What's the Multi-time Frame Analysis

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Multi-time Frame Analysis

Forex trading mein multi-time frame analysis ka istemal karna aham hai. Yeh tabadayi taur par aapko market ki mukhtalif time frames par nazar rakhne ki anumati deta hai taake aap sahi trading decisions le saken. Har time frame apne apne signals aur trends ke liye maqsoos hota hai. Sab se choti time frame, jise ham short-term kehte hain, aapko current market ki details deta hai. Ismein price ki choti si movement hoti hai, jo ke aapko immediate trading opportunities provide kar sakti hai. Multi-time frame analysis ka istemal karke traders apne forex trading strategies ko mazeed mazbooti aur nuqsan se bachane ke liye optimize kar sakte hain. Jab aap mukhtalif time frames, jese ke short-term aur long-term, par nazar daal kar market ki tafseelat ko samajhte hain, to aapko behtar insight milti hai. Choti time frames, masalan 15-minute ya 1-hour charts, aapko market ki taqat aur jald-baazi ko dikhate hain. In par nazar rakh kar, aap short-term trends aur entry/exit points ka pata laga sakte hain. Barabar mein, lambi time frames, jese ke daily ya weekly charts, aapko overall market trend ko dekhnay mein madad karte hain. Isse aap major trends aur badi movements ko samajh sakte hain, jo long-term investment ke liye important hote hain. Yeh approach traders ko nuqsan se bachane mein madad deta hai, kyun ke short-term fluctuations par focus karke long-term trends ko ignore nahi karta. Multi-time frame analysis se aap apni trading decisions ko solidify kar sakte hain, kyunki aap poora picture dekhte hain aur market ke mukhtalif facets ko samajhte hain. Dusri taraf, lambi time frame, ya long-term, aapko overall market trend aur badi movement ko dekhne mein madad karta hai. Ismein market ke macro trends aur major reversals nazar aate hain. Jab aap in mukhtalif time frames ko aapas mein combine karte hain, to aapko ek comprehensive picture milti hai. Short-term aur long-term trends ko dekhte waqt aapko sahi entry aur exit points ka pata chalta hai. Maqami aur lambe time frames ka aapas mein ta'alluqat dekhte waqt, aapko false signals kam milte hain aur aapki analysis zyada reliable hoti hai. Yeh tajaweez deti hai ke aap market ki asliyat ko samajh sakein. In conclusion, forex trading mein multi-time frame analysis se aap apni trading strategy ko refine kar sakte hain aur market ke mukhtalif pahluon ko samajh sakte hain, jo ke aapki trading success mein madadgar sabit ho sakta hai.

-

#3 Collapse

Multi-time Frame Analysis (MTFA) ek bohot hi powerful aur effective technique hai jo trading mein bohot zaroori hoti hai. MTFA ka matlab hai ek hi asset ya security ko alag-alag time frames par analyze karna taake trading decisions ko aur behtar banaya ja sake. Trading ke complex world mein, MTFA se trader ko ye samajhne mein madad milti hai ke market kis direction mein ja raha hai aur kaunse levels important hain.

Multi-time Frame Analysis ka Maqsad

MTFA ka basic maqsad yeh hota hai ke ek comprehensive view mil sake. Yeh approach different perspectives offer karti hai:- Higher Time Frames: Yeh long-term trends ko identify karte hain. In time frames ko use karke aapko yeh pata chalta hai ke market ki overall direction kya hai. Yeh long-term trends slow-moving hote hain lekin inka impact zyada hota hai.

- Medium Time Frames: Yeh medium-term trends ko identify karte hain. Inko use karke aapko short-term aur long-term trends ke beech ka connection samajh aata hai.

- Lower Time Frames: Yeh short-term trends aur price movements ko identify karte hain. Yeh short-term entries aur exits ke liye kaam aate hain.

- Comprehensive View: MTFA se trader ko market ka ek comprehensive view milta hai. Alag-alag time frames par analysis karke trader ko yeh samajh aata hai ke price kis direction mein move kar raha hai.

- Risk Management: MTFA risk management mein bhi madadgar hai. Agar ek higher time frame pe bullish trend hai lekin lower time frame pe bearish signal hai to yeh risk management mein help karta hai.

- Confirmation: Different time frames ko analyze karke trader ko signals ko confirm karne mein help milti hai. Agar ek hi direction ka signal multiple time frames pe milta hai to trade execute karne ka confidence barhta hai.

- Entry and Exit Points: MTFA entry aur exit points ko behtar banata hai. Higher time frames trend direction ko identify karte hain jab ke lower time frames entry aur exit points ko precise banate hain.

MTFA karne ka ek structured tarika hota hai jismein aap different time frames ka use karte hain:

Step 1: Higher Time Frame ko Analyze karna

Sab se pehle aap higher time frame ko analyze karte hain. Iska maqsad long-term trend ko identify karna hota hai. Higher time frame pe aapko trend direction, key support aur resistance levels ko identify karna hota hai.

Example: Agar aap daily chart dekh rahe hain, to aapko dekhna chahiye ke overall trend kya hai. Kya price higher highs aur higher lows bana raha hai ya lower highs aur lower lows bana raha hai?

Step 2: Medium Time Frame ko Analyze karna

Higher time frame analyze karne ke baad, medium time frame ko analyze karna hota hai. Yeh aapko short-term aur long-term trends ke beech ka connection samajhne mein madad karta hai. Medium time frame pe aapko trend continuation aur potential reversal points ko identify karna hota hai.

Example: Agar aap daily chart ko higher time frame ke tor pe use kar rahe hain, to aap 4-hour chart ko medium time frame ke tor pe use kar sakte hain. Aapko dekhna chahiye ke kya 4-hour chart daily chart ke trend ko confirm kar raha hai.

Step 3: Lower Time Frame ko Analyze karna

Last step mein aap lower time frame ko analyze karte hain. Lower time frame aapko precise entry aur exit points ko identify karne mein madad karta hai. Lower time frame pe aapko intraday price movements aur short-term trends ko analyze karna hota hai.

Example: Agar aap daily chart ko higher time frame aur 4-hour chart ko medium time frame ke tor pe use kar rahe hain, to aap 15-minute chart ko lower time

frame ke tor pe use kar sakte hain. Is pe aapko precise entry aur exit points dekhne chahiye.

Tools aur Indicators for MTFA

MTFA mein kaafi tools aur indicators use hote hain jo different time frames pe apply kiye ja sakte hain:- Moving Averages: Yeh different time frames pe trend direction ko identify karte hain. Higher time frame pe longer period moving average aur lower time frame pe shorter period moving average use ki ja sakti hain.

- Trend Lines: Trend lines se aap key support aur resistance levels ko identify kar sakte hain. Higher time frame pe drawn trend lines lower time frame pe bhi kaam aati hain.

- Fibonacci Retracement: Yeh tool key levels ko identify karne mein madad karta hai. Different time frames pe Fibonacci retracement levels ko draw karke key levels ko identify kiya ja sakta hai.

- Oscillators: RSI, MACD jaise oscillators different time frames pe trend strength aur reversal points ko identify karte hain.

- Candlestick Patterns: Candlestick patterns short-term price movements ko predict karne mein madadgar hote hain. Different time frames pe in patterns ko identify karke precise entry aur exit points ko define kiya ja sakta hai.

Aayiye ek practical example ke through MTFA ko samajhte hain. Assume karte hain ke aap EUR/USD pair trade kar rahe hain.

Higher Time Frame Analysis

Daily chart ko dekhte hain. Daily chart pe aapko pata chalta hai ke EUR/USD ek uptrend mein hai. Price consistently higher highs aur higher lows bana rahi hai. Aapne identify kiya ke 1.1800 ka level ek strong support hai aur 1.2100 ka level ek strong resistance hai.

Medium Time Frame Analysis

4-hour chart ko dekhte hain. 4-hour chart pe aapne dekha ke price 1.1900 se 1.2000 ke range mein consolidate kar rahi hai. Aapne dekha ke 1.1950 ka level ek key level hai jo short-term direction decide karega.

Lower Time Frame Analysis

15-minute chart ko dekhte hain. 15-minute chart pe aapne dekha ke price 1.1950 ke level pe approach kar rahi hai aur waha pe bullish candlestick pattern bana rahi hai. RSI bhi oversold region se nikal ke upwards move kar raha hai.

Trading Plan- Entry: 1.1950 pe bullish confirmation milne pe buy entry lete hain.

- Stop Loss: 1.1920 pe stop loss set karte hain jo ke recent swing low se thoda neeche hai.

- Target: 1.2050 pe first target set karte hain jo ke recent resistance level ke neeche hai. Second target 1.2100 pe set karte hain.

MTFA ek structured approach hai jo risk management aur trade confirmation mein bhi help karti hai. Different time frames ko use karke market trends aur key levels ko identify karna trading ko aur profitable aur less risky banata hai. Yad rakhein ke MTFA ek tool hai jo aapko trading decisions ko aur solid banane mein madad karta hai lekin trading mein hamesha risk management ko prioritize karna chahiye.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

- 1.0882 EURUSD

- Mentions 0

-

سا0 like

-

#4 Collapse

**Multi-time Frame Analysis Kya Hai?**

Trading aur investing ki duniya mein, ek effective strategy adopt karna bohot zaroori hai. Multi-time frame analysis (MTFA) ek aisi strategy hai jo traders aur investors ko market ko behtar samajhne aur achi trades karne mein madad deti hai. Aaj hum is post mein yeh janenge ke multi-time frame analysis kya hai aur isse kaise use kiya jata hai.

### Multi-time Frame Analysis ka Matlab

Multi-time frame analysis ek trading technique hai jismein ek asset ko mukhtalif time frames mein analyze kiya jata hai. Yeh traders ko market ka holistic view dene mein madad karta hai, jisse unko asset ke trend aur price movements ka behtar andaza hota hai. Aksar traders ek se zyada time frames ka use karte hain, jaise ke daily, hourly, aur minute charts.

### Multi-time Frame Analysis ke Faide

1. **Comprehensive Market View:** MTFA traders ko ek comprehensive market view provide karta hai. Alag alag time frames ka analysis karne se aapko pata chalta hai ke long-term aur short-term trends kya hain.

2. **Trend Confirmation:** Different time frames ko use karne se aap trend ko confirm kar sakte hain. Agar sab time frames ek hi direction mein hain, to aapke trade ke successful hone ke chances barh jate hain.

3. **Better Entry and Exit Points:** MTFA aapko better entry aur exit points identify karne mein madad karta hai. Short-term charts se aap ideal entry points dekh sakte hain, jabke long-term charts se exit points ka andaza hota hai.

4. **Risk Management:** MTFA se aap apne trades ka risk better manage kar sakte hain. Multiple time frames dekhne se aapko pata chal jata hai ke kab market volatile hai aur kab stable, jo aapke risk management plan ko improve karta hai.

### Kaise Karein Multi-time Frame Analysis

1. **Select Time Frames:** Pehle decide karein ke aap kin time frames ko use karenge. Common combination daily, hourly, aur 15-minute charts ka hota hai. Lekin yeh depend karta hai aapki trading style par.

2. **Analyze Long-Term Trend:** Pehle long-term chart (e.g. daily) ka analysis karein. Yeh aapko overall trend ke baare mein bataega. Long-term trend identify karna bohot zaroori hai.

3. **Check Intermediate Trend:** Intermediate time frame (e.g. hourly) par focus karein. Yeh aapko long-term trend ke within intermediate movements ka andaza dega.

4. **Look for Entry Points:** Short-term chart (e.g. 15-minute) ko analyze karein taake aapko ideal entry aur exit points mil sakein. Is se aapke trades zyada accurate ho jate hain.

### MTFA ka Asar

MTFA use karne se aap apne trades ko zyada precise aur profitable bana sakte hain. Yeh strategy aapko market ko different angles se dekhne ka moka deti hai, jo ke trading decisions ko improve karti hai. Lekin yaad rakhein ke MTFA bhi baqi strategies ki tarah foolproof nahi hai, aur isme bhi losses ho sakte hain. Isliye apni risk management strategies ko hamesha follow karein.

### Conclusion

Multi-time frame analysis ek powerful tool hai jo traders aur investors ko market ko behtar samajhne aur profitable trades karne mein madad deta hai. Alag alag time frames ko dekhne se aapko market ka holistic view milta hai, jo ke aapke trading decisions ko improve karta hai. Is strategy ko samajhna aur effectively use karna aapke trading success ke chances ko barhata hai.

-

#5 Collapse

**What's the Multi-time Frame Analysis**

Multi-time frame analysis ek ahem technique hai jo traders ko forex market mein behter faisle lene mein madad deti hai. Is technique ka maqsad market ko mukhtalif time frames par dekhna hota hai, taake trader ko puri tasweer samajh mein aaye aur woh sahi waqt par entry aur exit kar sake.

### Multi-time Frame Analysis ka Matlab

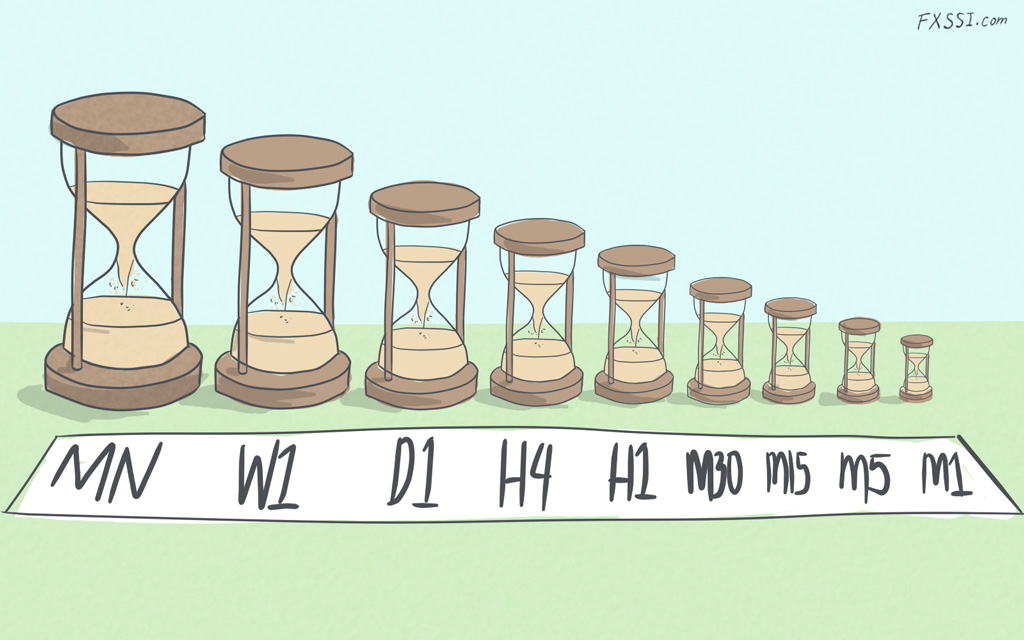

Multi-time frame analysis ka matlab hai ke aap ek currency pair ko ek se zyada time frames par analyse karte hain. Yeh time frames alag alag time periods ko represent karte hain, jaise ke 1-minute, 5-minute, 1-hour, daily, weekly, etc. Har time frame par market ki movement aur trends alag ho sakte hain, is liye unhein samajhna bohot zaroori hai.

### Kaise Kaam Karta Hai?

Aam tor par traders teen mukhtalif time frames ka istemal karte hain: higher time frame, intermediate time frame, aur lower time frame.

1. **Higher Time Frame (e.g., Daily):** Yeh time frame major trend ko identify karne mein madad karta hai. Is par dekh kar aapko pata chalega ke market kis direction mein ja rahi hai, taake aap apni trading ke liye basic trend ke sath chal sakein.

2. **Intermediate Time Frame (e.g., 4-hour):** Yeh time frame aapko trend ke andar ke chote trends ko samajhne mein madad deta hai. Is se aapko pata chalta hai ke market kis halat mein hai, jaise ke pullbacks ya consolidations.

3. **Lower Time Frame (e.g., 1-hour):** Is time frame ka istemal entry aur exit points ko determine karne ke liye hota hai. Is se aapko woh specific point milta hai jahan par aap trade kar sakte hain.

### Multi-time Frame Analysis ke Fayde

1. **Bari Tasveer:** Yeh aapko market ki bari tasveer dekhta hai, jis se aap trends aur patterns ko asani se samajh sakte hain.

2. **Risk Management:** Multi-time frame analysis aapko behter risk management mein madad deta hai, kyunki aap entry aur exit ke liye behter levels identify kar sakte hain.

3. **Improved Timing:** Aapko trade enter aur exit karne ka sahi waqt milta hai, jo ke profitabiltiy ko improve kar sakta hai.

4. **Flexibility:** Yeh technique aapko mukhtalif market conditions mein flexible banati hai, jise aap kisi bhi halat mein adjust kar sakte hain.

### Kya Khayal Rakhna Chahiye?

1. **Over-analysis:** Kabhi kabhi zyada analysis aapko confuse bhi kar sakti hai, is liye sirf wo time frames select karein jo aapke trading strategy ke liye relevant hain.

2. **Patience:** Yeh ek slow process ho sakta hai, is liye sabar se kaam lein aur impulsive decisions na lein.

### Conclusion

Multi-time frame analysis ek powerful tool hai jo aapko forex trading mein behter decision making aur risk management mein madad de sakta hai. Is se aap market ko mukhtalif angles se dekh kar, apni trading strategy ko aur bhi effective bana sakte hain. Agar aap is technique ko sahi tareeke se istemal karein, toh yeh aapko consistent success dilane mein madadgar sabit ho sakti hai. -

#6 Collapse

Multi-Time Frame Analysis: Ek Mukhtasir Jaiza

Muqaddama

Forex trading mein multi-time frame analysis ek important technique hai jo traders ko market trends aur trading opportunities ko behtar samajhne mein madad deti hai. Ye approach different time frames ko analyze karne par mabni hoti hai taake market ka comprehensive view mil sake. Is article mein hum multi-time frame analysis ko briefly explain karenge aur iske benefits aur istimaal ka tareeqa samjhenge.

Multi-Time Frame Analysis Kya Hai?

Multi-time frame analysis ka matlab hai ke ek hi asset ya currency pair ko mukhtalif time frames par analyze karna. Ye time frames short-term, medium-term aur long-term ho sakte hain. Is technique ka maqsad market ke different perspectives ko dekhna aur trading decisions ki accuracy ko barhana hota hai.

Common Time Frames- Short-Term Time Frames: Short-term time frames typically 1-minute, 5-minute, aur 15-minute charts hote hain. Ye time frames intraday traders ke liye zyada useful hote hain jo short-term price movements ko capture karte hain.

- Medium-Term Time Frames: Medium-term time frames 1-hour, 4-hour, aur daily charts hote hain. Swing traders in time frames ko use karte hain taake unhein medium-term trends aur reversals ka pata chal sake.

- Long-Term Time Frames: Long-term time frames weekly aur monthly charts hote hain. Ye time frames position traders aur investors ke liye useful hote hain jo long-term trends aur market direction ko dekhte hain.

Multi-Time Frame Analysis Ka Istemaal- Trend Identification: Sabse pehla step trend ko identify karna hota hai. Long-term time frame par overall trend ko dekhte hain, phir medium-term aur short-term time frames par trend ka confirmation karte hain. Agar sab time frames par same direction ka trend nazar aaye, toh ye strong trend ka indication hota hai.

- Entry aur Exit Points: Multi-time frame analysis ke zariye aap accurate entry aur exit points identify kar sakte hain. Pehle long-term time frame par major support aur resistance levels ko dekhte hain, phir medium-term aur short-term time frames par precise entry aur exit points decide karte hain.

- Risk Management: Multi-time frame analysis risk management mein bhi madadgar hoti hai. Different time frames par stop loss aur take profit levels ko set karke aap apne risk ko effectively manage kar sakte hain.

Benefits of Multi-Time Frame Analysis- Comprehensive Market View: Multi-time frame analysis se aapko market ka comprehensive view milta hai, jo aapko different perspectives se market ko analyze karne ki facility deti hai.

- Improved Accuracy: Jab aap different time frames ko analyze karte hain, toh aapke trading decisions ki accuracy barh jati hai. Multiple confirmations se aapke trade signals zyada reliable ho jate hain.

- Better Risk Management: Multi-time frame analysis risk management mein madadgar hoti hai. Is approach se aapko different levels par stop loss aur take profit set karne mein asani hoti hai.

Conclusion

Multi-time frame analysis ek valuable technique hai jo Forex traders ko market trends aur potential trading opportunities ko behtar samajhne mein madad deti hai. Is approach ko effectively use karke aap apne trading decisions ki accuracy ko improve kar sakte hain aur apne risk ko efficiently manage kar sakte hain. Har trader ke liye zaroori hai ke wo multi-time frame analysis ko apni trading strategy mein shaamil kare taki wo market ke har angle ko dekh sake aur profitable trading decisions le sake.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

### Multi-Time Frame Analysis: Kya Hai Aur Kaise Istemal Karein?

Multi-Time Frame Analysis (MTFA) ek trading technique hai jo traders ko market ke different time frames ka analysis karne ki ijazat deti hai. Yeh approach traders ko zyada comprehensive view provide karti hai, jisse wo apne trading decisions ko behtar bana sakte hain.

#### MTFA Ka Concept

MTFA ka basic concept yeh hai ke aap ek hi asset ya market ko mukhtalif time frames par dekhte hain. Iska maqsad yeh hota hai ke chhoti aur badi time frames ke darmiyan correlation samjha ja sake. Aam tor par, traders ek longer time frame (jaise daily ya weekly) ko trend ke liye dekhte hain, jabke chhoti time frames (jaise hourly ya 15-minute) ka istemal entry aur exit points dhoondne ke liye karte hain.

#### Multi-Time Frame Analysis Ka Istemal

1. **Trend Identification**: Pehle aap larger time frame par trend ka pata lagate hain. Agar daily chart par market bullish hai, to aap choti time frames par long positions dhoondne ki koshish karte hain.

2. **Entry and Exit Points**: Jab aapko larger time frame par trend ka confirmation mil jata hai, to aap smaller time frames par precise entry aur exit points dhoondte hain. Yeh aapko zyada profitable trades karne mein madad karta hai.

3. **Risk Management**: MTFA aapko risk ko behtar manage karne mein bhi madadgar hota hai. Aap jab larger time frame par support ya resistance levels dekhte hain, to aap apne stop-loss aur take-profit levels ko accordingly set kar sakte hain.

#### Precautions

1. **Time Frame Consistency**: Har time frame ka apna trend aur characteristics hota hai. Aapko yeh ensure karna hoga ke aap jo analysis kar rahe hain wo consistent ho. Misal ke taur par, agar aap daily trend bullish dekh rahe hain, to aapko hourly charts par bhi bullish signals ki talash karni chahiye.

2. **Market Conditions**: MTFA ka istemal sirf tab karein jab market trending ho. Sideways markets mein yeh approach itna effective nahi hota.

3. **Avoid Overtrading**: Mukhtalif time frames ko dekhte waqt overtrading ka khayal rakhein. Har chhoti movement par trade karna aapko loss mein daal sakta hai.

### Conclusion

Multi-Time Frame Analysis ek valuable tool hai jo traders ko market ko samajhne aur trading decisions lene mein madad karta hai. Is technique ka sahi istemal karke aap apne trading results ko behtar bana sakte hain. Trading mein discipline aur consistency rakhein, aur MTFA ko apne trading strategy ka hissa banayein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:54 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим