Fibonacci Retracement

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Fibonacci Retracement, technical analysis mein ek popular tool hai, jisse traders price movement aur trend reversal points ko identify karne ke liye istemal karte hain. Fibonacci Retracement, Fibonacci sequence aur golden ratio concepts par based hai. Fibonacci Retracement ki wazahat tafseel sa niche di gayi hai: 1. Fibonacci Sequence: Fibonacci sequence ek mathematical sequence hai, jisme har number apne previous two numbers ka sum hota hai. Ye sequence hai: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, aur aage aise hi jaata hai. 2. Golden Ratio: Fibonacci sequence ke har number ko apne next number se divide karne se golden ratio approximations milte hain, jo lagbhag 0.618 aur 1.618 hote hain. In ratios ko Fibonacci ratios ya golden ratios bhi kehte hain. 3. Fibonacci Retracement Levels: Fibonacci Retracement levels ko Fibonacci ratios ka istemal karke calculate kiya jata hai. Ye levels price movement ke important support aur resistance levels ko identify karne mein madad karte hain. Fibonacci Retracement levels hai: 23.6%, 38.2%, 50%, 61.8%, aur 78.6%. 4. Usage: Fibonacci Retracement ka istemal price movement ke retracement levels ko identify karne ke liye hota hai. Jab price trend mein retracement ya pullback hota hai, tab Fibonacci Retracement levels ko draw karke potential support aur resistance levels determine kiye jate hain. 5. Entry aur Exit Points: Fibonacci Retracement levels ko istemal karke traders entry aur exit points determine karte hain. Agar price retracement level ke near approach karta hai, to traders waha se buy ya sell kar sakte hain, depending on the trend direction. 6. Confirmation: Fibonacci Retracement levels ki confirmation ke liye, traders dusre technical indicators aur price action analysis ka istemal karte hain. Support aur resistance levels, trend lines, moving averages, ya candlestick patterns ki confirmation ki ja sakti hai. Fibonacci Retracement levels market mein price movement aur trend reversal points ko identify karne mein madad karte hain. Ye levels support aur resistance provide karte hain, aur traders ko entry aur exit points determine karne mein help karte hain.Mujhe umeed hai ke ye information apke liye helpful hogi.

1. Fibonacci Sequence: Fibonacci sequence ek mathematical sequence hai, jisme har number apne previous two numbers ka sum hota hai. Ye sequence hai: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, aur aage aise hi jaata hai. 2. Golden Ratio: Fibonacci sequence ke har number ko apne next number se divide karne se golden ratio approximations milte hain, jo lagbhag 0.618 aur 1.618 hote hain. In ratios ko Fibonacci ratios ya golden ratios bhi kehte hain. 3. Fibonacci Retracement Levels: Fibonacci Retracement levels ko Fibonacci ratios ka istemal karke calculate kiya jata hai. Ye levels price movement ke important support aur resistance levels ko identify karne mein madad karte hain. Fibonacci Retracement levels hai: 23.6%, 38.2%, 50%, 61.8%, aur 78.6%. 4. Usage: Fibonacci Retracement ka istemal price movement ke retracement levels ko identify karne ke liye hota hai. Jab price trend mein retracement ya pullback hota hai, tab Fibonacci Retracement levels ko draw karke potential support aur resistance levels determine kiye jate hain. 5. Entry aur Exit Points: Fibonacci Retracement levels ko istemal karke traders entry aur exit points determine karte hain. Agar price retracement level ke near approach karta hai, to traders waha se buy ya sell kar sakte hain, depending on the trend direction. 6. Confirmation: Fibonacci Retracement levels ki confirmation ke liye, traders dusre technical indicators aur price action analysis ka istemal karte hain. Support aur resistance levels, trend lines, moving averages, ya candlestick patterns ki confirmation ki ja sakti hai. Fibonacci Retracement levels market mein price movement aur trend reversal points ko identify karne mein madad karte hain. Ye levels support aur resistance provide karte hain, aur traders ko entry aur exit points determine karne mein help karte hain.Mujhe umeed hai ke ye information apke liye helpful hogi.

-

#3 Collapse

Assalamu Alaikum Dosto!

Fibonacci Retracement Indicator

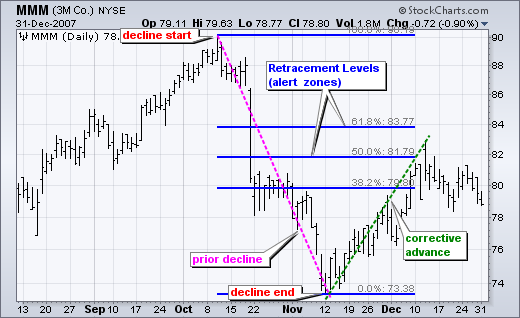

Fibonacci retracement tool, Fibonacci sequence ke andar matnati talluqat par mushtamil percentage retracement lines plot karta hai. Ye retracement levels support aur resistance levels provide karte hain jo ke price objectives ko target karne ke liye istemal kiye ja sakte hain.

Fibonacci retracements ko display karne ke liye sab se pehle do extreme points ke darmiyan aik trend line draw ki jati hai. Us trend line ko Fibonacci levels, jese ke 0.0%, 23.6%, 38.2%, 50%, 61.8%, aur 100%, par cross karnay wali chhah horizontal lines se intersect karte hain.

Percentage retracements possible support ya resistance areas ko identify karte hain, jese ke 23.6%, 38.2%, 50%, 61.8%, aur 100%. In percentages ko selected period ke high aur low price ke darmiyan ka farq apply karke price objectives ka ek set banaya jata hai. Market ki direction ke mutabiq, up ya down, prices aksar pehle ke trend ka acha hissa wapas karegi, phir woh original direction mein move karegi.

Ye countertrend moves aksar kisi khas parameters mein aate hain, jo ke frequently Fibonacci retracement levels hote hain. Ye indicator khud hi MT4 chart par Fibonacci levels (Fibo extensions) draw karta hai. Isne "flat market" stage ko filter out kiya hua hai aur sirf active price movement ke phases ko mad e nazar rakha hai.

Fibo extensions retracement (pullback) ki possible depth ko determine karne mein madad karte hain mutabiq primary trend ke sath. In levels se aap woh pivot points (ya pivots) spot kar sakte hain, jahan primary trend zyada bar qaim hoga. Fibo levels ke peeche wali philosophy ye hai ke jitna zyada pullback, utni zyada chances hain ke pivot points prevailing trend ke taraf hone ke zyada hain.

images (263).jpeg

Explaination

Fibonacci extensions percentages ke tor par show kiye jate hain aur inhe is tarah calculate kiya jata hai: Fibo grid ko set karen (0% se lekar 100% tak ke values ke tor par dikhaya jata hai) taake 23.6, 38.2, 50.0, aur 61.8 percentage values milen. Jo values hasil hoti hain, inhe Fibonacci levels draw karne ke liye istemal kiya jata hai (jo ke 6 hote hain):

100% – Fibonacci levels placement ka starting point.

61.8% – isay "golden ratio" bhi kehte hain. Ye level 50% ke liye acha complement hai. To agar pullback wave in dono levels ke aas paas ruk jata hai, to is se zyada chances hote hain ke pivot point hota hai.

50% – pivots is level ke aas paas ban sakte hain. Iski wajah ye hai ke short-term traders pullbacks ke baad apne positions par profit lock karte hain.

38.2% – traders jab zyada active aur confident hote hain, to pivots is level ke paas ban sakte hain.

23.6% – pivots is level ke aas paas bohot kam ban sakte hain. Forex market ke participants aksar ek zyada retracement ka intezar karte hain taake entry points identify kiye ja sake. 0% – ye value Fibonacci levels placement ka ending point hai.

Jab aap Fibonacci levels ko doosre indicators mein istemal karte hain, to aap 78.6% level dekhte hain. Aam taur par pullback waves is value tak nahi pohanchti. Iska ye mtlb hai ke trend movement pehle recover hota hai, yaani ke iske upper ke levels ke paas. Ye wajah hai ke 78.6% extension level ko FiboRetracement indicator se nikal diya gaya hai.

Theoretical description ke ilawa, aapko chart par har khaas situation ko mad e nazar rakhna chahiye. To agar retracement se pehle zor ka trend tha, aur pullback wave kamzor hai, to trend ko dobara shuru hone ke chances zyada hote hain. Ulta, agar pullbacks primary trend se zyada strong hain, to pullback naye aur ulta trend mein tabdeel ho sakta hai.

Iske ilawa, agar Fibo levels round-number levels (free RoundLevels indicator dekhein) ya doosre technical analysis tools ke saath milte hain, to primary trend ko recover karne ke chances zyada hote hain.

images (262).jpeg

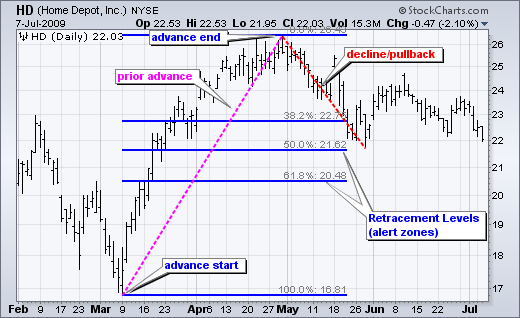

Fibonacci Indicator ka Istemal

Fibonacci Retracement ko apne trading system ka aik hissa banane ke liye, sath hi sath doosre indicators ke sath istemal karne ki tavsiya dete hain. Jitne zyada signals honge ke aapko trade kholna chahiye, utni hi chances hote hain ke trading outcome positive hoga.

Aik key tool of technical analysis, jese ke trendline, ko ek additional trading indicator ke tor par istemal karne ka hum example lete hain. Iske liye, aapko free AutoTrendLines indicator download karna hoga.

Misaal ke taur par, agar chart mein pullback wave Fibo levels 61.8% aur 50.0% ke qareeb ruk gaya hai. To ye pehla signal ho sakta hai ke pivot point aur selling ka aghaz hone wala hai.

Is example mein, trendline ek secondary indicator ke tor par kaam karti hai aur yeh dikhata hai ke downtrend ko wapas shuru hone ke chances kam hain.

Pivot points ko spot karna zaroori hai jab downward movement dobara shuru hota hai; Stop Loss ke liye ye behtar hai ke ise trendline ke bahir set kiya jaye. Bechnay ke doran is chart par aap trendline dekh sakte hain jo ek additional tool represent karti hai aur bullish trend ko indicate karti hai.

Bechnay mein, pullback movement ne sirf 38.2% Fibo level tak pohancha hai. Iska matlab hai ke Forex market ke participants optimistic hain aur pullbacks ke baad actively Buy trades kar rahe hain.

Is case mein, aap market price par trade khol sakte hain, aur Stop Loss ko support line ke bahir set karna behtar hoga.

Jab aap ek timeframe se doosre par switch karte hain, to indicator ke levels dobara draw nahi hote. Ye defect is tajaweez se theek kiya ja sakta hai ke indicator par double-click kiya jaye aur ise remove kiya jaye. Iske baad, indicator automatic mode mein aapke selected timeframe par run hoga.

Indicator ke levels ki major advantages ye hain ke ye useful hote hain. Chahe aap kisi bhi time interval par trade karein aur jo bhi method use karein (scalping, intraday trading, ya long-term trading), ye indicator pullbacks ke baad achay pivot points ko spot karne mein madad karega.

Fibo levels ka istemal karke aap Forex market ke participants ki overall sentiment bhi dekh sakte hain. Aur usko jaan kar aapko zyada chances honge ke aap price ka agla rukh kahan ja sakta hai.

images (1) (223).png

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

Fibonacci Retracement

fibonacci retracement aik khusoosi imtihani aala hai jo maliyati karobari shobo mein istemaal kya jata hai taakay fibonacci group bandi ke paish e nazar madad aur rukawat ki mumkina dgryon ko pehchana ja sakay. is ka naam atalwi rayazi daan lyonardo febonaci ke naam par rakha gaya hai, jis ne 1202 mein apni kitaab" liber abasi" mein maghribi duniya ke sath febonaci intizamaa se waaqif karwaya tha. brokrz aur mahireen laagat ke patteren mein mumkina ulta fox ka faisla karne ke liye febonaci retracemt level ka istemaal karte hain .

Key Fibonacci Levels:

0. 382 ( 38. 2 % ) :

yeh satah markazi aam rettracment level ko address karti hai. dealer aksar is satah par mumkina ulat ya skips ko dekhte hain .

0. 500 ( 50. 0 % ) :

yeh satah yakeeni tor par haqeeqi febonaci tanasub nahi hai phir bhi febonaci imthehaan ke liye yaad rakha jata hai. yeh aam tor par mutawaqqa wapsi ke liye aik mid point ke tor par istemaal hota hai .

0. 618 ( 61. 8 % ) :

yeh satah sab se ziyada mazbooti se dekhi jane wali fibonacci retracement levels mein se aik hai. mutadid tajir usay mumkina ulta fox ke thos nishaan ke tor par sochte hain .

0. 786 ( 78. 6 % ) :

yeh level aik aur aam rettracment level hai aur usay 61. 8 % level se mutaliq kayi baar istemaal kya jata hai .

1. 000 ( 100. 0 % ) :

yeh level retracemt level nahi hai abhi tak febonaci tehqiqaat ke liye aksar yaad kya jata hai. yeh bunyadi laagat ki muntaqili ki kal wapsi par tawajah deta hai .

hisaab kitaab :

fibonacci retracement ki sthon ka taayun aik graph par do ishtial angaiz fox, aam tor par aik chouti aur aik box, aur fibonacci tanasub ( 38. 2 %, 50. 0 %, 61. 8 %, waghera ) ko laago kar ke mutawaqqa madad ya rukawat ki sthon ka taayun karne ke liye kya jata hai .

Calculation:

fibonacci retracement ko istemaal karne ke liye marhala waar Hadayat :

patteren ko pehchanen :

karobari shobo ko muntaqil karne mein fibonacci retracement behtareen hai. aik ghair mutazalzal izafay ya neechay ke rujhan ko pehchanen .

soyng high aur soyng lo ko muntakhib karen :

tasleem shuda patteren mein sab se ziyada qabil zikar nuqta ( ouncha jhoolna ) aur mutlaq neechay ( neechay jhool ) ko muntakhib karen .

How to Use Fibonacci Retracement:

soyng lo se le kar ounchay jhulay tak hudood ki wazahat karne ke liye fibonacci retracement instrument ka istemaal karen. wapsi ki sthin qudrati tor par tay ki jayen gi .

mumkina ulat zonz :

dealers fibonacci retracement ki sthon par mumkina ulta ya tasalsul ke isharay talaash karte hain. aam alamaat mein skips, ulta, ya febonaci sthon ka dosray makhsoos markr ke sath majmoa shaamil hota hai .

Limitations and Caution:

Subjectivty

Febonaci levels ko samjhna kuch had tak jazbati ho sakta hai, aur mukhtalif mrchnts mamooli tor par munfarid jhoolon ka intikhab kar satke hain .

har waqt present nahi :

agarchay fibonacci retracement ki sthin taaqatwar ho sakti hain, lekin woh ehmaqana saboot nahi hain. markitin bartao ke herat angaiz tareeqay dikha sakti hain, aur mukhtalif anasir ke baray mein socha jana chahiye .

mukhtalif pointer ke sath istemaal karen :

ghair mutazalzal miyaar ko up grade karne ke liye, tajir kasrat se deegar khusoosi pointer aur imtihani hikmat amlyon se mutaliq Fibonacci rettracment ka istemaal karte hain .

Example:

utaar charhao mein, is soorat mein ke naqad jora aik nai bulandi se 61. 8 % fibonacci satah tak yaad rakhta hai aur madad ke isharay deta hai, brokrz aam tor par izafay ke tasalsul ki tawaqqa karte hue, aik qeemti khulay darwazay ki kharidari ke mumkina tor par is ko samajh satke hain .

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:37 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим