOSS aur Trailing STOP LOSS tools ke istemal se traders apne trading positions ko protect kar sakte hain aur emotional decision making se bach sakte hain. In tools ka sahi istemal karke, traders apne trading performance ko improve kar sakte hain.

Trading Strategies:

STOP LOSS aur Trailing STOP LOSS ke saath, traders ko confirmatory signals aur doosre risk management techniques ka bhi istemal karna chahiye. Saath hi, traders ko apni risk tolerance aur trading goals ke hisaab se STOP LOSS levels set karna chahiye.

Akhiri Kathan:

STOP LOSS aur Trailing STOP LOSS dono hi ahem risk management tools hain jo traders ko market volatility aur uncertainty ke samay apne positions ko protect karne mein madad karte hain. In tools ka sahi istemal karke, traders apni trading performance ko improve kar sakte hain aur consistent profits earn kar sakte hain.

- CL

- Mentions 0

-

سا1 like

-

#9 Collapse

STOP LOSS AUR TRAILING STOP LOSS:

Stop Loss Ka Matlab:- Stop Loss ek tijarati tariqa hai jisme tijaratdaron apne nuqsan se mehfooz rehne ke liye apne trading positions ko kisi had tak limit karte hain.

- Ye un tijarati munafe ko kam karne aur nuqsanat se bachne ka ek tareeqa hai.

Stop Loss Ke Ahmiyat:- Tijarat mein nuqsanat se bachne ke liye zaroori hai ke tijaratdaron ko stop loss ka istemal karna aata ho.

- Stop loss lagane se tijarati position ko tabah hone se bachaya ja sakta hai.

Stop Loss Ke Tareeqe:- Tijaratdaron ko apne trading platform par stop loss level set karne ki suvidha hoti hai.

- Ye level tijarati position ke nuqsan ko bardasht karne ki had ko mukarrar karta hai.

Trailing Stop Loss Ka Matlab:- Trailing Stop Loss ek aisa tareeqa hai jisme stop loss level ko asset ke keemat ke sath sath chalne diya jata hai.

- Agar asset ki keemat barhti hai, to trailing stop loss bhi barhta hai, lekin agar asset ki keemat ghat ti hai, to trailing stop loss wahi pe rehta hai.

Trailing Stop Loss Ke Fawaid:- Trailing stop loss tijarati munafa ko mehfooz karne mein madadgar hota hai jab asset ki keemat barhti hai.

- Ye tijarati position ko barhti keemat ke sath sath mehfooz rakhta hai.

Stop Loss Aur Trailing Stop Loss Ke Mukhtalif Istemal:- Stop loss position ko ek mukammal nuqsaan se bachane ke liye istemal hota hai jabke trailing stop loss nuqsan ko kam karne ke sath sath munafa ko mehfooz karne mein madad deta hai.

- Dono tijarati tareeqe apne maqasid aur situations ke mutabiq istemal kiye ja sakte hain.

Stop Loss Aur Trailing Stop Loss Ki Usool:- Stop loss aur trailing stop loss lagane se pehle, tijarati daron ko apni tijarati haisiyat, maali halat, aur risk bardasht karne ki salahiyat ko madde nazar rakhte hue faisle karne chahiye.

- Ye tijarati tareeqay sirf un logon ke liye faida mand hote hain jo apne nuqsanat se bachne ke liye tayyar hain.

Conclusion:- Stop loss aur trailing stop loss tijarat mein nuqsanat se bachne aur munafa ko mehfooz karne ke liye ahem tareeqay hain.

- In tijarati usoolon ka istemal karke, tijaratdaron ko apne trading positions ko mehfooz rakhte hue tijarati munafa kamane mein madad milti hai.

-

#10 Collapse

STOP LOSS & Trailing STOP LOSS

Stop Loss (Nuqsaan Rok)

Stop Loss ek strategy hai jo investors istemal karte hain apne nuqsan ko control karne ke liye jab wo trading karte hain. Ye unko trading positions ko nuqsan se bachane mein madad karta hai.

Kya Hai Stop Loss?

Stop Loss ek predefined level hai jise investor trading position mein enter karte waqt set karta hai. Jab market price us level tak pohanchti hai, to trade automatic taur par band ho jati hai, nuqsan ko kam karne ke liye.

Stop Loss Kaise Kaam Karta Hai?

Agar trader apne stock ya anya asset ke liye Stop Loss set karta hai, aur market price us level tak pohanchti hai, to uska position automatically close ho jata hai, taake nuqsan ko kam kiya ja sake.

Stop Loss Ke Fawaid- Nuqsan Ka Control: Stop Loss nuqsan ko control karne mein madad karta hai aur investor ko zyada nuqsan se bachata hai.

- Emotional Trading Se Bachao: Ye emotional trading se bachata hai kyunki trader ko manually position close karne ki zarurat nahi hoti.

- Risk Management: Stop Loss ki madad se traders apna risk manage kar sakte hain, apni trading strategy ko follow karte hue.

Trailing Stop Loss (Ghoomti Stop Loss)

Trailing Stop Loss bhi ek stop loss strategy hai, lekin isme stop level ko asset ke price ke sath sath ghoomne diya jata hai.

Kya Hai Trailing Stop Loss?

Trailing Stop Loss, asset ki price ke sath sath badhta ya ghatta hai. Agar asset ki price badhti hai, to stop level bhi badhta hai, lekin agar price ghatti hai, to stop level wahin rukta hai ya ghata diya jata hai.

Trailing Stop Loss Ke Fawaid- Profit Maximization: Trailing Stop Loss ke istemal se trader apne profits ko zyada kar sakta hai, kyunki stop level price ke sath sath badhta hai.

- Risk Reduction: Ye risk ko kam karne mein madad karta hai, kyun ke agar price girne lagti hai, to stop level bhi adjust hota hai, nuqsan ko kam karne ke liye.

- Trend Following: Trailing Stop Loss trend ko follow karne mein madad karta hai aur trader ko market ki movements ka behtar pata chal jata hai.

Stop Loss aur Trailing Stop Loss, dono hi important tools hain jo traders apni trading strategy mein istemal karte hain, taake nuqsan ko control kar sakein aur profits ko maximize kar sakein.

-

#11 Collapse

STOP LOSS & TRAILING STOP LOSS DEFINITION

Prices main momentary dips ke dauran apne trailing stop ko resist karne ki impulse ki reset karna crucial hai Varna aapka effective stop loss expected se lower up ho sakta hai same token ke by, Jab aap chart Mein Momentum ko reining per peaking See Hain especially Jab stock Ek new trend ko hitting kar raha hota hai to trailing stop loss per Lagane Ka advisable Diya jata hai Agar aapka tend aggressive Hai To aap apne profitability level and accept able losses ka approach less precise se kar sakte hain Jaise ke fundamental criteria ke mutabik trailing stops ki setting Shrewd trader always market Mein Sell order submitting Karva kar anytime position ko close karne ka option maintain rakhte Hain trailing stop loss fixed stop loss Se zyada flexible hota hai Kyunki yah stock ki price ki direction automatically track karta hai and usy mixed stop loss Ki Tarah manually reset karne ki zarurat Nahin Hai

:max_bytes(150000):strip_icc()/TrailingStop-21d9b90828874e13ada7282217d8244d.jpg)

TRADING WITH TRAILING STOP ORDER

Ek trailing stop Jo bahut large hai market ki normal movement se triggered nahi kiya hoga but is ka mean yah hai ke trader un necessarily risk taking on kar raha hai ya apni need Se zyada profit giving up kar raha hai Jab ke trailing stop profit ko lock kar deti hai and losses ko limit karti hai ideal trailing stop distance establish karna difficult hai Kyunki market and stock ki move Ka way always changing Hota rahata Hai Iske bavjud trailing stop effective tools hai exit ke har method Ke Apne pros and cons Hote Hain

WHAT IS A TRAILING STOP

Ek long position ke liye ek investor current market ki price se below trailing stop loss place hai short position ke liye ek investor trailing stop ko current market ki price se Above Rakhta hai Ek trailing stop usi time place Kiya jata hai Jab initial trade place ki Jaati Hai Although usse trade ke bad bhi placed Kiya Ja sakta hai trailing stop typical stop order ki modification hai Jaise security ki current market price Se Dur Ek defined percentage ya dollar ki amount per set Kiya Ja sakta hai

-

#12 Collapse

Stop Loss (SL) aur Trailing Stop Loss (TSL) dono trading mein risk management ke liye important tools hain. Yeh traders ko apne positions ko protect karne aur losses ko minimize karne mein madad karte hain.

Stop Loss (SL)

Stop Loss is a risk management tool used by traders to limit their potential losses on a trade. It's essentially a predefined price level at which a trader decides to exit a position if the market moves against their expectation.

For example, if a trader buys a stock at $50 per share and sets a Stop Loss at $45, it means that if the price falls to $45 or below, the position will be automatically closed, limiting the trader's loss to $5 per share. Stop Loss orders are typically placed with the broker and are executed automatically when the specified price level is reached.

The main purpose of a Stop Loss is to protect traders from significant losses in case the market moves unexpectedly against their position. It helps traders stick to their risk management plan and prevents emotions from influencing their trading decisions during adverse market conditions.

Stop Loss ek predefined price level hai jahan par trader apni position ko close karne ke liye order lagata hai. Agar price us level tak jaata hai, to position automatically close ho jati hai, jisse trader ko predefined loss face karna padta hai. Stop Loss positions ko protect karne ka ek effective tareeka hai, kyunki agar trade opposite direction mein move hota hai, to trader ki loss control mein rehti hai.

Trailing Stop Loss (TSL)

Trailing Stop Loss bhi ek stop loss order hai, lekin yeh dynamically adjust hota hai according to price movement. Isme, trader stop loss level ko fixed nahi rakhta, balki usse price ke sath move karata hai. Agar price favorable direction mein move karta hai, to TSL bhi us direction mein adjust hota hai, lekin agar price unfavorable direction mein move karta hai, to TSL apni current level par rehti hai ya phir move hoti hai, depending on predefined parameters. Yeh traders ko allow karta hai ki profits ko lock karne ke liye, jabki unhein losses ko control karne mein flexibility milti hai.

More details

Dono SL aur TSL traders ke risk management strategies ka ek important hissa hote hain, aur dono ko sahi tareeke se use karke traders apne trading accounts ko protect kar sakte hain.

-

#13 Collapse

Stop loss & trailing stop loss

Stop Loss aur Trailing Stop Loss - Forex Trading mein Istemal

Stop loss aur trailing stop loss, forex trading mein ahem tools hain jo ke traders ko apne trades ko protect karne aur potential losses se bachne mein madad karte hain. Ye dono techniques traders ke liye bohot zaroori hote hain takay wo apni trading strategy ko manage kar sakein aur risk ko kam kar sakein. Chaliye dekhte hain ke ye dono kya hote hain aur kaise istemal kiye jate hain.

Stop Loss kya hai?

Stop loss ek risk management tool hai jo traders ko nuksan se bachane mein madad karta hai. Jab trader ek trade enter karta hai, wo ek stop loss level set karta hai jo uski trade ke liye maximum acceptable loss ko darust karta hai. Agar price us level tak pohanch jati hai, to trade automatic tor par band ho jati hai, jis se nuksan ko minimize kiya ja sakta hai.

Stop Loss ka Istemal Kaise Kiya Jata hai?

Stop loss ka istemal karte waqt, trader ek specific price level set karta hai jahan par wo taiyar hota hai apni trade ko band karne ke liye. Agar price us level tak pohanch jati hai, to trade automatic tor par band ho jati hai aur nuksan se bacha ja sakta hai. Stop loss level ko set karte waqt, traders ko apne risk tolerance aur market conditions ka khayal rakhna chahiye.

Trailing Stop Loss kya hai?

Trailing stop loss ek dynamic version hai stop loss ka jo ke price ke saath move karta hai. Jab price trader ke favor mein move karta hai, trailing stop loss bhi uske saath move karta hai lekin ek fixed distance peechay rehta hai. Is tarah se, agar price aik mukarrah had tak pohanch jati hai, to trailing stop loss us level tak move karta hai, lekin agar price phir se ulta chalay jata hai, to trade band ho jati hai aur profit secured ho jata hai.

Trailing Stop Loss ka Istemal Kaise Kiya Jata hai?

Trailing stop loss ka istemal karte waqt, trader ek fixed distance set karta hai jis mein wo trailing stop loss ko rakhna chahta hai. Jab price us distance tak move hoti hai, trailing stop loss automatic tor par us level tak adjust ho jata hai. Agar price mazeed upar jaati hai, to trailing stop loss bhi uske saath move karta hai lekin fixed distance peechay rehta hai takay profit ko secure kiya ja sake.

Stop Loss aur Trailing Stop Loss ke Fawaid

Stop loss aur trailing stop loss ke kuch fawaid hain:- Risk Management: Ye dono techniques traders ko apne trades ko protect karne aur potential losses se bachne mein madad karte hain.

- Emotion Control: Stop loss aur trailing stop loss ka istemal kar ke traders apni emotions ko control kar sakte hain aur rational trading decisions le sakte hain.

- Profit Protection: Trailing stop loss traders ko profit ko secure karne mein madad karta hai jab price unke favor mein move karta hai.

- Automation: Ye dono techniques trading process ko automate karte hain, jis se traders ko constant monitoring ki zarurat nahi hoti.

Stop Loss aur Trailing Stop Loss ke Nuqsanat

Kuch nuqsanat bhi hain in techniques ka istemal karte waqt:- Premature Stoppage: Kabhi kabhi stop loss ya trailing stop loss ki setting itni tight hoti hai ke trade ko prematurely band kar diya jata hai, jis se potential profit miss ho jata hai.

- Whipsaws: Agar market mein sudden volatility hoti hai, to whipsaws ka samna karna parta hai jahan par price briefly stop loss ya trailing stop loss level tak pohanch jati hai lekin phir se ulta chalay jati hai.

Forex Trading mein Stop Loss aur Trailing Stop Loss ka Mustaqbil

Stop loss aur trailing stop loss forex trading mein bohot ahem hain aur inka mustaqbil mazeed taraqqi aur innovation ki taraf ja raha hai. Traders ko in techniques ka istemal kar ke apne trades ko manage karna chahiye aur risk ko kam karne ke liye inka faida uthana chahiye. Regulatory bodies bhi stop loss aur trailing stop loss ka istemal ko promote kar rahe hain takay traders ko protection aur market stability ka ahsaas ho. Mustaqbil mein, in techniques ka demand aur istemal mazeed barh sakta hai jis se traders ko aur bhi zyada opportunities mil sakti hain. Lekin, traders ko hamesha cautious rehna chahiye aur apne trading strategy ko improve karne ke liye constant effort karna chahiye.

-

#14 Collapse

**Stop Loss & Trailing Stop Loss: Trading Mein Aapki Protection**

Forex trading mein risk management bohot zaroori hota hai, aur iske liye Stop Loss aur Trailing Stop Loss jaise tools ka sahi istemaal aapko bade losses se bacha sakta hai. Yeh tools aapki trading strategy ka integral part hone chahiyein, taake aap apne capital ko protect kar sakein aur trading mein zyada confident ho sakein.

### **Stop Loss Ka Taruf:**

Stop Loss ek predefined price level hota hai jahan aapki trade automatically close ho jati hai jab market aapke khilaf move karta hai. Yeh tool aapko bade losses se bacha sakta hai, especially jab market unexpected tareeqe se move kare. For example, agar aapne ek buy trade open ki hai aur aapke analysis ke mutabiq market upar jana chahiye, lekin market neeche chala jata hai, toh Stop Loss aapke losses ko minimize karta hai.

Stop Loss lagane ka faida yeh hai ke aap emotional decision-making se bache rehte hain. Aksar traders market ke khilaf move hone par panic mein aa jate hain aur galat decisions lete hain. Lekin Stop Loss aapke liye ek safety net ka kaam karta hai, jisse aap apni trade ko predetermined risk ke sath manage kar sakte hain.

### **Trailing Stop Loss Ka Taruf:**

Trailing Stop Loss Stop Loss ka advanced version hai jo market ke favor mein move karne par adjust hota rehta hai. Iska matlab yeh hai ke jab market aapke favor mein move karta hai, toh Trailing Stop Loss automatically apni position ko adjust karta hai taake aapki trade profit lock ho sake aur aap apne profits ko protect kar sakein.

For example, agar aapki trade market ke favor mein move kar rahi hai aur aapka profit barh raha hai, toh Trailing Stop Loss apni level ko upar adjust karta rehta hai. Lekin agar market dubara neeche jata hai, toh yeh aapki trade ko usi level par close kar deta hai jahan aapka Trailing Stop Loss set hua hota hai, is tarah se aap apne profits ko protect kar lete hain.

### **Stop Loss & Trailing Stop Loss Ka Sahi Istemaal:**

Stop Loss aur Trailing Stop Loss ka sahi istemaal karna trading mein aapki long-term success ke liye bohot zaroori hai. In tools ka istemaal aapki trading strategy ke sath match hona chahiye. Jab aap Stop Loss set karein, toh aapko market ki volatility, support aur resistance levels, aur apne risk tolerance ko dhyan mein rakhna chahiye.

Trailing Stop Loss ka faida yeh hai ke yeh aapko profits ko lock karne mein madad karta hai jab market aapke favor mein move kar raha ho, lekin zaroori hai ke aap isko overly tight na set karein, warna market ke chhote fluctuations ke wajah se aapki trade prematurely close ho sakti hai.

### **Conclusion:**

Stop Loss aur Trailing Stop Loss aapki trading toolkit ke bohot important tools hain. Yeh aapko bade losses se bacha sakte hain aur profits ko lock karne mein madad karte hain. Lekin inka sahi istemaal karna bhi utna hi zaroori hai. Apne trades ke liye Stop Loss aur Trailing Stop Loss ko smartly set karein, taake aap apne capital ko protect kar sakein aur trading mein consistently profitable ban sakein. Trading mein disciplined approach aur strong risk management hi aapko long-term success dilane mein madad karega.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

### Stop Loss Aur Trailing Stop Loss Ki Tashreeh

**1. **Stop Loss:**

- **Definition:** Stop loss ek risk management tool hai jo trade ko certain level par automatically exit karne ke liye set kiya jata hai.

- **Purpose:** Iska maqsad losses ko limit karna hai aur trade ke adverse movement ke wajah se capital protection karna hai.

**2. **Setting Stop Loss:**

- **Fixed Level:** Stop loss ko ek fixed level par set kiya jata hai jo aapke entry price ke kuch points ke distance par hota hai.

- **Percentage-Based:** Trade size aur account balance ke hisaab se stop loss ko percentage basis par bhi set kiya ja sakta hai, jaise 1-2% of capital.

**3. **Benefits of Stop Loss:**

- **Loss Limitation:** Stop loss aapko unexpected market moves se protect karta hai aur losses ko manageable level tak limit karta hai.

- **Emotional Control:** Stop loss automatic exit provide karta hai jo emotional decision making se bachata hai.

**4. **Trailing Stop Loss:**

- **Definition:** Trailing stop loss ek dynamic risk management tool hai jo price ke favorable movement ke sath apne stop loss level ko adjust karta hai.

- **Purpose:** Yeh tool profit preservation aur risk reduction ke liye use hota hai jab market aapke favor mein move karta hai.

**5. **How Trailing Stop Loss Works:**

- **Distance Setting:** Trailing stop loss ko ek specific distance, jaise points ya percentage, ke hisaab se set kiya jata hai jo price ke current level se adjust hota hai.

- **Automatic Adjustment:** Jab price favorable direction mein move karti hai, trailing stop loss level bhi automatically adjust hota hai aur previous highs ke sath move karta hai.

**6. **Benefits of Trailing Stop Loss:**

- **Profit Lock-In:** Trailing stop loss aapke profits ko lock-in karta hai jab market favorable direction mein move karta hai.

- **Risk Management:** Yeh tool risk ko minimize karta hai aur profits ko secure karta hai jab market trends reverse ho jati hai.

**7. **Stop Loss vs. Trailing Stop Loss:**

- **Fixed vs. Dynamic:** Stop loss fixed level par hota hai jabke trailing stop loss dynamically adjust hota hai price movements ke sath.

- **Purpose:** Stop loss losses ko limit karne ke liye hai, jabke trailing stop loss profits ko secure karne aur losses ko minimize karne ke liye use hota hai.

**8. **Setting Parameters:**

- **Volatility Consideration:** Trailing stop loss ko set karte waqt market ki volatility aur price swings ko consider karna chahiye.

- **Distance Selection:** Distance for trailing stop loss ko market conditions aur trade setup ke hisaab se customize kiya jata hai.

**9. **Limitations:**

- **False Triggers:** Trailing stop loss sometimes false triggers bhi de sakta hai, khaaskar volatile markets mein.

- **Execution Delay:** Stop loss aur trailing stop loss orders execution delay se bhi impact ho sakte hain, jo price movement ko affect kar sakta hai.

**10. **Practical Tips:**

- **Regular Monitoring:** Stop loss aur trailing stop loss settings ko regular basis par monitor aur adjust karna chahiye.

- **Combining with Analysis:** In tools ko technical analysis aur market trends ke sath combine karke effective risk management strategies implement ki jati hain.

Stop loss aur trailing stop loss effective risk management tools hain jo trading decisions ko safeguard karte hain aur market fluctuations ke bawajood capital protection ko ensure karte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:31 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим