Japanese Candlestick Pattren in Forex Trading.

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Japanese Candlestick Pattren in Forex Trading. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

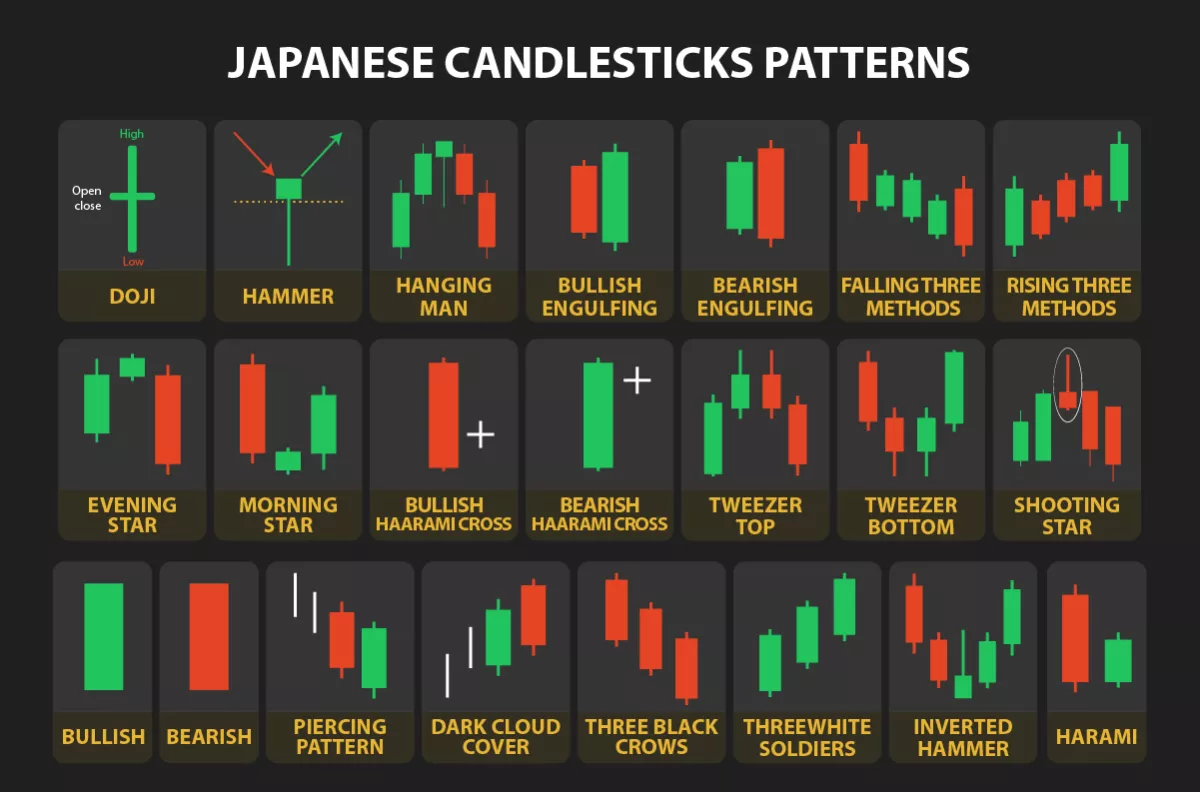

Japanese Candlestick Pattren in Forex Trading. Japanese Candlestick Patterns, Forex Trading mein ek important technical analysis tool hai. Yeh patterns price charts par base hotay hain aur traders ko market movements ke bare mein insights dete hain. Har candlestick ek specific formation ko represent karta hai, jise traders interpret karke future price movements ka prediction karte hain. Yahan kuch common Japanese Candlestick Patterns hain: Doji:Doji ek aesa pattern hai jisme opening price aur closing price ek dusre ke bohat kareeb hotay hain. Yeh indicate karta hai ke market indecision mein hai. Hammer: Hammer ek bullish reversal pattern hai, jo downtrend ke baad aata hai. Yeh ek small body aur long lower shadow wala candle hota hai. Shooting Star:Shooting star ek bearish reversal pattern hai, jo uptrend ke baad aata hai. Yeh ek small body aur long upper shadow wala candle hota hai. Engulfing Pattern: Engulfing pattern mein ek candle dusre candle ko puri tarah se engulf karta hai. Bullish engulfing uptrend ke end ko suggest karta hai jabki bearish engulfing downtrend ke end ko. Harami:Harami ek reversal pattern hai jisme ek small candle ek large candle ke andar fit hota hai. Bullish harami downtrend ke baad aane wale reversal ko suggest karta hai, jabki bearish harami uptrend ke baad aane wale reversal ko. Morning Star aur Evening Star:Morning star ek bullish reversal pattern hai, jabki evening star ek bearish reversal pattern hai. Inmein se koi bhi pattern trend reversal ko indicate karta hai. Yeh patterns traders ko market trends, reversals, aur potential entry/exit points ke bare mein information dete hain. Lekin, yaad rahe ke kisi bhi ek indicator par poora bharosa karke trading nahi karna chahiye. Multiple indicators aur analysis tools ka istemal karke hi sahi trading decisions liye ja sakte hain. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Aslamoalekum kesay hein ap sab members. Main umed krti hon ap sab thek hongay or apki posting behtreen ja rhi hogi isky sath apka trading session bhe acha ja raha hoga. Aj ka hmara discussion ka jo topic hay woh japanese candlestick pattern ky baray mein hey isy dekhty hein ky yh kia hy or hmen kia malomat faraham karta hai. Japanese candlestick pattern Forex trading mein Japanese Candlestick Patterns aam hote hain jo market trends ko zahir karte hain. Kuch am se patterns mein Doji, "Hammer," aur "Engulfing" shamil hain. Ye patterns traders ko market ki harkaat ka sara pata dete hain.Japanese Candlestick Patterns ki pehchan karne ke liye aap market charts par candlesticks ki shakal aur combinations ko dekhte hain.Doji ek esi he aur candlestick pattern hai jisme opening aur closing price aapas mein barabar hoti hai, isse market ke ger yaqeeni ka ishara milta hai. "Hammer" pattern mein, ek lambay nichlay saye aur choti body hoti hai, jo ke bullish reversal ko darust karti hai. "Engulfing" pattern mein, ek candle dusre ko puri tarah se cover karta hai, aik mumkina trend reversal ki neshandahi karta hai. patterns ki pehchan aur samajh aapko trading decisions mein madad karti hai.Japanese Candlestick Patterns ki ahmiyat yeh hai ke yeh traders ko market ke mood aur mumkin kch reversals ka pata lagane mein madad karte hain. In patterns se aap market ke buyer aur seller ke simat darmiyan ki takraar ko samajh sakte hain. Agar aapko lagta hai ke trend change hone wala hai, to aap in patterns ko use karke apne trading strategies ko munazam kar sakte hain. Ye patterns aapko entry aur exit points tay karne mein madad karte hain, aur risk management mein bhi istemal hote hain. Is tarah se, Japanese Candlestick Patterns trading decision lene mein ek istemal deh tool ban jate hain.Japanese Candlestick Patterns, Forex trading mein ek wazeh tarah ki technical analysis tool hain jo market ky halat ko zahir karte hain. Inki khas baat yeh hai ke ye visually strong signals muhaya karte hain. Characterization Dusre patterns aur indicators bhi hote hain, lekin Japanese Candlestick Patterns unki tarah Wazeh neshandahi nahi dete. Mesal kay tor pr, moving averages ek trend ka pata btata hua ishara hai jo price data ka average calculate karta hai, jabke esy Bollinger Bands volatility ko measure karte hain.Candlestick Patterns ka focus candlestick ki Tashkeel par hota hai, jo ke market sentiment ko zahir karte hain, jabki dusre indicators aur patterns alag tarah ke masawai calculations aur tasawur par munhasir hote hain. Is tarah se, Japanese Candlestick Patterns apni munfarid khobio mein market ki samajh mein madad karte hain.yeahi japanese Candlestick Patterns ka istemal karne ke kuch faiday hain. Ye patterns market trends aur reversals ko samajhne mein madad karte hain. Inse aap market ke mood ka pata laga sakte hain, jaise ke bullish ya bearish. Candlestick Patterns entry aur exit points tay karte waqt guide karte hain, jisse aap apne trades ko better time par execute kar sakte hain. Ye patterns traders ko quick visual insights dete hain, jisse unka waqat ma zaya ni hota hai, Japanese Candlestick Patterns ek powerful tool hote hain jo traders ko market analysis mein support karta hai. -

#4 Collapse

(((Forex Trading me Japanese Candlestick Pattern)))

Forex trading mein Japanese Candlestick Patterns ek prakar ka technical analysis tool hai, jiska istemal market trends ko samajhne aur future price movements ke liye kiya jata hai. Japanese Candlestick Patterns price charts par dikhaye gaye candlesticks ke specific arrangement ko darust karte hain.

Yeh patterns market psychology aur price action ko samajhne mein madad karte hain. Har candlestick ek specific time period ko represent karta hai, jisse trader ko pata chalta hai ki us time period mein market mein kya ghat raha hai.

(((Forex Trading me Japanese Candlestick Pattern Ki Types)))

Kuch pramukh Japanese Candlestick Patterns hain:- Doji: Jab opening price aur closing price ek dusre ke bohot kareeb hoti hain, tab ek Doji candle ban jata hai. Ye market mein indecision ya reversal ko darust karta hai.

- Hammer: Ek Hammer candle pattern market mein bearish trend ke bad hone wale reversal ko darust karta hai. Isme ek chhota body aur lambi lower shadow hoti hai.

- Engulfing Patterns: Bullish Engulfing aur Bearish Engulfing, dono hi patterns me ek candle dusre candle ko puri tarah se cover karta hai. Bullish Engulfing uptrend ka sign hota hai, jabki Bearish Engulfing downtrend ka sign hota hai.

- Morning Star aur Evening Star: Ye patterns trend reversal ko indicate karte hain. Morning Star bullish reversal ke liye hota hai, jabki Evening Star bearish reversal ke liye hota hai.

- Shooting Star aur Hanging Man: Ye dono patterns market mein possible reversal ko darust karte hain. Shooting Star uptrend ke baad bearish reversal ko, aur Hanging Man downtrend ke baad bullish reversal ko darust karta hai.

Traders in patterns ko study karke market movements ke predictions banate hain aur trading decisions lete hain. Importantly, ek hi pattern par poora bharosa na karein, aur hamesha dusre technical indicators aur analysis tools ke saath combine karein. Trading mein risk management ka bhi dhyan rakhna zaroori hai. -

#5 Collapse

Introduction About Japanese Candlestick Pattern:

Dear Friends Japanese Candlestick Patterns, Forex Trading mein ek important technical analysis tool hai. Yeh patterns price charts par base hoty hain aur traders ko market movements ke bary mein insights dety hain. Har candlestick ek specific formation ko represent karta hai, jis se traders interpret karke future price movements ka prediction karte hain. Yahan kuch common Japanese Candlestick Patterns be hain.

Important Information of Japanese Candlestick Pattern:

Dear Sisters and Brothers Forex trading mein Japanese Candlestick Patterns aam hoty hain jo market trends ko zahir karte hain. Kuch aam se patterns mein Doji, "Hammer," aur "Engulfing" shamil hain. Ye patterns traders ko market ki harkat ka sara pata dete hain.Japanese Candlestick Patterns ki pehchan karne ke liye aap market charts par candlesticks ki shakal aur combinations ko dekhte hain.Doji ek esi he aur candlestick pattern hai jisme opening aur closing price apas mein barabar hoti hai, isse market ke ger yaqeeni ka ishara milta hai. "Hammer" pattern mein, ek lambay nichlay saye aur choti body hoti hai, jo ke bullish reversal ko darust karti hai. "Engulfing" pattern mein, ek candle dusry ko puri tarah se cover karta hai, aik mumkina trend reversal ki neshandahi karta hai patterns ki pehchan aur samajh apko trading decisions mein madad karti hai.

Importance of Japanese Candlestick Pattern:

Pyary Bahio or Behno Japanese Candlestick Patterns ki ahmiyat yeh hai ke yeh traders ko market ke mood aur mumkin kuch reversals ka pata lagany mein madad karte hain. In patterns se ap market ke buyer aur seller ke simat darmiyan ki takrar ko samajh sakte hain. Agar apko lagta hai ke trend change hony wala hai, tou ap in patterns ko use karke apni trading strategies ko munazam kar sakte hain. Ye patterns apko entry aur exit points tay karne mein madad karty hain, aur risk management mein bhi istemal hoty hain.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex Trading Main Japanese Candlestick Patterns

Forex trading main Japanese candlestick patterns ka istemal karna aik ahem aur mufeed tareeqa hai jis se traders currency market ki movements ko samajh sakte hain aur behtar faislay kar sakte hain. Japanese candlestick patterns ko samajhna traders ke liye zaroori hai taake wo market trends ko samajh sakein aur trading strategies ko improve kar sakein.

Introduction

Japanese candlestick patterns, forex trading ke liye ek qadeem aur sab se popular tool hain. In patterns ka istemal market trends ko samajhne aur price movements ka andaza lagane ke liye hota hai. Ye patterns traders ko market sentiment ka idea dene mein madad karte hain.

Candlestick Patterns Ki Tareef

Candlestick patterns, price action analysis ka aik hissa hain jo traders ko market ki direction aur trend ke baray mein maloomat faraham karte hain. Har candlestick ek mukhtalif story keh rahi hoti hai, jis se traders ko market ki movement ka andaza hota hai.

Bullish Candlestick Patterns

Bullish candlestick patterns, jab market mein uptrend hoti hai, tab istemal kiye jate hain. Ye patterns indicate karte hain ke market ka trend upward hai aur price mein mazeed izafa hone ka imkan hai.

Bearish Candlestick Patterns

Bearish candlestick patterns, jab market mein downtrend hoti hai, tab istemal kiye jate hain. Ye patterns indicate karte hain ke market ka trend downward hai aur price mein mazeed kami hone ka imkan hai.

Single Candlestick Patterns

Single candlestick patterns, aik single candlestick se related hotay hain aur market trend ke baray mein immediate information faraham karte hain. In mein do mukhtalif types hoti hain: bullish aur bearish.

Doji

Doji aik powerful single candlestick pattern hai jo indicate karta hai ke market indecision ka shikar hai aur potential trend reversal hone ka ishara hai.

Hammer aur Hanging Man

Hammer aur Hanging Man candlestick patterns, trend reversal ke potential signals hote hain. Hammer uptrend ke end ko indicate karta hai jab ke Hanging Man downtrend ke end ka ishara karta hai.

Shooting Star aur Inverted Hammer

Shooting Star aur Inverted Hammer bhi trend reversal ke potential signals hote hain. Shooting Star uptrend ke end ko indicate karta hai jab ke Inverted Hammer downtrend ke end ka ishara karta hai.

Bullish aur Bearish Engulfing

Bullish aur Bearish Engulfing patterns, trend reversal ke strong signals hote hain. Bullish Engulfing downtrend ke end ko indicate karta hai jab ke Bearish Engulfing uptrend ke end ka ishara karta hai.

Multiple Candlestick Patterns

Multiple candlestick patterns, do ya zyada candlesticks ke combinations se bante hain aur detailed trend reversal ya trend continuation ke signals provide karte hain.

Morning Star aur Evening Star

Morning Star aur Evening Star patterns, trend reversal ke strong signals hote hain. Morning Star downtrend ke end ko indicate karta hai jab ke Evening Star uptrend ke end ka ishara karta hai.

Three Black Crows aur Three White Soldiers

Three Black Crows aur Three White Soldiers patterns, trend continuation ke strong signals hote hain. Three Black Crows uptrend ke end ko indicate karte hain jab ke Three White Soldiers downtrend ke end ka ishara karte hain. -

#7 Collapse

Forex Trading Mein Japanese Candlestick Patterns Ka Ahmiyat- Forex Trading Mein Japanese Candlestick Patterns Ka Kirdar

Forex trading mein Japanese candlestick patterns ka kirdar bohot ahem hai. Ye patterns traders ko market ki movement ko samajhne mein madad karte hain aur unhe trading decisions mein rehnumai dete hain. In patterns ka istemal karke traders market trends ko samajhte hain aur potential entry aur exit points ko pehchante hain.

Candlestick patterns ki tasveer trader ko market sentiment aur price action ka aik mukammal tasawwur deta hai. Ye patterns price movements, reversal points, aur market volatility ko samajhne mein madadgar sabit ho sakte hain.

- Japanese Candlestick Patterns Ki Tareekh

Japanese candlestick patterns ka ibtida Japan se hota hai. Munfarid shakal aur naam se pehchani jane wali ye patterns ne trading analysis ko naye andaz mein tabdeel kiya. Ye patterns pehle sirf Japani traders ke darmiyan mashhoor thay, lekin ab ye global forex markets mein bhi istemal kiye jate hain.

Munfarid shakal aur naam se pehchani jane wali ye patterns ne trading analysis ko naye andaz mein tabdeel kiya. Ye patterns pehle sirf Japani traders ke darmiyan mashhoor thay, lekin ab ye global forex markets mein bhi istemal kiye jate hain.

- Candlestick Patterns: Technical Analysis Ka Ahem Zariah

Candlestick patterns technical analysis ka ahem zariah hain. In patterns ka istemal karke traders market ke future direction ko forecast karte hain. Candlestick patterns ko samajh kar traders price movements ka andaza lagate hain aur trading strategies banate hain.

Technical analysis ke zariye traders market ke past price movements ko study karte hain aur uss information ko istemal karke future price movements ka andaza lagate hain. Candlestick patterns is process mein ahem kirdar ada karte hain.

- Bullish Aur Bearish Patterns: Kya Hain?

Bullish aur bearish patterns market mein mukhtalif trends ko darust karte hain. Bullish patterns market mein uptrend ya price increase ko represent karte hain jabke bearish patterns market mein downtrend ya price decrease ko show karte hain.

Bullish patterns mein traders ko buying opportunities milti hain jabke bearish patterns mein selling opportunities payi jati hain. In patterns ka istemal karke traders market direction ko samajhte hain aur apni trades ko accordingly adjust karte hain.

- Single Candlestick Patterns: Akele Mumtaz Pehchan

Single candlestick patterns market mein akele ek candle se mutalliq hote hain. Ye patterns short-term price movements ko identify karne mein madadgar hote hain. Chand ahem single candlestick patterns shamil hain Doji, Hammer, aur Shooting Star.

Ye patterns traders ko market sentiment aur price action ke baray mein immediate information faraham karte hain. In single candlestick patterns ko samajh kar traders apni trading strategies ko refine karte hain aur better trading decisions lete hain.

- Doji: Market Ki Indecision Ka Numaish

Doji ek ahem single candlestick pattern hai jo market ki indecision ko numaya karta hai. Ye pattern jab market mein koi clear trend na ho aur buyers aur sellers ke darmiyan barabar ka muqabla ho, tab banta hai. Doji ek chhoti si body ke saath hota hai jis ke upper aur lower shadows hote hain.

Doji pattern market mein potential trend reversal ya continuation ka indication deta hai. Traders is pattern ko samajh kar market ke future direction ko anticipate karte hain.

- Hammer Aur Hanging Man: Price Reversal Ka Pehchan

Hammer aur Hanging Man candlestick patterns price reversal ko pehchanne mein madadgar hote hain. Hammer bullish reversal ko indicate karta hai jabke Hanging Man bearish reversal ko represent karta hai.

Hammer ek bullish pattern hai jo market mein downtrend ke baad aata hai aur price ko neeche se upar le jata hai. Hanging Man ek bearish pattern hai jo market mein uptrend ke baad aata hai aur price ko upar se neeche le jata hai.

- Shooting Star Aur Inverted Hammer: Bearish Aur Bullish Signals

Shooting Star aur Inverted Hammer candlestick patterns bearish aur bullish signals provide karte hain. Shooting Star ek bearish reversal pattern hai jabke Inverted Hammer ek bullish reversal pattern hai.

Shooting Star ek upper shadow ke saath ek chhoti si body ke saath hota hai aur ye market mein uptrend ke baad aata hai. Inverted Hammer ek lower shadow ke saath ek chhoti si body ke saath hota hai aur ye market mein downtrend ke baad aata hai.

- Engulfing Patterns: Market Mein Major Price Movement

Engulfing patterns market mein major price movement ko indicate karte hain. Ye patterns do candles se mutalliq hote hain jin mein pehli candle ko dusri candle engulf karti hai. Bullish engulfing bullish reversal aur bearish engulfing bearish reversal ko darust karte hain.

Bullish engulfing pattern jab market mein downtrend ke baad aata hai aur ye bullish reversal ko indicate karta hai. Bearish engulfing pattern jab market mein uptrend ke baad aata hai aur ye bearish reversal ko indicate karta hai.

- Harami Patterns: Price Reversal Ki Dastan

Harami patterns price reversal ki dastan sunate hain. Harami patterns do candles se mutalliq hote hain jin mein pehli candle ki range doosri candle ki range mein sama jati hai. Bullish harami bullish reversal ko darust karta hai jabke bearish harami bearish reversal ko represent karta hai.

Harami patterns market mein trend change ko indicate karte hain aur traders ko potential entry aur exit points ka pata lagane mein madadgar hote hain.

- Morning Star Aur Evening Star: Trend Reversal Ki Nishani

Morning Star aur Evening Star candlestick patterns trend reversal ki nishani hote hain. Morning Star ek bullish reversal pattern hai jabke Evening Star ek bearish reversal pattern hai.

Morning Star pattern jab market mein downtrend ke baad aata hai aur ye bullish reversal ko indicate karta hai. Evening Star pattern jab market mein uptrend ke baad aata hai aur ye bearish reversal ko indicate karta hai.

- Doji Star Patterns: Kya Khaas Hai?

Doji Star patterns market mein khaas ahemiyat rakhte hain. Ye patterns Doji ke saath ek aur candle se mutalliq hote hain aur market mein indecision ko numaya karte hain. Bullish Doji Star aur Bearish Doji Star do mukhtalif trend reversal ko darust karte hain.

Doji Star patterns market mein potential trend change ke indications faraham karte hain aur traders ko market ke future direction ke baray mein idea dete hain.

- Abandoned Baby Aur Three White Soldiers: Rare Aur Powerful Patterns

Abandoned Baby aur Three White Soldiers candlestick patterns market mein rare aur powerful patterns hain. Abandoned Baby ek bullish reversal pattern hai jabke Three White Soldiers ek bearish reversal pattern hai.

Ye patterns market mein strong reversal signals faraham karte hain aur traders ko potential trend change ke baray mein advance warning dete hain. In patterns ka istemal karke traders market ke major movements ko capture kar sakte hain.

- Trading Strategies: Candlestick Patterns Ka Istemal

Candlestick patterns ko samajh kar traders apni trading strategies ko improve kar sakte hain. Traders in patterns ka istemal karke market trends ko samajhte hain aur trading decisions lete hain. Candlestick patterns ko samajhne ke liye traders ko patience aur practice ki zarurat hoti hai.

Trading strategies banate waqt traders ko market conditions ko madda lete hue candlestick patterns ka istemal karna chahiye. Ye patterns traders ko market mein hone wale price movements ka aik behtareen andaza faraham karte hain.

- Japanese Candlestick Patterns Ka Istemal Karke Trading Mein Kamyabi Ki Rahnumai

Japanese candlestick patterns ka istemal karke trading mein kamyabi hasil karne ke liye traders ko in patterns ko samajhna zaruri hai. Candlestick patterns market ki language ko samajhne mein madadgar sabit ho sakte hain aur traders ko market ke dynamics ko samajhne mein asani hoti hai.

Trading mein kamyabi ke liye traders ko candlestick patterns ke sath-sath dusre technical indicators ka bhi istemal karna chahiye. Is tarah se traders apni trading strategies ko mazbooti se banate hain aur market mein safar karte hain.

Yeh tha ek mukhtasir guzarish Forex trading mein Japanese candlestick patterns ke baray mein. In patterns ka istemal karke traders apni trading ko improve kar sakte hain aur market ke movements ko behtar taur par samajh sakte hain.

- CL

- Mentions 0

-

سا0 like

- Forex Trading Mein Japanese Candlestick Patterns Ka Kirdar

-

#8 Collapse

Japanese candlestick pattren in forex trading.

Forex (Foreign Exchange) trading mein Japanese candlestick patterns ek important tool hain jo traders ko market analysis aur price movements samajhne mein madad karte hain. Yeh patterns candlesticks (mombattiyon) ki shape aur arrangement ko use karte hain jisse market ka sentiment aur trend predict kiya ja sakta hai. Is article mein hum Japanese candlestick patterns ke concept ko samjhenge aur kuch popular patterns ke examples dekhenge.

Forex Trading Kya Hai?

Forex trading mein currencies ka exchange hota hai. Traders currencies ko buy aur sell karte hain ummeed hai ke unka currency pair ka price increase ya decrease hoga, jis se wo profit earn kar sakein. Forex market 24/7 chalti hai aur bohot dynamic aur liquid market hai.

Japanese Candlesticks Kya Hain?

Japanese candlesticks ek visual representation hai market ke price movements ka. Har candlestick ek specific time period ko represent karta hai (jaise ek din, ek ghanta, ya ek hafta) aur us time period ke opening, closing, high aur low prices ko darshata hai.

Har candlestick ke components:- Body (Shareer): Candlestick ka rectangular part hota hai jo opening aur closing price ke darmiyan ka area ko darshata hai. Agar candlestick bullish (price increase) hai, to body usually green ya white hoti hai. Agar candlestick bearish (price decrease) hai, to body usually red ya black hoti hai.

- Shadows (Chhaye): Candlestick ke body se bahar nikalne wale lines ko shadows ya wicks kaha jata hai. Upper shadow body ke top se high price tak aur lower shadow body ke bottom se low price tak extend hoti hai.

Japanese Candlestick Patterns ka Istemal

Japanese candlestick patterns market sentiment aur price reversals ko identify karne ke liye istemal hote hain. Neeche kuch popular candlestick patterns diye gaye hain:- Hammer aur Shooting Star:

- Hammer (Pashu): Yeh pattern downtrend ke baad hota hai aur bullish reversal ko indicate karta hai. Hammer ka body neeche ki taraf hota hai aur ek long lower shadow hota hai.

- Shooting Star (Goliyan): Yeh pattern uptrend ke baad hota hai aur bearish reversal ko indicate karta hai. Shooting star ka body upar ki taraf hota hai aur ek long upper shadow hota hai.

- Doji:

- Doji ek pattern hai jahan opening aur closing price barabar hote hain, jisse body almost na ke barabar hoti hai. Doji market ke indecision ya reversal ko indicate kar sakta hai.

- Bullish aur Bearish Engulfing:

- Bullish Engulfing: Yeh pattern downtrend ke baad hota hai aur bullish reversal ko indicate karta hai. Bullish engulfing mein ek small bearish candlestick ek bada bullish candlestick engulf karta hai.

- Bearish Engulfing: Yeh pattern uptrend ke baad hota hai aur bearish reversal ko indicate karta hai. Bearish engulfing mein ek small bullish candlestick ek bada bearish candlestick engulf karta hai.

- Morning aur Evening Star:

- Morning Star: Yeh pattern downtrend ke baad hota hai aur bullish reversal ko indicate karta hai. Morning star mein pehle ek long bearish candlestick hota hai, phir ek doji (indecision), aur phir ek long bullish candlestick.

- Evening Star: Yeh pattern uptrend ke baad hota hai aur bearish reversal ko indicate karta hai. Evening star mein pehle ek long bullish candlestick hota hai, phir ek doji, aur phir ek long bearish candlestick.

Candlestick Patterns ke Faide aur Nuqsanat

Candlestick patterns ka istemal karna forex trading mein kuch faide aur nuqsanat hain:

Faide:- Candlestick patterns market sentiment aur trend changes ko detect karne mein madad karte hain.

- In patterns ki madad se traders entry aur exit points decide kar sakte hain.

- Yeh visual aur clear way hai market analysis ke liye.

Nuqsanat:- Kabhi kabhi false signals bhi ho sakte hain, isliye sirf candlestick patterns par rely nahi kiya ja sakta.

- Patterns ko sahi se identify karna aur samajhna skills aur practice ki zarurat hai.

Conclusion

Japanese candlestick patterns ek powerful tool hain forex trading mein market analysis ke liye. In patterns ki madad se traders market sentiment, trend changes, aur price reversals ko samajhte hain aur trading decisions lete hain. Candlestick patterns ko samajhna aur istemal karna important hai taki traders market movements ko effectively analyze kar sakein aur successful forex trading kar sakein. Practice aur experience ke saath, traders candlestick patterns ko efficiently use karke apni trading strategies ko improve kar sakte hain. -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Japanese Candlestick Pattren in Forex Trading.

Japanese Candlestick Patterns kya hain?

Japanese Candlestick Patterns charts par dikhai dene wale pattern hain. Technical traders ka manana hai ki inka istemal karke bhavishya ki price action ka anuman lagaya ja sakta hai, jisse naye sambhavit mauke khojne mein madad milati hai.Technical analysis mein, market ki research karte samay aap sirf iske price chart ko hi dekhte hain.

Japanese Candlestick Patterns ke teen pramukh prakar hain:- Single pattern: Ye ek bar ke pattern hote hain, jaise ki Hammer ya Shooting Star.

- Double pattern: Ye do bar ke pattern hote hain, jaise ki Engulfing Pattern ya Harami Pattern.

- Triple pattern: Ye teen bar ke pattern hote hain, jaise ki Three Stars In Up Trend ya Three Stars In Down Trend.

Kuchh sabse aam Japanese Candlestick Patterns mein shamil hain:- Hammer:Is pattern mein ek chhoti body aur ek lambi lower wick hoti hai. Yah badi bearish pressure ke bad sambhavit bullish reversal ka sanket ho sakta hai.

- Shooting Star:Is pattern mein ek chhoti body aur ek lambi upper wick hoti hai. Yah badi bullish pressure ke bad sambhavit bearish reversal ka sanket ho sakta hai.

- Engulfing Pattern:Is pattern mein ek badi candle hoti hai jo ek chhoti candle ko puri tarah se gher leti hai. Yah trend mein badlav ka sanket ho sakta hai.

- Harami Pattern:Is pattern mein ek chhoti candle hoti hai jo ek badi candle ke andar banati hai. Yah bhi trend mein badlav ka sanket ho sakta hai.

- Three Stars In Up Trend:Is pattern mein teen chhoti white candle hoti hain jo ek uptrend mein banati hain. Yah uptrend ke jari rahane ka sanket ho sakta hai.

- Three Stars In Down Trend:Is pattern mein teen chhoti black candle hoti hain jo ek downtrend mein banati hain.Yah downtrend ke jari rahane ka sanket ho sakta hai.

Forex Trading mein Japanese Candlestick Patterns ka istemal karne ke kuchh sujhav:- Dusre technical indicators ke sath candlestick pattern ka istemal karen. Candlestick pattern sirf ek tool hain,aur inka istemal dusre indicators ke sath karna chahie jisse aapke trade ke liye behtar entry aur exit point mil sake.

- Confirmations ki talash karen. Koi bhi trade karne se pahle, hamesha pattern ki confirmation ke liye dusre indicators ya price action ka istemal karen.

- Risk management ka dhyan rakhen. Koi bhi trade karne se pahle, hamesha stop-loss order ka istemal karen jisse aapka nuksan simit ho sake.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#10 Collapse

# Japanese Candlestick Pattern in Forex Trading

Japanese candlestick patterns forex trading mein bohot hi maqbool aur effective tools hain. Yeh patterns traders ko market sentiment aur price movements ko samajhne mein madad dete hain. Japanese candlestick charting ka istemal 17th century se ho raha hai, jab Japanese rice traders ne is technique ko develop kiya tha. Aaj yeh trading community mein bohot popular hai, aur iske mukhtalif patterns traders ke liye valuable insights provide karte hain.

Candlestick patterns ko samajhne ke liye, pehle yeh samajhna zaroori hai ke ek candlestick do main components par mabni hoti hai: body aur wicks (shadows). Body price ke opening aur closing levels ko darshati hai, jabke wicks high aur low prices ko show karte hain. Is structure ki wajah se traders ko price movements ka achha andaza lagta hai.

Japanese candlestick patterns ki pehli category single candlestick patterns hain. Inmein sab se maqbool patterns hain: Doji, Hammer, aur Shooting Star. Doji candlestick tab banta hai jab opening aur closing price barabar hote hain, jo market ki indecision ko darshata hai. Hammer pattern bullish reversal ka indication hota hai jab yeh downtrend ke baad banta hai. Is pattern ki body choti hoti hai, jabke wick lambi hoti hai, jo buyers ki strength ko darshata hai. Shooting Star bearish reversal signal hai, jo uptrend ke baad banta hai.

Doosri category multi-candlestick patterns ki hoti hai. Ismein sab se famous patterns hain: Engulfing, Morning Star, aur Evening Star. Engulfing pattern tab banta hai jab ek bullish candlestick purani bearish candlestick ko completely engulf kar leti hai. Yeh bullish reversal signal hota hai. Morning Star pattern teen candles par mabni hota hai aur bullish reversal ko darshata hai, jabke Evening Star bearish reversal ka indication deta hai.

Japanese candlestick patterns ka faida yeh hai ke yeh traders ko market ki psychology samajhne mein madad karte hain. Jab aap patterns ko analyze karte hain, toh aapko pata chalta hai ke buyers ya sellers kis tarah se market par control rakh rahe hain. Is se aap informed trading decisions le sakte hain.

Risk management bhi candlestick patterns ke sath zaroori hai. Jab aap kisi pattern ki confirmation dekhte hain, toh stop-loss orders ka istemal karke apne losses ko limit kar sakte hain.

Aakhir mein, Japanese candlestick patterns forex trading mein ek valuable tool hain. In patterns ka sahi istemal karke, traders market ki movement ko samajh sakte hain aur profitable opportunities ka faida utha sakte hain. Agar aap in patterns ko apne trading strategy mein shamil karte hain, toh aap apne trading performance ko behtar bana sakte hain.

- CL

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:27 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим