Harmonic price chart pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Harmonic price chart patterns price action aur Fibonacci retracement levels ka istemal karke market trends aur potential reversal points ko identify karne ke liye istemal kiye jate hain. Ye patterns traders ko market movements aur potential entry/exit points ko samajhne mein madad karte hain. Harmonic price chart patterns ki ahmiyat neeche di gayi hai:1. Identify Market Reversals: - Harmonic price chart patterns, market trends ke reversal points ko identify karne mein madad karte hain. - Ye patterns traders ko ye batate hain ki market mein potential trend reversal hone wala hai aur ek naya trend shuru hone wala hai. - Isse traders ko opportunity milti hai ki woh trend reversal ke entry points aur potential profit targets ko identify kar sakein. 2. Entry and Exit Points: - Harmonic price chart patterns, traders ko entry aur exit points determine karne mein madad karte hain. - Jab harmonic pattern form hota hai, traders entry points ko identify kar sakte hain. Entry point usually pattern completion point ya pattern ke specific levels par set kiya jata hai. - Iske saath, harmonic patterns traders ko exit points ya profit targets ko bhi identify karne mein madad karte hain. Ye profit targets usually previous swing highs/low, Fibonacci retracement levels, ya pattern ke specific levels par set kiye jate hain. 3. Risk Management: - Harmonic price chart patterns acha risk management provide karte hain. - Jab traders harmonic patterns ka istemal karte hain, toh woh stop loss levels ko bhi set kar sakte hain. Stop loss levels usually pattern ke invalidation point ya pattern ke specific levels par set kiye jate hain. - Isse traders apne risk ko manage kar sakte hain aur potential losses ko control kar sakte hain. 4. Confirmation with Other Indicators: - Harmonic price chart patterns ko traders dusre technical indicators aur price action analysis ke saath combine karke istemal karte hain. - Isse patterns ki confirmation aur trading decisions par confidence badhata hai. - Traders Fibonacci retracement levels, moving averages, trend lines, aur oscillators jaise indicators ka istemal karke harmonic patterns ke saath confirmation karte hain.Harmonic price chart patterns, advanced level technical analysis tools hote hain. Inko recognize aur interpret karne ke liye practice, experience, aur knowledge ki zarurat hoti hai. Traders ko in patterns ki recognition aur confirmation ke liye aur technical analysis tools ka istemal karna zaruri hai.

-

#3 Collapse

Harmonic price chart pattern:

Harmonic price chart patterns forex market mein use hone wale specific price patterns hote hain. Ye patterns Fibonacci ratios aur geometry ka istemal karte hain. Kuch harmonic patterns hain Butterfly, Gartley, Bat, Crab, aur Cypher. Ye patterns specific price levels par form hote hain aur traders ko potential entry aur exit points provide karte hain. In patterns ko identify karne ke liye traders Fibonacci retracement aur extension levels ka istemal karte hain. Harmonic patterns ko samajhna aur identify karna traders ke liye technical analysis ka ek important aspect hai.

Trading with harmonic pattern:

Harmonic price chart patterns ke saath trading karne ke kuch characteristics hai:

1. Fibonacci ratios:

Harmonic patterns Fibonacci ratios ka istemal karte hain, jaise ki 0.382, 0.618, 1.272, 1.618, etc. In ratios ko use karke traders price levels ko identify karte hain.

2. Entry and exit points:

Harmonic patterns traders ko potential entry aur exit points provide karte hain. Traders in patterns ke formation ke baad positions enter ya exit kar sakte hain.

3. Risk management:

Harmonic patterns ke saath trading karte waqt risk management ka dhyan rakhna zaroori hai. Stop-loss orders aur proper position sizing ke istemal se risk ko control kiya ja sakta hai.

4. Confirmation from other indicators:

Harmonic patterns ko confirm karne ke liye, traders often other technical indicators jaise ki trend lines, moving averages, aur price action ka istemal karte hain.

5. Patience and practice:

Harmonic patterns ko identify karna aur unke saath trading karna patience aur practice ki zaroorat hoti hai. Traders ko patterns ko recognize karne aur unhe effectively trade karne ke liye sufficient knowledge aur experience hona chahiye. Harmonic patterns ke saath trading karte waqt, proper analysis, risk management, aur confirmation signals ka dhyan rakhna zaroori hai. -

#4 Collapse

;;;Forex me Harmonic price chart pattern;;;

Harmonic price chart patterns woh khaas banawat hain jo traders istemal karte hain taake woh forex ya doosre maarkaton mein mumkin rehtay hue trend reversals ya trend continuation points ko pehchaan saken. Ye patterns price movements ke darmiyan hissay mein matnati relaishanship par mabni hote hain aur aksar Fibonacci retracement aur extension levels ke saath joray jatay hain.

;;;Forex me Harmonic price chart pattern me Common Pattern;;;

Yahan kuch aam harmonic price chart patterns hain:- Bat Pattern:

- Ek bat ki shakal ka pattern hai jo khaas Fibonacci levels par mabni hota hai.

- Butterfly Pattern:

- Bat pattern ki tarah, butterfly pattern bhi khaas Fibonacci levels par mabni hota hai.

- Gartley Pattern:

- Gartley pattern mein price ka specific retracement hota hai, jise traders harmonic ratios ke sath map karte hain.

- Crab Pattern:

- Crab pattern ek advanced harmonic pattern hai, jisme Fibonacci levels ka specific arrangement hota hai.

- Cypher Pattern:

- Cypher pattern mein bhi Fibonacci ratios ka istemal hota hai, aur yeh trader ko potential reversal points batata hai.

- Shark Pattern:

- Shark pattern ek aur complex harmonic pattern hai, jisme price ka movement Fibonacci retracement aur extension levels ke saath match karta hai.

- Three-Drive Pattern:

- Three-Drive pattern mein three consecutive legs ya drives hote hain, jo Fibonacci extension levels ke sath correlate karte hain.

- AB=CD Pattern:

- AB=CD pattern mein price ka movement specific ratios ko follow karta hai. Yeh pattern market mein symmetry ko represent karta hai.

- Triangle Pattern:

- Triangle pattern, price ke movement ko ascending, descending, ya symmetric triangles ke andar represent karta hai, jo ki trend continuation ya reversal indicate kar sakte hain.

- Head and Shoulders Pattern:

- Head and Shoulders pattern price ke movement mein ek trend reversal ko suggest karta hai. Isme three peaks hote hain - ek head aur do shoulders.

- Harmonic patterns ka istemal traders price action ko predict karne aur market trends ko samajhne ke liye karte hain. In patterns ko pehchan kar, traders apne trading strategies ko refine karte hain aur market mein hone wale possible turns ko anticipate karte hain. Yeh patterns technical analysis ka hissa hain aur caution ke saath istemal kiye jaate hain, kyun ki market mein koi bhi pattern 100% guarantee nahi deta.

- CL

- Mentions 0

-

سا3 likes

- Bat Pattern:

-

#5 Collapse

Asslam o Alikum

kaise hain friends aap umeed hay ke aap ache hon gay aur aur forex ko enjoi kr rahe honge aaj hu discuss karenge ke harmonic price chart pattern kis ko kaha jata hay

Harmonic price chart pattern

Harmonic price chart pattern Fibonacci numbers ka use karke price movement ko predict karne ke liye use kiye jaate hain। In patternon mein, price movement ko 5 points mein divide kiya jata hai, jinmein se har point ki price ko Fibonacci numbers se measure kiya jata hai।

Yahan kuchh popular harmonic price chart pattern hain:- Gartley pattern

- Butterfly pattern

- Crab pattern

- Bat pattern

Use of harmonic price pattern

Harmonic price chart pattern ka use karke traders future price movement ko predict kar sakte hain aur profitable trade kar sakte hain। Lekin, in patternon ka use karne se pehle, iske risks aur benefits ko samajhna jaruri hai।

Harmonic price chart pattern ke kuchh advantages hain:- In patternon se traders ko future price movement ko predict karne mein madad mil sakti hai।

- In patternon ka use karke traders profitable trade kar sakte hain।

Harmonic price chart pattern ke kuchh disadvantages hain:- In patternon ko identify karna mushkil ho sakta hai।

- In patternon ka use karne se pehle, iske risks aur benefits ko samajhna jaruri hai।

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 Collapse

### Harmonic Price Chart Pattern Kya Hai?

Forex aur stock trading mein technical analysis tools ki madad se market trends aur price movements ko samajhne ki koshish ki jati hai. Harmonic price chart patterns ek aise advanced tools hain jo market ki price movements ko specific geometric shapes aur ratios ke zariye analyze karte hain. Is post mein, hum harmonic price chart patterns ke concepts, key patterns aur unki trading significance ko detail mein samjhenge.

**Harmonic Price Chart Patterns Kya Hai?**

Harmonic price chart patterns ek technical analysis technique hai jo price movements ko identify karne ke liye geometric shapes aur Fibonacci ratios ka use karti hai. Yeh patterns market ke potential reversals aur continuation points ko predict karne mein madadgar hote hain. Harmonic patterns ki formation precise price movements aur specific ratios ko follow karti hai.

**Key Harmonic Patterns:**

1. **Gartley Pattern**: Gartley pattern ek classic harmonic pattern hai jo ek uptrend ya downtrend ke baad formation hota hai. Is pattern mein, ek XA leg ke baad ek AB leg, phir BC leg aur finally CD leg develop hoti hai. Gartley pattern ka key feature yeh hai ke CD leg ko 78.6% Fibonacci retracement level par complete karna chahiye.

2. **Bat Pattern**: Bat pattern bhi ek important harmonic pattern hai jo price movements ke precise Fibonacci ratios ko follow karta hai. Is pattern mein, XA leg ke baad AB leg, BC leg aur CD leg ki formation hoti hai. CD leg typically 88.6% Fibonacci retracement level par complete hoti hai.

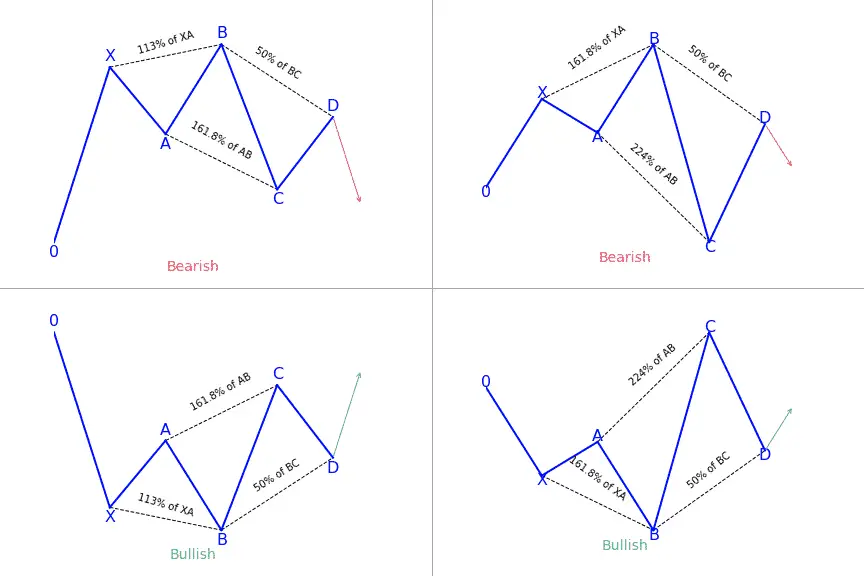

3. **Butterfly Pattern**: Butterfly pattern ek reversal pattern hai jo market ke extreme points ko capture karta hai. Is pattern mein XA leg ke baad AB leg, BC leg aur CD leg hoti hai. CD leg generally 127% ya 161.8% Fibonacci extension levels par complete hoti hai.

4. **Crab Pattern**: Crab pattern ek powerful harmonic pattern hai jo extreme price movements ko identify karta hai. Is pattern mein, XA leg ke baad AB leg, BC leg aur CD leg ki formation hoti hai. CD leg typically 161.8% Fibonacci extension level par complete hoti hai.

**Trading Significance:**

1. **Reversal Signals**: Harmonic patterns market ke potential reversal points ko identify karte hain. Jab patterns complete hoti hain, toh yeh market ke current trend ke reversal ka signal deti hain. Traders in patterns ko reversal trades ke liye use kar sakte hain.

2. **Risk Management**: Harmonic patterns ki precise Fibonacci ratios aur levels risk management mein madadgar hote hain. Traders entry aur exit points ko accurately set kar sakte hain aur stop-loss orders ko optimal levels par place kar sakte hain.

3. **Confirmation**: Harmonic patterns ko trading decisions ke liye confirmatory tools ke roop mein use kiya jata hai. Additional technical indicators aur price action analysis se patterns ke signals ko validate kiya jata hai, jo trading decisions ko strengthen karta hai.

**Conclusion:**

Harmonic price chart patterns ek advanced technical analysis technique hain jo market ke price movements ko geometric shapes aur Fibonacci ratios ke zariye analyze karti hain. Gartley, Bat, Butterfly aur Crab patterns key harmonic patterns hain jo market ke potential reversals aur trading opportunities ko identify karne mein madadgar hote hain. Accurate pattern recognition aur effective trading strategies ke zariye, traders market trends ko capitalize kar sakte hain aur informed trading decisions le sakte hain. Harmonic patterns ke signals ko confirmatory tools aur risk management techniques ke saath combine karke, trading performance ko enhance kiya ja sakta hai aur market fluctuations se efficiently cope kiya ja sakta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:40 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим