NFP Trading Strategy...

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

NFP (Non-Farm Payrolls) Trading Strategy, jo ki monthly US job report hai, ek popular trading strategy hai. Is report mein non-farm employment data release hoti hai, jise market participants closely monitor karte hain. NFP Trading Strategy ka istemal market volatility aur short-term price movements ka advantage lena ke liye kiya jata hai. NFP Trading Strategy ke liye aap kuch important points par focus kar sakte hain:1. Economic Calendar: Economic calendar par NFP release date aur time ko note karein. NFP usually first Friday of the month ko release hoti hai, around 8:30 AM Eastern Time (ET).2. Market Analysis: NFP release se pehle aur release ke time par market analysis karein. Previous NFP reports, market sentiment, aur economic indicators ko analyze karein. Isse aapko market expectations aur potential impact ke baare mein idea mil sakta hai.3. Volatility Management: NFP release ke time par market volatility high hoti hai. Isliye, aapko apne risk management ko optimize karna zaruri hai. Position size ko adjust karein aur stop loss levels ko set karein, taki aap downside risk ko control kar sakein.4. News Reaction: NFP release ke time par market mein instant reaction hoti hai. Aapko NFP release ke time par news feed, economic calendars, aur live market updates par focus karna chahiye. News reaction aur price movements ko closely monitor karein.5. Trade Entry: NFP release ke time par trade entry points ko identify karne ke liye aap technical analysis tools ka istemal kar sakte hain. Price levels, support and resistance, aur trend lines ko consider karein. Breakouts aur pullbacks par focus karein, jisse aapko entry points mil sakte hain.6. Trade Management: Trade management bahut zaruri hai NFP Trading Strategy mein. Stop loss aur take profit levels ko set karein. Price movements ke hisab se stop loss levels ko trail karein. Aur trade ko closely monitor karein, taki aap timely decisions le sakein.7. Post-NFP Analysis: NFP release ke baad, post-NFP analysis karein. Price movements, market reactions, aur trading results ko evaluate karein. Isse aap apne trading strategy ko improve kar sakte hain.Yad rahe ki NFP Trading Strategy high risk wali strategy hai, kyunki market volatility high hoti hai aur price movements unpredictable ho sakte hain. Isliye, aapko risk management principles aur apne trading plan ko follow karna zaruri hai.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

^^Forex Me NFP Trading Strategy^^

NFP (Non-Farm Payrolls) Trading Strategy forex market mein ek popular approach hai, jise traders economic calendar events ke sath combine karke use karte hain. Non-Farm Payrolls, United States ka ek economic indicator hai jo har mahine first Friday ko release hota hai aur ye show karta hai ki kitne jobs non-farm sectors mein create hue hain.

^^Forex Me NFP Trading Strategy Ke Kam Karne KA Tarikaa^^

Yeh strategy kaam kaise karti hai:- Economic Calendar Monitoring:

- Traders NFP release date ko advance mein note karte hain aur economic calendar par is event ke time ko dekhte hain.

- Volatility Expectation:

- NFP release ke time par market mein volatility (price movements) badh jati hai. Traders is volatility ko anticipate karte hain aur iske based par apne trades plan karte hain.

- Trade Plan:

- Kuch traders NFP release ke time par market mein hone wale sudden price movements se benefit uthane ke liye trades open karte hain. Ismein scalping strategies ka use hota hai jismein short-term positions li jati hain.

- Stop-Loss and Take-Profit Levels:

- Volatility ke high hone ki wajah se risk bhi badh jata hai. Isliye, traders stop-loss levels ka use karte hain taki unki positions ko protect kiya ja sake. Take-profit levels bhi set kiye jate hain taki profits secure kiye ja sake.

- Market Sentiment Analysis:

- NFP ke release ke baad market sentiment bhi change ho sakta hai. Traders is change in sentiment ko analyze karte hain aur future trades ke liye apne strategy ko adjust karte hain.

- Risk Management:

- NFP trading strategy mein risk management bahut important hai. Traders limit apne exposure ko control karte hain, position sizes ko monitor karte hain, aur overall trading plan ko follow karte hain.

- Technical Analysis:

- Kuch traders technical analysis ka use bhi karte hain, jaise ki support and resistance levels, trend lines, aur indicators, NFP trading strategy mein incorporate karne ke liye.

Yeh strategy advanced level ki hai aur ismein risk bhi high hota hai. Iske liye trader ko market conditions aur economic indicators ke acche se samajhne ki zarurat hoti hai. Har trader apni risk tolerance aur trading style ke hisab se is strategy ko customize karta hai. Isliye, agar aap NFP trading strategy use karna chahte hain, toh pehle demo account par practice karna aur experience gain karna important hai.

- Mentions 0

-

سا3 likes

- Economic Calendar Monitoring:

-

#4 Collapse

1. NFP Trading Strategy:

Forex mein NFP (Non-Farm Payrolls) report ek ahem economic indicator hai jo United States ki job market ki health ko darust karti hai. NFP release hone par market mein tez tarrar ghumawat hoti hai, aur is event ka traders par gehra asar hota hai. Is note mein, hum Roman Urdu mein NFP Trading Strategy par baat karenge.

2. Tareef (Definition):

NFP ek monthly economic report hai jo har mahine ki first Friday ko release hota hai. Is report mein ye mention hota hai ke maamoolan kitne jobs non-farm sectors mein shamil hue hain ya guzare hue mahine mein kitne jobs ghat gaye hain. Yeh report USD (US Dollar) aur global financial markets par direct impact daal sakta hai.

3. NFP Trading Strategy Ka Tariqa (Strategy Approach):

3.1. News Calendar Check Karna:- NFP report ka release time market mein volatility paida karta hai. Traders ko news calendar regularly check karna chahiye taake unhe pata chale ke NFP kab hone wala hai.

- NFP ke waqt market mein achanak tezi ya ghirawat aa sakti hai. Traders ko apne risk management rules ko strictly follow karna chahiye aur agar zarurat ho to position sizes ko adjust karna chahiye.

- NFP release ke waqt technical analysis ka istemal karna bhi ahem hai. Support aur resistance levels ko dekh kar, traders apne entry aur exit points ko define kar sakte hain.

- NFP release se pehle aur baad mein market ka analysis karna zaroori hai. Isse traders ko pata chalta hai ke market ke reaction ka kya asar hua hai aur future mein kis tarah ka movement expect kiya ja sakta hai.

4.1. Opportunity for Quick Profits:- NFP release ke waqt market mein tezi ya ghirawat hone ke chances hote hain, jo traders ke liye quick profit opportunities create kar sakte hain.

- NFP report ke release ke baad market ka trend ban sakta hai, jo traders ko future trades ke liye guide karta hai.

- NFP release se market mein volatility barh jati hai, jisse ke traders ko trading opportunities mil sakti hain.

5.1. Risk of Whipsaws:- NFP release ke baad market mein unexpected moves hote hain, jisse traders ko whipsaws ka risk ho sakta hai.

- High volatility ke waqt apne positions ko control karna challenging ho sakta hai, isliye risk management ka strict follow karna zaroori hai.

- News ke sahi taur par interpretation karna important hai, lekin ye traders ke liye mushkil ho sakta hai.

Pakistan mein bhi NFP report ke release se market mein ghumawat hoti hai, aur is event ko closely monitor karna zaroori hai. Local traders ko global economic indicators par nazar rakhna chahiye taake unhe market conditions ka theek se andaza ho.

7. Conclusion:

NFP Trading Strategy ka istemal karne se pehle, traders ko market conditions aur apne risk tolerance ka dhyan rakhna chahiye. Is strategy ko samajh kar aur sahi tarike se istemal karne se, traders ko NFP release ke events mein trading mein asani ho sakti hai.

-

#5 Collapse

NFP (Non-Farm Payrolls) trading strategy ka maqsad hota hai kisi bhi mahine ki aakhri Jumma ko jari hone wale jobs report se faida uthana. Yeh khas tor par Forex market mein istemal hota hai. NFP report mein agar jobs ki tadad ziada hoti hai toh USD strengthen ho sakta hai, jabke agar kam hoti hai toh USD weak ho sakta hai. Traders is waqt positions lete hain takay woh market ke volatile waqt mein munafa kamayen. Yeh strategy risk se bharpoor hoti hai, is liye acchi tarah se research aur risk management ki zarurat hoti hai. NFP (Non-Farm Payrolls) trading strategy ka maqsad hota hai jobs report ke waqt market mein hone wale volatility ka faida uthana.

Report Ki Tadad Ki Scottish:

NFP report mein jobs ki tadad ka tafteesh karna ahem hai. Agar jobs ki tadad ziada hai, toh USD mein izafah ho sakta hai aur agar kam hai toh USD mein kami ho sakti hai.

Economic Calendar Ka Ismail:

Economic calendar se pichle reports aur expectations ka ilm hasil karen. Is se market ka trend samajhna asan ho jata hai.

Volatility Management:

NFP ke waqt market mein tez gati (volatility) hoti hai, is liye position sizes ko control mein rakhna aur stop-loss orders ka istemal karna zaroori hai.

Pre-Planning:

Trading strategy ko pehle se tay karen aur market ke reactions ke liye tayyar rahein. News ke waqt aksar unexpected movements hote hain.

Multiple Timeframes Ka Ismail:

Trading charts par multiple timeframes ka istemal karke overall market trend ko samajhne ki koshish karen.

Market Sentiment Ka Tafteesh:

Traders ki jama'at ka tajziya karna bhi ahem hai. Market sentiment ka ilm hona madad karta hai.

Risk-Reward Ratio:

Har trade mein risk-reward ratio ka khayal rakhna zaroori hai. Zayada risk lene se bachna chahiye.Technical Analysis Ka Istemal: Support aur resistance levels ka istemal karke entry aur exit points tay karna.

Quick Decision Making:

NFP report ke waqt market mein jaldi fazool ghumao se bachne ke liye tez faislay karne ki zarurat hoti hai.Learning from Experience: Har trade se kuch sikhen aur apni strategy ko improve karen.Yeh strategy risky hoti hai, is liye ehtiyaat baratna aur research kar ke hi is mein shamil hona chahiye.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

NFP Trading Strategy"NFP Trading Strategy: Rozgar Riwayati Dastavizat ki Roshan Raah"

Non-Farm Payrolls (NFP) economic report, jo har maah ke pehle Jumma ko jaari hota hai, tijarat mein aik aham waqia hai. Yeh report America mein rozgar ki maqami halat ka acha tasawwur faraham karta hai, jisme ghair-kisan mazdooron ke liye maahana hissab lagaya jata hai. NFP trading strategy, is maqami riwayati dastavez ke mukhalif rewayat aur asarat ka jawab dene ka tariqa tajwez karta hai.

Maqami Rozgar Ki Ma'loomat

NFP report, ek tijarat karne wale ke liye intehai ahem ho sakta hai, kyun ke is report ke zariye tijarat karne wale ko maqami mazdooron ki taqat aur mazduri ka hisaab milta hai. Report mein izafah ya kami, tijarat karne wale ke liye market mein taqat ya kamzori ko darust karta hai.

NFP Trading Strategy

Ta'ayun-e-Mawafiqat (Expectation Analysis)

Pehle qadam mein trader ko NFP report ke aane se pehle market ki expectations ka tajziya karna chahiye. Agar expectations se ziada jobs izafah hote hain, toh is usually positive impact daalta hai aur market mein bullish trend create hota hai. Wahi agar expectations se kam jobs aati hain, toh market mein bearish trend create hota hai.

Immediate Reaction (Fori Jawab)

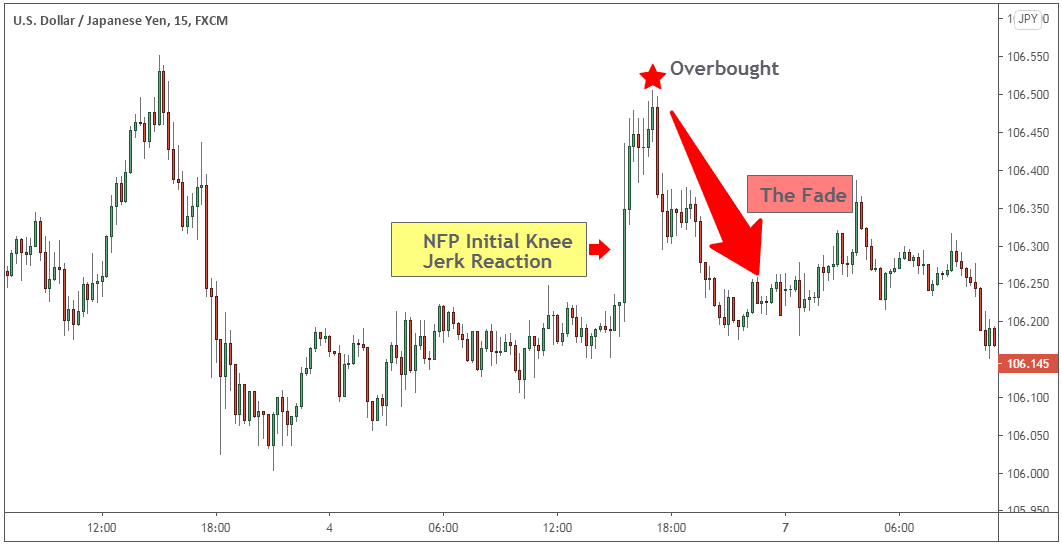

NFP report ke turant baad market mein tezi se taqat ya kamzori aajati hai. Trader ko is initial reaction ko samajhna chahiye, kyun ke is waqt market mein tezi se ghair-mutawater aur overbought/oversold conditions banti hain.

Volatility Ka Faida Uthana

NFP report ke waqt market mein aam taur par zyada volatility hoti hai. Traders ko is volatility ka faida uthana chahiye aur market mein quick moves ke liye tayyar rehna chahiye.

Risk Management (Khatra Nigrani)

Har trading strategy mein risk management ka khaas khayal rakhna zaroori hai. NFP report ke baad market mein tez tareen harkat hoti hai, is liye trader ko apne positions ko monitor karna aur stop-loss orders ka istemal karna chahiye.

News Trading (Khabar Tijarat)

NFP trading strategy ka aham hissa hai khabron par tijarat karna. Isme trader ko tijarat karne se pehle market ki khabron ka intezar karna hota hai aur jab report aati hai, toh fori tijarat karna hota hai.

Kuch Zaruri Hidayat

Time Management (Waqt Ka Intizam)

NFP report ke waqt market mein tezi se harkat hoti hai, is liye tijarat karne wale ko waqt ka behtareen intezam karna chahiye. Yeh report New York session ke doraan aati hai, is liye traders ko apne waqt ka behtar intezam karna chahiye.

Technical Aur Fundamental Analysis Ka Istemal

NFP trading strategy mein technical aur fundamental analysis ka behtareen istemal karna zaroori hai. Technical analysis ke zariye trends ka pata lagaya ja sakta hai, jabke fundamental analysis se economic indicators ki understanding milti hai.

Educated Decision (Taleem Yafta Faisla)

NFP trading strategy ko behtareen taur par istemal karne ke liye trader ko apne faislay ko educated taur par lena chahiye. Market mein hone wale harkaton ko samajhne ke liye tijarat karne wale ko tijarat ke asoolon aur economic indicators par malumat hona chahiye.

Aakhri Khyal

NFP trading strategy, tijarat karne wale ko market ki harkaton ko samajhne mein aur maqami mazdooron ki halaat ka acha tasawwur karne mein madad karti hai. Yeh report market mein temporary volatility aur opportunities create karti hai, jise behtareen taur par istemal karne ke liye tijarat karne wale ko tayyar rehna chahiye. Hamesha yaad rahe ke har tijarat mein risk hota hai, is liye hifazati tadabeer aur sahi analysis ke saath hi tijarat karni chahiye.

-

#7 Collapse

NFP Trading Strategy...

NFP Trading Strategy: Non-Farm Payrolls aur Trading Ka Tijaratii Manzir

Non-Farm Payrolls (NFP) ek aham maishiyat ka anasir hai jo amuman har maah ke pahle Jumma ko jari kiye jate hain. Ye Ameriki maeeshat ki halat ka aik aham dalail hai aur iski asalat hamesha tajziyah ki jati hain. NFP ka asar forex tijarat mein bhi bohat ahmiyat rakhta hai, aur isay sahi tarikay se samajh kar tijarat karne wale traders ke liye ye aik buland mauqa ho sakta hai.

NFP Trading Strategy:- Research aur Tijarat ki Tayyari: NFP se pehle tijarat karne se pehle tayyari bohat zaroori hai. Tijarat karne se pehle forex market ka tajziyah karna aur NFP report ki tafseelat samajhna aham hai. Isme jobs data, unemployment rate, aur average hourly earnings shamil hote hain. Is tayyari se trader ko market ki samajh hoti hai aur wo tijarat karne ke liye behtareen faislay kar sakta hai.

- Economic Calendar Ka Estemal: Tijarat karne wale ko economic calendar ka istemal karna chahiye. Economic calendar, aane wale NFP release ki date aur waqt ke baray mein malumat farahem karta hai. Is calendar se trader tijarat karne ka behtareen waqt tay kar sakta hai.

- Volatility Ka Imkan: NFP release ke waqt market mein tez tarrarriyan hoti hain. Is waqt market mein volatility barh jati hai. Trader ko is volatility ko apne faiday ke liye istemal karna chahiye. High volatility ke dauran, trader ko chand pips ka faida ho sakta hai agar wo sahi tarikay se tijarat kare.

- Stop Loss aur Take Profit Orders: NFP release ke waqt market mein jhatke aane ke imkanat barh jate hain. Isliye, stop loss orders ka istemal karna bohat zaroori hai taaki trader apne nuksanat ko kam kar sake. Take profit orders bhi tay karna aham hai taki trader apne maqasid tak pahunch sake.

- Short-Term Trading: NFP release ke waqt short-term trading ko ahmiyat di jati hai. Is waqt market mein chand minutes mein bari tarrarriyan ho sakti hain, aur isse short-term trading mein munafa kamana asan ho sakta hai.

- Currency Pairs Ka Intikhab: NFP release ke waqt currency pairs ka intikhab karna bhi aham hai. Major currency pairs jese ke EUR/USD aur USD/JPY is waqt zyada maqbool hote hain. In pairs par trading kar ke trader apne faiday ko barha sakta hai.

- Risk Management: Har tijarat mein risk management ka ehtiram karna bohat zaroori hai. Trader ko apne maqasid aur nuksanat ko tay kar ke tijarat

- 147.8900 USDJPY

- Mentions 0

-

سا0 like

-

#8 Collapse

What is NFP treading Strategy

NFP (Non-Farm Payrolls) Trading Strategy ek trading approach hai jo specifically Non-Farm Payrolls report release ke time par istemal hoti hai. Non-Farm Payrolls report United States mein har mahine release hota hai aur ye employment data provide karta hai, jismein non-farm jobs ki quantity, unemployment rate, aur average hourly earnings shamil hote hain.Non-Farm Payrolls report ek major economic indicator hai aur iska impact currency markets par significant hota hai. Traders NFP release ke time par volatility aur price movements expect karte hain, aur is opportunity ko capture karne ke liye kuch strategies istemal karte hain.

Yahan kuch common NFP trading strategies hain:- News Trading Strategy:

- Traders news trading strategy ka istemal karte hain jismein woh directly NFP release ke time par trades enter karte hain. Ismein unka focus hota hai market reaction par jo report ke announcement ke turant baad hoti hai.

- Wait-and-See Strategy:

- Kuch traders NFP release se pehle ya immediately baad mein trade nahi karte hain. Wo market ke initial volatility ka wait karte hain aur phir clear trend emerge hone ke baad trade karte hain.

- Volatility Trading:

- NFP release ke time par market mein increased volatility hoti hai. Kuch traders is increased volatility ka istemal karke short-term trades karte hain, jismein unka focus hota hai price fluctuations ke quick capture par.

- Using Options:

- Options trading ek strategy ho sakti hai jismein traders NFP release ke time par options ka istemal karte hain. Options unko flexibility dete hain market direction ke upar bet lagane mein.

- Hedging Positions:

- Kuch traders apne existing positions ko NFP release ke time par hedge karte hain takke wo market volatility se protect rahein.Hamesha dhyan rakhein ke NFP release ke time par market unpredictable ho sakta hai, aur is volatility mein trading karna risk laden ho sakta hai. Risk management bahut zaroori hai, aur beginners ko NFP ke time par trading se bachne ki salahiyat honi chahiye. Professional advice aur thorough market analysis ke bina trading na karein.

- News Trading Strategy:

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

NFP Trading Strategy

NFP Trading Strategy (NFP Trading Strategy) ek tijarat ki strateji hai jo Non-Farm Payrolls (NFP) report par mabni hoti hai. Yeh report har mahine Jumeraat ko jaari hoti hai aur ye darust karta hai ke America mein non-farm jobs kitne izafay ya kamio mein shamil hue hain. Yeh tijarat karne walayon ke liye aham ho sakti hai kyun ke is report ke mutabiq market mein tezi ya tazad (volatility) peda ho sakti hai.

NFP Trading Strategy ka Tariqa:- Tay Karein Entry aur Exit Points:

- NFP announcement se pehle entry aur exit points tay karein.

- Limit aur stop orders ka istemal karein taake market ke tej tazad mein bhi control bana rahe.

- News Calendar Check Karein:

- Economic calendar mein NFP announcement ka waqt dekhein aur apni tijarat ko is waqt ke mutabiq tay karein.

- Volatility Management:

- NFP ke waqt market mein aasmani tezi peda ho sakti hai, is liye position size ko control mein rakhein.

- Stop-loss orders ka istemal karein taake nuksan se bacha ja sake.

- News Analysis:

- NFP report ke asar ko samajhne ke liye news analysis karein.

- Agar jobs mein izafa hua ho to market mein tezi ka imkan hai, jabke jobs mein kami ho to market mein girawat ka imkan hai.

- Trend Analysis:

- Market trend ko samajhne ke liye technical analysis ka istemal karein.

- Agar market uptrend mein hai to long position le sakte hain, aur downtrend mein hai to short position le sakte hain.

- Risk-Reward Ratio:

- Risk aur reward ka munasib ratio tay karein.

- Zayada tazad hone par risk ko kam karein aur reward ko barhaein.

Yeh yaad rahe ke NFP trading strategy mein risk hota hai aur ismein tijarat karne se pehle aapko achhi tarah se taiyari karni chahiye. News events ke doraan market mein aasmani tazad hoti hai, is liye cautious approach rakhna zaroori hai. Trading mein istiqamat aur risk management ka khaas khayal rakhna buhat zaroori hai.

- Tay Karein Entry aur Exit Points:

-

#10 Collapse

Introduction of the post.

I hope NFP (Non-Farm Payrolls) Trading Strategy ek trading approach hai jo specifically Non-Farm Payrolls report release ke time par istemal hoti hai. Non-Farm Payrolls report United States mein har mahine release hota hai aur ye employment data provide karta hai, jismein non-farm jobs ki quantity, unemployment rate, aur average hourly earnings shamil hote hain.Non-Farm Payrolls report ek major economic indicator hai aur iska impact currency markets par significant hota hai. Traders NFP release ke time par volatility aur price movements expect karte hain, aur is opportunity ko capture karne ke liye kuch strategies istemal karte hain.

Yahan kuch common NFP trading strategies hain:- News Trading Strategy:

- Traders news trading strategy ka istemal karte hain jismein woh directly NFP release ke time par trades enter karte hain. Ismein unka focus hota hai market reaction par jo report ke announcement ke turant baad hoti hai.

- Wait-and-See Strategy:

- Kuch traders NFP release se pehle ya immediately baad mein trade nahi karte hain. Wo market ke initial volatility ka wait karte hain aur phir clear trend emerge hone ke baad trade karte hain.

- Volatility Trading:

- NFP release ke time par market mein increased volatility hoti hai. Kuch traders is increased volatility ka istemal karke short-term trades karte hain, jismein unka focus hota hai price fluctuations ke quick capture par.

- Using Options:

- Options trading ek strategy ho sakti hai jismein traders NFP release ke time par options ka istemal karte hain. Options unko flexibility dete hain market direction ke upar bet lagane mein.

- Hedging Positions:

- Kuch traders apne existing positions ko NFP release ke time par hedge karte hain takke wo market volatility se protect rahein.Hamesha dhyan rakhein ke NFP release ke time par market unpredictable ho sakta hai, aur is volatility mein trading karna risk laden ho sakta hai. Risk management bahut zaroori hai, aur beginners ko NFP ke time par trading se bachne ki salahiyat honi chahiye. Professional advice aur thorough market analysis ke bina trading na karein.

- News Trading Strategy:

-

#11 Collapse

Nfp trading strategy...

NFP (Non-Farm Payrolls) trading strategy ka maqsad hota hai ke jab United States ke Department of Labor har mahine non-farm payrolls report publish karta hai, toh traders is event ko istemal karke market mein trade karen. NFP report mein United States ke non-farm employment data diya jata hai, jo ke ek ahem economic indicator hai. Yeh report market mein volatility aur trading opportunities create kar sakta hai.

NFP trading strategy mein kuch key points hain:- Event Calendar Check karna:

- Traders ko pehle yeh confirm karna chahiye ke NFP report kab aayega. Typically, yeh report har first Friday of the month ko release hota hai.

- Market Expectations Janana:

- Traders ko yeh samajhna important hai ke market mein kis tarah ki expectations hain regarding NFP data. Iske liye economic calendars aur market analysis ka istemal hota hai.

- Volatility Management:

- NFP release ke waqt market mein tez price movements hone ke chances hote hain. Traders ko apne risk tolerance ke hisab se apne positions ke size ko manage karna chahiye.

- News Trading Strategies:

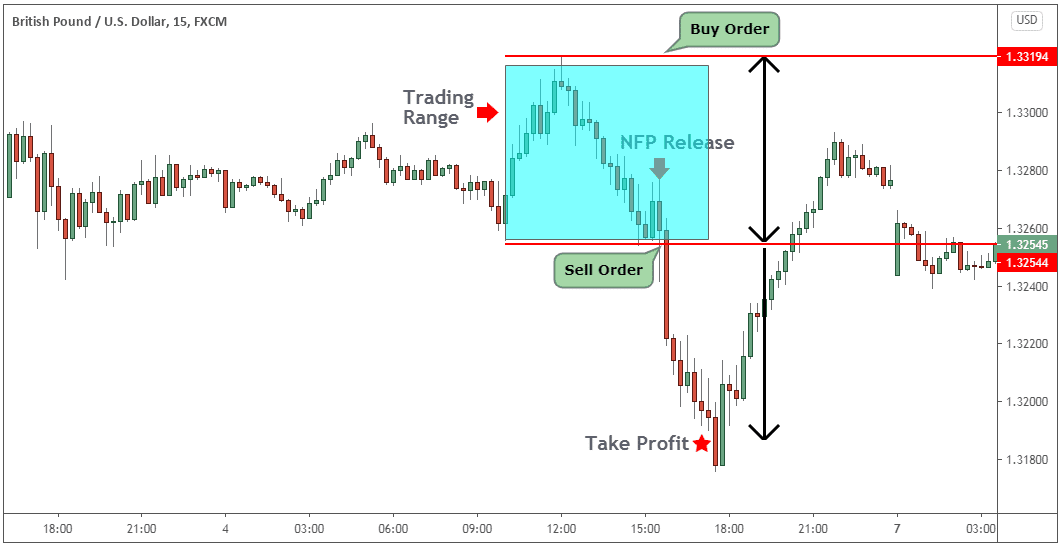

- Some traders use news trading strategies to take advantage of the immediate market reaction to the NFP release. For example, they may place pending orders above and below the current market price to catch potential breakouts.

- Technical Analysis ka Istemal:

- Traders technical analysis ka istemal karte hain to identify key support and resistance levels, trendlines, aur chart patterns. In levels ko NFP release ke time par istemal karke potential entry aur exit points tay kiye jate hain.

- Risk Management:

- Risk management bahut zaroori hai NFP trading strategy mein. Traders ko stop-loss levels aur target prices ko tay karte waqt apne risk tolerance ko madde nazar rakna chahiye.

- Slippage aur Market Spread ka Dhyan Rakhein:

- NFP release ke time par slippage aur market spread ka risk hota hai. Traders ko yeh bhi samajhna chahiye ke order execution mein deri ho sakti hai.

Yeh important hai ke NFP trading strategy ko carefully plan kiya jaye aur market conditions ko madde nazar rakha jaye, kyun ke NFP release ke baad market mein sudden aur volatile movements ho sakte hain. Har trader apne apne risk tolerance aur trading style ke mutabiq apni strategy customize karta hai.

- Mentions 0

-

سا0 like

- Event Calendar Check karna:

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

NFP Trading Strategy... kai hai

NFP (Non-Farm Payrolls) Trading Strategy ek trading approach hai jo Non-Farm Payrolls report ke release ke time par istemal hoti hai. Ye ek monthly economic report hai jo United States Bureau of Labor Statistics (BLS) dwara publish kiya jata hai aur isme non-farm employment data shamil hota hai. NFP report market mein volatility create kar sakta hai, aur traders is volatility ka faida uthane ke liye specific strategies istemal karte hain.

Yahan kuch key points hain jo NFP Trading Strategy mein madad karti hain:- Economic Calendar Follow Karein:

- NFP report ka release date economic calendar par pehle se hi announce hota hai. Traders ko is date ko note karna chahiye taki wo market movements ke liye ready ho sakein.

- Volatility Expectations:

- NFP release se pehle aur baad mein market mein zyada volatility expect hoti hai. Traders ko is volatility ka dhyan rakhna chahiye aur apni trading strategy ko iske hisab se adjust karna chahiye.

- News Trading Strategies:

- Kuch traders news trading strategies ka istemal karte hain, jisme wo NFP release ke turant baad positions lete hain. Ismein price action aur technical indicators ka bhi istemal hota hai.

- Risk Management:

- NFP trading mein risk management ka khayal rakhna zaroori hai. Volatility ke chalte unexpected price movements ho sakte hain, isliye stop-loss orders ka istemal important hai.

- Major Currency Pairs:

- NFP release ke waqt major currency pairs, jese ke EUR/USD, USD/JPY, GBP/USD, mein zyada liquidity hoti hai. Traders in pairs par focus karte hain.

- Pre-Release Analysis:

- Kuch traders NFP release se pehle fundamental analysis aur economic indicators ka istemal karte hain taki unhe pata chal sake ke kis direction mein market move ho sakta hai.

- Post-Release Analysis:

- NFP release ke baad, market movements ko closely monitor karna important hai. Traders ko dekhein ke kya unki expectations ke mutabiq price move ho raha hai ya phir kya unexpected changes hain.

Hamesha yaad rahe ke NFP trading high risk wala hota hai aur ismein loss hone ke chances bhi hote hain. Isliye, careful planning, risk management, aur experience ke sath hi is strategy ko implement karna chahiye.

- Economic Calendar Follow Karein:

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:52 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим