Forex trading ka session aur inki overlapping....

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

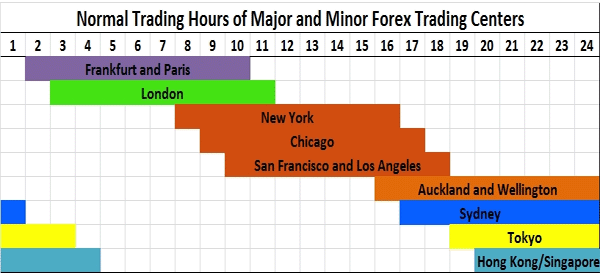

Introduction:- Aslam u alaikum, Dear forex member umeed karta hoon ap sab khairiyat se hoon gy dear members apka trading week bahut acha Jara hoga .Dear members ajki post main Forex market k trading session ko according to Pakistan time discuss krn r phir hmm is m overlapping talash krn.Trading sessions: Dear members forex aik aisii market h jis m 24 ghnty trade hotii h r is ki vja se isky trading session 4 hoty hn. Jo k neechy btay gay hn.1) US session (New York) 2) Asian session (Tokyo) 3) European session (London) 4) Sydney sessionOverlapping kiya hai? Dear members overlapping us time Jo kaha jata h jbb 2 sessions aik time m open hoty hn.for example new York session k end hony se kuch hours pehly Asian session open ho jata h isii trah 2 sessions m ikthy trade hotiii h r market m volatile hotii hjiski vja se achii trading hotii h.r aksr traders overlapping m hii trade krty hn. R is m Pakistan k time k mutabik 3 overlaps hoty hn. 1.new York and London overlap 2.london and Tokyo overlap 3.sydney and Tokyo overlap

In m 7 mostly trading currencies neechy btaii gaii hn. 1. US dollars 2. British pounds 3. Japanese yen 4. Euro 5. Canadian dollar 6. New Zealand dollar 7. Australian dollar Asian session: Tokyo market ka pehla session hota h trading ka r tkreeban total market ka 60% trade es session m hota h. BHT se traders is session m hi momentum k hisab se apni strategies btaty hn r trade krty hn. R iska time pak time k hisab se 11am 8am hota h. European session: Ye trading session tkreeban 34% trading ko cover krta h r is m kafii volatility hotii h q k es doran BHT trading volume hota h.r kafi banks is doran open hoty hn.iska tine 7am se 4pm tkk hotaradinUs trading session; Ye trading session tkreeban 16%trading Jo cover krrta h r tkreeban tmam trades us r Europe trades session ki overlap mhotii h r is m b kafiii volatility hotii h .r iska time afternoon to 8pm hota h.

Ap Ka aik thanks bohat zrori ha -

#3 Collapse

Assalamu Alaikum Dosto!

Forex Trading Sessions: Types Aur Features

Forex trading sessions ka schedule trader ko behtareen waqt ka tajwez dete hain. Mukhtalif sessions mein assets ki volatility badal jati hai: barh jati hai ya kam ho jati hai. Sab se zyada trading volume tab hoti hai jab mukhtalif platforms aur exchanges mukhtalif jughrafiai zones mein ek sath kaam karte hain. Traders trading sessions ke indicator ke zariye chart ko track karte hain - ek khaas technical analysis ka tool.

Aik trading session woh waqt hota hai jab market par tezi se trading hoti hai. Exchange haftay ke paanch dinon tak continuously kaam karta hai: jab aik jughrafiai zone mein kaam ka din khatam hota hai, aur activity slow ho jati hai, to doosre mein - aik naya din shuru hota hai, aur local platforms khulte hain. Is tarah, traders pooray haftay bhar kisi bhi waqt, kahin bhi duniya mein kaam kar sakte hain, haftay ke akhri do dinon aur duniya bhar ke holidays jaise Christmas, New Year, etc. ke ilawa. In dinon market band hota hai.

Agar aap M5-M15 time frame lete hain, to aap dekhein ge ke currency pair ki movement activity ke bursts aur almost complete decay ke sath hoti hai. Iski wajah yeh hai ke countries din mein 6 se 10 ghante tak trade karte hain. Phir ek country mein trading day khatam hota hai aur doosre time zone mein shuru hota hai.

Forex market mein ek khaas baat yeh hai ke har waqt, har muddat mein aisa koi jagah hoti hai jahan lagbhag tamam currency pairs trade hoti hain. Quotes sirf non-business days par tooti hain.

Market mein dakhilat karne ka faida hota hai jab exchange periods overlap hoti hain: aik session shuru ho gaya hai, jabke pichla khatam nahi hua. Is waqt market volatility barhti hai, aur traded assets ka volume maximum hota hai, jo ke behtareen taur par traders ke liye faidaymand hai. Unhe ye maloom hona chahiye ke unke liye interest wale exchanges kab khulte hain - trading sessions ka schedule.

Types Of Trading Sessions

Forex trading sessions ko location ke hisab se char major groups mein taqseem kiya gaya hai:- Asian

Pacific

American

European

Har ek ki apni khaas features hain aur doosron se wazeh farq hai.

Working Hours Of Trading Sessions

Forex par kamyaabi se kaam karne ke liye, ek trader ko trading sessions ke waqt ko mad e nazar rakhna zaroori hai. Session 21.00 GMT par Wellington, New Zealand ke platform se shuru hota hai. Yeh waqt aam taur par reference point ke tor par istemal hota hai taa ke mukhtalif regions mein session ke opening time ko ulajhaya na jaye.

Yeh waqt aksar brokers ke opening time hai. Kuch session ke start ke paanch minute baad khulte hain, aur doosre aik ghante baad: jis broker ke sath kaam karna chuna hai, us se maloomat hasil karen. Trades ke opening time ka asar non-working days ke gaps par hota hai, aur daily candle ko ek khaas shakal deta hai.

Haftay ke shuruwat mein keemat haftay ke akhri din se kafi mukhtalif ho sakti hai. Jab non-working days par events hote hain jo currencies ki movement par taasir daalte hain. Is waqt trading orders zyada dheere se execute hote hain. Iske alawa, jis waqt assets kharidte aur bechte hain, us waqt ke price difference (spreads) mein bohot farq ho sakta hai. Jab market mein volatility hoti hai, to in asoolon ko mad e nazar rakhein jab market par amal karte hain.

Client terminal mein trader zarurat ke mutabiq time set karta hai aur trading sessions ka schedule hasil karta hai.

Bas apne time zone ko specify karna kafi hai, aur program is parameter ko mad e nazar rakhte hue trading schedule ko reform kar degi. Is tarah, trader trading ki shuruat tay karta hai aur dekhta hai ke unke interest wale exchanges ki sites par sessions ka intersection kab hota hai, jab trading sab se active hoti hai.

Main Features Of Forex Trading Sessions

Ek professional trader ke liye ye zaroori hai ke usko sirf trading sessions ke waqt maloom ho, balki unke doosre se kaise farq hai. Har ek region apne jughrafiai ilaake ke events ka zyada strong jawab deta hai apne door ke economic factors ke mukable mein.

Common features:- Raat ke hours mein currency pairs ki dheemi harkatein.

- Din ke dauran fluctuations (volatility) mein izafah.

- Farq trading ki khaslaton mein hai: mashhoor currency pairs ke types, volatility, aur global economic aspects ke asar.

Asian Trading Session

Asian trading session Tokyo se shuru hoti hai. Yeh woh traders ke liye interesting hai jo duniya bhar ki currencies trade karte hain. Ye 00:00 GMT par shuru hota hai.

Tokyo floor ka ahemiyat:- Japan ka stock market region mein sab se bara hai.

- Mulq bohot si cheezein paida karta hai.

- Japanese economy United States markets ke saath mazbooti se juri hoti hai.

- U.S. dollar/yen currency pair is waqt active hota hai.

- China mein bhi floors kaam karti hain, lekin forex market ke liye ye khaas interesting nahi hote, kyun ke yuan exchange rate ko state strictly regulate karta hai.

- Chinese trades sirf gold market par asar dal sakti hain, jo ke wide range of volatility hai.

Dheere-dheere, doosre Asian exchanges judte hain; India, Thailand, Laos, aur doosre mulkon ki currencies trading mein shamil hoti hain.

Isi doran major currencies ki transactions bhi hoti hain. Agar kuch important hota hai, jo ke kam hota hai, toh assets mein tezi se strong movements hoti hain. Jab market kisi noticeable trend se bahir nazar aata hai, toh usually use Asian sites support karte hain.

Asian session ki khaasiyat hai ke market horizontal movement mein hota hai, yaani ke flat hota hai. Japanese Central Bank ki currency operations, mulk ke development ke baare mein malumat ka izhar, aur macroeconomics ke news volatility par asar dal sakte hain.

Raat ke dheere trading, jis par kam volatility hoti hai, woh ek khaas design ki gayi strategy hai jo un logon ko munafa pohanchati hai jo is tarah ke market movements ka adap karna seekh gaye hain. Trader ka maqsad hai ke Japanese currency ki jump ko ya to pehchanen ya phir gaps - non-working days aur working week ke shuruat ke currency prices mein farq - par strategy banayen.

European Trading Session

European trading session ki shuruat ko traders ke faal kaam ka aghaz samjha jata hai. Yeh session Frankfurt Stock Exchange ke khulte hi shuru hota hai, aur aik ghante baad London Stock Exchange – jo ke Europe ki main exchange hai – khulta hai. Dhire dhire, Europe ke traders trading mein shamil ho jate hain.

Aise bohot se instruments hain jin par trading ki ja sakti hai, is liye bohot se traders European session ka intezaar karte hain. Shuruat mein lagta hai ke opening ke baad quotes ki movement mein koi logic nahi hoti. Trend movement dheere dheere samne aata hai. Agar yeh nahi hota to market flat hoti hai, lekin iski range Asia se zyada hoti hai. Asian session ki activity 5 am se 9 pm GMT tak peak par hoti hai, jab European markets khule hote hain.

Experts do highs ko taqseem karte hain:- Jab London mein trading shuru hoti hai aur yeh Asian session ke khatam hone se milta hai.

- Jab European session band hoti hai aur yeh American session ke khulne se overlap hoti hai.

- Pehle case mein, traders European players ke behavior par decision lete hain aur trading potential estimate karte hain. Dusre case mein, Europeans apne

- American colleagues ke actions se mutasir hote hain.

Forex market ke experts ke mutabiq, European session sab se ahem hai. Trades with the British pound aur Swiss franc relevant ho jate hain. High volatility do teen ghante tak rehti hai, aur lunchtime ke doran yeh noticeably kam ho jati hai. European trading ki khaasiyat hai ke yahan high volatility, large volumes, aur tezi se price changes hoti hain.

London Stock Exchange 16:30 GMT par band hoti hai. Thodi der pehle, minute candles apni range mein sharp tabdeeli la deti hain. Agar aap candlesticks se trade karte hain to dhyan rahe ke yeh kuch minute market band hone se pehle change ho sakti hain.

American Trading Session

American trading session is lihaz se mukhtalif hai ke iska asar currency markets par kam hota hai: asal trading floors stocks aur commodities par mabni hoti hain.

Major trades American period ke pehle hisse mein hoti hain jab European session abhi khuli hoti hai. Iske baad assets slow ho jate hain: woh thoda fluctuate karte hain ya trend ke sath dheere dheere move karte hain.

Kyunki United States bohot se mulkon ke economies se jura hua hai, isliye American session mein sab key currency pairs trade hote hain. Inme se sab se mashhoor hain:- Euro – U.S. dollar

- Japanese yen – U.S. dollar

- Canadian dollar – U.S. dollar

Mukhtalif markets New York aur Chicago mein hain. Canadian exchanges ka bara role nahi hota, aur Latin American exchanges ka trading volume bohot kam hota hai, is liye unka forex mein koi hissa nahi hota.

Yeh maana jata hai ke American session aggressive aur unpredictable hai. United States ki subah ki statistics Europe ke afternoon par asar dalte hain, aur transactions ki tadad barh jati hai. Sab se zyada activity 16 se 19 ghante ke darmiyan hoti hai.

American session ke khatam hone ke aik ghante ke baad aam taur par market mein koi movement nahi hoti. Dhyan rakhein ke is waqt swaps ada kiye jate hain: jo currency pairs ke loans ke interest rates ke farq par mabni hoti hain. Open trades har din recalculated hote hain, aur har trade par swap ada hota hai. Aik baat dhyan mein rakhein ke Wednesday night triple rate accrue ke liye waqt hoti hai, kyun ke agle din exchange band hoti hai.

Pacific Trading Session

American session ke khatam hone ke baad, Pacific session khulti hai. Yeh 10 pm se 7 am tak chalti hai. Wellington exchange bari turnovers nahi deta, lekin yeh trading day ki shuruat hoti hai. Aik ghante baad, bada Sydney Stock Exchange khulta hai. Mazeed aur zyada players market mein aate hain aur assets ki liquidity barh jati hai. Khaas tor par stock market mein ziada activity hoti hai. Iski wajah yeh hai ke Sydney exchange U.S. indices ke liye futures trade karta hai. Aur baqi instruments ke trades in par depend karte hain. Sydney schedule mein pehla bara marketplace hai. Sab se zyada turnover Australian, New Zealand, U.S. dollar, aur Japanese yen mein hota hai.

VBO Trading Sessions Indicator

VBO indicator ko trading sessions ke opening aur timing ka maloom karna ke liye aik zyada istemal hone wale tools mein se aik samjha jata hai. Installation ke baad, yeh chart window ke neeche aik alag se window mein dikhai deta hai.

Sessions ko colored horizontal lines ki tarah dikhaya jata hai. Har session ko aik mukhtalif rang se mark kiya jata hai, is liye indicator ke sath kaam karna bohot asaan hai. Is tool mein aik hour scale bhi hoti hai, jo exactly batati hai ke naya trading period kab khula tha.

Is indicator ki aur aik useful feature hai - yeh sessions ko seedha price chart par display karne ki salahiyat. Is case mein, desired periods ko rectangles ki form mein highlight kiya jata hai.

Aap indicator ke upper right corner mein ek chhote se icon par click karke sessions ko main chart par ya neeche dikhane ke modes mein switch kar sakte hain.

Installation standard hoti hai aur iske liye koi khaas maharat ki zarurat nahi hoti. Archive se distribution files ko terminal data directory mein move karen aur program ko restart karen. Iske baad, indicator platform ke main menu ke zariye dastiyab ho jayega.

Forex Trading Sessions: Strategy

Yeh strategy chart ki fundamental analysis par mabni hai. Iski bunyadikiyaat yeh hai ke trades London session ki direction mein khulti hain. Yeh ek bohot mashhoor strategy hai aur almost sabhi doosre assets ke liye "movement set" karti hai.

Trades ek din mein ek baar 08.00 am GMT par lagayi jati hain jab London session khulta hai. Aap major currency pairs par trade kar sakte hain, jaise ke EUR/USD, EUR/JPY, aur aise hi. Chart ka time frame thirty minutes ka hota hai.

Trading Rules:- 08.00 am par, required currency pair ka chart kholen, aur pehle 30 minutes tak koi trade na lagayen, bas price direction analyze karen.

- Jab chart ka pehla candle close hota hai, to further price movement ke liye ek impulse milta hai.

- Dusre 30-minute candle ke opening moment mein, orders lagane hain. Pehle candle ki high price se 5 points upar Buy Stop order lagayen. Aur pehle candle ki low price se 5 points neeche Sell Stop order lagayen.

- Stop Loss ka istemal nahi kiya ja sakta, kyun ke opposite orders ek dosre ke liye Stop Loss positions ka kirdar ada karte hain.

- Agar 2 ghante ke baad koi bhi order trigger nahi hota, to dono positions ko delete kar dena chahiye, aur us din is strategy par trade nahi karna chahiye. Puri sequence of actions ko agle din dohraya ja sakta hai.

- Is strategy mein trading sessions indicator sirf reference point ke taur par istemal hota hai. Aap kisi bhi doosre mujarrad tool ko bhi choose kar sakte hain.

Conclusion

Alag alag types ke trading sessions ki khaas batein ko madde nazar rakhte hue aapko forex trading strategy develop karna chahiye. Currency pairs ki highest activity periods ko maloom karke aap trades se maximum profit hasil kar sakte hain aur nuksan ke risk ko kam kar sakte hain. Apne trading terminal mein trading session indicator install karen, aur aap apne open positions ko waqt par band karne ko bhoolenge nahi. Market time par tawajju dena aapko apne kaam ke ghante intelligent taur par plan karne mein madad karega.

- Asian

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

FOREX TRADING KA SESSION AUR INKI OVERLAPPING ...DEFINITION

best possible currency trading ke opportunity Hasil karne ke liye aapko sabse most liquid and highly trade ki jaane wali currency pair ko Janna chahie ek hi time mein yah understanding ke Jab forex market volume and volatility ke lihaz se highly active hoti hai to yah bhi Paramount hai forex market ki Harkiyat and Technicalities crucial ko jazb karna khwahishmand and Yahan Tak ke seasoned market ke participant ke liye bhi bahut zaruri hai yah article aapko market ke avkaat and significant forex trading session se guzarta hai Yeh is Baat per bhi discuss karta hai ke overlapping forex session Kyon zaruri hai and in se zyaada Se Zyada fayda Kaise uthaya Jaaye market ki some best To-know ine Kahi kahaniyon Se Parda uthane ke liye Hamare sath rahe

UNDERSTANDING FOREX MARKET HOURS

Market ke participant in hour Ke dauran currencies ki trade kar sakte hain Jise k commonly forex market Hours Kahate Hain chunke currencies over the account exchange and computer ke network per trade karti hai isliye almost Kahin Se Bhi Koi anyone internet ke zarie forex market mein participate Le sakta hai market weeks Mein 25 days 24 hours trade karti hai yah Sundays ko five PM EST se begin hai and Fridays ko 5 PM EST tak closes Hota Hai significant financial hubs ki closure and Center Bank; financial institution hedge funds and investment ki management frame Jaise market ke numaya players prominent absence ki vajah se yah weekend ke dauran closed rehta hai

WHY IS THE FOREX MARKET VOLATILE DURING THE OVERLAPPING SESSION

Sabse zyada trade ki jaane wali currency ke pair ammtur per liquid Hote Hain Kyunke aap Unki exchange rate mein any significant change Nahin dekhenge however woh currency pair overlapping forex trading session Ke dauran zyada volume ko Apni Taraf attract kar sakte hain overlapping session ke dauran liquidity volatility and trading volume main increase hota hai is. period ke dauran wide Pimane per phaile hue ilake ke market ke participant ke Taur per currency ki trade ki Gai Ham trading volume and volatility main drastic improvement dekh sakte hain

- CL

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:31 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим