Black Hallow Candlestick Pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Black Hallow Candlestick Pattern

Assalamu Alaikum dear Forex friends i hope ke aap sab khairiyat se honge aur Forex trading business Mein Apne task aur target acche tarike se pure kar rahe honge. Introduction: Black hallow candlestick pattern, jo ke candlestick chart analysis ka aik ahem hissa hai, stock market aur financial markets mein istemal hota hai. Yeh pattern traders aur investors ke liye ahem hota hai kyunki isse future price movements ka andaza lagaya ja sakta hai. Black hallow candlestick pattern ka main maqsad price reversals ko pehchan'na hota hai, jahan market trend ek direction se doosri direction mein badalne ke amkanat hote hain. Black Hallow Candlestick Pattern: Black hallow candlestick pattern ek technical analysis tool hai jo stock market mein istemal hota hai. Yeh pattern candlestick charts par dikhaye jatay hain aur market sentiment ko samajhne aur price reversals ko pehchan'ne mein madadgar hota hai.Working Strategy: Black hallow candlestick pattern, ek specific candlestick formation ko darust karti hai jo bearish (girawat ki taraf) reversal ko indicate karta hai. Is pattern mein, aik lambi bearish candlestick (jo ke price opening aur closing mein girawat darust karti hai) aik choti bullish candlestick (jo opening aur closing mein girawat darust nahi karti) se precede hoti hai. Is choti bullish candlestick ki shadow ya tail aksar lambi hoti hai, aur iska matlab hota hai ke buyers initially tried to push the price up, lekin phir se sellers ne control hasil kar liya. Explanation: Black hallow candlestick pattern ke kuch ahem pehlu hain: Bearish Reversal Signal: Is pattern ka primary maqsad bearish reversal ko signal karna hota hai. Iska matlab hota hai ke market trend jo pehle bullish (tezi) tha, ab bearish (girawat) ki taraf badalne ka amkanat ho sakta hai. -

#3 Collapse

Introduction: Black Hallow Candlestick Pattern ek technical analysis indicator hai jo market charts par hone wale price movements ko represent karta hai. Ye pattern market trends ke potential reversals ko indicate karta hai aur traders ko market conditions ko samajhne mein madad karta hai. Is article mein, hum Black Hallow Candlestick Pattern ke tafseel se baat karenge aur iske characteristics aur asarat ko explore karenge.

Black Hallow Candlestick Pattern Kya Hai: Black Hallow Candlestick Pattern ek bearish reversal pattern hai jo typically uptrend ke baad aata hai. Is pattern ka appearance ek downtrend ki shuruaat ko indicate karta hai. Pattern ko "Hallow" is liye kehte hain kyun ke isme ek small bullish candle ke baad ek large bearish candle aata hai jiska open aur close prices barabar hote hain.

Black Hallow Candlestick Pattern ka formation do stages mein hota hai:- Uptrend:

- Pehle stage mein, market uptrend mein hota hai aur bullish candles dominate karte hain.

- Hallow Formation:

- Dusre stage mein, ek small bullish candle aata hai jiska close price bearish candle ki opening price ke barabar hoti hai. Iske baad ek large bearish candle aata hai jiska open aur close prices barabar hote hain, lekin iska overall body pehle candle se zyada hota hai. Ye pattern indicate karta hai ke uptrend ke baad bearish momentum badh raha hai.

Black Hallow Candlestick Pattern ka appearance ek reversal signal provide karta hai aur traders ko ye batata hai ke market direction badalne wala hai.

Black Hallow Candlestick Pattern Ke Characteristics:- Small Bullish Candle:

- Black Hallow Candlestick Pattern ka sabse ahem characteristic hai ek small bullish candle ke appearance ka. Ye candle uptrend ke end ko darust karta hai aur indicate karta hai ke bullish momentum weak ho raha hai.

- Large Bearish Candle:

- Is pattern mein ek large bearish candle aata hai jiska open aur close prices barabar hote hain, lekin overall body pehle candle se zyada hoti hai. Ye large bearish candle indicate karta hai ke market mein bearish momentum strong ho raha hai.

- Volume Analysis:

- Black Hallow Candlestick Pattern ke sath volume analysis bhi important hota hai. Agar pattern ke sath volume increase hota hai, toh ye indicate karta hai ke traders mein interest badh raha hai aur reversal ke chances high hain.

Black Hallow Candlestick Pattern Ka Tafseeli Asarat: Black Hallow Candlestick Pattern ka tafseeli asarat ye hote hain:- Reversal Signal:

- Ye pattern market mein trend reversal ko indicate karta hai, aur traders ko ye signal deta hai ke uptrend ke baad ab downtrend shuru hone wala hai.

- Confirmation of Weakness:

- Black Hallow Candlestick Pattern trend ke weakness ko confirm karta hai. Agar market mein strong uptrend tha aur Black Hallow Candlestick Pattern appear hota hai, toh ye darust karta hai ke bullish momentum kamzor ho raha hai.

- Entry Aur Exit Points:

- Traders is pattern ka istemal karke entry aur exit points ko tay kar sakte hain. Pattern ka appearance traders ko indicate karta hai ke market mein potential reversal hone wala hai, jisse unhein apne positions ko adjust karne mein madad milti hai.

Black Hallow Candlestick Pattern Ka Asar Pakistan Ki Chat Language Mein: Pakistan ki chat language mein, Black Hallow Candlestick Pattern ka asar trading community mein tajaweezat aur discussions ke zariye hota hai. Traders is pattern par frequently discussion karte hain aur apne observations ko share karte hain. Black Hallow Candlestick Pattern ki tafheem hona traders ke liye zaroori hai, kyun ke iske istemal se wo market ke potential reversals ko pehchan sakte hain.

Chat language mein, traders apne dosto aur community members ke sath Black Hallow Candlestick Pattern ke baray mein mashawarat karte hain aur apne experiences ko share karte hain. Isse unki technical analysis mein improvement hoti hai aur wo market ke movements ko samajhne mein maharat hasil karte hain. Pakistan ke trading community mein, Black Hallow Candlestick Pattern ka popular istemal hai aur is par discussions hone ka amal roz marra ka hai.

Conclusion: Black Hallow Candlestick Pattern ek important technical analysis pattern hai jo traders ko market trends ke potential reversals ke bare mein agah karta hai. Pakistan ki chat language mein, is pattern par baat cheet aur tajaweezat hona trading community ke liye zaroori hai. Black Hallow Candlestick Pattern ki samajh, traders ko market ke uncertainties ko handle karne mein madad karti hai aur unhein behtar trading decisions lene mein saksham banati hai. Is liye, har ek trader ko chahiye ke is pattern ko seekhe aur apne trading journey mein iska istemal kare.

- Uptrend:

-

#4 Collapse

Black Hallow Candlestick Pattern:

Assalam o alaikum!Dear forex traders Black Hallow Candlestick Pattern aik bearish reversal pattern hai, jiska matlab hai ke iska appearance uptrend ke baad market mein bearish reversal hone ke chances ko indicate karta hai. Is pattern ko identify karne ke liye, traders ko candlestick charts ki detail ko janna bohot zaroori hai.Black Hallow Candlestick Pattern ek specific candlestick configuration hai jo do parts se milta hai aik long black candlestick aur aik small hollow candlestick. Yeh pattern uptrend ke baad aata hai aur bearish reversal ko suggest karta hai.Black Hallow Candlestick Pattern aik bohot important technical analysis tool hai jo traders ko market trends aur potential reversals ke bare mein malumaat deta hai.Ye pattern candlestick charts par based hai aur market sentiment ko samajhne mein madad karta hai.

Important parts of Black Hallow Candlestick Pattern:

Yeh candlestick pattern two parts mein taqseem hota hy:

Long Black Candlestick:

Dear my students Pehla step yeh hota hai ky aik long black candlestick ka hona. Is candlestick ka matlab hai ke sellers ne market mein control hasil kar liya hai aur price mein significant decline hua hai.

Small Hollow Candlestick:

Dear forex members Dusra step hota hai ky aik small hollow candlestick ka hona jise hum "hallow" kehte hain. Is candlestick ka matlab hai ke bearish pressure kamzor ho raha hai aur buyers mein se kuch control regain kar rahe hain. Hollow candlestick ki body black candlestick ke andar hoti hai lekin iska size chota hota hai.

How can we trade with Black Hallow Candlestick Pattern:

Dear my siblings Black Hallow pattern ko trading strategy mein use karne se pehle, traders ko is pattern ki confirmation ke liye aur technical analysis tools ka use karna zaruri hai.Jab black hallow pattern form hota hai, traders long positions enter kar sakte hain. Iske liye, entry point white candlestick ke high price se thoda above set kiya jata hai. - Stop loss level black candlestick ke low price se thoda below set kiya jata hai.Target levels ko previous resistance levels, Fibonacci retracement levels, ya kisi aur technical analysis tool ke support se determine kiya jata hai.Black Hallow Candlestick pattern ke saath trading karne se pehle, traders ko is pattern ki recognition aur interpretation ko samajhna zaruri hai. Isky saath, confirmation ke liye dusre technical indicators, price patterns, aur price action analysis ka use karna bhi bohot zaroori hai.Mujhe umeed hai ki yeh information aapko samajh mein aayi hogi. -

#5 Collapse

Black Hallow Candlestick Pattern

"Black Hallow Candlestick Pattern" ek technical analysis term hai jo ke financial markets mein use hoti hai, khaas kar ke stock market mein. Yeh ek candlestick pattern hai jo traders aur investors ko market trends ke bare mein information dene mein madad karta hai.

"Black Hallow Candlestick Pattern" ka basic idea hai ki market mein bearish trend hone ke chances hain. Is pattern mein, ek candlestick kaafi important hota hai. Yeh candlestick do parts mein hota hai:

Black Candlestick: Pehla hissa black (ya dark) rang ka hota hai aur iski length market movement ko represent karta hai. Agar yeh candlestick market mein downward movement ko indicate karta hai, to iska matlab hai ke bearish trend hai.

Hallow (Gap) Portion: Dusra hissa, black candlestick ke neeche ek chhota sa white (ya light) rang ka portion hota hai, jise "hallow" ya "gap" kehte hain. Yeh gap market mein ek pause ko represent karta hai aur yeh dikhaata hai ke selling pressure kam ho rahi hai.

Yeh pattern sirf ek indicator hai aur isay doosre technical analysis tools ke saath mila kar hi istemal karna chahiye. Traders ko apni strategies banate waqt is pattern ko bhi consider karna important hota hai, lekin yeh kisi bhi guarantee ya surety ko represent nahi karta. Market dynamics hamesha change hote rehte hain aur isliye, prudent trading ke liye thorough analysis aur risk management ka bhi dhyan rakhna zaroori hai.

Overall, "Black Hallow Candlestick Pattern" bearish reversal signal provide karta hai. Yani ke, jab yeh pattern form hota hai, to traders ko lagta hai ke market mein downward movement hone ke chances hain aur woh apne trading strategies ko is signal ke mutabiq adjust karte hain.

-

#6 Collapse

Black Hallow Candlestick Pattern:

Assalam o alaikum!Dear forex traders Black Hallow Candlestick Pattern aik bearish reversal pattern hai, jiska matlab hai ke iska appearance uptrend ke baad market mein bearish reversal hone ke chances ko indicate karta hai. Is pattern ko identify karne ke liye, traders ko candlestick charts ki detail ko janna bohot zaroori hai.Black Hallow Candlestick Pattern ek specific candlestick configuration hai jo do parts se milta hai aik long black candlestick aur aik small hollow candlestick. Yeh pattern uptrend ke baad aata hai aur bearish reversal ko suggest karta hai.Black Hallow Candlestick Pattern aik bohot important technical analysis tool hai jo traders ko market trends aur potential reversals ke bare mein malumaat deta hai.Ye pattern candlestick charts par based hai aur market sentiment ko samajhne mein madad karta hai.

Important parts of Black Hallow Candlestick Pattern:

Yeh candlestick pattern two parts mein taqseem hota hy:

Long Black Candlestick:

Dear my students Pehla step yeh hota hai ky aik long black candlestick ka hona. Is candlestick ka matlab hai ke sellers ne market mein control hasil kar liya hai aur price mein significant decline hua hai.

Small Hollow Candlestick:

Dear forex members Dusra step hota hai ky aik small hollow candlestick ka hona jise hum "hallow" kehte hain. Is candlestick ka matlab hai ke bearish pressure kamzor ho raha hai aur buyers mein se kuch control regain kar rahe hain. Hollow candlestick ki body black candlestick ke andar hoti hai lekin iska size chota hota hai.

How can we trade with Black Hallow Candlestick Pattern:

Dear my siblings Black Hallow pattern ko trading strategy mein use karne se pehle, traders ko is pattern ki confirmation ke liye aur technical analysis tools ka use karna zaruri hai.Jab black hallow pattern form hota hai, traders long positions enter kar sakte hain. Iske liye, entry point white candlestick ke high price se thoda above set kiya jata hai. - Stop loss level black candlestick ke low price se thoda below set kiya jata hai.Target levels ko previous resistance levels, Fibonacci retracement levels, ya kisi aur technical analysis tool ke support se determine kiya jata hai.Black Hallow Candlestick pattern ke saath trading karne se pehle, traders ko is pattern ki recognition aur interpretation ko samajhna zaruri hai. Isky saath, confirmation ke liye dusre technical indicators, price patterns, aur price action analysis ka use karna bhi bohot zaroori hai.Mujhe umeed hai ki yeh information aapko samajh mein aayi hogi.

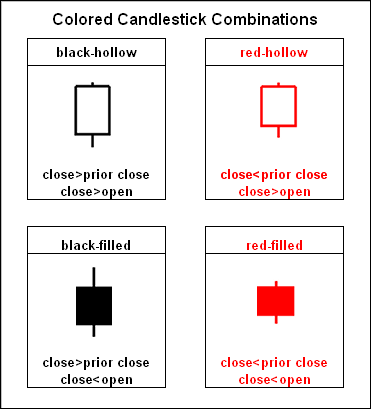

Example of Hollow Candlestick Chart.

-

#7 Collapse

Black Hallow Candlestick Pattern:

"Black Hollow Candlestick Pattern" technical analysis mein ek candlestick pattern hai jo bearish reversal ko darust karta hai. Ye pattern ek downtrend ke doran dikhai deta hai aur traders ko indicate karta hai ke selling pressure kamzor ho rahi hai aur potential reversal hone ka chance hai.

Formation of Black Hollow Candlestick Pattern:

Black Hollow Candlestick Pattern ek specific type ka candlestick hota hai jo upper shadow yaani ke wick (dhaga) nahi hota, aur lower shadow bhi kamzor hoti hai. Is candlestick ka body (the wide part) fully colored hota hai, generally black ya dark color mein. Iska matlab hai ke opening price aur closing price ke darmiyan ka area completely filled hota hai.

Interpretation:- Bearish Trend (Mandi Hona): Black Hollow Candlestick Pattern bearish trend ke doran dikhai deta hai. Yani ke market mein sellers control mein hain aur prices neeche ja rahe hain.

- Weak Selling Pressure: Is pattern ka main point yeh hai ke jab bhi ye dikhe, to ye indicate karta hai ke recent downtrend mein hone wala selling pressure kamzor ho raha hai. Agar is pattern ke baad ek bullish candlestick aata hai, to ye ek potential trend reversal ka sign ho sakta hai.

- Confirmation Required: Hamesha yaad rahe ke ek single candlestick pattern par pura bharosa na karein aur dusre technical indicators ya price action patterns ke saath combine karein. Confirmation ke liye market ke aur signals ka bhi intezar karein.

Trading Strategy:

Traders is pattern ko dekhte hue expect karte hain ke market mein potential reversal hone ka chance hai, aur agar next candlestick bullish hai, to wo entry point ban sakta hai. Stop-loss orders ka istemal karna important hai taki unforeseen market movements se bacha ja sake.

Yeh zaroori hai ke traders apne trading decisions ko confirm karne ke liye aur bhi factors ka tajziya karein, jese ke trendlines, support aur resistance levels, aur dusre technical indicators. Trading mein sabr aur analysis ke sath istemal karna zaroori hai.

- CL

- Mentions 0

-

سا0 like

-

#8 Collapse

What is black Hollow candlestick pattern

Black Hollow Candlestick" ek technical analysis term hai, jo Japanese candlestick charts mein istemal hoti hai. Candlestick patterns market sentiment aur price action ke changes ko identify karne mein madad karti hain. Black Hollow Candlestick ek specific type ka candlestick hai, jo bearish (girawat) price movement ko represent karta hai.

Black Hollow Candlestick ka appearance kuch is tarah hota hai:- Open Price: Open price black hollow candlestick ke upper side par hoti hai.

- Close Price: Close price black hollow candlestick ke lower side par hoti hai.

- Body: Candlestick ka body black color ka hota hai, lekin iski interior ya middle portion hollow (khali) hoti hai, iska matlab hai ki open price aur close price ke beech ka area khali hota hai.

- Upper Shadow: Upper shadow kam ya zero hoti hai, kyun ki open price upper side par hoti hai.

- Lower Shadow: Lower shadow hoti hai, jo close price se niche extend hoti hai.

Black Hollow Candlestick bearish reversal ya bearish continuation ko indicate kar sakta hai, lekin iske signals ko confirm karne ke liye doosre technical indicators aur price action analysis ki zarurat hoti hai. Ye pattern market mein bearish pressure ya selling interest ko darust kar sakta hai.Traders candlestick patterns ka istemal karte hain taaki wo price movements ko predict kar sake aur trading decisions mein madad le sakein. Hamesha yaad rahe ke ek hi pattern par pura bharosa na karein, aur use doosre technical tools ke saath milakar dekhein taki aapko ek holistic view mile.

-

#9 Collapse

Black hallow candlestick pattern

"Black Hollow Candlestick Pattern" technical analysis mein ek makhsoos candlestick pattern hai, jo ke traders aur analysts istemal karte hain forex aur stock markets mein. Ye pattern bearish reversals ko darust karta hai, yaani ke uptrend ke baad market mein girawat hone ki sambhavna ko indicate karta hai.

Is pattern ka tajaweez is tareeqe se hota hai ke candlestick ki body mein aik hollow (khula hua) area hota hai, jiska matlab hai ke opening aur closing prices mein koi significant difference nahi hota, lekin woh chhota sa gap ya space ho sakta hai. Ye pattern doosre technical indicators ke saath mila kar istemal hota hai aur traders ko potential price reversals ke liye advance warning deta hai.

Yahan Black Hollow Candlestick Pattern ke kuch key features hain:- Hollow Body:

- Is pattern ka sabse ahem pehlu hai ke candlestick ki body khuli hoti hai, jismein opening aur closing prices mein kam ya koi bhi farq nahi hota. Iske andar aik chhota sa gap ho sakta hai.

- Color:

- Is pattern ko visual representation ke liye kala ya dark color diya jata hai, jo ke bearish sentiment ko darust karta hai.

- Volume:

- Trading volume ko bhi observe kiya jata hai, kyunki agar ye pattern high volume ke saath aata hai, toh uski authenticity aur bhi barh jati hai.

- Previous Trend:

- Black Hollow Candlestick Pattern ka mool mantra hota hai ke ye uptrend ke baad aata hai, aur iska appearance downtrend ki shuruaat ko indicate kar sakta hai.

Black Hollow Candlestick Pattern ka istemal karne ke liye traders ko ye samajhna zaroori hai ke ye ek piece of information hai, aur doosre technical indicators aur market analysis tools ke saath mila kar istemal karna chahiye. Trading decisions lene se pehle, market conditions aur risk tolerance ko mad e nazar rakhte hue prudent analysis ki zarurat hoti hai. Hamesha yaad rahe ke market mein risk hota hai, isliye risk management principles ko bhi dhyan mein rakhna bahut zaroori hai.

- Hollow Body:

-

#10 Collapse

Black hallow candlestick pattern

"Black Hollow Candlestick Pattern" ek candlestick pattern hai jo market charts par dikhai deta hai. Yeh pattern typically bearish reversal pattern ke roop mein aata hai aur indicate karta hai ke current uptrend weak ho sakta hai ya phir reversal hone ke chances hain. Is pattern ko samajhne ke liye, aapko candlestick charts aur basic candlestick analysis ki samajh honi chahiye.

Black Hollow Candlestick Pattern Ki Pehchan:

Black Hollow Candlestick Pattern ka formation kuch aise hota hai:- Pehla Candle (Bullish):

- Pehla candle ek strong bullish (upward) candle hota hai jo existing uptrend ko confirm karta hai.

- Is candle ki opening price low ke bohot qareeb hoti hai aur closing price high ke bohot qareeb hoti hai.

- Doosra Candle (Black Hollow):

- Doosra candle bearish (downward) hota hai aur pehle wale bullish candle ke andar hota hai.

- Is bearish candle ki opening price pehle bullish candle ki opening price ke bohot qareeb hoti hai.

- Closing price bhi pehle bullish candle ki closing price ke bohot qareeb hoti hai.

- Is candle ka body chhota hota hai aur iske andar ek hollow area hota hai, jo ke pehle bullish candle ke body ke andar fit hota hai.

Black Hollow Candlestick Pattern Ka Maqsad:

Black Hollow Candlestick Pattern ka maqsad hai indicate karna ke uptrend mein weakness aa sakti hai ya phir bearish reversal hone ke chances hain. Is pattern ke appearance ke baad, traders ko ye lagta hai ke buyers ke control mein kamzori aa gayi hai.

Trading Signals:- Weakness in Uptrend:

- Black Hollow Candlestick Pattern uptrend mein weakness ko dikhata hai, lekin ye confirmation signal nahi hai.

- Traders is pattern ko dekhte hain takay wo market ko aur closely monitor karen aur confirmatory signals ka intezar karen.

- Volume Analysis:

- Trading signals ko confirm karne ke liye, traders ko volume analysis bhi karna chahiye.

- Agar Black Hollow Candlestick Pattern ke sath high volume dikhai de rahi hai, to ye indicate karta hai ke selling pressure strong ho sakti hai.

Savdhaan:- Candlestick patterns ka istemal karte waqt hamesha market conditions aur doosre technical indicators ko madde nazar rakhein.

- Ek hi pattern par pura bharosa na karein, hamesha confirmatory signals ka intezar karein.

- Risk management ko madde nazar rakhein aur stop-loss orders ka istemal karein.

Black Hollow Candlestick Pattern ke appearance ke baad, traders ko market ke potential changes ke liye alert rehna chahiye aur confirmatory signals ka wait karna chahiye. Is pattern ka istemal ek holistic trading approach ke tahat kiya jana chahiye. - Pehla Candle (Bullish):

-

#11 Collapse

Black Hallow Candlestick Pattern

Black Hallow Candlestick Pattern: Ek Tafseeli Jaiza

Candlestick patterns, jinhe technical analysis mein istemal kiya jata hai, market trends aur price movements ko samajhne mein madadgar sabit ho sakte hain. Black Hallow Candlestick Pattern ek aisa pattern hai jo traders ko bearish market conditions ke bare mein malumat farahem karta hai. Is pattern ki pehchan, candlestick charts par chandni ki mombatti ki tarah dikhaye gaye specific candles se hoti hai. Is article mein, hum Black Hallow Candlestick Pattern ke tafseelat par ghor karenge aur samjhenge ke ye kis tarah se market analysis mein istemal hota hai.

Black Hallow Candlestick Pattern Kya Hai?

Black Hallow Candlestick Pattern, ek bearish reversal pattern hai jo market ke trend ko indicate karta hai. Is pattern ka sabse ahem pehlu hai ke isme do alag alag candles ko shamil kiya jata hai. Pehli candle bullish hoti hai, jo ke uptrend ko represent karti hai, aur doosri candle bearish hoti hai, jo ke trend reversal ko darust karti hai.

Black Hallow Candlestick Pattern Ki Pechan:

Black Hallow Candlestick Pattern ko pehchanne ke liye, aapko do mukhtalif candles par tawajjuh deni hogi:- Pehli Candle (Bullish): Pehla candle jo ke uptrend ko darust karta hai, lamba hota hai aur zyadatar green ya white color ka hota hai.

- Doosri Candle (Bearish): Doosra candle jo ke trend reversal ko darust karta hai, chota hota hai aur black color ka hota hai. Is candle mein pehle candle ki opening price ke qareeb open hota hai, lekin iski closing price pehli candle ki body ke andar hoti hai.

- Khaas Baatien: Is pattern ki pehchan ke liye, doosre candle ki body ke andar hone wali closing price ke qareeb hone wala gap bhi madadgar hota hai. Agar ye gap pehli candle ki body ke oopar hota hai, to iska matlub hai ke trend reversal hone ke imkanat zyada hain.

Black Hallow Candlestick Pattern Ka Istemal:

Black Hallow Candlestick Pattern ka istemal market ke trend reversal ko predict karne mein hota hai. Is pattern ko samajh kar traders apne trading strategies ko improve kar sakte hain. Yahan kuch tajaweez hain ke kis tarah se aap is pattern ka faida utha sakte hain:- Sell Signals: Jab aap Black Hallow Candlestick Pattern dekhte hain, to iska matlub hai ke market mein bearish reversal hone ke chances hain. Aap is signal ko istemal karke apne positions ko sell kar sakte hain ya short positions enter kar sakte hain.

- Stop Loss Placement: Agar aap pehle bullish trend mein hain aur Black Hallow Candlestick Pattern aata hai, to aap apne stop loss orders ko adjust kar sakte hain. Isse aap apne nuksanat ko kam kar sakte hain agar market mein trend reversal hota hai.

- Confirmation Ke Liye: Black Hallow Candlestick Pattern ko dusre technical indicators ke sath istemal karke aap apne trading decisions ko aur bhi mazboot bana sakte hain. Is pattern ko confirm karne ke liye aap RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence) jaise tools ka istemal kar sakte hain.

Khud Ko Mehfooz Rakhne Ke Liye Sawalat:- Kya Black Hallow Candlestick Pattern Har Bar Sahi Hota Hai?

Black Hallow Candlestick Pattern sirf ek indicator hai aur iski 100% guarantee nahi hoti. Isliye, is pattern ko dusre technical analysis tools ke sath mila kar istemal karna zaruri hai. - Kab Ye Pattern Asar Andaz Hota Hai?

Is pattern ka asar market conditions par mabni hota hai. Kabhi-kabhi ye pattern strong signals deta hai, jabke kabhi iski tawajjuh kam hoti hai. Isliye, market ki overall health ko bhi madde nazar rakhte hue iska istemal karna chahiye. - Kis Time Frame Par Black Hallow Candlestick Pattern Ka Istemal Behtar Hai?

Is pattern ko har time frame par istemal kiya ja sakta hai, lekin zyadatar traders daily charts par is par tawajjuh dete hain. Daily charts par iska istemal karne se aapko long-term trends ke baray mein behtar malumat milti hai.

Ikhtitam:

Black Hallow Candlestick Pattern ek ahem tool hai jo traders ko market trends aur reversals ke bare mein malumat farahem karta hai. Is pattern ko samajhna aur sahi taur par istemal karna, ek mahir trader banne ke liye zaruri hai. Yeh yaad rahna chahiye ke har ek indicator ki tarah, Black Hallow Candlestick Pattern bhi akela hi nahi kaam karta, balki ise dusre technical tools ke sath istemal karke behtar taur par samajha jana chahiye. Trading mein kamiyabi hasil karne ke liye, hamesha apne risk ko manage karna aur market conditions ko dhyan mein rakhna zaruri hai.

-

#12 Collapse

Black hallow candlestick pattern

"Black Hollow Candlestick" pattern ek candlestick chart pattern hai jo technical analysis mein istemal hota hai. Ye pattern bearish reversal ko indicate karta hai aur downtrend ke baad aane wale possible bullish movement ko darust karnay ki koshish karta hai. Is pattern ko dekhte hue traders market mein hone wale trend changes ka andaza lagate hain.

Black Hollow Candlestick Pattern Ki Tafsilaat:- Appearance:

- Black Hollow Candlestick pattern, jise kuch log "Black Piercing" bhi kehte hain, ek do candlestick pattern hai. Iska pehla candle bearish hota hai (downward movement), aur dusra candle ise cover karta hai lekin bullish hota hai (upward movement).

- Characteristics:

- Pehle candle ka open price pehle day ki closing price se nicha hota hai.

- Pehle candle ka close price pehle day ki opening price se nicha hota hai.

- Dusra candle pehle day ke close price ke above open hota hai aur market mein upward movement hota hai.

- Significance:

- Jab Black Hollow Candlestick pattern ban jata hai, to yeh indicate karta hai ke market mein bearish trend ke baad bulls ka aana shuru ho sakta hai. Dusra candle pehle candle ko partially cover karta hai, jise traders bullish reversal ka signal samajh sakte hain.

- Volume ki Tawajjuh:

- Is pattern ke breakout ke waqt, traders volume ki bhi tawajjuh dete hain. Agar breakout volume ke sath hota hai, to yeh indicate karta hai ke trend reversal strong ho sakta hai.

Kaise Kaam Karta Hai:- Downtrend Ke Baad:

- Black Hollow Candlestick pattern typically downtrend ke baad aata hai. Yani ke pehle market mein sellers ka control hota hai, lekin jab yeh pattern ban jata hai, to iska matlab hai ke buyers market mein strong ho rahe hain.

- Trend Reversal Indicator:

- Black Hollow Candlestick pattern bearish trend ko indicate karta hai aur traders ko yeh batata hai ke ab market mein possible trend reversal ho sakta hai. Is pattern ke baad market mein bullish movement ki ummed hoti hai.

- Confirmation Ki Zarurat:

- Hamesha yaad rahe ke kisi bhi pattern ko confirm karne ke liye doosre technical indicators aur factors ki bhi tawajjuh deni chahiye. Ek single pattern par pura bharosa na karein.

Black Hollow Candlestick pattern ek important bearish reversal indicator hai, lekin isay confirm karne ke liye doosre technical tools aur market analysis ki zarurat hoti hai. Market mein hone wale reversals aur trend changes ko samajhne ke liye traders ko mawafiq tajaweezat aur risk management ke sath kaam karna chahiye.

- Appearance:

-

#13 Collapse

Black hallow candlestick pattern ek technical analysis tool hai jo market trends ko samajhne aur price movements ke patterns ko predict karne mein istemal hota hai. Yeh pattern candlestick charts par dekha ja sakta hai aur traders ko potential price reversals ki indication deta hai. Is pattern ko samajhna aur istemal karna traders ke liye zaroori hai taake woh market movements ko samajh sakein aur sahi waqt par trading decisions le sakein.

Black Hallow Candlestick Pattern Ki Tafseel

Black hallow candlestick pattern ek bearish reversal pattern hai jo uptrend ke baad market ko indicate karta hai. Yeh pattern do alag alag candlesticks se banta hai jo ke kisi specific sequence mein appear hotay hain:

Pehla Candlestick- Pehla candlestick ek uptrend ke dauran hota hai.

- Is candlestick ka body bara hota hai jo ke bullish movement ko indicate karta hai.

- Pehla candlestick ke open aur close ke darmiyan ki range long hoti hai.

Doosra Candlestick- Doosra candlestick pehle candlestick ke upar open hota hai, lekin iski closing pehli candlestick ke andar hoti hai.

- Iski body pehli candlestick ke andar hoti hai.

- Doosri candlestick ki range pehli candlestick ki range ke andar hoti hai.

Volume- Volume ko bhi dhyan mein rakha jata hai jab black hallow candlestick pattern ko analyze kiya jata hai. Agar volume pehli candlestick mein ziada hai aur doosri candlestick mein kam hai, to yeh pattern strong hota hai.

Black Hallow Candlestick Pattern Ka Matlab

Black hallow candlestick pattern ko samajhna zaroori hai taake traders market ke direction ko samajh sakein aur sahi trading decisions le sakein. Is pattern ke appearance ka matlab hota hai ke market mein bearish reversal honay ka chance hai.

Black Hallow Candlestick Pattern Ke Istemal

Black hallow candlestick pattern ko istemal karne ke liye traders ko kuch cheezein dhyan mein rakhni chahiye:

Confirmatory Signals- Black hallow candlestick pattern ko confirm karne ke liye, traders ko doosri technical indicators aur patterns ka istemal karna chahiye jaise ke RSI, MACD, aur moving averages.

- Agar doosri indicators bhi bearish signals indicate kar rahe hain to black hallow candlestick pattern ki validity aur strength barh jati hai.

Stop Loss Aur Risk Management- Har trading strategy ke saath sahi risk management aur stop loss lagana zaroori hai.

- Agar black hallow candlestick pattern ke baad bearish reversal confirm hota hai, to traders ko apne positions ko protect karne ke liye stop loss lagana chahiye.

Price Action Analysis- Black hallow candlestick pattern ko analyze karte waqt, traders ko price action ka bhi dhyan rakhna chahiye.

- Agar pattern ke appearance ke saath saath koi significant price action bhi ho rahi hai, jaise ke support level break, to yeh pattern aur bhi reliable ho jata hai.

Hallow Candlestick Pattern Ke Limitations

Black hallow candlestick pattern ke istemal mein kuch limitations bhi hain jo traders ko samajhna zaroori hai:

False Signals- Jaise ke har technical indicator aur pattern, black hallow candlestick pattern bhi false signals generate kar sakta hai.

- Isliye, traders ko doosri confirmatory signals aur indicators ka istemal karna chahiye pattern ki validity ko confirm karne ke liye.

Market Conditions- Market conditions aur volatility bhi black hallow candlestick pattern ke effectiveness ko influence kar sakte hain.

- Choppy ya sideways markets mein yeh pattern kam effective hota hai compared to trending markets mein.

Risk Management- Black hallow candlestick pattern ka istemal karne se pehle, traders ko apni risk management strategy ko samajhna zaroori hai.

- Bina sahi risk management ke, pattern ke istemal se trading losses ka risk barh jata hai.

-

#14 Collapse

**Black Hollow Candlestick Pattern: Forex Trading Mein Iski Ahmiyat**

Forex trading aur technical analysis mein, candlestick patterns market ke price movements aur potential trend reversals ko samajhne mein madadgar hote hain. In patterns mein se ek ahem pattern jo traders ko market ke bearish signals provide karta hai, woh hai Black Hollow Candlestick Pattern. Yeh pattern market ke trend changes aur trading opportunities ko identify karne mein badi ahmiyat rakhta hai. Aaj hum Black Hollow Candlestick Pattern ko detail mein samjhenge aur dekhenge ke yeh forex trading mein kis tarah se use hota hai.

**Black Hollow Candlestick Pattern Kya Hai?**

Black Hollow Candlestick Pattern ek candlestick formation hai jisme ek candlestick ka body hollow ya empty hota hai. Yeh pattern market ke bearish signals ko indicate karta hai aur potential trend reversals ko highlight karta hai. Is pattern mein body ka color generally white ya green hota hai, aur iska hollow nature price ke previous closing aur opening prices ke beech ka difference dikhata hai.

**Pattern Ki Pehchaan:**

1. **Candlestick Structure:**

Black Hollow Candlestick Pattern ek single candlestick se milkar banta hai jiska body hollow hota hai. Iska body previous closing price aur current opening price ke beech ke distance ko dikhata hai. Agar candlestick ka body hollow hai, to yeh indicate karta hai ke market ke sellers ka dominance increase ho raha hai.

2. **Formation:**

Black Hollow Candlestick tab develop hota hai jab price previous closing price se niche open hoti hai aur closing price bhi previous closing price se kam hoti hai. Yeh pattern market ke bearish trend ko signal karta hai aur potential selling opportunities ko indicate karta hai.

3. **Signal:**

Black Hollow Candlestick Pattern ek bearish signal provide karta hai. Jab yeh pattern uptrend ke dauran develop hota hai, to yeh indicate karta hai ke market mein buying pressure kam ho raha hai aur sellers ka control increase ho raha hai. Isse traders ko potential sell signals milte hain.

**Trading Strategy:**

Black Hollow Candlestick Pattern ko trading strategies mein incorporate karte waqt traders ko kuch key points ko consider karna chahiye:

1. **Confirmation:**

Pattern ke formation ke baad trend reversal ka confirmation zaroori hai. Traders ko is pattern ke saath additional technical indicators, price action, aur volume analysis ka use karke signal ko validate karna chahiye.

2. **Support aur Resistance Levels:**

Pattern ke signals ko support aur resistance levels ke context mein analyze karna zaroori hai. Agar Black Hollow Candlestick pattern resistance level ke paas develop hota hai, to yeh bearish signal ko aur strengthen karta hai.

3. **Risk Management:**

Trading decisions ko validate karne ke liye risk management practices ka implementation zaroori hai. Stop-loss aur target levels ko define karke trading risks ko manage kiya ja sakta hai.

**Example:**

Agar EUR/USD currency pair ke chart par Black Hollow Candlestick Pattern develop hota hai ek strong uptrend ke dauran, to yeh bearish reversal ka signal ho sakta hai. Traders is pattern ko dekh kar sell positions consider kar sakte hain aur market ke downward movement se faida utha sakte hain.

**Conclusion:**

Black Hollow Candlestick Pattern forex trading mein ek valuable tool hai jo market ke potential bearish reversals ko identify karne mein madad karta hai. Is pattern ko samajhkar aur effectively use karke, traders market trends aur trading opportunities ko better predict kar sakte hain. Hamesha yaad rahe ke technical analysis aur risk management practices ko follow karna zaroori hai taake trading decisions ko optimize kiya ja sake.

- CL

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

### Black Hallow Candlestick Pattern

Black Hallow Candlestick Pattern forex trading ki ek ahem pattern hai jo bearish trends ki indication karti hai. Is pattern ko samajhna aur pehchanna traders ke liye zaroori hai, taake woh market ke changes ko timely identify kar sakein aur apni trading strategies ko accordingly adjust kar sakein.

Black Hallow pattern ek specific candlestick formation hota hai jisme ek candle ka body black ya filled hota hai aur uski upper aur lower wicks hoti hain. Iska matlab ye hai ke closing price opening price se niche hoti hai, aur is pattern mein shadow ya wick bhi dekha ja sakta hai jo ki price movement ko indicate karti hai. Black Hallow pattern ko bearish reversal signal ke tor par dekha jata hai, jo ke traders ko market ke niche jane ka signal deta hai.

Pattern ke formation ke liye kuch specific conditions hain:

1. **Long Black Body**: Pehli condition ye hai ke candle ka body lamba aur filled hona chahiye. Ye market mein strong bearish pressure ko show karta hai.

2. **Upper and Lower Shadows**: Candle ke upar aur niche shadows honi chahiye jo ke price movement ko show karti hain.

3. **Following Candlestick**: Agar Black Hallow pattern ke baad ek bearish candle aati hai, to iska matlab ye hai ke trend continue ho sakta hai.

Traders is pattern ko market ke short-term aur long-term trends ko samajhne ke liye use karte hain. Jab ye pattern ban jaata hai to traders ko is baat ka dhyan rakhna chahiye ke bearish trend strong ho sakta hai aur iski basis par trading decisions lena chahiye.

Black Hallow pattern ko identify karte waqt traders ko kuch additional tools aur indicators bhi use karne chahiye jese ke moving averages ya RSI (Relative Strength Index) taake pattern ki confirmation mil sake aur false signals se bacha ja sake. Is pattern ko alone nahi, balki other technical indicators ke saath combine karke use karna zyada effective hota hai.

In conclusion, Black Hallow Candlestick Pattern forex trading mein bearish trends ko identify karne aur trading decisions lene ke liye ek useful tool hai. Is pattern ko samajhna aur effectively use karna traders ke liye market me success paane mein madadgar ho sakta hai. Trading strategies ko is pattern ke saath align karke aur accurate analysis karke better trading results hasil kiye ja sakte hain.

- CL

- Mentions 0

-

سا0 like

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:10 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим