Details Of Dark Cloud Cover Pattern:

gehray baadalon ka ihata aik candle stuck patteren hai jo bearish ki taraf momentum shift ka ishara deta hai. gehray baadalon ka ihata ziyada tar aik taweel up trained ke baad zahir hota hai jo rujhan ko neechay ke rujhan mein tabdeel karne ki nishandahi karta hai. woh waqt ke sath sath kisi khaas security ke khilnay, band honay, aur ziyada aur kam qeematein dikhata hain .

black cloud cover candle stick ka bunyadi faida yeh hai ke taajiron ko taweel holdngz ko tark karne ya mukhtasir pozishnon mein daakhil honay ka ibtidayi ishara faraham karna hai, jis se woh mumkina qeematon mein kami ka faida utha satke hain. dark cloud cover candle stuck ka aik ahem nuqsaan yeh hai ke yeh kabhi kabhar ghalat signals peda kar sakta hai, jis ki wajah se tajir kharab tijarti faislay kar satke hain .

gehray baadalon ka ihata is waqt hota hai jab aik lambi blush candle ke baad aik lambi bearish candle aati hai jis ke sath pichli candle ke wast point ke neechay band hoti hai. yeh patteren is baat ki nishandahi karta hai ke khredar market ki taaqat ko barqarar rakhnay se qassar thay aur farokht knndgan ne is par qabza kar liya hai, jis ke nateejay mein mumkina tor par kami ka rujhan hai. yeh patteren aksar taajiron ki taraf se mukhtasir pozishnon ko baichnay ya daakhil karne ke liye aik signal ke tor par istemaal kya jata hai .

dark cloud cover candle stick kya hai ?

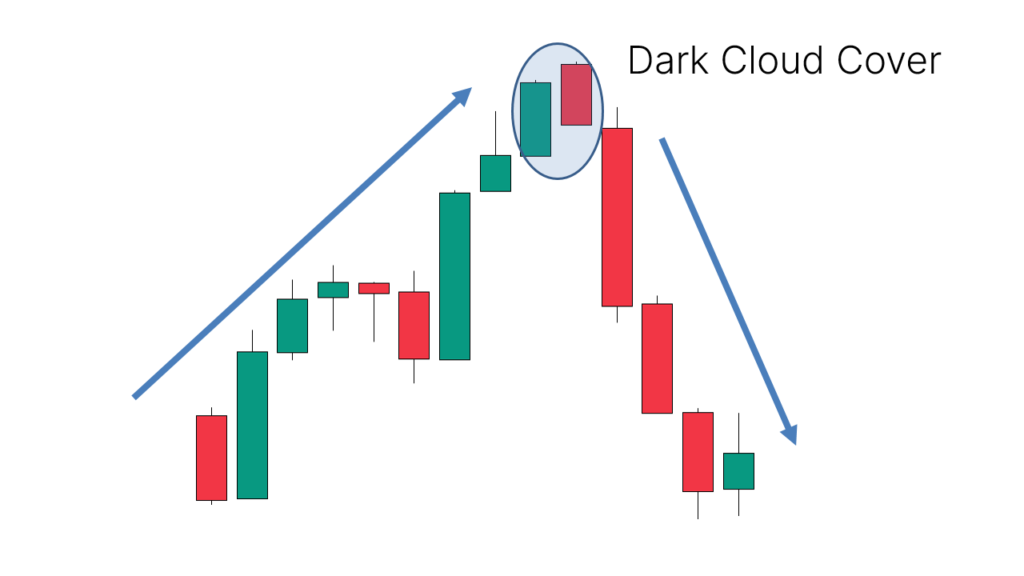

dark cloud cover candle stuck patteren aik do candle bearish reversal patteren hai jo aik taweel up trained ke ekhtataam par hota hai. pehli mom batii aik lambi blush candle hai, jis se zahir hota hai ke market kharidaron ke haath mein thi. doosri mom batii aik lambi bearish candle hai jo pichli mom batii ki oonchai ke oopar khulti hai lekin pichli mom batii ke wast se neechay band hojati hai, is baat ka ishara hai ke baichnay walon ne market par qabza kar liya hai. zail mein mom batii ki tasweerai numaindagi hai .

aap yahan dekh satke hain ke shuru mein market taizi ke rujhan mein hai. jaisay hi gehray baadal ke ihata ka namona zahir hota hai market mandi ka shikaar ho jati hai .

patteren do mom btyon ke zareya tayyar kya jata hai, jin mein se pehli lambi blush candle hai aur doosri aik lambi bearish candle hai jo pichli candle ki oonchai se shuru hoti hai lekin is ke wast se neechay band hojati hai. tajir aksar dark cloud cover patteren ke bherne ke baad tayyar honay ka intzaar karte hain, kyunkay yeh is baat ki nishandahi karta hai ke khredar raftaar kho rahay hain aur rujhan ko tabdeel karna mumkin hai. patteren ki mojoodgi market ke mood mein mumkina tabdeeli ki nishandahi kar sakti hai, jis se taajiron ko mukhtasir position farokht karne ya daakhil honay ki ijazat millti hai .

dark cloud cover candle stick patteren kitni baar hota hai ?

dark cloud cover candle stuck patteren ki mojoodgi ka taayun market ke halaat aur zair ghhor time frame se hota hai. patteren aik bearish reversal patteren hai jo up trained ke baad aata hai, aur yeh is baat ki nishandahi karta hai ke market ka jazba taizi se mandi mein badal raha hai. yeh patteren ghair mustahkam aur ghair yakeeni market ke halaat mein ziyada aam hai jis mein market ki koi wazeh simt nahi hai. yeh patteren taajiron ke liye apni tijarti hikmat e amli ko tabdeel karne aur aisay mamlaat mein apni position ki hifazat ke liye aik wazeh isharay ke tor par kaam kar sakta hai. dark cloud cover patteren mustahkam aur rujhan saaz baazaaron mein kam kasrat se zahir ho sakta hai, kyunkay mazboot rujhanaat tabdeel honay se pehlay taweel arsay tak qaim rehtay hain .

takneeki tajzia mein dark cloud cover candle stuck patteren ki shanakht kaisay ki jaye ?

tajir takneeki tajzia mein dark cloud cover candle stuck patteren ki shanakht ke liye makhsoos iqdamaat istemaal karte hain. traders pehlay patteren ko talaash karne ke liye market mein up trained talaash karte hain. is ke baad woh pehli mom batii ki jaanch karte hain, jo ke aik lambi blush candle honi chahiye jo kharidari ke dabao ki nishandahi karti hai. is ke baad woh doosri mom batii ka muaina karte hain, jo aik lambi bearish candle honi chahiye jo pichli mom batii ke ounchay oopar khulti hai aur pehli mom batii ke wast point ke neechay band hoti hai. patteren ki tasdeeq ho jati hai agar bearish candle pichlle din ke band se neechay band ho jati hai. neechay di gayi tasweer ka hawala den .

taajiron ko mom btyon ki lambai aur patteren ke peechay volume par bhi ghhor karna chahiye, kyunkay ziyada tijarti hajam wali lambi aur ziyada ahem mom batian mumkina rujhan ke ulat jane ki tasdeeq kar sakti hain .takneeki tajzia mein dark cloud cover candle stuck patteren ki durustagi ki sharah kya hai ?

takneeki tajzia mein dark cloud cover candle stuck patteren ki durustagi ki sharah ko aam tor par qabil aetmaad samjha jata hai jab yeh oopri rujhan ke baad zahir hota hai. lekin durustagi market ke halaat aur deegar awamil ke lehaaz se mukhtalif ho sakti hai. mtalaat se pata chalta hai ke patteren ki is waqt barh jati hai jab is ki tasdeeq deegar takneeki isharay, jaisay hajam aur raftaar ke isharay se hoti hai. aap ko dark cloud cover patteren ko aik barray takneeki tajzia ki hikmat e amli ke hissay ke tor par istemaal karna chahiye, bajaye is ke ke is par stand akailey signal ke tor par inhisaar karen .

kya dark cloud cover candle stuck patteren ki durustagi ko behtar bananay ka koi tareeqa hai ?

haan, tajir takneeki tajzia mein dark cloud cover candle stuck patteren ki durustagi ko behtar bananay ke liye chaar ahem harbe istemaal karte hain. deegar takneeki isharay jaisay ke rsi, tijarti hajam, ya deegar mutaliqa isharay istemaal karen taakay patteren ki inhisaar ko mazboot karne ke liye is ki tasdeeq karen. aik aur nuqta nazar barray bazaar ke mahol ka jaiza lena hai, kyunkay patteren ki durustagi market ki taraqqi se mutasir ho sakti hai. mutadid time framoon ka istemaal, jaisay rozana aur hafta waar chart, patteren ki mustaqil mizaji ki tasdeeq mein madad karte hain. aap sab se ziyada qabil aetmaad set ups ko daryaft karne ke liye market ke mukhtalif halaat mein patteren ki karkardagi ka mutalea aur back test karkay apni trading taknik ko barha satke hain .

dark cloud cover candle stuck patteren ki kamyabi ki sharah kya hai ?

dark cloud cover patteren ko bearish reversal patteren ke tor par kamyabi ki aala sharah ke tor par samjha jata hai, khaas tor par market mein really ke baad. patteren taizi se mandi ki raftaar mein tabdeeli ko zahir karta hai, aur agar izafi takneeki isharay aur tehqeeqi tools se tasdeeq ki jati hai, to yeh taajiron ke liye mukhtasir position mein daakhil honay ke liye aik qabil aetmaad tup ke tor par kaam kar sakta hai. lekin koi bhi tijarti tareeqa ya patteren bilkul durustagi ke sath market ki chalon ki paish goi nahi kar sakta. dark cloud cover patteren ki kamyabi ki sharah veriables par munhasir hai jaisay market mein utaar charhao, likoyditi, aur tajir ki mahaarat. tijarti funds ki hifazat aur mumkina nuqsanaat ko kam karne ke liye aap ko hamesha munasib rissk managment iqdamaat, jaisay ke stap las orders ko istemaal karna chahiye .

stock market mein dark cloud cover candle stuck patteren ke sath tijarat kaisay ki jaye ?

dark cloud cover candle stuck patteren ke sath tijarat karna aik saada teen qadmi amal hai. zail mein iqdamaat ki wazahat ki gayi hai .

aisa karne ka pehla kaam patteren ki shanakht karna hai. aap aik lambi taizi ke baad aik lambi mandi wali mom batii talaash kar rahay hain. zail ki tasweer aik tasweerai numaindagi hai .

dosra marhala takneeki isharay se rujhan ki tasdeeq karna hai. aap ko is ke liye rsi jaisay isharay ka istemaal karna chahiye. aap is rujhan par amal karte hain jab isharay is baat ki tasdeeq karta hai ke namonon ne kya tajweez kya hai .

gehray baadal ka ihata mandi wali market ki tajweez karta hai. aap bunyadi tor par shorting ke zariye mandi walay baazaaron mein tijarat karte hain. shorting is waqt hoti hai jab aap baazaaron mein girnay ki shart lagatay hain. mazeed nuqsaan se bachney ke liye aap apni position se bhi nikal satke hain ( agar aap ke paas pehlay se hi tha ) .

gehray baadal ki mom btyon ke sath tijarat karte waqt market ke halaat par bhi ghhor karna behtareen hai. patteren katay hue bazaar ya intehai utaar charhao walay bazaar mein ghalat signal peda kar sakta hai .

gehray baadalon ka ihata aik candle stuck patteren hai jo bearish ki taraf momentum shift ka ishara deta hai. gehray baadalon ka ihata ziyada tar aik taweel up trained ke baad zahir hota hai jo rujhan ko neechay ke rujhan mein tabdeel karne ki nishandahi karta hai. woh waqt ke sath sath kisi khaas security ke khilnay, band honay, aur ziyada aur kam qeematein dikhata hain .

black cloud cover candle stick ka bunyadi faida yeh hai ke taajiron ko taweel holdngz ko tark karne ya mukhtasir pozishnon mein daakhil honay ka ibtidayi ishara faraham karna hai, jis se woh mumkina qeematon mein kami ka faida utha satke hain. dark cloud cover candle stuck ka aik ahem nuqsaan yeh hai ke yeh kabhi kabhar ghalat signals peda kar sakta hai, jis ki wajah se tajir kharab tijarti faislay kar satke hain .

gehray baadalon ka ihata is waqt hota hai jab aik lambi blush candle ke baad aik lambi bearish candle aati hai jis ke sath pichli candle ke wast point ke neechay band hoti hai. yeh patteren is baat ki nishandahi karta hai ke khredar market ki taaqat ko barqarar rakhnay se qassar thay aur farokht knndgan ne is par qabza kar liya hai, jis ke nateejay mein mumkina tor par kami ka rujhan hai. yeh patteren aksar taajiron ki taraf se mukhtasir pozishnon ko baichnay ya daakhil karne ke liye aik signal ke tor par istemaal kya jata hai .

dark cloud cover candle stick kya hai ?

dark cloud cover candle stuck patteren aik do candle bearish reversal patteren hai jo aik taweel up trained ke ekhtataam par hota hai. pehli mom batii aik lambi blush candle hai, jis se zahir hota hai ke market kharidaron ke haath mein thi. doosri mom batii aik lambi bearish candle hai jo pichli mom batii ki oonchai ke oopar khulti hai lekin pichli mom batii ke wast se neechay band hojati hai, is baat ka ishara hai ke baichnay walon ne market par qabza kar liya hai. zail mein mom batii ki tasweerai numaindagi hai .

aap yahan dekh satke hain ke shuru mein market taizi ke rujhan mein hai. jaisay hi gehray baadal ke ihata ka namona zahir hota hai market mandi ka shikaar ho jati hai .

patteren do mom btyon ke zareya tayyar kya jata hai, jin mein se pehli lambi blush candle hai aur doosri aik lambi bearish candle hai jo pichli candle ki oonchai se shuru hoti hai lekin is ke wast se neechay band hojati hai. tajir aksar dark cloud cover patteren ke bherne ke baad tayyar honay ka intzaar karte hain, kyunkay yeh is baat ki nishandahi karta hai ke khredar raftaar kho rahay hain aur rujhan ko tabdeel karna mumkin hai. patteren ki mojoodgi market ke mood mein mumkina tabdeeli ki nishandahi kar sakti hai, jis se taajiron ko mukhtasir position farokht karne ya daakhil honay ki ijazat millti hai .

dark cloud cover candle stick patteren kitni baar hota hai ?

dark cloud cover candle stuck patteren ki mojoodgi ka taayun market ke halaat aur zair ghhor time frame se hota hai. patteren aik bearish reversal patteren hai jo up trained ke baad aata hai, aur yeh is baat ki nishandahi karta hai ke market ka jazba taizi se mandi mein badal raha hai. yeh patteren ghair mustahkam aur ghair yakeeni market ke halaat mein ziyada aam hai jis mein market ki koi wazeh simt nahi hai. yeh patteren taajiron ke liye apni tijarti hikmat e amli ko tabdeel karne aur aisay mamlaat mein apni position ki hifazat ke liye aik wazeh isharay ke tor par kaam kar sakta hai. dark cloud cover patteren mustahkam aur rujhan saaz baazaaron mein kam kasrat se zahir ho sakta hai, kyunkay mazboot rujhanaat tabdeel honay se pehlay taweel arsay tak qaim rehtay hain .

takneeki tajzia mein dark cloud cover candle stuck patteren ki shanakht kaisay ki jaye ?

tajir takneeki tajzia mein dark cloud cover candle stuck patteren ki shanakht ke liye makhsoos iqdamaat istemaal karte hain. traders pehlay patteren ko talaash karne ke liye market mein up trained talaash karte hain. is ke baad woh pehli mom batii ki jaanch karte hain, jo ke aik lambi blush candle honi chahiye jo kharidari ke dabao ki nishandahi karti hai. is ke baad woh doosri mom batii ka muaina karte hain, jo aik lambi bearish candle honi chahiye jo pichli mom batii ke ounchay oopar khulti hai aur pehli mom batii ke wast point ke neechay band hoti hai. patteren ki tasdeeq ho jati hai agar bearish candle pichlle din ke band se neechay band ho jati hai. neechay di gayi tasweer ka hawala den .

taajiron ko mom btyon ki lambai aur patteren ke peechay volume par bhi ghhor karna chahiye, kyunkay ziyada tijarti hajam wali lambi aur ziyada ahem mom batian mumkina rujhan ke ulat jane ki tasdeeq kar sakti hain .takneeki tajzia mein dark cloud cover candle stuck patteren ki durustagi ki sharah kya hai ?

takneeki tajzia mein dark cloud cover candle stuck patteren ki durustagi ki sharah ko aam tor par qabil aetmaad samjha jata hai jab yeh oopri rujhan ke baad zahir hota hai. lekin durustagi market ke halaat aur deegar awamil ke lehaaz se mukhtalif ho sakti hai. mtalaat se pata chalta hai ke patteren ki is waqt barh jati hai jab is ki tasdeeq deegar takneeki isharay, jaisay hajam aur raftaar ke isharay se hoti hai. aap ko dark cloud cover patteren ko aik barray takneeki tajzia ki hikmat e amli ke hissay ke tor par istemaal karna chahiye, bajaye is ke ke is par stand akailey signal ke tor par inhisaar karen .

kya dark cloud cover candle stuck patteren ki durustagi ko behtar bananay ka koi tareeqa hai ?

haan, tajir takneeki tajzia mein dark cloud cover candle stuck patteren ki durustagi ko behtar bananay ke liye chaar ahem harbe istemaal karte hain. deegar takneeki isharay jaisay ke rsi, tijarti hajam, ya deegar mutaliqa isharay istemaal karen taakay patteren ki inhisaar ko mazboot karne ke liye is ki tasdeeq karen. aik aur nuqta nazar barray bazaar ke mahol ka jaiza lena hai, kyunkay patteren ki durustagi market ki taraqqi se mutasir ho sakti hai. mutadid time framoon ka istemaal, jaisay rozana aur hafta waar chart, patteren ki mustaqil mizaji ki tasdeeq mein madad karte hain. aap sab se ziyada qabil aetmaad set ups ko daryaft karne ke liye market ke mukhtalif halaat mein patteren ki karkardagi ka mutalea aur back test karkay apni trading taknik ko barha satke hain .

dark cloud cover candle stuck patteren ki kamyabi ki sharah kya hai ?

dark cloud cover patteren ko bearish reversal patteren ke tor par kamyabi ki aala sharah ke tor par samjha jata hai, khaas tor par market mein really ke baad. patteren taizi se mandi ki raftaar mein tabdeeli ko zahir karta hai, aur agar izafi takneeki isharay aur tehqeeqi tools se tasdeeq ki jati hai, to yeh taajiron ke liye mukhtasir position mein daakhil honay ke liye aik qabil aetmaad tup ke tor par kaam kar sakta hai. lekin koi bhi tijarti tareeqa ya patteren bilkul durustagi ke sath market ki chalon ki paish goi nahi kar sakta. dark cloud cover patteren ki kamyabi ki sharah veriables par munhasir hai jaisay market mein utaar charhao, likoyditi, aur tajir ki mahaarat. tijarti funds ki hifazat aur mumkina nuqsanaat ko kam karne ke liye aap ko hamesha munasib rissk managment iqdamaat, jaisay ke stap las orders ko istemaal karna chahiye .

stock market mein dark cloud cover candle stuck patteren ke sath tijarat kaisay ki jaye ?

dark cloud cover candle stuck patteren ke sath tijarat karna aik saada teen qadmi amal hai. zail mein iqdamaat ki wazahat ki gayi hai .

aisa karne ka pehla kaam patteren ki shanakht karna hai. aap aik lambi taizi ke baad aik lambi mandi wali mom batii talaash kar rahay hain. zail ki tasweer aik tasweerai numaindagi hai .

dosra marhala takneeki isharay se rujhan ki tasdeeq karna hai. aap ko is ke liye rsi jaisay isharay ka istemaal karna chahiye. aap is rujhan par amal karte hain jab isharay is baat ki tasdeeq karta hai ke namonon ne kya tajweez kya hai .

gehray baadal ka ihata mandi wali market ki tajweez karta hai. aap bunyadi tor par shorting ke zariye mandi walay baazaaron mein tijarat karte hain. shorting is waqt hoti hai jab aap baazaaron mein girnay ki shart lagatay hain. mazeed nuqsaan se bachney ke liye aap apni position se bhi nikal satke hain ( agar aap ke paas pehlay se hi tha ) .

gehray baadal ki mom btyon ke sath tijarat karte waqt market ke halaat par bhi ghhor karna behtareen hai. patteren katay hue bazaar ya intehai utaar charhao walay bazaar mein ghalat signal peda kar sakta hai .

تبصرہ

Расширенный режим Обычный режим