Average True Range Indicator in Forex Trading.

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

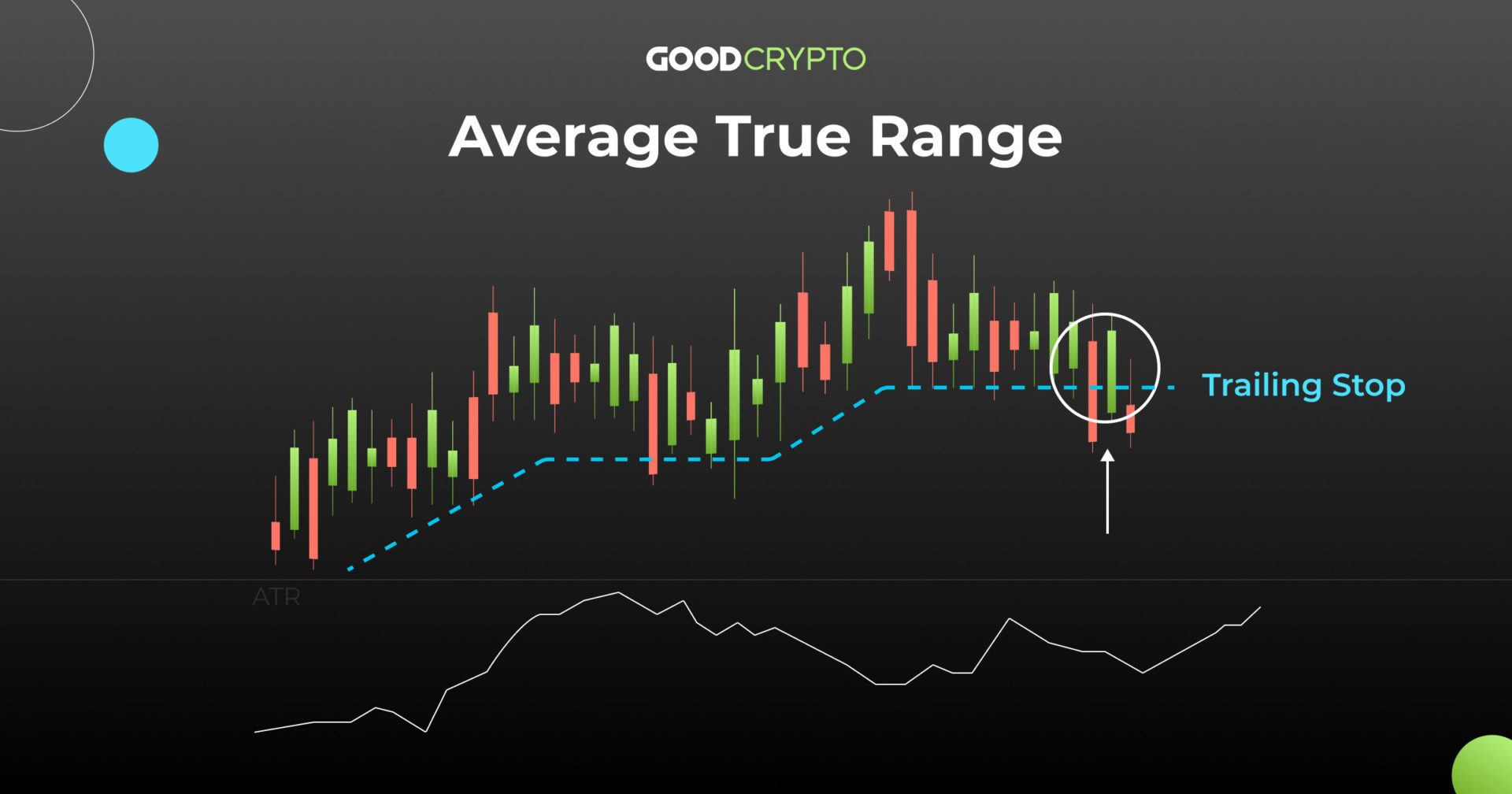

ATR Indicator Kya Hai: Average True Range (ATR) ek technical analysis indicator hai jo market volatility ko measure karta hai. Ye trader ko ye batata hai ke market kitni volatile hai aur potential price movements ko samajhne me madadgar hota hai. ATR Calculation: ATR ka calculation previous trading session's closing price, current session's high, and low prices par based hota hai. Iska result ek numerical value hota hai jo price volatility ko represent karta hai. ATR Ka Istemal: ATR indicator traders ko stop-loss levels aur position sizes decide karne me madadgar hota hai. Jaise agar ATR value zyada ho, to traders apne stop-loss levels ko bada sakte hain taake market ki volatility ko tolerate kiya ja sake. ATR Ke Istemal Ke Fawaid: Risk management: ATR traders ko yeh samajhne me madadgar hota hai ke kitna risk unke trades me involved hai, jisse unka risk management behtar hota hai. Stop-loss placement: ATR se traders apne trades ke liye appropriate stop-loss levels tayyar kar sakte hain. Position sizing: ATR traders ko ye samajhne me help karta hai ke kitni shares ya lots trade ke liye behtar honge. Volatility-based trading strategies: ATR ke istemal se traders volatility-based trading strategies develop kar sakte hain, jaise breakout or trend-following strategies. ATR Trading Strategies: 1. ATR Breakout Strategy: ATR ka istemal breakout trading me hota hai. Jab ATR value high hoti hai, to market me breakout hone ke chances bhi zyada hote hain. 2. ATR for Stop-Loss: Traders ATR ka istemal apne trades ke stop-loss levels decide karne me karte hain. Higher ATR value, wider stop-loss. 3. ATR Trailing Stop: ATR ko trailing stop order ke liye istemal kia jata hai, jisse trade ke profits maximize kiye ja sakte hain. Conclusion: Average True Range (ATR) indicator market volatility ko measure karne me madadgar hai aur traders ko risk management aur trading strategies me guide karta hai. Iska istemal karke, traders apne trading decisions ko improve kar sakte hain.ATR indicator ke tafseelat aur tafseeli istemal se traders market volatility ko behtar samajhte hain aur apne trading decisions ko improve karte hain. Iska istemal unke trading success me madadgar hota hai. -

#3 Collapse

Assalamu Alaikum Dosto!Average True Range (ATR) Indicator

Average True Range Indicator (ATR) ek technical analysis tool hai, jo traders aur investors dwaara price volatility ko measure karne ke liye istemal kiya jata hai. ATR ki madad se traders ko market ke up-downs ka pata chalta hai aur unhe market ke movements ko better understand karne mein madad milti hai. Is article mein, hum ATR ke bare mein detail se jaankari denge aur ATR ki value set karne ke baare mein baat karenge.

ATR ki calculation volatility ko measure karne ke liye istemal kiya jata hai. Iska formula is tarah se hai:

ATR = (Current High – Current Low), (Previous Close – Current High), (Previous Close – Current Low)

Yahan par, ‘Current High’ hote hai current trading session ka sabse bada price, ‘Current Low’ hote hai current trading session ka sabse chhota price, aur ‘Previous Close’ hote hai last trading session ke closing price. ATR ki value price volatility ko measure karti hai, aur iski value jyada hone se price volatility jyada hoti hai, jabki iski value kam hone se price volatility kam hoti hai.

ATR ki value ka size market volatility ke hisaab se badal jaata hai. Agar market volatility jyada hai to ATR ki value jyada hoti hai aur agar market volatility kam hai to ATR ki value kam hoti hai. ATR ki value ko badi aasani se samajh paya jata hai, jaise ki agar ATR ki value 5 hai to iska matlab hai ki market ke average range ka pata lagane ke liye last 5 trading sessions ka price range istemal kiya jata hai.

ATR ki value set karte waqt, traders ke paas kuch factors hote hai jin se wo madad lete hai. Inmein se kuch factors neeche diye gaye hai:- Trading Strategy

Har trader ki apni trading strategy hoti hai, aur iske hisaab se vah ATR ki value set karte hai. Agar trading strategy ko long-term mein maintain karna hai to ATR ki value ko kam set kiya jata hai, jabki agar trading strategy ko short-term mein maintain karna hai to ATR ki value ko jyada set kiya jata hai. - Market Volatility

Market volatility ATR ki value ko bhi prabhavit karta hai. Agar market volatility jyada hai to ATR ki value jyada set kiya jata hai aur agar market volatility kam hai to ATR ki value kam set kiya jata hai. - Risk Tolerance

Har trader ke paas risk tolerance ka apna level hota hai. ATR ki value set karte waqt, traders apne risk tolerance ke hisaab se value ko set karte hai.

ATR Indicator ke sath trading karne se, traders ko price movements ka sahi jankari milta hai, jisse unhe trading decisions lene mein madad milti hai. Isliye, ATR ki value set karte waqt traders ko in factors ko dhyan mein rakhna chahiye aur apni trading strategy aur risk tolerance ke hisaab se value ko set karna chahiye.

Average True Range (ATR) ka Dosre Indicators k Sath Istemal

ATR ka istemal karke traders aur investors market ke up-downs ke bare mein pata laga sakte hai aur market ke movements ko better understand kar sakte hai. Is article mein hum ATR Indicator ke dosre indicators ke sath istemal ke bare mein baat karenge.- Moving Averages (MA)

Moving Averages ek trend-following indicator hai, jo traders ko price ke trend ke bare mein bataata hai. ATR Indicator ke sath MA ka istemal karne se traders ko price trend aur volatility ke bare mein sahi jankari milti hai. Is tarah se, traders MA ka istemal karke trend ko identify kar sakte hai, aur ATR ka istemal karke price volatility ko measure kar sakte hai. - Bollinger Bands (BB)

Bollinger Bands ek volatility indicator hai, jo traders ko price volatility ke bare mein bataata hai. ATR Indicator ke sath BB ka istemal karne se traders ko price volatility ke bare mein sahi jankari milti hai. Is tarah se, traders BB ka istemal karke price volatility ko identify kar sakte hai, aur ATR ka istemal karke price volatility ko measure kar sakte hai. - Relative Strength Index (RSI)

Relative Strength Index ek momentum indicator hai, jo traders ko price ke momentum ke bare mein bataata hai. ATR Indicator ke sath RSI ka istemal karne se traders ko price momentum ke bare mein sahi jankari milti hai. Is tarah se, traders RSI ka istemal karke momentum ko identify kar sakte hai, aur ATR ka istemal karke price volatility ko measure kar sakte hai. - Ichimoku Cloud

Ichimoku Cloud ek trend-following indicator hai, jo traders ko trend aur price momentum ke bare mein bataata hai. ATR Indicator ke sath Ichimoku Cloud ka istemal karne se traders ko trend aur price momentum ke bare mein sahi jankari milti hai. Is tarah se, traders Ichimoku Cloud ka istemal karke trend aur momentum ko identify kar sakte hai, aur ATR ka istemal karke price volatility ko measure kar sakte hai.

In sabhi indicators ke sath ATR ka istemal karne se traders ko price movements aur volatility ke bare mein sahi jankari milti hai. Traders ko in indicators ko ek sath istemal karne se market ke movements ko better understand karne mein madad milti hai, aur sahi trading decisions lene mein madad milti hai.

ATR ke sath in sabhi indicators ko istemal karne se traders ko market ke movements aur price ke trends ke bare mein puri tarah se samajh aa jaati hai. Isliye, traders ko in indicators ka sahi tarah se istemal karne ke liye inki knowledge hona bahut zaruri hai. Traders ko in indicators ko samajhne mein thoda time lag sakta hai, lekin jab ek baar traders in indicators ko samajh lete hai to market ke movements aur price ke trends ko identify karna bahut aasan ho jata hai.

ATR Indicator Advantages & Drawbacks

Average True Range (ATR) Indicator price volatility ko measure karne ke liye istemal kiya jata hai. ATR Indicator ke istemal ke kuch advantages aur drawbacks hote hai, jo is article mein discuss kiye jayenge.- Advantages of ATR Indicator:

- Measure Price Volatility

ATR Indicator ka sabse bada advantage ye hai ki ye price volatility ko measure karne mein madad karta hai. Price volatility ka pata lagane se traders aur investors ko market ke movements ke bare mein sahi jankari milti hai, aur iske alawa traders ko stop-loss aur profit targets ko set karne mein bhi madad milti hai. - Customizable

ATR Indicator ki value customizable hoti hai, iska matlab ye hai ki traders apni trading strategies ke according ATR Indicator ki value ko set kar sakte hai. Isse traders ko apni trading strategies ke hisab se sahi price movements aur volatility ko identify karne mein madad milti hai. - Works for Different Time Frames

ATR Indicator kisi bhi time frame ke liye kaam karta hai, iska matlab ye hai ki traders aur investors isko apni trading strategies ke hisab se apne pasandeeda time frame par istemal kar sakte hai. - Works for Different Markets

ATR Indicator different markets ke liye bhi kaam karta hai, jaise ki stocks, forex, commodities, aur cryptocurrencies. Isliye, traders aur investors different markets mein bhi ATR Indicator ka istemal karke price volatility ko measure kar sakte hai.

- Measure Price Volatility

- Drawbacks of ATR Indicator:

- Delayed Indicator

ATR Indicator ka sabse bada drawback ye hai ki ye ek delayed indicator hai. Iska matlab ye hai ki ye price movements aur volatility ke bare mein pata lagane mein thoda time leta hai. Agar market bahut jyada volatile hai, to ATR Indicator ka istemal karne se traders ko pata lagne mein aur bhi jyada time lag sakta hai. - No Directional Information

ATR Indicator price volatility ko measure karta hai, lekin ismein koi directional information nahi hoti hai. Iska matlab ye hai ki ATR Indicator traders ko ye nahi bata sakta ki price kis direction mein move karega, isliye traders ko ATR Indicator ke sath dusre indicators ka istemal karna zaruri hota hai. - False Signals

ATR Indicator ke istemal se kabhi-kabhi false signals bhi aate hai. Iska matlab ye hai ki ATR Indicator ko follow karke traders aur investors ko wrong trading decisions bhi lena padh sakta hai. - Can't Predict Sudden Events

ATR Indicator market mein sudden events ko predict nahi kar sakta hai, jaise ki natural disasters, political events, aur other unexpected events. Isliye, traders aur investors ko in events ke liye bhi prepared rehna zaruri hota hai.

- Delayed Indicator

ATR Indicator ka istemal karke traders aur investors price volatility ke bare mein sahi jankari paa sakte hai, lekin iske sath-sath ye bhi zaruri hai ki traders aur investors dusre indicators ko bhi apni trading strategies ke sath istemal kare aur sudden events ke liye bhi prepared rahe.

ATR Indicator Uses

ATR Indicator ke istemal se traders aur investors price volatility ko measure kar sakte hai aur iske sath-sath buy aur sell ki trading strategies bhi banai ja sakti hai. Iske alawa, traders aur investors ko market trends ko aur dusre technical indicators ko bhi dhyan mein rakhe, aur sudden events ke liye bhi prepared rahe. Isse traders aur investors ko sahi trading decisions lene mein madad milti hai aur unki trading strategies aur successful banane mein madad milti hai.- ATR Breakout Trading Strategy

ATR Breakout Trading Strategy ek popular trading strategy hai, jisme traders aur investors ATR Indicator ka istemal karke market mein breakout points ko identify karte hai. Ismein traders aur investors breakout point ke upar buy aur breakout point ke niche sell karte hai. Is trading strategy mein ATR Indicator ka istemal karke traders aur investors breakout point ke bare mein sahi jankari paate hai, aur iske alawa, stop-loss aur profit target ko bhi set karne mein madad milti hai. - ATR Moving Average Trading Strategy

ATR Moving Average Trading Strategy mein traders aur investors ATR Indicator ko Moving Average Indicator ke sath combine karte hai. Is trading strategy mein ATR Indicator ka istemal karke traders aur investors price volatility ko measure karte hai, aur Moving Average Indicator ka istemal karke trend ko identify karte hai. Is trading strategy mein traders aur investors trend ke hisab se buy aur sell karte hai, aur ATR Indicator ke sath-sath Moving Average Indicator ka istemal karke sahi stop-loss aur profit target ko set karte hai. - ATR Channel Trading Strategy

ATR Channel Trading Strategy mein traders aur investors ATR Indicator ko channel ke sath combine karte hai. Is trading strategy mein traders aur investors ATR Indicator ka istemal karke channel ke upar buy aur channel ke niche sell karte hai. Is trading strategy mein ATR Indicator ke sath-sath channel ka istemal karke traders aur investors sahi stop-loss aur profit target ko set karte hai.

ATR Indicator ke istemal se buy aur sell ki trading strategies ke alawa, traders aur investors ko ye bhi zaruri hai ki wo market trends ko aur dusre technical indicators ko bhi dhyan mein rakhe. Iske alawa, traders aur investors ko sudden events ke liye bhi prepared rehna zaruri hai, jaise ki natural disasters, political events, aur other unexpected events. - Trading Strategy

-

#4 Collapse

Forex trading ek aisa shoba hai jahan investors duniya bhar ke currencies ki khareed o farokht karte hain, unki qeemat barhta aur girti rehti hai. Ye maamoolan high risk aur high reward ka shoba hai jahan har kadam soch samajh kar uthana zaroori hai. Is shobe mein kamyabi hasil karne ke liye, traders ko market ki qayadat aur rukh ko samajhna zaroori hai. Is maqsad ke liye, woh mukhtalif technical indicators ka istemal karte hain. Ek aham indicator jise forex traders istemal karte hain, woh hai "Average True Range" ya ATR.

1. ATR Ka Tareef Average True Range (ATR) ek volatility indicator hai jo market ki fluctuation ko measure karta hai. Is indicator ka maqsad yeh hai keh market ki volatility ko quantify karna aur is se pata lagana hai keh ek currency pair kitni tezi ya susti se bewakoof ho raha hai.

2. ATR Ka Istemal ATR ka istemal forex trading mein market ki volatility ka andaza lagane ke liye hota hai. Is indicator ko istemal kar ke traders market ki tezi ya susti ko samajh sakte hain aur apni trading strategy ko us ke mutabiq adjust kar sakte hain.

3. ATR Ka Calculation ATR ka calculation market ki high, low aur close prices ke basis par hota hai. Is tarah se har ek din ke liye ATR calculate kiya jata hai. Phir traders is information ko istemal kar ke market ki volatility ka andaza lagate hain.

4. ATR Ka Istemal Trading Strategy Mein ATR ka istemal trading strategy ko design karne mein kiya jata hai. Zayada ATR wale markets mein traders apni stop loss aur take profit levels ko adjust kar sakte hain taake woh market ki ziada fluctuation se bach sakein.

5. ATR Ka Importance ATR ka istemal karte hue traders market ki volatility ka andaza lagate hain, jo unhein behtar trading decisions karne mein madad deta hai. Is ke zariye traders market ki movements ko samajh sakte hain aur apni trading strategy ko us ke mutabiq adjust kar sakte hain.

6. ATR Ke Benefits ATR ke istemal se traders market ki volatility ko samajh sakte hain aur apni trading strategy ko us ke mutabiq adjust kar sakte hain. Is ke zariye woh apne trading positions ko better risk management ke saath handle kar sakte hain.

7. ATR Ke Limitations ATR sirf market ki volatility ko measure karta hai, lekin yeh kisi bhi trend ki taraf ishara nahi karta. Is liye, traders ko ATR ke saath doosre indicators ka bhi istemal karna chahiye taake woh market ke trends ko sahi taur par samajh sakein.

Forex trading mein Average True Range (ATR) ek ahem tool hai jo market ki volatility ko measure karta hai. Traders is indicator ka istemal kar ke market ki movements ko samajh sakte hain aur apni trading strategy ko us ke mutabiq adjust kar sakte hain. Lekin yaad rahe ke sirf ATR par na aitmad karein aur doosre technical indicators ka bhi istemal karein taake aap behtar trading decisions le sakein.

- CL

- Mentions 0

-

سا0 like

-

#5 Collapse

Average True Range Indicator in Forex Trading.

Average-True-Range.webp

"Average True Range" (ATR) ek technical indicator hai jo forex trading mein volatility ko measure karne ke liye istemal hota hai. Is indicator ka main maqsad hai market volatility ko quantify karna taki traders ko market ke movements ka idea mil sake aur unke trading strategies ko adjust karne mein madad mile.

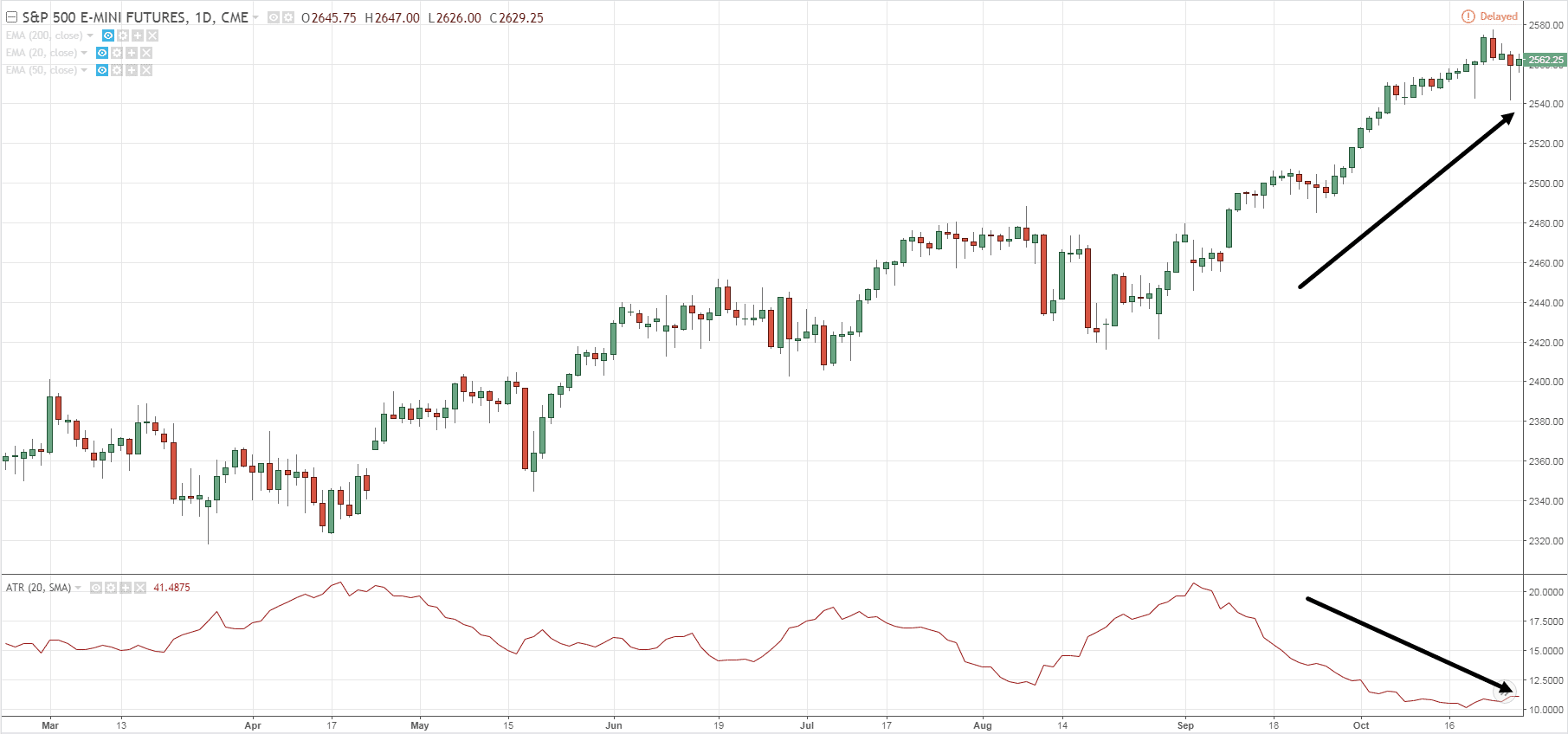

Yahan Average True Range Indicator ke tafseelat di gayi hain:- Calculation: ATR ka calculation high, low aur close prices ke basis par hota hai. Har trading session ke liye, ATR calculate kiya jata hai aur phir isse ek moving average bana kar use kiya jata hai. ATR typically kai sessions ka average hota hai, jo market volatility ko reflect karta hai.

- Volatility Measurement: ATR volatility ke measure ke liye use hota hai. Jab market ki volatility zyada hoti hai, ATR ki value bhi zyada hoti hai, aur jab market ki volatility kam hoti hai, ATR ki value bhi kam hoti hai. Isse traders ko pata chalta hai ke market kitna active ya choppy hai.

- Interpretation: ATR ki value ki interpretation context par depend karti hai. High ATR values indicate zyada volatility, jabki low ATR values kam volatility ko indicate karte hain. Agar ATR ki value zyada hai, to traders apne stop-loss levels aur position sizes ko adjust kar sakte hain taake unka risk market ki zyada volatility ke according manage ho sake.

- Trading Strategies: ATR ke istemal se traders apne trading strategies ko customize kar sakte hain. For example, agar ATR ki value zyada hai, to traders apne profit targets aur stop-loss levels ko bada sakte hain taake zyada volatility ke dauran bhi positions hold kar sakein. Aur agar ATR ki value kam hai, to traders apne profit targets aur stop-loss levels ko kam karke positions ko tight kar sakte hain.

- Trend Confirmation: ATR ka istemal trend confirmation ke liye bhi kiya jata hai. Agar ATR ki value zyada hai aur price trend bhi strong hai, to yeh ek confirmation ho sakta hai ke trend strong hai aur traders apni positions ko hold kar sakte hain.

Overall, Average True Range Indicator forex traders ko market volatility ke baray mein information provide karta hai aur unhein trading decisions ke liye madad karta hai, specifically stop-loss levels aur position sizes ko determine karne mein.

-

#6 Collapse

Average True Range Indicator in Forex Trading :

Assalam o alaikum dear all forex member umeed karta hon sub theak hongay is mein jo average true range indicator in forex trading hai wo yeh hai keh

:max_bytes(150000):strip_icc()/Average-True-Range-FINAL-90c6d31cebf640b8bfb618a280b842be.jpg)

ATR yaani "Average True Range" forex trading mein istemal hone wala aik ahem indicator hai jo market ki volatility ko measure karta hai. Is indicator ka istemal kar ke traders ko yeh pata lagta hai ke market kitna active hai aur kitna volatility hai. ATR aam tor par pichle kuch sessions ki high aur low prices ko dekhte hue calculate kiya jata hai. Jab market zyada volatile hota hai, ATR ki value barh jati hai, aur jab market thanda hota hai, ATR ki value kam ho jati hai. Is tarah se, traders ATR ka istemal kar ke trading strategies ko design karte hain aur stop loss aur take profit levels ko set karte hain.Forex trading mein safar tay karna aksar jaise toofani samundar par chalna hota hai, jahan har kadam par naye samundaron ka samna hota hai. Is musafir mein, ek trader ko samajhna hota hai ke market ki volatility kya hai, aur is volatility ko samajh kar sahi faislay lena hota hai. Is maksad ke liye, traders Average True Range (ATR) jaise ahem indicator ka istemal karte hain.ATR, yaani Average True Range, market ki volatility ko measure karne ke liye istemal hone wala ek technical indicator hai. Is indicator ka mukhya maqsad market ki harkat ko quantify karna hai, taki traders ko pata chale ke market kitni tezi se hila hai. ATR ke calculation mein pichle kuch sessions ki high aur low prices ka istemal hota hai.ATR ka istemal karte waqt, traders ko market ki volatility ka andaza lagane mein madad milti hai. Jab market zyada volatile hoti hai, ATR ki value bhi zyada hoti hai, jabke market thanda hota hai, ATR ki value kam hoti hai. Is tarah se, ATR traders ko market ki tezi ya susti ka pata lagane mein madad karta hai.Forex trading mein ATR ka istemal mukhtalif trading strategies ke liye kiya jata hai. Kuch traders ATR ka istemal kar ke stop loss aur take profit levels ko set karte hain. Agar market zyada volatile hai, to stop loss levels ko adjust kar ke apni positions ko protect karte hain. Dusri taraf, agar market sust hai, to traders apne take profit levels ko adjust kar ke zyada faida kamane ki koshish karte hain.

- Volatility Ka Pata: ATR traders ko market ki volatility ka pata lagane mein madad karta hai. Is se traders ko pata chalta hai ke market kitni tezi ya susti se hila hai, jis se wo apne trading strategies ko accordingly adjust kar sakte hain.

- Stop Loss aur Take Profit Levels Ko Set Karna: ATR ka istemal kar ke traders apne stop loss aur take profit levels ko set kar sakte hain. Agar market zyada volatile hai, to stop loss levels ko adjust kar ke positions ko protect kar sakte hain.

- Risk Management: ATR ke istemal se traders apne risk management ko behtar bana sakte hain. Zyada volatile market mein, positions ko chhote stop loss ke sath enter kar ke risk ko kam kar sakte hain.

- Trend Identification: ATR ke madhyam se traders trend ki strength aur reversals ko identify kar sakte hain. Jab ATR ki value barh rahi hoti hai, to yeh indicate karta hai ke trend strong hai aur jab ATR ki value ghat rahi hoti hai, to yeh reversals ki possibility indicate karta hai.

Nuqsanat:- Lagging Indicator: ATR ek lagging indicator hai, yaani ke yeh market ki previous harkaton ko dekhta hai. Is wajah se, kabhi kabhi yeh current market conditions ko accurately reflect nahi kar pata.

- Over-Reliance: Kuch traders ATR par zyada depend kar lete hain, jis se unka analysis one-dimensional ho jata hai. Yeh unhe market ke aur aspects se ghafil kar sakta hai jaise ke fundamental factors.

- False Signals: Jaise har indicator ki tarah, ATR bhi false signals generate kar sakta hai, khas kar jab market abnormal harkat karti hai ya range-bound hoti hai.

- Volatility Measurement: ATR measures the average range between high and low prices over a specified period, indicating the degree of price movement or volatility in a currency pair. This information can help traders assess the potential risk and set appropriate stop-loss levels or determine position size.

- Setting Stop Loss and Take Profit Levels: ATR can assist traders in setting stop-loss and take-profit levels. Since it provides an indication of the average price range, traders can adjust their stop-loss levels based on current market volatility, potentially reducing the risk of premature stop-outs or missed profit-taking opportunities.

- Identifying Breakouts and Trend Strength: High ATR values may indicate strong market movements, which can signal potential breakout opportunities or the strength of an existing trend. Traders often use ATR in conjunction with other technical indicators to confirm trends or identify reversal points.

- Risk Management: ATR can be integrated into risk management strategies by helping traders adjust their position sizes according to market volatility. During periods of high volatility, traders may reduce their position sizes to manage risk effectively, while during low volatility periods, they may increase their positions to capitalize on potential price movements.

- Trading System Development: ATR can also be used in developing trading strategies or systems. By incorporating ATR-based rules into trading algorithms, traders can automate their decision-making process based on changes in market volatility.

For example, if you're a day trader focusing on short-term price movements, you might calculate and monitor the ATR on shorter time frames like 5-minute or 15-minute charts. On the other hand, if you're a swing trader or a position trader interested in longer-term trends, you might prefer to calculate and monitor the ATR on daily or weekly charts.

-

#7 Collapse

Forex trading ek aise shobha hai jo duniya bhar mein logon ko apni taraf kheenchta hai, lekin ismein safalta hasil karna aam tor par mushkil ho sakta hai. Market ki volatile nature aur bhavishya ke liye anuman lagana asaan nahi hota. Ismein ek chunoti hai ki kaise vyavsayi sahi samay par entry aur exit karein, aur ismein Average True Range (ATR) indicator ka istemal ek mazboot rahbar ban sakta hai.

1. ATR Ki Tareef

ATR ek volatility indicator hai jo market ke samarthan aur pratirodhak staron ko darshata hai. Iska matlab hai ki yeh batata hai ki market kitna active hai aur kitna movement ho sakta hai. Iske zariye vyavsayi samajh sakte hain ki kitna risk unhein lena chahiye aur kitni profit expect ki ja sakti hai.

2. ATR Ka Calculation

ATR ka calculation market ke previous trading sessions ke based par hota hai. Ismein har session ke high, low aur closing prices ka average calculate kiya jata hai. Isse current volatility ka ek estimate milta hai.

3. ATR Ka Istemal

Forex trading mein ATR ka istemal karte waqt, vyavsayi iska upyog market volatility ko samajhne aur trading strategies ko optimize karne ke liye karta hai. ATR ke madhyam se vyavsayi apne stop loss aur take profit levels ko set kar sakte hain, taki unki trading positions ko manage karne mein madad mile.

4. ATR Ka Trend Confirmation Mein Istemal

ATR indicator ko trend confirmation ke liye bhi istemal kiya ja sakta hai. Jab market mein trend strong hota hai, tab ATR ki value bhi zyada hoti hai. Isse vyavsayi ko pata chalta hai ki trend mein majbooti hai aur unhein us trend ke saath trading karna chahiye ya nahi.

5. ATR Ka Volatility Ka Pata Lagana

ATR ki madad se vyavsayi market ki current volatility ka pata laga sakta hai. Jab ATR ki value badh jati hai, tab market mein volatility bhi zyada hoti hai aur vice versa. Isse vyavsayi ko pata chalta hai ki market kitni tezi se move kar rahi hai aur unhein kitna risk lena chahiye.

6. ATR Ka Risk Management Mein Istemal

ATR vyavsayi ko risk management mein madad karta hai. Vyavsayi ATR ke base par apne stop loss aur take profit levels ko set karke apne trading positions ko manage kar sakte hain. Isse unka risk control mein madad milti hai aur unka trading performance improve hota hai.

7. ATR Ka Multiple Time Frame Analysis Mein Istemal

ATR ko multiple time frame analysis mein istemal kiya ja sakta hai, jismein vyavsayi alag-alag time frames par ATR ki values ko compare karke market ki overall volatility ka pata lagate hain. Isse unhein market ke mukhya trend aur chhoti-moti movements ka pata chalta hai, jo unhein sahi samay par trading decisions lene mein madad karta hai.

ATR indicator ek shaktishali tool hai jo forex traders ko market volatility ko samajhne aur unke trading strategies ko optimize karne mein madad karta hai. Iska sahi istemal karke vyavsayi apne risk ko manage kar sakte hain aur safalta ke raaste par aage badh sakte hain. Magar yaad rahe, har indicator ki tarah ATR bhi sirf ek tool hai aur uska istemal samajhdari aur sahi analysis ke saath karna zaroori hai. -

#8 Collapse

Average True Range(ATR)

Average True Range (ATR) ek technical analysis indicator hai jo market volatility ko measure karne ke liye istemal hota hai. Ye traders ko market ke movement ka pata lagane mein madad karta hai aur unhe trading decisions lene mein help karta hai. ATR market ki volatility ka ek sahi estimate deta hai jo traders ko market conditions ko samajhne mein madad karta hai. ATR ko primarily trend strength aur entry/exit points determine karne ke liye istemal kiya jata hai.

ATR ka calculation prices ki volatility ko analyze karne ke liye hota hai. Iska basic purpose ye hai ki traders ko samajh mein aaye ki market kitna volatile hai, jisse unhe apne trades ko manage karne mein madad milti hai.

Formula:

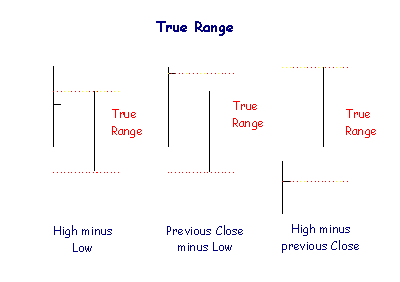

ATR ka formula simple hai, lekin thoda lamba ho sakta hai. Ye ek simple moving average (SMA) hai jo True Range (TR) ki values ka average hota hai. True Range ko calculate karne ke liye, maximum value ko minimum value se minus kiya jata hai:- Current High - Current Low

- Absolute Value (Current High - Previous Close)

- Absolute Value (Current Low - Previous Close)

In teeno values mein se jo sabse bada hota hai, wo True Range hota hai. Fir, ATR ka average nikala jata hai, typically ek 14-day period ke liye, lekin ye timeframe traders ke preference ke according vary kar sakta hai.

Average True Range Indicator ka Istemal

ATR ka istemal traders ko market volatility ke levels ko samajhne mein madad karta hai, jo ki unhe trading strategies banane aur risk management ke liye important hai. Kuch mukhya tareeke jinme ATR ka istemal hota hai, voh hain:- Trend Confirmation: ATR ko trend confirmation ke liye istemal kiya jata hai. Agar ATR ki value badh rahi hai, to yeh indicate karta hai ki market volatility bhi badh rahi hai, jo ek trend ke confirmation ke liye important ho sakta hai.

- Stop Loss Placement: Traders stop loss orders ko ATR ke basis par place karte hain. ATR ki value se, traders apne trades ke liye appropriate stop loss levels set kar sakte hain, taking into account the volatility of the market.

- Position Sizing: ATR ka istemal position sizing ke liye bhi hota hai. Agar market zyada volatile hai, to traders apni positions ko chhote rakhte hain, aur agar market kam volatile hai, to wo apne positions ko bada sakte hain.

- Volatility Breakouts: ATR ki help se traders volatility breakouts ko identify kar sakte hain. Jab ATR ki value sudden increase hoti hai, to yeh ek potential breakout ka signal ho sakta hai, jo traders ke liye trading opportunities create karta hai.

ATR ka istemal karte waqt kuch sawalon ka jawab dhundhna bhi important hota hai. Kuch traders sirf ATR ka istemal karke trading decisions nahi lete, balki wo ise dusre indicators ke saath combine bhi karte hain jaise ki moving averages, RSI, ya MACD. Is tarah ke multiple indicators ka istemal karke, traders apne analysis ko aur bhi robust bana sakte hain.

ATR ke kuch faide hain:

- Market Volatility Ka Pata: ATR ki calculation se market volatility ka pata chalta hai, jo traders ke liye important hai trading strategies banane mein.

- Risk Management: ATR ke istemal se traders apne positions ko size karne aur stop loss levels set karne mein madad lete hain, jo unki risk management ko improve karta hai.

- Trend Confirmation: ATR ke istemal se traders trend ke confirmation ke liye use kar sakte hain, jo unhein sahi samay par entry aur exit points dhoondhne mein madad karta hai.

- Trading Opportunities: ATR ki help se traders volatility breakouts aur other trading opportunities ko identify kar sakte hain, jo unke liye profitable trades create karta hai.

- Flexible: ATR ki value financial instrument ke nature aur market conditions ke according change hoti hai, isliye yeh flexible tool hai jo har ek trader ke liye useful ho sakta hai.

In sabhi faaydo ke saath, ATR ke istemal mein kuch limitations bhi hain. Ye include karte hain:

- Lagging Indicator: ATR lagging indicator hai, yaani ki iski values market movements ke baad aati hain. Iska matlab hai ki ATR current volatility level ko nahi batata, balki past volatility ko reflect karta hai.

- Sensitivity: ATR ka sensitivity depend karta hai uske specified period par. Agar period chhota hai, to ATR zyada sensitive hoga, lekin agar period bada hai, to yeh kam sensitive hoga.

- Alone Not Sufficient: ATR alone trading decisions ke liye sufficient nahi hota. Traders ko dusre indicators aur tools ke saath ATR ka istemal karna chahiye for better analysis.

ATR ka istemal karke traders apni risk management ko improve kar sakte hain aur market ke movements ko samajhne mein madad milti hai. Ye ek powerful tool hai jo traders ko market analysis mein madad karta hai aur unhe better trading decisions lene mein support karta hai.

-

#9 Collapse

Average True Range (ATR) ek volatility indicator hai jo forex trading mein istemal hota hai. Yeh indicator price volatility ka measure karta hai, jisse traders ko market volatility ka pata chalta hai. ATR usually trading range ko calculate karke indicate karta hai ki market kitna volatile hai. Niche diye gaye points par focus karte hue, main ATR ke bare mein tafseel se bayan karunga:

1. Calculation

ATR ka calculation typically ek moving average ka hota hai, jo ki price ki daily highs aur lows ko istemal karke calculate kiya jata hai. Har day ke liye, True Range calculate hota hai, jo high aur low ke difference ka maximum hota hai in comparison with the previous day's close. Phir, ek specified period ke (jaise ki 14 days) True Range ka average calculate kiya jata hai, jise ATR kehte hain.

2. Volatility Measure

ATR volatility ko measure karta hai, jisse traders ko pata chalta hai ki market kitna volatile hai. Jyada ATR value high volatility ko indicate karta hai, jabki kam ATR value low volatility ko show karta hai.

3. Trend Strength

ATR traders ko trend strength ko bhi determine karne mein madad karta hai. Agar ATR ki value badhti hai, toh yeh ek strong trend ko darshata hai. Kam ATR ki value ek weak or ranging market ko suggest karta hai.

4. Stop Loss Placement

ATR ka istemal stop loss placement ke liye bhi kiya jata hai. Traders ATR ke multiples ko use karke stop loss levels set karte hain. Jyada volatile market mein, traders apne stop loss levels ko bhi adjust karte hain, jisse unka risk manage hota hai.

5. Entry and Exit Points

ATR ko entry aur exit points ke liye bhi istemal kiya jata hai. Jyada ATR value wale markets mein traders apne profit targets ko adjust kar sakte hain, kyunki wahaan price swings zyada hote hain.

Overall, ATR ek versatile indicator hai jo traders ko market volatility ka pata lagane mein madad karta hai, stop loss placement ke liye istemal hota hai, aur trend strength ko determine karne mein madad karta hai. Iske alawa, ATR ki value ko samajhkar traders apne trading strategies ko bhi customize kar sakte hain.

-

#10 Collapse

Average True Range Indicator in Forex Trading.

1.Introduction: Average True Range (ATR) ek volatility indicator hai jo market ke volatility ko measure karta hai. Ye indicator traders ko potential price movements ke size ko samajhne mein madad karta hai.

2. How it Works: ATR ek technical indicator hai jo price volatility ko quantify karta hai. Iska calculation market ke recent price movements ke basis par hota hai.

3. Components of ATR Indicator:- True Range (TR): ATR ka calculation True Range ke basis par hota hai. True Range ek measure hai volatility ka, jo highest of the following three values hoti hai:

- Current high minus the current low

- Absolute value of the current high minus the previous close

- Absolute value of the current low minus the previous close

- Average True Range (ATR): ATR ka calculation TR ka moving average hota hai, typically over a specified number of periods.

4. Interpretation:- High ATR: High ATR values indicate high volatility in the market, suggesting larger price movements.

- Low ATR: Low ATR values indicate low volatility, suggesting smaller price movements.

- ATR Bands: Some traders use ATR bands to set stop-loss and take-profit levels. These bands are derived from multiplying the ATR value by a specified factor and adding/subtracting the result from the current price.

5. Trading Strategies using ATR:- Volatility Breakout Trading: Traders use ATR to identify periods of high volatility and trade breakouts accordingly.

- Position Sizing: ATR can be used to adjust position sizes based on market volatility. Traders may decrease position sizes during high volatility to manage risk.

- Setting Stop-loss and Take-profit Levels: ATR can help traders set dynamic stop-loss and take-profit levels based on market volatility.

6. Limitations:- ATR is a lagging indicator, meaning it reacts to past price movements rather than predicting future movements.

- ATR may not work well in trending markets where volatility remains relatively constant.

- Different markets may have different ATR values, so it's essential to calibrate the indicator according to the specific market being traded.

7. Conclusion: Average True Range (ATR) Indicator ek valuable tool hai jo traders ko market volatility ke measure karne mein madad karta hai. Iska istemal karke traders price movements ka size samajh sakte hain aur trading strategies ko customize kar sakte hain. Lekin, iske saath proper risk management aur aur technical analysis ka istemal kiya jana chahiye trading performance ko improve karne ke liye.

- True Range (TR): ATR ka calculation True Range ke basis par hota hai. True Range ek measure hai volatility ka, jo highest of the following three values hoti hai:

-

#11 Collapse

Forex Trading Mein Average True Range (ATR) Indicator:

Average True Range (ATR) ek mahatvapurn technical analysis indicator hai jo forex trading mein volatility ko measure karne aur trading decisions ko optimize karne ke liye istemal kiya jata hai. Yeh indicator market ki volatility aur price movement ka andaza lagane mein madad karta hai.

Average True Range (ATR) Indicator Kya Hai?

Average True Range (ATR) ek volatility indicator hai jo market ki asuraksha aur price range ko measure karta hai. Yeh indicator typically ek line graph ke roop mein darshaya jata hai aur trading platform par aasani se uplabdh hota hai.

ATR Ka Calculation:

ATR ka calculation price ke highs aur lows ke adhar par hota hai. Har candlestick ya bar ke liye, ATR price range ko measure karta hai aur phir uska average calculate kiya jata hai, aam tor par 14 periods ke liye.

ATR Ka Interpretation:

ATR ki value market ki volatility ko darust karta hai. Jab ATR ki value badhti hai, toh iska matlab hai ke market ki volatility bhi badhti hai. Jab ATR ki value ghat rahi hai, toh iska matlab hai ke market ki volatility kam ho rahi hai.

ATR Ka Upyog:

ATR indicator ka upyog traders dwara stop-loss levels aur position sizes ko determine karne ke liye kiya jata hai. Zayada volatility wale market mein traders typically zyada stop-loss levels istemal karte hain taaki unki positions market ki fluctuations se surakshit rahein. Kam volatility wale market mein, stop-loss levels kam ho sakte hain.

Nateeja:

Ant mein, Average True Range (ATR) ek zaroori technical analysis tool hai jo traders ko market ki volatility aur price movement ko samajhne mein madad karta hai. Is indicator ke sahi istemal se traders apne risk management ko behtar bana sakte hain aur market mein safalta prapt kar sakte hain. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#12 Collapse

Average True Range ATR aik technical analysis indicator hai jo J. Welles Wilder ne develop kiya tha. Yeh indicator pehlay commodities aur futures markets ke liye design kiya gaya tha, lekin ab yeh Forex market mein bhi bohat zyada use hota hai. ATR market volatility ko measure karne ke liye use hota hai, jo traders ko price movement ke baray mein insights deta hai. ATR ka main purpose market volatility ko measure karna hai. ATR price movement ki range ko measure karta hai aik specific period ke doran, aam tor par 14 periods. True Range TR ka concept ATR ke liye central hai, jahan TR ko teen values mein se sabse bari value ke tor par define kiya jata hai:- Current high aur current low ke darmiyan difference.

- Previous close aur current high ke darmiyan difference.

- Previous close aur current low ke darmiyan difference.

ATR Ka Calculation

ATR ko True Range values se derive kiya jata hai aik specific period ke doran. ATR calculate karne ka process kuch is tarah hai:- Har Period Ke Liye True Range (TR) Calculate Karna: TR ko calculate karne ke liye current high aur current low, previous close aur current high, aur previous close aur current low ke darmiyan differences ko dekha jata hai aur in mein se sabse bari value ko choose kiya jata hai.

- ATR Calculate Karna:

- Pehle period ke liye, ATR initial period 14 days ke TR values ka average hota hai.

- Baqi periods ke liye, ATR previous ATR aur current TR values ko use karke aik smoothing factor apply karke calculate hota hai.

Practical Application

Volatility Measure Karna

ATR ka primary function Forex trading mein market volatility ko gauge karna hai. Higher ATR value zyada volatility indicate karti hai, jo bari price movements suggest karti hai, jabke lower ATR kam volatility aur choti price swings reflect karta hai. Volatility ko samajhna Forex traders ke liye bohat zaroori hai kyunki yeh risk management, position sizing, aur trading strategies ke selection ko impact karta hai. ATR ko wide use kiya jata hai stop-loss levels set karne ke liye, jo trades ko normal market fluctuations ke andar sufficient room deta hai. Aik common practice yeh hai ke stop-loss orders ATR value ka multiple lekar entry price se neechay ya upar place kiye jate hain, depend karta hai ke trade long hai ya short. Misal ke tor par, aik trader 1.5 times ATR below entry point stop-loss set kar sakta hai aik long trade mein. Yeh method random market noise se protect karta hai aur disciplined risk management approach maintain karta hai.

Breakout Points Identify Karna

Traders aksar ATR ko use karte hain potential breakout points identify karne ke liye. Jab ATR sharply rise karta hai, toh yeh increased volatility indicate karta hai, jo aik new trend ya consolidation phase se breakout ka signal ho sakta hai. Iske contrast mein, declining ATR aik consolidation ya low volatility period suggest karta hai. In changes ko monitor karke, traders breakouts anticipate karke apni positions accordingly adjust kar sakte hain. Effective position sizing Forex trading mein risk manage karne aur returns maximize karne ke liye crucial hai. ATR market volatility ko adjust karte hue trade size determine karne mein madad karta hai. Misal ke tor par, zyada volatile markets higher ATR mein, traders apna position size reduce karte hain risk mitigate karne ke liye, jabke kam volatile conditions lower ATR mein, woh apna position size increase karte hain. Yeh dynamic adjustment different market conditions mein balanced risk profile maintain karne mein madad karta hai.

ATR Use Karne Ke Fayde

Adaptability Across Markets

ATR ka aik key advantage yeh hai ke yeh different markets aur timeframes mein adaptable hai. Chahay Forex, stocks, commodities, ya indices mein trading ho, ATR aik consistent measure of volatility provide karta hai jo different trading strategies aur market conditions par apply hota hai. ATR aik objective measure of volatility offer karta hai jo price movements ke direction se influenced nahi hota. Dusre indicators ke contrast mein jo bullish ya bearish trends se skew ho sakte hain, ATR sirf price movements ki range par focus karta hai, jo market volatility ka clear picture deta hai. ATR ko risk management practices mein shamil karke aik trader apni risk control aur mitigate karne ki ability enhance kar sakta hai. Stop-loss levels set karke aur ATR ke basis par position sizes determine karke, traders excessive risk exposure se bachte hain aur apne capital ko effectively protect karte hain.

ATR Ki Limitations

Lagging Nature

Aik lagging indicator hone ki wajah se, ATR historical data par based hota hai, jo ke sudden market changes ke liye timely signals nahi provide karta. Traders ko is limitation ka pata hona chahiye aur ATR ko dusre leading indicators ke sath use karna chahiye taake apne trades ka timing improve kar sakein. ATR price movements ke direction ke baray mein information provide nahi karta; yeh sirf volatility measure karta hai. Is liye, traders ko market ka likely direction determine karne ke liye dusre indicators ya analysis methods use karni chahiye. Sirf ATR par rely karna risky ho sakta hai, kyunki yeh sab market factors ko account nahi karta. ATR ko dusre technical aur fundamental analysis tools ke sath combine karna essential hai comprehensive trading approach ke liye.

ATR Ko Dusre Indicators Ke Sath Combine Karna

Moving Averages

ATR ko moving averages ke sath combine karke traders trends identify kar sakte hain aur breakout signals confirm kar sakte hain. Misal ke tor par, agar ATR rise ho raha hai jabke price aik moving average se upar break kar rahi hai, toh yeh increasing volatility ke sath strong bullish trend indicate kar sakta hai, jo long trades ke liye potential entry point suggest karta hai. ATR ko Relative Strength Index (RSI) ke sath use karke overbought ya oversold conditions validate ki ja sakti hain. High ATR value jab RSI overbought signal de raha ho, toh yeh excessive volatility ki wajah se potential reversal indicate kar sakta hai, jabke low ATR jab RSI oversold signal de raha ho, toh yeh consolidation period suggest kar sakta hai.

Bollinger Bands

Bollinger Bands, jo ke standard deviations ka use karte hue moving average se volatility measure karte hain, ATR ko complement kar sakti hain by providing price volatility ka visual representation. Jab bands widen ho rahi hain aur ATR rise ho raha hai, toh yeh increasing volatility aur potential breakout scenarios indicate karta hai.

Example

Aik Forex trader jo EUR/USD currency pair analyze kar raha hai. Trader aik 14-period ATR use karta hai market volatility gauge karne ke liye. Pichle 14 dinon mein, ATR steadily increase ho raha hai, jo rising volatility indicate karta hai. Trader notice karta hai ke ATR 0.0050 se 0.0080 tak climb kar gaya hai, jo larger daily price swings reflect karta hai.

Is information ko dekhte hue, trader apni strategy adjust karta hai:- Stop-Loss Adjustment: Aik long position ke liye, trader stop-loss 1.5 times ATR 0.0080 par set karta hai, jo entry price se 0.0120 120 pips neechay place hota hai. Yeh wider stop-loss increased volatility ko account karta hai aur random market fluctuations se bacha ke likelihood reduce karta hai.

- Position Sizing: Higher volatility ki wajah se, trader risk effectively manage karne ke liye smaller position size choose karta hai. Trade size reduce karke, trader aik balanced risk profile maintain karta hai, ensure karta hai ke potential losses acceptable limits mein rahein.

- Monitoring for Breakouts: Trader dekhta hai ke rising ATR EUR/USD pair mein consolidation period ke sath coincide kar raha hai. Potential breakout anticipate karke, trader recent high ke upar aur recent low ke neechay entry orders set karta hai, taake aglay significant price movement se capitalize kar sake.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:39 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим