Comman and Breakway Gaps in Forex

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

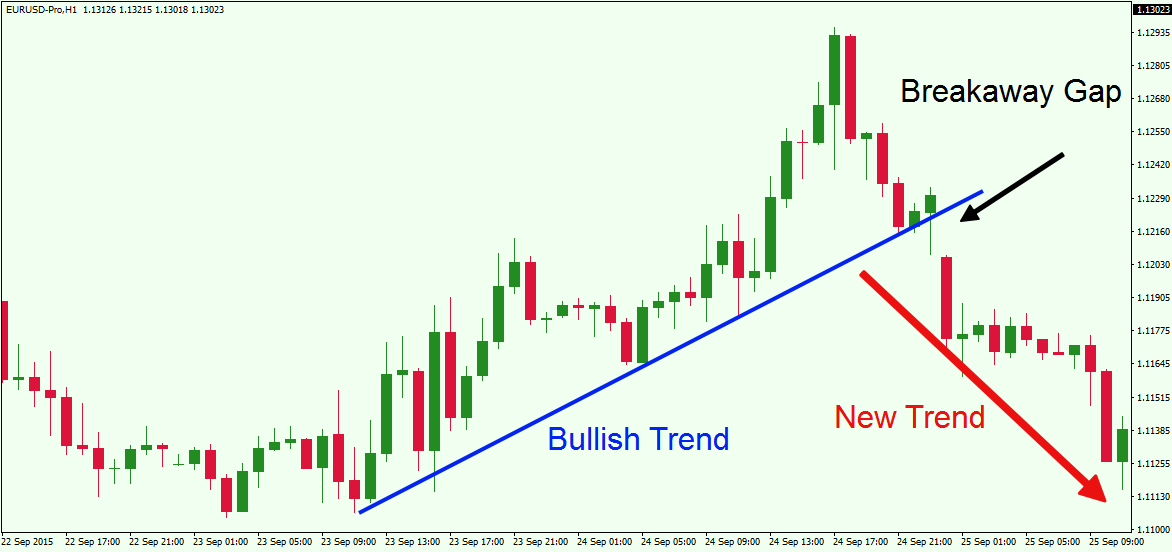

Forex trading mein, alag alag qisam ke price gaps samajhna, traders ke liye aham hai takay woh sahi faislay kar sakein aur risk ko manage kar sakein. Do aam qisam ke gaps hote hain jo traders aksar face karte hain, woh hai common gaps aur breakaway gaps. Ye gaps tab hotay hain jab aik candlestick ki closing price aur agle candlestick ki opening price mein farq hota hai. Lekin, ye gaps traders ke liye alag matlab rakhte hain aur market sentiment aur future price movements ke liye qeemati maloomat farahem kar sakte hain. Common Gaps Common gaps, jo ke trading gaps ya area gaps ke naam se bhi jante hain, ye chhotay price gaps hote hain jo pehle din ke trading range mein hotay hain. Ye gaps aam tor par market sentiment mein koi tabdeeli nahi late aur aksar jald bhar jatay hain. Common gaps aksar raat ko aane wale news events, economic data releases, ya geopolitical developments ki wajah se hotay hain jo consecutive candlesticks ki closing aur opening prices mein chhotay farq ko paida karte hain. Traders aam tor par common gaps ko maamoolan ehmiyat nahi dete aur trading decisions banane ke liye doosri technical indicators aur analysis methods ka istemal karte hain. Kyunki common gaps aam tor par jald bhar jatay hain, to ye future price movements ke liye zyada ehm nahi hote. Traders ko common gaps ki interpretation mein ehtiyaat bartna chahiye aur apni trading strategies ko sirf in par na bunayen. Breakaway Gaps Dusra wakfa breakaway gaps ka hota hai, jo ke ahem price gaps hote hain jo aik price pattern ya consolidation period ke end mein hotay hain. Ye gaps aam tor par high trading volumes ke saath hotay hain aur ye dikha dete hain ke market sentiment mein taqat ka achaal hua hai. Breakaway gaps is liye kehlaye jate hain kyun ke ye aksar aik lambi downtrend ya uptrend ke baad hotay hain aur indicate karte hain ke market ne us trend se bahar nikalna shuru kar dia hai. Breakaway gaps market ke future direction ke liye qeemati maloomat farahem kar sakte hain. For example, agar aik lambi downtrend ke baad breakaway gap hota hai, to ye indicate kar sakta hai ke naya bullish trend shuru hone wala hai. Umgeer, agar aik lambi uptrend ke baad breakaway gap hota hai, to ye naye bearish trend ki ibtida hone ki taraf ishara kar sakta hai. Traders aksar breakaway gaps par tawajjah se ghor karte hain kyun ke ye significant price movement ki ibtida hone ki taraf ishara kar sakte hain. Ye gaps zyada tar sustained price trends ke saath aane ke imkaanat rakhte hain as compared to common gaps. Lekin, breakaway gaps ki analysis ko confirm karne ke liye doosri technical indicators aur chart patterns ka istemal karna zaroori hai.

Breakaway Gaps Dusra wakfa breakaway gaps ka hota hai, jo ke ahem price gaps hote hain jo aik price pattern ya consolidation period ke end mein hotay hain. Ye gaps aam tor par high trading volumes ke saath hotay hain aur ye dikha dete hain ke market sentiment mein taqat ka achaal hua hai. Breakaway gaps is liye kehlaye jate hain kyun ke ye aksar aik lambi downtrend ya uptrend ke baad hotay hain aur indicate karte hain ke market ne us trend se bahar nikalna shuru kar dia hai. Breakaway gaps market ke future direction ke liye qeemati maloomat farahem kar sakte hain. For example, agar aik lambi downtrend ke baad breakaway gap hota hai, to ye indicate kar sakta hai ke naya bullish trend shuru hone wala hai. Umgeer, agar aik lambi uptrend ke baad breakaway gap hota hai, to ye naye bearish trend ki ibtida hone ki taraf ishara kar sakta hai. Traders aksar breakaway gaps par tawajjah se ghor karte hain kyun ke ye significant price movement ki ibtida hone ki taraf ishara kar sakte hain. Ye gaps zyada tar sustained price trends ke saath aane ke imkaanat rakhte hain as compared to common gaps. Lekin, breakaway gaps ki analysis ko confirm karne ke liye doosri technical indicators aur chart patterns ka istemal karna zaroori hai.  Trading Strategies Traders apni interpretation ke mutabiq common aur breakaway gaps par mabni khas strategies develop kar sakte hain. Common gaps ke liye, ye zaroori hai ke unki temporary nature ko samjha jaye aur in chhotay price farqon par zyada reaction na dikhaya jaye. Traders ye dekhne ke liye wait kar sakte hain ke gap bhar jata hai ya phir apni trading decisions banane ke liye doosri indicators ka istemal kar sakte hain. Breakaway gaps ke liye traders aksar apni trading strategies ko mazboot karne ke liye additional confirmation signals talash karte hain. Woh overall trend, support aur resistance levels, aur candlestick patterns jaise factors ko consider kar sakte hain ke breakaway gap ki ehmiyat ko confirm karen. Iske ilawa, volume analysis ka istemal karke traders ye jan sakte hain ke gap ke saath jo market sentiment judi hui hai, wo kitni taqatwar hai. Ye gaps high trading volumes ke saath hote hain aur indicate karte hain ke market sentiment mein taqat ka achaal hua hai. Breakaway gaps potential trend reversals ya continuations ke liye qeemati maloomat farahem kar sakte hain, jin se traders ko madad milti hai ke woh sahi faislay kar sakein. Traders ko ihtiyaat aur sahi interpretation ke liye gaps ki analysis ke liye technical analysis tools, indicators, aur chart patterns ka sahi istemal karna chahiye. Common aur breakaway gaps ke farq ko samajhna traders ki salahiyat ko behtar banata hai ke woh sahi faislay kar sakein aur forex market ke complexities ko asani se samajh sakein.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Trading Strategies Traders apni interpretation ke mutabiq common aur breakaway gaps par mabni khas strategies develop kar sakte hain. Common gaps ke liye, ye zaroori hai ke unki temporary nature ko samjha jaye aur in chhotay price farqon par zyada reaction na dikhaya jaye. Traders ye dekhne ke liye wait kar sakte hain ke gap bhar jata hai ya phir apni trading decisions banane ke liye doosri indicators ka istemal kar sakte hain. Breakaway gaps ke liye traders aksar apni trading strategies ko mazboot karne ke liye additional confirmation signals talash karte hain. Woh overall trend, support aur resistance levels, aur candlestick patterns jaise factors ko consider kar sakte hain ke breakaway gap ki ehmiyat ko confirm karen. Iske ilawa, volume analysis ka istemal karke traders ye jan sakte hain ke gap ke saath jo market sentiment judi hui hai, wo kitni taqatwar hai. Ye gaps high trading volumes ke saath hote hain aur indicate karte hain ke market sentiment mein taqat ka achaal hua hai. Breakaway gaps potential trend reversals ya continuations ke liye qeemati maloomat farahem kar sakte hain, jin se traders ko madad milti hai ke woh sahi faislay kar sakein. Traders ko ihtiyaat aur sahi interpretation ke liye gaps ki analysis ke liye technical analysis tools, indicators, aur chart patterns ka sahi istemal karna chahiye. Common aur breakaway gaps ke farq ko samajhna traders ki salahiyat ko behtar banata hai ke woh sahi faislay kar sakein aur forex market ke complexities ko asani se samajh sakein.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 Collapse

Assalamu Alaikum Dosto!Gap Trading

Forex market mein gaps traders ko price movement clues, dakhli aur ikhtitaam signals, aur trend reversals pehchanne mein madad karte hain. Seedhe alfaz mein kaha jaye to gap trading ek munazzam tareeqa hai assets ko khareedne aur bechne ka. Aap volatile markets mein asset prices ya gaps mein faida utha sakte hain aur in gaps ko trading opportunities mein badal sakte hain.

Gap ka matlab hota hai ke currency pair ka opening price aur pichle din ka closing price mein farq hai. Jo bhi tez upar ya neeche ki taraf currency pair price ka movement hota hai, use gap kehte hain.

Gap trading mein traders currency pairs dhoondhte hain jo apne previous day ke closing price se ziada ya kam price par open hoti hain, iski movement ko monitor karte hain, aur trade karte hain.

Gaps ko Forex chart pattern par candlesticks ke roop mein pehchana ja sakta hai, aur sharp price movements trading volume mein kam liquidity ke sath zahir hote hain.

Yahan hai kaise aap gaps ko pehchana ja sakta hai:- Market mein strong support aur resistance levels dhoondhein

- Agar ek strong resistance level hai aur currency pair price us level se guzar kar apne asal position par wapas aati hai, to ye currency pair bechnay ka signal hai

- Agar ek strong support level hai, aur currency pair price us level se neeche ja kar apne asal position par wapas aati hai, to ye currency pair khareednay ka signal hai aur nuksan ko had se zyada hone se rokne ka tareeqa

Gaps K Types

Aapko janne ki zaroorat hai chaar qisam ke gaps ki:- Breakaway Gaps

Breakaway gaps sab se zyada taqatwar support aur resistance price levels ko pehchante hain. Ye aam tor par trend reversal ko darust karte hain jab wo current trend se bahar ja rahe hote hain. - Common Gaps

Common gaps aik currency pair price se doosre tak non-linear giravat ya chhalaang ko darust karte hain. Jaise naam se zahir hai, ye gaps dekhne mein sab se aam hote hain. - Exhaustion Gaps

Exhaustion gaps tab paida hote hain jab kisi currency pair ki price mein tezi se giravat hoti hai ek tezi se izafay ke baad. Ye gap traders ko batata hai ke ab currency pair ki demand mein giravat aagai hai. - Runaway Gaps

Forex market mein runaway gaps mojood trend ke beech mein aati hain. Ye trend ke rukh mein hoti hain aur ye gap currency pair ki price ke 5% se ziada izafay ko darust karta hai.

Gaps Identification

Forex trading mein gapon ko pehchanne ke liye traders kuch ahem tareeqay istemal karte hain:- Price Charts Ki Tafseelati Jaiza:

- Gapon ko price charts par visual taur par pehchana ja sakta hai jahan par price ne tezi se upar ya niche ki taraf chal di hai aur beech mein koi trading na hui ho.

- Traders purani session ki high se zyada opening price ko dekhte hain (gap up) ya phir purani session ki low se kam opening price ko dekhte hain (gap down).

- Market Openings Ka Nigraani:

- Forex market mein, gapon aam tor par Monday ke subah ya major holidays ke baad market ke khulne par hotay hain, kyunke in doran market band hoti hai.

- Traders market ke khulne par nazar rakhte hain taake agar koi gap ban gaya ho to unhe pehchan sakein.

- Technical Analysis Tools Ka Istemal:

- Traders candlestick charts jaise technical analysis tools ka istemal kar sakte hain taa ke price action mein gap ko aasani se dekh sakein.

- Fibonacci retracements aur support/resistance levels jaise tools bhi gapon ki ahmiyat ko pehchanne mein madadgar hotay hain.

- Economic Events aur News Ka Track Karna:

- Maamooli tor par bade economic data releases, central bank decisions, ya geopolitical events forex market mein bade price gaps ka sabab bante hain.

- Traders economic calendar aur news flow ka track karte hain taake wo potential gaps ka anumaan laga sakein.

- Opening aur Closing Prices Ka Mawazna:

- Traders current session ki opening price ko pehle session ki closing price ke saath mawazna karte hain taake agar koi gap ho to wo pehchan sakein.

- Agar opening price pehle close se kafi zyada upar ya niche hoti hai, to gap samjha jata hai.

- Automated Gap Scanning Ka Istemal:

- Kuch trading platforms aur software automated gap scanning features faraham karte hain jo traders ko market mein gapon ka mojoodgi ka elaan kar sakte hain.

- Ye tools traders ko jaldi jaldi gap trading opportunities ko pehchanne mein madad karte hain.

In techniques ka istemal karke forex traders market mein gapon ko tajziya kar sakte hain, jo phir unke trading strategies aur decisions ko inform karne ke liye istemal kiya ja sakta hai.

Gap Trading Significance

Forex trading mein gap ki ahmiyat ka tajziya karne ke kuch ahem tareeqay hain:- Gap Ka Size:

- Gap ka size, pips mein nap kar, uski ahmiyat tay karnay mein aham factor hota hai.

- Baray gaps, jin ka size am tor par 75 pips se zyada hota hai, zyada ahmiyat rakhte hain aur jaldi bhar jate hain.

- Chotay gaps, 75 pips ke neeche wale, aksar jaldi bhar jate hain, khaaskar agar wo long-term trend ki taraf ho.

- Gap Ka Type:

- Gap ka type bhi ahmiyat rakhta hai, kyunke alag type ke gaps alag market conditions ko darust karte hain.

- Breakaway gaps, jo kisi price pattern ke end par hotay hain, wo naye trend ka aghaz signal karte hain aur zyada ahmiyat rakhte hain.

- Continuation (runaway) gaps aur exhaustion gaps bhi market ke direction ke liye mukhtalif namunaat rakhte hain.

- Market Conditions:

-

- Traders gap ki ahmiyat ko tay karne ke liye overall market conditions aur trend direction ka tajziya karte hain.

- Gaps jo long-term trend ki taraf hote hain, wo jaldi bhar jate hain.

- Agar gap prevailing trend ke khilaf ho, to wo bharna mushkil ho sakta hai aur ye potential reversal ka signal bhi ho sakta hai.

- Trading Volume:

- Gap ke ird gird trading volume bhi ahmiyat rakhta hai, kyunke zyada volume wale gaps ko price move ke peechay zyada conviction ka pata chalta hai.

- Gaps jo zyada volume ke saath hote hain, wo aam tor par low volume wale gaps se zyada ahmiyat rakhte hain.

- Fundamental Factors:

- Traders fundamental factors ko bhi madde nazar rakhte hain, jaise economic data releases ya central bank decisions, jo gap ko banane ka sabab bante hain.

- Significant news events ke zariye aane wale gaps unse bhi zyada ahmiyat rakhte hain jo bina kisi fundamental catalyst ke ho.

Ye factors ko madde nazar rakhte hue, traders gap ki ahmiyat ko behtar taur par tajziya kar sakte hain aur uske bharne ki sambhavna ka andaza laga sakte hain, jo unke trading strategies aur risk management approaches ko inform karta hai.

Gaps Trading Strategies

Forex traders ke liye chaar behtareen gap trading strategies:- Full Gap Trading Strategy

Full gapping trading strategy tab hoti hai jab koi currency pair opening price apne previous day ke closing price se upar ya neeche hoti hai. Full gaps taqatwar market sentiment shift ko darust karte hain aur traders ko entry aur exit signals dete hain.- Jab prices apne previous day ke high price se upar khulti hain, to ye ek long position ya buy signal bhejti hai

- Jab prices first trading hour mein opening price se neeche jaate hain, to ye traders ko ek sell ya short position signal bhejti hai

- Jab prices apne previous day ke closing price aur us se do din pehle ke low price ke mawafiq tezi se girte hain, to ye traders ko ek long position order place karne ka signal deta hai

- Jab koi currency pair apne previous day ke lowest price se neeche khulta hai, to ye traders ko trade ko short karne ka signal deta hai

- Partial Gap Trading Strategy

Partial gapping trading strategy tab hoti hai jab currency pair ka opening price pichle din ke closing price se upar ya neeche jaata hai. Lekin opening price pichle din ke price range ke andar rehta hai. Partial gap trading strategy traders ko 6% ke qareeb trailing stop orders place karne ki ijazat deta hai.- Jab currency pair apne previous day ke closing price se upar khulta hai, lekin previous day ke high price se neeche, to ye traders ko currency pair ko aur khareedne ka signal deta hai

- Jab current day ke price previous day ke closing price se kam hota hai, to ye traders ko ek buy signal deta hai

- Jab currency pair apne previous day ke closing price se kam price par khulta hai, to ye traders ko currency pair ko short karne ka signal deta hai

- End of Day Gap Trading Strategy

End of day gap trading strategy traders ko currency pairs ko din ki akhri trading session mein scan aur review karne ki ijazat deta hai takay woh analyze kar saken ke konse pairs mein behtareen potential hai. Kyun ke Forex market Sunday se Friday tak 24 ghante kaam karta hai, end of the day for Forex traders 5:00 P.M. EST on Fridays hota hai. Is ghante ke doran ki volatility traders ko ye batata hai ke market mein gap ki direction mein agay ka movement hone wala hai.- Jab koi currency pair price ek gap create karta hai jo resistance level se bahar jaata hai, to ye traders ko aglay haftay ke liye entry signal bhejta hai

- Jab prices ek gap create karte hain jo support level se neeche jaata hai, to ye traders ko market se nikalne ka signal bhejta hai aglay naye trading week ke liye

- Modified Gap Trading Strategy

Modified gap trading strategy mein, ek trader market trend ke darmiyan positions place karta hai. Modified gap trading strategy ko trade karne ka ek shart ye hai ke currency pair ne peechle paanch dinon se kam se kam do (ya zyada) average trading volume ke hisab se trade kiya ho.- Jab koi currency pair apne previous day ke highest price par khulta hai, to ye traders ko ek buy signal bhejta hai. Long ya sell order ke liye price current day ke first trading hour ke high price aur opening price ka average hona chahiye

- Jab prices apne previous day ke lowest price par khulta hai, to ye traders ko ek sell signal bhejta hai.

- Long ya sell order ke liye price current day ke first trading hour ke low price aur opening price ka average hona chahiye

-

#4 Collapse

Forex mein Common aur Breakaway Gaps: Aham Tafseelat

Introduction:

Forex mein gaps ka concept.

Gaps forex market mein aham hotay hain jo kee price charts par aik khali jagah ya jump ko darust karte hain. Ye gaps market mein price movement mein sudden aur unexpected changes ko darust karte hain. Gaps typically weekend ya kisi major news event ke baad hotay hain jab market band hoti hai aur phir kholne par naye prices par open hoti hai.

Common Gaps:

Aam gaps ka tajziya.

Common gaps market mein aam tor par hotay hain aur ye usually price consolidation ya normal market activity ke doran paida hotay hain. Ye gaps usually small hotay hain aur trading mein zyada importance nahi detay. Common gaps ko fill karne ki tendency hoti hai, matlab ke market price gap ko jald hi fill kar deta hai.

Common gaps ko samajhne ke liye, trader ko market trend aur volume ke mutabiq analyze karna chahiye. Agar market stable hai aur volume normal hai, to common gaps ke chances zyada hote hain.- Breakaway Gaps:

- Breakaway gaps ki pehchan aur asool.

Breakaway gaps usually market mein strong price movement ya trend ke shuru hone par paye jate hain. Ye gaps typically high volume ke sath paida hote hain aur trend reversal ya trend continuation ke indications dete hain. Breakaway gaps ko samajhna traders ke liye zaroori hai kyunki ye market ke major turning points ko darust karte hain.

Breakaway gaps ko pehchanne ke liye, traders ko volume aur price action ko closely monitor karna chahiye. Agar kisi major support ya resistance level ko break karte hue gap paida hota hai, to ye breakaway gap ke taur par consider kiya jata hai.

- Common Gaps ki Wazahat:

- Aam gaps ka tafsili jaiza.

Common gaps market mein frequently paye jate hain aur ye usually minor price fluctuations ya market noise ke doran paida hote hain. In gaps ki wazahat karne ke liye, traders ko price action aur market sentiment ko samajhna zaroori hai. Common gaps ko fill karne ki tendency hoti hai, isliye traders ko in gaps par zyada emphasis nahi dena chahiye.

Common gaps ko samajhne ke liye, traders ko price patterns aur market context ko consider karna chahiye. Agar market mein strong trend hai aur volume normal hai, to common gaps ki probability zyada hoti hai.

- Breakaway Gaps ki Tafseel:

- Breakaway gaps ka mutaliya.

Breakaway gaps usually market mein strong price movement ke doran paida hote hain aur ye trend reversal ya trend continuation ke indications dete hain. Ye gaps typically high volume ke sath hotay hain aur market ke major turning points ko darust karte hain.

Breakaway gaps ko samajhne ke liye, traders ko price action aur volume ko closely monitor karna chahiye. Agar kisi major support ya resistance level ko break karte hue gap paida hota hai, to ye breakaway gap ke taur par consider kiya jata hai.

Common Gaps ke Asbab:

Aam gaps ki wajohat.

Common gaps usually market mein normal price fluctuations aur market noise ke doran paida hote hain. Ye gaps typically low volume aur price consolidation ke doran hotay hain. Common gaps ki asal wajah market mein minor price imbalances ya temporary supply-demand shifts hoti hain.

Common gaps ko samajhne ke liye, traders ko price action aur market sentiment ko closely monitor karna chahiye. Agar market mein stable trend aur normal volume hai, to common gaps ki probability zyada hoti hai.- Breakaway Gaps ke Asbab:

- Breakaway gaps ki wajohat.

Breakaway gaps usually market mein major price movement ke doran paida hote hain aur ye high volume ke sath hotay hain. Ye gaps typically major news events, earnings releases, ya market sentiment changes ke doran hotay hain. Breakaway gaps ki asal wajah market mein major trend shifts aur strong buying ya selling pressure hoti hai.

Breakaway gaps ko samajhne ke liye, traders ko price action aur market context ko closely monitor karna chahiye. Agar kisi major support ya resistance level ko break karte hue gap paida hota hai, to ye breakaway gap ke taur par consider kiya jata hai.

- Common Gaps ke Nuqsanat:

- Aam gaps ke nuqsanat aur inka asar.

Common gaps usually market mein minor price fluctuations ya noise ko darust karte hain aur ye trading mein zyada importance nahi detay. Ye gaps typically short-term hote hain aur jald hi fill ho jate hain. Common gaps ki ek bari nuqsanat ye hai ke inki predictability low hoti hai aur in par trading karna risky ho sakta hai.

Common gaps ko samajhne ke liye, traders ko price action aur market sentiment ko closely monitor karna chahiye. Agar market mein stable trend aur normal volume hai, to common gaps ki probability zyada hoti hai.

- Breakaway Gaps ke Fawaid:

- Breakaway gaps ka kya faida hai.

Breakaway gaps usually market mein major price movement aur trend changes ko darust karte hain. Ye gaps typically high volume ke sath hotay hain aur trend reversal ya trend continuation ke indications dete hain. Breakaway gaps ki ek bari fawaid ye hai ke ye traders ko major turning points ko recognize karne mein madad karte hain.

Breakaway gaps ko samajhne ke liye, traders ko price action aur volume ko closely monitor karna chahiye. Agar kisi major support ya resistance level ko break karte hue gap paida hota hai, to ye breakaway gap ke taur par consider kiya jata hai.

- Gaps ki Shariyat:

- Forex mein gaps ke shariyat kiya kehti hai?

Forex mein gaps ki shariyat ke mutabiq, gaps market mein normal price movement aur volatility ko darust karte hain. Ye gaps typically natural market phenomena hote hain aur in par trading karna jaiz hai. Gaps ki shariyat ke mutabiq, traders ko gaps ko samajhne aur un par trading karte hue risk management ka khayal rakhna chahiye.

Gaps ko samajhne ke liye, traders ko price action aur market sentiment ko closely monitor karna chahiye. Agar market mein strong trend aur high volume hai, to gaps ki probability zyada hoti hai.

- Gaps ki Pehchan:

- Gaps ko pehchanne ke tariqay.

Gaps ko pehchanne ke liye, traders ko price charts aur volume ko closely analyze karna chahiye. Agar kisi price chart par sudden aur unexpected khali jagah ya jump nazar aata hai, to ye gap ke taur par consider kiya jata hai. Gaps typically price bars ke beech mein khali jagah ya jump ko darust karte hain.

Gaps ko samajhne ke liye, traders ko market context aur price action ko consider karna chahiye. Agar kisi major support ya resistance level ko break karte hue gap paida hota hai, to ye breakaway gap ke taur par consider kiya jata hai.

- Trading Strategies for Gaps:

- Gaps par trading ke asaan tareeqay. Gaps par trading ke liye, traders ko specific strategies ka istemal karna chahiye jo unhe gaps ke liye tayyar karte hain. Kuch common gap trading strategies mein include hain gap fill trading, gap reversal trading, aur gap continuation trading. Har strategy apne risk aur reward ke saath aati hai, isliye traders ko apne trading plan ke mutabiq strategy choose karna chahiye.

- Gaps par trading ke liye, traders ko market context, price action, aur volume ko closely monitor karna chahiye. Agar kisi major support ya resistance level ko break karte hue gap paida hota hai, to ye breakaway gap ke taur par consider kiya jata hai.

- Risk Management:

- Gaps par trading mein khatre ka izala.

Gaps par trading mein risk management ek aham factor hai. Traders ko apne trading plan ke mutabiq risk ko manage karna chahiye aur apne positions ko hedge karna chahiye. Gaps typically sudden aur unexpected price movements ko darust karte hain, isliye traders ko apne positions ko protect karne ke liye stop loss aur take profit orders ka istemal karna chahiye.

Risk management ke liye, traders ko apne risk tolerance aur trading plan ke mutabiq position sizes ko adjust karna chahiye. Agar kisi major support ya resistance level ko break karte hue gap paida hota hai, to ye breakaway gap ke taur par consider kiya jata hai.

- Real-life Examples:

- Haqeeqati misaalon ki roshni mein gaps ka istemal.

Real-life examples ke zariye, traders ko gaps ko samajhne aur un par trading karne ka tajurba hasil hota hai. Kuch haqeeqati misaalein hain jahan gaps ne traders ko major turning points ko recognize karne mein madad ki hai aur unhe profit dilaayi hai.

Real-life examples ke zariye, traders ko apne trading plan aur strategies ko refine karne ka mauqa milta hai. Agar kisi major support ya resistance level ko break karte hue gap paida hota hai, to ye breakaway gap ke taur par consider kiya jata hai.

- Conclusion:

- Forex mein gaps ka mahatva aur istemal.

Forex mein gaps ek aham market phenomenon hain jo price movement aur volatility ko darust karte hain. Ye gaps market mein sudden aur unexpected changes ko indicate karte hain aur traders ko major turning points ko recognize karne mein madad karte hain. Gaps par trading karte waqt, traders ko market context, price action, aur risk management ka khayal rakhna chahiye. Gaps ko samajh kar aur un par trading kar ke, traders apne trading strategies ko improve kar sakte hain aur consistent profits earn kar sakte hain.

-

#5 Collapse

### Forex Trading Mein Common Aur Breakaway Gaps: Ek Jaiza

Forex trading mein price movements ko samajhne aur market trends ko predict karne ke liye technical analysis ka use kiya jata hai. Is analysis mein gaps bhi ek ahem role ada karte hain. Gaps woh areas hote hain jahan price ek period se doosre period tak significant change karti hai bina kisi trade ke. Common aur Breakaway Gaps Forex trading mein important signals provide karte hain. Aaiye dekhte hain in dono gaps ko detail se.

**Common Gaps Kya Hain?**

Common Gaps woh gaps hain jo market ke normal fluctuations aur consolidation phases ke dauran bante hain. Ye gaps usually low volume aur chhote price movements ke saath hoti hain. Common Gaps ka pattern:

1. **Formation:** Common Gaps typically market ke sideway movement ya consolidation phases ke dauran bante hain. Ye gaps tab bante hain jab price ek period se doosre period tak slightly move karti hai aur koi significant news ya event nahi hota.

2. **Significance:** Common Gaps ko zyada importance nahi di jati, kyunki ye temporary fluctuations aur consolidation ko indicate karte hain. In gaps ka market ke future direction par zyada asar nahi hota.

3. **Trading Strategy:** Common Gaps ko trading decisions ke liye use karna mushkil ho sakta hai, kyunki ye gaps market ki general trend ko indicate nahi karte. Traders ko in gaps ke signals ko confirmatory indicators ke saath analyze karna chahiye.

**Breakaway Gaps Kya Hain?**

Breakaway Gaps woh gaps hain jo significant price movement aur trend reversal ko indicate karte hain. Ye gaps typically high volume aur strong price movements ke saath hoti hain. Breakaway Gaps ka pattern:

1. **Formation:** Breakaway Gaps tab bante hain jab market ek strong trend ya consolidation phase se breakout karti hai. Ye gaps usually ek major news, economic event, ya trend reversal ke baad hoti hain.

2. **Significance:** Breakaway Gaps market ke future direction ke liye important signals provide karte hain. Ye gaps ek new trend ke shuru hone ka indication dete hain aur traders ko market ke bullish ya bearish trend ka pata chal sakta hai.

3. **Trading Strategy:** Breakaway Gaps ke baad traders ko entry points aur trading strategies carefully plan karni chahiye. Agar gap bullish direction mein hai, to long positions consider ki ja sakti hain, aur agar bearish direction mein hai, to short positions open ki ja sakti hain. Confirmatory indicators, jaise volume analysis aur moving averages, ko bhi consider karna chahiye.

**Conclusion:**

Common aur Breakaway Gaps Forex trading mein market trends aur price movements ko samajhne ke liye important signals provide karte hain. Common Gaps temporary fluctuations ko indicate karte hain, jabke Breakaway Gaps significant trend reversals aur strong price movements ko show karte hain. In gaps ko accurately identify karna aur unke signals ko confirmatory indicators ke saath analyze karna traders ko behtar trading decisions lene mein madad karta hai. Ye gaps market ki volatility aur direction ko samajhne ke liye useful tools hain.

-

#6 Collapse

# Common Aur Breakaway Gaps in Forex: Kya Hain?

Forex trading mein gaps ka concept ek ahm role play karta hai. Gaps tab bante hain jab price kisi asset ke beech mein kisi level par open hota hai, bina kisi trading activity ke. Ye gaps market sentiment aur price movements ko samajhne mein madadgar sabit hote hain. Is post mein, hum common gaps aur breakaway gaps ko detail mein samjhenge aur inka istemal trading mein kaise hota hai, is par bhi baat kareinge.

### Common Gaps Kya Hain?

Common gaps, jise “area gaps” bhi kaha jata hai, wo gaps hote hain jo price movements ke doran banate hain. Ye gaps zyada significant nahi hote aur aam tor par price action ke sath bhool jate hain. Inka aksar kisi khas news ya events ke bina hona hota hai.

**Characteristics of Common Gaps**:

1. **Less Significant**: Common gaps ko market ka strong signal nahi mana jata. Ye aam tor par temporary hote hain aur jaldi bhar jate hain.

2. **Filled Quickly**: Ye gaps aksar price movement ke baad jaldi bhar jaate hain, isliye traders ko in par jyada reliance nahi rakhna chahiye.

### Breakaway Gaps Kya Hain?

Breakaway gaps wo gaps hain jo kisi price level se breakout ke doran bante hain. Ye gaps tab hoti hain jab price kisi significant resistance ya support level ko todti hai. Is tarah ke gaps trading signals ko darshate hain aur market sentiment ka pata dete hain.

**Characteristics of Breakaway Gaps**:

1. **Significant Price Movement**: Breakaway gaps strong price movements ko darshate hain aur ye ek new trend ka signal ho sakte hain.

2. **Low Likelihood of Filling**: Ye gaps filling ke liye kam probability rakhte hain kyunki ye market ki direction ko change karte hain.

### Trading Strategies Using Gaps

1. **Common Gaps**: Common gaps ko identify karne ke liye traders ko price action ko dekhna chahiye. Agar gap banta hai, to iska matlab ho sakta hai ke market ke liye koi major event nahi hai. In gaps par long or short positions lena risky ho sakta hai.

2. **Breakaway Gaps**: Breakaway gaps ko identify karne par traders ko unke saath trade karna chahiye. Agar price resistance level ko todti hai aur gap banta hai, to ye bullish signal hota hai. Traders is point par long position lene ka soch sakte hain. Iske liye stop loss ko previous support level ke neeche rakhna chahiye.

### Example of Gaps in Forex

Misaal ke taur par, agar ek currency pair, jaise EUR/USD, 1.2000 se 1.2200 tak barhta hai aur wahan breakaway gap banta hai, to ye bullish signal hai. Is situation mein, agar gap fill nahi hota hai, to traders ko long position le sakte hain.

### Conclusion

Common aur breakaway gaps forex trading mein important tools hain jo market sentiment aur price action ko samajhne mein madad karte hain. Common gaps ko zyada significance nahi di jati, jabke breakaway gaps strong trading signals hain. Gaps ko samajhne aur sahi tarike se istemal karne se traders ko profitable opportunities mil sakti hain. Hamesha risk management ko nazar mein rakhein taake aap gaps ka maximum faida utha saken. Is tarah, gaps forex trading ko enhance karne ka ek effective zariya hain.

-

#7 Collapse

### Comman aur Breakaway Gaps in Forex

Forex trading mein gaps ka concept bahut important hai. Gaps wo moments hote hain jab market ki price ek level se doosre level par chali jati hai bina kisi trading activity ke. Is post mein, hum common aur breakaway gaps ko samjhenge aur inke trading implications par baat karenge.

**Common Gaps:**

Common gaps wo gaps hote hain jo kisi specific news ya event se nahi, balki market ke normal fluctuations se bante hain. Yeh gaps aksar price action ke beech mein bante hain aur inka koi significant impact nahi hota. Common gaps aksar range-bound markets mein dekhe jate hain.

Jab market ek narrow range mein move karti hai, to kabhi-kabhi price suddenly ek level se dusre level par chali jati hai, jo common gap ka indication hota hai. Yeh gaps aasani se bhar jaate hain, aur inka koi long-term effect nahi hota. Isliye traders in gaps par zyada dhyan nahi dete, lekin phir bhi inhe identify karna ahem hota hai, taake aap market ki overall trend ko samajh sakein.

**Breakaway Gaps:**

Breakaway gaps un gaps ko kehte hain jo kisi strong trend ke dauran bante hain. Yeh gaps aksar major news announcements ya economic events ke baad bante hain, jab market kisi level ko break karke ek naya trend shuru karti hai. Jab price kisi resistance ya support level ko break karti hai, to yeh breakaway gap ka indication hota hai.

Breakaway gaps typically strong volume ke saath bante hain, jo yeh dikhata hai ke market mein strong buying ya selling pressure hai. In gaps ka long-term impact hota hai, aur yeh traders ko naye trends identify karne mein madad karte hain. Agar aap breakaway gap dekhte hain, to yeh signal ho sakta hai ke market mein ek naya trend shuru ho raha hai, aur aapko is trend ke against position lene ki bajaye us trend ka saath dena chahiye.

**Trading Strategies:**

Gaps ko trade karte waqt kuch strategies istemal ki ja sakti hain. Common gaps ko identify karne ke liye aapko price action aur volume ko dekhna chahiye. Agar aap dekhte hain ke price ek common gap banane ke baad wapas us level par aa rahi hai, to yeh signal ho sakta hai ke market mein consolidation ho rahi hai.

Breakaway gaps ke liye, aapko volume ka dhyan rakhna chahiye. Agar gap strong volume ke saath banta hai, to yeh trend ke continuation ka indication hota hai. Aap is gap ke aas paas entry points identify kar sakte hain, lekin stop-loss set karna na bhoolen, kyunki markets kabhi bhi unexpected turns le sakti hain.

**Conclusion:**

Forex market mein common aur breakaway gaps ko samajhna aapke trading strategy ko behtar banane mein madadgar sabit ho sakta hai. Gaps ka istemal karte waqt hamesha market ki overall trend aur volume ko dhyan mein rakhna zaroori hai. Is tarah, aap effective trading decisions le sakte hain aur apne profits ko maximize kar sakte hain.

- CL

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

# Common and Breakaway Gaps in Forex

Forex trading mein gaps ka concept bohot ahmiyat rakhta hai. Gaps woh points hain jahan price ek level se agle level par bina kisi trading activity ke jump karti hai. Aaj hum "Common Gaps" aur "Breakaway Gaps" ke darmiyan farq aur inke istemal par baat karenge.

### Common Gaps

Common gaps, jo ke "trading gaps" bhi kehlate hain, aksar short-term price movements mein dekhe jaate hain. Yeh gaps tab bante hain jab market ke liye kisi khas news ya event ka asar nahi hota. Common gaps aksar market ke beech mein hoti hain aur inka koi significant significance nahi hota.

#### Characteristics:

1. **Frequency**: Common gaps aksar hoti hain, lekin inki significance kam hoti hai.

2. **Filling**: Yeh gaps jaldi bhar jaate hain. Price aksar gap ke area par laut aati hai.

3. **Market Sentiment**: Yeh gaps aksar market sentiment ki tabdeeli ko dikhate hain, lekin ye zyada stable nahi hote.

Traders in gaps ko ignore kar sakte hain, kyunki inka zyada asar nahi hota. Lekin, agar aap inhe samajhte hain, to aap market ki dynamics ko behtar samajh sakte hain.

### Breakaway Gaps

Breakaway gaps un gaps ko kehte hain jo kisi strong trend ke dauran bante hain. Yeh gaps tab hoti hain jab price kisi major support ya resistance level ko todti hai. Breakaway gaps market ki direction ko badalne ki nishani hoti hain aur isliye inhe zyada ahmiyat di jaati hai.

#### Characteristics:

1. **Trend Reversal**: Breakaway gaps aksar trend reversal ya continuation ka signal dete hain.

2. **Volume**: In gaps ke saath zyada trading volume dekha jaata hai, jo inki significance ko aur barhata hai.

3. **Durability**: Breakaway gaps zyada der tak rahte hain aur inki wajah se price movements mein strong momentum aata hai.

Traders in gaps ko trading strategies mein shamil karte hain. Jab aap ek breakaway gap dekhte hain, to yeh aapko trade lene ka signal de sakta hai, khas tor par jab price breakout hone ke baad stable rahe.

### Conclusion

Common aur breakaway gaps ko samajhna Forex trading mein kaafi madadgar ho sakta hai. Common gaps ko aap short-term fluctuations ke liye samajh sakte hain, jabke breakaway gaps aapko significant trading opportunities provide karte hain.

Agar aap in gaps ko pehchaan kar sahi waqt par trading decisions lete hain, to aap apni trading performance ko behtar bana sakte hain. Hamesha apne analysis par focus karein aur gaps ke asar ko samajhne ki koshish karein. Is tarah aap Forex market mein apne trades ko behtar taur par manage kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:03 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим